Beruflich Dokumente

Kultur Dokumente

Form No 16

Hochgeladen von

Chasa raviOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Form No 16

Hochgeladen von

Chasa raviCopyright:

Verfügbare Formate

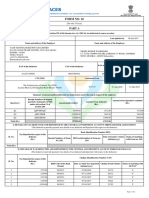

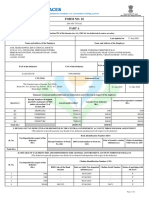

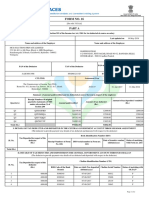

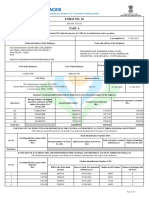

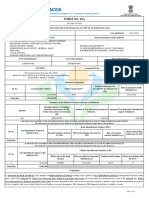

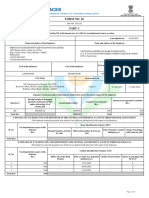

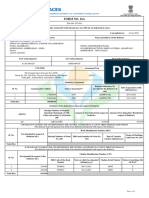

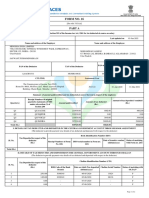

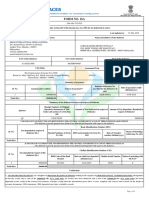

FORM NO.

16

[See rule 31(1)(a)]

PART A

Certificate under section 203 of the Income-tax Act,1961 for tax deducted at source on salary

Certificate No. PHLWDCL Last updated on 12-Jul-2018

Name and address of the Employer Name and address of the Employer

GOVERNMENT HOSPITAL MUTHU KANAGARAJAN SHENBAGAM

GOVERNMENT HOSPITAL,GOVT HOSPITAL ROAD,THENI, 117,FIRST STREET,CHINNAPPA NAGAR-622004 Tamil Nadu

THENI,THENI-625531

Tamil Nadu

deangtmc@gmail.com

PAN of the Deductor TAN of the Deductor PAN of the Employee Employee Reference number provided

by the Employer

(if available)

PANNOTREQD MRIG00250F DLCPS5119G

CIT (TDS) Assessment Year Period with the employer

The commissioner of Income Tax (TDS) From To

7th Floor,New Block,Aayakar Bhawan,121,M.G.Road, 2018-2019 01-apr-2017 31-mar-2018

Chennai-6000034

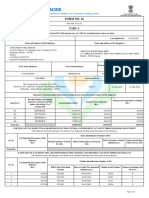

Summary of amount paid/Credited and tax deducted at source thereon in respect of the employee

Quarter(s) Receipt Number of Original

Quarterly statements of TDS Amount paid/Credited Amount of tax deducted Amount of tax

under sub-section (3) of (Rs.) deposited / remitted

Section 200 (Rs.)

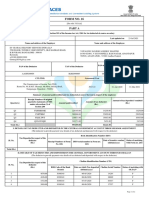

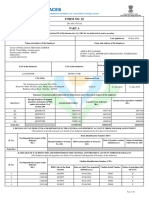

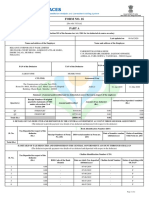

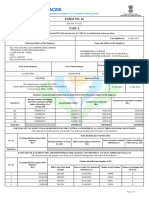

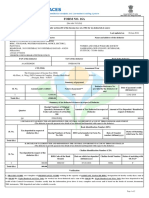

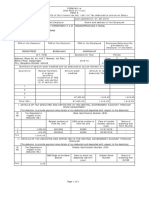

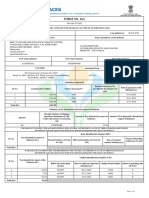

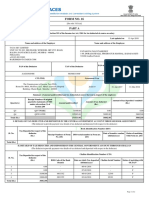

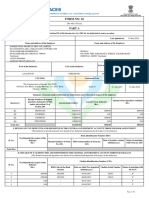

I.DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to deductee)

Book Identification Number (BIN)

SI.No Tax Deposited in respect of the

deductee Receipt number of Form DDO serial number in Form Date of transfer Status of matching

(Rs.) No.24G no. voucher with Form no.24G

24G (dd/mm/yyyy)

I.DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to deductee)

Book Identification Number (BIN)

SI.No Tax Deposited in respect of the

deductee Receipt number of Form DDO serial number in Form Date of transfer Status of matching

(Rs.) No.24G no. voucher with Form no.24G

24G (dd/mm/yyyy)

