Beruflich Dokumente

Kultur Dokumente

Philippine Fisheries Development Authority V CA

Hochgeladen von

Emil BautistaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Philippine Fisheries Development Authority V CA

Hochgeladen von

Emil BautistaCopyright:

Verfügbare Formate

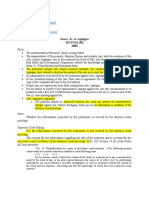

PHILIPPINE FISHERIES DEVELOPMENT AUTHORITY v CA GR No.

169836 July 31, 2007

Buri, Kenneth Roger R.

FACTS: The PFDA was created by then Pres. Marcos and became an attached agency of the Department of

Agriculture. Ministry of Public Works and Highways reclaimed from the sea a 21-hectare parcel of land in Brgy..

Tanza, Iloilo City, and constructed the Iloilo Fishing Port Complex (IFPC), consisting of breakwater, a landing quay, a

refrigeration building, a market hall, a municipal shed, an administration building, a water and fuel oil supply system

and other port related facilities and machineries.

Upon its completion, the Ministry of Public Works and Highways turned over IFPC to the Authority, pursuant to Section 11 of PD

977, which places fishing port complexes and related facilities under the governance and operation of the PFDA.

Notwithstanding said turn over, title to the land and buildings of the IFPC remained with the Republic.

The Authority thereafter leased portions of IFPC to private firms and individuals engaged in fishing related

businesses.

Sometime in May 1988, the City of Iloilo assessed the entire IFPC for real property taxes.

ISSUES: Whether or not PFDA is liable to pay real property tax to the City of Iloilo.

HELD: Yes but only insofar as those properties which are leased to private firms and individuals!

The Court rules that the Authority is not a GOCC but an instrumentality of the national government which is

generally exempt from payment of real property tax. However, said exemption does not apply to the portions of the

IFPC which the Authority leased to private entities. With respect to these properties, the Authority is liable to pay

real property tax.

The Authority which is tasked with the special public function to carry out the government’s policy "to promote

the development of the country’s fishing industry and improve the efficiency in handling, preserving, marketing, and

distribution of fish and other aquatic products," exercises the governmental powers of eminent domain, and the

power to levy fees and charges. At the same time, the Authority exercises "the general corporate powers conferred

by laws upon private and government-owned or controlled corporations."

In light of the foregoing, the Authority should be classified as an instrumentality of the national government

which is liable to pay taxes only with respect to the portions of the property, the beneficial use of which were vested

in private entities. When local governments invoke the power to tax on national government instrumentalities, such

power is construed strictly against local governments. The rule is that a tax is never presumed and there must be

clear language in the law imposing the tax. Any doubt whether a person, article or activity is taxable is resolved

against taxation. This rule applies with greater force when local governments seek to tax national government

instrumentalities.20

Thus, the real property tax assessments issued by the City of Iloilo should be upheld only with respect to the

portions leased to private persons. In case the Authority fails to pay the real property taxes due thereon, said

portions cannot be sold at public auction to satisfy the tax delinquency. In Chavez v. Public Estates Authority it was

held that reclaimed lands are lands of the public domain and cannot, without Congressional fiat, be subject of a sale,

public or private

In sum, the Court finds that the Authority is an instrumentality of the national government, hence, it is liable to pay real

property taxes assessed by the City of Iloilo on the IFPC only with respect to those portions which are leased to private entities.

Notwithstanding said tax delinquency on the leased portions of the IFPC, the latter or any part thereof, being a property of public

domain, cannot be sold at public auction. This means that the City of Iloilo has to satisfy the tax delinquency through means other

than the sale at public auction of the IFPC.

