Beruflich Dokumente

Kultur Dokumente

Pros and Cons of MFS Regulations 2018 August 03 2018

Hochgeladen von

Farjana Hossain DharaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Pros and Cons of MFS Regulations 2018 August 03 2018

Hochgeladen von

Farjana Hossain DharaCopyright:

Verfügbare Formate

Pros and cons of MFS regulations 2018 August 03

2018

Mobile banking has now become the most popular medium for monetary transactions in

Bangladesh because of its ease and speed. This concept of mobile financial services (MFS) has

brought under its fold a huge unbanked segment of the population, especially in rural

Bangladesh, within a span of seven years after its launching in 2011. Whereas the proportion of

MFS account holders in the population was only 3.0 per cent in 2014, it rose to around 38 per

cent this year. This is higher than the South Asian average of 33 per cent and the global lower

middle-income country average of 27 per cent. This phenomenal success is transforming the

rural economy in many ways and has made Bangladesh the regional leader in the field of mobile

banking. The issuance of the Bangladesh Mobile Financial Services Regulations, 2018 by the

Bangladesh Bank on Monday has been the latest step in this gradual unfolding of a narrative that

has huge potential for promoting socio-economic dynamism, mobility and growth. Although the

issuance of the regulations may have been laudable, it seems to have some limitations and

drawbacks.

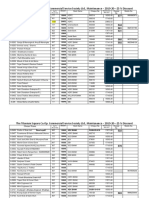

According to the latest figures from the Bangladesh Bank, the number of banks currently

providing MFS services is 18. Registered clients in June 2018 were 618,000, while the number

of active accounts was 272 thousand. The number of agents, on the other hand, was around 830

thousand. The average number of daily transactions in June was 192.59 million, while the

average value of daily transactions was over Taka 11 billion. Significantly, the number of active

accounts grew by 18.8 per cent and the average number of daily transactions rose by 7.3 per cent

in just one month. Apart from cash-in, cash-out and person-to-person transactions, the MFS

services are also being utilised for utility bill payments, salary disbursements, merchant

payments, government payments and inward remittances.

Originally, the central bank provided the framework for MFS operations and their ownership

through issuing a guideline on MFS for banks in September 2011. This was followed by a

revised guidelines in December 2011 and then regulatory guidelines in July 2015. The recently

published regulations appear to be an updated version of the earlier guidelines, which some may

even label as 'old wine in a new bottle'.

As in the previous guidelines, the latest regulations stipulate that the MFS providers will be led

by only the scheduled commercial banks. The banks already running MFS operations have been

allowed to hold on to their existing licence or form a subsidiary for the purpose. On the other

hand, the new applicants shall have to form a subsidiary. It is not clear, why the banks that

already provide MFS could not be asked to open subsidiaries instead of providing the services on

their own. It certainly violates the principles of uniformity and equality. The regulations also

stipulate that the parent banks have to own at least 51 per cent of the subsidiary's equity; but they

are permitted to take equity partners from other banks and non-bank financial institutions,

NGOs, investment and fin-tech companies. The mobile network operators (MNOs) have been

kept outside the list of permitted partners, but have been allowed to become distributors or super-

agents along with NGOs and the postal department. This appears to be justified as the BTRC,

and not Bangladesh Bank, is the controlling authority of MNOs.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Survey On CP Food in BangladeshDokument1 SeiteSurvey On CP Food in BangladeshFarjana Hossain DharaNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Non-Lending Financial Services of Sonali Bank Limited: A Report OnDokument5 SeitenNon-Lending Financial Services of Sonali Bank Limited: A Report OnFarjana Hossain DharaNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Parties and Their Roles Within The SyndicationDokument1 SeiteParties and Their Roles Within The SyndicationFarjana Hossain DharaNoch keine Bewertungen

- Definition:: Offshore BankingDokument3 SeitenDefinition:: Offshore BankingFarjana Hossain DharaNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Loan Syndication Alamgir Sir Assignment 05 AutosavedDokument6 SeitenLoan Syndication Alamgir Sir Assignment 05 AutosavedFarjana Hossain DharaNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Chapter 7 Practice ProblemsDokument12 SeitenChapter 7 Practice ProblemsFarjana Hossain DharaNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Assignment On: 02: "Social Entrepreneur"Dokument3 SeitenAssignment On: 02: "Social Entrepreneur"Farjana Hossain DharaNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- What Is Green Banking?Dokument4 SeitenWhat Is Green Banking?Farjana Hossain DharaNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Bibi Russell": Assignment OnDokument5 SeitenBibi Russell": Assignment OnFarjana Hossain DharaNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- What Is Agent Banking?Dokument6 SeitenWhat Is Agent Banking?Farjana Hossain DharaNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Assignment On:: Submitted ToDokument1 SeiteAssignment On:: Submitted ToFarjana Hossain DharaNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- What Is Schedule and Non-Schedule Bank?Dokument8 SeitenWhat Is Schedule and Non-Schedule Bank?Farjana Hossain DharaNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Defining Non-Bank Financial InstitutionsDokument3 SeitenDefining Non-Bank Financial InstitutionsFarjana Hossain DharaNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Chapter 06Dokument25 SeitenChapter 06Farjana Hossain DharaNoch keine Bewertungen

