Beruflich Dokumente

Kultur Dokumente

CD - 12 Perla Compania v. CA and Cayas

Hochgeladen von

Alyssa Alee Angeles JacintoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CD - 12 Perla Compania v. CA and Cayas

Hochgeladen von

Alyssa Alee Angeles JacintoCopyright:

Verfügbare Formate

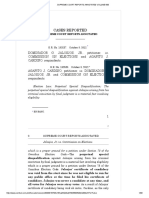

PERLA COMPANIA DE SEGUROS, INC vs.

CA and CAYAS

G.R. No. 78860

FACTS:

Milagros Cayas was the registered owner of a Mazda bus which was insured with petitioner PERLA

COMPANIA DE SEGUROS, INC (PCSI). The bus figured in an accident in Cavite, injuring several of its

passengers. One of them, Edgardo Perea, sued Cayas for damages in the CFI, while three other victims

agreed to a settlement of P4,000.00 each with Cayas.

After trial, the court rendered a decision in favor of Perea, Cayas was ordered to compensate the

latter with damages. Cayas filed a complaint with the CFI, seeking reimbursement from PCSI for the

amounts she paid to ALL victims, alleging that the latter refused to make such reimbursement

notwithstanding the fact that her claim was within its contractual liability under the insurance policy. The

decision of the CA affirmed in toto the decision of the RTC of Cavite, the dispositive portion of which states.

IN VIEW OF THE FOREGOING, judgment is hereby rendered ordering defendant PCSI to pay

plaintiff Cayas the sum of P50,000.00 under its maximum liability as provided for in the insurance policy.

In this petition for review on certiorari, petitioner seeks to limit its liability only to the payment made

by private respondent to Perea and only up to the amount of P12,000.00. It altogether denies liability for

the payments made by private respondents to the other 3 injured passengers totaling P12,000.00.

ISSUE: How much should PCSI pay?

HELD: The decision of the CA is modified, petitioner only to pay Cayas P12,000,000.00

The insurance policy involved explicitly limits PCSI's liability to P12,000.00 per person and to

P50,000.00 per accident.

We have ruled in Stokes vs. Malayan Insurance Co., Inc., that the terms of the contract constitute

the measure of the insurer's liability and compliance therewith is a condition precedent to the insured's right

of recovery from the insurer.

In the case at bar, the insurance policy clearly and categorically placed PCSI's liability for all

damages arising out of death or bodily injury sustained by one person as a result of any one accident at

P12,000.00. Said amount complied with the minimum fixed by the law then prevailing, Section 377 of

Presidential Decree No. 612 (which was retained by P.D. No. 1460, the Insurance Code of 1978), which

provided that the liability of land transportation vehicle operators for bodily injuries sustained by a passenger

arising out of the use of their vehicles shall not be less than P12,000. In other words, under the law, the

minimum liability is P12,000 per passenger. PCSI's liability under the insurance contract not being less than

P12,000.00, and therefore not contrary to law, morals, good customs, public order or public policy, said

stipulation must be upheld as effective, valid and binding as between the parties.

In like manner, we rule as valid and binding upon Cayas the condition in the policy in requiring her

to secure the written permission of PCSI before effecting any payment in settlement of any claim against

her. There is nothing unreasonable, arbitrary or objectionable in this stipulation as would warrant its

nullification. The same was obviously designed to safeguard the insurer's interest against collusion between

the insured and the claimants.

In her cross-examination before the trial court, Milagros Cayas admitted that PCSI did not give any

written authority that Cayas were supposed to pay those claims.

It being specifically required that PCSI's written consent be first secured before any payment in

settlement of any claim could be made, Cayas is precluded from seeking reimbursement of the payments

made to del Carmen, Magsarili and Antolin in view of her failure to comply with the condition contained in

the insurance policy.

Clearly, the fundamental principle that contracts are respected as the law between the contracting

parties finds application in the present case. Thus, it was error on the part of the trial and appellate courts

to have disregarded the stipulations of the parties and to have substituted their own interpretation of the

insurance policy.

We observe that although Milagros Cayas was able to prove a total loss of only P44,000.00, PCSI

was made liable for the amount of P50,000.00, the maximum liability per accident stipulated in the policy.

This is patent error. An insurance indemnity, being merely an assistance or restitution insofar as can be

fairly ascertained, cannot be availed of by any accident victim or claimant as an instrument of enrichment

by reason of an accident.

