Beruflich Dokumente

Kultur Dokumente

PH Tax in A Dot Implementing Rules Regulations Train Law 21mar2018 PDF

Hochgeladen von

Wilmar AbriolOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PH Tax in A Dot Implementing Rules Regulations Train Law 21mar2018 PDF

Hochgeladen von

Wilmar AbriolCopyright:

Verfügbare Formate

Philippines | Tax & Corporate Services | 21 March 2018

Implementing rules and regulations

of the TRAIN Law

The Bureau of Internal Revenue (BIR) issued Revenue Regulations

No. (RR) 13-2018 implementing the value-added tax (VAT)

provisions of Republic Act No. 10963 or Tax Reform for Acceleration

and Inclusion (TRAIN) Law by amending RR 16-2005 (Consolidated

VAT Regulations of 2005), with its salient features as follows:

VAT zero-rated sales of goods and properties

1. The VAT zero rating on the following sales by VAT registered

taxpayers shall be removed upon satisfaction of the following

conditions: (a) the successful establishment and

implementation of an enhanced VAT refund system that

grants and pays refunds of creditable input tax within 90 days

from the filing of the VAT refund application with the BIR; and

(b) cash refund by 31 December 2019 of all pending VAT

refund claims as of 31 December 2017.

a. The sale of raw materials or packaging materials to a

non-resident buyer for delivery to a resident local

export-oriented enterprise to be used in

manufacturing, processing, packing, or repacking in

the Philippines of the said buyer's goods, paid for in

acceptable foreign currency, and accounted for in

accordance with the rules and regulations of the

Bangko Sentral ng Pilipinas (BSP)

b. The sale of raw materials or packaging materials to an

export-oriented enterprise whose export sales exceed

70% of total annual production

c. Transactions considered export sales under Executive

Order No. 226, otherwise known as the Omnibus

Investments Code of 1987, and other special laws

2. Sales to bonded manufacturing warehouse for export-oriented

manufacturers, export traders, diplomatic missions, and

Philippine Economic Zone Authority (PEZA) are considered

export sales under Executive Order No. 226 and other special

laws subject to 0% VAT.

Even without actual exportation, the following shall be

considered constructively exported subject to 0% VAT: (1)

sales to bonded manufacturing warehouses of export-oriented

manufacturers; (2) sales to export processing zones; (3)

sales to registered export traders operating bonded trading

warehouses supplying raw materials in the manufacture of

export products under guidelines to be set by the Board in

consultation with the Bureau of Internal Revenue (BIR) and

the Bureau of Customs (BOC); (4) sales of locally

manufactured, assembled, or repacked products - whether

paid for in foreign currency or not - to diplomatic missions

and other agencies and/or instrumentalities granted tax

immunities.

However, VAT zero rating on sales to bonded manufacturing

warehouse for export-oriented manufacturers, export traders,

diplomatic missions, and PEZA shall be removed upon

establishment of enhanced refund system and cash refund by

31 December 2019 of all pending VAT refund claims as of 31

December 2017.

3. VAT zero rating on sale of goods, supplies, and equipment to

international shipping and international air transport

companies

To be subject to 0% VAT, the sale of goods, supplies,

equipment, and fuel to persons engaged in international

shipping or international air transport operations should be

used exclusively for international shipping or air transport

operations.

VAT zero-rated sale of services

1. VAT zero rating on sale of service to international shipping

and international air transport companies

To be subject to 0% VAT, services rendered to persons

engaged in international shipping or air transport operations,

including leases of property, shall be exclusively for

international shipping or air transport operations.

2. The transport of passengers and cargo by domestic air or sea

vessels from the Philippines to a foreign country is a VAT

zero-rated transaction.

3. The VAT zero rating on the following sales by VAT registered

taxpayers shall be removed upon satisfaction of the following

conditions: (a) the successful establishment and

implementation of an enhanced VAT refund system that

grants and pays refunds of creditable input tax within 90 days

from the filing of the VAT refund application with the BIR; and

(b) cash refund by 31 December 2019 of all pending VAT

refund claims as of 31 December 2017.

