Beruflich Dokumente

Kultur Dokumente

HDFC 25 2 08 PL

Hochgeladen von

v_divaOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

HDFC 25 2 08 PL

Hochgeladen von

v_divaCopyright:

Verfügbare Formate

HDFC Bank

HDFC, CBoP merger marginally in favour of former

February 25, 2008 HDFC Bank and Centurion Bank of Punjab (CBoP) boards have given in-

Event Update

principle approval for a merger between the two banks. The deal is

likely to be valued at just under Rs100bn based on last Friday’s,

Rating Outperformer (February 22nd) closing prices and a swap ratio of 1:29. The market was

expecting a marginally higher valuation for CBoP; hence we feel the final

Price Rs1422

swap ratio is slightly in favour of HDFC Bank.

Target Price Under Review

HDFC Bank is likely to issue 67 million shares to CBoP shareholders,

Implied Upside N/A

resulting in 19% expansion in current equity base to Rs4.2bn from

Sensex 17,651 Rs3.5bn at present.

(Prices as on February 25, 2008)

Post merger, HDFC Bank’s shareholding is likely to come down from

23.3% at present to 19.6% and the bank has made an offer to HDFC to

make a preferential allotment post the merger to help it maintain its

Trading Data current share holding in the bank. Post preferential allotment to HDFC,

Market Cap. (Rs bn) 503.9 the total equity base is likely to increase by 25% to Rs4.4bn from Rs3.5bn

Shares o/s (m) 354.1

at present.

Free Float 77.7% The deal is priced on the higher side, considering CBoP’s profitability and

Avg. Daily Vol (‘000) 103.5

return ratios being much lower than that of HDFC Bank. The positive side

is that HDFC Bank gains access to 394 branches of CBoP, which will make

Avg. Daily Value (Rs m) 167.4

the combined entity have the highest private banking branch network of

1,148 branches in the country.

Our estimates suggest that, based on currently available facts on the

expected merger, FY08E & FY09E EPS (for HDFC Bank post merger) are

Major Shareholders likely to decline by 11% from the standalone expected EPS for the same

Promoters 23.3% period.

Foreign 50.3% However, the decline in HDFC Bank’s RoE and EPS due to the significant

Domestic Inst. 6.2% impending dilution in equity, we feel stock performance in the near term

Public & Others 20.2% is likely to remain subdued. We maintain Outperformer rating on the

stock, while our target price is under review.

Key financials (Rs m) FY07 FY08E FY09E FY10E

Net interest income 37,096 54,513 75,358 101,686

Growth (%) 45.7 47.0 38.2 34.9

Stock Performance

Operating profit 25,639 39,511 51,707 67,580

(%) 1M 6M 12M PAT 11,419 16,015 21,158 28,054

Absolute (11.2) 29.1 48.5 EPS (Rs) 35.8 45.0 59.5 78.9

Growth (%) 28.5 25.9 32.1 32.6

Relative (7.4) 6.8 19.0

Net DPS (Rs) 8.2 11.3 14.9 19.7

Source: Company Data; PL Research * Financials of HDFC Bank pre-merger

Price Performance (RIC:HDBK.BO, BB:HDFCB IN) Profitability & valuation FY07 FY08E FY09E FY10E

2000 NIM (%) 4.5 4.8 4.7 4.7

RoAE (%) 19.5 17.6 16.9 19.6

1800

RoAA (%) 1.4 1.4 1.3 1.3

1600 P / BV (x) 7.1 4.3 3.8 3.3

P / ABV (x) 7.3 4.4 3.9 3.4

(Rs )

1400

PE (x) 39.8 31.6 23.9 18.0

1200

Net dividend yield (%) 0.6 0.8 1.0 1.4

1000

Source: Company Data; PL Research * Financials of HDFC Bank pre-merger

800

Apr-07

Dec-07

Feb-07

Jun-07

Aug-07

Oct-07

Abhijit Majumder Bharat Gorasiya

AbhijitMajumder@PLIndia.com BharatGorasiya@PLIndia.com

Source: Bloomberg

+91-22-6632 2236 +91-22-6632 2242

HDFC Bank

Details of merged entity

1. HDFC Bank would become the seventh largest Indian bank in terms of total

assets (as on March 2007), up from the 11th place earlier.

2. It will have the largest branch network among private sector banks.

3. Will have a larger footprint in the northern and southern parts of the

country.

