Beruflich Dokumente

Kultur Dokumente

O.A 57.06 and 64.06 DB Regularization of Services 0613 PDF

Hochgeladen von

TEJASH INGALE0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

26 Ansichten11 SeitenOriginaltitel

O.A 57.06 and 64.06 DB Regularization of services 0613.pdf

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

26 Ansichten11 SeitenO.A 57.06 and 64.06 DB Regularization of Services 0613 PDF

Hochgeladen von

TEJASH INGALECopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 11

IN THE MAHARASHTRA ADMINISTRATIVE TRIBUNAL

MUMBAI BENCH

ORIGINAL APPLICATION NOS 57/2006 & 64/2006

DISTRICT : THANE

1. ORIGINAL APPLICATION NO 57 OF 2006

Shri Abhiman Maruti Sarvade, )

Govt. service as Clerk-cum-Typist, )

In the office of Government Post-basic )

Ashram School, At Post-Sakur, )

Taluka – Javhar, Dist-Thane. )

C/o: Rambhau Gawale, )

Panchasheel Nagar, At H.N. Colony, )

Mohone, Tal-Kalyan, Dist-Thane. )...Applicant

Versus

1. The State of Maharashtra )

Through the Principal Secretary, )

Tribal Development Department, )

Mantralaya, Mumbai 400 032. )

2 O.A 57/2006 & 64/2006

2. The Addl. Commissioner, )

Tribal Development, Thane. )...Respondents

2. ORIGINAL APPLICATION NO 64 OF 2006

Shri Prafulla Damodar Thakare, )

Govt. service as Clerk-cum-Typist, )

In the office of Government Post-basic )

Ashram School, At Post-Murbad, )

Taluka – Dahanu, Dist-Thane. )

At Nane, Post-Gorhe, Tal-Wada, )

Dist-Thane. )...Applicant

Versus

1. The State of Maharashtra )

Through the Principal Secretary, )

Tribal Development Department, )

Mantralaya, Mumbai 400 032. )

2. The Addl. Commissioner, )

Tribal Development, Thane. )...Respondents

Shri A.V. Bandiwadekar, learned advocate for the

Applicants.

Shri A.J. Chougule, learned Presenting Officer for the

Respondents.

3 O.A 57/2006 & 64/2006

CORAM : Dr Justice S. Radhakrishnan (CHAIRMAN)

Shri Rajiv Agarwal (VICE-CHAIRMAN)

DATE : 13.06.2013

PER : Shri Rajiv Agarwal (VICE-CHAIRMAN)

ORDER

1. Heard Shri A.V. Bandiwadekar, learned advocate for

the Applicants and Shri A.J. Chougule, learned

Presenting Officer for the Respondents.

2. These two Original Applications are heard together

and are being disposed of by a common order as the facts

in both the Original Applications are identical.

3. The Applicants in both the Original Applications are

seeking regularization of their temporary services in the

post of Clerk-cum-typist in terms of G.R dated

18.6.1983.

4. Learned Advocate Shri A.V. Bandiwadekar,

contended on behalf of the Applicants that the Applicant

in O.A No 57 of 2006 joined the Government service on

30.11.1995 while the Applicant in O.A No 64 of 2006 did

so on 4.12.1995. The initial appointments were for a

period of six months. After giving a technical break

services of the Applicants were continued. The

appointment was valid till availability of candidate from

4 O.A 57/2006 & 64/2006

the Selection Board or six month whichever was earlier.

The appointment of the Applicant in O.A 57/2006

continued up to 1.6.1997 and then there was a break of

two years. Similarly, the Applicant in O.A 64/2006 was

continued up to 2.6.1997 when there was a break of two

years. In both cases, there were another break of more

than 2 years from 2000 to 2002. The learned Counsel for

the Applicants argued that the Applicants have been

working from 1995/1996 for the Respondent No. 2 and

are entitled to be given benefit of regularization in terms

of G.R dated 18.6.1983. Learned counsel for the

Applicants argued that the Respondent No. 2 has in fact,

sent a proposal to the Respondent no. 1on 20.12.1999

proposing regularization of service of the Applicants and

others from the dates of their initial appointment.