a. Processing, manufacturing, or repacking of goods for

other persons doing business outside the Philippines,

which are subsequently exported, where the services

are paid for in acceptable foreign currency and

accounted for in accordance with the rules and

regulations of the BSP

b. Services performed by subcontractors and/or

contractors in processing, converting, or manufacturing

goods for an enterprise whose export sales exceed 70%

of the total annual production

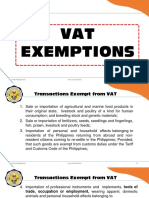

VAT-exempt sale of goods and services

1. VAT-free importation of personal belongings of OFWs or

Filipinos settling in the Philippines

The importation of professional instruments and implements,

tools of trade, occupation or employment, wearing apparel,

domestic animals, and personal and household effects

belonging to persons coming to settle in the Philippines or

Filipinos or their families who are considered residents or

citizens of other countries, such as OFWs, in quantities and of

class suitable to the profession, rank, or position of the

person importing said items, for their own use and not for

barter or sale, or arriving within a reasonable time, shall be

exempt from VAT.

2. Sale of electricity subject to 12% VAT

The sale of electricity, transmission by any entity, including

the National Grid Corporation of the Philippines, and

distribution companies, including electric cooperatives, shall

be subject to 12% VAT.

3. VAT on sale and lease of real properties

Beginning 1 January 2021, the VAT exemption shall only

apply to sale of real properties not primarily held for sale to

customers or held for lease in the ordinary course of trade or

business, sale of real property utilized for socialized housing

as defined by Republic Act (RA) No. 7279, sale of house and

lot, and other residential dwellings with selling price of not

more than P2,000,000.

Lease of residential units with a monthly rental fee per unit

not exceeding P15,000 is VAT exempt. In cases where a

lessor has several residential units for lease where some are

leased out for a monthly rental fee per unit not exceeding

P15,000 while others are leased out for more than P15,000

per unit, his tax liability will be as follows:

a. The gross receipts from rentals not exceeding

P15,000 per month per unit shall be exempt from VAT

regardless of the aggregate annual gross receipts. It

is also exempt from the 3% percentage tax.

b. The gross receipts from rentals exceeding P15,000

per month per unit shall be subject to VAT if the

aggregate annual gross receipts from said units only

exceeds P3,000,000. Otherwise, the gross receipts

will be subject to the 3% tax imposed under Section

116 of the National Internal Revenue Code of 1997,

as amended (Tax Code).

4. VAT on importation of fuel, goods, and supplies by

international shipping and air transport operators

The importation of fuel, goods, and supplies by persons

engaged in international shipping or air transport operations

shall be used for international shipping or air transport

operations to be exempt from VAT.

5. VAT-exempt sale or lease of goods and services to senior

citizens and persons with disabilities

The sale or lease of goods and services to senior citizens and

persons with disabilities, as provided under RA 9994

(Expanded Senior Citizens Act of 2010) and RA 10754 (An Act

Expanding the Benefits and Privileges of Persons with

Disability), respectively, shall be exempt from VAT.

6. VAT-exempt transfer of property under Section 40(C)(2) of

the Tax Code

The transfer of property pursuant to Section 40(C)(2) of the

Tax Code is exempt from VAT.

7. VAT exemption of condominium dues

Association dues, membership fees, and other assessments

and charges collected on a purely reimbursement basis by

homeowners’ associations and condominium corporations

established under RA 9904 (Magna Carta for Homeowners

and Homeowners’ Association) and RA 4726 (The

Condominium Act), respectively, are exempt from VAT.

8. VAT-exempt sale of gold to BSP

The sale of gold to BSP shall be exempt from VAT, instead of

subject to 0% VAT.

9. Sale of drugs and medicines for diabetes and cholesterol and

hypertension shall be VAT exempt starting 1 January 2019.

The sale of drugs and medicines prescribed for diabetes, high

cholesterol, and hypertension beginning 1 January 2019, as

determined by the Department of Health, shall be exempt

from VAT.

10. VAT-exempt threshold increased to P3 million

The VAT-exempt threshold on sale or lease of goods or

properties or the performance of services is increased from

P1,500,000 (P1,919,500) gross annual sales and/or receipts

to P3,000,000.

Phase-out of amortization of input VAT on capital goods

The amortization of input VAT shall only be allowed until 31

December 2021, after which taxpayers with unutilized input VAT on

capital goods purchased or imported shall be allowed to apply the

same as scheduled until fully utilized.

Refund of input tax due to cancellation of VAT registration

The date of cancellation for refund purposes is the date of issuance

of tax clearance by the BIR after full settlement of all tax liabilities

relative to cessation of business or change of status of the concerned

taxpayer. The filing of the claim for refund in relation to the

retirement or cessation of business shall be made only after

completion of the mandatory audit of all internal revenue tax

liabilities covering the immediately preceding year and the short

period return and the issuance of the applicable tax clearance/s by

the appropriate Revenue District Office (RDO) having jurisdiction

over the taxpayer.

