Beruflich Dokumente

Kultur Dokumente

Required

Hochgeladen von

aklank_218105Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Required

Hochgeladen von

aklank_218105Copyright:

Verfügbare Formate

Apex Computer Company manufactures and sells large, mainframe computers.

The

computers range in price from $1 to $3 million and gross profit averages 40% of sales

price. The company has a liberal trade-in policy. Customers are allowed to trade in their

computers for a new generation machine anytime within three years of sale. The trade-in

allowance granted will vary depending on the number of years between original sale and

trade-in. However, in all cases, the allowance is expected to be approximately 25% higher

than the prevailing market price of the computer.

As an example, in 2011 a customer who purchased a computer in 2009 for $2 million (the

computer cost Apex $1,200,000 to manufacture) decided to trade it in for a new

computer. The sales price of the new computer was $2.5 million and a trade-in allowance

of $600,000 was granted on the old machine. As a result of the trade-in allowance, the

customer had to pay only $1.9 million ($2.5 million less $600,000) for the new computer.

The old computer taken back by Apex had a resale value of $480,000. The new computer

cost $1.5 million to manufacture. The company accounted for the trade-in by recognizing

revenue of $2,380,000 ($1.9 million received in cash + $480,000 value of old computer).

Required:

Does the company's revenue recognition policy for trade-ins seem appropriate? If not,

describe the problem created by the liberal trade-in policy.

SOLUTION

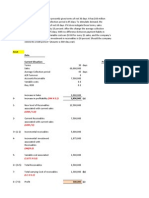

The revenue recognition policy is questionable. The liberal trade-in policy causes gross

profit to be overstated on the original sale and understated on the trade-in sale. This

results from the granting of a trade-in allowance for the old computer that is greater than

the old computer's resale value. Using the company's recognition policy, gross profit

recognized on the two sales would be as follows:

Original sale Trade-in sale

Sales price $2,000,000 $2,380,000

Cost of goods sold 1,200,000 1,500,000

Gross profit $ 800,000 $ 880,000

Gross profit percentage 40% 37%

Of course, there is no guarantee that the customer will exercise the trade-in option.

If, however, a large percentage of customers do exercise the option, and the

distortion in gross profit is material, the company should adopt a revenue

recognition policy that results in a more stable gross profit percentage for the two

transactions.

Das könnte Ihnen auch gefallen

- Managerial Economics Assignment 1Dokument6 SeitenManagerial Economics Assignment 1Crea Madula Sedano100% (1)

- ECG Company Sells Lightweight Tables. One Table Is Sold For $45. Variable and Fixed Expenses Data Is Given Below: Variable Expenses Per Unit: $18 Fixed Expenses Per Year: $540,000Dokument2 SeitenECG Company Sells Lightweight Tables. One Table Is Sold For $45. Variable and Fixed Expenses Data Is Given Below: Variable Expenses Per Unit: $18 Fixed Expenses Per Year: $540,000UMAIR AFZALNoch keine Bewertungen

- CVP Analysis Review Problem With SolutionDokument1 SeiteCVP Analysis Review Problem With SolutionSUNNY BHUSHAN0% (1)

- STRAT ReviewerDokument13 SeitenSTRAT ReviewerCrisel SalomeoNoch keine Bewertungen

- Cost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3Dokument3 SeitenCost & Managerial Accounting Cost-Volume-Profit Analysis: Page 1 of 3mohammad bilal0% (1)

- Strategy Simulation Managerial Decision Making: Strategy and Value Creation in Traditional IndustriesDokument7 SeitenStrategy Simulation Managerial Decision Making: Strategy and Value Creation in Traditional Industriesmmhoward20100% (5)

- Strat Cost PAA1Dokument12 SeitenStrat Cost PAA1Katrina Jesrene DatoyNoch keine Bewertungen

- Lecture Questions-SolDokument5 SeitenLecture Questions-SolRami RRKNoch keine Bewertungen

- Final Exam - Practice FinalDokument12 SeitenFinal Exam - Practice FinalShi FrankNoch keine Bewertungen

- CVP H101Dokument4 SeitenCVP H101poppy2890Noch keine Bewertungen

- Accounting For ManagerDokument8 SeitenAccounting For ManagerVarun SinghalNoch keine Bewertungen

- Chapter 2 Test Study Guide MSDokument4 SeitenChapter 2 Test Study Guide MSdestinyv07100% (1)