However, the Respondent No. 1 by letter dated 3.2.2000

asked the Respondent No. 2 to take action if the

Applicants fulfilled the condition No 10(A) in G.R dated

18.6.1983. The learned counsel for the Applicants

claimed that the Applicants satisfy the condition 10(A) of

the G.R dated 18.6.1983 and the Respondent No. 2 was

bound to regularize their services in view of the directive

of the Respondent No. 1 by letter dated 3.2.2000.

Learned Counsel for the Applicants further contended

that the Respondent No. 1 has regularized the services of

some other persons who were appointed after the

applicants. Two such persons, viz. Shri K.M. Kodape and

Shri D.N. Choudhari were first given temporary

5 O.A 57/2006 & 64/2006

appointment on 15.12.1997 and later their services were

regularized. Similarly, Shri K.D. Gavit was first appointed

Clerk-typist on 1.4.1999 and his services were

regularized by order dated 17.2.2000. However, the

Respondents are not taking any action to regularize the

services of the Applicants.

5. Learned Presenting Officer (P.O) Shri N.K.

Rajpurohit, on behalf of the Respondents argued that the

Applicants are not entitled to be given the benefit of the

regularization as they were appointed on ad hoc basis for

periods up to six months or till the appointment of

candidates recommended by the Selection Boards

(fuoMeaMG). The Applicants were never recommended by

the Selection Boards, and their appointments were purely

ad hoc and temporary. This fact was fully known to

them. Learned Presenting Officer relied on judgment of

the Apex Court in Secretary, State of Karnataka & Others

Vs. Umadevi & others reported in 2006 AIR SCW 1991,

wherein it is held that appointment de hors due process

of selection envisaged by Constitutional scheme confers

no right on appointee. Learned Presenting Officer further

relied on the judgment of the Hon. Bombay High Court in

Writ Petition No. 632 of 1989 wherein it is held that the

appointing authority (here the Respondent No. 2) would

be competent to give appointments on purely temporary

basis to the posts specified in the Government Resolution

dated 22.2.1988 until the candidates recommended by

6 O.A 57/2006 & 64/2006

the Regional Subordinate Selection Board becomes

available and those appointed on temporary basis will

have no legal right of continuance of their services. This

decision was upheld by Hon. Apex Court. Learned

Presenting Officer cited other judgments also in support

of his contention that those who are appointed on purely

temporary / ad hoc basis have no right to have their

services regularized.

6. It is seen that the Applicant’s case is based mainly

on the fact that services of some employees who were

appointed later in time, were regularized. If the rules and

law as laid down in the judgments of Hon. Apex Court

and Bombay High Court did not confer any right to the

Applicants to get their services regularized, the same

principle should have been applied in the case of other

employees also. It is seen that in the affidavit in reply

filed on behalf of the Respondents, in para 15, it is stated

that:

“So far as Shri K.D Gavit is concerned, he was

initially appointed on 5.7.1996. He has been

considered to be regularized in services with effect

from 1.4.1999 against the quota reserved for

candidates belonging to Scheduled Tribes and the

orders dated 17.2.2000 were issued to that effect.

Similarly, Shri M.M. Kodape and Shri D.N

Choudhary were appointed on 15.12.1997 on

7 O.A 57/2006 & 64/2006

temporary basis consequent upon the decision to fill

up the backlog of Scheduled Tribe candidates taken

by the Selection Committee in its meeting held on

15.12.1997.

In the facts and circumstances under which

the services of Shri K.D. Gavit, Shri M.M. Kodape

and Shri D.N. Choudhary were regularized are

found to be quite different with that of the

applicants”.

