Beruflich Dokumente

Kultur Dokumente

2 Tax Rates PDF

Hochgeladen von

ekta singhOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2 Tax Rates PDF

Hochgeladen von

ekta singhCopyright:

Verfügbare Formate

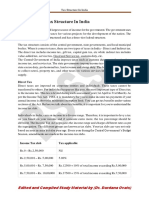

TAX RATES

In this part you can gain knowledge about the normal tax rates applicable to different taxpayers.

For special tax rates applicable to special incomes like long term capital gains, winnings from

lottery, etc. refer “Tax Rates” under “Tax Charts & Tables”. The tax rates discussed in this part

are applicable for assessment year 2019-20 i.e. financial year 2018-19.

Normal tax rates applicable to an individual

The normal tax rates applicable to a resident individual will depend on the age of the individual.

However, in case of a non-resident individual the tax rates will be same irrespective of his age.

For the purpose of ascertainment of the applicable tax slab, an individual can be classified as

follows:

Resident individual below the age of 60 years.

Resident individual of the age of 60 years or above at any time during the year but below

the age of 80 years.

Resident individual of the age of 80 years or above at any time during the year.

Non-resident individual irrespective of the age.

Normal tax rates applicable to a resident individual below the age of 60 years i.e. born on

or after 1.4.1958

Net income range Income-tax rates Health and

Education Cess

Up to Rs. 2,50,000 Nil Nil

Rs. 2,50,000 – Rs. 5,00,000 5% of (total income minus Rs. 2,50,000) 4% of income tax

[*]

Rs. 5,00,000 – Rs. 10,00,000 Rs. 12,500 + 20% of (total income minus 4% of income tax

Rs. 5,00,000)

Above Rs. 10,00,000 Rs. 1,12,500 + 30% of (total income 4% of income tax

minus Rs. 10,00,000)

Surcharge: Surcharge is levied @ 10% on the amount of income-tax if net income exceeds Rs 50

Lakh but doesn’t exceed Rs. 1 crore and @ 15% on the amount of income tax if net income

exceeds Rs. 1 crore. In a case where surcharge is levied, health and education cess of 4% will be

[As amended by Finance Act, 2018]

levied on the amount of income tax plus surcharge.

However, marginal relief is available from surcharge in such a manner that in the case where net

income exceeds Rs. 50 lakh but doesn’t exceed Rs. 1 Crore, the amount payable as income tax

and surcharge shall not exceed the total amount payable as income tax on total income of Rs 50

Lakh by more than the amount of income that exceeds Rs 50 Lakhs.

Further, in a case where net income exceeds Rs. 1 crore, marginal relief shall be available from

surcharge in such a manner that the amount payable as income tax and surcharge shall not

exceed the total amount payable as income-tax on total income of Rs. 1 crore by more than the

amount of income that exceeds Rs. 1 crore.

AMT : In the case of a non-corporate taxpayer to whom the provisions of Alternate Minimum

Tax (AMT) applies, tax payable cannot be less than 18.5% (+HEC) of "adjusted total income"

computed as per section 115JC. For provisions relating to AMT refer tutorial on “MAT/AMT” in

tutorial section.

However, w.e.f. Assessment Year 2019-20, In case of a unit located in an IFSC which derives its

income solely in convertible foreign exchange, the rate of AMT under section 115JF shall be at

the rate of 9% instead of existing rate of 18.50%.

[*] A resident individual (whose net income does not exceed Rs. 3,50,000) can avail rebate under

section 87A. It is deductible from income-tax before calculating education cess. The amount of

rebate is 100 per cent of income-tax or Rs. 2,500, whichever is less.

Normal tax rates applicable to a resident individual of the age of 60 years or above at any

time during the year but below the age of 80 years

Net income range Income-tax rates Health and Education

Cess

Up to Rs. 3,00,000 Nil Nil

Rs. 3,00,000 – Rs. 5,00,000 5% of (total income minus Rs. 4% of income-tax

3,00,000) [*]

Rs. 5,00,000 – Rs. 10,00,000 Rs. 10,000 + 20% of (total income 4% of income-tax

minus Rs. 5,00,000)

Above Rs. 10,00,000 Rs. 1,10,000 + 30% of (total income 4% of income-tax

minus Rs. 10,00,000)

[As amended by Finance Act, 2018]

Surcharge: Surcharge is levied @ 10% on the amount of income-tax if net income exceeds Rs 50

Lakh but doesn’t exceed Rs. 1 crore and @ 15% on the amount of income tax if net income

exceeds Rs. 1 crore. In a case where surcharge is levied, health and education cess of 4% will be

levied on the amount of income tax plus surcharge.

However, marginal relief is available from surcharge in such a manner that in the case where net

income exceeds Rs. 50 lakh but doesn’t exceed Rs. 1 Crore, the amount payable as income tax

and surcharge shall not exceed the total amount payable as income tax on total income of Rs 50

Lakh by more than the amount of income that exceeds Rs 50 Lakhs.

Further, in a case where net income exceeds Rs. 1 crore, marginal relief shall be available from

surcharge in such a manner that the amount payable as income tax and surcharge shall not

exceed the total amount payable as income-tax on total income of Rs. 1 crore by more than the

amount of income that exceeds Rs. 1 crore.

AMT: In the case of a non-corporate taxpayer to whom the provisions of Alternate Minimum

Tax (AMT) applies, tax payable cannot be less than 18.5% (+HEC) of "adjusted total income"

computed as per section 115JC. For provisions relating to AMT refer tutorial on “MAT/AMT” in

tutorial section.

However, w.e.f. Assessment Year 2019-20, In case of a unit located in an IFSC which derives its

income solely in convertible foreign exchange, the rate of AMT under section 115JF shall be at

the rate of 9% instead of existing rate of 18.50%.

[*] A resident individual (whose net income does not exceed Rs. 3,50,000) can avail rebate under

section 87A. It is deductible from income-tax before calculating education cess. The amount of

rebate is 100 per cent of income-tax or Rs. 2,500, whichever is less.