- Incremental AnalysisDokument40 SeitenIncremental Analysismehnaz kNoch keine Bewertungen

- Chapter 6 - FullDokument11 SeitenChapter 6 - FullRakan AnawassrahNoch keine Bewertungen

- Chapter 13: Answers To Questions and Problems: I I I I IDokument4 SeitenChapter 13: Answers To Questions and Problems: I I I I Idt8302Noch keine Bewertungen

- Mas 04 - CVP AnalysisDokument7 SeitenMas 04 - CVP AnalysisCarl Angelo LopezNoch keine Bewertungen

- 15 ManagementDokument69 Seiten15 ManagementBelista25% (4)

- Incremental Analysis 2Dokument12 SeitenIncremental Analysis 2enter_sas100% (2)

- Cost Volume Profit AnalysisDokument15 SeitenCost Volume Profit AnalysisxxpinkywitchxxNoch keine Bewertungen

- Coma Quiz 6 KeyDokument20 SeitenComa Quiz 6 KeyMD TARIQUE NOORNoch keine Bewertungen

- Chapter OneDokument5 SeitenChapter OneHazraphine LinsoNoch keine Bewertungen

- MAS 5 - CVPA ExercisesDokument4 SeitenMAS 5 - CVPA ExercisesAngela Miles DizonNoch keine Bewertungen

- DMMR CVP MathDokument2 SeitenDMMR CVP MathSabbir ZamanNoch keine Bewertungen

- Materi Amb CH 8Dokument73 SeitenMateri Amb CH 8Sri HaryantiNoch keine Bewertungen

- 3 ManAcc CasesDokument5 Seiten3 ManAcc CasesalexsophieNoch keine Bewertungen

- Cost Volume Profit Analysis - With KEYDokument8 SeitenCost Volume Profit Analysis - With KEYPatricia AtienzaNoch keine Bewertungen

- Ms 03 - CVP AnalysisDokument10 SeitenMs 03 - CVP AnalysisDin Rose GonzalesNoch keine Bewertungen

- Solutions To Week 3 Practice Text ExercisesDokument6 SeitenSolutions To Week 3 Practice Text Exercisespinkgold48Noch keine Bewertungen

- CVP Analysis Exercise-OLDDokument3 SeitenCVP Analysis Exercise-OLDIftekhar Uddin M.D EisaNoch keine Bewertungen

- HW 6-19Dokument9 SeitenHW 6-19tgawri100% (2)

- Case Review - PPTMDokument23 SeitenCase Review - PPTMLeonardo TukimanNoch keine Bewertungen

- COST VOLUME PROFIT ANALYSIS - ExercisesDokument4 SeitenCOST VOLUME PROFIT ANALYSIS - ExercisesLloyd Vincent O. TingsonNoch keine Bewertungen

- 6e Brewer CH05 B EOCDokument18 Seiten6e Brewer CH05 B EOCLiyanCenNoch keine Bewertungen

- Orange and Black Minimalist Thesis Defense PresentationDokument40 SeitenOrange and Black Minimalist Thesis Defense PresentationthegreatNoch keine Bewertungen

- 02 CVP Analysis For PrintingDokument8 Seiten02 CVP Analysis For Printingkristine claire50% (2)

- Chapter 8 - PricingDokument10 SeitenChapter 8 - PricingrasmimoqbelNoch keine Bewertungen

- 8.1 Allied Office Product Case McsDokument5 Seiten8.1 Allied Office Product Case McsMahfoz Kazol100% (1)

- 2-4 2004 Jun QDokument11 Seiten2-4 2004 Jun QAjay TakiarNoch keine Bewertungen

- CVPDokument45 SeitenCVPRona Mae Ocampo ResareNoch keine Bewertungen

- 52 Resource 7Dokument4 Seiten52 Resource 7gurudevgaytri0% (1)

- Day 17 Chap 10 Rev. FI5 Ex PRDokument13 SeitenDay 17 Chap 10 Rev. FI5 Ex PRFyaj Rohan100% (1)

- Chapter 7 Pricing SVDokument27 SeitenChapter 7 Pricing SVGayan AkilaNoch keine Bewertungen

- TUTORIAL 6 & 7 QuestionsDokument1 SeiteTUTORIAL 6 & 7 QuestionsgasdadsNoch keine Bewertungen

- Accounting MCQDokument7 SeitenAccounting MCQsamuelkishNoch keine Bewertungen

- Week 04-05 - Exercise 01 (Financial Ratios)Dokument5 SeitenWeek 04-05 - Exercise 01 (Financial Ratios)ريم الميسريNoch keine Bewertungen