Das könnte Ihnen auch gefallen

- Taxes Completing A 1040ez NGPFDokument3 SeitenTaxes Completing A 1040ez NGPFShahnawaz DolaniNoch keine Bewertungen

- Form 16 1Dokument2 SeitenForm 16 1Vijay JiíväNoch keine Bewertungen

- Basha Form 16Dokument6 SeitenBasha Form 16BakiarajNoch keine Bewertungen

- Form 16 TDS CertificateDokument2 SeitenForm 16 TDS Certificatejatin kuashikNoch keine Bewertungen

- Abfpw1788f 2017-18 PDFDokument2 SeitenAbfpw1788f 2017-18 PDFNikhil121314Noch keine Bewertungen

- Form 16 Salary CertificateDokument9 SeitenForm 16 Salary CertificateHarish KumarNoch keine Bewertungen

- Form 16 20-21 PartaDokument2 SeitenForm 16 20-21 PartaTEMPORARY TEMPNoch keine Bewertungen

- Form 16Dokument9 SeitenForm 16KOKILA VIJAYAKUMARNoch keine Bewertungen

- FORM 16 TDS CERTIFICATEDokument6 SeitenFORM 16 TDS CERTIFICATEVinuthna ChinnapaNoch keine Bewertungen

- C - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFDokument5 SeitenC - Program Files (x86) - Folklore Payroll - ITReports - FORM16 - FORM16 - 02358756 PDFPrudhvi Raj ChowdaryNoch keine Bewertungen

- FORM 16 DETAILSDokument2 SeitenFORM 16 DETAILSKushal MalhotraNoch keine Bewertungen

- Salary Jan 2001Dokument2 SeitenSalary Jan 2001Kharde HrishikeshNoch keine Bewertungen

- Form 16 TDS CertificateDokument2 SeitenForm 16 TDS CertificateMANJUNATH GOWDANoch keine Bewertungen

- Form No. 16: Part ADokument8 SeitenForm No. 16: Part AParikshit ModiNoch keine Bewertungen

- Form16 742768 PDFDokument6 SeitenForm16 742768 PDFAtulsing thakurNoch keine Bewertungen

- CTS FormB16 202021Dokument6 SeitenCTS FormB16 202021Milind MoreNoch keine Bewertungen

- Form16 Part ADokument2 SeitenForm16 Part ATrinadh CheemaladinneNoch keine Bewertungen

- Form16 - Vinoth Subramaniyan PDFDokument6 SeitenForm16 - Vinoth Subramaniyan PDFi netsty BROWSING & TICKETSNoch keine Bewertungen

- Life insurance premium receiptDokument1 SeiteLife insurance premium receiptani dNoch keine Bewertungen

- A-Radha@dxc - Com F16Dokument9 SeitenA-Radha@dxc - Com F16Radha PraveenNoch keine Bewertungen

- Aofpc1472d 2020-21Dokument2 SeitenAofpc1472d 2020-21uday digumarthiNoch keine Bewertungen

- Nandigam Chandrasekhar Anspc5216h Fy202223 SignedDokument6 SeitenNandigam Chandrasekhar Anspc5216h Fy202223 SignedChandrasekhar NandigamNoch keine Bewertungen

- Form No. 16 Part A (2020)Dokument2 SeitenForm No. 16 Part A (2020)Dharmendra ParmarNoch keine Bewertungen

- Form 16 SummaryDokument9 SeitenForm 16 SummarySujata ChoudharyNoch keine Bewertungen

- Form16 ANNPM2039F 40000516 PDFDokument8 SeitenForm16 ANNPM2039F 40000516 PDFDr. Pankaj MishraNoch keine Bewertungen

- Form No. 16: Part ADokument5 SeitenForm No. 16: Part AHarish KumarNoch keine Bewertungen

- GCRO Module 120 - 07 Computation of TaxDokument34 SeitenGCRO Module 120 - 07 Computation of TaxKezia100% (1)

- 110773Dokument6 Seiten110773asheesh kumarNoch keine Bewertungen

- Form 16 2020-2021Dokument2 SeitenForm 16 2020-2021Parth BeriNoch keine Bewertungen

- Awyps9796h Q4 2018-19 PDFDokument2 SeitenAwyps9796h Q4 2018-19 PDFKuldeep SinghNoch keine Bewertungen

- Form No 16Dokument3 SeitenForm No 16rsharma09170Noch keine Bewertungen

- T D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19Dokument2 SeitenT D S Certificate Last Updated On 09 Jun 2018, BPCL AAATW0620Q - Q4 - 2018 19MinatiBindhaniNoch keine Bewertungen

- Form16-2021-2022 Part A (1)Dokument2 SeitenForm16-2021-2022 Part A (1)thaarini doraiswamiNoch keine Bewertungen

