Beruflich Dokumente

Kultur Dokumente

Pan Reject

Hochgeladen von

Raja RajCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Pan Reject

Hochgeladen von

Raja RajCopyright:

Verfügbare Formate

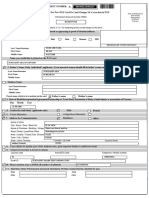

INCOME TAX PAN SERVICES UNIT

(Managed By NSDL e-Governance Infrastructure Limited)

5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8,

Model Colony, Near Deep Bungalow Chowk, Pune - 411 016.

Ref.No.TIN/PAN/CR-/88103222172758202 Date: 02-JUL-2018

Shri VIGNESH THANGARASU

NO 3-524/172 S.NARIKUDI

SUBBALAPURAM POST PERAIYUR TALUK

MADURAI Tamil Nadu 625702

Dear Sir/Madam,

Subject : Discrepancy in the documents received for PAN application

1. This has reference to documents received in connection with your request for New PAN card and/or changes/correction in PAN data for PAN CTXPA9046C made vide

acknowledgement no. 881032221727582. Following discrepancies are observed between details provided in application and details available with Income Tax Department

(ITD).

Particular As per Application As per ITD's Database Discrepancy in documents submitted

Applicant's Name VIGNESH THANGARASU VIGNESH ARUMUGAM Name change from VIGNESH ARUMUGAM to VIGNESH

THANGARASU has not been specified in AADHAR Card issued by

the Unique Identification Authority of India provided by you (Please

refer list 1)

Father's Name THANGARASU ARUMUGAM Father's name change from ARUMUGAM to THANGARASU has

not been specified in AADHAR Card issued by the Unique

Identification Authority of India provided by you (Please refer list 2)

2. Please submit the below specified documents (with details as per application) to clear the above mentioned discrepancy (ies).

Name Father's Name

( any one of the following - List 1 ) ( any one of the following - List 2 )

Marriage Certificate or Marriage invitation Card or Public notification in official gazette or clarification for

Publication of name change in official gazatte or copy of change in father name along with relevant proof of Identity

passport showing husband's name or certificate issued by of applicant having father name as desired.

gazetted officer along with copy of office Identity proof of

gazetted officer.

Publication of name change in official gazatte or certificate

issued by a gazetted officer along with copy of office

identity proof of gazetted officer.

3. Please note your PAN application will be processed only on receipt of documents as explained above.

4. If we do not receive documents as mentioned above within 30 days, then your application will be filed and no further action will be taken.

5. Information relating to all PAN Services of ITD can be obtained by making a phone call to Aaykar Sampark Kendra (1800-180-1961) or TIN-Call Centre (020-27218080)

or from the website: www.incometaxindia.gov.in or www.tin-nsdl.com

(This being a computer-generated letter,no signature is required) Income Tax Department

Caution : Income Tax Department does not send e-mails regarding refunds and does not seek any taxpayer information like user name, password, details of ATM, bank accounts,

credit cards, etc. Taxpayers are advised not to part with such information on the basis of emails.

To be sent to NSDL along with documents RETURN-SLIP

ACKNOWLEDGEMENT NO.881032221727582

Please indicate how you want your application to be processed by putting tick in appropriate boxes.

A. Reprint PAN card with ITD data, no change required: [ ]

B. For following fields, details available with Income Tax Department is / are correct and should not be changed (ignore application data):

[ ] Name [ ] Father's Name [ ] DOB

C. For following fields, details available with Income Tax Department is / are incorrect and should be changed:

[ ] Name [ ] Father's Name [ ] DOB (provide documents to support changes as described overleaf)

List of Documents attached: (1)_____________(2)___________(3)___________(4)____________

Name of Applicant: Shri VIGNESH THANGARASU

Signature of Applicant: _______________

Das könnte Ihnen auch gefallen

- Defining Free Cash Flow Top-Down ApproachDokument2 SeitenDefining Free Cash Flow Top-Down Approachchuff6675100% (1)

- Parallax US Equity Valuation Neural Network ModelDokument84 SeitenParallax US Equity Valuation Neural Network ModelAlex BernalNoch keine Bewertungen

- Trading System Development Final Report PDFDokument102 SeitenTrading System Development Final Report PDFAditya Risqi Pratama100% (1)

