Beruflich Dokumente

Kultur Dokumente

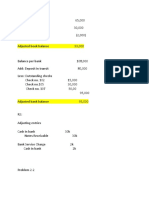

Working Program-Cash and Cash Equivalent

Hochgeladen von

Nanette Rose HaguilingCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Working Program-Cash and Cash Equivalent

Hochgeladen von

Nanette Rose HaguilingCopyright:

Verfügbare Formate

CASH AND CASH EQUIVALENTS

Cash on hand

Audit Objectives

To ascertain whether all collections were receipted and deposited intact with the corporation’s

depository bank

To determine whether cash collections are completely and properly recorded

To determine whether cash collections in foreign are properly valued in local currency at the

current exchange rate as of balance sheet date

Audit Program

Audit Procedures WP Remarks

ref

1. Check whether the beginning balance per GL is

the ending balance in the prior year's audited

Balance Sheet

2. Conduct cash Examination on the cash and

accounts of the collecting officer on or before

end of December 31,2015

3. Compare cash counted with collections in the

report of collections and deposits/cash receipt

record on the date of count and reconcile with

the SL to establish undeposited collections

4. See to it that undeposited collections are

deposited not later than the next banking day

and that all checks counted are deposited and

honoured by the bank

5. Trace the undeposited collection to subsequent

bank validated deposit slips and bank statements

6. Trace the account balances from GL to trial

balance to statement of financial condition

7. Verify subsidiary ledger balance of the collecting

officer and compare total SL with the general

Ledger Balance

8. Determine whether the account is presented as

current asset in the statement of financial

condition and adequate disclosures were made.

CASH IN BANK

Audit Objectives

To ascertain the existence or occurrence of cash in bank account balances

To determine whether foreign deposits and withdrawals from cash in bank accounts are

completely recorded and properly valued at the current exchange rate of the BSP in accordance

with existing laws, rules and regulations.

To determine whether the placements in time deposits are completely and properly recorded.

To determine whether placement and termination of time deposits are authorized

Audit Program

Audit Procedures WP ref Remarks

1. Check whether the beginning balance per GL is

the ending balance in the prior year's audited

Balance Sheet

2. Review entries made in the GL/SL on a test

basis

For Debits to the account:

Trace entries to the Journal of

collections and deposits to report of

Collections to Bank Statements to

deposit slips

For Credits to the account:

trace entries to Report of Checks

Issued to disbursement voucher

3. Obtain Bank Statement and examine in detail

the bank reconciliation

4. Confirm with the bank the balance of each

bank account

5. Obtain the ending balance per books with the

balance confirmed on the bank Confirmation

6. Establish the mathematical accuracy of the

Bank Reconciliation Statements

7. Investigate items which have been long

outstanding

8. For Time Deposits:

Verify the Original copies of the

Certificates of Time Deposits and

check whether the certificates are in

the name of the agency

Verify terms of placement, particularly

the rates of interest and maturity

period

Test samples on the computation of

interest earned from matured and pre

–terminated placements

Review the agency’s authority to place

cash in time deposits from the charter,

Board Resolutions and agency’s

policies

9. For Cash in Bank- Foreign Currency:

Obtain from BSP/BTr foreign exchange

rates prevailing at transaction and

balance sheet dates

Test check correctness of conversion to

local currency at transaction dates of

entries

Check if foreign gain/loss is properly

recorded and presented in the

Statement of comprehensive Income

10. Verify/check subsidiary ledger balance of each

bank account and compare total balances if

agreed with the General Ledger Balances

11. Determine whether the account is presented

as current asset in the Statement of Financial

Condition and adequate disclosures were

made

Das könnte Ihnen auch gefallen

- Audit Program - Amusement TaxDokument9 SeitenAudit Program - Amusement TaxNanette Rose HaguilingNoch keine Bewertungen

- Audit Program - Breeding StockDokument4 SeitenAudit Program - Breeding StockNanette Rose HaguilingNoch keine Bewertungen

- Audit Program - Awards and Indemnities RewardsDokument4 SeitenAudit Program - Awards and Indemnities RewardsNanette Rose HaguilingNoch keine Bewertungen

- Audit Working Program - Loans PayableDokument5 SeitenAudit Working Program - Loans PayableNanette Rose HaguilingNoch keine Bewertungen

- Audit Program - Capital StockDokument4 SeitenAudit Program - Capital StockNanette Rose HaguilingNoch keine Bewertungen

- BOT PartBDokument49 SeitenBOT PartBNanette Rose HaguilingNoch keine Bewertungen

- Annex 1 RiskDokument11 SeitenAnnex 1 RiskNanette Rose HaguilingNoch keine Bewertungen

- Eo 888Dokument3 SeitenEo 888Nanette Rose HaguilingNoch keine Bewertungen

- Res92 217Dokument1 SeiteRes92 217Nanette Rose HaguilingNoch keine Bewertungen

- A. Preliminary EvaluationDokument8 SeitenA. Preliminary EvaluationNanette Rose HaguilingNoch keine Bewertungen

