Beruflich Dokumente

Kultur Dokumente

Indus Freedom February2017

Hochgeladen von

HeartKiller LaxmanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Indus Freedom February2017

Hochgeladen von

HeartKiller LaxmanCopyright:

Verfügbare Formate

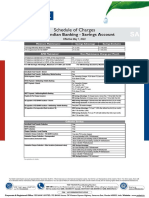

Schedule of Charges for Indus Freedom (w.e.f.

1st February, 2017)

NON-TRANSACTION OTHER FEATURES & CHARGES

Minimum Transaction Commitment 1 Financial Transaction to be done in a calendar month at POS Limit on Debit Card Limit as per Debit Card Taken, Refer Standard Schedule

ATM or Net Banking or Mobile App of Charges for Debit Card

Charges for Non-Transaction (NTC) ` 600 per month, if Transactions as mentioned above not Email Statement (Daily) Free

done in calendar month E-statement - Free, Print Statement - ` 100 per instance

Adhoc Statement

PAYMENTS & COLLECTIONS Dormant Account Activation Free

Local Cheque Deposit Free DOORSTEP BANKING*

Cheques Deposited at any location of Free Cash Delivery / Pick-up (Per call)

IndusInd Bank for clearing in same location Till 2 Lacs ` 150

Outstation Cheque Deposit on IndusInd Bank Free 2 - 5 Lacs ` 250

Location

5 - 10 Lacs ` 400

Outstation Cheque Deposit on Non-IndusInd Free up to ` 5 Lacs per month beyond which charges

Bank Location per cheque as under: 10 - 20 Lacs ` 800

Up to and including ` 5,000 - ` 25 > 20 Lacs Contact Branch

Above ` 5,000 and up to and ` 50 Cash Delivery / Pick-up (Beat delivery) per month

including ` 10,000 -

Till 1 Lac ` 2,000

Above ` 10,000 and up to ` 100

and including ` 1,00,000 - 1 - 2 Lacs ` 3,000

Above ` 1,00,000 - ` 200 per instrument 2 - 5 Lacs ` 5,500

Funds Transfer within IndusInd Bank Free 5 - 10 Lacs ` 9,000

10 - 20 Lacs ` 16,000

Payments at any location of IndusInd Bank for Free

clearing in same location through PAP cheque > 20 Lacs Contact Branch

NEFT / RTGS / IMPS Free Cheque Pick-up (On call)* ` 50 per call / Instance

DD / PO (At IndusInd Bank Branch Locations) Cheque Pick-up (Beat) per month* ` 500

Free

PAP- Payable At Par,

Charges for Correspondent Bank DD ` 2/1,000 Min. ` 25 Max. ` 15,000

NTC - Non-Transaction charges

DD / PO (Non-Correspondent Bank) ` 3/1,000 Min. ` 25 Max. ` 15,000 Taxes as applicable on charges

# For other variant of Debit Cards and further information, please refer Debit Card Schedule of Charges at

CASH TRANSACTIONS

www.indusind.com

Cash Deposit *Services Available on Request at Select Locations

Free Limit per month (Home Location) Free up to ` 4 Lacs per month

Free Limit per month (Non-Home Location) No Free limits

Additional Charges on incremental deposits ` 4/1,000 min. ` 50

Cash Withdrawal

Cash Withdrawal from Branch / IndusInd Bank ATM Free

Cash Withdrawal Non-IndusInd Bank ATMs Free

Cash Withdrawal Outside India ` 125

Cash Withdrawal Limit at ATM Refer Standard Schedule of Charges for Debit Card

OTHER FEATURES & CHARGES

Cheque Book Issuances Free

Stop Payment Single Cheque - ` 100, Series Cheque - ` 150, Nil Charges

if requested through IndusNet /IndusMobile /IVR

Cheque Return (Inward) For Financial Reasons Up to 2 instruments per month - ` 350 per instrument

