Beruflich Dokumente

Kultur Dokumente

Income Tax Slab 2011-2012

Hochgeladen von

Nand Kishore DubeyOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Income Tax Slab 2011-2012

Hochgeladen von

Nand Kishore DubeyCopyright:

Verfügbare Formate

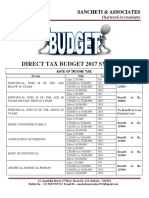

Income tax slab 2011-2012

Here is the latest income tax slab rates for Year 2011-2012. This tax table based on the latest income

tax slab is a ready reference for calculating your income tax for year 2011-12. Quick highlights

Base slab for general tax payers increased to 1.8 lakh from original 1.6 lakh

Senior citizen age reduced to 60 years from last years 65 years. Senior citizen now include

people between 60 and 80 years. Also increased the base slab for senior citizen to 2.5 lakh

from previous years 2.4 lakh

A new category called "Very Senior citizen" added for people above 80 years.

Income tax slab (in Rs.) Tax

0 to 1,80,000 No tax

1,80,001 to 5,00,000 10%

5,00,001 to 8,00,000 20%

Above 8,00,000 30%

Income tax slabs 2011-2012 for Women

Income tax slab (in Rs.) Tax

0 to 1,90,000 No tax

1,90,001 to 5,00,000 10%

5,00,001 to 8,00,000 20%

Above 8,00,000 30%

Income tax slabs 2011-2012 for Senior citizen (Aged 60 years but less

than 80 years)

Income tax slab (in Rs.) Tax

0 to 2,50,000 No tax

2,50,001 to 5,00,000 10%

5,00,001 to 8,00,000 20%

Above 8,00,000 30%

Income tax slabs 2011-2012 for Very Senior citizen (Above 80 years)

Income tax slab (in Rs.) Tax

0 to 5,00,000 0%

5,00,001 to 8,00,000 20%

Above 8,00,000 30%

Das könnte Ihnen auch gefallen

- Income Tax SlabDokument2 SeitenIncome Tax SlabKalpesh ChudasamaNoch keine Bewertungen

- Income Tax RatesDokument1 SeiteIncome Tax RatesshubhozNoch keine Bewertungen

- Tax Audit Limit & Tax RatesDokument6 SeitenTax Audit Limit & Tax RatesPhani SankaraNoch keine Bewertungen

- Income Tax Slab For Ay 11Dokument1 SeiteIncome Tax Slab For Ay 11mmmukhtarNoch keine Bewertungen

- Income Tax Slabs A.Y. 2012-2013Dokument1 SeiteIncome Tax Slabs A.Y. 2012-2013yogitatanavadeNoch keine Bewertungen

- EURION - Union BudgetDokument3 SeitenEURION - Union BudgetEurion ConstellationNoch keine Bewertungen

- Income Tax Slab Fy 2009-10Dokument1 SeiteIncome Tax Slab Fy 2009-10naveenNoch keine Bewertungen

- Union Budget of IndiaDokument6 SeitenUnion Budget of Indiashalinivd3Noch keine Bewertungen

- Income Tax Slabs 2007-08 To 2010-11Dokument4 SeitenIncome Tax Slabs 2007-08 To 2010-11Manoj ThuthijaNoch keine Bewertungen

- Unit 1 Topic 2ndDokument2 SeitenUnit 1 Topic 2ndAnjali. 1999Noch keine Bewertungen

- Tax Rates For IndividualsDokument2 SeitenTax Rates For Individualspiyushpandey451876Noch keine Bewertungen

- IncomeTax Calculator 2010-11Dokument2 SeitenIncomeTax Calculator 2010-11Vimal PatelNoch keine Bewertungen

- Income Tax Calculator FY 2023 24 Age Below 60 YearsDokument4 SeitenIncome Tax Calculator FY 2023 24 Age Below 60 YearsRrrNoch keine Bewertungen

- Budget 2011 Tax Structure For MenDokument1 SeiteBudget 2011 Tax Structure For MenSujan AnnaiahNoch keine Bewertungen

- Income TaxDokument1 SeiteIncome TaxManoj KNoch keine Bewertungen

- Income Tax Rates Ay12-13Dokument1 SeiteIncome Tax Rates Ay12-13Kashmira RNoch keine Bewertungen

- 80.1cm (32) HD Flat TV FH4003 Series 4Dokument6 Seiten80.1cm (32) HD Flat TV FH4003 Series 4Jose JohnNoch keine Bewertungen

- Types of TaxesDokument15 SeitenTypes of TaxesNischal KumarNoch keine Bewertungen

- Slab Rates IncometaxDokument8 SeitenSlab Rates IncometaxPPEARL09Noch keine Bewertungen