Das könnte Ihnen auch gefallen

- Sps. Cha v. CADokument1 SeiteSps. Cha v. CAJohn Mark RevillaNoch keine Bewertungen

- Saludo Vs SBCDokument5 SeitenSaludo Vs SBCLou StellarNoch keine Bewertungen

- The Diocese of Bacolod vs. Commission On Elections 747 SCRA 1, January 21, 2015Dokument129 SeitenThe Diocese of Bacolod vs. Commission On Elections 747 SCRA 1, January 21, 2015bananayellowsharpieNoch keine Bewertungen

- Insurance Code SummaryDokument24 SeitenInsurance Code SummaryTherese Diane SudarioNoch keine Bewertungen

- Benny Go vs. BacaronDokument9 SeitenBenny Go vs. BacaronLouvanne Jessa Orzales BesingaNoch keine Bewertungen

- UCPB vs. MasaganaDokument2 SeitenUCPB vs. MasaganaQuennie Mae ZalavarriaNoch keine Bewertungen

- CJH Development Corporation Vs Bureau of Internal Revenue Et AlDokument6 SeitenCJH Development Corporation Vs Bureau of Internal Revenue Et AlThe ChogsNoch keine Bewertungen

- National Power Corporation vs. Benjamin Ong Co (G.R. No. 166973, Feb 10, 2009)Dokument4 SeitenNational Power Corporation vs. Benjamin Ong Co (G.R. No. 166973, Feb 10, 2009)Clint Octavius Eamiguel LabticNoch keine Bewertungen

- Verendia V Ca (Fidelity & Surety Co. of The Phils)Dokument1 SeiteVerendia V Ca (Fidelity & Surety Co. of The Phils)Praisah Marjorey PicotNoch keine Bewertungen

- Prudential Bank vs. AbasoloDokument4 SeitenPrudential Bank vs. AbasoloLou StellarNoch keine Bewertungen

- GR No. 97251-52Dokument2 SeitenGR No. 97251-52Bea CapeNoch keine Bewertungen

- PHILIPPINE FIRST INSURANCE CO., INC. and PARAMOUNT GENERAL INSURANCE CORPORATION v. PYRAMID LOGISTICS AND TRUCKING CORPORATIONDokument2 SeitenPHILIPPINE FIRST INSURANCE CO., INC. and PARAMOUNT GENERAL INSURANCE CORPORATION v. PYRAMID LOGISTICS AND TRUCKING CORPORATIONambonulanNoch keine Bewertungen

- 17 FGU Insurance vs. CA, G.R. No. 137775Dokument19 Seiten17 FGU Insurance vs. CA, G.R. No. 137775blessaraynesNoch keine Bewertungen

- Sumbingco, Cruz, Lozada & Sanicas Law Office For Plaintiffs-Appellants. Victor B. Cuñada For Defendants-AppelleesDokument3 SeitenSumbingco, Cruz, Lozada & Sanicas Law Office For Plaintiffs-Appellants. Victor B. Cuñada For Defendants-AppelleesClaudine SumalinogNoch keine Bewertungen

- Suroza Vs Honrado PDFDokument13 SeitenSuroza Vs Honrado PDFAnjNoch keine Bewertungen

- Sanitary Steam Laundry Responsible for Fatal CrashDokument4 SeitenSanitary Steam Laundry Responsible for Fatal CrashLulu VedNoch keine Bewertungen

- Great Pacific Life-vs-CADokument2 SeitenGreat Pacific Life-vs-CAmario navalezNoch keine Bewertungen

- Malayan Insurance CoDokument2 SeitenMalayan Insurance CoJeru SagaoinitNoch keine Bewertungen

- Stipulation Pour Autrui in Insurance ContractsDokument3 SeitenStipulation Pour Autrui in Insurance ContractsAhmed GakuseiNoch keine Bewertungen

- Court Upholds Promissory Note as Negotiable InstrumentDokument7 SeitenCourt Upholds Promissory Note as Negotiable InstrumentAngelie FloresNoch keine Bewertungen

- Bautista v. Commission On ElectionsDokument25 SeitenBautista v. Commission On Electionsryusuki takahashiNoch keine Bewertungen

