Beruflich Dokumente

Kultur Dokumente

First Metro V. Este Del Sol Mountain Reserve (Armand)

Hochgeladen von

AM0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten3 Seitenaaa

Originaltitel

40-42

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenaaa

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten3 SeitenFirst Metro V. Este Del Sol Mountain Reserve (Armand)

Hochgeladen von

AMaaa

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

FIRST METRO v. ESTE DEL SOL MOUNTAIN RESERVE (Armand) balance.

balance. It was payable in 36 equal and consecutive monthly amortizations

November 15, 2001 | Perlas-Bernabe, J. | “Hidden” usurious loans to commence at the beginning of the 13th month from the date of first

release in accordance with the Schedule of Amortization.

PETITIONER: First Metro Investment Corp 3. In case of default, an acceleration clause was provided and the amount due

RESPONDENTS: Este Del Sol Mountain Reserve, Inc was made subject to a 20% one time penalty on the amount due and such

amount shall bear interest at the rate of 2% per month compounded

SUMMARY: Este del Sol executed a Loan Agreement in virtue of a PHP 7M quarterly on the unpaid balance and accrued interests together with all the

loan from petitioner FMIC to finance the construction and dev’t of a sports/ penalties, fees, expenses or charges thereon until the balance is paid, plus

resort complex. As security, Este Del Sol executed 1) a Real Estate Mortgage attorney’s fees equivalent to 25% of the sum sought to be recovered which

over parcels of land used as site of development project and 2) Surety in no case shall be less than 20,000 pesos if the services of a lawyer were

agreements with co-respondents. On the same day the Loan Agreement was hired.

executed, a Consultancy Agreement was also executed by Este del Sol. FMIC 4. EDS executed several documents as security for payment:

extrajudicially foreclosed mortgage and obtained the property because Este del a) real estate mortgage (1,028,029 sqm) inclusive of all improvements

Sol defaulted. FMIC instituted a collection suit against Este del Sol and co- b) individual continuing suretyship agreements by co-respondents (listed

respondents for the remaining balance plus 21% interest and 25% Attorney’s names of people) to guarantee the payment of all obligations of EDS up to

fees. Central Bank issued Circular 905 which removed the ceiling on interest the aggregate sum of P7.5M each

rates for secured and unsecured loans, regardless of maturity. The issue is WoN 5. Respondent Este del Sol also executed, an Underwriting Agreement with

the Underwriting and Consultancy Agreements were executed to conceal a the ff terms:

usurious loan. a) Petitioner FMIC shall underwrite on a best-efforts basis the public offering

Petition denied. Judgment not in favor of FMIC. of 120,000 common shares of respondent Este del Sol's capital stock for a

The Court held that CB Circ. 905 cannot be applied retroactively, contrary to one-time underwriting fee of P200,000

Este del Sol’s contention because it merely suspended the Usury Law’s b) Respondent Este del Sol shall pay petitioner FMIC an annual supervision

effectivity. The SC also noted several circumstances showing that the fee of P200,000 per annum for a period of 4 consecutive years.

Agreements were simply cloaks or devices used by FMIC to collect excessively c) Payment by respondent Este del Sol to petitioner FMIC a consultancy fee of

usurious interest. An apparently lawful loan is usurious when it is intended that P332,500.00 per annum for a period of 4 consecutive years.

additional compensation for the loan be disguised by an unrelated contract d) A Consultancy Agreement was also executed whereby respondent Este del

providing for payment by the borrower for the lender’s services which are of Sol engaged the services of petitioner FMIC for a fee as consultant to render

little value. general consultancy services.