On 3rd & 4th instrument - ` 500 per instrument

5th Instrument onwards - ` 750 per instrument

Cheque Return (Outward) IndusInd Bank Location ` 50 per cheque

Cheque Return (Outward) Other Locations ` 100 per cheque + Out of pocket Expenses

Internal Transfer Return Charges NIL

NACH / ECS Returns ` 200

#

Debit Card

Gold Business CHIP / Titanium Debit Card ` 249 (Issuance, Annual Charges, Replacement &

Supplementary Card)

Platinum Business CHIP Debit Card ` 699 (Issuance, Annual Charges, Replacement &

Supplementary Card)

Balance Inquiry at Other ATMs within India Free within India, ` 20 per instance outside India

For more details, call our Phone Banking Numbers: 1860 500 5004 / +91 22 4406 6666. • Visit us at www.indusind.com

Das könnte Ihnen auch gefallen

- Mortgage Compliance Investigators - Level 3 Securitization AuditDokument35 SeitenMortgage Compliance Investigators - Level 3 Securitization AuditBilly BowlesNoch keine Bewertungen

- Bread of Heaven or Wines of LightDokument14 SeitenBread of Heaven or Wines of LightLuisa Navarro ArriazaNoch keine Bewertungen

- Sri Bhakti-Sandarbha 9Dokument20 SeitenSri Bhakti-Sandarbha 9api-19975968Noch keine Bewertungen

- Keller SME 12e PPT CH01Dokument19 SeitenKeller SME 12e PPT CH01NAM SƠN VÕ TRẦN100% (1)

- Indus Infotech December292017Dokument1 SeiteIndus Infotech December292017Harssh S ShrivastavaNoch keine Bewertungen

- Indus Business Account SOC 30.07.2020Dokument1 SeiteIndus Business Account SOC 30.07.2020Rameshchandra SolankiNoch keine Bewertungen

- Schedule of Charges for Current AccountsDokument2 SeitenSchedule of Charges for Current AccountsdhruvsaidavaNoch keine Bewertungen

- Gib Savings Account Wef 01may2022Dokument3 SeitenGib Savings Account Wef 01may2022Ankur VermaNoch keine Bewertungen

- SOC Savings AdityaDokument2 SeitenSOC Savings AdityaDenny PjNoch keine Bewertungen

- Regular Savings SOC 2023Dokument2 SeitenRegular Savings SOC 2023megha90909Noch keine Bewertungen

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDokument2 SeitenSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNoch keine Bewertungen

- Current Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILDokument1 SeiteCurrent Account For CSC - VLE W.E.F 1st September 2016: Monthly Average Balance NILKulwinder Singh MayaanNoch keine Bewertungen

- Documents Required For Title TransferDokument2 SeitenDocuments Required For Title TransferChaitanya Chaitu CANoch keine Bewertungen

- Digital Savings Account Effective July 2021Dokument3 SeitenDigital Savings Account Effective July 2021Nikhil KumarNoch keine Bewertungen

- Business Essential AccountDokument4 SeitenBusiness Essential Accountshekharsap284Noch keine Bewertungen

- Compare Premium Regular Current AccountDokument1 SeiteCompare Premium Regular Current AccountJay BhushanNoch keine Bewertungen

- SOC Next Gen Savings AccountDokument2 SeitenSOC Next Gen Savings AccountSUBHRAKANTA DASNoch keine Bewertungen

- Wealth CA Schedule of ChargesDokument6 SeitenWealth CA Schedule of ChargesSayan Kumar PatiNoch keine Bewertungen

- PIONEER Current Account SOB Eff 1st Dec 2022Dokument2 SeitenPIONEER Current Account SOB Eff 1st Dec 2022Rajat AgarwalNoch keine Bewertungen

- CABCA_SOC_July 22 (1) (1)Dokument2 SeitenCABCA_SOC_July 22 (1) (1)anjumNoch keine Bewertungen