- SpecproDokument22 SeitenSpecproj_alamedaNoch keine Bewertungen

- Churchill v. ConcepcionDokument6 SeitenChurchill v. ConcepcionUnis BautistaNoch keine Bewertungen

- Sps. Morata v. Sps. Go (Conciliation Mandatory Even in Cases Under RTC)Dokument4 SeitenSps. Morata v. Sps. Go (Conciliation Mandatory Even in Cases Under RTC)Sarah Jane-Shae O. SemblanteNoch keine Bewertungen

- Acar Vs RosalDokument2 SeitenAcar Vs RosalJean HerreraNoch keine Bewertungen

- 02 Sheker vs. Estate of Alice O. Sheker, 540 SCRA 111, G.R. No. 157912 Dec 13, 2007Dokument14 Seiten02 Sheker vs. Estate of Alice O. Sheker, 540 SCRA 111, G.R. No. 157912 Dec 13, 2007Galilee RomasantaNoch keine Bewertungen

- Liability of The Employers - FornesteDokument13 SeitenLiability of The Employers - FornesteIrish Claire FornesteNoch keine Bewertungen

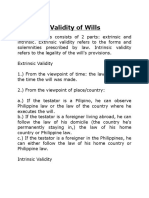

- Rules On Validity of WillsDokument2 SeitenRules On Validity of WillsManu SalaNoch keine Bewertungen

- Independent Civil Action Allowed for Damages to Property During Criminal CaseDokument3 SeitenIndependent Civil Action Allowed for Damages to Property During Criminal CaseGellomar AlkuinoNoch keine Bewertungen

- Rule on Compulsory Joinder of Indispensable Parties in Cases Involving Co-Owned Personal Properties (39Dokument52 SeitenRule on Compulsory Joinder of Indispensable Parties in Cases Involving Co-Owned Personal Properties (39carlo dumlaoNoch keine Bewertungen

- 16 Santos Ventura Hocorma Foundation Inc VS Ernesto SantosDokument7 Seiten16 Santos Ventura Hocorma Foundation Inc VS Ernesto Santosvj hernandezNoch keine Bewertungen

- Hongkong and Shanghai Banking Corp. v. ShermanDokument5 SeitenHongkong and Shanghai Banking Corp. v. ShermanpetraNoch keine Bewertungen

- CSC rules on appointment exceeding 3-grade limitDokument2 SeitenCSC rules on appointment exceeding 3-grade limitEstel TabumfamaNoch keine Bewertungen

- Malayan Insurance Co. Inc. v. StrongholdDokument12 SeitenMalayan Insurance Co. Inc. v. StrongholdReah Shyne RefilNoch keine Bewertungen

- G.R. No. 78780. July 23, 1987. 152 SCRA 284 Case DigestDokument1 SeiteG.R. No. 78780. July 23, 1987. 152 SCRA 284 Case DigestKTNoch keine Bewertungen

- Railroad Accident Lawsuit Raises Questions of Negligence and Duty of CareDokument17 SeitenRailroad Accident Lawsuit Raises Questions of Negligence and Duty of CareJovelan V. EscañoNoch keine Bewertungen

- In The Matter of The Petition For The Probate of The Will of Consuelo Santiago GarciaDokument2 SeitenIn The Matter of The Petition For The Probate of The Will of Consuelo Santiago GarciaEdel VillanuevaNoch keine Bewertungen

- Riofero V CADokument2 SeitenRiofero V CAElah ViktoriaNoch keine Bewertungen

- Corpo Week 1Dokument35 SeitenCorpo Week 1Angelo BasaNoch keine Bewertungen

- 16 - Probate of The Will of ConsueloDokument6 Seiten16 - Probate of The Will of ConsueloAkagamiNoch keine Bewertungen

- Teves vs. CADokument8 SeitenTeves vs. CAnoonalawNoch keine Bewertungen

- De Joya Vs CADokument2 SeitenDe Joya Vs CAElead Gaddiel S. Albuero100% (1)

- Legal Ethics Cases No. 10Dokument39 SeitenLegal Ethics Cases No. 10vj hernandezNoch keine Bewertungen

- Chavez vs. CA GR 159411Dokument6 SeitenChavez vs. CA GR 159411Vernis VentilacionNoch keine Bewertungen

- Rule 11 Time To File Rspnsive PldngsDokument6 SeitenRule 11 Time To File Rspnsive PldngsMarichelNoch keine Bewertungen