- Hybrid Financing, Preferred Stock, Leasing, Warrants and ConvertiblesDokument30 SeitenHybrid Financing, Preferred Stock, Leasing, Warrants and ConvertiblesannafuentesNoch keine Bewertungen

- Right OffeDokument296 SeitenRight OffeRdy SimangunsongNoch keine Bewertungen

- Stress Testing ProjectDokument28 SeitenStress Testing Projectjeetu998800Noch keine Bewertungen

- New Trader, Rich Trader How To Make Money in The Stock Market by Steve BurnsDokument191 SeitenNew Trader, Rich Trader How To Make Money in The Stock Market by Steve BurnsRaj RahulNoch keine Bewertungen

- Batalec v. Cir, Cta Case No. 8423Dokument23 SeitenBatalec v. Cir, Cta Case No. 8423annieeelwsNoch keine Bewertungen

- American Chemical Corp EX NOTESDokument18 SeitenAmerican Chemical Corp EX NOTESRex Jose50% (2)

- Annex 582729700036153Dokument1 SeiteAnnex 582729700036153venkatNoch keine Bewertungen

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881035292293111Dokument1 SeiteIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881035292293111MSEB WalujNoch keine Bewertungen

- Annex 603869700012681Dokument1 SeiteAnnex 603869700012681ULTIMA SERVICESNoch keine Bewertungen

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.845739700001221Dokument1 SeiteIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.845739700001221SameerNoch keine Bewertungen

- Annex 881038200955301Dokument1 SeiteAnnex 881038200955301cads vjaNoch keine Bewertungen

- Annex 830355500000272Dokument1 SeiteAnnex 830355500000272raj sanganiNoch keine Bewertungen

- Annex 033779700803822Dokument1 SeiteAnnex 033779700803822Sayed ShoiabNoch keine Bewertungen

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881036279775761Dokument1 SeiteIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.881036279775761surinderNoch keine Bewertungen

- Income Tax Pan Services Unit: ACKNOWLEDGEMENT NO.091019703743452Dokument1 SeiteIncome Tax Pan Services Unit: ACKNOWLEDGEMENT NO.091019703743452Sumanth RNoch keine Bewertungen

- Rajesh Annex-259579700022090Dokument1 SeiteRajesh Annex-259579700022090sona singhNoch keine Bewertungen

- Annex 030409710286616Dokument1 SeiteAnnex 030409710286616sameer pashaNoch keine Bewertungen

- Annex 205919700005773Dokument1 SeiteAnnex 205919700005773Brisk VpnNoch keine Bewertungen

- Annex 010109703338232Dokument1 SeiteAnnex 010109703338232Sahil RajputNoch keine Bewertungen

- Annex - 071469700651425Dokument1 SeiteAnnex - 071469700651425KALYAN KUMARNoch keine Bewertungen

- Annex 881037244760002Dokument1 SeiteAnnex 881037244760002Shamim AkhtarNoch keine Bewertungen

- Income Tax Pan Services Unit: Reference: Our Letter Ref - No. TIN/PAN/CR-II/N-8810552613810721171 Dated 11-SEP-2021Dokument3 SeitenIncome Tax Pan Services Unit: Reference: Our Letter Ref - No. TIN/PAN/CR-II/N-8810552613810721171 Dated 11-SEP-2021Rashid KhanNoch keine Bewertungen

- Annex 717329700375352Dokument1 SeiteAnnex 717329700375352niharxerox180Noch keine Bewertungen

- Annex 882038275424342Dokument1 SeiteAnnex 882038275424342Shree Nath Transport Co.Noch keine Bewertungen

- Income Tax Pan Services Unit: (Managed by NSDL E-Governance Infrastructure Limited)Dokument2 SeitenIncome Tax Pan Services Unit: (Managed by NSDL E-Governance Infrastructure Limited)Moinuddin AnsariNoch keine Bewertungen

- 881053278006296Dokument2 Seiten881053278006296Sameer MittalNoch keine Bewertungen

- Annex 882039274666970Dokument1 SeiteAnnex 882039274666970sandeep.soniNoch keine Bewertungen