Period to refund or credit input taxes

The BIR has 90 days to grant the refund of creditable input VAT from

the date of submission of the official receipts or invoices and other

documents in support of the application filed.

The 90-day period to process and decide, pending the establishment

of the enhanced VAT Refund System, shall only be up to the date of

approval of the Recommendation Report on such application for VAT

refund by the Commissioner or his duly authorized representative.

All claims for refund/tax credit certificate filed prior to 1 January

2018 will be governed by the 120-day processing period.

Failure on the part of any official, agent, or employee of the BIR to

act on the application within the 90- day period shall be punishable

under Section 269 of the Tax Code, as amended.

No more monthly VAT returns beginning 1 January 2023

Beginning 1 January 2023, the filing and payment required under the

Tax Code shall be done within 25 days following the close of each

taxable quarter.

Shift to creditable withholding VAT system on government

money payments starting from 1 January 2021

Beginning 1 January 2021, the 5% final withholding VAT system on

sales to government will shift to creditable VAT system, except for

payments for purchase of goods and services arising from projects

funded by the Official Development Assistance (ODA) as defined

under RA 8182 (Official Development Assistance Act of 1996), which

shall not be subject to the final/creditable withholding taxes.

Cooperatives and self-employed individuals/professionals

availing of 8% tax exempt from payment of 3% percentage

tax

Cooperatives and self-employed individuals and professionals

availing of the 8% tax on gross sales and/or receipts and other non-

operating income whose sales or receipts are exempt from the

payment of VAT and who are not VAT-registered persons shall be

exempt from the payment of 3% percentage tax (Section 4-116).

Transitory rules

1. An existing VAT-registered taxpayer whose gross sales/receipts

in the preceding taxable year did not exceed the VAT threshold of

P3,000,000 may continue to be VAT-registered taxpayer and

avail of the “Optional Registration for Value-Added Tax of Exempt

Person”. Once availed, the taxpayer shall not be entitled to

cancel the VAT registration for the next three years.

2. A VAT-registered taxpayer who opted to register as non-VAT as a

result of the implementation of the TRAIN Law shall immediately:

a. Submit an inventory list of unused invoices and/or

receipts as of the date of filing of application for update of

registration from VAT to non-VAT, indicating the number

of booklets and its corresponding serial numbers

b. Surrender the said invoices and/or receipts for

cancellation

A number of unused invoices/receipts, as determined by the

taxpayer with the approval of the appropriate RDO, may be

allowed for use provided the phrase “Non-VAT registered as

of (date of filing an application for update of

registration). Not valid for claim of input tax.” shall be

stamped on the face of each and every copy thereof, until new

registered non-VAT invoices or receipts have been received by

the taxpayer. Upon such receipt, the taxpayer shall submit a

new inventory list of, and surrender for cancellation, all unused

previously-stamped invoices/receipts.

Please click here to view Revenue Regulations No. 13-2018 for your

reference and guidance.

For inquiries, please contact:

Walter L. Abela Jr. Richard R. Lapres

Tax Partner Tax Partner

wabela@deloitte.com rlapres@deloitte.com

+63 2 581 9034 +63 2 581 9044

Alvin Noel R. Saldana

Tax Principal

asaldana@deloitte.com

+63 2 581 9046

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited

by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of

its member firms are legally separate and independent entities. DTTL (also referred to as “Deloitte

Global”) does not provide services to clients. Please see www.deloitte.com/ph/about to learn more

about our global network of member firms.

This communication contains general information only, and none of Deloitte Touche Tohmatsu

Limited, its member firms, or their related entities (collectively, the “Deloitte Network”) is, by

means of this communication, rendering professional advice or services. Before making any

decision or taking any action that may affect your finances or your business, you should consult a

qualified professional adviser. No entity in the Deloitte Network shall be responsible for any loss

whatsoever sustained by any person who relies on this communication.

© 2018 Navarro Amper & Co.

To no longer receive emails about this topic please send a return email to the sender with the

word “Unsubscribe” in the subject line.