Das könnte Ihnen auch gefallen

- Philippine Fisheries Development Authority vs. CA 169836Dokument1 SeitePhilippine Fisheries Development Authority vs. CA 169836magenNoch keine Bewertungen

- Tax Case Digest Income Inclusions and ExclusionsDokument17 SeitenTax Case Digest Income Inclusions and ExclusionsJuris PasionNoch keine Bewertungen

- Lim Tian Teng CaseDokument1 SeiteLim Tian Teng CasedonsiccuanNoch keine Bewertungen

- Case No. 1 Zapanta vs. Posadas G.R. Nos. L-29204-09, December 29, 1928 FactsDokument29 SeitenCase No. 1 Zapanta vs. Posadas G.R. Nos. L-29204-09, December 29, 1928 FactsChan ChanNoch keine Bewertungen

- Remulla V MaliksiDokument2 SeitenRemulla V MaliksiGreghvon MatolNoch keine Bewertungen

- CIR v. Sony PhilippinesDokument1 SeiteCIR v. Sony PhilippinesMarcella Maria KaraanNoch keine Bewertungen

- 09.la Perla Vs CigarDokument1 Seite09.la Perla Vs CigarRhenfacelManlegroNoch keine Bewertungen

- 10 CIR V CitytrustDokument1 Seite10 CIR V CitytrustAnn QuebecNoch keine Bewertungen

- COMMISSIONER OF INTERNAL REVENUE, Petitioner, vs. CITYTRUST INVESTMENT PHILS., INC., Respondent.Dokument1 SeiteCOMMISSIONER OF INTERNAL REVENUE, Petitioner, vs. CITYTRUST INVESTMENT PHILS., INC., Respondent.Charles Roger Raya100% (1)

- Mid-Term-Day 1-Other Percentage Taxes (Opt)Dokument52 SeitenMid-Term-Day 1-Other Percentage Taxes (Opt)Christine Joyce MagoteNoch keine Bewertungen

- CIR v. CA and Castaneda GR 96016 October 17, 1991Dokument1 SeiteCIR v. CA and Castaneda GR 96016 October 17, 1991Vel JuneNoch keine Bewertungen

- 2.2. Province of Nueva Ecija vs. Imperial Mining Co., IncDokument4 Seiten2.2. Province of Nueva Ecija vs. Imperial Mining Co., IncAaron CariñoNoch keine Bewertungen

- CIR Vs CIR and CASTANEDA G.R. No. 96016, October 17, 1991Dokument2 SeitenCIR Vs CIR and CASTANEDA G.R. No. 96016, October 17, 1991Gwen Alistaer CanaleNoch keine Bewertungen

- CIR v. Phoenix Assurance Co., Ltd. (14 SCRA 52)Dokument3 SeitenCIR v. Phoenix Assurance Co., Ltd. (14 SCRA 52)Karl MinglanaNoch keine Bewertungen

- Bertillo - Phil. Guaranty Co. Inc. Vs CIR and CTADokument2 SeitenBertillo - Phil. Guaranty Co. Inc. Vs CIR and CTAStella BertilloNoch keine Bewertungen

- CIR v. Next Mobile IncDokument11 SeitenCIR v. Next Mobile IncPaulineNoch keine Bewertungen

- Cir Vs Bank of Commerce DigestDokument3 SeitenCir Vs Bank of Commerce Digestwaws20Noch keine Bewertungen

- GROUP 7 CASE DIGESTGenovis Ferrer Orbita SultanDokument4 SeitenGROUP 7 CASE DIGESTGenovis Ferrer Orbita SultanJoatham GenovisNoch keine Bewertungen

- TAX-Alhambra Cigar v. CIRDokument2 SeitenTAX-Alhambra Cigar v. CIRGrezyl AmoresNoch keine Bewertungen

- Basilan Estates, Inc. vs. Commissioner of Internal Revenue, 21 SCRA 17, September 05, 1967Dokument14 SeitenBasilan Estates, Inc. vs. Commissioner of Internal Revenue, 21 SCRA 17, September 05, 1967Jane BandojaNoch keine Bewertungen

- CIR vs. Phoenix Assurance L-19727Dokument1 SeiteCIR vs. Phoenix Assurance L-19727magenNoch keine Bewertungen

- CIR v. The Estate of Benigno P. TodaDokument2 SeitenCIR v. The Estate of Benigno P. TodaKyle DionisioNoch keine Bewertungen

- Raytheon-Production-vs-COMMISSIONER OF INTERNAL REVENUEDokument2 SeitenRaytheon-Production-vs-COMMISSIONER OF INTERNAL REVENUECharles Roger RayaNoch keine Bewertungen