- Form 1 EnglishDokument2 SeitenForm 1 Englishashish yadavNoch keine Bewertungen

- Income Tax Pan Services Unit: (Managed by National Securities Depository Limited)Dokument2 SeitenIncome Tax Pan Services Unit: (Managed by National Securities Depository Limited)MalliMurthyNoch keine Bewertungen

- Portal1.Passportindia - Gov.in AppOnlineProject Secure ViewDraftAction Arn 13-0007206836Dokument2 SeitenPortal1.Passportindia - Gov.in AppOnlineProject Secure ViewDraftAction Arn 13-0007206836patelaxayNoch keine Bewertungen

- Appointment RecieptDokument3 SeitenAppointment RecieptNitish MittalNoch keine Bewertungen

- Appointment Reciept DILIP KUMARDokument4 SeitenAppointment Reciept DILIP KUMARSatish MandapetaNoch keine Bewertungen

- Service RequiredDokument2 SeitenService RequiredGnanaprakasu MNoch keine Bewertungen

- Rameshbha ApplicationDokument3 SeitenRameshbha ApplicationTejas ShahNoch keine Bewertungen

- Area DwaignDokument2 SeitenArea DwaignAbuzar BanderkarNoch keine Bewertungen

- Nominee FormDokument2 SeitenNominee FormraydipanjanNoch keine Bewertungen

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Dokument1 SeiteItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Manogya SharmaNoch keine Bewertungen

- Rommy Garg COCDokument1 SeiteRommy Garg COCJaspreet Singh KhalsaNoch keine Bewertungen

- Passport Application ReceiptDokument3 SeitenPassport Application ReceiptAbhay GuptaNoch keine Bewertungen

- Appointment RecieptDokument3 SeitenAppointment RecieptShanmuka SreenivasNoch keine Bewertungen

- Emudhra Application FormDokument4 SeitenEmudhra Application FormSiddharth ChNoch keine Bewertungen

- Common Subscriber Registration Form 20223354484Dokument8 SeitenCommon Subscriber Registration Form 20223354484GANESWAR SARANGINoch keine Bewertungen

- 881060224386252-Sai NadhDokument3 Seiten881060224386252-Sai NadhVlcomputers TenaliNoch keine Bewertungen

- Appointment Reciept SHDokument3 SeitenAppointment Reciept SHsam995995Noch keine Bewertungen

- New Vendor Registration Form - VER - 2 3Dokument4 SeitenNew Vendor Registration Form - VER - 2 3keyurNoch keine Bewertungen

- XXXPH2966X ITRV - UnlockedDokument1 SeiteXXXPH2966X ITRV - UnlockedVivek HaldarNoch keine Bewertungen

- (Registration Wing) Form For Capturing Details of Parent's Name & Communication DetailsDokument1 Seite(Registration Wing) Form For Capturing Details of Parent's Name & Communication DetailsVinesh NairNoch keine Bewertungen

- JD FormDokument3 SeitenJD FormMinal BaderaNoch keine Bewertungen

- BBL PanDokument1 SeiteBBL Pankhan100% (2)

- Abhay Adhar AppointmentDokument1 SeiteAbhay Adhar Appointmentharshsharmaq123Noch keine Bewertungen

- Government of India, Ministry of External Affairs: Service RequiredDokument3 SeitenGovernment of India, Ministry of External Affairs: Service RequiredAkshay DandekarNoch keine Bewertungen

- Ack K000667649Dokument1 SeiteAck K000667649pan phNoch keine Bewertungen

- N PanDokument2 SeitenN PanMonika BansalNoch keine Bewertungen

- IncomeeDokument2 SeitenIncomeeRtl GdsNoch keine Bewertungen

- Account Opening Form (For Individuals Only) Know Your Client (KYC) Kra Kyc FormDokument2 SeitenAccount Opening Form (For Individuals Only) Know Your Client (KYC) Kra Kyc FormSandesh Kulkarni RNoch keine Bewertungen

- BharwDokument3 SeitenBharwHarshith S0% (1)

- Appointment Reciept SWDokument3 SeitenAppointment Reciept SWsam995995Noch keine Bewertungen

- AnkurDokument1 SeiteAnkurpancard1098Noch keine Bewertungen

- Appointment Reciept LADokument3 SeitenAppointment Reciept LAsam995995Noch keine Bewertungen

- वदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptDokument3 Seitenवदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment Receiptdream onlineNoch keine Bewertungen