Das könnte Ihnen auch gefallen

- Value Added TaxDokument14 SeitenValue Added TaxWyndell AlajenoNoch keine Bewertungen

- Zero-Rated Sales PDFDokument24 SeitenZero-Rated Sales PDFNEstandaNoch keine Bewertungen

- Digest RR 13-2018Dokument9 SeitenDigest RR 13-2018Maria Rose Ann BacilloteNoch keine Bewertungen

- Value Added Tax 3Dokument8 SeitenValue Added Tax 3Nerish PlazaNoch keine Bewertungen

- RR No. 13-2018 CorrectedDokument20 SeitenRR No. 13-2018 CorrectedRap BaguioNoch keine Bewertungen

- RR 13-2018Dokument20 SeitenRR 13-2018Nikka Bianca Remulla-IcallaNoch keine Bewertungen

- VAT Summary of Changes Under The TRAIN LawDokument4 SeitenVAT Summary of Changes Under The TRAIN LawrafastilNoch keine Bewertungen

- 1) 7.22.19 VAT DiscussionsDokument30 Seiten1) 7.22.19 VAT DiscussionsJanarie Bosco OrofilNoch keine Bewertungen

- Joan REPORTING TAX 1Dokument6 SeitenJoan REPORTING TAX 1Jasmin CaoileNoch keine Bewertungen

- Business Taxation 3Dokument47 SeitenBusiness Taxation 3Prince Isaiah JacobNoch keine Bewertungen

- BUSINESS-TAXATION-group 5Dokument22 SeitenBUSINESS-TAXATION-group 5jheanniver nabloNoch keine Bewertungen

- Antonio, Gladys C. Bagon, Jaleen Anne A. Lapura, MelgenDokument22 SeitenAntonio, Gladys C. Bagon, Jaleen Anne A. Lapura, MelgenJayvee FelipeNoch keine Bewertungen

- VAT ModuleDokument50 SeitenVAT ModuleRovi Anne IgoyNoch keine Bewertungen

- TAX 302 VAT Exempt Transactions 1Dokument6 SeitenTAX 302 VAT Exempt Transactions 1Jeen JeenNoch keine Bewertungen

- TAX-302 (VAT-Exempt Transactions)Dokument7 SeitenTAX-302 (VAT-Exempt Transactions)Edith DalidaNoch keine Bewertungen

- SUMMARY OF TAX TABLES AND RATES Train LawDokument5 SeitenSUMMARY OF TAX TABLES AND RATES Train LawErnest Christopher Viray GonzaludoNoch keine Bewertungen

- VAT Codal and RegulationsDokument6 SeitenVAT Codal and RegulationsVictor LimNoch keine Bewertungen

- Application For VAT Zero RatingDokument9 SeitenApplication For VAT Zero RatingHanabishi RekkaNoch keine Bewertungen

- Felipe, Emmyrose N. BSA-3 (Tax 2 MW 8:30-10:00am)Dokument5 SeitenFelipe, Emmyrose N. BSA-3 (Tax 2 MW 8:30-10:00am)AustinNoch keine Bewertungen

- Tax Supplemental Reviewer - October 2019Dokument48 SeitenTax Supplemental Reviewer - October 2019Queenie ValleNoch keine Bewertungen

- Tax 30222Dokument5 SeitenTax 30222Ronariza BondocNoch keine Bewertungen

- DomondonDokument40 SeitenDomondonCharles TamNoch keine Bewertungen

- VAT ReviewerDokument72 SeitenVAT ReviewerJohn Kenneth AcostaNoch keine Bewertungen

- Tax UpdatesDokument19 SeitenTax UpdatesYeoh MaeNoch keine Bewertungen

- Value-Added TaxDokument30 SeitenValue-Added TaxmeriiNoch keine Bewertungen

- Business Tax IntroductionDokument5 SeitenBusiness Tax IntroductionJessica MalijanNoch keine Bewertungen

- Revenue Regulations No. 13-18: CD Technologies Asia, Inc. © 2019Dokument17 SeitenRevenue Regulations No. 13-18: CD Technologies Asia, Inc. © 2019Lance MorilloNoch keine Bewertungen

- Tax Alert No. 36 - PWC PhilippinesDokument4 SeitenTax Alert No. 36 - PWC PhilippinesbenedickNoch keine Bewertungen

- Reviewer BTTDokument14 SeitenReviewer BTTAlthea Frances VasalloNoch keine Bewertungen

- RR No. 13-2018 (VAT Refund)Dokument23 SeitenRR No. 13-2018 (VAT Refund)Hailin QuintosNoch keine Bewertungen

