Beruflich Dokumente

Kultur Dokumente

2016 Matrix Persons Tax Base PDF

Hochgeladen von

Dewm Dewm0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten1 SeiteOriginaltitel

2016 Matrix Persons Tax Base.pdf

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

28 Ansichten1 Seite2016 Matrix Persons Tax Base PDF

Hochgeladen von

Dewm DewmCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

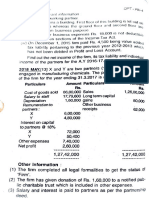

WHO ARE COVERED BY INCOME TAXATION?

PERSONS [S22(A)]

INDIVIDUALS Rule of Taxation Tax base Source

(S24, 25, 26) NIRC Reference

Resident Citizens S24(A)(1)(a) Taxable income W/in & w/out the Phils

Non-resident S24(A)(1)(b) Taxable income W/in the Phils

Citizen [S22(E)]

Resident Aliens S24(A)(1)(c) Taxable income W/in the Phils

[S22(F)]

Non-resident Aliens S25(A) Taxable income W/in the Phils

engaged in trade or

business [S25(A)]

Non-resident Aliens S25(B) Gross income W/in the Phils

not engaged in

trade or business

[S25(A)]

General S26 Taxable income W/in or/& w/out the

Professional Phils (similar to a

Partnership [S22(B)] corporation)

ESTATES & TRUSTS S60,61,62 Taxable Income Same basis as an

(S60-66) individual

CORPORATIONS

[S22(B)]

(S27,28, 29 & 30)

Domestic S27 Taxable income W/in & w/out the Phils

Corporation

[S22(C)]

Resident Foreign S28(A) Taxable income W/in the Phils

Corporation

[S22(H)]

Non-resident S28(B) Gross income W/in the Phils

Foreign Corporation

[S22(I)]

Das könnte Ihnen auch gefallen

- Mark Scheme (Results) January 2022Dokument28 SeitenMark Scheme (Results) January 2022Fahim AhmedNoch keine Bewertungen

- 2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFDokument5 Seiten2018 11 12 09 56 17 498 - Cinpm3915m - 2018 - PDFMohammed MaazNoch keine Bewertungen

- Chapter 3 Employment Income BKAT2013Dokument82 SeitenChapter 3 Employment Income BKAT2013Nurul AfiqahNoch keine Bewertungen

- AY5122 Semester 2 2022 2023 StudentsDokument8 SeitenAY5122 Semester 2 2022 2023 StudentsRahulNoch keine Bewertungen

- PDFDokument7 SeitenPDFprateekNoch keine Bewertungen

- TAX 388 Exempt Income 2023 StudentDokument37 SeitenTAX 388 Exempt Income 2023 StudentGimbaZANoch keine Bewertungen

- Sampa Video Case ExhibitsDokument1 SeiteSampa Video Case ExhibitsOnal RautNoch keine Bewertungen

- T04 - Profits TaxDokument18 SeitenT04 - Profits Taxting ting shihNoch keine Bewertungen

- Module A (June 2013) - AnswerDokument16 SeitenModule A (June 2013) - Answer徐滢Noch keine Bewertungen

- Term Test 2 SolutionDokument5 SeitenTerm Test 2 Solutionlalshahbaz57Noch keine Bewertungen

- Solution To P3-5: Chapter 8) - When The Shares Are Sold in 2021, When Landry Is A Non-Resident, TheDokument23 SeitenSolution To P3-5: Chapter 8) - When The Shares Are Sold in 2021, When Landry Is A Non-Resident, TheLucyNoch keine Bewertungen

- Indian Income Tax Return: (Refer Instructions For Eligibility)Dokument6 SeitenIndian Income Tax Return: (Refer Instructions For Eligibility)Rajat DubeyNoch keine Bewertungen

- Computation Format PDFDokument2 SeitenComputation Format PDFRajesh Jaiswal100% (1)

- Full Personal Income Tax ComputationDokument5 SeitenFull Personal Income Tax ComputationLi TingNoch keine Bewertungen

- Session 2 - Exempt Income and DeductionsDokument23 SeitenSession 2 - Exempt Income and DeductionsLesediNoch keine Bewertungen

- Extra Session 4 (25 Nov 2022) Spreadsheet (CH 5)Dokument2 SeitenExtra Session 4 (25 Nov 2022) Spreadsheet (CH 5)georgius gabrielNoch keine Bewertungen

- Itr 4 - Indian Income Tax ReturnDokument8 SeitenItr 4 - Indian Income Tax ReturnGAYATRI MOHAPATRANoch keine Bewertungen

- 01 Public Dislosue On Website Q2 FY22-23Dokument74 Seiten01 Public Dislosue On Website Q2 FY22-23assmexellenceNoch keine Bewertungen