- Essso Vs CirDokument2 SeitenEssso Vs CirCates dela RosaNoch keine Bewertungen

- Gutierrez v. CTADokument3 SeitenGutierrez v. CTAHoney BiNoch keine Bewertungen

- Cir V AcostaDokument2 SeitenCir V AcostaJennilyn TugelidaNoch keine Bewertungen

- Deutsche Bank AG Manila Branch v. CIRDokument3 SeitenDeutsche Bank AG Manila Branch v. CIRDonna DumaliangNoch keine Bewertungen

- 28 Municipality of Cainta Vs City of PasigDokument2 Seiten28 Municipality of Cainta Vs City of Pasighigoremso giensdks100% (3)

- AFISCO Insurance Corp. v. CA DigestDokument3 SeitenAFISCO Insurance Corp. v. CA DigestAbigayle Recio100% (1)

- Lotto Restaurant Corp Vs BPIDokument5 SeitenLotto Restaurant Corp Vs BPIEricson Sarmiento Dela CruzNoch keine Bewertungen

- La Suerte Cigar 0 Cigarette Factory Vs CADokument1 SeiteLa Suerte Cigar 0 Cigarette Factory Vs CAReynald LacabaNoch keine Bewertungen

- Republic Bank v. CTA DigestDokument3 SeitenRepublic Bank v. CTA DigestKaren Panisales100% (2)

- Pilipinas Total Gas v. CIRDokument4 SeitenPilipinas Total Gas v. CIRDanJalbunaNoch keine Bewertungen

- PNB Vs CA Case DigestDokument2 SeitenPNB Vs CA Case Digesttine delos santosNoch keine Bewertungen

- Javier v. AnchetaDokument1 SeiteJavier v. AnchetaGSSNoch keine Bewertungen

- Commissioner of Internal Revenue V. Lancaster Philippines, Inc. FactsDokument11 SeitenCommissioner of Internal Revenue V. Lancaster Philippines, Inc. FactsJun Bill CercadoNoch keine Bewertungen

- CIR-v-American-Airlines-180-SCRA-274Dokument6 SeitenCIR-v-American-Airlines-180-SCRA-274Darrel John Sombilon100% (1)

- Case Digest - CIR v. Fitness by Design (Tax II)Dokument1 SeiteCase Digest - CIR v. Fitness by Design (Tax II)Nin BritanucciNoch keine Bewertungen

- Facts:: Philippine Petroleum Corporation Vs Municipality of Pililla, Rizal, GR 90776 (June 03, 1991)Dokument2 SeitenFacts:: Philippine Petroleum Corporation Vs Municipality of Pililla, Rizal, GR 90776 (June 03, 1991)pnp bantayNoch keine Bewertungen

- CIR V Castaneda DigestDokument1 SeiteCIR V Castaneda DigestKTNoch keine Bewertungen

- Howden Vs CollectorDokument2 SeitenHowden Vs CollectorLouise Bolivar DadivasNoch keine Bewertungen

- Smart Communications Vs City of DavaoDokument1 SeiteSmart Communications Vs City of DavaoPilyang SweetNoch keine Bewertungen

- CD - 36. CIR v. Aquafresh SeafoodsDokument3 SeitenCD - 36. CIR v. Aquafresh SeafoodsCzarina CidNoch keine Bewertungen

- 1smied Vs CirDokument2 Seiten1smied Vs CirBam BathanNoch keine Bewertungen

- Republic Vs GonzalesDokument2 SeitenRepublic Vs GonzalesCarl MontemayorNoch keine Bewertungen

- 142 CIR v. CitytrustDokument3 Seiten142 CIR v. CitytrustclarkorjaloNoch keine Bewertungen

- Carlos Superdrug CorpDokument2 SeitenCarlos Superdrug CorpLeslie TanNoch keine Bewertungen

- DigestDokument2 SeitenDigestJeepers KreepersNoch keine Bewertungen

- 10 Coca-Cola-Philippines-vs-CIRDokument1 Seite10 Coca-Cola-Philippines-vs-CIRhigoremso giensdksNoch keine Bewertungen

- 26 - Davao Gulf Lumber v. CIR, GR No. 117359Dokument2 Seiten26 - Davao Gulf Lumber v. CIR, GR No. 117359Lloyd LiwagNoch keine Bewertungen