- Report Summary-Managerial AccountingDokument4 SeitenReport Summary-Managerial AccountingClaudine Mae G. TeodoroNoch keine Bewertungen

- 20PT31 Cf-IiDokument4 Seiten20PT31 Cf-IiSakthivelayudham BhyramNoch keine Bewertungen

- Practice of Cost Volume Profit Breakeven AnalysisDokument4 SeitenPractice of Cost Volume Profit Breakeven AnalysisHafiz Abdulwahab100% (1)

- MBA 504 Ch8 SolutionsDokument11 SeitenMBA 504 Ch8 SolutionspheeyonaNoch keine Bewertungen

- Strategic Cost MidtermDokument15 SeitenStrategic Cost MidtermhsjhsNoch keine Bewertungen

- f5 2013 Jun A PDFDokument11 Seitenf5 2013 Jun A PDFcatcat1122Noch keine Bewertungen

- I. Questions:: Let's Check!Dokument15 SeitenI. Questions:: Let's Check!Santiago BuladacoNoch keine Bewertungen

- Savant FrameworkDokument41 SeitenSavant FrameworkফেরদৌসআলমNoch keine Bewertungen

- Which Type of Benchmarking Is The Company Using?Dokument20 SeitenWhich Type of Benchmarking Is The Company Using?Aslam SiddiqNoch keine Bewertungen

- Chapter 18 Solutions ManualDokument46 SeitenChapter 18 Solutions ManualLan Anh0% (1)

- Net Profit (Review and Analysis of Cohan's Book)Von EverandNet Profit (Review and Analysis of Cohan's Book)Noch keine Bewertungen

- Pioneering Views: Pushing the Limits of Your C/ETRM – Volume 1Von EverandPioneering Views: Pushing the Limits of Your C/ETRM – Volume 1Noch keine Bewertungen

- Summary of Heather Brilliant & Elizabeth Collins's Why Moats MatterVon EverandSummary of Heather Brilliant & Elizabeth Collins's Why Moats MatterNoch keine Bewertungen

- CSM 404 Module 11 AssignmentDokument1 SeiteCSM 404 Module 11 Assignmentaklank_218105Noch keine Bewertungen

- Ratio AnalysisDokument11 SeitenRatio Analysisaklank_218105Noch keine Bewertungen

- Running Head: Financial Accounting ManagementDokument7 SeitenRunning Head: Financial Accounting Managementaklank_218105Noch keine Bewertungen

- Assignment #1 Solution (Chapters 3 and 5)Dokument5 SeitenAssignment #1 Solution (Chapters 3 and 5)aklank_218105Noch keine Bewertungen

- 5 7Dokument2 Seiten5 7aklank_218105100% (1)

- Shca20 eDokument6 SeitenShca20 eaklank_218105Noch keine Bewertungen

- Case 2 Template For Brookstone OB - Gyn - CompleteDokument9 SeitenCase 2 Template For Brookstone OB - Gyn - Completeaklank_218105100% (1)

- Index Movements: Index Based Graphical RepresentationDokument1 SeiteIndex Movements: Index Based Graphical Representationaklank_218105Noch keine Bewertungen

- IE 3265 Production & Operations Planning: Ch. 3 - Aggregate Planning R. Lindeke UMDDokument43 SeitenIE 3265 Production & Operations Planning: Ch. 3 - Aggregate Planning R. Lindeke UMDaklank_218105Noch keine Bewertungen

- Indicate What Do You Infer From The Numbers You Computed in Geometric Mean and Geometric Mean With Price Relatives?Dokument3 SeitenIndicate What Do You Infer From The Numbers You Computed in Geometric Mean and Geometric Mean With Price Relatives?aklank_218105Noch keine Bewertungen

- Project 1Dokument6 SeitenProject 1aklank_218105Noch keine Bewertungen

- Name Surname MSFT RatiosDokument64 SeitenName Surname MSFT Ratiosaklank_218105Noch keine Bewertungen

- QuestionDokument1 SeiteQuestionaklank_218105Noch keine Bewertungen

- State Tax Return NC-F14Dokument2 SeitenState Tax Return NC-F14aklank_218105Noch keine Bewertungen

- Search WaiverDokument1 SeiteSearch WaiverHacer Gungoray100% (1)