7. The Respondents have clearly admitted that services

of three employees who were appointed in 1997 and 1999

were regularized. Let us now examine the reasons for

non-regularization of services of the applicants. Some

portions from para 14 of the affidavit in reply of the

Respondent No. 2 are reproduced below:-

“However, to be more precise, it is submitted that in

pursuance to the directions issued by the

Respondent No. 1 under Government letter dated

3.2.2000, the Respondent No. 2 has considered the

services of the applicants for regularization and

rejected the claim of the applicants on the ground

that they were neither appointed on or before the

day of the issuance of G.R dated 18.6.1983 nor they

could satisfy the condition of one year continuous

services as on 1st April, 1999 as contemplated under

8 O.A 57/2006 & 64/2006

G.R dated 8.3.1999 issued by the Government in

G.A.D.”

It is seen that the proposal sent by the Respondent

No. 2 to the Respondent No. 1 to regularize the services

of the Applicant was returned by the Respondent No. 1 to

the Respondent No. 2 by letter dated 3.2.2000 asking the

Respondent No. 2 to take a decision while the services of

S/Shri Gavit, Kodape and Chaudhari were regularized by

the Respondent No. 1 by order dated 17.2.2000. Why the

Respondent No. 1 changed his mind regarding who

should regularize service of temporary / ad hoc

employees within 2 weeks is not explained anywhere.

8. Let us now see what the G.R dated 8.3.1999

provides. Clause 2 of the above said G.R is reproduced

below:-

Izkknsf’kd nqa;;e lsok eaMGs] &&&&&&&&&&&&

‘kklukus vkrk vlk fu.kZ; ?ksryk vkgs dh g;k deZpk&;kaP;k

lsok ^,ssdosGph ckc* Eg.kwu [kkyhy vVhaP;k v/AhuLr

fu;fer dj.;kr ;kO;kr&

v- lacaf/Ar deZpk&;kaus lsok izos’k fu;ekizek.ks fofgr

dsysyh ‘kS{kf.kd vgZrk o o;kph vV ewG fu;qDrhP;k osGh

iw.kZ dsysyh vlkoh-

c- fnukad 1 ,fizy 1999 jksth ,d o”kkZph lyx lsok >kysyh

vlkoh o dkekpk ntkZ fdeku pkaxyk vlkok]

d- ins miyC/k vlkohr

9 O.A 57/2006 & 64/2006

M- fu;ehrdj.k djrkuk vkj{k.k fcanq vkf.k lekarj vkj{k.k ;k

lanaHkkZrhy rRokaps@fu;ekaps iky.k dj.;kr vkys vlkos-

b- deZpk&;kaph lsok ts”Vrk izLrqr vkns’k fuxZehr

>kY;kP;k fnukadkiklqu /kj.;kr ;koh

bZ- vHAkfor fu;qDrhpk Qk;nk dqBY;kgh

iz;kstukFkZ@dkj.kklkBh ns.;kr ;s.kkj ukgh-

9. It is not the case of the Respondents that the

services of Applicants were not regularized on any of the

above grounds except that at (B), i.e. on 1.4.1999, they

did not have one year’s continuous service. Service

particulars of the Applicant Shri Sarvade in O.A 57/2006

and Shri Thakre in O.A 64/2006 are provided by the

Respondent No. 2 in paragraph 6 of its affidavit in reply.

It is seen that Applicant in O.A 57/2006 was in service

from 1.12.1995 to 1.6.1997 as Clerk-typist. There were 2

days technical break on two occasions, which have to be

ignored as similar breaks in respect of S/Shri Gavit,

Kodape and Chaudhari must have been condoned.

