Beruflich Dokumente

Kultur Dokumente

20 Regional Mid Year Convention Auditing Cup

Hochgeladen von

BSAOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

20 Regional Mid Year Convention Auditing Cup

Hochgeladen von

BSACopyright:

Verfügbare Formate

20TH REGIONAL MID YEAR CONVENTION

AUDITING CUP

Quiz Master’s Copy

ELIMINITATION ROUND

EASY ROUND

EASY # 1

Which of the following sets of information does an auditor usually confirm using one form?

a. Cash in bank and collateral for loans.

b. Accounts payable and purchase commitments.

c. Accounts receivable and accrued interest receivable.

d. Inventory on consignment and contingent liabilities.

Answer: A

EASY # 2

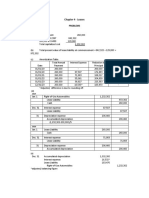

1. The following information was provided by the bookkeeper of COW, Inc.:

a. Sales for the month totaled 286,000 units.

b. The following purchases were made in June:

Date Quantity Unit Cost

June 4 50,000 P13.00

8 62,500 12.50

11 75,000 12.00

24 70,000 12.40

c. There were 108,500 units on hand on June 1 with a total cost of P1,450,000.

d. COW, Inc. uses a periodic FIFO costing system. The company’s gross profit for June was

P2,058,750.

What is the FIFO cost of the company’s inventory on June 30?

Answer: 988,000

From Quantity Unit Cost Amount

June 24 purchase 70,000 P12.40 P868,000

June 11 purchase 10,000 P12.00 120,000

80,000 P988,000

EASY # 3

Which of the following is not a factor that might affect the likelihood that a control deficiency could result in a

misstatement in an account balance?

a. The susceptibility of the related assets or liability to loss or fraud.

b. The interaction or relationship of the control with other controls.

c. The financial statement amounts exposed to the deficiency.

d. The nature of the financial statement accounts, disclosures, and assertions involved.

Answer: C

EASY # 4

For what primary purpose does the auditor obtain an understanding of the entity and its environment?

a. To determine the audit fee.

b. To decide which facts about the entity to include in the audit report.

c. To plan the audit and determine the scope of audit procedures to be performed.

d. To limit audit risk to an appropriately high level.

Answer: C

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 1 of 19

EASY # 5

On January 1, 2016, JERVS COMPANY established a petty cash fund of P10,000.

On December 31, 2016, the petty cash fund was examined and found to have receipts and documents for

miscellaneous general expenses amounting to P8,120. In addition, there was cash amounting to P1,500.

What is the amount of patty cash shortage or overage?

Answer: P380 shortage

Cash P1,500

Miscellaneous general expenses 8,120

Petty cash accounted 9, 620

Petty cash per ledger (10,000)

Petty cash shortage (P380)

EASY # 6

By the audit process, the auditor enhances the usefulness and the value of the financial statements, and also:

a. Decreases the liability of management

b. Decreases the complexity of investor valuation

c. Increases the credibility of other non-audited information released by management

d. Increases the performance of the corporation

Answer: C

EASY # 7

Roses, Inc. offers sales discount to customers who will pay their accounts in full within 10 days from the date of

sale. On October 1, it sold goods on account for P420,000. Payment of P411,600 in satisfaction of this account was

received on October 9.

What is the sales discount rate?

Answer: 2%

Gross receivable P420,000

Less: Amount Received 411,600

Sales Discount 8,400

Divide by Gross Receivable 420,000

Sales discount Rate 2%

EASY # 8

The terms of the engagement include consideration of what is to be done (the objective, scope and report of the

audit) by who (the staff) and:

a. For how much

b. What experience the auditors have

c. What certifications does the signing partner have

d. What employees will participate in the audit

Answer: A

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 2 of 19

EASY # 9

An audit is a systematic process of objectively obtaining and evaluating evidence regarding assertions ______ to

ascertain the degree of correspondence between these assertions and established criteria and communicating the

results to interested users.

a. About stakeholder expectations

b. About economic actions and events

c. Regarding compliance with national laws

d. About identification of fraud

Answer: B

EASY # 10

In an audit of EDWARD COMPANY for the year ended December 31, 2016, the entity took its annual physical

inventory count on November 30, 2016. The entity’s inventory which includes raw materials and work in progress

is on a perpetual basis and FIFO pricing is used. There are no finished goods.

a. Data pertaining to November 30, 2016 inventory:

i. Direct labor included in the physical inventory amounted to P500,000.

ii. Overhead was applied at 200% of direct labor.

iii. The physical inventory on November 30, 2016 revealed that the book inventory of

P2,913,500 was understated by P150,000. To avoid distorting the interim financial

statements, the entity decided not to adjust the book inventory until year-end.

What is the correct amount of physical inventory as of November 30, 2016?

Answer: 3,063,500

Inventory, November 30, 2016 P2,913,500

Understatement 150,000

Correct Inventory, November 30, 2016 P3,063,500

AVERAGE ROUND

AVERAGE # 1

Entity-level controls can have a pervasive effect on the entity's ability to meet the control criteria. Which one of the

following is not an entity-level control?

a. Controls to monitor results of operations.

b. Management's risk-assessment process.

c. Controls to monitor the inventory taking process.

d. The period-end financial reporting process.

Answer: C

AVERAGE # 2

Which of the following are not common internal control documentation techniques used by auditors?

a. Company internal control manuals

b. Narrative descriptions

c. Check lists

d. Questionnaires

Answer: A

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 3 of 19

AVERAGE # 3

On December 31, 2015, Hercules Company has a note payable to the bank of P8,400,000. The following are the

transactions during 2016 and other information relating to the Company’s liabilities:

a. The note payable to the bank bears a 12% interest. It is dated April 1, 2015 and is payable in four

equal annual installments beginning April 1, 2016. Hercules Company made the first principal and

interest payment on April 1, 2016.

b. On July 1, 2016, Hercules Company issued P5,322,000 at P 6,000,000 face value note to a wealthy

shareholder. The note, dated July 1, 2016, will mature on July 1, 2017. No explicit interest rate is

stated in the note and the entire face amount is due on maturity date.

What is Hercules Company’s total current liability on December 31, 2016?

Answer: 8,328,000

Note Payable – Bank P2,100,000

Note Payable – Shareholder P6,000,000

Discount on note payable (P 678,000 x (339,000) 5,661,000

½)

Accrued Interest Payable

(P6,300,000 x 12% x 9/12) 567,000

Total Current Liabilities P8,328,000

AVERAGE # 4

The following audited balances pertain to ABC Company.

Account payable:

January 1, 2016 P286,924

December 31, 2016 737,824

Inventory balance:

January 1, 2016 815,386

December 31, 2016 488,874

Cost of goods sold 1,859,082

How much was paid by ABC Company to its suppliers in 2016?