6. On February 22, 1978, petitioner billed respondent Este del Sol for the

DOCTRINE: Central Bank Circular No. 905 which took effect on January 1, underwriting fee, consultancy fee (for a period of 4 years) and supervision

1983, and removed the ceiling on interest rates for secured and unsecured loans, fee.

regardless of maturity, cannot be made to retroactively apply to a contract 7. The said amounts of fees were deemed paid by respondent EDS to

executed earlier while the Usury Law was in full force and effect; It is an petitioner FMIC which deducted the same from the first release of the loan.

elementary rule of contracts that the laws, in force at the time the contract was 8. Then, EDS failed to meet the schedule of repayment in accordance with a

made and entered into, govern it; A Central Bank Circular cannot repeal a law, revised Schedule of Amortization. It incurred a total obligation of

only a law can repeal another law. The form of the contract is not conclusive for P12,679,630 according to FMIC’s Statement of Account.

the law will not permit a usurious loan to hide itself behind a legal form; Parol 9. Accordingly, petitioner FMIC caused the extrajudicial foreclosure of the

evidence is admissible to show that a written document though legal in form real estate mortgage. FMIC was the highest bidder of the mortgaged

was in fact a device to cover usury. properties for P9,000,000. However, there was still a remaining

P6,863,297.73 balance on the principal amount of the loan.

FACTS: 10. FMIC instituted a collection suit against the sureties to collect the

1. Petitioner FMIC granted Respondent Este del Sol (EDS) a loan of remaining balance plus interest at 21% per annum from June 24, 1980 until

P7,385,500 to finance the construction and development of the Este del Sol fully paid, and 25% percent thereof for attorney's fees and costs.

Mountain Reserve, a sports/resort complex projected at Montalban, Rizal. 11. EDS and the sureties contended that the Underwriting and Consultancy

2. Under the agreement, the proceeds of the loan were to be released on Agreements executed simultaneously with and as integral parts of the Loan

staggered basis. Interest at 16% per annum based on the diminishing Agreement and which provided for the payment of Underwriting,

Consultancy and Supervision fees were in reality subterfuges resorted to by instrument, such document is ordinarily the best evidence of the terms of

petitioner FMIC and imposed upon respondent EDS to camouflage the the contract. Courts only need to rely on the face of written contracts to

usurious interest being charged by petitioner FMIC. determine the intention of the parties.

12. The trial court ruled in favor of FMIC, ordering EDS and the sureties to a. This rule is not without exception. The form of the contract is

jointly and severally pay FMIC the amount of P6,863,297.73 plus 21% not conclusive for the law will not permit a usurious loan to hide

interest per annum, from June 24, 1980, until the entire amount is fully paid, itself behind a legal form. Parol evidence is admissible to show that a

plus attorney’s fees of 25% of the total amount due plus costs of suit. written document though legal in form was in fact a device to cover

13. On November 8, 1999, the appellate court reversed the decision of the trial usury. If from a construction of the whole transaction it becomes

court. apparent that there exists a corrupt intention to violate the Usury Law,

a) It found and declared that the fees provided for in the Underwriting and the courts should and will permit no scheme, however ingenious, to

Consultancy Agreements were mere subterfuges to camouflage the becloud the crime of usury.

3.

excessively usurious interest charged by the petitioner FMIC on the loan of In the instant case, several facts and circumstances2 taken altogether show

respondent Este del Sol that the Underwriting and Consultancy Agreements were simply cloaks or

b) And that the stipulated penalties, liquidated damages and attorney's fees devices to cover an illegal scheme employed by petitioner FMIC to conceal

were "excessive, iniquitous, unconscionable and revolting to the and collect excessively usurious interest. These clearly belie the contention

conscience," and declared that in place thereof, the stipulated one time 20% of petitioner FMIC that the Loan, Underwriting and Consultancy

penalty on the amount due and 10% percent of the amount due as attorney's Agreements are separate and independent transactions. The Underwriting

fees would be reasonable and suffice to compensate petitioner FMIC for and Consultancy Agreements which were executed and delivered

those items. contemporaneously with the Loan Agreement on January 31, 1978 were

c) It dismissed the complaint as against the individual respondents sureties and exacted by petitioner FMIC as essential conditions for the grant of the loan.

ordered petitioner FMIC to pay or reimburse respondent EDS the amount 4. An apparently lawful loan is usurious when it is intended that

paid. additional compensation for the loan be disguised by an ostensibly

14. FMIC’s motion for reconsideration was denied. unrelated contract providing for payment by the borrower for the

lender's services which are of little value or which are not in fact to be

ISSUES:

1. WoN the Underwriting and Consultancy Agreements were executed to

conceal a usurious loan. – YES 1. 2

The Underwriting and Consultancy Agreements are both dated January 31, 1978 which is the same date of

the Loan Agreement. Furthermore, under the Underwriting Agreement payment of the supervision and

consultancy fees was set for a period of 4 years to coincide ultimately with the term of the Loan Agreement.