4. NIM likely to decline as CBoP’s margins are lower than that of HDFC Bank.

5. Asset quality likely to deteriorate post merger.

Key financials (Rs bn)

Particulars HDFC Bank CBOP HDFC Bank

post merger

Advances 714 151 865

Deposits 994 207 1,201

Low cost deposits 506 51 556

% of total 50.9 24.5 46.3

Business 1,708 358 2,066

Total assets 1,314 254 1,568

Asset quality

GNPAs 8.7 5.6 14.3

NNPAs 2.8 2.5 5.3

GNPAs (%) 1.2 3.7 1.7

NNPAs (%) 0.4 1.7 0.6

Coverage 68% 55% 63%

Size

Branches 754 394 1148

Licences in hand 180 20 200

ATMs 1906 452 2358

Employees 35,200 8,300 43,500

Profitability

NIM (%) 4.50 3.60 4.35

PAT 16.0* 1.6** 17.6

* FY2008E PAT

** M9FY08 annualized PAT

February 25, 2008 2

HDFC Bank

HDFC Bank gearing for competition

ICICI Bank, the largest private sector bank in the country, is likely to open

around 425 new branches by June 2008, taking its total tally to 1,380. HDFC

Bank, which currently has 754 branches and approval for 200 other branches,

is in for stiff competition from ICICI Bank its peers who are eager to increase

their share in the low cost deposit base. Hence, the current merger will

catapult HDFC Bank with the highest network among private banks.

Additional branches counter balance high deal value

At times when branch licences are difficult to come by and with the

possibility of the sector opening up to foreign competition post March 2009,

leading domestic private banks are unlikely to sit idle. There is high

possibility that these banks scale up their reach through the organic and

inorganic route. We feel CBoP’s major presence in the northern part of the

country (in Punjab post its merger with Bank of Punjab) and in the south

(post its acquisition of Lord Krishna Bank) gives HDFC Bank sufficient room to

leverage these branches going ahead.

Profitability and return ratios to be affected

HDFC Bank’s NIM at 4.5% is much higher than CBoP’s 3.6%, hence we expect

NIM of the merged entity to decline in the medium term, but show

improvement once HDFC Bank is able to leverage branches optimally. HDFC

Bank’s productivity and profitability ratios are among the best in the

industry, which is also expected decline in case of the merged entity.

Outlook & valuation

The HDFC Bank scrip has corrected in the recent past along with other major

banking stocks. The stock has underperformed the market in recent times

with a decline of 22% from its high in January 2008, while the market has

corrected by 15% in the same period. We feel the premium valuations for

HDFC Bank is likely to get toned down due to decline in NIM, RoE and EPS,

post merger. Again the integration of CBoP operations remains a key

challenge. Hence, we feel in the near term the stock performance is likely

to remain subdued; however, we maintain Outperformer rating on the stock,

while our target price is under review.

February 25, 2008 3

HDFC Bank

Prabhudas Lilladher Pvt. Ltd.

3rd Floor, Sadhana House, 570, P. B. Marg, Worli, Mumbai-400 018, India.

Tel: (91 22) 6632 2222 Fax: (91 22) 6632 2209

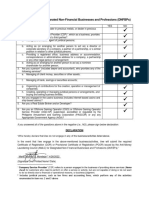

PL’s Recommendation Nomenclature

BUY : > 15% Outperformance to BSE Sensex Outperformer (OP) : 5 to 15% Outperformance to Sensex

Market Performer (MP) : -5 to 5% of Sensex Movement Underperformer (UP) : -5 to -15% of Underperformace to Sensex

Sell : <-15% Relative to Sensex

Not Rated (NR) : No specific call on the stock Under Review (UR) : Rating likely to change shortly

This document has been prepared by the Research Division of Prabhudas Lilladher Pvt. Ltd. Mumbai, India (PL) and is meant for use by the recipient only as information

and is not for circulation. This document is not to be reported or copied or made available to others without prior permission of PL. It should not be considered or taken

as an offer to sell or a solicitation to buy or sell any security.

The information contained in this report has been obtained from sources that are considered to be reliable. However, PL has not independently verified the accuracy or

completeness of the same. Neither PL nor any of its affiliates, its directors or its employees accept any responsibility of whatsoever nature for the information,

statements and opinion given, made available or expressed herein or for any omission therein.

Recipients of this report should be aware that past performance is not necessarily a guide to future performance and value of investments can go down as well. The

suitability or otherwise of any investments will depend upon the recipient's particular circumstances and, in case of doubt, advice should be sought from an independent

expert/advisor.

Either PL or its affiliates or its directors or its employees or its representatives or its clients or their relatives may have position(s), make market, act as principal or

engage in transactions of securities of companies referred to in this report and they may have used the research material prior to publication.

We may from time to time solicit or perform investment banking or other services for any company mentioned in this document.