Answer: P1,081,670

Cost of goods sold – 2016 P1,859,082

Add: Inventory, December 31, 2016 488,874

Goods available for sale 2,347,956

Less: Inventory, January 1, 2016 815,386

Purchases 1,532,570

Add: Accounts payable, January 1, 2016 286,924

Total 1,819,494

Less: Accounts payable , December 31, 2016 737,824

Accounts paid to suppliers in 2016 P1,081,670

AVERAGE # 5

Which of the following is not a situation where an auditor might use an expert?

a. Amortization of patents

b. Determination of physical condition of assets

c. Actuarial valuation

d. Value of contracts in progress

Answer: A

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 4 of 19

AVERAGE # 6

On July 7, 2016, ABC Company received its bank statement for the month ending June 30. The statement showed a

P209,500 balance while the cash account balance on June 30 was P35,000. In reconciling the balances, the auditor

discovered the following:

The June 30 collections amounting to P176,000 were recorded on the books but were not

deposited until July.

The bank charged the company for a DAUD (Drawn Against Uncollected Deposit) check of a

customer, P21,900.

A paid check for P24,300 was entered incorrectly in the cash disbursement journal as P42,300.

Outstanding checks as of June 30 totaled P354,400.

The adjusted cash balance is:

Answer: P31,100

Book Bank

Unadjusted balances P35,000 P209,500

Bank charges for a DAUD check (21,900)

Overstatement of book disbursement (P42,300 – P24,300) 18,000

Outstanding checks (354,400)

Undeposited collections 176,000

Adjusted balances P31,100 P31,100

AVERAGE # 7

Which of the following statements best describes the role of materiality in a financial statement audit?

a. Materiality refers to the "material" from which audit evidence is developed.

b. The higher the level at which the auditor assesses materiality, the greater the amount of evidence the

auditor must gather.

c. The lower the level at which the auditor assesses materiality, the greater the amount of evidence the

auditor must gather.

d. The level of materiality has no bearing on the amount of evidence the auditor must gather.

Answer: C

AVERAGE # 8

In an audit of ISABELA COMPANY for the year ended December 31, 2016, the entity took its annual physical

inventory count on November 30, 2016. The entity’s inventory which includes raw materials and work in progress

is on a perpetual basis and FIFO pricing is used. There are no finished goods.

a. Data pertaining to November 30, 2016 inventory:

i. Direct labor included in the physical inventory amounted to P500,000.

ii. Overhead was applied at 200% of direct labor.

b. Data pertaining to December 31, 2016 inventory are:

i. Total debits during December are

Purchases P1,235,000

Direct Labor 605,000

Manufacturing Overhead 1,260,000

ii. A special order started and completed December has excessive scrap loss of

P40,000 which was charged to manufacturing overhead expense.

iii. Cost of Sales for the year ended December 31, 2016 amounted to P3,417,500 where in

Direct Labor Cost amounted to P690,000.

What is the amount of direct labor included in the December 31 inventory?

Answer: P415,000

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 5 of 19

Direct Labor as of November 31, 2016 P500,000

Direct Labor for period December 31, 2016 605,000

Total as of December 31, 2016 1,105,000

Direct Labor in COS for the year ended December 31, 2016 (690,000)

Direct Labor in Inventory as of December 31, 2016 P415,000

AVERAGE # 9

Which of the following is an example of fraudulent financial reporting?

a. Company management falsifies inventory count tags, thereby overstating ending inventory and

understating cost of sales.

b. An employee diverts customer payments to his personal use, concealing his actions by debiting an

expense account, thus overstating expenses.

c. An employee steals inventory, and the shrinkage is recorded as a cost of goods sold.

d. An employee borrows small tools from the company and neglects to return them; the cost is

reported as a miscellaneous operating expense.

Answer: A

AVERAGE # 10

The following amounts are shown on the 2016 and 2015 financial statements of San Francisco Co.:

2016 2015

Accounts Receivable P? P 470,000

Allowance for bad debts 20,000 10,000

Net Sales 2,600,000 2,400,000

Cost of Goods Sold 1,900,000 1,752,000

San Francisco Co.’s accounts receivable turnover for 2016 is 6.5 times. All sales are on credit.

What is the accounts receivable balance at December 31, 2016?

Answer: 340,000

A/R Turnover = Net Sales / Average Net Receivables

6.5 = P2,600,000 / (P460,000 +X/2)

(P2,990,000 +6.5x)/2 = P2,600,000

P2,990,000 + 6.5x = P5,200,000

6.5x = P2,210,000

X = P340,000

Net Receivables, December 31, 2016 P340,000

Add: Allowance for bad debts, December 31, 2016 20,000

Accounts Receivable, December 31, 2016 P360,000

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 6 of 19

DIFFICULT ROUND

DIFFICULT #1

. Which of the following procedures would an auditor most likely perform in planning a financial statement audit?

a. Performing analytical procedures to identify areas that may represent specific risks.

b. Reviewing investment transactions of the audit period to determine whether related parties were

credited.

c. Reading the minutes of stockholder and director meetings to discover whether any unusual

transactions have occurred.

d. Obtaining a written representation letter from the client to emphasize management’s responsibilities.

Answer: A

DIFFICULT #2

The following are the cash balances of ABC Company at December 31, 2016:

Undeposited collections (in currency and coins) P40,200

Current account – unrestricted 620,000

Disbursement checks written and recorded in December 31,

2016 but are to be released to the payees in January 2017 130,000

Restricted time deposits (expected use in January 2018) 2,000,000

ABC Company has agreed to maintain a P200,000 balance in unrestricted current account in accordance with the

loan covenant. How much should ABC Company report as cash on its December 31, 2016 statement of financial

position?

Answer: P790,200

Undeposited collections (in currency and coins) P40,200

Current account – unrestricted 620,000

Disbursement checks written and recorded in December 31, 2016 but

are to be released to the payees in January 2017 130,000

Total P790,200

DIFFICULT #3

During 2016, Pen Corporation acquired common stock of Rap Company as follows:

Lot Date No. of Shares Cost per Share Total Cost

A January 25 800 P560 P448,000

B April 5 600 600 360,000

Rap Company issued a 20% stock dividend on February 14, 2016. Common stock rights were issued on October

30, 2016 entitling holders to purchase one new common share at P450 for each ten shares held. On this date, the

rights were being traded at P20 each and the stock ex-rights were being traded at P620 per share.

On November 8, 2016, Pen sold 500 rights that pertained to Lot A. Sales price was P25 per right. The corporation

paid a brokerage fee of P500 on the sale of the stock rights. Pen exercised the remaining rights on November 11,

2016.