- 26 - Apostolic Prefect Vs City of BaguioDokument4 Seiten26 - Apostolic Prefect Vs City of BaguioAgnes SantosNoch keine Bewertungen

- CM Hoskins DigestDokument2 SeitenCM Hoskins DigestkarlonovNoch keine Bewertungen

- Title I - Obligations General Provisions 1156. An Obligation Is A Juridical Necessity To Give, To Do, or Not To DoDokument37 SeitenTitle I - Obligations General Provisions 1156. An Obligation Is A Juridical Necessity To Give, To Do, or Not To Dohit that songNoch keine Bewertungen

- CRISOLOGO v. PEOPLEDokument2 SeitenCRISOLOGO v. PEOPLEMarife MinorNoch keine Bewertungen

- Case Digest On Taxation 1Dokument32 SeitenCase Digest On Taxation 1Carl Vincent QuitorianoNoch keine Bewertungen

- 1060 PLDT Vs City of Davao - GR No. 143867Dokument1 Seite1060 PLDT Vs City of Davao - GR No. 143867Estee XoohNoch keine Bewertungen

- Philippine Acetylen v. CIRDokument2 SeitenPhilippine Acetylen v. CIRJemima FalinchaoNoch keine Bewertungen

- Philippine Fisheries Development Authority V CADokument3 SeitenPhilippine Fisheries Development Authority V CAKenneth BuriNoch keine Bewertungen

- Philippine Fisheries Development Authority vs. CADokument2 SeitenPhilippine Fisheries Development Authority vs. CAGean Pearl Pao IcaoNoch keine Bewertungen

- Philippine Fisheries Development Authority vs. Court of Appeals G.R. No. 169836 July 31, 2007 Ynares-Santiago, J.Dokument1 SeitePhilippine Fisheries Development Authority vs. Court of Appeals G.R. No. 169836 July 31, 2007 Ynares-Santiago, J.Maraipol Trading Corp.Noch keine Bewertungen

- Alano vs. CA 283 S 269 - GoogleDokument7 SeitenAlano vs. CA 283 S 269 - GoogleEmil BautistaNoch keine Bewertungen

- Digest Escra Lawphil Digest Escra LawphilDokument11 SeitenDigest Escra Lawphil Digest Escra LawphilEmil BautistaNoch keine Bewertungen

- Marcos V Heirs of Navarro GR 198240 July 3, 2013Dokument9 SeitenMarcos V Heirs of Navarro GR 198240 July 3, 2013Emil BautistaNoch keine Bewertungen

- Marcos V Heirs of Navarro GR 198240 July 3, 2013Dokument22 SeitenMarcos V Heirs of Navarro GR 198240 July 3, 2013Emil BautistaNoch keine Bewertungen

- Case Digest in Evidence (Remedial Law) : Silot vs. de La Rosa Gregorio Silot, Jr. vs. Estrella de La RosaDokument2 SeitenCase Digest in Evidence (Remedial Law) : Silot vs. de La Rosa Gregorio Silot, Jr. vs. Estrella de La RosaEmil BautistaNoch keine Bewertungen

- Digest Escra Lawphil Digest Escra LawphilDokument14 SeitenDigest Escra Lawphil Digest Escra LawphilEmil BautistaNoch keine Bewertungen

- TUASON v. CA, 241 SCRADokument14 SeitenTUASON v. CA, 241 SCRAEmil BautistaNoch keine Bewertungen

- CIR vs. Cebu Portland Cement Company and CTA, G.R. No. L-29059, December 15, 1987Dokument6 SeitenCIR vs. Cebu Portland Cement Company and CTA, G.R. No. L-29059, December 15, 1987Emil BautistaNoch keine Bewertungen

- Saura Vs Atty Agdeppa AC 4426 February 17, 2000Dokument6 SeitenSaura Vs Atty Agdeppa AC 4426 February 17, 2000Emil BautistaNoch keine Bewertungen

- Heirs of The Late Spouses Maglasang v. Manila Banking Corp+Dokument15 SeitenHeirs of The Late Spouses Maglasang v. Manila Banking Corp+Emil BautistaNoch keine Bewertungen

