Beruflich Dokumente

Kultur Dokumente

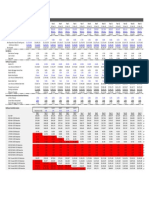

Raw Input Calculated Financial Projections and Valuation

Hochgeladen von

Fırat Şık0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

25 Ansichten5 SeitenOriginaltitel

Damoran.xlsx

Copyright

© © All Rights Reserved

Verfügbare Formate

XLSX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

25 Ansichten5 SeitenRaw Input Calculated Financial Projections and Valuation

Hochgeladen von

Fırat ŞıkCopyright:

© All Rights Reserved

Verfügbare Formate

Als XLSX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 5

Raw Input Calculated

Year Revenues Change in Revenue Sales/Capital Ratio Reinvestment Capital Invested

Current $187 $1,657

1 $562 $375 1.50 $250 $1,907

2 $1,125 $563 1.50 $375 $2,282

3 $2,025 $900 1.50 $600 $2,882

4 $3,239 $1,214 1.50 $809 $3,692

5 $4,535 $1,296 1.50 $864 $4,556

6 $5,669 $1,134 1.50 $756 $5,312

7 $6,803 $1,134 1.50 $756 $6,068

8 $7,823 $1,020 1.50 $680 $6,748

9 $8,605 $782 1.50 $521 $7,269

10 $9,035 $430 1.50 $287 $7,556

From Industry Average

Operating Income Imputed RoC

-$787

-$1,125 -67.9%

-$1,012 -53.1%

-$708 -31.0%

-$243 -8.4%

$284 7.7%

$744 16.3%

$1,127 21.2%

$1,430 23.6%

$1,647 24.4%

$1,768 24.3%

High Growth Period

Current Cashflow to Firm Year 1 2

EBIT (1-t) $1,414 Growth Rate 11.44% 11.44%

- Nt CpX $831 Reinvestment Rate 57.43% 57.43%

- Chg WC -$19 EBIT $2,483 $2,767

- FCFF $602 EBIT (1-t) $1,576 $1,756

Reinvestment Amount $812 - Reinvestment $905 $1,009

Reinvestment Rate 57.43% = FCFF $671 $748

Cash $3,016 Unlevered β for Sectors 1.25

Equity $34,656 Levered β for Firm 1.26

Debt $558

Riskfree Rate for Euro 3.41%

Corporate Tax Rate 36.54% Company Risk Premium 4.00%

Country Risk Premium 0.25%

Stable Growth Conditions

Growth Rate 3.41% Total Risk Premium 4.25%

β 1.00

Debt Ratio 20% Cost of Equity 8.78%

Cost of Capital 6.62%

RoC 6.62% Credit Default Spread 0.35%

Tax Rate 35% Cost of Debt 3.76%

Reinvestment Rate 52%

WACC 8.64%

RoC in Emerging Markets 19.93% Expected Growth Rate 11.44%

High Growth Period Growth Period inclining to Stable Growth

3 4 5 6 7 8 9 10

11.44% 11.44% 11.44% 9.84% 8.23% 6.62% 5.02% 3.41%

57.43% 57.43% 57.43% 56.25% 55.07% 53.89% 52.72% 51.54%

$3,084 $3,437 $3,830 $4,207 $4,554 $4,855 $5,099 $5,273

$1,957 $2,181 $2,431 $2,670 $2,890 $3,081 $3,236 $3,346

$1,124 $1,253 $1,396 $1,502 $1,591 $1,661 $1,706 $1,725

$833 $929 $1,035 $1,168 $1,298 $1,421 $1,530 $1,621

=FCFt+1 * (1+g) / (r-g)

Terminal Value

$52,289

NPV of Growth Period: 6,854 ₺

NPV of Terminal Value: 25,842 ₺

Total Current Value: 32,696 ₺

Das könnte Ihnen auch gefallen

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachVon EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachBewertung: 3 von 5 Sternen3/5 (3)

- I. Income StatementDokument27 SeitenI. Income StatementNidhi KaushikNoch keine Bewertungen

- TVM 10Dokument10 SeitenTVM 10mobinil1Noch keine Bewertungen

- Netflix Financial StatementsDokument2 SeitenNetflix Financial StatementsGoutham RaoNoch keine Bewertungen