- Perez, Hilado v. CADokument9 SeitenPerez, Hilado v. CAPepper PottsNoch keine Bewertungen

- Barredo V Garcia (Group1)Dokument1 SeiteBarredo V Garcia (Group1)Justin ParasNoch keine Bewertungen

- Plebiscite Required for Downgrading City StatusDokument3 SeitenPlebiscite Required for Downgrading City Statusrgtan3Noch keine Bewertungen

- NPC Vs NamercoDokument5 SeitenNPC Vs NamercoMa. Princess CongzonNoch keine Bewertungen

- CivPro IV Civil Procedure-No. 2Dokument226 SeitenCivPro IV Civil Procedure-No. 2John Henry CasugaNoch keine Bewertungen

- 038-Palting vs. San Jose Petroleum Inc. 18 Scra 924 (1966)Dokument10 Seiten038-Palting vs. San Jose Petroleum Inc. 18 Scra 924 (1966)wewNoch keine Bewertungen

- Suntay v. Suntay, G.R. Nos. L-3087 & L-3088, (July 31, 1954), 95 PHIL 500-553)Dokument39 SeitenSuntay v. Suntay, G.R. Nos. L-3087 & L-3088, (July 31, 1954), 95 PHIL 500-553)yasuren2Noch keine Bewertungen

- Corpo Law 2001 ReviewerDokument131 SeitenCorpo Law 2001 ReviewerNodlesde Awanab ZurcNoch keine Bewertungen

- Cebu Shipyard and Engineering Works, Inc. v. William Lines, Inc.Dokument1 SeiteCebu Shipyard and Engineering Works, Inc. v. William Lines, Inc.naomi alanoNoch keine Bewertungen

- 36 Mandarin Villa v. CADokument5 Seiten36 Mandarin Villa v. CAGedan TanNoch keine Bewertungen

- Ark Travel Express V AbrogarDokument11 SeitenArk Travel Express V AbrogarAntonio RealNoch keine Bewertungen

- Delayed Delivery of Raw Sugar Allocation Leads to DamagesDokument13 SeitenDelayed Delivery of Raw Sugar Allocation Leads to Damagesyan_saavedra_1Noch keine Bewertungen

- Ong Lim Sing, Jr. vs. FEB Leasing & Finance CorporationDokument19 SeitenOng Lim Sing, Jr. vs. FEB Leasing & Finance CorporationArya StarkNoch keine Bewertungen

- Digest of Vda de Gabriel V Ca GR No 103883 PDFDokument2 SeitenDigest of Vda de Gabriel V Ca GR No 103883 PDFXtian HernandezNoch keine Bewertungen

- Perla Compania de Seguros vs. CA DigestDokument1 SeitePerla Compania de Seguros vs. CA DigestMarconni B. AndresNoch keine Bewertungen

- CD - 1. Calanoc vs. Court of Appeals and Philippine American LifeDokument1 SeiteCD - 1. Calanoc vs. Court of Appeals and Philippine American LifeAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CD - 9. Nogales vs. Capitol Medical CenterDokument2 SeitenCD - 9. Nogales vs. Capitol Medical CenterAlyssa Alee Angeles JacintoNoch keine Bewertungen

- Arroyo v. de Venecia Digested)Dokument1 SeiteArroyo v. de Venecia Digested)Mano PoNoch keine Bewertungen

- Caltex V Court of AppealsDokument21 SeitenCaltex V Court of AppealsebenezermanzanormtNoch keine Bewertungen

- VOL. 227, OCTOBER 12, 1993 161: Big Country Ranch Corp. vs. Court of AppealsDokument9 SeitenVOL. 227, OCTOBER 12, 1993 161: Big Country Ranch Corp. vs. Court of AppealsAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CentralBooks Reader6 PDFDokument9 SeitenCentralBooks Reader6 PDFAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CentralBooks Reader6 PDFDokument9 SeitenCentralBooks Reader6 PDFAlyssa Alee Angeles JacintoNoch keine Bewertungen