- View - Print Submitted FormDokument2 SeitenView - Print Submitted FormHARSH NITINNoch keine Bewertungen

- Annex 055840100375124Dokument2 SeitenAnnex 055840100375124Siddhi PatilNoch keine Bewertungen

- Screenshot 2023-08-14 at 10.29.53Dokument3 SeitenScreenshot 2023-08-14 at 10.29.53Yoga man dr Ogyen DongagNoch keine Bewertungen

- KARITIDokument1 SeiteKARITIANIL KUMARNoch keine Bewertungen

- Acknowledgment For Request For New PAN Card or - and Changes or Correction in PAN Data (881030205408706)Dokument1 SeiteAcknowledgment For Request For New PAN Card or - and Changes or Correction in PAN Data (881030205408706)kapilchandanNoch keine Bewertungen

- Thlif XG Ge JG GJ Jpuk : Tulk : Tulk ML THD ) Njhif &ghaDokument2 SeitenThlif XG Ge JG GJ Jpuk : Tulk : Tulk ML THD ) Njhif &ghaRaja RajNoch keine Bewertungen

- Du 70575801Dokument1 SeiteDu 70575801Durga Charan PradhanNoch keine Bewertungen

- Thlif XG Ge JG GJ Jpuk : Tulk : Tulk ML THD ) Njhif &ghaDokument2 SeitenThlif XG Ge JG GJ Jpuk : Tulk : Tulk ML THD ) Njhif &ghaRaja RajNoch keine Bewertungen

- Thlif XG Ge JG GJ Jpuk : Tulk : Tulk ML THD ) Njhif &ghaDokument2 SeitenThlif XG Ge JG GJ Jpuk : Tulk : Tulk ML THD ) Njhif &ghaRaja RajNoch keine Bewertungen

- Preferences For TNAU UG Admission 2019: Registration Number: Name of CandidateDokument3 SeitenPreferences For TNAU UG Admission 2019: Registration Number: Name of CandidateRaja RajNoch keine Bewertungen

- Thlif XG Ge JG GJ Jpuk : Tulk : Tulk ML THD ) Njhif &ghaDokument2 SeitenThlif XG Ge JG GJ Jpuk : Tulk : Tulk ML THD ) Njhif &ghaRaja RajNoch keine Bewertungen

- Thlif XG Ge JG GJ Jpuk : Tulk : Tulk ML THD ) Njhif &ghaDokument2 SeitenThlif XG Ge JG GJ Jpuk : Tulk : Tulk ML THD ) Njhif &ghaRaja RajNoch keine Bewertungen

- वदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptDokument3 Seitenवदेश मं ालय भारत सरकार Ministry of External Affairs Government of India Online Appointment ReceiptRaja RajNoch keine Bewertungen

- BBBDokument147 SeitenBBBRaja RajNoch keine Bewertungen

- FW Table SL PDFDokument12 SeitenFW Table SL PDFSelva PrakashNoch keine Bewertungen

- INDIRDokument3 SeitenINDIRRaja RajNoch keine Bewertungen

- Tamil Nadu Veterinary and Animal Sciences University: Application For BVSC & Ah Degree Course 2020-21Dokument2 SeitenTamil Nadu Veterinary and Animal Sciences University: Application For BVSC & Ah Degree Course 2020-21Raja RajNoch keine Bewertungen

- FFFDokument2 SeitenFFFRaja RajNoch keine Bewertungen

- FFFDokument2 SeitenFFFRaja RajNoch keine Bewertungen

- Conduct Certificate Radian PDFDokument1 SeiteConduct Certificate Radian PDFswarna BaiNoch keine Bewertungen

- Police ResultDokument19 SeitenPolice ResultRaja RajNoch keine Bewertungen

- FFFDokument2 SeitenFFFRaja RajNoch keine Bewertungen

- FFFDokument2 SeitenFFFRaja RajNoch keine Bewertungen

- Notify RecruitmentDokument32 SeitenNotify RecruitmentJagan nivassNoch keine Bewertungen

- Conduct Certificate Radian PDFDokument1 SeiteConduct Certificate Radian PDFswarna BaiNoch keine Bewertungen