Normal tax rates applicable to a resident individual of the age of 80 years or above at any

time during the year

Net income range Income-tax rates Health and Education

Cess

Up to Rs. 5,00,000 Nil Nil

Rs. 5,00,000 – Rs. 10,00,000 20% of (total income minus Rs. 4% of income-tax

5,00,000)

Above Rs. 10,00,000 Rs. 1,00,000 + 30% of (total income 4% of income-tax

minus Rs. 10,00,000)

[As amended by Finance Act, 2018]

Surcharge: Surcharge is levied @ 10% on the amount of income-tax if net income exceeds Rs 50

Lakh but doesn’t exceed Rs. 1 crore and @ 15% on the amount of income tax if net income

exceeds Rs. 1 crore. In a case where surcharge is levied, health and education cess of 4% will be

levied on the amount of income tax plus surcharge.

However, marginal relief is available from surcharge in such a manner that in the case where net

income exceeds Rs. 50 lakh but doesn’t exceed Rs. 1 Crore, the amount payable as income tax

and surcharge shall not exceed the total amount payable as income tax on total income of Rs 50

Lakh by more than the amount of income that exceeds Rs 50 Lakhs.

Further, in a case where net income exceeds Rs. 1 crore, marginal relief shall be available from

surcharge in such a manner that the amount payable as income tax and surcharge shall not

exceed the total amount payable as income-tax on total income of Rs. 1 crore by more than the

amount of income that exceeds Rs. 1 crore.

AMT : In the case of a non-corporate taxpayer to whom the provisions of Alternate Minimum

Tax (AMT) applies, tax payable cannot be less than 18.5% (+HEC) of "adjusted total income"

computed as per section 115JC. For provisions relating to AMT refer tutorial on “MAT/AMT” in

tutorial section.

However, w.e.f. Assessment Year 2019-20, In case of a unit located in an IFSC which derives its

income solely in convertible foreign exchange, the rate of AMT under section 115JF shall be at

the rate of 9% instead of existing rate of 18.50%.

Non-resident individual irrespective of age

Net income range Income-tax rates Health and

Education Cess

Up to Rs. 2,50,000 Nil Nil

Rs. 2,50,000 – Rs. 5,00,000 5% of (total income minus Rs. 4% of income-tax

2,00,000) [*]

Rs. 5,00,000 – Rs. 10,00,000 Rs. 12,500 + 20% of (total income 4% of income-tax

minus Rs. 5,00,000)

Above Rs. 10,00,000 Rs. 1,12,500 + 30% of (total income 4% of income-tax

minus Rs. 10,00,000)

[As amended by Finance Act, 2018]

Surcharge: Surcharge is levied @ 10% on the amount of income-tax if net income exceeds Rs 50

Lakh but doesn’t exceed Rs. 1 crore and @ 15% on the amount of income tax if net income

exceeds Rs. 1 crore. In a case where surcharge is levied, health and education cess of 4% will be

levied on the amount of income tax plus surcharge.

However, marginal relief is available from surcharge in such a manner that in the case where net

income exceeds Rs. 50 lakh but doesn’t exceed Rs. 1 Crore, the amount payable as income tax

and surcharge shall not exceed the total amount payable as income tax on total income of Rs 50

Lakh by more than the amount of income that exceeds Rs 50 Lakhs.

Further, in a case where net income exceeds Rs. 1 crore, marginal relief shall be available from

surcharge in such a manner that the amount payable as income tax and surcharge shall not

exceed the total amount payable as income-tax on total income of Rs. 1 crore by more than the

amount of income that exceeds Rs. 1 crore.

AMT : In the case of a non-corporate taxpayer to whom the provisions of Alternate Minimum

Tax (AMT) applies, tax payable cannot be less than 18.5% (+HEC) of "adjusted total income"

computed as per section 115JC. For provisions relating to AMT refer tutorial on “MAT/AMT” in

tutorial section.

However, w.e.f. Assessment Year 2019-20, In case of a unit located in an IFSC which derives its

income solely in convertible foreign exchange, the rate of AMT under section 115JF shall be at

the rate of 9% instead of existing rate of 18.50%.

[*] Rebate under section 87A is available only to a resident individual (whose net income does

not exceed Rs. 3,50,000), thus, no rebate is available to a non-resident individual.

Normal tax rate applicable to resident/non-resident Hindu Undivided Family (HUF)

Net income range Income-tax rates Health and Education

Cess

Up to Rs. 2,50,000 Nil Nil

Rs. 2,50,000 – Rs. 5,00,000 5% of (total income minus Rs. 4% of income-tax

2,50,000)

Rs. 5,00,000 – Rs. 10,00,000 Rs. 12,500 + 20% of (total income 4% of income-tax

minus Rs. 5,00,000)

Above Rs. 10,00,000 Rs. 1,12,500 + 30% of (total income 4% of income-tax

minus Rs. 10,00,000)

Surcharge: Surcharge is levied @ 10% on the amount of income-tax if net income exceeds Rs 50

[As amended by Finance Act, 2018]

Lakh but doesn’t exceed Rs. 1 crore and @ 15% on the amount of income tax if net income

exceeds Rs. 1 crore. In a case where surcharge is levied, health and education cess of 4% will be

levied on the amount of income tax plus surcharge.

However, marginal relief is available from surcharge in such a manner that in the case where net

income exceeds Rs. 50 lakh but doesn’t exceed Rs. 1 Crore, the amount payable as income tax

and surcharge shall not exceed the total amount payable as income tax on total income of Rs 50

Lakh by more than the amount of income that exceeds Rs 50 Lakhs.

Further, in a case where net income exceeds Rs. 1 crore, marginal relief shall be available from

surcharge in such a manner that the amount payable as income tax and surcharge shall not

exceed the total amount payable as income-tax on total income of Rs. 1 crore by more than the

amount of income that exceeds Rs. 1 crore.