Similarly, Applicant in O.A 64/2006 was in service from

1.12.1995 to 2.6.1997 with two technical breaks, one of

one day and another of two days duration. The period of

service of the Applicants is more than one year and both

the Applicants fulfill the condition ‘B’ of the G.R dated

8.3.1999. It is true that they were not in service as Clerk-

typist on 1.4.1999, but that is not the stipulation in the

aforesaid G.R. The Respondent No. 1 regularized services

10 O.A 57/2006 & 64/2006

of 43 employees by G.R dated 8.4.1999. Again by G.R

dated 3.7.1999 services of 43 more employees were

regularized. These facts are given in paragraph 10 of the

affidavit in reply.

10. The Applicants have filed copy of order dated

23.7.1997 passed by the Respondent No. 2 whereby they

were again appointed for two months. Again by order

dated 14.6.1999, both the Applicants were appointed for

six months as Clerk-typists. It is noted that all

subsequent appointments of the Applicants are without

holding any fresh test/interview, while the first

appointment by letter dated 18.11.1995 was after written

or oral tests. The conclusion is inevitable that the

subsequent appointments were in continuation of earlier

appointments. The initial appointments of the Applicants

were fully in consonance with the Government

instructions, so they cannot be called ‘back door’

appointments. Hon. Apex Court’s judgment in Umadevi’s

case will not be applicable. Similarly, the Applicants are

not claiming continuation in service by virtue of initial

appointment. They are claiming the benefit based on the

Government policy enunciated in G.R dated 8.3.1999.

They fulfill the condition of the said G.R for continuation

of their services. On the ground that other employees

viz. S/Shri Kodape, Choudhari & Gavit who were

appointed on ad hoc /temporary basis later in time got

the benefit of regularization of their services is another

11 O.A 57/2006 & 64/2006

fact in support of the claim of the Applicants for similar

treatment. The Respondents have not given any

satisfactory explanation as to how the services of S/Shri

Gavit, Kodape and Choudhari were regularized. The only

explanation is that they belong to Scheduled Tribe.

However, the Respondents especially learned Presenting

Officer could not produce any document to support the

claim that employees belonging to S.T category were

entitled to be given a special dispensation in this regard

by the Respondents.

11. In view of the above facts and circumstances of the

case, the Respondents are directed to consider the case

of the Applicants in both the Original Applications to

regularize their services in terms of G.R dated 8.3.1999.

There will be no order as to costs.

(Dr. S. Radhakrishnan.J)

Chairman

Place : Mumbai (Rajiv Agarwal)

Date : 13.06.2013 Vice-Chairman.

Typed by : A.K. Nair.

D:\Anil Nair\Judgments\2013\June 2013\FORMAT SB. Dr S.Radhakrishan.doc

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Lecture 5 Wills, Trust Deeds & Powers of AttorneyDokument40 SeitenLecture 5 Wills, Trust Deeds & Powers of AttorneyShi LuNoch keine Bewertungen

- GeoTechnical FormulasDokument34 SeitenGeoTechnical FormulasTptaylor100% (3)

- 67CDokument16 Seiten67CTEJASH INGALE77% (13)

- If It' S Not Forever - Durjoy Datta Nikita SinghDokument152 SeitenIf It' S Not Forever - Durjoy Datta Nikita SinghVivek Patel91% (32)

- Bill of Rights Sec 1Dokument295 SeitenBill of Rights Sec 1Anabelle Talao-UrbanoNoch keine Bewertungen

- PNP Administrative MachineryDokument11 SeitenPNP Administrative MachinerySpear Rule100% (4)

- Msedcl Advt. No. 06 - 2018 PDFDokument11 SeitenMsedcl Advt. No. 06 - 2018 PDFMandar IrleNoch keine Bewertungen

- Study of Tunnels: Shaikh AdilDokument30 SeitenStudy of Tunnels: Shaikh AdilTEJASH INGALENoch keine Bewertungen

- 2015-16 BE Civil Engineering CGPADokument94 Seiten2015-16 BE Civil Engineering CGPATEJASH INGALE0% (1)

- BOCW Cess Act 1996Dokument6 SeitenBOCW Cess Act 1996Antione WhiteNoch keine Bewertungen