- Dizon V CTA G.R. No. 140944 April 30, 2008Dokument11 SeitenDizon V CTA G.R. No. 140944 April 30, 2008Emil BautistaNoch keine Bewertungen

- CIR vCIR v. PINEDA GR No. L-22734, September 15, 1967 21 SCRA 105Dokument1 SeiteCIR vCIR v. PINEDA GR No. L-22734, September 15, 1967 21 SCRA 105Emil BautistaNoch keine Bewertungen

- A European-Style Tax?Dokument3 SeitenA European-Style Tax?Emil BautistaNoch keine Bewertungen

- CIR vs. Embroidery & Garments Industries Phils, GR 96262 March 22, 1999Dokument5 SeitenCIR vs. Embroidery & Garments Industries Phils, GR 96262 March 22, 1999Emil BautistaNoch keine Bewertungen

- Collector vs. Zulueta 100 Phil 872, G.R. No. L-8840. February 8, 1957Dokument5 SeitenCollector vs. Zulueta 100 Phil 872, G.R. No. L-8840. February 8, 1957Emil BautistaNoch keine Bewertungen

- BIR Ruling No. 113-98 Dated July 23, 1998Dokument1 SeiteBIR Ruling No. 113-98 Dated July 23, 1998Emil BautistaNoch keine Bewertungen

- CIR v. Pascor Realty and Development DigestDokument11 SeitenCIR v. Pascor Realty and Development DigestEmil BautistaNoch keine Bewertungen

- VALUE ADDED TAX Notes From BIRDokument30 SeitenVALUE ADDED TAX Notes From BIREmil BautistaNoch keine Bewertungen

- Converse Vs Universal Rubber G.R. No. L-27906 January 8, 1987Dokument5 SeitenConverse Vs Universal Rubber G.R. No. L-27906 January 8, 1987Emil BautistaNoch keine Bewertungen

- NPC Indirect Tax Exemption - Under Section 13, Pars. (A) and (D) of R. A. No. 6395, AsDokument1 SeiteNPC Indirect Tax Exemption - Under Section 13, Pars. (A) and (D) of R. A. No. 6395, AsEmil BautistaNoch keine Bewertungen

- Inchausti & Company v. Song Fo & Company, G.R. No. 6623 (January 26, 1912) PDFDokument3 SeitenInchausti & Company v. Song Fo & Company, G.R. No. 6623 (January 26, 1912) PDFEmil BautistaNoch keine Bewertungen

- Inchausti & Company v. Song Fo & Company, G.R. No. 6623 (January 26, 1912)Dokument2 SeitenInchausti & Company v. Song Fo & Company, G.R. No. 6623 (January 26, 1912)Emil BautistaNoch keine Bewertungen

- FREDCO MANUFACTURING Vs (HARVARD UNIVERSITY), G.R. No. 185917Dokument12 SeitenFREDCO MANUFACTURING Vs (HARVARD UNIVERSITY), G.R. No. 185917Emil BautistaNoch keine Bewertungen

- Etepha v. Director of Patents (G.R. No. L-20635)Dokument1 SeiteEtepha v. Director of Patents (G.R. No. L-20635)Emil BautistaNoch keine Bewertungen

- Sta - Ana v. Maliwat Digest G.R. No. L-23023 August 31, 1968Dokument7 SeitenSta - Ana v. Maliwat Digest G.R. No. L-23023 August 31, 1968Emil BautistaNoch keine Bewertungen

- American Wire Vs Director of Patents G.R. No. L-26557 February 18, 1970Dokument3 SeitenAmerican Wire Vs Director of Patents G.R. No. L-26557 February 18, 1970Emil BautistaNoch keine Bewertungen

- Arba Minch University Institute of Technology Faculty of Computing & Software EngineeringDokument65 SeitenArba Minch University Institute of Technology Faculty of Computing & Software Engineeringjemu mamedNoch keine Bewertungen

- Consumer Behaviour Models in Hospitality and TourismDokument16 SeitenConsumer Behaviour Models in Hospitality and Tourismfelize padllaNoch keine Bewertungen

- WI-824-003 First Article InspectionDokument2 SeitenWI-824-003 First Article InspectionAndreas Schlager100% (1)