- Gurusamy ScanDokument7 SeitenGurusamy ScanRaja RajNoch keine Bewertungen

- (TT, VRL : G6Bpp 0 Dfu-D (SDokument2 Seiten(TT, VRL : G6Bpp 0 Dfu-D (SRaja RajNoch keine Bewertungen

- GOPALSSLCDokument2 SeitenGOPALSSLCRaja RajNoch keine Bewertungen

- Labar CanrketDokument1 SeiteLabar CanrketRaja RajNoch keine Bewertungen

- Vallammal 1Dokument2 SeitenVallammal 1Raja RajNoch keine Bewertungen

- Labar CanrketDokument1 SeiteLabar CanrketRaja RajNoch keine Bewertungen

- Guidelines For Opening of New Pradhan Mantri Bhartiya Janaushadhi Kendra (PMBJK)Dokument20 SeitenGuidelines For Opening of New Pradhan Mantri Bhartiya Janaushadhi Kendra (PMBJK)Raja RajNoch keine Bewertungen

- Vallammal 1Dokument1 SeiteVallammal 1Raja RajNoch keine Bewertungen

- Small Former CertificateDokument1 SeiteSmall Former CertificateRaja RajNoch keine Bewertungen

- Interest RatesDokument5 SeitenInterest Ratesagupta_16Noch keine Bewertungen

- Investment: A Study On The Alternatives in IndiaDokument45 SeitenInvestment: A Study On The Alternatives in Indiasayantan96Noch keine Bewertungen

- JK Cement LTD.: S W N SDokument5 SeitenJK Cement LTD.: S W N STeja_Siva_8909Noch keine Bewertungen

- Change of Financial YearDokument2 SeitenChange of Financial YearirfanNoch keine Bewertungen

- Assignment 10Dokument2 SeitenAssignment 10Management twoNoch keine Bewertungen

- Interview QuestionsDokument11 SeitenInterview QuestionsAshajyoti Sahoo100% (1)

- EY Sebi Listing Obligations and Disclosure Requirements Amendment Regulations 2018Dokument64 SeitenEY Sebi Listing Obligations and Disclosure Requirements Amendment Regulations 2018pankajddeore100% (1)

- Valuation: Dr. Kumar Bijoy Financial ConsultantDokument26 SeitenValuation: Dr. Kumar Bijoy Financial ConsultantrajanNoch keine Bewertungen

- Corporation Law Course Syllabus Part I - General ProvisionsDokument11 SeitenCorporation Law Course Syllabus Part I - General ProvisionsJani MisterioNoch keine Bewertungen

- CPR BY KGS Newsletter Issue 17Dokument5 SeitenCPR BY KGS Newsletter Issue 17ApNoch keine Bewertungen

- Contrarian CapDokument8 SeitenContrarian CapjamesbrentsmithNoch keine Bewertungen

- Test Paper Deduction From GtiDokument2 SeitenTest Paper Deduction From GtiAkshit GuptaNoch keine Bewertungen

- JPMorgan Chase London Whale GDokument15 SeitenJPMorgan Chase London Whale GMaksym ShodaNoch keine Bewertungen

- United States of America v. Prospero Ventures, L.P. - Document No. 28Dokument4 SeitenUnited States of America v. Prospero Ventures, L.P. - Document No. 28Justia.comNoch keine Bewertungen

- Amulya Kumar Verma 26asDokument4 SeitenAmulya Kumar Verma 26asSatyendra SinghNoch keine Bewertungen

- Roaring 20s PPDokument11 SeitenRoaring 20s PPapi-385685813Noch keine Bewertungen

- Online Trading Academy 23 - Course CurriculumDokument6 SeitenOnline Trading Academy 23 - Course Curriculumkabhijit0460% (5)

- Solutions Manual, Chapter 10: 2005 Mcgraw-Hill Ryerson Limited. All Rights Reserved. 416Dokument60 SeitenSolutions Manual, Chapter 10: 2005 Mcgraw-Hill Ryerson Limited. All Rights Reserved. 416salehin1969Noch keine Bewertungen

- Statement No.7 - ManilaDokument4 SeitenStatement No.7 - ManilaIyla Marie FerrerNoch keine Bewertungen

- BS Case StudiesDokument6 SeitenBS Case StudiesAnisha RohatgiNoch keine Bewertungen