RULING: WHEREFORE, the instant petition is hereby DENIED, and the assailed a.

This fact means that all the said agreements which were executed simultaneously were set to

Decision of the Court of Appeals is AFFIRMED. Costs against petitioner. mature or shall remain effective during the same period of time

2.

The Loan Agreement dated January 31, 1978 stipulated for the execution and delivery of an underwriting

agreement and specifically mentioned that such underwriting agreement is a condition precedent for

RATIO: petitioner FMIC to extend the loan to respondent Este del Sol, indicating and as admitted by petitioner

FMIC's employees, that such Underwriting Agreement is "part and parcel of the Loan Agreement."

1. There is no merit to petitioner FMIC's contention that Central Bank Circular 3.

Respondent Este del Sol was billed P1,330,000 as consultancy fee despite the clear provision in the

No. 905 which took effect on January 1, 1983 and removed the ceiling on Consultancy Agreement that the said agreement is for P332,500 per annum for 4 years and that only the first

year consultancy fee shall be due upon signing of the said consultancy agreement.

interest rates for secured and unsecured loans, regardless of maturity, 4.

The Underwriting, Supervision and Consultancy fees in the amounts of P200,000, and P1,330,000,

should be applied retroactively to a contract executed on January 31, 1978 respectively, were billed by petitioner to respondent Este del Sol on February 22, 1978, that is, on the same

(while the Usury Law was in full force and effect). occasion of the first partial release of the loan in the amount of P2,382,500. It is from this first partial release

of the loan that the said corresponding bills for Underwriting, Supervision and Constantly fees were

a. It is an elementary rule of contracts that the laws, in force at the time the conducted and apparently paid, thus, reverting back to petitioner FMIC the total amount of P1,730,000 as

contract was made and entered into, govern it. 5.

part of the amount loaned to respondent Este del Sol.

Petitioner FMIC was in fact unable to organize an underwriting/selling syndicate to sell any share of stock

b. More significantly, Central Bank Circular No. 905 did not repeal nor of respondent Este del Sol and much less to supervise such a syndicate, thus failing to comply with its

in any way amend the Usury Law but simply suspended the latter's obligation under the Underwriting Agreement. Besides, there was really no need for an Underwriting

Agreement since respondent Este del Sol had its own licensed marketing arm to sell its shares and all its

effectivity. The illegality of usury is wholly the creature of shares have been sold through its marketing arm.

legislation. A Central Bank Circular cannot repeal a law. Only a law 6.

Petitioner FMIC failed to comply with its obligation under the Consultancy Agreement, aside from the fact

can repeal another law. Thus, retroactive application of a Central that there was no need for a Consultancy Agreement, since respondent Este del Sol's officers appeared to be

more competent to be consultants in the development of the projected sports/resort complex

Bank Circular cannot, and should not, be presumed.

2. Second, when a contract between two parties is evidenced by a written

rendered. (accdg to Art. 1957)

5. In usurious loans, the entire obligation does not become void because of an

agreement for usurious interest; the unpaid principal debt still stands and

remains valid but the stipulation as to the usurious interest is void,

consequently, the debt is to be considered without stipulation as to the

interest.

a. The reason for this rule is that in simple loan with stipulation of

usurious interest, the prestation of the debtor to pay the principal debt,

which is the cause of the contract (Article 1350, Civil Code), is not

illegal. The illegality lies only as to the prestation to pay the stipulated

interest; hence, being separable, the latter only should be deemed void,

since it is the only one that is illegal.

6. Thus, the nullity of the stipulation on the usurious interest does not affect

the lender's right to receive back the principal amount of the loan. With

respect to the debtor, the amount paid as interest under a usurious

agreement is recoverable by him, since the payment is deemed to have

been made under restraint, rather than voluntarily.