The gain/loss on the sale of right is:

Answer: P4,708 gain

Selling price (25 x 500) P12,500

Less: Brokerage fee 500

Cost of rights (448,000 x 20/640 x 500/960) 7,292

Gain on sale P 4,708

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 7 of 19

DIFFICULT #4

Which of the following is not a benefit of international auditing standards?

a. Foreign investors are more likely to channel funds into a developing country

b. Financial statement disclosure is more consistent

c. Encourage and assist developing nations to adopt national standards

d. Investors can more readily comprehend a set of financial statements drawn up in another country

Answer: B

DIFFICULT #5

The Notes Receivable account of Bunsoy Co. has a debit balance of P239,200 on

December 31, 2016. There was no balance at the beginning of the year. Your analysis of the account

reveals the following:

• Notes amounting to P845,000 were received from customer during the year.

• Notes of P416,000 were collected on due dates and notes amounting to P221,000 were discounted

at the Aggressive Bank. The Notes Receivable account was credited for the notes discounted.

• Of the P221,000 notes discounted, P104,000 was paid on maturity date while a note for

P31,200 was dishonored and was charged back to Notes Receivable account.

• Cash of P33,000 was received as partial payment on notes not yet due. The amount received was

credited to Liability on Partial Payments account.

• A note for P50,000 was pledged as collateral for a bank loan.

• Included in the company’s cash account balance is a three-month note from an officer amounting to

P8,000 which is over a month past due.

Assuming that Bunsoy Co. will use a Notes Receivable Discounted account, the adjusted balance of the Notes

Receivable account on December 31, 2016 is?

Answer: P260,800

Unadjusted Balance (845,000 - 416,000 - 221,000 + 31,200) P239,200

Partial collection recorded as Liability (33,000)

Notes Receivable discounted and still outstanding (221,000 - 104,000 - 31,200) 85,800

Dishonored Note (31,200)

Adjusted Balance P260,800

DIFFICULT # 6

ABC Company’s annual net income for the period 2012 to 2016 are as follows: 2012 P150,000; 2013 P340,000;

2014 P645,000; 2015 (P100,000); and 2016 P250,000.

The review of the company’s records reveals the following inventory errors at yearend: overstatement of P3,000

in 2013; understatement of P6,000 in 2014; understatement of P4,500 in 2015 and understatement of P11,000 in

2016.

What is the adjusted net income in 2016?

Answer: P256,500

Unadjusted net income, 2016 P250,000

Understatement in 2015 (4,500)

Understatement in 2016 11,000

Adjusted net income P256,500

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 8 of 19

DIFFICULT #7

Which of the following forms of evidence represents the most competent evidence that a receivable actually exists?

a. A positive confirmation

b. A sales invoice

c. A receiving report

d. A bill of lading

Answer: A

DIFFICULT #8

The ABC Company had weak internal controls over cash transactions. Facts about its cash position at November

30, 2016 were as follows:

The cash book showed a balance of P94,508 which included undeposited receipts. A credit of P500 on the bank’s

records did not appear on the books of the company. The balance per bank statement was P77,750. Outstanding

checks were no. 8420 for P581, no. 8422 for P750, no. 8430 for P1,266, no.8621 for P954, no. 8623 for P1,034 and

no. 8632 for P726.

The cashier stole all undeposited receipts in excess of P18,972 and prepared the following reconciliation:

P94,508

Balance per books, November 30, 2016

Add: Outstanding checks

8621 P954

8623 1,034

8632 726 2,214

Total 96,722

Less: Undeposited receipts 18,972

Balance per bank, November 30, 2016 77,750

Less: Unrecorded credit 500

True cash, November 30, 2016 P77,250

How much cash was stolen by the cashier?

Answer: P3,597

Cash balance per books, P94,508

Add: Bank credit 500

Adjusted cash bank balance (on hand and in bank) 95,008

Less: Adjusted bank balance :

Bank balance, November 30 P77,750

Less: Outstanding checks

No. 8420 P581

8422 750

8430 1,266

8621 954

8623 1,034

8632 726 5,311 72,439

Cash that should be on hand for deposit 22,569

Cash reported 18,972

Cash stolen P3,597

DIFFICULT #9

Which of the following procedures would least likely lead the auditor to detect unrecorded fixed asset additions?

a. Examine insurance policies.

b. Review property tax files.

c. Scan invoices for fixed asset additions.

d. Review repairs and maintenance expense.

Answer: A

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 9 of 19

DIFFICULT #10

ABC Company reported the following amounts in the shareholders’ equity section of its December 31, 2015,

statement of financial position:

Preference shares, 10%, P10 par (100,000 shares authorized, 20,000

shares issued P200,000

Ordinary shares, P5 par (50,000 shares authorized, 10,000 shares 50,000

issued

Share premium 96,000

Retained earnings 600,000

P946,000

The following transaction occurred during 2016:

a. Paid the annual 2015 P1 per share dividend on preference shares and P0.50 per share dividend

on ordinary shares. These dividends had been declared on December 31, 2015.

b. Purchased 2,000 shares of its own outstanding ordinary shares for P20 per shares.

c. Reissued 700 treasury shares for equipment valued P25,000.

d. Issued 5,000 preference shares at P15 per share.

e. Declared a 10% stock dividend on the outstanding ordinary shares when the shares were selling

for P12 per share.

f. Issued the stock dividend.

g. Declared the annual 2016 P1 per share dividend on preference and P0.50 per share dividend on

ordinary shares. These dividends are payable in 2017.

h. Appropriated retained earnings for plant expansion, P300,000.

i. Appropriated retained earnings for treasury shares.

j. The net income for 2016 amounted to P470,000.

Based on the information above, determine the correct amount of December 31, 2016 unappropriated retained

earnings.

Answer: P703,775

Balance, January 1, 2016 P600,000

Stock dividend – ordinary shares (P12 x 870) (10,440)

Cash dividends:

Preference shares (P1 x 25,000) (25,000)

Ordinary shares (P0.50 x 9,570) (4,785)

Appropriated for plant expansion (300,000)

Appropriated for treasury shares (2,000 – 700 = 1,300 x P20) (26,000)

2016 net income 470,000

Balance, December 31, 2016 P703,775

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 10 of 19

FINAL ROUND

FINAL # 1 (EASY T)

Which of the following AASC (Auditing and Assurance Standards Council) Engagement Standard applies on

engagements to apply agreed-upon procedures to information?

a. PSAs

b. PSREs

c. PSAEs

d. PSRSs

Answer: D

PSAs, PSREs, PSAEs and PSRSs are collectively referred to as the AASC’s Engagement Standards.

Philippines Standards on Auditing (PSAs) applies to the audit of historical financial information.

Philippine Standards on Review Engagements (PSREs) applies to review of historical financial information.

Philippine Standards on Assurance Engagements (PSAEs) applies to assurance engagements dealing with subject

matters other than historical financial information.

Philippine Standards on Related Services (PSRSs) applies to compilation engagements, engagements to apply agreed-

upon procedures to information and other related service engagements as specified by the AASC.