- Genzyme DCF PDFDokument5 SeitenGenzyme DCF PDFAbinashNoch keine Bewertungen

- BNI 111709 v2Dokument2 SeitenBNI 111709 v2fcfroicNoch keine Bewertungen

- Amazon ValuationDokument22 SeitenAmazon ValuationDr Sakshi SharmaNoch keine Bewertungen

- Lady M DCF TemplateDokument4 SeitenLady M DCF Templatednesudhudh100% (1)

- Lesson 3Dokument29 SeitenLesson 3Anh MinhNoch keine Bewertungen

- Current Financial Analysis and ValuationDokument30 SeitenCurrent Financial Analysis and ValuationAbhinav PandeyNoch keine Bewertungen

- Bac DCFDokument7 SeitenBac DCFVivek GuptaNoch keine Bewertungen

- Valuation of AppleDokument25 SeitenValuation of AppleQuofi SeliNoch keine Bewertungen

- Sbux, Peet, and Pro-Forma Pete-DdrxDokument12 SeitenSbux, Peet, and Pro-Forma Pete-DdrxfcfroicNoch keine Bewertungen

- Income Statement and Balance Sheet AnalysisDokument4 SeitenIncome Statement and Balance Sheet Analysisbittesh chakiNoch keine Bewertungen

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Dokument6 SeitenSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoNoch keine Bewertungen

- UST Debt Policy Spreadsheet (Reduced)Dokument9 SeitenUST Debt Policy Spreadsheet (Reduced)Björn Auðunn ÓlafssonNoch keine Bewertungen

- Meerut Adventure Company CV1Dokument9 SeitenMeerut Adventure Company CV1Ayushi GuptaNoch keine Bewertungen

- Inputs For Valuation Current InputsDokument6 SeitenInputs For Valuation Current InputsÃarthï ArülrãjNoch keine Bewertungen

- FcffevaDokument6 SeitenFcffevaShobhit GoyalNoch keine Bewertungen

- Revised ModelDokument27 SeitenRevised ModelAnonymous 0CbF7xaNoch keine Bewertungen

- ABNB ValuationDokument4 SeitenABNB ValuationKasturi MazumdarNoch keine Bewertungen

- Fin 600 - Radio One-Team 3 - Final SlidesDokument20 SeitenFin 600 - Radio One-Team 3 - Final SlidesCarlosNoch keine Bewertungen

- Evercore Partners 8.6.13 PDFDokument6 SeitenEvercore Partners 8.6.13 PDFChad Thayer VNoch keine Bewertungen

- Common Size Income StatementDokument7 SeitenCommon Size Income StatementUSD 654Noch keine Bewertungen

- Refinance Analysis v1.01Dokument1 SeiteRefinance Analysis v1.01AlexNoch keine Bewertungen

- Session 7 - Financial Statements and RatiosDokument23 SeitenSession 7 - Financial Statements and Ratiosalanablues1Noch keine Bewertungen

- Solucion Caso Lady MDokument13 SeitenSolucion Caso Lady Mjohana irma ore pizarroNoch keine Bewertungen

- LORL Write UpDokument5 SeitenLORL Write UpAIGswap100% (1)

- Tire City Case AnalysisDokument10 SeitenTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)Noch keine Bewertungen

- Class Exercise Fashion Company Three Statements Model - CompletedDokument16 SeitenClass Exercise Fashion Company Three Statements Model - CompletedbobNoch keine Bewertungen

- Flash - Memory - Inc From Website 0515Dokument8 SeitenFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- Pacific Grove Spice CompanyDokument3 SeitenPacific Grove Spice CompanyLaura JavelaNoch keine Bewertungen

- SENEA Financial AnalysisDokument22 SeitenSENEA Financial Analysissidrajaffri72Noch keine Bewertungen

- Revenue projections for 5 years of membership growth and transactionsDokument68 SeitenRevenue projections for 5 years of membership growth and transactionsDGLNoch keine Bewertungen

- 1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678Dokument18 Seiten1/29/2010 2009 360 Apple Inc. 2010 $1,000 $192.06 1000 30% 900,678X.r. GeNoch keine Bewertungen

- Apple Case StudyDokument2 SeitenApple Case StudyPrakhar MorchhaleNoch keine Bewertungen

- Under Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Dokument14 SeitenUnder Armour Valuation and Forecasts Spreadsheet Completed On 7/1/2019Iqbal YusufNoch keine Bewertungen