- Bharat Sanchar Nigam Limited: Invoice For Post Paid ServicesDokument2 SeitenBharat Sanchar Nigam Limited: Invoice For Post Paid ServicessuryaNoch keine Bewertungen

- Welcome Speech For Seminar in College 2Dokument4 SeitenWelcome Speech For Seminar in College 2Niño Jay C. GastonesNoch keine Bewertungen

- HGP Year End Report 2021-2022 NewDokument169 SeitenHGP Year End Report 2021-2022 Newangelica sungaNoch keine Bewertungen

- Chapter 3 MethodologyDokument22 SeitenChapter 3 MethodologySiva KrishnaNoch keine Bewertungen

- Anodizing PDFDokument12 SeitenAnodizing PDFsanjay ukalkarNoch keine Bewertungen

- Demand Management in Global Supply Chain - Disertasi S3Dokument166 SeitenDemand Management in Global Supply Chain - Disertasi S3Ahmad BuchoriNoch keine Bewertungen

- Pega DevOps Release Pipeline OverviewDokument200 SeitenPega DevOps Release Pipeline OverviewArun100% (1)

- Piezometers: Types, Functions, & How It Works?Dokument38 SeitenPiezometers: Types, Functions, & How It Works?Encardio RiteNoch keine Bewertungen

- Krunker SettingsDokument2 SeitenKrunker SettingsArsyad DanishNoch keine Bewertungen

- Book Review Module 8Dokument18 SeitenBook Review Module 8Asherah Mica MarquezNoch keine Bewertungen

- Focus: Optimised Efficiency For The Paper IndustryDokument24 SeitenFocus: Optimised Efficiency For The Paper IndustryZoran BadurinaNoch keine Bewertungen

- Site AnalysisDokument4 SeitenSite AnalysisS O NALNoch keine Bewertungen

- Colony Earth - Part X: The Myriad WorldsDokument7 SeitenColony Earth - Part X: The Myriad WorldsV. Susan FergusonNoch keine Bewertungen

- Effect of Water On Quality and Preservation of FoodDokument10 SeitenEffect of Water On Quality and Preservation of FoodrupinisinnanNoch keine Bewertungen

- HSE Inspection Report-07Dokument32 SeitenHSE Inspection Report-07najihahNoch keine Bewertungen

- Student EssaysDokument41 SeitenStudent EssaysAsif RahmanNoch keine Bewertungen

- Marketing Plan Potato Food TruckDokument25 SeitenMarketing Plan Potato Food TruckAhasan h. ShuvoNoch keine Bewertungen

- 5CT PDVSA em - 18!00!05 EnglishDokument27 Seiten5CT PDVSA em - 18!00!05 EnglishJuan Gutierrez100% (1)

- HandwritingDokument4 SeitenHandwritingManujNoch keine Bewertungen

- Medicine Colloquium Exam - 2015 ADokument41 SeitenMedicine Colloquium Exam - 2015 ArachaNoch keine Bewertungen

- Service Installation Rules For Connection To Electricity Network (See Chapter 14)Dokument83 SeitenService Installation Rules For Connection To Electricity Network (See Chapter 14)EduardoMorcilloNoch keine Bewertungen

- Oleg Losev NegativeDokument2 SeitenOleg Losev NegativeRyan LizardoNoch keine Bewertungen

- LAC BrigadaDokument6 SeitenLAC BrigadaRina Mae LopezNoch keine Bewertungen

- Personal Tutor: 11 + MATHS Test 6Dokument10 SeitenPersonal Tutor: 11 + MATHS Test 6siddhant4uNoch keine Bewertungen

- Head and Neck Seminal Papers From Tata HospitalDokument29 SeitenHead and Neck Seminal Papers From Tata HospitalSudhir NairNoch keine Bewertungen

- Table of SpecificationDokument2 SeitenTable of SpecificationAya AlisasisNoch keine Bewertungen

- Factors Influencing The Selection Of: MaterialsDokument22 SeitenFactors Influencing The Selection Of: MaterialsMaulik KotadiyaNoch keine Bewertungen

- 1353apni KakshaDokument43 Seiten1353apni KakshaArush GautamNoch keine Bewertungen

- Effect of Different Laser Texture Configurations On Improving Surface Wettability and Wear Characteristics of Ti6Al4V Implant MaterialDokument14 SeitenEffect of Different Laser Texture Configurations On Improving Surface Wettability and Wear Characteristics of Ti6Al4V Implant Materialnitish kumar100% (1)