7. Attorney's fees as provided in penal clauses are in the nature of liquidated

damages. So long as such stipulation does not contravene any law, morals,

or public order, it is binding upon the parties. Nonetheless, courts are

empowered to reduce the amount of attorney's fees if the same is "iniquitous

or unconscionable.” (Art. 1229 and Art. 2227)

8. In the case at bar, the amount of P3,188,630.75 for the stipulated attorney's

fees equivalent to 25% of the alleged amount due is manifestly exorbitant

and unconscionable. Accordingly, the Court agreed with the appellate court

that a reduction of the attorney's fees to 10% is appropriate and reasonable

under the facts and circumstances of this case as well as a 20% penalty on

the amount due. (Total amount due to EDS: P1.7M; to FMCI: P759,000)

9. Lastly, there is no merit to petitioner FMIC's contention that the appellate

court erred in awarding an amount allegedly not asked nor prayed for by

respondents. Whether the exact amount of the relief was not expressly

prayed for is of no moment for the reason that the relief was plainly

warranted by the allegations of the respondents as well as by the facts as

found by the appellate court. A party is entitled to as much relief as the

facts may warrant.

Das könnte Ihnen auch gefallen

- First Metro Investment Corporation vs. Este Del Sol Mountain Reserve, Inc FactsDokument2 SeitenFirst Metro Investment Corporation vs. Este Del Sol Mountain Reserve, Inc FactsKaren Ryl Lozada BritoNoch keine Bewertungen

- First Metro Investment Corporation vs. Este de SolDokument2 SeitenFirst Metro Investment Corporation vs. Este de SolLoNoch keine Bewertungen

- FMIC v. Este Del Sol Mountain Reserve G.R. No. 141811Dokument2 SeitenFMIC v. Este Del Sol Mountain Reserve G.R. No. 141811Google ClientNoch keine Bewertungen

- CASE NO. 6 First Metro Investment Corporation v. Este Del Sol Mountain Reserve, Inc.Dokument4 SeitenCASE NO. 6 First Metro Investment Corporation v. Este Del Sol Mountain Reserve, Inc.John Mark MagbanuaNoch keine Bewertungen

- 14 First Metro InvestmentDokument2 Seiten14 First Metro InvestmentCristelle Elaine ColleraNoch keine Bewertungen

- First Metro Investment vs. Este. Del SolDokument3 SeitenFirst Metro Investment vs. Este. Del SolAce MarjorieNoch keine Bewertungen

- Digest 02.14.19Dokument2 SeitenDigest 02.14.19Janine OlivaNoch keine Bewertungen

- First Metro Investment Vs Estate of Del Sol 420 Phil 902 (2001)Dokument1 SeiteFirst Metro Investment Vs Estate of Del Sol 420 Phil 902 (2001)Benitez Gherold100% (1)

- First Metro Investment Corporation Vs Este Del Sol 369 SCRA 99Dokument2 SeitenFirst Metro Investment Corporation Vs Este Del Sol 369 SCRA 99Roseve Batomalaque100% (1)

- First Metro Investment vs. Estate of Del SolDokument3 SeitenFirst Metro Investment vs. Estate of Del SolEmir MendozaNoch keine Bewertungen

- Oblicon Chapter2 DigestDokument57 SeitenOblicon Chapter2 DigestEzekiel Japhet Cedillo EsguerraNoch keine Bewertungen

- 131870-1989-Manila Banking Corp. v. Teodoro Jr.20160321-9941-1tqp9q1 PDFDokument9 Seiten131870-1989-Manila Banking Corp. v. Teodoro Jr.20160321-9941-1tqp9q1 PDFTintin SumawayNoch keine Bewertungen

- Manila Banking V TeodoroDokument2 SeitenManila Banking V Teodoroluiz ManieboNoch keine Bewertungen

- 54 First Metro Investment V Este Del SolDokument15 Seiten54 First Metro Investment V Este Del Soljuan aldabaNoch keine Bewertungen

- First Metro Investment Corporation VsDokument4 SeitenFirst Metro Investment Corporation VsAnne MiguelNoch keine Bewertungen

- First Metro Vs Este Del SolDokument1 SeiteFirst Metro Vs Este Del SolPaula GasparNoch keine Bewertungen

- Credtrans First MetroDokument2 SeitenCredtrans First MetroCarl ReinanteNoch keine Bewertungen