- Transfer and Business Taxation - MIDTERMDokument14 SeitenTransfer and Business Taxation - MIDTERMYvette Pauline JovenNoch keine Bewertungen

- 4 VAT ExemptionsDokument28 Seiten4 VAT ExemptionsMobile LegendsNoch keine Bewertungen

- Secret Files For TXDokument118 SeitenSecret Files For TXGrace EnriquezNoch keine Bewertungen

- TAX-302 (VAT-Exempt Transactions) PDFDokument5 SeitenTAX-302 (VAT-Exempt Transactions) PDFclara san miguelNoch keine Bewertungen

- Revenue Regulations No. 16-2005 (Digest)Dokument19 SeitenRevenue Regulations No. 16-2005 (Digest)JERepaldoNoch keine Bewertungen

- VALUE Added TaxDokument20 SeitenVALUE Added TaxMadz Rj MangorobongNoch keine Bewertungen

- Business TaxesDokument50 SeitenBusiness TaxesMacatol KristineNoch keine Bewertungen

- Business TaxesDokument50 SeitenBusiness TaxesSunny DaeNoch keine Bewertungen

- Adzu Tax02 A Learning Packet 2 Value Added TaxDokument9 SeitenAdzu Tax02 A Learning Packet 2 Value Added TaxJustine Paul Pangasi-an100% (1)

- PT, Excise and DST NotesDokument10 SeitenPT, Excise and DST NotesFayie De LunaNoch keine Bewertungen

- Domondon Reviewer - Tax 2Dokument38 SeitenDomondon Reviewer - Tax 2Mar DevelosNoch keine Bewertungen

- Vat On Sale of Goods or PropertiesDokument7 SeitenVat On Sale of Goods or Propertiesnohair100% (3)

- Feb 23 Class VATDokument58 SeitenFeb 23 Class VATybun100% (1)

- Title Iv Value-Added Tax: Chapter I - Imposition of TaxDokument3 SeitenTitle Iv Value-Added Tax: Chapter I - Imposition of TaxNickNoch keine Bewertungen

- Value Added TaxDokument32 SeitenValue Added Taxsei1davidNoch keine Bewertungen

- Value Added TaxDokument11 SeitenValue Added TaxYvette Pauline JovenNoch keine Bewertungen

- Chapter I - Imposition of Tax: Title Iv Value-Added TaxDokument8 SeitenChapter I - Imposition of Tax: Title Iv Value-Added TaxCher TantiadoNoch keine Bewertungen

- Zero - Rated / Effectively Zero-Rated Transactions ExplanationDokument2 SeitenZero - Rated / Effectively Zero-Rated Transactions ExplanationValerie Kaye BinayasNoch keine Bewertungen

- Lesson 5 BtaxDokument6 SeitenLesson 5 Btaxdin matanguihanNoch keine Bewertungen

- Vat AssDokument6 SeitenVat AssRhanda BernardoNoch keine Bewertungen

- Introduction To Business TaxesDokument32 SeitenIntroduction To Business TaxesGracelle Mae Oraller100% (2)

- Pre-Week Notes On Vat: Prepared by Dr. Jeannie P. LimDokument11 SeitenPre-Week Notes On Vat: Prepared by Dr. Jeannie P. LimMark MagnoNoch keine Bewertungen

- Value Added Tax (VAT) : Sec. 105 To 115Dokument52 SeitenValue Added Tax (VAT) : Sec. 105 To 115Alice WuNoch keine Bewertungen

- Module 4 - Value Added TaxDokument16 SeitenModule 4 - Value Added Taxanon_455551365Noch keine Bewertungen

- Articles About VAT Zero-RatingDokument8 SeitenArticles About VAT Zero-RatingkmoNoch keine Bewertungen

- Async 2022 VAT UPDATEDokument8 SeitenAsync 2022 VAT UPDATEBogs QuitainNoch keine Bewertungen

- A. Business TaxesDokument10 SeitenA. Business TaxesLeonard CañamoNoch keine Bewertungen

- Tax Feb 17Dokument103 SeitenTax Feb 17Lolit CarlosNoch keine Bewertungen

- Executive Summary: Financial ConditionDokument3 SeitenExecutive Summary: Financial ConditionWilmar AbriolNoch keine Bewertungen

- WarzoneDokument3 SeitenWarzoneWilmar Abriol0% (1)