- Parameter Au Samriddhi Current AccountDokument2 SeitenParameter Au Samriddhi Current Accounthiteshmohakar15Noch keine Bewertungen

- YES FIRST Programme Criteria and Benefits w.e.f. February 1, 2020Dokument2 SeitenYES FIRST Programme Criteria and Benefits w.e.f. February 1, 2020Ayush JadhavNoch keine Bewertungen

- Service Charges and Fees For Current Account Advantage Effective July 01 2022Dokument2 SeitenService Charges and Fees For Current Account Advantage Effective July 01 2022rupak.album.03Noch keine Bewertungen

- Savings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthDokument2 SeitenSavings Accounts: Cash Deposit Limit at Branch - Free Value OR Instance Per MonthSiddhant GaurNoch keine Bewertungen

- GSFC MpowerDokument2 SeitenGSFC Mpowerneerajsibgh434Noch keine Bewertungen

- Sba 2 0 Ivy PDFDokument2 SeitenSba 2 0 Ivy PDFChandan SahNoch keine Bewertungen

- Regular Salary AccountDokument3 SeitenRegular Salary AccountPrashant KumarNoch keine Bewertungen

- YES Premia Soc - Savings Account - A5 Dec 2019 - 01Dokument4 SeitenYES Premia Soc - Savings Account - A5 Dec 2019 - 01Rasmiranjan PradhanNoch keine Bewertungen

- Service Charges and Fees For Current Account Club 50 Effective July 01 2022Dokument2 SeitenService Charges and Fees For Current Account Club 50 Effective July 01 2022Nitin BNoch keine Bewertungen

- KFS Current ACDokument23 SeitenKFS Current ACFakharNoch keine Bewertungen

- Annexure BDokument3 SeitenAnnexure BMayapur CommunicationNoch keine Bewertungen

- Indus AdvantageDokument1 SeiteIndus Advantagesubhasish paulNoch keine Bewertungen

- GSFC Kotak811 Apr17Dokument1 SeiteGSFC Kotak811 Apr17karthip08Noch keine Bewertungen

- Au Royale: Schedule ofDokument2 SeitenAu Royale: Schedule ofsahilNoch keine Bewertungen

- From Kotak WebsiteDokument20 SeitenFrom Kotak WebsiteHimadri Shekhar VermaNoch keine Bewertungen

- New Dgtca SocDokument2 SeitenNew Dgtca SocchintankantariaNoch keine Bewertungen

- DCB Benefit Savings AccountDokument2 SeitenDCB Benefit Savings AccountDesikanNoch keine Bewertungen

- SOC Indus Multiplier MaxDokument4 SeitenSOC Indus Multiplier Maxmanoj baroka0% (1)

- Service Charges and Fees of Current Account For Arthiyas 21102020Dokument2 SeitenService Charges and Fees of Current Account For Arthiyas 21102020joyfulsenthilNoch keine Bewertungen

- Regular Business Account 1 LakhDokument2 SeitenRegular Business Account 1 LakhNiraj PandeyNoch keine Bewertungen

- Au Digital Savings Account - 31 - MarchDokument5 SeitenAu Digital Savings Account - 31 - MarchZach KingNoch keine Bewertungen

- Casil Soc 01 07 23Dokument2 SeitenCasil Soc 01 07 23rishisiliveri95Noch keine Bewertungen

- Proposition Edge Business Prime Business Exclusive BusinessDokument1 SeiteProposition Edge Business Prime Business Exclusive Businesskazaalite1008Noch keine Bewertungen

- SOB Indus ProgressDokument2 SeitenSOB Indus ProgressAMit PrasadNoch keine Bewertungen

- Myworld Pricing 2021Dokument3 SeitenMyworld Pricing 2021carinaNoch keine Bewertungen

- schedule of charges yes bank 5Dokument1 Seiteschedule of charges yes bank 5Sayantika MondalNoch keine Bewertungen