- Q.No. Type Section Key/Range MarksDokument3 SeitenQ.No. Type Section Key/Range MarksTEJASH INGALENoch keine Bewertungen

- 21 StewartDokument9 Seiten21 StewartTEJASH INGALENoch keine Bewertungen

- The Theorem of Least Work - 2012 CastiglianosDokument5 SeitenThe Theorem of Least Work - 2012 Castiglianospgp655484Noch keine Bewertungen

- PWD AE & JE Advertisement PDFDokument1 SeitePWD AE & JE Advertisement PDFTEJASH INGALENoch keine Bewertungen

- Msedcl Advt. No. 06 - 2018 PDFDokument11 SeitenMsedcl Advt. No. 06 - 2018 PDFMandar IrleNoch keine Bewertungen

- 2015-16 BE Civil Engineering CGPADokument94 Seiten2015-16 BE Civil Engineering CGPATEJASH INGALE0% (1)

- FD 2 Mark PDFDokument27 SeitenFD 2 Mark PDFaerotinuNoch keine Bewertungen

- Civil EngineeringDokument3 SeitenCivil EngineeringDhaked Shahab67% (3)

- Aceenggacademy ComDokument1 SeiteAceenggacademy ComTEJASH INGALENoch keine Bewertungen

- HGLDokument2 SeitenHGLvijayunity100% (3)

- Kesavan NewDokument20 SeitenKesavan NewTEJASH INGALENoch keine Bewertungen

- 5.10.4 Marshall Mix Design Calc 03.24Dokument14 Seiten5.10.4 Marshall Mix Design Calc 03.24Seble GetachewNoch keine Bewertungen

- Estimating and CostingDokument4 SeitenEstimating and CostingTEJASH INGALE100% (1)

- Compressivestrength Concrete PDFDokument34 SeitenCompressivestrength Concrete PDFFeras TemimiNoch keine Bewertungen

- 2015-16 BE Civil Engineering Teacher ManualDokument71 Seiten2015-16 BE Civil Engineering Teacher ManualSagar NandagawaliNoch keine Bewertungen

- 2015-16 BE Civil Engineering Teacher ManualDokument71 Seiten2015-16 BE Civil Engineering Teacher ManualSagar NandagawaliNoch keine Bewertungen

- Lec 20Dokument36 SeitenLec 20TEJASH INGALENoch keine Bewertungen

- Maharashtra Engineering Services (Civil), Gr. A & Gr. B (Main) ExamDokument3 SeitenMaharashtra Engineering Services (Civil), Gr. A & Gr. B (Main) ExamErRajivAmieNoch keine Bewertungen

- If It's Not Forever Blast Diary Leads to MysteryDokument12 SeitenIf It's Not Forever Blast Diary Leads to Mysterykaran_bhatia767887% (15)

- Spillway DesignDokument18 SeitenSpillway DesignFrancisco Alves100% (2)

- New Text DocumentDokument1 SeiteNew Text DocumentTEJASH INGALENoch keine Bewertungen

- G R - No - 157547Dokument1 SeiteG R - No - 157547Noel Christopher G. BellezaNoch keine Bewertungen

- Contractualization 4Dokument4 SeitenContractualization 4grace hutallaNoch keine Bewertungen

- Sandeep Yadav Stay and Transfer ApplicationDokument9 SeitenSandeep Yadav Stay and Transfer ApplicationAakash BhattNoch keine Bewertungen

- The ICC and Confronting Myths in AfricaDokument24 SeitenThe ICC and Confronting Myths in AfricaWendel DamascenoNoch keine Bewertungen

- DM No. 2021-0245 Creation of PCWHS Health Promotion CommitteeDokument4 SeitenDM No. 2021-0245 Creation of PCWHS Health Promotion CommitteegeraldanderzoneNoch keine Bewertungen

- Visit RelativesDokument5 SeitenVisit RelativesYahring AbdullohNoch keine Bewertungen