FINAL # 2 (AVE T)

Audit risk is a function of the risk of material misstatement and ___________.

a. Inherent risk

b. Control Risk

c. Detection Risk

d. All of the above

Answer: C

Please see PSA200 paragraph 13. Audit risk is defined as “The risk that the auditor expresses an inappropriate audit

opinion when the financial statements are materially misstated. Audit risk is a function of the risks of material misstatement

and detection risk”. Additionally material misstatement composes of inherent and control risk.

FINAL # 3 (DIFF T)

When inherent risk is high, there will be need to

A lower More evidence

assessment of audit risk accumulated by the auditor

a. YES YES

b. NO NO

c. YES NO

d. NO YES

Answer: D

Since audit risk is the complement of audit assurance, if the auditor is willing to accept a lower risk, say 5%, he must design the

audit to have a 95% assurance of confidence level that his opinion is correct. Thus a high inherent risk will result to a higher

assessment for audit risk, resulting to lower substantive procedures and more audit evidence. (Ref: Audit Theory by JG.

Salosagcol et.al)

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 11 of 19

FINAL # 4 (AVE P)

ABC Company has the following loans payable scheduled to be repaid in February of the next year. The

company’s accounting year ends on December 31.

The company intends to repay Loan1 for P100,000 when it comes due in February. In the following

October, the company intends to get a new loan for P80,000 from the same bank.

The company intends to refinance Loan 2 for P150,000 when it comes due in February. The refinancing

agreement of P180,000 will be signed in April, after the financial statements for this year have been

authorize for release.

The company intends to refinance Loan 3 for P200,000 before it comes due in February. The actual

refinancing for P175,000 took place in January before the financial statements for this year have been

authorize for issue.

As of December 31 of this year, the total noncurrent liabilities to be reported on the company’s statement

of financial position should be:

Answer: P0

Current liabilities

Loan 1 P100,000

Loan 2 150,000

Loan 3 200,000

Total P450,000

Noncurrent liabilities P0

FINAL # 5 (DIFF T)

Cedie Company uses its sales invoices for posting perpetual inventory records. Inadequate internal control over the

invoicing function allows goods to be shipped but not invoiced. The inadequate controls could cause what type of

misstatement in each of the following accounts?

Revenues Receivables Inventories

a. Understatement Understatement Understatement

b. Overstatement Overstatement Understatement

c. Understatement Understatement Overstatement

d. Overstatement Overstatement Overstatement

Answer: C

Since sales are shipped but not invoiced, no proper recording of revenue is done, this would cause revenue and receivables to be

understated. Meanwhile since the company uses perpetual inventory records overstatement of inventory is to be expected.

FINAL # 6 (DIFF P)

Dolo Company leased office premises to Dole Company for a 8-year term starting January 2, 2014 Under the terms

of the lease, rent for the first year is P300,000 and rent for years 2 through 8 is P500,000 annually. As an inducement

to enter the lease, Dolo Company waives the first six months of rental payments. Dole Company likewise paid a

P70,000 security deposit of which 80% is refundable at the end of the lease term. Furthermore, contingent rent equal

to 3% of sales in excess of P13,000,000 shall be paid by Dole Company. Dolo Company incurred initial direct cost

of P40,000 while Dole Company paid P80,000 in costs in relation to the lease. In 2015, Dole Company reported sales

of P15,000,000.

Rental expense to be included in Dole Company’s 2015 income statement is

Answer: P528,000

Total rental payments for five years (P300,000/2) + (P500,000*7) P3,650,000

Divided by total years 8 years

Annual rental expense (fixed) 456,250

Contingent rent [(15M – 13M) * 3%] 60,000

Direct cost incurred (80,000 / 8) 10,000

Non-refundable portion of security deposit (70,000 * 20%) / 8 1,750

Total rental expense P528,000

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 12 of 19

FINAL # 7 (AVE P)

Abe Chan has been employed as an accountant by ABC Company for a number of years. She handles all accounting

duties, including the preparation of financial statements. The following is the earned surplus prepared by Abe Chan

for 2016:

ABC Company

Statement of Earned Surplus for 2016

Balance at January 1, 2016 P365,000

Additions:

Positive change in estimate of 2015 amortization P5,000

Gain on sale of trading securities 3,000

Interest revenue 2,000

Net income for 2016 150,000

Decreased depreciation due to change in estimated 13,000 173,000

life

538,000

Deductions:

Dividends declared and paid P100,000

Loss of sale of equipment 2,500

Loss on earthquake 83,000 185,500

Balance at December 31, 2016 P352,500

What is the correct net income for ABC Company for 2016?

Answer: P87,500

Reported income P150,000

Change in amortization expense 5,000

Gain on sale of trading securities 3,000

Interest revenue 2,000

Decrease in depreciation – due to change in estimated useful life 13,000

Loss on sale of equipment (2,500)

Loss on earthquake (83,000)

Corrected net income for 2016 87,500

FINAL # 8 (EASY T)

In conducting an audit in accordance with PSAs the auditor shall (choose one that doesn’t apply)

a. Obtain sufficient appropriate audit evidence to reduce inherent risk to an acceptably low level.

b. Comply with all PSAs relevant to the audit.

c. Exercise professional judgment in planning and performing an audit of financial statement.

d. Comply with relevant ethical requirements.

Answer: A

Remember that inherent risk is the susceptibility of an account balance or class of transactions to a material misstatement

assuming that there were no related internal controls. As auditors we are trying to reduce the audit risk by assessing the

level of inherent and control risk and determining the acceptable level of detection risk.

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 13 of 19

FINAL # 9 (DIFF T)

Which of the following test of controls most likely would help assure auditors that goods shipped are properly

billed?

a. Scan the sales journal for sequential and unusual entries.

b. Examine shipping documents for matching sales invoice.

c. Compare the accounts receivable ledger to daily sales summaries.

d. Inspect unused sales invoices for consecutive prenumbering.

Answer: B

Examining shipping documents ensures that goods are shipped and comparing such documents to its sales invoices assure

auditors that goods are properly billed.

FINAL # 10 (AVE T)

The auditor shall obtain written representations from management regarding to the following except:

a. It has disclosed to the auditor the results of its assessment of the risk that the financial statements

may be materially misstated as a result of fraud.

b. It acknowledges its responsibility for the design, implementation and maintenance of audit

procedures to prevent and detect fraud.

c. It has disclosed to the auditor its knowledge of fraud or suspected fraud affecting the entity.

d. It has disclosed to the auditor its knowledge of any allegations of fraud, or suspected fraud, affecting

the entity’s financial statements communicated by employees, former employees, analysts, regulators

or others.

Answer: B

It acknowledges its responsibility for the design, implementation and maintenance of internal control to prevent and detect fraud.