- Facts:: Verdejo vs. CADokument2 SeitenFacts:: Verdejo vs. CAclaire beltranNoch keine Bewertungen

- Manila Banking VS TeodoroDokument2 SeitenManila Banking VS TeodoroSoltan Michael AlisanNoch keine Bewertungen

- Cases in OBLIGATIONS AND CONTRACTSDokument17 SeitenCases in OBLIGATIONS AND CONTRACTSRommell Esteban ConcepcionNoch keine Bewertungen

- L. Coconut Planters Vs BelusoDokument2 SeitenL. Coconut Planters Vs BelusoCJ FaNoch keine Bewertungen

- 131870-1989-Manila Banking Corp. v. Teodoro Jr.20230815-12-1r7uu2qDokument10 Seiten131870-1989-Manila Banking Corp. v. Teodoro Jr.20230815-12-1r7uu2qAileen ReyesNoch keine Bewertungen

- MWSS V DawayDokument4 SeitenMWSS V Dawayab_munsayac3434Noch keine Bewertungen

- 35 Country Bankers Insurance V CADokument2 Seiten35 Country Bankers Insurance V CAGabriel CruzNoch keine Bewertungen

- Credtrans 5. Gsis vs. CA, GR L-52478Dokument1 SeiteCredtrans 5. Gsis vs. CA, GR L-52478Kim SimagalaNoch keine Bewertungen

- Gilat Satellite Networks, Ltd. v. UCPB, G.R. No. 189563, April 7, 2014Dokument8 SeitenGilat Satellite Networks, Ltd. v. UCPB, G.R. No. 189563, April 7, 2014Ramil GarciaNoch keine Bewertungen

- MWSS V DAWAYDokument3 SeitenMWSS V DAWAYNiajhan PalattaoNoch keine Bewertungen

- Manila Banking Corporation v. Teodoro JR., G.R. No. 53955, January 13, 1989 DIGESTDokument3 SeitenManila Banking Corporation v. Teodoro JR., G.R. No. 53955, January 13, 1989 DIGESTAprilNoch keine Bewertungen

- DIGESTS Credit Interest PDFDokument15 SeitenDIGESTS Credit Interest PDFKoko GonzalesNoch keine Bewertungen

- RACQUEL-SANTOS v. CA - G.R. No. 174986 - July 7, 2009Dokument82 SeitenRACQUEL-SANTOS v. CA - G.R. No. 174986 - July 7, 2009Jhai Jhai DumsyyNoch keine Bewertungen

- Mondragon V CaDokument5 SeitenMondragon V CaLiv PerezNoch keine Bewertungen

- BPI vs. Ulrich Forester G.R. No. L-25811Dokument1 SeiteBPI vs. Ulrich Forester G.R. No. L-25811Xander 4thNoch keine Bewertungen

- Atok Finance Corporation vs. Court of Appeals FactsDokument4 SeitenAtok Finance Corporation vs. Court of Appeals FactsasdfghjkattNoch keine Bewertungen

- ONG v. RobanDokument2 SeitenONG v. RobanStacy Shara Cabusas OtazaNoch keine Bewertungen

- Final Format For Credit MidtermDokument8 SeitenFinal Format For Credit MidtermCloieRjNoch keine Bewertungen

- Guaranty and Suretyship (Dela Cruz)Dokument6 SeitenGuaranty and Suretyship (Dela Cruz)Geriel Dela CruzNoch keine Bewertungen

- MWSS vs. DawayDokument3 SeitenMWSS vs. DawayLindsay Mills100% (1)

- Commonwealth Insurance Corporation vs. Ca: Insurance Company, Inc. We Have Sustained TheDokument6 SeitenCommonwealth Insurance Corporation vs. Ca: Insurance Company, Inc. We Have Sustained TheAisha TejadaNoch keine Bewertungen

- Vdocuments - MX - Contracts Case DigestsDokument22 SeitenVdocuments - MX - Contracts Case DigestsMaan LucsNoch keine Bewertungen

- Bañas vs. Asia Pacific Corp., 343 SCRA 527 October 18, 2000 TEODORO BAÑASDokument39 SeitenBañas vs. Asia Pacific Corp., 343 SCRA 527 October 18, 2000 TEODORO BAÑASRizza Mae EudNoch keine Bewertungen