- Busl320 Week11Dokument5 SeitenBusl320 Week11ZHOU JUNHUINoch keine Bewertungen

- LC032ALP000EVDokument32 SeitenLC032ALP000EVAttia FatimaNoch keine Bewertungen

- Numerical Solution Question 1 To 10Dokument7 SeitenNumerical Solution Question 1 To 10fmayo5402Noch keine Bewertungen

- This Assessment Is in Three Parts, Please Answer All ElementsDokument5 SeitenThis Assessment Is in Three Parts, Please Answer All ElementsAyesha SheheryarNoch keine Bewertungen

- 0202 - RGTECH - QR - 2020-12-31 - Radiant Globaltech Berhad - Quarterly Results - 31.12.2020 - 670632592Dokument20 Seiten0202 - RGTECH - QR - 2020-12-31 - Radiant Globaltech Berhad - Quarterly Results - 31.12.2020 - 670632592Iqbal YusufNoch keine Bewertungen

- Taxation of Tax Residents IndividualsDokument79 SeitenTaxation of Tax Residents IndividualsxueqiNoch keine Bewertungen

- ITR-4 Sugam: Indian Income Tax ReturnDokument5 SeitenITR-4 Sugam: Indian Income Tax ReturnJay Prakash shuklaNoch keine Bewertungen

- Indian Income Tax Return: (Refer Instructions For Eligibility)Dokument6 SeitenIndian Income Tax Return: (Refer Instructions For Eligibility)Isaac Joel RajNoch keine Bewertungen

- Business Tax and Tax PlanningDokument106 SeitenBusiness Tax and Tax PlanningSPHM HospitalityNoch keine Bewertungen

- Schedule 24DDokument1 SeiteSchedule 24DArpon D144Noch keine Bewertungen

- Schedule 24DDokument1 SeiteSchedule 24Driyadh al kamalNoch keine Bewertungen

- c91cdcb0-2b62-4b4a-9f3a-c2f82124965bDokument11 Seitenc91cdcb0-2b62-4b4a-9f3a-c2f82124965bAvnish KhuranaNoch keine Bewertungen

- Coi 2023 Sag PipesDokument3 SeitenCoi 2023 Sag Pipesprateek gangwaniNoch keine Bewertungen

- Exemptions 2024Dokument9 SeitenExemptions 2024mthandazomathNoch keine Bewertungen

- Schedule 24DDokument1 SeiteSchedule 24DMd.Samsuzzaman SobuzNoch keine Bewertungen

- ATX MYS - Examinable Documents Guidance Notes - 2020 0ct-2021sept - FINALDokument3 SeitenATX MYS - Examinable Documents Guidance Notes - 2020 0ct-2021sept - FINALAmy LauNoch keine Bewertungen

- Advanced Accounting Chapter 1 Problems 5-7Dokument2 SeitenAdvanced Accounting Chapter 1 Problems 5-7Mitch Boehm0% (1)

- Itr-1 Sahaj Individual Income Tax Return: Part A General InformationDokument5 SeitenItr-1 Sahaj Individual Income Tax Return: Part A General Informationrajesh kumar sharmaNoch keine Bewertungen

- Indian Income Tax ReturnDokument12 SeitenIndian Income Tax ReturnSharanu DodamaniNoch keine Bewertungen

- Learning Unit 6 Acquisition of An Interest in A Subsidiary DuringDokument17 SeitenLearning Unit 6 Acquisition of An Interest in A Subsidiary DuringThulani NdlovuNoch keine Bewertungen

- Form PDF 429324390030921Dokument9 SeitenForm PDF 429324390030921Good NamNoch keine Bewertungen

- 10 LossesDokument34 Seiten10 LossesHasnain SubtainNoch keine Bewertungen

- Indian Income Tax Return: (Refer Instructions For Eligibility)Dokument7 SeitenIndian Income Tax Return: (Refer Instructions For Eligibility)Yogesh SharmaNoch keine Bewertungen

- Mark Scheme (Results) Summer 2016: Pearson Edexcel IAL in Accounting (WAC11) Paper 01 The Accounting System and CostingDokument30 SeitenMark Scheme (Results) Summer 2016: Pearson Edexcel IAL in Accounting (WAC11) Paper 01 The Accounting System and CostingFarhad AhmedNoch keine Bewertungen

- Mark Scheme (Results) Summer 2016: Pearson Edexcel IAL in Accounting (WAC11) Paper 01 The Accounting System and CostingDokument30 SeitenMark Scheme (Results) Summer 2016: Pearson Edexcel IAL in Accounting (WAC11) Paper 01 The Accounting System and CostingFahim AhmedNoch keine Bewertungen

- Taxation 388, Chapter 7 Natural Persons Student 2023Dokument46 SeitenTaxation 388, Chapter 7 Natural Persons Student 2023GimbaZANoch keine Bewertungen