(Ref: Para. A57-A58 of PSA240)

FINAL # 11 (DIFF P)

AGAPE Corporation must determine the December 31, 20X5 year-end accruals for advertising and rent expenses.

A P50,000 advertising bill was received on January 10, 20X6 comprising costs of P37,500 for advertisements in

December 20X5 issues, and P12,500 for advertisements in January 20X6 issues of newspaper.

A store lease, effective December 16, 20X5, calls for fixed rent of P120,000 per month, payable one month from

the effective date and monthly thereafter. In addition, rent equal to 5% of net sales over P6,000,000 per calendar

year is payable on January 31 of the following year. Net sales of 20X5 amounted to P7,500,000.

What is the total accrued liability that should be reported by ABC Corporation on its statement of financial position

as at December 31, 20X5?

Answer: P172,500

FINAL # 12 (AVE T)

According to PSA240 - The Auditor’s Responsibility to Consider Fraud in an Audit of Financial Statements,

which of the following concepts related to the risk of fraud is true?

a. Material misstatement due to fraudulent financial reporting relating to revenue recognition often

results from an understatement of revenues.

b. The presumption that there are risks of fraud in revenue recognition cannot be rebutted.

c. Management may make judgments on the nature and extent of the controls it chooses to implement,

and the nature and extent of the risks it chooses to assume.

d. In determining which controls to implement to prevent and detect fraud, management cannot

consider the risk that the financial statements may be materially misstated as a result of fraud.

Answer: C

The rest are false since:

•Material misstatement due to fraudulent financial reporting relating to revenue recognition often results from an overstatement

of revenues.

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 14 of 19

•The presumption that there are risks of fraud in revenue recognition can be rebutted. (ref Paragraph 26 of PSA240)

•In determining which controls to implement to prevent and detect fraud, management consider the risk that the financial

statements may be materially misstated as a result of fraud. (ref para 27, PSA240)

FINAL # 13 (DIFF P)

Yan Company acquires 7,200 shares of common stock of Tay Corp. on Feb. 12, 2015. The P100 par stock, costing

P819,000, is included in the company’s available-for-sale securities portfolio. The following transactions related to

this investment occurred during 2015:

On June 15, Tay Corp. announces that rights are to be issued. One right is to be received for each share

owned.

The rights mentioned in the previous transaction are received on July 10; 3,600 shares of P100 par stock

may be purchased with these rights at par. The stock is currently for P120 per share. Market value of

the stock right is P20 per right.

On August 8, 4,200 rights are exercised.

On August 20, the remaining rights are sold for P23 per right

On September 30, Yan Company sells 1,500 shares of those acquired February 12, at P124 a share.

What is the total cost of the stock acquired by Yan Company on August 08?

Answer: P278,250

(819,000x20/140)/7,200 x 4,200 + 4,200/2 x 100 = 278,250

FINAL # 14 (EASY P)

The following information is from ABC Co.’s first year of operations:

Merchandised purchased, P450,000

Ending merchandise inventory, P123,000

Collections from customers, P150,000

All sales are on account and good sell at 30% above cost.

What is the accounts receivable balance at the end of the company’s first year of operations?

Answer: P275,100

Purchases P450,000

Merchandise inventory, ending (123,000)

Cost of goods sold 327,000

Multiply by sales ratio 130%

Sales 425,100

Collections from customers 150,000

Accounts receivable, ending P275,100

FINAL # 15 (EASY P)

As of January 1, 2016, Seniors decided to change the method of computing depreciation on its sole piece of equipment

from the sum-of-the-years' digits method to the straight-line method. The equipment, acquired in January 2013 for

P520,000, had an estimated life of five years and a salvage value of P20,000. The amount of the depreciation expense

for 2016 is

Answer: P50,000

Acquisition Cost P520,000

A/D based on SYD (3 years) (400,000)

BV 120,000

RV (20,000)

Depreciable Amount 100,000

Remaining Useful life /2

Depreciation expense 50,000

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 15 of 19

FINAL # 16 (DIFF P)

Corp. uses Machine A in its manufacturing process. It acquired this machine from manufacturers. The following

information relates to Machine A that it has recorded in 20X2.

Machine A, purchased

Cost paid for equipment P250,000

Cost of transporting machine – insurance and transport 9,000

Labor cost of installation by expert filter 15,000

Labor cost of testing equipment 12,000

Insurance cost of 20X2 4,500

Cost of training for personnel who will use the machine 7,500

Cost of safety rails and platforms surrounding machine 18,000

Cost of water devices to keep machine cool 24,000

Cost of adjustments to machine during 20X2 to make it

operate more efficiently 22,500

What is the cost of Machine A?

Answer: P350,500

Machine A

Cost paid for equipment P250,000

Cost of transporting machine – insurance and transport 9,000

Labor cost of installation by expert filter 15,000

Labor cost of testing equipment 12,000

Cost of safety rails and platforms surrounding machine 18,000

Cost of water devices to keep machine cool 24,000

Cost of adjustments to machine during 20X2 to make it operate more 22,500

efficiently

Total costs P350,500

FINAL # 17 (EASY T)

The Framework of Philippine Standards on Auditing applies to:

a. Taxation

b. Consultancy

c. Financial and Accounting Advice

d. All of the Above.

e. None of the above.

Answer: E

The framework, according to PSA 120, only applies on auditing and its related services.

FINAL # 18 (DIFF T)

The auditor shall identify and assess the risks of material misstatement at the financial statement and the assertion

level for classes of transactions, account balances and disclosures. For this purpose, the auditor shall consider the

following except:

a. Identify risks throughout the process of obtaining an understanding of the entity and its

environment, including relevant controls that relate to the risks, and by considering the classes of

transactions, account balances, and disclosures in the financial statements.

b. Assess the identified risks, and evaluate whether they relate more pervasively to the financial

statements as a whole and potentially affect many assertions.

c. Relate the identified risks to what can go wrong at the financial statement level, taking account of

relevant controls that the auditor intends to test.

d. Consider the likelihood of misstatement, including the possibility of multiple misstatements, and

whether the potential misstatement is of a magnitude that could result in a material misstatement.

Answer: C

Relate the identified risks to what can go wrong at the assertion level, taking account of relevant controls that the auditor intends

to test. (Ref: Para. A109-A111 of PSA 315)

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 16 of 19

FINAL # 19 (AVE T)

When performing a compilation engagement, the accountant is required to?

a. Assess the internal controls.

b. Make inquiries of management to assess the reliability and completeness of the information provided.

c. Verify matters and explanations.

d. Obtain a general knowledge of the business and operations of the entity.

Answer: D

A, B and C refers to procedures done during audit. During compilation engagements the accountant is engaged to use accounting

expertise as opposed to auditing expertise to collect, classify and summarize financial information. Please see PSA 120.