- Attpp2455j 2021-22Dokument2 SeitenAttpp2455j 2021-22Aditya PLNoch keine Bewertungen

- Anspg5953f 2018-19Dokument3 SeitenAnspg5953f 2018-19virajv1Noch keine Bewertungen

- Form No. 16A: From ToDokument2 SeitenForm No. 16A: From Tomuinbaig11Noch keine Bewertungen

- Form 16A TDS CertificateDokument2 SeitenForm 16A TDS CertificateRichardNoelFernandesNoch keine Bewertungen

- TDS Certificate SummaryDokument2 SeitenTDS Certificate SummaryAkriti JhaNoch keine Bewertungen

- Form16 488Dokument4 SeitenForm16 488karpaga prasannaNoch keine Bewertungen

- DFCPS4106B Ay201920 16 Unsigned PDFDokument6 SeitenDFCPS4106B Ay201920 16 Unsigned PDFAnuj SrivastavaNoch keine Bewertungen

- Private YofDokument9 SeitenPrivate YofSasi KumarNoch keine Bewertungen

- Documents - 5ab25ae789bcd942d600247c - TCL00427 BCWPK5181K16 07 2019 17 22 39 PDFDokument5 SeitenDocuments - 5ab25ae789bcd942d600247c - TCL00427 BCWPK5181K16 07 2019 17 22 39 PDFsadanand kanadeNoch keine Bewertungen

- పెరుగుదల - వికాస నియమాలుDokument6 Seitenపెరుగుదల - వికాస నియమాలుIliyas GNoch keine Bewertungen

- FORM 16 TAX DEDUCTION CERTIFICATEDokument2 SeitenFORM 16 TAX DEDUCTION CERTIFICATEpiyushkumar patelNoch keine Bewertungen

- Form 16A TDS CertificateDokument2 SeitenForm 16A TDS CertificatePridex Medical Technologies LLNoch keine Bewertungen

- Form No. 16A: From ToDokument2 SeitenForm No. 16A: From ToNanu PatelNoch keine Bewertungen

- Form No. 16A: From ToDokument2 SeitenForm No. 16A: From Tomukti nath guptaNoch keine Bewertungen

- Form 16A TDS CertificateDokument2 SeitenForm 16A TDS CertificateMohd QadeerNoch keine Bewertungen

- Form No. 16A: From ToDokument2 SeitenForm No. 16A: From ToRomendro ThokchomNoch keine Bewertungen

- Form No. 16A: From ToDokument2 SeitenForm No. 16A: From ToSurbhiNoch keine Bewertungen

- PDFReports PDFDokument6 SeitenPDFReports PDFAnonymous NzCr2mvNoch keine Bewertungen

- Dr. Archana B Behl - (11262-5733) - Cbipb4665b - 2020-21Dokument8 SeitenDr. Archana B Behl - (11262-5733) - Cbipb4665b - 2020-21Archana BNoch keine Bewertungen

- 005 TDSDokument2 Seiten005 TDSMohd QadeerNoch keine Bewertungen

- AAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartADokument2 SeitenAAFREEN MANSURI - CXVPM5640J - AY201920 - 16 - PartAmanishNoch keine Bewertungen

- FORM 16 TDS CERTIFICATEDokument8 SeitenFORM 16 TDS CERTIFICATESaleemNoch keine Bewertungen

- QwertabacbDokument3 SeitenQwertabacbNDKKMDBNoch keine Bewertungen

- Azepm3818m 2018-19 PDFDokument2 SeitenAzepm3818m 2018-19 PDFlogu prabhuNoch keine Bewertungen

- Form No. 16A: From ToDokument2 SeitenForm No. 16A: From ToHotel Elegance DelhiNoch keine Bewertungen

- Abdfa2602a Q2 2019-20 PDFDokument2 SeitenAbdfa2602a Q2 2019-20 PDFTarun AgarwalNoch keine Bewertungen

- 2022-23 TDSDokument6 Seiten2022-23 TDSMujtabaAliKhanNoch keine Bewertungen

- GBVPM5241K 2020 21Dokument6 SeitenGBVPM5241K 2020 21Nishant RoyNoch keine Bewertungen

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesVon EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNoch keine Bewertungen

- Ad in Faculty PlusDokument2 SeitenAd in Faculty PlusChasa raviNoch keine Bewertungen

- Smart CCTV Camera Surveillance System at Rastha Dedicated To Police Department AmaravadipudurDokument3 SeitenSmart CCTV Camera Surveillance System at Rastha Dedicated To Police Department AmaravadipudurChasa raviNoch keine Bewertungen