- 332 Supreme Court Reports Annotated: Permanent Concrete Products, Inc. vs. TeodoroDokument7 Seiten332 Supreme Court Reports Annotated: Permanent Concrete Products, Inc. vs. TeodoroAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CD 3. Caltex Phil V CADokument2 SeitenCD 3. Caltex Phil V CAAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CD 5. Ang Tek Lian Vs Court of AppealsDokument1 SeiteCD 5. Ang Tek Lian Vs Court of AppealsAlyssa Alee Angeles JacintoNoch keine Bewertungen

- Caltex V Court of AppealsDokument21 SeitenCaltex V Court of AppealsebenezermanzanormtNoch keine Bewertungen

- CD 4. Salas Vs Court of Appeals and Filinvest FinanceDokument1 SeiteCD 4. Salas Vs Court of Appeals and Filinvest FinanceAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CD 6. Abubakar v. Auditor GeneralDokument1 SeiteCD 6. Abubakar v. Auditor GeneralAlyssa Alee Angeles JacintoNoch keine Bewertungen

- 332 Supreme Court Reports Annotated: Permanent Concrete Products, Inc. vs. TeodoroDokument7 Seiten332 Supreme Court Reports Annotated: Permanent Concrete Products, Inc. vs. TeodoroAlyssa Alee Angeles JacintoNoch keine Bewertungen

- Tibajia Jr. v. Court of Appeals (G.R. No. 100290. June 4, 1993)Dokument1 SeiteTibajia Jr. v. Court of Appeals (G.R. No. 100290. June 4, 1993)Evangelyn EgusquizaNoch keine Bewertungen

- Oporto v. Members of The Board of Inquiry and Discipline of The National Power CorporationDokument2 SeitenOporto v. Members of The Board of Inquiry and Discipline of The National Power CorporationAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CD - 4. First Philippine Industrial Corp. v. Court of AppealsDokument1 SeiteCD - 4. First Philippine Industrial Corp. v. Court of AppealsAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CD - 2. First Philippine Industrial Corp. v. CADokument2 SeitenCD - 2. First Philippine Industrial Corp. v. CAAlyssa Alee Angeles JacintoNoch keine Bewertungen

- Jalosjos vs. COMELECDokument99 SeitenJalosjos vs. COMELECAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CD - 11. Fabre vs. CADokument2 SeitenCD - 11. Fabre vs. CAAlyssa Alee Angeles JacintoNoch keine Bewertungen

- 5 OTHER ADR FORMS, Intro To ArbitrationDokument3 Seiten5 OTHER ADR FORMS, Intro To ArbitrationAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CD - 8. Philippine American General Insurance Co V PKS ShippingDokument2 SeitenCD - 8. Philippine American General Insurance Co V PKS ShippingAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CD - 7. Calvo v. UCPBDokument2 SeitenCD - 7. Calvo v. UCPBAlyssa Alee Angeles JacintoNoch keine Bewertungen

- 1 Ang Tibay V Court of Industrial RelationsDokument6 Seiten1 Ang Tibay V Court of Industrial RelationsAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CD - 10. Planters Product Inc. Vs CA, September 15, 1993Dokument2 SeitenCD - 10. Planters Product Inc. Vs CA, September 15, 1993Alyssa Alee Angeles JacintoNoch keine Bewertungen

- CD - 5. Caltex (Phils) Vs Sulpicio Lines, 315 SCRADokument2 SeitenCD - 5. Caltex (Phils) Vs Sulpicio Lines, 315 SCRAAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CD - 1.philippine Bank of Commerce Vs CADokument2 SeitenCD - 1.philippine Bank of Commerce Vs CAAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CD - 1.philippine Bank of Commerce Vs CADokument1 SeiteCD - 1.philippine Bank of Commerce Vs CAAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CD - 6. Coastwise Ligtherage vs. CADokument2 SeitenCD - 6. Coastwise Ligtherage vs. CAAlyssa Alee Angeles JacintoNoch keine Bewertungen

- CD - 3. National Steel Corp V CADokument1 SeiteCD - 3. National Steel Corp V CAAlyssa Alee Angeles JacintoNoch keine Bewertungen

- Selected Candidates For The Post of Stenotypist (BS-14), Open Merit QuotaDokument6 SeitenSelected Candidates For The Post of Stenotypist (BS-14), Open Merit Quotaامین ثانیNoch keine Bewertungen

- ACCA F6 Taxation Solved Past PapersDokument235 SeitenACCA F6 Taxation Solved Past Paperssaiporg100% (1)