- Road To Independence: Discuss Any Five Social Developments in Ghana From 1957-1966 (Submission 28 June, 2022)Dokument163 SeitenRoad To Independence: Discuss Any Five Social Developments in Ghana From 1957-1966 (Submission 28 June, 2022)Mary DonnaNoch keine Bewertungen

- Rule 111Dokument2 SeitenRule 111Mara MartinezNoch keine Bewertungen

- Notice: Pollution Control Consent Judgments: All Oceans Transportation, Inc. Et Al.Dokument1 SeiteNotice: Pollution Control Consent Judgments: All Oceans Transportation, Inc. Et Al.Justia.comNoch keine Bewertungen

- Recase T - THBT ASEAN Should Suspend The Membership of Myanmar Until The Tatmadaw Cedes Power To The Democratically Elected GovernmentDokument3 SeitenRecase T - THBT ASEAN Should Suspend The Membership of Myanmar Until The Tatmadaw Cedes Power To The Democratically Elected GovernmentTania Regina PingkanNoch keine Bewertungen

- CIVPRO Mod 1 CompilationDokument33 SeitenCIVPRO Mod 1 CompilationKatrina PerezNoch keine Bewertungen

- Schedule G Ownership DetailsDokument2 SeitenSchedule G Ownership DetailsMoose112Noch keine Bewertungen

- JUNE22 - ACT InvoiceDokument2 SeitenJUNE22 - ACT InvoiceSamarth HandurNoch keine Bewertungen

- Sworn Statement of Assets, Liabilities and Net WorthDokument4 SeitenSworn Statement of Assets, Liabilities and Net WorthJeffrey MacalinoNoch keine Bewertungen

- Caragay-Layno V CADokument1 SeiteCaragay-Layno V CAGel TolentinoNoch keine Bewertungen

- Mambayya House: Aminu Kano Centre For Democratic StudiesDokument51 SeitenMambayya House: Aminu Kano Centre For Democratic Studieshamza abdulNoch keine Bewertungen

- 216sp-Engl-1302-10 47464075 Hgamez Rhetorical Analysis Final DraftDokument4 Seiten216sp-Engl-1302-10 47464075 Hgamez Rhetorical Analysis Final Draftapi-317700316Noch keine Bewertungen

- San Miguel Corporation v. MonasterioDokument6 SeitenSan Miguel Corporation v. MonasterioAlyssaOgao-ogaoNoch keine Bewertungen

- 2GO Travel - Itinerary ReceiptDokument2 Seiten2GO Travel - Itinerary ReceiptGeoseff Entrata100% (1)

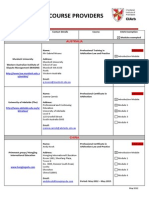

- Recognised Course Providers ListDokument13 SeitenRecognised Course Providers ListSo LokNoch keine Bewertungen

- Overview of The BSPDokument27 SeitenOverview of The BSPSherra ElizagaNoch keine Bewertungen

- Certification Requirements: Medical Council of Canada Le Conseil Médical Du CanadaDokument2 SeitenCertification Requirements: Medical Council of Canada Le Conseil Médical Du Canadailovem2foodNoch keine Bewertungen

- REVUP Notes in Criminal LawDokument28 SeitenREVUP Notes in Criminal LawAndrea Klein LechugaNoch keine Bewertungen

- Federal Register PostDokument4 SeitenFederal Register PostThe Western JournalNoch keine Bewertungen

- History Class 9 FRENCH REVOLUTIONDokument18 SeitenHistory Class 9 FRENCH REVOLUTIONAngadNoch keine Bewertungen

- Antonio Lejano Case DigestDokument5 SeitenAntonio Lejano Case DigestMcNoch keine Bewertungen

- Class Topic: Political Question G.R. No. 196231 January 28, 2014Dokument2 SeitenClass Topic: Political Question G.R. No. 196231 January 28, 2014DEAN JASPERNoch keine Bewertungen