- Income TaxDokument4 SeitenIncome Taxsai santhoshNoch keine Bewertungen

- Income Tax Amendments 2018-2019Dokument6 SeitenIncome Tax Amendments 2018-2019Thileep SathyaNoch keine Bewertungen

- Taxable - Income - Formula - Excel - TemplateDokument8 SeitenTaxable - Income - Formula - Excel - TemplateFaizan AhmadNoch keine Bewertungen

- Income Tax Rates For The Past 10 YearsDokument10 SeitenIncome Tax Rates For The Past 10 YearsTarang DoshiNoch keine Bewertungen

- Direct and Indirect Taxes: Assignment OnDokument9 SeitenDirect and Indirect Taxes: Assignment Onpurn kaurNoch keine Bewertungen

- Income Tax Rates SlabsDokument2 SeitenIncome Tax Rates Slabspankaj_adv5314Noch keine Bewertungen

- Old Vs New Tax Rates Regime (6 Cases)Dokument6 SeitenOld Vs New Tax Rates Regime (6 Cases)Jigeesha BhargaviNoch keine Bewertungen

- Sols-Dr RajniDokument5 SeitenSols-Dr Rajnialex breymannNoch keine Bewertungen

- Comparison of Tax Liabilities PreDokument2 SeitenComparison of Tax Liabilities Presandipon1Noch keine Bewertungen

- Chidambaram Pranab Mukherjee: Arya Baride. Amruta Bage. Tejas Aptikar. Shital Girigosavi. Pradnya ChaudhariDokument10 SeitenChidambaram Pranab Mukherjee: Arya Baride. Amruta Bage. Tejas Aptikar. Shital Girigosavi. Pradnya ChaudhariAnkit JainNoch keine Bewertungen

- 1 3+part+2Dokument28 Seiten1 3+part+2jaspreet kaurNoch keine Bewertungen

- About & Tax Regime: Frequently Asked Questions (FAQ)Dokument6 SeitenAbout & Tax Regime: Frequently Asked Questions (FAQ)umasankarNoch keine Bewertungen

- Income Tax Slab Fy 2020-21Dokument1 SeiteIncome Tax Slab Fy 2020-21Nabhya's FamilyNoch keine Bewertungen

- Income Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)Dokument2 SeitenIncome Tax Rates: For AY 2021-22 (New) & A.Y. 2020-21 (Old)pankaj goyalNoch keine Bewertungen

- Income Tax Rates/Slabs For A.Y. (2011-12) : Slab (RS.) Tax (RS.)Dokument4 SeitenIncome Tax Rates/Slabs For A.Y. (2011-12) : Slab (RS.) Tax (RS.)Achal MittalNoch keine Bewertungen

- Income Tax: Click HereDokument3 SeitenIncome Tax: Click HereRrrNoch keine Bewertungen

- Budget Slab ChangesDokument3 SeitenBudget Slab ChangesPaymaster ServicesNoch keine Bewertungen

- Other Than Senior and Super Senior CitizenDokument6 SeitenOther Than Senior and Super Senior CitizenKishan PatelNoch keine Bewertungen

- Income Tax RatesDokument1 SeiteIncome Tax RatesAcharla NarasimhaNoch keine Bewertungen

- Income Tax Rates For Financial Year 2010-11Dokument2 SeitenIncome Tax Rates For Financial Year 2010-11tekleyNoch keine Bewertungen

- Tax CalculatorDokument3 SeitenTax CalculatorumaNoch keine Bewertungen

- International Tax ComparisonsDokument23 SeitenInternational Tax ComparisonsJahnavi BadlaniNoch keine Bewertungen

- Indian Income Tax Rates (AY 1998-99 To 2011-12)Dokument5 SeitenIndian Income Tax Rates (AY 1998-99 To 2011-12)Himanshu0% (1)

- Income Tax SlabsDokument2 SeitenIncome Tax SlabsGhulam AwaisNoch keine Bewertungen

- TAX LIABILITY PDF) OkDokument7 SeitenTAX LIABILITY PDF) OksaeNoch keine Bewertungen

- AY 20-21 Tax RatesDokument4 SeitenAY 20-21 Tax Ratesashim1Noch keine Bewertungen

- Tax - Calc 09 10Dokument1 SeiteTax - Calc 09 10sahubh100% (3)

- Income TaxDokument2 SeitenIncome TaxsunilgswmNoch keine Bewertungen

- Income Taxation PPT - pptx-1Dokument28 SeitenIncome Taxation PPT - pptx-1Irfan AhmedNoch keine Bewertungen