- Investment CalculationsDokument7 SeitenInvestment CalculationsBEYBI JOEL ESTEBAN VARGASNoch keine Bewertungen

- Simple Interest CalculationDokument7 SeitenSimple Interest CalculationBeybi EstebanNoch keine Bewertungen

- ანრი მაჭავარიანი ფინალურიDokument40 Seitenანრი მაჭავარიანი ფინალურიAnri MachavarianiNoch keine Bewertungen

- Applications 2Dokument7 SeitenApplications 2jaNoch keine Bewertungen

- FM and Dupont of GenpactDokument11 SeitenFM and Dupont of GenpactKunal GarudNoch keine Bewertungen

- TN-1 TN-2 Financials Cost CapitalDokument9 SeitenTN-1 TN-2 Financials Cost Capitalxcmalsk100% (1)

- Case Study No. 3 PDFDokument6 SeitenCase Study No. 3 PDFMuhammadZahirGulNoch keine Bewertungen

- Mercury CaseDokument23 SeitenMercury Caseuygh gNoch keine Bewertungen

- Financial Statement Analysis: I Ntegrated CaseDokument13 SeitenFinancial Statement Analysis: I Ntegrated Casehtet sanNoch keine Bewertungen

- Input: Eurmn - Dec Y/E 2015A 2016A 2017E 2018E 2019E 2020EDokument4 SeitenInput: Eurmn - Dec Y/E 2015A 2016A 2017E 2018E 2019E 2020ERam persadNoch keine Bewertungen

- 08 ENMA302 InflationExamplesDokument8 Seiten08 ENMA302 InflationExamplesMotazNoch keine Bewertungen

- NPV IRR CalculatorDokument3 SeitenNPV IRR CalculatorAli TekinNoch keine Bewertungen

- 61 10 Shares Dividends AfterDokument10 Seiten61 10 Shares Dividends Aftermerag76668Noch keine Bewertungen

- Apple & RIM Merger Model and LBO ModelDokument50 SeitenApple & RIM Merger Model and LBO ModelDarshana MathurNoch keine Bewertungen

- CLW Analysis 6-1-21Dokument5 SeitenCLW Analysis 6-1-21HunterNoch keine Bewertungen

- 07 12 Sensitivity Tables AfterDokument30 Seiten07 12 Sensitivity Tables Aftermerag76668Noch keine Bewertungen

- 04 06 Public Comps Valuation Multiples AfterDokument19 Seiten04 06 Public Comps Valuation Multiples AfterShanto Arif Uz ZamanNoch keine Bewertungen

- Wso Case Study For MF - PruDokument23 SeitenWso Case Study For MF - Prubrentk112Noch keine Bewertungen

- Stryker Corporation - Assignment 22 March 17Dokument4 SeitenStryker Corporation - Assignment 22 March 17Venkatesh K67% (6)

- Valuation - PepsiDokument24 SeitenValuation - PepsiLegends MomentsNoch keine Bewertungen

- Start Startup Financial ModelDokument5 SeitenStart Startup Financial ModelRaman TiwariNoch keine Bewertungen

- 2 Million / 40%) + $5 Million Post-Money Valuation $7 MillionDokument1 Seite2 Million / 40%) + $5 Million Post-Money Valuation $7 MillionShabnam ShahNoch keine Bewertungen

- Inputs For Valuation Current InputsDokument6 SeitenInputs For Valuation Current Inputsapi-3763138Noch keine Bewertungen

- Raw Input Calculated Financial Projections and ValuationDokument5 SeitenRaw Input Calculated Financial Projections and ValuationFırat ŞıkNoch keine Bewertungen

- NYSF - Walmart - TempleateDokument1 SeiteNYSF - Walmart - TempleateFırat ŞıkNoch keine Bewertungen

- Raw Input Calculated Financial Projections and ValuationDokument5 SeitenRaw Input Calculated Financial Projections and ValuationFırat ŞıkNoch keine Bewertungen

- Old School PlaylistDokument1 SeiteOld School PlaylistFırat ŞıkNoch keine Bewertungen

- Why ManufacturingDokument1 SeiteWhy ManufacturingFırat ŞıkNoch keine Bewertungen

- 1st Part of Loan AmortizationDokument3 Seiten1st Part of Loan AmortizationOptimistic ShanNoch keine Bewertungen