FINAL # 20 (AVE P)

The following selected transactions occurred during the year ended December 31, 2016:

Gross sales (cash and credit) P750,000

Collections from credit customers, net of 2% cash discount 245,000

Cash sales 150,000

Uncollectible accounts written off 16,000

Credit memos issued to credit customers for sales returns and 8,400

allowances

Cash refunds given to cash customers for sales returns and 12,640

allowances

Recoveries on accounts receivable written off in prior years (not

included in cash received stated above) 5.421

At year-end, the company provides for estimated bad debt losses by crediting the Allowance for Bad Debts

account for 2% of its net credit sales for the year.

The bad debt expense for 2016 is:

Answer: P11,732

Gross credit sales (P750,000 - P150,000) P600,000

Less: Sales discount (P245,000 / 98% = P250,000 x 2%) P5,000

Sales returns and allowances 8,400 13,400

Net credit sales P586,600

Bad debt expense (P586,600 x 2%) P11,732

FINAL # 21 (EASY T)

Which of the following is true about assurance:

a. For agreed-upon procedures, the auditor provides a report of the factual findings, moderate

assurance is expressed.

b. In a review engagement, the auditor provides a moderate level of assurance that the information

subject to review is free of material misstatement. This is expressed in the form of positive

assurance.

c. In a compilation engagement, although the users of the compiled information derive some benefit

from the accountant's involvement, no assurance is expressed in the report

d. In an audit engagement, the auditor provides a low reasonable level of assurance that the

information subject to audit is free of material misstatement.

Answer: C

Please refer to PSA 120:

For agreed-upon procedures, the auditor provides a report of the factual findings, no assurance is expressed.

In a review engagement, the auditor provides a moderate level of assurance that the information subject to review is free

of material misstatement. This is expressed in the form of negative assurance.

In an audit engagement, the auditor provides a high, but not absolute, level of assurance that the information subject to

audit is free of material misstatement.

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 17 of 19

FINAL # 22 (DIFF T)

In establishing the overall audit strategy, the auditor shall consider all except:

a. Ascertain the reporting objectives of the engagement to plan the timing of the audit and the nature

of the communications required.

b. Consider the factors that, in the management’s judgment, are significant in directing the engagement

team’s efforts.

c. Consider the results of preliminary engagement activities and, where applicable, whether knowledge

gained on other engagements performed by the engagement partner for the entity is relevant.

d. Ascertain the nature, timing and extent of resources necessary to perform the engagement.

Answer: B

The auditor should consider the factors that, the auditor’s professional judgment, are significant in directing the engagement

team’s efforts. (Ref: Para. A9-A12 of PSA 300)

FINAL # 23 (AVE P)

1. The following information was taken from the records of ABC Company for the month of December:

Sales P198,000

Sales returns 4,000

Sales discount 2,000

Additional markups 20,000

Markup cancellations 3,000

Markdowns 18,600

Markdown cancellations 5,600

Freight in 4,800

Purchases at cost 96,000

Purchases at retail 176,000

Purchases returns at cost 4,000

Purchases returns at retail 6,000

Beginning inventory at cost 60,000

Beginning inventory at retail 93,000

What is the cost of ABC Company’s ending inventory under the retail inventory (average cost) method?

Answer: P43,070

Cost Retail

Beginning inventory P60,000 P93,000

Purchases 96,000 176,000

Freight in 4,800

Purchases returns (4,000) (6,000)

Additional mark-ups 20,000

Mark-up cancellations (3,000)

Markdowns (18,600)

Markdown cancellations 5,600

Goods available for sale P156,800 P267,000

Less: Net sales (P198,000 – P4,000) 194,000

Ending inventory at retail P73,000

Cost ratio (P156,800 / P267,000) 59%

Ending inventory at cost (P73,000 x 59%) P43,070

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 18 of 19

FINAL # 24 (DIFF P)

8. On December 31, VSG Company noted the following transactions that occurred during 2014, some or all of

which might require adjustment to the books.

I. Payment of = P 2,900 to suppliers was made for purchases on account during the year and was not

recorded.

II. Building and land were purchased on January 2 for a basket price of = P 400,000. The building’s

fair market value was = P 180,000 while the land’s fair value is also P180,000 at the time of

purchase. The building is being depreciated over a 25-year life using the straight-line method,

assuming no salvage value.

III. Of the = P 45,800 in Accounts Receivable, 2.7% is estimated to be uncollectible. Currently,

Allowance for Bad Debts shows a debit balance of = P 780.

IV. On September 1, = P 45,000 was loaned to a customer on a 6-month note with interest at an annual

rate of 10%.

V. During 2008, VSG received = P 8,500 in advance for services, 85% of which will be performed in

2009. The P8,500 was credited to sales revenue.

VI. The interest expense account was debited for all interest charges incurred during the year and

shows a balance of = P 1,100. However, of this amount, = P 600 represents a discount on a 60-day

note payable, due January 30, 2015.

The net reduction in reported net income as a result of the required adjustments is

Answer : P15,441.60

Effect to Income

+/(-)

Depreciation (200/25) (8,000)

Doubtful Expense (45,800x2.7%+780) (2,016.6)

Interest Income (45,000x10%x4/12) 1,500

Service Revenue (8,500x85%) (7,225)

Interest Expense (600x30/60) 300

Net effect to income (15,441.6)

FINAL # 25 (EASY P)

Company uses the direct method to prepare its statement of cash flows. The company had the following cash flows

during the current year

Cash receipts from the issuance of ordinary shares P400,000

Cash receipts from customers 200,000

Cash receipts from dividends on long-term investments 30,000

Cash receipts from repayment of loan made to another company 220,000

Cash payments for wages and other operating expenses 120,000

Cash payments for insurance 10,000

Cash payments for dividends 20,000

Cash payments for taxes 40,000

Cash payment to purchase land 80,000

The net cash provided by (used in) operating activities is

Answer: P30,000

Cash receipts from customers 200,000

Cash payments for wages and other operating expenses 120,000

Cash payments for insurance 10,000

Cash payments for taxes 40,000

30,000

20TH REGIONAL MID-YEAR CONVENTION – Academic League

Auditing Cup

Page 19 of 19

Das könnte Ihnen auch gefallen

- RecvbleDokument24 SeitenRecvbleJoseph Salido100% (1)

- Audit of Inventories and Cost of Goods SDokument10 SeitenAudit of Inventories and Cost of Goods SJessaNoch keine Bewertungen

- AP5Dokument5 SeitenAP5Sweetcell Anne50% (2)

- Audit of Receivables GuideDokument13 SeitenAudit of Receivables GuideMary Joanne Tapia0% (1)

- Estimating Ending InventoryDokument1 SeiteEstimating Ending InventorywarsidiNoch keine Bewertungen

- Acc 422Dokument4 SeitenAcc 422papas22100% (3)