- Gilat Satellite Network Vs UCPB General Insurance Co., Inc.Dokument8 SeitenGilat Satellite Network Vs UCPB General Insurance Co., Inc.CyrusNoch keine Bewertungen

- Banking Law Case DIGEST (Gen. Banking Law and Central Bank ACT)Dokument8 SeitenBanking Law Case DIGEST (Gen. Banking Law and Central Bank ACT)maizcornNoch keine Bewertungen

- Plaintiff-Appellant Defendants-Appellees Intervenor-Appellee Block, Johnston & Greenbaum Lutero, Lutero & Maza Arroyo & EvangelistaDokument22 SeitenPlaintiff-Appellant Defendants-Appellees Intervenor-Appellee Block, Johnston & Greenbaum Lutero, Lutero & Maza Arroyo & EvangelistaJerwin DaveNoch keine Bewertungen

- 059 Cuyco V Cuyco - PeraltaDokument2 Seiten059 Cuyco V Cuyco - PeraltaClarisse Anne PeraltaNoch keine Bewertungen

- CivRev2 10th AssignmentDokument12 SeitenCivRev2 10th AssignmentLorenzo Luigi GayyaNoch keine Bewertungen

- Manila Banking Corp. v. TeodorDokument3 SeitenManila Banking Corp. v. TeodorGrace Ann TamboonNoch keine Bewertungen

- Loc PDFDokument16 SeitenLoc PDFdwight yuNoch keine Bewertungen

- SpecCom General Banking CasesDokument61 SeitenSpecCom General Banking CasesStevensonYuNoch keine Bewertungen

- Asia Trust Development Bank Vs TubleDokument5 SeitenAsia Trust Development Bank Vs TubleWresen AnnNoch keine Bewertungen

- Petitioners vs. vs. Respondents Guillermo B. Ilagan Jorge, Perez & AssociatesDokument13 SeitenPetitioners vs. vs. Respondents Guillermo B. Ilagan Jorge, Perez & AssociatesGericah RodriguezNoch keine Bewertungen

- Credit Transaction Cases 1st SetDokument106 SeitenCredit Transaction Cases 1st SetKira JorgioNoch keine Bewertungen

- 1st Lec DigestDokument3 Seiten1st Lec DigestKrissaNoch keine Bewertungen

- Pledge DigestDokument30 SeitenPledge DigestBoyong HachasoNoch keine Bewertungen

- City of Manila v. Chinese Cemetery of Manila, 40 Phil 349 (1919)Dokument68 SeitenCity of Manila v. Chinese Cemetery of Manila, 40 Phil 349 (1919)Jose Hazil J. MoralaNoch keine Bewertungen

- Chattel Mortgage Law: Christian Arbiol San Beda College Alabang School of LawDokument187 SeitenChattel Mortgage Law: Christian Arbiol San Beda College Alabang School of LawYieMaghirangNoch keine Bewertungen

- Bañas vs. Asia Pacific Finance Corporation: G.R. No. 128703. October 18, 2000.Dokument10 SeitenBañas vs. Asia Pacific Finance Corporation: G.R. No. 128703. October 18, 2000.Krisha FayeNoch keine Bewertungen

- Martin Danao, Minda Danao and Co-Petitioner Concepcion S. Danao) and Concepcion S. Danao Philippine Islands (Effective June 29, 1979)Dokument11 SeitenMartin Danao, Minda Danao and Co-Petitioner Concepcion S. Danao) and Concepcion S. Danao Philippine Islands (Effective June 29, 1979)Nelly Louie CasabuenaNoch keine Bewertungen

- How to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersVon EverandHow to Get Rid of Your Unwanted Debt: A Litigation Attorney Representing Homeowners, Credit Card Holders & OthersBewertung: 3 von 5 Sternen3/5 (1)

- Columbia Pictures Inc Vs CA 1994Dokument1 SeiteColumbia Pictures Inc Vs CA 1994AMNoch keine Bewertungen

- 20th Century Fox Vs CADokument1 Seite20th Century Fox Vs CAAMNoch keine Bewertungen