AMT : In the case of a non-corporate taxpayer to whom the provisions of Alternate Minimum

Tax (AMT) applies, tax payable cannot be less than 18.5% (+HEC) of "adjusted total income" as

per section 115JC. For provisions relating to AMT refer tutorial on “MAT/AMT” in tutorial

section.

However, w.e.f. Assessment Year 2019-20, In case of a unit located in an IFSC which derives its

income solely in convertible foreign exchange, the rate of AMT under section 115JF shall be at

the rate of 9% instead of existing rate of 18.50%.

Normal tax rates applicable to every AOP/BOI/Artificial juridical person

Net income range Income-tax rates Health and Education

Cess

Up to Rs. 2,50,000 Nil Nil

Rs. 2,50,000 – Rs. 5,00,000 5% of (total income minus Rs. 4% of income-tax

2,50,000)

Rs. 5,00,000 – Rs. 10,00,000 Rs. 12,500 + 20% of (total income 4% of income-tax

minus Rs. 5,00,000)

Above Rs. 10,00,000 Rs. 1,12,500 + 30% of (total income 4% of income-tax

minus Rs. 10,00,000)

Surcharge: Surcharge is levied @ 10% on the amount of income-tax if net income exceeds Rs 50

Lakh but doesn’t exceed Rs. 1 crore and @ 15% on the amount of income tax if net income

[As amended by Finance Act, 2018]

exceeds Rs. 1 crore. In a case where surcharge is levied, health and education cass of 4% will be

levied on the amount of income tax plus surcharge.

However, marginal relief is available from surcharge in such a manner that in the case where net

income exceeds Rs. 50 lakh but doesn’t exceed Rs. 1 Crore, the amount payable as income tax

and surcharge shall not exceed the total amount payable as income tax on total income of Rs 50

Lakh by more than the amount of income that exceeds Rs 50 Lakhs.

Further, in a case where net income exceeds Rs. 1 crore, marginal relief shall be available from

surcharge in such a manner that the amount payable as income tax and surcharge shall not

exceed the total amount payable as income-tax on total income of Rs. 1 crore by more than the

amount of income that exceeds Rs. 1 crore.

AMT : In the case of a non-corporate taxpayers to whom the provisions of Alternate Minimum

Tax (AMT) applies, tax payable cannot be less than 18.5% (+HEC) of "adjusted total income"

computed as per section 115JC. For provisions relating to AMT refer tutorial on “MAT/AMT” in

tutorial section.

However, w.e.f. Assessment Year 2019-20, In case of a unit located in an IFSC which derives its

income solely in convertible foreign exchange, the rate of AMT under section 115JF shall be at

the rate of 9% instead of existing rate of 18.50%.

Normal tax rates applicable to a firm

A firm is taxed at a flat rate of 30%. Apart from tax @ 30%, Health and Education Cess is levied

@ 4% of income-tax.

Surcharge : Surcharge is levied @ 12% on the amount of income-tax where net income exceeds

Rs. 1 crore. In a case where surcharge is levied, health and education cess of 4% will be levied

on the amount of income-tax plus surcharge.

However, marginal relief is available from surcharge in such a manner that in the case of a

person having a net income of exceeding Rs. 1 crore, the amount payable as income tax and

surcharge shall not exceed the total amount payable as income-tax on total income of Rs. 1 crore

by more than the amount of income that exceeds Rs. 1 crore.

AMT : In the case of a non-corporate taxpayers to whom the provisions of Alternate Minimum

Tax (AMT) applies, tax payable cannot be less than 18.5% (+SC+HEC) of "adjusted total

income" computed as per section 115JC. For provisions relating to AMT refer tutorial on

“MAT/AMT” in tutorial section.

Normal Tax rates applicable to a domestic company

[As amended by Finance Act, 2018]

A domestic company is taxed at a flat rate of 30%. However, tax rate is 25% where turnover or

the gross receipt of the company in the previous year 2016-17 doesn't exceed Rs. 250 crore.

Apart from tax @ 30% or 25%, as the case may be, Health and Education Cess is levied @ 4%

of income-tax.

Surcharge : In addition to tax at above rate, surcharge is levied @ 7% on the amount of income-

tax if net income exceeds Rs. 1 crore but does not exceed Rs. 10 crore and @ 12% on the amount

of income-tax if net income exceeds Rs. 10 crore. In a case where surcharge is levied, health and

education cess of 4% will be levied on the amount of income-tax plus surcharge.

However, marginal relief is available from surcharge in such a manner that in the case of a

company whose net income exceeds Rs. 1 crore but does not exceed Rs. 10 crore, the amount

payable as income-tax and surcharge shall not exceed the total amount payable as income-tax on

total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1 crore.

In case of a domestic company whose net income exceeds Rs. 10 crore, marginal relief is

available from surcharge in such a manner that the amount payable as income-tax and surcharge

shall not exceed the total amount payable as income-tax and surcharge on total income of Rs. 10

crore by more than the amount of income that exceeds Rs. 10 crore.

MAT : In the case of a corporate taxpayer to whom the provisions of Minimum Alternate Tax

(MAT) applies, tax payable cannot be less than 18.5% (+HEC) of "Book profit" computed as per

section 115JB. However, MAT is levied at the rate of 9% (plus surcharge and cess as applicable)

in case of a company, being a unit of an International Financial Services Centre and deriving its

income solely in convertible foreign exchange. For provisions relating to MAT refer tutorial on

“MAT/AMT” in tutorial section.

Normal tax rates applicable to a foreign company

A foreign company is taxed at a flat rate of 40%. Apart from tax @ 40%, Health and Education

Cess is levied @ 4% of income-tax.

Surcharge : In addition to tax at above rate, surcharge is levied @ 2% on the amount of income-

tax if net income exceeds Rs. 1 crore but does not exceed Rs. 10 crore and @ 5% on the amount

of income-tax if net income exceeds Rs. 10 crore. In a case where surcharge is levied, health and

education cess of 4% will be levied on the amount of income-tax plus surcharge.

