Beruflich Dokumente

Kultur Dokumente

NZ Investment Transaction Monitor Sep 2010

Hochgeladen von

David PareiraOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

NZ Investment Transaction Monitor Sep 2010

Hochgeladen von

David PareiraCopyright:

Verfügbare Formate

CB RICHARD ELLIS

NZ Investment Transaction Monitor

www.cbre.co.nz/research September 2010

Six Monthly Total Investment Sales Volume ($5 Million+)

SUMMARY – FIRST HALF 2010 2.0 200

1.8 No. Sales 180

•Dramatic fall in sales numbers and volumes 1.6

$ Sales

160

Sales ($ Billions)

SALES

•Biggest decline ACTIVITY

in Wellington 2009 1.4 140

No. Of Sales

1.2 120

•A number of significant sales which have large bearing on trends 1.0 100

•Disposal of assets by managed funds a large contributor to sales 0.8 80

0.6 60

•Private purchasers still the most active 0.4 40

•Nearly half a billion dollars of overseas funds has exited NZ p 0.2 20

0.0 -

plproperty over the past two and a half years

The performance of the property market is reflected in a

number of market variables with total transaction volumes AUCKLAND

being one of the more prominent indicators. Our analysis The Auckland market is the largest, therefore has the

of sales covers transactions over $5 million in the Auckland, biggest influence on nationwide figures. The number of

Wellington and Christchurch regions for the various non sales halved, however due to some large deals, sales

residential investment property types. It covers both overall volumes were not hit as hard. There were 26 sales above

sales volume as well as a more detailed breakdown of $5 million amounting to $463 million.

activity by vendor and purchaser types, property sector and

The largest sale in the first half of 2010 was the sale of the

price stratum.

Deloitte Centre for $177 million. This was sold by

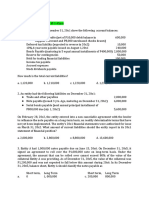

In the first half of 2010 (for sales above $5 million each) developer Brookfield Multiplex to Sabina Ltd and was the

there were 33 sales totaling $597 million. 2010 has seen largest ever sale of a single office building in New Zealand.

fewer sales compared to 2009, resulting in a lower volume The 23,000 sqm tower is leased to Deloitte, Bank of New

of transactions. However average transaction sizes have Zealand and True Alliance (Lacoste, Ben Sherman,

increased. Transaction volumes are only slightly better than Rockport and the North Face stores). The sale comes after

volumes recorded in 2008 when the market receded and being marketed for the past two years and this length of

the actual number of sales is the lowest since 2002. time indicates the lack of potential buyers in the current

Altogether, volumes over the past two and a half years market for large assets despite having strong

have been well down compared to the years leading up to fundamentals. This single sale contributed to 30% of the

the peak of the market in 2007. total sales volume in the first half of 2010.

1H 2010 2H 2009 Six month average over 5 years

Volume Volume Volume

No. Sales No. Sales No. Sales

($mill) ($mill) ($mill)

Auckland $463 26 $675 52 $786 55

Wellington $67 5 $171 13 $202 14

Christchurch $67 2 $37 4 $65 6

TOTAL $597 33 $883 69 $1,053 75

© 2010, CB Richard Ellis, Inc.

DETAILED SALES ANALYSIS 1H 10

NZ Investment Transactions Monitor MarketView

The next largest sale in the first half of 2010 was Dress

PROPERTY SECTOR

Smart Onehunga for $80 million as part of the $185

The office sector recorded the highest volume of sales

million Lend Lease deal to buy ING Retail Property

above $5 million, accounting for $254 million. The

Fund’s New Zealand assets. Both of these parties are

volume of retail transactions accounted for $244 million.

predominantly Australian owned. The deal included the

The industrial sector has performed worst over the first

acquisition of the Meridian Mall (Dunedin), and Dress

half of 2010 with total sales reaching only $99 million.

Smart outlet stores in Onehunga (Auckland), Tawa

Office sales have historically accounted for the highest

(Wellington) and Hornby (Christchurch).

proportion of sales, followed by industrial. However with

a number of shopping centres transacting in the first half

WELLINGTON

of 2010, the volume of retail transactions has been

Over the first half of 2010, total sales volume totaled

higher than industrial.