- Macabago vs. Commission On Elections, 392 SCRA 178, November 18, 2002Dokument14 SeitenMacabago vs. Commission On Elections, 392 SCRA 178, November 18, 2002AMNoch keine Bewertungen

- RMC No. 57-2019 - DigestDokument1 SeiteRMC No. 57-2019 - DigestAMNoch keine Bewertungen

- RMC No. 135-2019 - Digest PDFDokument2 SeitenRMC No. 135-2019 - Digest PDFAMNoch keine Bewertungen

- RMC No. 68-2019 - DigestDokument3 SeitenRMC No. 68-2019 - DigestAMNoch keine Bewertungen

- RMO No. 10-2019 - DigestDokument3 SeitenRMO No. 10-2019 - DigestAMNoch keine Bewertungen

- Saligumba vs. Palanog G.R. No. 143365 December 4, 2008 Carpio, J.: FactsDokument1 SeiteSaligumba vs. Palanog G.R. No. 143365 December 4, 2008 Carpio, J.: FactsAMNoch keine Bewertungen

- Mendoza vs. Philippine Airlines, IncDokument13 SeitenMendoza vs. Philippine Airlines, IncAMNoch keine Bewertungen

- Rule 59Dokument2 SeitenRule 59AMNoch keine Bewertungen

- GUIZANO vs. VENERACIONDokument1 SeiteGUIZANO vs. VENERACIONAMNoch keine Bewertungen

- Lu Du, Et Al. vs. BinamiraDokument6 SeitenLu Du, Et Al. vs. BinamiraAMNoch keine Bewertungen

- Macam vs. Court of AppealsDokument13 SeitenMacam vs. Court of AppealsAMNoch keine Bewertungen

- MANESE vs. SPS. VELASCODokument1 SeiteMANESE vs. SPS. VELASCOAM0% (1)

- Ngo Burca v. RepublicDokument12 SeitenNgo Burca v. RepublicAMNoch keine Bewertungen

- Heirs of Medrano Vs de VeraDokument3 SeitenHeirs of Medrano Vs de VeraAMNoch keine Bewertungen

- Statute and Soft Law Civil Code Art. 17Dokument1 SeiteStatute and Soft Law Civil Code Art. 17AMNoch keine Bewertungen

- BPI vs. SPOUSES SANTIAGODokument1 SeiteBPI vs. SPOUSES SANTIAGOAMNoch keine Bewertungen

- Saraza vs. Francisco FactsDokument4 SeitenSaraza vs. Francisco FactsAMNoch keine Bewertungen

- Cu vs. Republic of The PhilippinesDokument7 SeitenCu vs. Republic of The PhilippinesAMNoch keine Bewertungen

- Cases For FriDokument5 SeitenCases For FriAMNoch keine Bewertungen

- Unsworth - Re-Branding The City - Changing The Images of PlacesDokument45 SeitenUnsworth - Re-Branding The City - Changing The Images of PlacesNatalia Ney100% (2)

- Outbreaks Epidemics and Pandemics ReadingDokument2 SeitenOutbreaks Epidemics and Pandemics Readingapi-290100812Noch keine Bewertungen

- Calcutta Bill - Abhimanyug@Dokument2 SeitenCalcutta Bill - Abhimanyug@abhimanyugirotraNoch keine Bewertungen

- Clinical Handbook of Infectious Diseases in Farm AnimalsDokument146 SeitenClinical Handbook of Infectious Diseases in Farm Animalsigorgalopp100% (1)

- Abstraction and Empathy - ReviewDokument7 SeitenAbstraction and Empathy - ReviewXXXXNoch keine Bewertungen

- ( (LEAD - FIRSTNAME) ) 'S Spouse Visa PackageDokument14 Seiten( (LEAD - FIRSTNAME) ) 'S Spouse Visa PackageDamon Culbert0% (1)

- Sabena Belgian World Airlines vs. CADokument3 SeitenSabena Belgian World Airlines vs. CARhea CalabinesNoch keine Bewertungen

- WatsuDokument5 SeitenWatsuTIME-TREVELER100% (1)