- Sbprime - Bde'sDokument16 SeitenSbprime - Bde'sParteek JangraNoch keine Bewertungen

- Schedule of Service Charges for TASC AccountsDokument4 SeitenSchedule of Service Charges for TASC AccountsSathishraam CPNoch keine Bewertungen

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Dokument2 SeitenMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNoch keine Bewertungen

- Minimum Disclosure of Bank Fees and Charges 2021Dokument1 SeiteMinimum Disclosure of Bank Fees and Charges 2021Bahati RaphaelNoch keine Bewertungen

- SOC-DCB-Classic-Current-AccountDokument4 SeitenSOC-DCB-Classic-Current-AccountpanditipabmaNoch keine Bewertungen

- HSBC Retail Business Banking: Transaction TypeDokument2 SeitenHSBC Retail Business Banking: Transaction TypeDanish MohammedNoch keine Bewertungen

- JIFI Charges PDFDokument2 SeitenJIFI Charges PDFRamesh SinghNoch keine Bewertungen

- SOC DCB Privilege Current AccountDokument4 SeitenSOC DCB Privilege Current Accountsunilverma202320Noch keine Bewertungen

- Yes Bank India ChargesDokument2 SeitenYes Bank India ChargesRKNoch keine Bewertungen

- 2918 Stanbic August TarrifsDokument1 Seite2918 Stanbic August TarrifsNyamutatanga MakombeNoch keine Bewertungen

- Au Abhi 31-MarchDokument2 SeitenAu Abhi 31-MarchShubhra Kanti GopeNoch keine Bewertungen

- Schedule of Charges for Branchless Banking ServicesDokument2 SeitenSchedule of Charges for Branchless Banking ServicesJahangirNoch keine Bewertungen

- Dubai Islamic Bank January June 2021 SOCDokument26 SeitenDubai Islamic Bank January June 2021 SOCAD ADNoch keine Bewertungen

- SOC DCB Privilege Savings AccountDokument4 SeitenSOC DCB Privilege Savings AccountBVS NAGABABUNoch keine Bewertungen

- Au Digital Savings AccountDokument5 SeitenAu Digital Savings AccountQuaint ZoneNoch keine Bewertungen

- Titanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowDokument2 SeitenTitanium Chip Card: Rs. 249/-P.A# For Upgrading To Premium Debit Cards, Please Refer Premium Debit Cards Soc BelowGaurav Singh RathoreNoch keine Bewertungen

- Schedule of Business Bank Account ChargesDokument2 SeitenSchedule of Business Bank Account ChargesJella RamakrishnaNoch keine Bewertungen

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaVon EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNoch keine Bewertungen

- Empanelled Hospitals 070715Dokument9 SeitenEmpanelled Hospitals 070715HeartKiller LaxmanNoch keine Bewertungen

- HadoopDokument22 SeitenHadoopHeartKiller LaxmanNoch keine Bewertungen

- Cryptography & Network SecurityDokument52 SeitenCryptography & Network SecurityHeartKiller LaxmanNoch keine Bewertungen

- Microsoft SurfaceDokument10 SeitenMicrosoft SurfaceHeartKiller LaxmanNoch keine Bewertungen

- Surface ComputingDokument29 SeitenSurface Computinggauravgd16Noch keine Bewertungen

- ZigbeeDokument35 SeitenZigbeerush2sami1462Noch keine Bewertungen

- PaceDokument9 SeitenPaceHeartKiller LaxmanNoch keine Bewertungen

- Black PoodleDokument13 SeitenBlack Poodledianaioana19870% (1)

- 1) Introduce The Graph: Write at Least 150 WordsDokument7 Seiten1) Introduce The Graph: Write at Least 150 WordsSaomNoch keine Bewertungen

- Chandigarh Shep PDFDokument205 SeitenChandigarh Shep PDFAkash ThakurNoch keine Bewertungen