However, marginal relief is available from surcharge in such a manner that in the case of a

foreign company whose net income exceeds Rs. 1 crore but does not exceed Rs. 10 crore the

amount payable as income-tax and surcharge shall not exceed the total amount payable as

income-tax on total income of Rs. 1 crore by more than the amount of income that exceeds Rs. 1

[As amended by Finance Act, 2018]

crore.

In case of a foreign company whose net income exceeds Rs. 10 crore, marginal relief is available

from surcharge in such a manner that the amount payable as income-tax and surcharge shall not

exceed the total amount payable as income-tax and surcharge on total income of Rs. 10 crore by

more than the amount of income that exceeds Rs. 10 crore.

MAT : In the case of a corporate taxpayer to whom the provisions of Minimum Alternate Tax

(MAT) applies, tax payable cannot be less than 18.5% (+HEC) of "Book profit" as per section

115JB. However, as per Explanation 4 to section 115JB as amended by Finance Act, 2016 with

retrospective effect from 1/4/2001, it is clarified that the MAT provisions shall not be applicable

and shall be deemed never to have been applicable to an assessee, being a foreign company, if—

(i) the assessee is a resident of a country or a specified territory with which India has an

agreement referred to in sub-section (1) of section 90 or the Central Government has adopted any

agreement under sub-section (1) of section 90A and the assessee does not have a permanent

establishment in India in accordance with the provisions of such agreement; or [As amended by

Finance Act, 2016] (ii) the assessee is a resident of a country with which India does not have an

agreement of the nature referred to in clause (i) and the assessee is not required to seek

registration under any law for the time being in force relating to companies. For provisions

relating to MAT refer tutorial on “MAT/AMT” in tutorial section.

Normal tax rates applicable to a Co-operative societies

Net income range Rate of income-tax

Up to Rs. 10,000 10%

Rs. 10,000 - Rs. 20,000 20%

Above Rs. 20,000 30%

Apart from tax at above rate, Health and Education Cess is levied @ 4% of income-tax.

Surcharge : Surcharge is levied @ 12% on the amount of income-tax where net income exceeds

Rs. 1 crore. In a case where surcharge is levied, HEC of 4% will be levied on the amount of

income-tax plus surcharge.

However, marginal relief is available from surcharge in such a manner that in the case of a

person having a net income exceeding Rs. 1 crore, the amount payable as income tax and

surcharge shall not exceed the total amount payable as income-tax on total income of Rs. 1 crore

by more than the amount of income that exceeds Rs. 1 crore.

[As amended by Finance Act, 2018]

AMT : In the case of a non-corporate taxpayer to whom the provisions of Alternate Minimum

Tax (AMT) applies, tax payable cannot be less than 18.5% (+SC+HEC) of "adjusted total

income" computed as per section 115JC. For provisions relating to AMT refer tutorial on

“MAT/AMT” in tutorial section.

Normal tax rates applicable to local authorities

A local authority is taxed at a flat rate of 30%. Apart from tax @ 30%, Health and Education

Cess is levied @ 4% of income-tax.

Surcharge : Surcharge is levied @ 12% on the amount of income-tax where net income exceeds

Rs. 1 crore. In a case where surcharge is levied, HEC of 4% will be levied on the amount of

income-tax plus surcharge.

However, marginal relief is available from surcharge in such a manner that in the case of a

person having net income exceeding Rs. 1 crore, the amount payable as income tax and

surcharge shall not exceed the total amount payable as income-tax on total income of Rs. 1 crore

by more than the amount of income that exceeds Rs. 1 crore.

AMT : In the case of a non-corporate taxpayer to whom the provisions of Alternate Minimum

Tax (AMT) applies, tax payable cannot be less than 18.5% (+SC+HEC) of "adjusted total

income" computed as per section 115JC. For provisions relating to AMT refer tutorial on

“MAT/AMT” in tutorial section.

However, w.e.f. Assessment Year 2019-20, In case of a unit located in an IFSC which derives its

income solely in convertible foreign exchange, the rate of AMT under section 115JF shall be at

the rate of 9% instead of existing rate of 18.50%.

[As amended by Finance Act, 2018]

MCQ on tax rates

Q1. The normal tax rates applicable to a resident individual will depend on the _________.

(a) Age of the individual (b) Gender of the individual

Correct answer : (a)

Q2. The basic exemption limit (for the assessment year 2019-20) in case of a resident individual

of the age of below 60 years is Rs. ___________.

(a) Rs. 2,00,000 (b) Rs. 2,50,000

(c) Rs. 3,00,000 (d) Rs. 5,00,000

Correct answer : (b)

Q3. The basis exemption limit (for the assessment year 2019-20) in case of a resident individual

of the age of 60 years or above but below 80 years is Rs. ___________.

(a) Rs. 2,00,000 (b) Rs. 2,50,000

(c) Rs. 3,00,000 (d) Rs. 5,00,000

Correct answer : (c)

Q4. The basis exemption limit (for the assessment year 2019-20) in case of a resident individual

of the age of 80 years or above is Rs. ___________.

(a) Rs. 2,00,000 (b) Rs. 2,50,000

(c) Rs. 3,00,000 (d) Rs. 5,00,000

Correct answer : (d)

Q5. The basis exemption limit (for the assessment year 2019-20) in case of a non-resident

individual irrespective of his age is Rs. ___________.

(a) Rs. 2,00,000 (b) Rs. 2,50,000

(c) Rs. 3,00,000 (d) Rs. 5,00,000

Correct answer : (b)

Q6. The basis exemption limit (for the assessment year 2019-20) in case of a Hindu Undivided

Family is Rs. ___________.