- Audit Problems CashDokument18 SeitenAudit Problems CashYenelyn Apistar Cambarijan0% (1)

- Audit of Inventory ProblemsDokument2 SeitenAudit of Inventory ProblemsZeeNoch keine Bewertungen

- Problem 5: QuestionsDokument6 SeitenProblem 5: QuestionsTk KimNoch keine Bewertungen

- Problems Audit of InvestmentsDokument15 SeitenProblems Audit of InvestmentsKm de Leon75% (4)

- Pre-Week Auditing Problems 2014Dokument41 SeitenPre-Week Auditing Problems 2014Pat Closa80% (15)

- Audit of Inventories - Roque 2018Dokument60 SeitenAudit of Inventories - Roque 2018Renelyn David69% (13)

- Audit of InventoriesDokument4 SeitenAudit of InventoriesMc Gavriel VillenaNoch keine Bewertungen

- Audit of Invest. in Equity and Debt SecuritiesDokument23 SeitenAudit of Invest. in Equity and Debt SecuritiesJoseph SalidoNoch keine Bewertungen

- Audit of Property, Plant and Equipment for Dok ManufacturingDokument13 SeitenAudit of Property, Plant and Equipment for Dok ManufacturingHijabwear BizNoch keine Bewertungen

- Audit of Allowance For Doubtful AccountsDokument4 SeitenAudit of Allowance For Doubtful AccountsCJ alandyNoch keine Bewertungen

- InventoryDokument8 SeitenInventoryJoana Marie Mara SorianoNoch keine Bewertungen

- Inventory LatojaDokument2 SeitenInventory Latojalisa juganNoch keine Bewertungen

- Audit Tips for Analyzing Trading Securities ProblemsDokument6 SeitenAudit Tips for Analyzing Trading Securities ProblemsJazzy100% (3)

- Audit of CashDokument14 SeitenAudit of CashMarah ArcederaNoch keine Bewertungen

- 5 Questions InventoryDokument15 Seiten5 Questions Inventoryyousef0% (1)

- CHAPTER 10 - Pre-Board Examinations-1Dokument35 SeitenCHAPTER 10 - Pre-Board Examinations-1Mr.AccntngNoch keine Bewertungen

- 09.30.2017 Audit of CashDokument7 Seiten09.30.2017 Audit of CashPatOcampoNoch keine Bewertungen

- 4 - Audit of InvestmentsDokument11 Seiten4 - Audit of InvestmentsSharmaine Clemencio0Noch keine Bewertungen

- Auditing Appplications PrelimsDokument5 SeitenAuditing Appplications Prelimsnicole bancoroNoch keine Bewertungen

- AudcisDokument6 SeitenAudcisJessa May MendozaNoch keine Bewertungen

- Lagundi's Allowance for Credit LossDokument31 SeitenLagundi's Allowance for Credit LossJessa E. FabilaneNoch keine Bewertungen

- Audit Receivables Problem ADokument1 SeiteAudit Receivables Problem AXandae MempinNoch keine Bewertungen

- Aud HW 1Dokument12 SeitenAud HW 1Ma. BeatriceNoch keine Bewertungen

- Nfjpia Nmbe Auditing 2017 AnsDokument10 SeitenNfjpia Nmbe Auditing 2017 AnsSamieeNoch keine Bewertungen

- Rolito DionelaDokument40 SeitenRolito DionelaRolito Dionela50% (2)

- Documento - MX Ap Receivables Quizzer QDokument10 SeitenDocumento - MX Ap Receivables Quizzer QMiel Viason CañeteNoch keine Bewertungen

- InvestorsDokument8 SeitenInvestorsJohahn MacabuhayNoch keine Bewertungen

- Chapter 13Dokument25 SeitenChapter 13Clarize R. Mabiog50% (2)

- Audit of InventoryDokument7 SeitenAudit of InventoryDianne Antoinette Basallo0% (1)

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDokument9 SeitenEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaan50% (2)

- Problem No.1: D. P147,000 C. P349,000 C. P639,000Dokument6 SeitenProblem No.1: D. P147,000 C. P349,000 C. P639,000debate ddNoch keine Bewertungen

- Audit Prob Cash AnsDokument7 SeitenAudit Prob Cash AnsNoreen BinagNoch keine Bewertungen

- Audit of PPE 2Dokument2 SeitenAudit of PPE 2Raz MahariNoch keine Bewertungen

- Audit of Inventories - STDokument7 SeitenAudit of Inventories - STFrancine Holler0% (2)

- Gavial inventory costing and profit calculationDokument5 SeitenGavial inventory costing and profit calculationalford sery CammayoNoch keine Bewertungen

- AP 5905Q InventoriesDokument4 SeitenAP 5905Q Inventoriesxxxxxxxxx100% (1)

- Drill - ReceivablesDokument7 SeitenDrill - ReceivablesMark Domingo MendozaNoch keine Bewertungen

- ConsolidatedDokument18 SeitenConsolidatedjikee11Noch keine Bewertungen

- MQ 1 Receivables and InventoryDokument4 SeitenMQ 1 Receivables and Inventorymarygraceomac100% (2)

- PPE NotesDokument4 SeitenPPE Notesaldric taclanNoch keine Bewertungen

- Cpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Dokument11 SeitenCpa Review School of The Philippines Manila Auditing Problems Audit of Inventories Problem No. 1Angelou100% (1)

- 0Dokument5 Seiten0Nicco Ortiz50% (2)

- Advanced Accounting 2-DayagDokument472 SeitenAdvanced Accounting 2-DayagNazee Mohammad IsaNoch keine Bewertungen

- Measurement of Inventory and Inventory Shortage5Dokument3 SeitenMeasurement of Inventory and Inventory Shortage5CJ alandyNoch keine Bewertungen

- Answer KeyDokument6 SeitenAnswer KeyClaide John OngNoch keine Bewertungen

- Refresher Course: Audit of Cash and Cash EquivalentsDokument4 SeitenRefresher Course: Audit of Cash and Cash EquivalentsFery Ann100% (1)

- Audit of Investments - Set BDokument4 SeitenAudit of Investments - Set BZyrah Mae Saez0% (1)

- Compute the depreciation expense for each asset for the year 2015Dokument5 SeitenCompute the depreciation expense for each asset for the year 2015Marie Fe GullesNoch keine Bewertungen

- 2015 Solman AsuncionDokument219 Seiten2015 Solman AsuncionMarwin AceNoch keine Bewertungen

- Answer: A: 20 Regional Mid Year Convention Auditing CupDokument23 SeitenAnswer: A: 20 Regional Mid Year Convention Auditing CupJefferson ArayNoch keine Bewertungen

- Auditing - MasterDokument11 SeitenAuditing - MasterJohn Paulo SamonteNoch keine Bewertungen