- Pokemon Evolution Stages GuideDokument9 SeitenPokemon Evolution Stages GuideOsvaldo BevilacquaNoch keine Bewertungen

- CV - Inderpreet KaurDokument2 SeitenCV - Inderpreet Kaurkunal sharmaNoch keine Bewertungen

- LEOSA (2law Enforcement Officers Safety Act Frequently Asked QuestionsDokument6 SeitenLEOSA (2law Enforcement Officers Safety Act Frequently Asked QuestionsElaine VechorikNoch keine Bewertungen

- The Hollywood Reporter 4 Julio 2014Dokument108 SeitenThe Hollywood Reporter 4 Julio 2014Sebastián Santillán100% (2)

- BPI Credit Corporation Vs Court of AppealsDokument2 SeitenBPI Credit Corporation Vs Court of AppealsMarilou Olaguir SañoNoch keine Bewertungen

- About Languages of EuropeDokument9 SeitenAbout Languages of EuropeAlexandr VranceanNoch keine Bewertungen

- Crimes and Civil Wrongs: Wrong Adjetivo X Substantivo (Legal English) Right Adjetivo X Substantivo (Legal English)Dokument10 SeitenCrimes and Civil Wrongs: Wrong Adjetivo X Substantivo (Legal English) Right Adjetivo X Substantivo (Legal English)mraroNoch keine Bewertungen

- GCRT Revised AllocationDokument5 SeitenGCRT Revised AllocationVijaykumar BellamkondaNoch keine Bewertungen

- (REVISED) Investiture With The Pallium - Cardinal Jose AdvinculaDokument37 Seiten(REVISED) Investiture With The Pallium - Cardinal Jose AdvinculaRomain Garry Evangelista LazaroNoch keine Bewertungen

- Ilé-Ifè: : The Place Where The Day DawnsDokument41 SeitenIlé-Ifè: : The Place Where The Day DawnsAlexNoch keine Bewertungen

- QSCL035284B Air Quote For Expeditors Chile Transportes Internacionales Limitada - OSL - SCL - P0640220Dokument2 SeitenQSCL035284B Air Quote For Expeditors Chile Transportes Internacionales Limitada - OSL - SCL - P0640220MINEC SpANoch keine Bewertungen

- QS World University Rankings 2020 - Las Mejores Universidades Mundiales - Universidades PrincipalesDokument36 SeitenQS World University Rankings 2020 - Las Mejores Universidades Mundiales - Universidades PrincipalesSamael AstarothNoch keine Bewertungen

- Christianity symbols guideDokument1 SeiteChristianity symbols guideartbyashmore AshmoreNoch keine Bewertungen

- Ebook Download The Nectar of PainDokument2 SeitenEbook Download The Nectar of Paintrndsttr queenNoch keine Bewertungen

- Akin Ka NalangDokument413 SeitenAkin Ka NalangJobelle GenilNoch keine Bewertungen

- Case StudyDokument2 SeitenCase StudyMicaella GalanzaNoch keine Bewertungen

- The Real Original Sin of Modern European CivilizationDokument10 SeitenThe Real Original Sin of Modern European CivilizationOscar CabreraNoch keine Bewertungen

- October - On Global MethodsDokument79 SeitenOctober - On Global MethodsMaria Carolina BoaventuraNoch keine Bewertungen

- Structure of Banking in IndiaDokument22 SeitenStructure of Banking in IndiaTushar Kumar 1140Noch keine Bewertungen

- Foreign Affairs (May & June 2020)Dokument220 SeitenForeign Affairs (May & June 2020)muhammad aslamNoch keine Bewertungen

- Residential Status Problems - 3Dokument15 SeitenResidential Status Problems - 3ysrbalajiNoch keine Bewertungen

- Topics PamelaDokument2 SeitenTopics Pamelaalifertekin100% (2)

- Investment in TurkeyDokument41 SeitenInvestment in TurkeyLalit_Sharma_2519100% (2)