(a) Rs. 2,00,000 (b) Rs. 2,50,000

(c) Rs. 3,00,000 (d) Rs. 5,00,000

Correct answer : (b)

Q7. In the case of an individual surcharge @ 15% is levied on the amount of income-tax if the

[As amended by Finance Act, 2018]

net income exceeds Rs. _________

(a) 10 lakhs (b) 1 crore

(c) 5 crore (d) 10 crore

Correct answer : (b)

Q8. A resident individual (whose net income does not exceed Rs. 3,50,000) can avail rebate

under section 87A. It is deductible from income-tax before calculating education cess. The

amount of rebate is 100 per cent of income-tax or Rs. _______, whichever is less.

(a) 10,000 (b) 2,500

(c) 2,000 (d) 1,000

Correct answer : (b)

Q9. In the case of a non-corporate taxpayer who is subject to provisions of Alternate Minimum

Tax (AMT), tax payable by it cannot be less than _____% (+SC+EC+SHEC) of "adjusted total

income" computed as per section 115JC.

(a) 15 (b) 18

(c) 18.5 (d) 20

Correct answer : (c)

[As amended by Finance Act, 2018]

Das könnte Ihnen auch gefallen

- 1040 Exam Prep: Module I: The Form 1040 FormulaVon Everand1040 Exam Prep: Module I: The Form 1040 FormulaBewertung: 1 von 5 Sternen1/5 (3)

- Notes On DTC BillDokument5 SeitenNotes On DTC Billshikah sidarNoch keine Bewertungen

- Income Tax: Administrative Set-UpDokument25 SeitenIncome Tax: Administrative Set-UpMohit RahejaNoch keine Bewertungen

- Income Tax Slabs & Rates For Assessment Year 2014-15Dokument4 SeitenIncome Tax Slabs & Rates For Assessment Year 2014-15ptk_guly3871Noch keine Bewertungen

- Income Tax On SalaryDokument23 SeitenIncome Tax On SalarySarvesh MishraNoch keine Bewertungen

- Income Tax Calculator Calculate Income Tax For FY 2022-23Dokument1 SeiteIncome Tax Calculator Calculate Income Tax For FY 2022-23Vivek LakkakulaNoch keine Bewertungen

- Individual, HUF, AOP or BOIDokument4 SeitenIndividual, HUF, AOP or BOIABC 123Noch keine Bewertungen

- Alternative Tax Regime (This Has Been Dealt in 1.1A of Chapter 1 in YourDokument6 SeitenAlternative Tax Regime (This Has Been Dealt in 1.1A of Chapter 1 in YourRhea SharmaNoch keine Bewertungen

- Income Tax Slab RatesDokument5 SeitenIncome Tax Slab RatesBaibhav JauhariNoch keine Bewertungen

- Tax Rates As 2015-16Dokument1 SeiteTax Rates As 2015-16Jatin PatelNoch keine Bewertungen

- Taxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22Dokument8 SeitenTaxguru - In-Income Tax Rates For FY 2020-21 Amp FY 2021-22JiyalalNoch keine Bewertungen

- Income Tax Slabs & Rates For Assessment Year 2013-14Dokument37 SeitenIncome Tax Slabs & Rates For Assessment Year 2013-14Jigar RavalNoch keine Bewertungen

- Income Tax Slab FY 2014-15Dokument3 SeitenIncome Tax Slab FY 2014-15zveeraNoch keine Bewertungen

- The List of Components Which You Can Use For Salary BreakupDokument8 SeitenThe List of Components Which You Can Use For Salary BreakupAnonymous VhqxrXNoch keine Bewertungen

- Guidance Note On Option For Old Vs New Tax Regime - FY22-23 & AY23-24 PDFDokument3 SeitenGuidance Note On Option For Old Vs New Tax Regime - FY22-23 & AY23-24 PDFgowtham DevNoch keine Bewertungen

- Tax Deduction - DR Sajjad Wani JKASDokument26 SeitenTax Deduction - DR Sajjad Wani JKASMohmad Yousuf100% (1)

- Taxation ProjectDokument23 SeitenTaxation ProjectAkshata MasurkarNoch keine Bewertungen

- Tax Saving GuideDokument36 SeitenTax Saving GuideSamantha JNoch keine Bewertungen

- Income Tax A.Y. 2023-24Dokument6 SeitenIncome Tax A.Y. 2023-24sandeepsbiradar100% (3)

- Note On Budget Proposals-2020Dokument4 SeitenNote On Budget Proposals-2020Dhananjai SharmaNoch keine Bewertungen

- MATH PROJECT TOPIC 2 (Income Tax)Dokument7 SeitenMATH PROJECT TOPIC 2 (Income Tax)avinamakadiaNoch keine Bewertungen

- T AXDokument6 SeitenT AXKaustubh RaksheNoch keine Bewertungen

- Upload 2Dokument27 SeitenUpload 2NAGESH PORWALNoch keine Bewertungen

- Taxation LawDokument67 SeitenTaxation LawAdv Sheetal SaylekarNoch keine Bewertungen

- Section 192 of The Income-Tax Act, 1961 - Deduction of Tax at Source - Income-Tax Deduction From Salaries During The Financial Year 2008-09Dokument32 SeitenSection 192 of The Income-Tax Act, 1961 - Deduction of Tax at Source - Income-Tax Deduction From Salaries During The Financial Year 2008-09api-19795300Noch keine Bewertungen

- Submitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharDokument17 SeitenSubmitted To: Rashi Madam: Presented By: Saloni Gupta Viveka Bothra Aakanksha Jain Rakshita ParasharViveka BothraNoch keine Bewertungen

- Tax Structure of Pakistan: (A Bird Eye View)Dokument16 SeitenTax Structure of Pakistan: (A Bird Eye View)Kiran AliNoch keine Bewertungen

- TDS On SalaryDokument5 SeitenTDS On SalaryAato AatoNoch keine Bewertungen

- RATES OF INCOME-TAX After Budget 2013 Date 28.02.2013 A. Normal Rates of TaxDokument3 SeitenRATES OF INCOME-TAX After Budget 2013 Date 28.02.2013 A. Normal Rates of TaxIla YagnikNoch keine Bewertungen