- Itr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 856116270220718 Assessment Year: 2018-19Dokument5 SeitenItr-1 Sahaj Individual Income Tax Return: Acknowledgement Number: 856116270220718 Assessment Year: 2018-19sky2flyboy@gmail.comNoch keine Bewertungen

- Hls Fy2010 Fy Results 20110222Dokument14 SeitenHls Fy2010 Fy Results 20110222Chin Siong GohNoch keine Bewertungen

- ITR 4 Sugam Form For Assessment Year 2018 19Dokument9 SeitenITR 4 Sugam Form For Assessment Year 2018 19sureshstipl sureshNoch keine Bewertungen

- (Marks 15) : DPT - Pbi-4Dokument22 Seiten(Marks 15) : DPT - Pbi-4chandrani4029Noch keine Bewertungen

- Assignment Cover: Course Code: Course Name: Assignment Title: Instructor's Name: Student's Name: DateDokument5 SeitenAssignment Cover: Course Code: Course Name: Assignment Title: Instructor's Name: Student's Name: DateΣταυρος ΑνιNoch keine Bewertungen

- RupalDokument6 SeitenRupalsivaganga MNoch keine Bewertungen

- Purpose Codes ForexDokument6 SeitenPurpose Codes ForexSundeep SinghNoch keine Bewertungen

- Tax Audit Taxing Audit!!... : By:-CA. Krishan Vrind JainDokument52 SeitenTax Audit Taxing Audit!!... : By:-CA. Krishan Vrind JainVrind JainNoch keine Bewertungen

- SS Tutorial 3 Sample ExamDokument4 SeitenSS Tutorial 3 Sample ExamFeahRafeah KikiNoch keine Bewertungen

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 525402640240619 Assessment Year: 2019-20Dokument6 SeitenItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 525402640240619 Assessment Year: 2019-20రాకేష్ బాబు చట్టిNoch keine Bewertungen

- Indian Income Tax Return Assessment Year 2021 - 22: SugamDokument12 SeitenIndian Income Tax Return Assessment Year 2021 - 22: SugamArihant SatpathyNoch keine Bewertungen

- 0452 Accounting: MARK SCHEME For The October/November 2012 SeriesDokument10 Seiten0452 Accounting: MARK SCHEME For The October/November 2012 SeriesJoel GwenereNoch keine Bewertungen

- Fac2601-2013-10 - Answers PDFDokument12 SeitenFac2601-2013-10 - Answers PDFcandiceNoch keine Bewertungen

- Form PDF 905926560311222Dokument6 SeitenForm PDF 905926560311222AkshitGuptaNoch keine Bewertungen

- TaxationDokument13 SeitenTaxationneshh16Noch keine Bewertungen

- Lesson 6Dokument4 SeitenLesson 6Dewm DewmNoch keine Bewertungen

- Last-Minute TipsDokument36 SeitenLast-Minute TipsDewm DewmNoch keine Bewertungen

- Concepts Discussed in Cases Decided by JABC in Civil Law Part IIDokument81 SeitenConcepts Discussed in Cases Decided by JABC in Civil Law Part IIDewm DewmNoch keine Bewertungen

- Postal Id Application FormDokument2 SeitenPostal Id Application FormDewm Dewm100% (2)

- 2016 Tax Aid Classification of TaxpayersDokument4 Seiten2016 Tax Aid Classification of TaxpayersDewm DewmNoch keine Bewertungen

- Court: Atty. Baconawa: Court: Atty. Baconawa To WitnessDokument3 SeitenCourt: Atty. Baconawa: Court: Atty. Baconawa To WitnessDewm DewmNoch keine Bewertungen

- Constitutional Law II Assigned Cases 2Dokument5 SeitenConstitutional Law II Assigned Cases 2Dewm DewmNoch keine Bewertungen

- Tax ReviewerDokument16 SeitenTax ReviewerDewm DewmNoch keine Bewertungen

- Civil Velasco Cases PDFDokument65 SeitenCivil Velasco Cases PDFAmicus CuriaeNoch keine Bewertungen

- Appointing Power 2. Judicial Department: Luego V CSC GR L-69137, Aug 5,1986Dokument1 SeiteAppointing Power 2. Judicial Department: Luego V CSC GR L-69137, Aug 5,1986Dewm DewmNoch keine Bewertungen

- Bo SanchezDokument4 SeitenBo SanchezDewm DewmNoch keine Bewertungen

- Corpo Reviewer PrelimDokument41 SeitenCorpo Reviewer PrelimDewm DewmNoch keine Bewertungen

- Pontaoe Vs PontaoeDokument5 SeitenPontaoe Vs PontaoeDewm DewmNoch keine Bewertungen

- Case Digest Conflict FinalDokument161 SeitenCase Digest Conflict FinalDewm Dewm100% (1)

- No Build Zone PolicyDokument8 SeitenNo Build Zone PolicyDewm DewmNoch keine Bewertungen