- AACA 1 QE (Suggested)Dokument7 SeitenAACA 1 QE (Suggested)JamesNoch keine Bewertungen

- ACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREDokument12 SeitenACCO30053-AACA1 Final-Examination 1st-Semester AY2021-2022 QUESTIONNAIREKabalaNoch keine Bewertungen

- FAR Practice ProblemsDokument34 SeitenFAR Practice ProblemsJhon Eljun Yuto EnopiaNoch keine Bewertungen

- ASPECTSDokument4 SeitenASPECTSBSANoch keine Bewertungen

- Chapter 1Dokument5 SeitenChapter 1BSANoch keine Bewertungen

- ASPECTSDokument4 SeitenASPECTSBSANoch keine Bewertungen

- 2017 Vol 2 CH 4 AnsDokument18 Seiten2017 Vol 2 CH 4 AnsBSANoch keine Bewertungen

- 8 FraudDokument16 Seiten8 FraudBSANoch keine Bewertungen

- Chapter 1Dokument5 SeitenChapter 1BSANoch keine Bewertungen

- November 2018: "Life Will Only Change When You Become More Committed To Your Dreams Than You Are To Your Comfort Zone."Dokument1 SeiteNovember 2018: "Life Will Only Change When You Become More Committed To Your Dreams Than You Are To Your Comfort Zone."BSANoch keine Bewertungen

- Aircraft Cockpit Ergonomics DesignDokument1 SeiteAircraft Cockpit Ergonomics DesignBSANoch keine Bewertungen

- Chapter 12 CisDokument93 SeitenChapter 12 CisBSANoch keine Bewertungen

- Chap 12Dokument8 SeitenChap 12BSANoch keine Bewertungen

- CHAPTER 1 Auditing and Internal ControlDokument13 SeitenCHAPTER 1 Auditing and Internal ControlBSANoch keine Bewertungen

- Taxation First Preboard 2017 (PRTC) PDFDokument15 SeitenTaxation First Preboard 2017 (PRTC) PDFBSANoch keine Bewertungen

- Header and FooterDokument1 SeiteHeader and FooterBSANoch keine Bewertungen

- 1st PB-TADokument12 Seiten1st PB-TAGlenn Patrick de LeonNoch keine Bewertungen

- CG Theories, Board Structure, CommitteesDokument40 SeitenCG Theories, Board Structure, CommitteesMohd ThahzinNoch keine Bewertungen

- Department of Accountancy: Page - 1Dokument17 SeitenDepartment of Accountancy: Page - 1Mae Danica CalunsagNoch keine Bewertungen

- Re: Bank of Baroda - Reviewed Standalone & Consolidated Financial Results - Q2 (FY2022-23) - Regulation 33 of SEBI (LODR) Regulations, 2015Dokument43 SeitenRe: Bank of Baroda - Reviewed Standalone & Consolidated Financial Results - Q2 (FY2022-23) - Regulation 33 of SEBI (LODR) Regulations, 2015Mahesh DhalNoch keine Bewertungen

- Chap 4 - Audit in Automated EnvironmentDokument19 SeitenChap 4 - Audit in Automated EnvironmentTejas jogadeNoch keine Bewertungen

- BCom Third Year AssignmentsDokument2 SeitenBCom Third Year AssignmentsRamesh0% (4)

- Annual Report 2019Dokument483 SeitenAnnual Report 2019Sharif UL AhasanNoch keine Bewertungen

- 11 7110 22 FP Webonly AfpDokument89 Seiten11 7110 22 FP Webonly AfpAminaarshadwarriachNoch keine Bewertungen

- Fraud Chapter 1Dokument3 SeitenFraud Chapter 1Jeffrey O'LearyNoch keine Bewertungen

- P6 and P5 study notes on MABS, IM, and P2 MADMDokument7 SeitenP6 and P5 study notes on MABS, IM, and P2 MADMMxolisi NcubeNoch keine Bewertungen

- Subject Outline Strategic Management AccountingDokument10 SeitenSubject Outline Strategic Management AccountingsharpenxuNoch keine Bewertungen

- Compliance Audit GuidelinesDokument74 SeitenCompliance Audit GuidelinesVedran Stanetic100% (1)

- JPSP 2022 019Dokument9 SeitenJPSP 2022 019AGBA NJI THOMASNoch keine Bewertungen

- Accounting T1 - Companies Memo-1Dokument36 SeitenAccounting T1 - Companies Memo-1nhlesekanene100% (1)

- Brief Exercises PDFDokument6 SeitenBrief Exercises PDFRamzan AliNoch keine Bewertungen

- Group 1Dokument50 SeitenGroup 1agparcoNoch keine Bewertungen

- La Trobe Offer Letter Angad Singh Arneja 17602542 08.04.2013Dokument2 SeitenLa Trobe Offer Letter Angad Singh Arneja 17602542 08.04.2013Travis Conner67% (3)

- Treasury ManagementDokument39 SeitenTreasury ManagementRohit AggarwalNoch keine Bewertungen

- V ResumeDokument3 SeitenV ResumeAshwani AggarwalNoch keine Bewertungen

- EAPP Accounting Outline Jargon OpinionDokument4 SeitenEAPP Accounting Outline Jargon OpinionArthur AquinoNoch keine Bewertungen

- 01 NBP Chest Examination Report Main BodyDokument6 Seiten01 NBP Chest Examination Report Main BodyAhsan AliNoch keine Bewertungen

- Audit Functions in BankDokument23 SeitenAudit Functions in BankKavithaNoch keine Bewertungen

- IFE Matrix guide for evaluating internal factorsDokument4 SeitenIFE Matrix guide for evaluating internal factorsSudip DhakalNoch keine Bewertungen

- Audit of Insurance Companies NotesDokument38 SeitenAudit of Insurance Companies NotesHimangshu Hazarika57% (7)

- CPA Examination Form 2016Dokument2 SeitenCPA Examination Form 2016Atif KhanNoch keine Bewertungen

- Financial ManagementDokument88 SeitenFinancial ManagementSomevi Bright KodjoNoch keine Bewertungen

- Mas Problems 2018Dokument30 SeitenMas Problems 2018Christine Ballesteros Villamayor75% (4)

- Acn201 (Ques) ..Assign-1Dokument1 SeiteAcn201 (Ques) ..Assign-1tafeem kamalNoch keine Bewertungen

- HR Planning Forecasting Module 1 and Half of Module 2Dokument12 SeitenHR Planning Forecasting Module 1 and Half of Module 2Mich Albania100% (1)

- Ganzon Accounting FirmDokument41 SeitenGanzon Accounting FirmTeng Deguzman GanzonNoch keine Bewertungen

- Build Better Models with the SMART Financial Modelling MethodologyDokument20 SeitenBuild Better Models with the SMART Financial Modelling Methodologyjpware920% (1)