- Assessment of Individuals and Assessment of Firms: Dr. Sugandh Rawal DSPSRDokument8 SeitenAssessment of Individuals and Assessment of Firms: Dr. Sugandh Rawal DSPSRAnshu kumarNoch keine Bewertungen

- E PDF - Know Your Income Tax Rate AY 2021 22 23Dokument8 SeitenE PDF - Know Your Income Tax Rate AY 2021 22 23CHANDAN CHANDUNoch keine Bewertungen

- Types of TaxesDokument15 SeitenTypes of TaxesNischal KumarNoch keine Bewertungen

- Ajit Kumar SatapathyDokument32 SeitenAjit Kumar Satapathyajitkumarsatapathy3Noch keine Bewertungen

- Tax Slabs of India 2014-15Dokument13 SeitenTax Slabs of India 2014-15Rachna JayaraghavNoch keine Bewertungen

- Tax Presentation-29.01.2023Dokument25 SeitenTax Presentation-29.01.2023Abhinav Parhi100% (2)

- Tax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Dokument7 SeitenTax Structure in India: Edited and Complied Study Material by (Dr. Durdana Ovais)Harshita MarmatNoch keine Bewertungen

- Circlular No 1 - 2010 F No 275 - 192 - 2009 - IT - B Dated 11 - 01 - 2010Dokument63 SeitenCirclular No 1 - 2010 F No 275 - 192 - 2009 - IT - B Dated 11 - 01 - 2010Kirit J Patel100% (1)

- Tax PlanningDokument7 SeitenTax PlanningCharan AdharNoch keine Bewertungen

- Tax Liability For The Assessment Years 2014-15 and 2015-16Dokument11 SeitenTax Liability For The Assessment Years 2014-15 and 2015-16Accounting & TaxationNoch keine Bewertungen

- Introduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentDokument19 SeitenIntroduction of Tax Sections Under It Act 1961 & Tax Slabs: SsignmentRtr Sandeep ShekharNoch keine Bewertungen

- Individuals and Hufs: Income Tax Rates / Income Tax Slabs For Ay 2012-13 (Fy 2011-12)Dokument4 SeitenIndividuals and Hufs: Income Tax Rates / Income Tax Slabs For Ay 2012-13 (Fy 2011-12)Saurabh AkareNoch keine Bewertungen

- IFBPDokument11 SeitenIFBPmohanraokp2279Noch keine Bewertungen

- Income Tax - IT Returns, E Filing, Tax Saving, Income Tax Slabs, Rules & Laws - All About Income TaxDokument6 SeitenIncome Tax - IT Returns, E Filing, Tax Saving, Income Tax Slabs, Rules & Laws - All About Income TaxLAKSHMANARAO P100% (1)

- BudgetDokument21 SeitenBudgetshweta_narkhede01Noch keine Bewertungen

- Income Tax Basics in IndiaDokument5 SeitenIncome Tax Basics in IndiaashankarNoch keine Bewertungen

- Income Tax Law & PracticeDokument60 SeitenIncome Tax Law & Practicesebastianks94% (17)

- Tds SALARY FOR A.Y. 2011-12Dokument59 SeitenTds SALARY FOR A.Y. 2011-12Pragnesh ShahNoch keine Bewertungen

- FY 2022-23 (AY 2023-24) - Taxguru - inDokument3 SeitenFY 2022-23 (AY 2023-24) - Taxguru - inHarshilNoch keine Bewertungen

- Amendment Finance Act 2009Dokument66 SeitenAmendment Finance Act 2009Sanjay GuptaNoch keine Bewertungen

- How To Calculate Ur Income TaxDokument3 SeitenHow To Calculate Ur Income TaxrazeemshipNoch keine Bewertungen

- The Slab Codes in The Table ViewDokument5 SeitenThe Slab Codes in The Table ViewAmritaShuklaNoch keine Bewertungen

- Income Tax Saving: Using Only 80C For Tax Saving? New Tax Regime May Be Beneficial For You at This Income - The Economic Times PDFDokument5 SeitenIncome Tax Saving: Using Only 80C For Tax Saving? New Tax Regime May Be Beneficial For You at This Income - The Economic Times PDFDDSingh SinghNoch keine Bewertungen

- Tax Planning For Year 2010Dokument24 SeitenTax Planning For Year 2010Mehak BhargavaNoch keine Bewertungen

- Supplementary Paper 7 16 June2020Dokument24 SeitenSupplementary Paper 7 16 June2020avneetNoch keine Bewertungen

- Scenario 1# You Do Not Have Outstanding Tax LiabilityDokument7 SeitenScenario 1# You Do Not Have Outstanding Tax LiabilityBhupendra SharmaNoch keine Bewertungen

- Ca Inter Full Book 2Dokument32 SeitenCa Inter Full Book 2Amar SharmaNoch keine Bewertungen

- Comparis I OnDokument2 SeitenComparis I Onkrishna italiaNoch keine Bewertungen

- Tax Slabs & Tax Saving Strategies For New Tax Payers 2011-12Dokument5 SeitenTax Slabs & Tax Saving Strategies For New Tax Payers 2011-12channaveer sgNoch keine Bewertungen

- GO - Ms.No. 259Dokument2 SeitenGO - Ms.No. 259Anonymous 9Yv6n5qvSNoch keine Bewertungen

- 889 PDFDokument1 Seite889 PDFAnonymous 9Yv6n5qvSNoch keine Bewertungen

- Government of Andhra PradeshDokument20 SeitenGovernment of Andhra PradeshAnonymous 9Yv6n5qvS100% (2)

- QIC ProformaDokument2 SeitenQIC ProformaAnonymous 9Yv6n5qvSNoch keine Bewertungen

- Data On Quarantine Cum Isolation Centers ReportDokument2 SeitenData On Quarantine Cum Isolation Centers ReportAnonymous 9Yv6n5qvSNoch keine Bewertungen