- Bar ChartDokument3 SeitenBar ChartVanh VũNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- IED 3. AR & CBQ New Economic PolicyDokument43 SeitenIED 3. AR & CBQ New Economic Policysayooj tvNoch keine Bewertungen

- International Economics II Ch-3Dokument62 SeitenInternational Economics II Ch-3Terefe Bergene bussaNoch keine Bewertungen

- Security Analysis of HDFCDokument9 SeitenSecurity Analysis of HDFCKanika GuptaNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Main 201bbbbbb9 20 Bank Cheque & Receipt No 1Dokument12 SeitenMain 201bbbbbb9 20 Bank Cheque & Receipt No 1Govind ThakorNoch keine Bewertungen

- Bananas Bananaindustry Bananachips: PHL Banana Industry Pins Hope On Chips For Revenue TagsDokument4 SeitenBananas Bananaindustry Bananachips: PHL Banana Industry Pins Hope On Chips For Revenue TagsJonah Nobleza0% (1)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- LRG BNK LSTDokument89 SeitenLRG BNK LSTIrfan sidik PrabowoNoch keine Bewertungen

- 06 Task Performance 1Dokument1 Seite06 Task Performance 1Kim JessiNoch keine Bewertungen

- Cbse - Class 10 - Economics - Globalisation and The Indian EconomyDokument2 SeitenCbse - Class 10 - Economics - Globalisation and The Indian EconomyDibyasha DasNoch keine Bewertungen

- Data Jagung 10 Tahun (1993-2003)Dokument11 SeitenData Jagung 10 Tahun (1993-2003)manajemen agribisnisNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

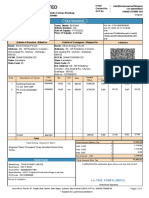

- GST InvoiceDokument1 SeiteGST Invoicemrutyunjaya1Noch keine Bewertungen

- Types of IndustriesDokument14 SeitenTypes of IndustriesKyla CaraggayanNoch keine Bewertungen

- Budget PPT Group 6 (1) - 1Dokument17 SeitenBudget PPT Group 6 (1) - 17336 Vikas MouryaNoch keine Bewertungen

- Madhyanchal Vidyut Vitran Nigam Limited, Lucknow: Shabnam ShabnamDokument2 SeitenMadhyanchal Vidyut Vitran Nigam Limited, Lucknow: Shabnam ShabnamYadav Manish KumarNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Indian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruDokument1 SeiteIndian Income Tax Return Acknowledgement: Do Not Send This Acknowledgement To CPC, BengaluruMithlesh KumarNoch keine Bewertungen

- Manoj VasudevanDokument2 SeitenManoj VasudevanPRIYANKNoch keine Bewertungen

- De Assignment 2 - Ayaan Aziz 19043Dokument9 SeitenDe Assignment 2 - Ayaan Aziz 19043ayaan azizNoch keine Bewertungen

- MBF14e Chap05 FX Markets PbmsDokument20 SeitenMBF14e Chap05 FX Markets PbmsNhi Phạm Trần YếnNoch keine Bewertungen

- Quiz School Level Winners 2022Dokument12 SeitenQuiz School Level Winners 2022Menma MaxNoch keine Bewertungen

- MergedDokument299 SeitenMergedTanu GuptaNoch keine Bewertungen

- The Basics of Non-Discrimination Principle WTODokument5 SeitenThe Basics of Non-Discrimination Principle WTOFirman HamdanNoch keine Bewertungen

- Statement - 50291311034 - 20230529 - 123959 (4) ADITIDokument12 SeitenStatement - 50291311034 - 20230529 - 123959 (4) ADITIRajeev kumar AgarwalNoch keine Bewertungen

- Sum An GalDokument2 SeitenSum An GalkbvaliaNoch keine Bewertungen

- Ib06 A2Dokument4 SeitenIb06 A2ParidhiNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Aon Salary Inc Trends Survey 2020 - STCDokument28 SeitenAon Salary Inc Trends Survey 2020 - STCRatneshNoch keine Bewertungen

- FIJI InfographicDokument2 SeitenFIJI InfographicIzabella CuartasNoch keine Bewertungen

- Senator Schumer - Federal Aid Request LetterDokument2 SeitenSenator Schumer - Federal Aid Request LetterDaily FreemanNoch keine Bewertungen

- Banks and Their ClassificationDokument9 SeitenBanks and Their ClassificationRodica CebanNoch keine Bewertungen

- 879 Eltron Energy PVT LTDDokument1 Seite879 Eltron Energy PVT LTDHaseeb TyzNoch keine Bewertungen

- Punjab and Kerala Regional Development in India Case Study Write UpDokument4 SeitenPunjab and Kerala Regional Development in India Case Study Write UpBastiaan van de LooNoch keine Bewertungen

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryVon EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryBewertung: 4 von 5 Sternen4/5 (26)