- CBSE Class 10 Geography Chapter 3 Notes - Water ResourcesDokument4 SeitenCBSE Class 10 Geography Chapter 3 Notes - Water Resourcesrishabh gaunekarNoch keine Bewertungen

- Repair Almirah QuotationsDokument1 SeiteRepair Almirah QuotationsManoj Kumar BeheraNoch keine Bewertungen

- B2 (Upper Intermediate) ENTRY TEST: Task 1. Choose A, B or CDokument2 SeitenB2 (Upper Intermediate) ENTRY TEST: Task 1. Choose A, B or CОльга ВетроваNoch keine Bewertungen

- Research ProposalDokument7 SeitenResearch Proposalswarna sahaNoch keine Bewertungen

- Cpar Q1 Las 1Dokument10 SeitenCpar Q1 Las 1Jaslor LavinaNoch keine Bewertungen

- Varifuel2 300-190 30.45.300-190D: Technical Reference Material Created by DateDokument1 SeiteVarifuel2 300-190 30.45.300-190D: Technical Reference Material Created by DateRIGOBERTO LOZANO MOLINANoch keine Bewertungen

- Features of A Newspaper Report Differentiated Activity Sheets - Ver - 2Dokument4 SeitenFeatures of A Newspaper Report Differentiated Activity Sheets - Ver - 2saadNoch keine Bewertungen

- Attestation Process ChecklistDokument2 SeitenAttestation Process Checklistkim edwinNoch keine Bewertungen

- Skills 360 - Negotiations 2: Making The Deal: Discussion QuestionsDokument6 SeitenSkills 360 - Negotiations 2: Making The Deal: Discussion QuestionsTrần ThơmNoch keine Bewertungen

- Dinie Zulkernain: Marketing Executive / Project ManagerDokument2 SeitenDinie Zulkernain: Marketing Executive / Project ManagerZakri YusofNoch keine Bewertungen

- MNC diversity factors except expatriatesDokument12 SeitenMNC diversity factors except expatriatesGanesh Devendranath Panda100% (1)

- Altar Server GuideDokument10 SeitenAltar Server GuideRichard ArozaNoch keine Bewertungen

- Lawyer Disciplinary CaseDokument8 SeitenLawyer Disciplinary CaseRose De JesusNoch keine Bewertungen

- Compounding & Reduplication: Forms and Analysis Across LanguagesDokument23 SeitenCompounding & Reduplication: Forms and Analysis Across LanguagesUtari ListiyaniNoch keine Bewertungen

- MSA BeijingSyllabus For Whitman DizDokument6 SeitenMSA BeijingSyllabus For Whitman DizcbuhksmkNoch keine Bewertungen

- Sto NinoDokument3 SeitenSto NinoSalve Christine RequinaNoch keine Bewertungen

- 11th English ExamDokument4 Seiten11th English ExamsandchhonkarNoch keine Bewertungen

- Uttara ClubDokument16 SeitenUttara ClubAccounts Dhaka Office75% (4)

- Disadvantages of PrivatisationDokument2 SeitenDisadvantages of PrivatisationumamagNoch keine Bewertungen

- Jffii - Google SearchDokument2 SeitenJffii - Google SearchHAMMAD SHAHNoch keine Bewertungen

- 2022 ICT Mentorship 5Dokument50 Seiten2022 ICT Mentorship 5dcratns dcratns100% (21)

- AZ 104 - Exam Topics Testlet 07182023Dokument28 SeitenAZ 104 - Exam Topics Testlet 07182023vincent_phlNoch keine Bewertungen

- Valve SheetDokument23 SeitenValve SheetAris KancilNoch keine Bewertungen

- The War Against Sleep - The Philosophy of Gurdjieff by Colin Wilson (1980) PDFDokument50 SeitenThe War Against Sleep - The Philosophy of Gurdjieff by Colin Wilson (1980) PDFJosh Didgeridoo0% (1)

- Final PaperDokument5 SeitenFinal PaperJordan Spoon100% (1)

- ASEAN-Maybank Scholarship - Parents Income Declaration Form v1Dokument1 SeiteASEAN-Maybank Scholarship - Parents Income Declaration Form v1hidayanti.ridzuanNoch keine Bewertungen

- Stores & Purchase SopDokument130 SeitenStores & Purchase SopRoshni Nathan100% (4)