- Introduction About Computer Science and Engineering: Prepared by P.Ponvasan, Hod /cse SrrcetDokument39 SeitenIntroduction About Computer Science and Engineering: Prepared by P.Ponvasan, Hod /cse SrrcetChasa raviNoch keine Bewertungen

- State Bank of India: Two Year Post Doctoral Research FellowshipDokument2 SeitenState Bank of India: Two Year Post Doctoral Research FellowshipChasa raviNoch keine Bewertungen

- S T Syllabus 120718Dokument15 SeitenS T Syllabus 120718Chasa raviNoch keine Bewertungen

- Tax Invoice for Mobile PurchaseDokument1 SeiteTax Invoice for Mobile Purchaseayushi singhNoch keine Bewertungen

- Calculating unilateral tax credit for foreign incomeDokument17 SeitenCalculating unilateral tax credit for foreign incomenabilah natashaNoch keine Bewertungen

- Earnings Statement: Labor Solutions - Staff Right, LLCDokument1 SeiteEarnings Statement: Labor Solutions - Staff Right, LLCCoro'naado LinNoch keine Bewertungen

- Payslip For The Month of May 2021: 16 Iris House Business Centre Nangal Raya New Delhi 110046Dokument1 SeitePayslip For The Month of May 2021: 16 Iris House Business Centre Nangal Raya New Delhi 110046Manisha ThakurNoch keine Bewertungen

- Calculating MACRS DepreciationDokument10 SeitenCalculating MACRS DepreciationM ShahidNoch keine Bewertungen

- Salary AnnexureDokument1 SeiteSalary Annexuredpnair50% (4)

- Sadoy-Provisions Contengiences Exercise 3-Garfield CompanyDokument6 SeitenSadoy-Provisions Contengiences Exercise 3-Garfield CompanyReymark SadoyNoch keine Bewertungen

- f1098t PDFDokument6 Seitenf1098t PDFashley valdiviaNoch keine Bewertungen

- OMB No.1545-0008: DescriptionDokument1 SeiteOMB No.1545-0008: DescriptionHolanNoch keine Bewertungen

- Domestic CompanyDokument3 SeitenDomestic CompanyNIRAVKUMAR PATELNoch keine Bewertungen

- Source:: Dion Global Solutions LimitedDokument1 SeiteSource:: Dion Global Solutions LimitedPRATEEK JAROLIANoch keine Bewertungen

- 63-2003 Local Water District Franchise and Income TaxDokument2 Seiten63-2003 Local Water District Franchise and Income Taxapi-247793055100% (1)

- Vvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceDokument2 SeitenVvneq1m5ymzryny1nuj2swrlwef0dz09 InvoiceTYCS35 SIDDHESH PENDURKARNoch keine Bewertungen

- Payment Receipt: Applicant DetailsDokument1 SeitePayment Receipt: Applicant Detailsakhil SrinadhuNoch keine Bewertungen

- Minimum Alternate TaxDokument20 SeitenMinimum Alternate Taxapi-3832224100% (2)

- At The Time of AdjustmentDokument4 SeitenAt The Time of AdjustmentLavkesh SinghNoch keine Bewertungen

- Income Taxation Guide for Individuals and BusinessesDokument8 SeitenIncome Taxation Guide for Individuals and BusinessesPeligrino MacNoch keine Bewertungen

- Philippine Income Tax Explained in 40 CharactersDokument5 SeitenPhilippine Income Tax Explained in 40 CharactersGarcia Alizsandra L.Noch keine Bewertungen

- 08 NPC Vs CabanatuanDokument2 Seiten08 NPC Vs CabanatuanJanno SangalangNoch keine Bewertungen

- 1-Consumption Tax ExercisesDokument2 Seiten1-Consumption Tax ExercisesVu Thi ThuongNoch keine Bewertungen

- Quiz 7 - Dealings in PropertyDokument8 SeitenQuiz 7 - Dealings in PropertyCarlo manejaNoch keine Bewertungen

- FedEx RatesDokument2 SeitenFedEx RatesH.K. WORLWIDENoch keine Bewertungen

- Inv TG B1 92033426 101003789746 March 2023 PDFDokument4 SeitenInv TG B1 92033426 101003789746 March 2023 PDFVara Prasad dasariNoch keine Bewertungen

- Lecture 2c - Dealings in PropertyDokument4 SeitenLecture 2c - Dealings in PropertyCPANoch keine Bewertungen

- Revised InvoiceDokument1 SeiteRevised InvoiceShaik NoorshaNoch keine Bewertungen

- MyGlamm Invoice 1689772647-46Dokument1 SeiteMyGlamm Invoice 1689772647-46honeybunny6515Noch keine Bewertungen