- Tax CalculatorDokument3 SeitenTax CalculatorRohit KumarNoch keine Bewertungen

- Few Points To Be Kept in Mind While Doing Investment DeclarationDokument8 SeitenFew Points To Be Kept in Mind While Doing Investment Declarationcool rock MohindraNoch keine Bewertungen

- Few Points To Be Kept in Mind While Doing Investment DeclarationDokument8 SeitenFew Points To Be Kept in Mind While Doing Investment Declarationcool rock MohindraNoch keine Bewertungen

- Income Tax Slab FY 2014-15Dokument3 SeitenIncome Tax Slab FY 2014-15zveeraNoch keine Bewertungen

- Budget - 2017 - 2018Dokument3 SeitenBudget - 2017 - 2018kannnamreddyeswarNoch keine Bewertungen

- Direct Tax BlogDokument3 SeitenDirect Tax BlogArpit GuptaNoch keine Bewertungen

- Income Tax Rates PDFDokument1 SeiteIncome Tax Rates PDFAditi SharmaNoch keine Bewertungen

- Module 1 Direct Tax DR BRR 2022 StudentsDokument9 SeitenModule 1 Direct Tax DR BRR 2022 StudentsDr. Batani Raghavendra RaoNoch keine Bewertungen

- Tax Sheet - A.Y 2024-25Dokument3 SeitenTax Sheet - A.Y 2024-25bajajvanshica23Noch keine Bewertungen

- Tax Slab 10-11Dokument2 SeitenTax Slab 10-11Mohit TandonNoch keine Bewertungen

- ASSESSMENT YEAR 2009-2010 Tax Rates For Assessment Year 2009-10 For Resident Woman (Who Is Below 65 Years)Dokument4 SeitenASSESSMENT YEAR 2009-2010 Tax Rates For Assessment Year 2009-10 For Resident Woman (Who Is Below 65 Years)sayyedasif56Noch keine Bewertungen

- Project Cruitment Selection ProcessDokument69 SeitenProject Cruitment Selection ProcessNand Kishore DubeyNoch keine Bewertungen

- Project EportDokument109 SeitenProject EportNand Kishore DubeyNoch keine Bewertungen

- Report Vi Mba 73Dokument74 SeitenReport Vi Mba 73Nand Kishore DubeyNoch keine Bewertungen

- Docs of TDSDokument147 SeitenDocs of TDSNand Kishore DubeyNoch keine Bewertungen

- Synopsis TDSDokument20 SeitenSynopsis TDSNand Kishore DubeyNoch keine Bewertungen

- Growth of Retail SectorDokument93 SeitenGrowth of Retail SectorNand Kishore DubeyNoch keine Bewertungen

- Real Estate Management MbaDokument65 SeitenReal Estate Management MbaNand Kishore DubeyNoch keine Bewertungen

- Key Features of The PMKVY AreDokument3 SeitenKey Features of The PMKVY AreNand Kishore DubeyNoch keine Bewertungen

- Documentation of Insurance Compny Management SystemsDokument131 SeitenDocumentation of Insurance Compny Management SystemsNand Kishore DubeyNoch keine Bewertungen

- MBA Project ReportDokument99 SeitenMBA Project ReportNand Kishore DubeyNoch keine Bewertungen

- Online-Shopping - 3Dokument90 SeitenOnline-Shopping - 3Nand Kishore DubeyNoch keine Bewertungen

- Documentation of Tax Deduction at SourceDokument147 SeitenDocumentation of Tax Deduction at SourceNand Kishore DubeyNoch keine Bewertungen

- Registration and Wallet Creation Process PDFDokument11 SeitenRegistration and Wallet Creation Process PDFNand Kishore DubeyNoch keine Bewertungen

- Layout PlanDokument1 SeiteLayout PlanNand Kishore DubeyNoch keine Bewertungen

- LIst of ITI in DeoriaDokument4 SeitenLIst of ITI in DeoriaNand Kishore DubeyNoch keine Bewertungen

- Fitter SyllabusDokument29 SeitenFitter SyllabusNand Kishore DubeyNoch keine Bewertungen

- ITI ListDokument16 SeitenITI ListNand Kishore DubeyNoch keine Bewertungen

- Electrician (Semester Pattern) : Syllabus For The Trade OFDokument30 SeitenElectrician (Semester Pattern) : Syllabus For The Trade OFNand Kishore DubeyNoch keine Bewertungen

- NmartDokument41 SeitenNmartNand Kishore DubeyNoch keine Bewertungen

- Eten-Ias RM Training 7 May'18Dokument81 SeitenEten-Ias RM Training 7 May'18Nand Kishore DubeyNoch keine Bewertungen