- Cadre StrengthDokument3 SeitenCadre StrengthAnonymous 9Yv6n5qvSNoch keine Bewertungen

- Research Books PDFDokument118 SeitenResearch Books PDFAnonymous 9Yv6n5qvSNoch keine Bewertungen

- Budget Re AppropriationDokument1 SeiteBudget Re AppropriationAnonymous 9Yv6n5qvSNoch keine Bewertungen

- Manual On Risk Management PDF - (English)Dokument74 SeitenManual On Risk Management PDF - (English)Anonymous 9Yv6n5qvSNoch keine Bewertungen

- Transit (The Celestial Delivery Boy) - Autored by ADokument104 SeitenTransit (The Celestial Delivery Boy) - Autored by AAnonymous 9Yv6n5qvSNoch keine Bewertungen

- 01 12582018rev MS361 PDFDokument2 Seiten01 12582018rev MS361 PDFAnonymous 9Yv6n5qvSNoch keine Bewertungen

- Inspector of Factories Draft Notification PDFDokument26 SeitenInspector of Factories Draft Notification PDFAnonymous 9Yv6n5qvSNoch keine Bewertungen

- How To Achieve Speed in Maths Calculations PDFDokument6 SeitenHow To Achieve Speed in Maths Calculations PDFAnonymous 9Yv6n5qvSNoch keine Bewertungen

- Important Planetary Transits PDFDokument37 SeitenImportant Planetary Transits PDFAnonymous 9Yv6n5qvS100% (1)

- Racetrack Memory Based Reconfigurable ComputingDokument4 SeitenRacetrack Memory Based Reconfigurable ComputingAnonymous 9Yv6n5qvSNoch keine Bewertungen

- Integrated-Circuits Research For Wireless Communications: Prof. Yun ChiuDokument14 SeitenIntegrated-Circuits Research For Wireless Communications: Prof. Yun ChiuAnonymous 9Yv6n5qvSNoch keine Bewertungen

- Upanayana MuhurtamDokument5 SeitenUpanayana MuhurtamAnonymous 9Yv6n5qvSNoch keine Bewertungen

- GOMS67Dokument36 SeitenGOMS67Anonymous 9Yv6n5qvSNoch keine Bewertungen

- T631 CDDokument3 SeitenT631 CDAnonymous 9Yv6n5qvSNoch keine Bewertungen

- Welcome To Jntu Kakinada Results Announcement System: Please Enter Your Hallticket NumberDokument1 SeiteWelcome To Jntu Kakinada Results Announcement System: Please Enter Your Hallticket NumberAnonymous 9Yv6n5qvSNoch keine Bewertungen

- CONTEX vs. CIRDokument3 SeitenCONTEX vs. CIRAnneNoch keine Bewertungen

- ASSIGNMENT NO. 2 - Chapter 6 - Capital Gains TaxationDokument5 SeitenASSIGNMENT NO. 2 - Chapter 6 - Capital Gains TaxationElaiza Jayne PongaseNoch keine Bewertungen

- Om Prakash Sharma: Bill To / Ship To: Seller DetailsDokument1 SeiteOm Prakash Sharma: Bill To / Ship To: Seller DetailsRaju KumarNoch keine Bewertungen

- CAC 4202 Farming Tutorial 2020: Livestock AccountDokument2 SeitenCAC 4202 Farming Tutorial 2020: Livestock AccountnkosieNoch keine Bewertungen

- OCTOBER 2021: PT. Shopee Internasional IndonesiaDokument1 SeiteOCTOBER 2021: PT. Shopee Internasional IndonesiaRifka FitrotuzzakiaNoch keine Bewertungen

- GST Session 43Dokument20 SeitenGST Session 43manjulaNoch keine Bewertungen

- Steps Involved in Filing GST ReturnsDokument9 SeitenSteps Involved in Filing GST ReturnssaranistudyNoch keine Bewertungen

- Assessment in Income TaxDokument3 SeitenAssessment in Income Taxayush sikkewalNoch keine Bewertungen

- Taxation: Bmbes 2020 Barangay Micro Business Enterprise BMBE Law's ObjectiveDokument3 SeitenTaxation: Bmbes 2020 Barangay Micro Business Enterprise BMBE Law's Objectivekris mNoch keine Bewertungen

- The City of Asher Had The Following Transactions Among OthersDokument1 SeiteThe City of Asher Had The Following Transactions Among Otherstrilocksp SinghNoch keine Bewertungen

- This Study Resource Was: Determine The Following 1. Deductible Interest Expense For The Year P129,500.00Dokument8 SeitenThis Study Resource Was: Determine The Following 1. Deductible Interest Expense For The Year P129,500.00Kin LeeNoch keine Bewertungen

- BIR Ruling 27-02Dokument2 SeitenBIR Ruling 27-02erikagcv100% (1)

- Order 119 MiscComm 31 1 24Dokument6 SeitenOrder 119 MiscComm 31 1 24Mmkpss Sriram Sista MmkpssNoch keine Bewertungen

- Invoice: "Thank You For Staying With Us at Holiday Inn Chandigarh Zirakpur"Dokument1 SeiteInvoice: "Thank You For Staying With Us at Holiday Inn Chandigarh Zirakpur"dprosenjitNoch keine Bewertungen

- Trashed-1684049848-Cprs - Payslip1 JSP PDFDokument1 SeiteTrashed-1684049848-Cprs - Payslip1 JSP PDFPrashant SinghNoch keine Bewertungen

- 2021 City of Watertown Tax Sale Certificate AuctionDokument7 Seiten2021 City of Watertown Tax Sale Certificate AuctionNewzjunky50% (2)

- Public RevenueDokument17 SeitenPublic RevenueNamrata More100% (1)

- CBIC Civil List As On 01.01.2011Dokument302 SeitenCBIC Civil List As On 01.01.2011रुद्र प्रताप सिंह ८२Noch keine Bewertungen