- FIP & CouponsDokument5 SeitenFIP & CouponsKosme DamianNoch keine Bewertungen

- BS Company RecordsDokument2 SeitenBS Company RecordstNoch keine Bewertungen

- Tingalpa Green New Townhouse Development BrochureDokument12 SeitenTingalpa Green New Townhouse Development BrochureMick MillanNoch keine Bewertungen

- D13A540, EU4SCR - Eng - 01 - 1499912Dokument2 SeitenD13A540, EU4SCR - Eng - 01 - 1499912javed samaaNoch keine Bewertungen

- MSA & Destructive TestDokument4 SeitenMSA & Destructive Testanon_902607157100% (1)

- Gitanjali Gems Annual Report FY2012-13Dokument120 SeitenGitanjali Gems Annual Report FY2012-13Himanshu JainNoch keine Bewertungen

- Unit 1 Notes (Tabulation)Dokument5 SeitenUnit 1 Notes (Tabulation)RekhaNoch keine Bewertungen

- Move It 3. Test U3Dokument2 SeitenMove It 3. Test U3Fabian AmayaNoch keine Bewertungen

- Packing Shipping InstructionsDokument2 SeitenPacking Shipping InstructionsJ.V. Siritt ChangNoch keine Bewertungen

- Intro To Forensic Final Project CompilationDokument15 SeitenIntro To Forensic Final Project Compilationapi-282483815Noch keine Bewertungen

- ScriptDokument7 SeitenScriptAllen Delacruz100% (1)

- Assignment Mid Nescafe 111173001Dokument5 SeitenAssignment Mid Nescafe 111173001afnan huqNoch keine Bewertungen

- Jay Ekbote FINAL PROJECT - HDFC ERGO Health InsuranceDokument71 SeitenJay Ekbote FINAL PROJECT - HDFC ERGO Health InsuranceAditi SawantNoch keine Bewertungen

- Software Test ISO StandardsDokument2 SeitenSoftware Test ISO StandardsTony DavisNoch keine Bewertungen

- MBA-CM - ME - Lecture 16 Market Structure AnalysisDokument11 SeitenMBA-CM - ME - Lecture 16 Market Structure Analysisrohan_solomonNoch keine Bewertungen

- JJDokument119 SeitenJJAnonymous 5k7iGyNoch keine Bewertungen

- Defensive Driving TrainingDokument19 SeitenDefensive Driving TrainingSheri DiĺlNoch keine Bewertungen

- Application Rebuilding Kits: Kit BulletinDokument2 SeitenApplication Rebuilding Kits: Kit Bulletinhidraulic100% (1)

- Manual Honda CivicDokument469 SeitenManual Honda CivicshikinNoch keine Bewertungen

- Manufacturer MumbaiDokument336 SeitenManufacturer MumbaiNafa NuksanNoch keine Bewertungen

- C++ & Object Oriented Programming: Dr. Alekha Kumar MishraDokument23 SeitenC++ & Object Oriented Programming: Dr. Alekha Kumar MishraPriyanshu Kumar KeshriNoch keine Bewertungen

- Automatic Star Delta StarterDokument11 SeitenAutomatic Star Delta StarterAmg 360Noch keine Bewertungen

- Aaa0030imb02 FDokument30 SeitenAaa0030imb02 FJvr Omar EspinozaNoch keine Bewertungen

- Food Truck Ordinance LetterDokument7 SeitenFood Truck Ordinance LetterThe Daily News JournalNoch keine Bewertungen

- Diagrama Electronico EGED 285Dokument2 SeitenDiagrama Electronico EGED 285Carlos Juarez Chunga100% (1)

- (English) 362L Stereoselective Wittig Reaction - Synthesis of Ethyl Trans-Cinnamate (#7) (DownSub - Com)Dokument6 Seiten(English) 362L Stereoselective Wittig Reaction - Synthesis of Ethyl Trans-Cinnamate (#7) (DownSub - Com)moNoch keine Bewertungen

- Artificial Intelligence and Parametric Construction Cost Estimate Modeling State-of-The-Art ReviewDokument31 SeitenArtificial Intelligence and Parametric Construction Cost Estimate Modeling State-of-The-Art ReviewmrvictormrrrNoch keine Bewertungen