- Loan Amortization Schedule1 IBFDokument4 SeitenLoan Amortization Schedule1 IBFM Shiraz KhanNoch keine Bewertungen

- Lecture 1 - Introduction To BankingDokument23 SeitenLecture 1 - Introduction To BankingLeyli MelikovaNoch keine Bewertungen

- International Trade TheoriesDokument38 SeitenInternational Trade Theoriestrustme77Noch keine Bewertungen

- Events Prevented Calculator OverviewDokument5 SeitenEvents Prevented Calculator OverviewAlvaro MuñozNoch keine Bewertungen

- Guidance Note On Audit of Abridged Financial StatementsDokument13 SeitenGuidance Note On Audit of Abridged Financial Statementsstarrydreams19Noch keine Bewertungen

- Curriculum VitaéDokument3 SeitenCurriculum VitaéKaushik MukherjeeNoch keine Bewertungen

- FIN20014 Assignment 2015 SP2 - Capital Budgeting AssignmentDokument3 SeitenFIN20014 Assignment 2015 SP2 - Capital Budgeting AssignmentAssignment Consultancy0% (1)

- Telecommunications in Nepal - Current State and NeedsDokument3 SeitenTelecommunications in Nepal - Current State and NeedsSomanta BhattaraiNoch keine Bewertungen

- Model Trust Deed for Public CharityDokument12 SeitenModel Trust Deed for Public CharityYugandhar venkatram100% (1)

- Chapter 6Dokument20 SeitenChapter 6Federico MagistrelliNoch keine Bewertungen

- MBA - SyllabusDokument56 SeitenMBA - SyllabusPreethi GopalanNoch keine Bewertungen

- A Study On HDFC Mutual FundDokument88 SeitenA Study On HDFC Mutual FundSagar Paul'gNoch keine Bewertungen

- PDF - BASIC ACCOUNTING-CHAPTER-1 (Questions)Dokument3 SeitenPDF - BASIC ACCOUNTING-CHAPTER-1 (Questions)James Ygn100% (3)

- Mahindra FinanceDokument39 SeitenMahindra FinanceRanjeet Rajput50% (2)

- PROMECH Company ProfileDokument38 SeitenPROMECH Company ProfileAbu UmarNoch keine Bewertungen

- Role of Business in Socioeconomic DevelopmentDokument5 SeitenRole of Business in Socioeconomic DevelopmentSydney CagatinNoch keine Bewertungen

- Project Report On Comparison of Mutual Funds With Other Investment OptionsDokument57 SeitenProject Report On Comparison of Mutual Funds With Other Investment Optionsdharmendra dadhichNoch keine Bewertungen

- Relative Strength Index: HistoryDokument4 SeitenRelative Strength Index: HistoryAnonymous sDnT9yuNoch keine Bewertungen

- Introduction to Securitization GuideDokument65 SeitenIntroduction to Securitization GuideVipin GuptaNoch keine Bewertungen

- Financial Markets and Institutions: Ninth EditionDokument59 SeitenFinancial Markets and Institutions: Ninth EditionShahmeer KamranNoch keine Bewertungen

- Match The Concepts With Their Definitions. Look at The ExampleDokument2 SeitenMatch The Concepts With Their Definitions. Look at The ExampleJenny Zulay SUAREZ SOLANO100% (1)

- SbiDokument55 SeitenSbiJaiHanumankiNoch keine Bewertungen

- DCCB STATUTORY RETURNSDokument7 SeitenDCCB STATUTORY RETURNSTannyCharayaNoch keine Bewertungen

- My Crusade Against Permanent Gold BackwardationDokument12 SeitenMy Crusade Against Permanent Gold BackwardationlarsrordamNoch keine Bewertungen

- Model Guide To Securitisation Techniques: Slaughter and MayDokument42 SeitenModel Guide To Securitisation Techniques: Slaughter and May111Noch keine Bewertungen

- Financial Management Notebook 1Dokument14 SeitenFinancial Management Notebook 1ngocmytrieuNoch keine Bewertungen

- Chey Khana Research by Arif HussainDokument17 SeitenChey Khana Research by Arif HussainArif KhanNoch keine Bewertungen

- Cadbury Poland CaseDokument2 SeitenCadbury Poland CaseWint Wah Hlaing0% (1)

- Chapter # 2 Financial AnalysisDokument94 SeitenChapter # 2 Financial Analysiswondosen birhanuNoch keine Bewertungen