- Chapter 2Dokument16 SeitenChapter 2nannaNoch keine Bewertungen

- Performance Task in Mathematics 10 First Quarter: GuidelinesDokument2 SeitenPerformance Task in Mathematics 10 First Quarter: Guidelinesbelle cutiee100% (3)

- Porn Sex Versus Real Sex: How Sexually Explicit Material Shapes Our Understanding of Sexual Anatomy, Physiology, and BehaviourDokument23 SeitenPorn Sex Versus Real Sex: How Sexually Explicit Material Shapes Our Understanding of Sexual Anatomy, Physiology, and Behaviourzyryll yowNoch keine Bewertungen

- NIPMR Notification v3Dokument3 SeitenNIPMR Notification v3maneeshaNoch keine Bewertungen

- Course Hand Out Comm. Skill BSC AgDokument2 SeitenCourse Hand Out Comm. Skill BSC Agfarid khanNoch keine Bewertungen

- 100 Commonly Asked Interview QuestionsDokument6 Seiten100 Commonly Asked Interview QuestionsRaluca SanduNoch keine Bewertungen

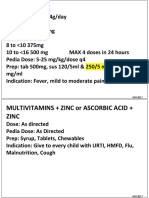

- Common RHU DrugsDokument56 SeitenCommon RHU DrugsAlna Shelah IbañezNoch keine Bewertungen

- The Impact of Video Gaming To The Academic Performance of The Psychology Students in San Beda UniversityDokument5 SeitenThe Impact of Video Gaming To The Academic Performance of The Psychology Students in San Beda UniversityMarky Laury GameplaysNoch keine Bewertungen

- Native Americans - Clothing & Head DressesDokument28 SeitenNative Americans - Clothing & Head DressesThe 18th Century Material Culture Resource Center100% (15)

- Tutor InvoiceDokument13 SeitenTutor InvoiceAbdullah NHNoch keine Bewertungen

- Q4-ABM-Business Ethics-12-Week-1Dokument4 SeitenQ4-ABM-Business Ethics-12-Week-1Kim Vpsae0% (1)

- AD&D 2nd Edition - Dark Sun - Monstrous Compendium - Appendix II - Terrors Beyond Tyr PDFDokument130 SeitenAD&D 2nd Edition - Dark Sun - Monstrous Compendium - Appendix II - Terrors Beyond Tyr PDFWannes Ikkuhyu100% (8)

- Book Review Leffel Cateura, Oil Painting SecretsDokument4 SeitenBook Review Leffel Cateura, Oil Painting SecretsAnonymous H3kGwRFiENoch keine Bewertungen

- Timothy Ajani, "Syntax and People: How Amos Tutuola's English Was Shaped by His People"Dokument20 SeitenTimothy Ajani, "Syntax and People: How Amos Tutuola's English Was Shaped by His People"PACNoch keine Bewertungen

- Literature Review LichenDokument7 SeitenLiterature Review LichenNur Fazrina CGNoch keine Bewertungen

- BurnsDokument80 SeitenBurnsAlina IlovanNoch keine Bewertungen

- Đại Từ Quan Hệ Trong Tiếng AnhDokument5 SeitenĐại Từ Quan Hệ Trong Tiếng AnhNcTungNoch keine Bewertungen

- Statistical TestsDokument47 SeitenStatistical TestsUche Nwa ElijahNoch keine Bewertungen

- Material Concerning Ukrainian-Jewish Relations (1917-1921)Dokument106 SeitenMaterial Concerning Ukrainian-Jewish Relations (1917-1921)lastivka978Noch keine Bewertungen

- Simple Linear Regression Analysis: Mcgraw-Hill/IrwinDokument16 SeitenSimple Linear Regression Analysis: Mcgraw-Hill/IrwinNaeem AyazNoch keine Bewertungen

- The Students Ovid Selections From The Metamorphoses by Ovid, Margaret Worsham MusgroveDokument425 SeitenThe Students Ovid Selections From The Metamorphoses by Ovid, Margaret Worsham MusgroveMiriaam AguirreNoch keine Bewertungen

- Mohd Ali 17: By:-Roll NoDokument12 SeitenMohd Ali 17: By:-Roll NoMd AliNoch keine Bewertungen