- Bookkeeping NC IIIDokument73 SeitenBookkeeping NC IIILonAtanacio82% (11)

- Advance Reversal Strat Wysetrade WebinarDokument39 SeitenAdvance Reversal Strat Wysetrade WebinarWilmar Abriol93% (15)

- Executive Summary: Particulars 2017 2016 Increase (Decrease) Amount % Financial ConditionDokument4 SeitenExecutive Summary: Particulars 2017 2016 Increase (Decrease) Amount % Financial ConditionWilmar AbriolNoch keine Bewertungen

- Sasmuan Pampanga ES2019Dokument7 SeitenSasmuan Pampanga ES2019Wilmar AbriolNoch keine Bewertungen

- Advance Reversal Strat Wysetrade WebinarDokument39 SeitenAdvance Reversal Strat Wysetrade WebinarWilmar Abriol93% (15)

- Data Entry Training MaterialsDokument4 SeitenData Entry Training MaterialsWilmar AbriolNoch keine Bewertungen

- PFRS and RCA Training Course Outline With RPs - Class 1 and 2Dokument2 SeitenPFRS and RCA Training Course Outline With RPs - Class 1 and 2Wilmar AbriolNoch keine Bewertungen

- Formulas For Business Combination PDFDokument28 SeitenFormulas For Business Combination PDFJulious CaalimNoch keine Bewertungen

- MCQ - Taxation Law ReviewDokument24 SeitenMCQ - Taxation Law ReviewphiongskiNoch keine Bewertungen

- PRTC Tax PDFDokument13 SeitenPRTC Tax PDFWilmar AbriolNoch keine Bewertungen

- Documentary Stamp Tax PDFDokument9 SeitenDocumentary Stamp Tax PDFQuinnee VallejosNoch keine Bewertungen

- Business Law Preboard FinalDokument7 SeitenBusiness Law Preboard Finalxxxxxxxxx100% (1)

- AFAR Answer-KeyDokument8 SeitenAFAR Answer-KeyShirliz Jane Benitez100% (1)

- AFAR Foreign Exchange TransactionsDokument24 SeitenAFAR Foreign Exchange TransactionsWilmar AbriolNoch keine Bewertungen

- #5 Forex Transactions PDFDokument9 Seiten#5 Forex Transactions PDFJohn Mahatma AgripaNoch keine Bewertungen

- Canthelpfallingelvis PDFDokument1 SeiteCanthelpfallingelvis PDFWilmar AbriolNoch keine Bewertungen

- Advanced Accounting Test Bank Chapter 07 Susan HamlenDokument60 SeitenAdvanced Accounting Test Bank Chapter 07 Susan HamlenWilmar AbriolNoch keine Bewertungen

- RMC No 50-2018Dokument18 SeitenRMC No 50-2018JajajaNoch keine Bewertungen

- FINAL - New Product Development and Feasibility PDFDokument7 SeitenFINAL - New Product Development and Feasibility PDFRenz PamintuanNoch keine Bewertungen

- Business Combination and Consolidation On Acquisition Date SummaryDokument6 SeitenBusiness Combination and Consolidation On Acquisition Date SummaryWilmar Abriol100% (1)

- Securities Regulation Code of The Philippines (R.A. 8799) PurposeDokument11 SeitenSecurities Regulation Code of The Philippines (R.A. 8799) PurposeWilmar AbriolNoch keine Bewertungen

- Business Combination and Consolidation On Acquisition Date SummaryDokument6 SeitenBusiness Combination and Consolidation On Acquisition Date SummaryWilmar Abriol100% (1)

- Accounting For Foreign Currency TransactionDokument3 SeitenAccounting For Foreign Currency TransactionWilmar AbriolNoch keine Bewertungen

- 660a1 eDokument63 Seiten660a1 eJessicaWeinNoch keine Bewertungen

- Tax Updates Vs Tax Code OldDokument7 SeitenTax Updates Vs Tax Code OldGianna Chloe S Victoria100% (1)

- Mancons HandoutsDokument12 SeitenMancons HandoutsWilmar AbriolNoch keine Bewertungen

- MT PS With Solutions PDFDokument11 SeitenMT PS With Solutions PDFWilmar AbriolNoch keine Bewertungen

- TympanometerDokument12 SeitenTympanometerAli ImranNoch keine Bewertungen

- Hilti AnchorsDokument202 SeitenHilti AnchorsmwendaNoch keine Bewertungen

- Chapter 2 Body CoordinationDokument25 SeitenChapter 2 Body CoordinationnanarahmannaimNoch keine Bewertungen