- TAX-801 (Sources of Income)Dokument2 SeitenTAX-801 (Sources of Income)MABI ESPENIDONoch keine Bewertungen

- Form DGTDokument4 SeitenForm DGTDee 123Noch keine Bewertungen

- Multiple Choice: Chapter 16 - SolvingDokument19 SeitenMultiple Choice: Chapter 16 - SolvingElla LopezNoch keine Bewertungen

- Wa0084Dokument3 SeitenWa0084akshay chauhanNoch keine Bewertungen

- Value-Added TaxDokument33 SeitenValue-Added TaxvicsNoch keine Bewertungen

- Over Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Dokument2 SeitenOver Not Over Tax: Basic Income Table (Tax Code, Section 24 A)Juliana ChengNoch keine Bewertungen

- EXCEL INC TAX FinalDokument2 SeitenEXCEL INC TAX FinalLysss EpssssNoch keine Bewertungen

- An Introduction To GST: Himanshu Kushwaha Assistant Professor, Malda College, Malda, West BengalDokument18 SeitenAn Introduction To GST: Himanshu Kushwaha Assistant Professor, Malda College, Malda, West Bengalneha pandeyNoch keine Bewertungen

- Income Tax Limits Days Summay by CA Vivek Gaba TAX LOVE. 1Dokument82 SeitenIncome Tax Limits Days Summay by CA Vivek Gaba TAX LOVE. 1KrishnaNoch keine Bewertungen

- Corporate Tax in Dubai and UAEDokument5 SeitenCorporate Tax in Dubai and UAEcharlielucaslieNoch keine Bewertungen

- 2007 Sro 660Dokument5 Seiten2007 Sro 660Haseeb JavidNoch keine Bewertungen

- Tax Review Syllabus A.Y. 2019-2020Dokument6 SeitenTax Review Syllabus A.Y. 2019-2020Kelvin Culajará100% (1)

- How to get US Bank Account for Non US ResidentVon EverandHow to get US Bank Account for Non US ResidentBewertung: 5 von 5 Sternen5/5 (1)

- What Your CPA Isn't Telling You: Life-Changing Tax StrategiesVon EverandWhat Your CPA Isn't Telling You: Life-Changing Tax StrategiesBewertung: 4 von 5 Sternen4/5 (9)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesVon EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNoch keine Bewertungen

- Tax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProVon EverandTax Strategies: The Essential Guide to All Things Taxes, Learn the Secrets and Expert Tips to Understanding and Filing Your Taxes Like a ProBewertung: 4.5 von 5 Sternen4.5/5 (43)

- Small Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyVon EverandSmall Business Taxes: The Most Complete and Updated Guide with Tips and Tax Loopholes You Need to Know to Avoid IRS Penalties and Save MoneyNoch keine Bewertungen

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessVon EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessBewertung: 5 von 5 Sternen5/5 (5)

- Invested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Von EverandInvested: How I Learned to Master My Mind, My Fears, and My Money to Achieve Financial Freedom and Live a More Authentic Life (with a Little Help from Warren Buffett, Charlie Munger, and My Dad)Bewertung: 4.5 von 5 Sternen4.5/5 (43)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingVon EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Lower Your Taxes Legally for Business, InvestingBewertung: 5 von 5 Sternen5/5 (3)

- Small Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessVon EverandSmall Business: A Complete Guide to Accounting Principles, Bookkeeping Principles and Taxes for Small BusinessNoch keine Bewertungen

- Tax Savvy for Small Business: A Complete Tax Strategy GuideVon EverandTax Savvy for Small Business: A Complete Tax Strategy GuideBewertung: 5 von 5 Sternen5/5 (1)

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCVon EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCBewertung: 4 von 5 Sternen4/5 (5)

- Tax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthVon EverandTax-Free Wealth For Life: How to Permanently Lower Your Taxes And Build More WealthNoch keine Bewertungen

- The Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionVon EverandThe Tax and Legal Playbook: Game-Changing Solutions To Your Small Business Questions 2nd EditionBewertung: 5 von 5 Sternen5/5 (27)

- The Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyVon EverandThe Panama Papers: Breaking the Story of How the Rich and Powerful Hide Their MoneyBewertung: 4 von 5 Sternen4/5 (52)

- Make Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionVon EverandMake Sure It's Deductible: Little-Known Tax Tips for Your Canadian Small Business, Fifth EditionNoch keine Bewertungen

- Deduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesVon EverandDeduct Everything!: Save Money with Hundreds of Legal Tax Breaks, Credits, Write-Offs, and LoopholesBewertung: 3 von 5 Sternen3/5 (3)

- The Payroll Book: A Guide for Small Businesses and StartupsVon EverandThe Payroll Book: A Guide for Small Businesses and StartupsBewertung: 5 von 5 Sternen5/5 (1)

- Taxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.Von EverandTaxes for Small Businesses 2023: Beginners Guide to Understanding LLC, Sole Proprietorship and Startup Taxes. Cutting Edge Strategies Explained to Reduce Taxes for Business, Investing, & More.Noch keine Bewertungen

- The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesVon EverandThe Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS PenaltiesNoch keine Bewertungen

- The 6% Life: 7 Legal Tax Loopholes That Any Business Owner Can Use to Design Their Life and Pay the Government 6% or LessVon EverandThe 6% Life: 7 Legal Tax Loopholes That Any Business Owner Can Use to Design Their Life and Pay the Government 6% or LessNoch keine Bewertungen

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsVon EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNoch keine Bewertungen

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerVon EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerNoch keine Bewertungen

![The Taxes, Accounting, Bookkeeping Bible: [3 in 1] The Most Complete and Updated Guide for the Small Business Owner with Tips and Loopholes to Save Money and Avoid IRS Penalties](https://imgv2-1-f.scribdassets.com/img/audiobook_square_badge/711600370/198x198/d63cb6648d/1712039797?v=1)