- CertificateofauthenticityDokument1 SeiteCertificateofauthenticityNanette Rose HaguilingNoch keine Bewertungen

- Commission On Audit: Republic of The PhilippinesDokument8 SeitenCommission On Audit: Republic of The PhilippinesNanette Rose HaguilingNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Banking OmbudsmanDokument14 SeitenBanking OmbudsmanAarti MaanNoch keine Bewertungen

- Kaleidoscopic View of BankingDokument89 SeitenKaleidoscopic View of BankingRahul D'abreoNoch keine Bewertungen

- Order To Cash Walkthrough TemplateDokument31 SeitenOrder To Cash Walkthrough TemplateleonciongNoch keine Bewertungen

- 基金认购意向书 英文版Dokument3 Seiten基金认购意向书 英文版Anonymous rGBeIwYccTNoch keine Bewertungen

- Daily Use AugDokument8 SeitenDaily Use AugShashank Nainwal50% (2)

- Internship Report (Final)Dokument22 SeitenInternship Report (Final)Shreeya PoudelNoch keine Bewertungen

- SPDokument28 SeitenSPkrizzmaaaayNoch keine Bewertungen

- Summer Internship Project HDFC Bank PDFDokument109 SeitenSummer Internship Project HDFC Bank PDFarunima60% (10)

- Bank of Tanzania Act 1965Dokument23 SeitenBank of Tanzania Act 1965Hassan Mussa KhamisNoch keine Bewertungen

- Determinants of Capital Adequacy Ratio of Commercial Banks in NepalDokument15 SeitenDeterminants of Capital Adequacy Ratio of Commercial Banks in NepalSabinaNoch keine Bewertungen

- Accounts of Banking CompaniesDokument9 SeitenAccounts of Banking Companieskunjap0% (1)

- CSP Audit Compliance SpecimenDokument9 SeitenCSP Audit Compliance SpecimenVikash Mishra100% (1)

- Bank Reconciliation StatementDokument40 SeitenBank Reconciliation StatementPrashant100% (1)

- CRM HSBCDokument26 SeitenCRM HSBCRavi Shankar100% (1)

- Activity Diagram PDFDokument10 SeitenActivity Diagram PDFNiño AnthonyNoch keine Bewertungen

- RBI Lender of Last ResortDokument18 SeitenRBI Lender of Last ResortHemantVermaNoch keine Bewertungen

- Shapland and Turner Cases in Financial Accounting 1st Edition Julia Solutions ManualDokument25 SeitenShapland and Turner Cases in Financial Accounting 1st Edition Julia Solutions ManualLesterBriggssNoch keine Bewertungen

- Project On NRI ACCOUNT (BANKING) Rno46 PDFDokument65 SeitenProject On NRI ACCOUNT (BANKING) Rno46 PDFVishalNoch keine Bewertungen

- LAW NOTES Including Mortgage, Foreclosure Notes & Unlawful Detainer NotesDokument62 SeitenLAW NOTES Including Mortgage, Foreclosure Notes & Unlawful Detainer NotesCarrieonicNoch keine Bewertungen

- Branch Banking CompleteDokument250 SeitenBranch Banking CompleteSarim ShahidNoch keine Bewertungen

- Banking Finals Samplex Sample Answers (Ver.2)Dokument2 SeitenBanking Finals Samplex Sample Answers (Ver.2)Florence RoseteNoch keine Bewertungen

- RFBT Final ExamDokument8 SeitenRFBT Final ExamClarice GonzalesNoch keine Bewertungen

- Commercial Banking 2Dokument5 SeitenCommercial Banking 2polmulitriNoch keine Bewertungen

- 1%. The Book That The Financial Establishment Doesn - T Want You To Read. - The First Ever Behind-The-curtain Look at How Banks Really Function, and Their Impact On Society.Dokument85 Seiten1%. The Book That The Financial Establishment Doesn - T Want You To Read. - The First Ever Behind-The-curtain Look at How Banks Really Function, and Their Impact On Society.Daniyal AbbasNoch keine Bewertungen

- Bank ReconciliationDokument6 SeitenBank Reconciliationclarisse jaramillaNoch keine Bewertungen

- Acct Statement - XX6097 - 06042023Dokument5 SeitenAcct Statement - XX6097 - 06042023SAGAR STATIONERYNoch keine Bewertungen

- Aka Manual CompleteDokument400 SeitenAka Manual CompleteMihai ZaineaNoch keine Bewertungen

- Internship ReportDokument85 SeitenInternship ReportHassan IkhlaqNoch keine Bewertungen

- Internship Report On Rupali Bank LTD: BUS 401, SPRING 2019Dokument52 SeitenInternship Report On Rupali Bank LTD: BUS 401, SPRING 2019Nokib AhammedNoch keine Bewertungen

- Test Bank Auditng ProbDokument11 SeitenTest Bank Auditng ProbTinne PaculabaNoch keine Bewertungen