- Alfa Laval M6: Gasketed Plate Heat Exchanger For A Wide Range of ApplicationsDokument2 SeitenAlfa Laval M6: Gasketed Plate Heat Exchanger For A Wide Range of ApplicationsCyrilDepalomaNoch keine Bewertungen

- Introduction HmoleDokument32 SeitenIntroduction HmoleBrian Montales BaggayanNoch keine Bewertungen

- DR - Vyshnavi Ts ResumeDokument2 SeitenDR - Vyshnavi Ts ResumeSuraj SingriNoch keine Bewertungen

- Food Habits & Dance Culture Faridkot (Punjab) : Presented By: Kendriya Vidyalaya FaridkotDokument17 SeitenFood Habits & Dance Culture Faridkot (Punjab) : Presented By: Kendriya Vidyalaya FaridkotJagdeep KaurNoch keine Bewertungen

- Why Is ICS Important For Schools?Dokument8 SeitenWhy Is ICS Important For Schools?Spit FireNoch keine Bewertungen

- Resume - Niloofar MojaradDokument2 SeitenResume - Niloofar Mojaradmohammadrezahajian12191Noch keine Bewertungen

- Transition FX3U - C To iQ-F Series HandbookDokument58 SeitenTransition FX3U - C To iQ-F Series HandbookKelly Leandro MazieroNoch keine Bewertungen

- Gazettes 1686290048232Dokument2 SeitenGazettes 1686290048232allumuraliNoch keine Bewertungen

- BCRSPDokument2 SeitenBCRSPDastan YermegaliyevNoch keine Bewertungen

- 250 Watt Solar Panel SpecificationsDokument2 Seiten250 Watt Solar Panel Specificationsfopoku2k20% (1)

- 1716 ch05Dokument103 Seiten1716 ch05parisliuhotmail.comNoch keine Bewertungen

- Co JetDokument4 SeitenCo JetJaime PaulNoch keine Bewertungen

- Contextual Marketing Based On Customer Buying Pattern In: Nesya Vanessa and Arnold JaputraDokument12 SeitenContextual Marketing Based On Customer Buying Pattern In: Nesya Vanessa and Arnold Japutraakshay kushNoch keine Bewertungen

- ITCC in Riyadh Residential Complex J10-13300 16715-1 Voice & Data Communication CablingDokument16 SeitenITCC in Riyadh Residential Complex J10-13300 16715-1 Voice & Data Communication CablinguddinnadeemNoch keine Bewertungen

- Identification of Plastics Identification of PlasticsDokument41 SeitenIdentification of Plastics Identification of PlasticsSoumickNoch keine Bewertungen

- 17.8 Inheritance IGCSE CIE Biology Ext Theory MS - LDokument9 Seiten17.8 Inheritance IGCSE CIE Biology Ext Theory MS - LBlessing TshumaNoch keine Bewertungen

- Hide and DrinkDokument562 SeitenHide and DrinkMao Lee100% (1)

- ThreeDokument6 SeitenThreeapi-340425056Noch keine Bewertungen

- Calcium Cyanide: Hydrogen Cyanide. CONSULT THE NEW JERSEYDokument6 SeitenCalcium Cyanide: Hydrogen Cyanide. CONSULT THE NEW JERSEYbacabacabacaNoch keine Bewertungen

- Maxipro NewDokument2 SeitenMaxipro NewLokendraNoch keine Bewertungen

- CH - 3 DrainageDokument3 SeitenCH - 3 DrainageVeena VermaNoch keine Bewertungen

- 138 Student Living: New Returning Yes NoDokument2 Seiten138 Student Living: New Returning Yes NojevaireNoch keine Bewertungen

- Components of FitnessDokument3 SeitenComponents of Fitnessapi-3830277100% (1)

- HC Letter Templates 26jun13Dokument2 SeitenHC Letter Templates 26jun13Jasdeep0% (1)

- I. Leadership/ Potential and Accomplishments Criteria A. InnovationsDokument5 SeitenI. Leadership/ Potential and Accomplishments Criteria A. InnovationsDEXTER LLOYD CATIAG100% (1)

- Ra Radtech Cdo July2018Dokument4 SeitenRa Radtech Cdo July2018Angelo MercedeNoch keine Bewertungen