February 25, 2008 4

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Statement of Cash FlowsDokument12 SeitenStatement of Cash FlowsDaniel PeterNoch keine Bewertungen

- Chapter 6 - Job Order CostingDokument63 SeitenChapter 6 - Job Order CostingXyne FernandezNoch keine Bewertungen

- General Security AgreementDokument19 SeitenGeneral Security AgreementTheodoor KoenenNoch keine Bewertungen

- PRTC Corporation Equity SecuritiesDokument2 SeitenPRTC Corporation Equity SecuritieshersheyNoch keine Bewertungen

- FINA 2330 Assignment 5Dokument4 SeitenFINA 2330 Assignment 5rebaNoch keine Bewertungen

- Lao VS lAODokument2 SeitenLao VS lAOJuris Renier MendozaNoch keine Bewertungen

- Recognition and MeasurementDokument16 SeitenRecognition and MeasurementajishNoch keine Bewertungen

- Templete Laporan Keuangan UMKMDokument110 SeitenTemplete Laporan Keuangan UMKMabuhaifaNoch keine Bewertungen

- EMI Group PLC Case Study Report: CFIN-522: Applied Topics: Corporate FinanceDokument11 SeitenEMI Group PLC Case Study Report: CFIN-522: Applied Topics: Corporate FinanceJauhari WicaksonoNoch keine Bewertungen

- Deductions From Gross IncomeDokument5 SeitenDeductions From Gross IncomeWenjunNoch keine Bewertungen

- Icfai P.A. IiDokument11 SeitenIcfai P.A. Iiapi-3757629Noch keine Bewertungen

- New ProjectDokument10 SeitenNew Projectvishal soniNoch keine Bewertungen

- Acceleron Posted SlidesDokument12 SeitenAcceleron Posted SlidesJunlin LiuNoch keine Bewertungen

- Illustrative Problem On Contingent Consideration and Measurement PeriodDokument8 SeitenIllustrative Problem On Contingent Consideration and Measurement PeriodasdasdaNoch keine Bewertungen

- Linear Tech Dividend PolicyDokument25 SeitenLinear Tech Dividend PolicyAdarsh Chhajed0% (2)

- Advanced Accounting (Plant Assets)Dokument3 SeitenAdvanced Accounting (Plant Assets)John JackNoch keine Bewertungen

- Taxation: Dr. Maina N. JustusDokument10 SeitenTaxation: Dr. Maina N. JustusSkyleen Jacy VikeNoch keine Bewertungen

- SURYA TutoringDokument3 SeitenSURYA Tutoringhweeping.goh0% (1)

- Ishares Msci Brazil Etf: Fact Sheet As of 03/31/2020Dokument2 SeitenIshares Msci Brazil Etf: Fact Sheet As of 03/31/2020SupermanNoch keine Bewertungen

- PRTC AUD-1stPB 05.22Dokument14 SeitenPRTC AUD-1stPB 05.22Ciatto SpotifyNoch keine Bewertungen

- Castillo Et - Al Vs BalinghasayDokument10 SeitenCastillo Et - Al Vs BalinghasaySimeon SuanNoch keine Bewertungen

- Common Questions in Finance and BankingDokument16 SeitenCommon Questions in Finance and BankingParth GakharNoch keine Bewertungen

- KKJJHHHGGDokument50 SeitenKKJJHHHGGJuan SanguinetiNoch keine Bewertungen

- Corporate Reporting November 2018Dokument28 SeitenCorporate Reporting November 2018swarna dasNoch keine Bewertungen

- Tax Homework Chapter 6Dokument4 SeitenTax Homework Chapter 6RosShanique ColebyNoch keine Bewertungen

- Bacc 402 Financial Stat 1Dokument9 SeitenBacc 402 Financial Stat 1ItdarareNoch keine Bewertungen

- Financial Ratio Analysis ExplainationDokument5 SeitenFinancial Ratio Analysis ExplainationSyaiful RokhmanNoch keine Bewertungen

- Analysis and Interpretation Name: - of Financial Statements 2 SectionDokument5 SeitenAnalysis and Interpretation Name: - of Financial Statements 2 SectionMylene Santiago100% (1)

- SIGNED Questionnaire For Designated Non Financial Businesses and Professions DNFBPsDokument2 SeitenSIGNED Questionnaire For Designated Non Financial Businesses and Professions DNFBPsCoco MondejarNoch keine Bewertungen

- Fulbari - 6 Kavre: Cash Flow StatementDokument21 SeitenFulbari - 6 Kavre: Cash Flow StatementSudeep RegmiNoch keine Bewertungen