$67 million, well below the $171 million over the

second half of 2009. The largest sale in the first half of Sales By Property Sector

2010 was the sale of Morrison Kent House for $33 300

million. This was a mortgagee sale and was purchased

250

by the Farmers Trading Company. The Lambton Quay Sales ($ Millions)

200

Farmers store operates from retail portion the 23 storey

office building. The sale of two properties in Lower Hutt 150

by DNZ to Oyster Group were also a large contributor. 100

These were the sale of the Lower Hutt Bunnings store

50

and 266-274 High Street, which is leased to the Ministry

-

of Social Development and ACC.

Office Retail Industrial

CHRISTCHURCH LOCAL/FOREIGN VENDORS & PURCHASERS

Sales activity for property above $5 million also totaled In the first half of 2010 there has been a large outflow of

$67 million in the first half of 2010. This was the result foreign funds in New Zealand property. This is largely due

of two large retail sales. The largest was the sale of to the sale of assets by Brookfield Multiplex (Australia). The

South City Mall on Colombo Street for $34 million. It trends over the past two years are in stark contrast with the

was sold by Brookfield Multiplex to South City Holdings. period between 2006 and 2007, when there was a net

The mall includes anchor tenants, The Warehouse and inflow of nearly half a billion dollars worth of foreign funds

New World Supermarket. The other significant sale was into New Zealand property. However since then, nearly

the sale of Dress Smart Hornby for around $33 million half a billion dollars of foreign funds has flown out of New

as part of the $185 million Lend Lease deal to buy ING Zealand property through ownership changes of physical

Retail Property Fund’s New Zealand Assets. assets.

City By City Sales Volumes Comparison Net Inflow of Foreign Funds into NZ Property

1,800 300

Christchurch

1,600 Auckland 250

1,400 Wellington 200

150

Sales ($ Millions)

1,200

Sales ($ Millions)

100

1,000

50

800

-

600

-50

400 -100

200 -150

- -200

September 2010

© 2010, CB Richard Ellis, Inc.

due to developers making up a larger proportion as a

NZ Investment Transactions Monitor MarketView

VENDOR & PURCHASER TYPE PROFILES

result of the sale of The Deloitte Centre by developer

Looking at the profile of vendors, “Other Managed Brookfield Multiplex.

Funds” have been dominant. This is predominantly due

to large sell downs by Brookfield Multiplex and ING Looking at purchasers, investors account for 87% of

Retail Property Fund. We have classified DNZ as a sales volumes. Owner occupiers are the next largest

managed fund, however since their recent share market sector with 9%. Like in the past 2 years, developers once

listing, they will be classified as a listed property trust in again account for a very small proportion of the

the future. Private vendors contributed to 25% of all purchasers.

transactions, while mortgagee sales are still occurring,

Vendor Purpose Type

but make up only a small proportion of total sales at 5%.

Developer

40%

The majority of the active purchasers in the market have

once again been private. As a result of Lend Lease’s (ASX

listed) purchase of a number of shopping centres, listed

Owner

property trusts have featured, contributing 22% of total Occupier

2%

transaction volumes. The remaining transactions have Other

6%

been purchased by other managed funds, corporations Undisclosed

1%

and syndicates.

Investor

51%

Vendor Ownership Type

Purchaser Purpose Type

Private Developer

25% 2%

Owner

Occupier

Mortgagee In 9%

Possession

Other

5% Undisclosed

Managed Fund

66% Other 2%

1%

Undisclosed

1% Investor

Government 87%

2%

Purchaser Ownership Type

PRICE STRATUM

Syndicate

3% In the first half of 2010 there has been a large fall in

Undisclosed

2% transaction numbers across all price stratums. As the

Corporation chart shows below, transaction numbers are also well

4%

Private

65% below those in 2008 when the number of transactions fell

significantly.

Listed Property

Trust

22% Sales By Price Stratum

45

Other 1H 08

Managed Fund 40 2H 08

4%

35 1H 09

VENDOR & PURCHASER PURPOSE PROFILES 2H 09

30 1H 10

No. Sales

We also classify each party of the sale according to the 25

nature or purpose of their activity. Vendors who have 20

15

held for the purpose of investment account for half of

10

the total transaction volumes. This is significantly lower

5

than the average of 75% over the past two years and is

September 2010

0

$5-10 mill $10-15 mill $15-20 mill $20 mill +

© 2010, CB Richard Ellis, Inc.

NZ Investment Transactions Monitor MarketView

FOR MORE INFORMATION PLEASE CONTACT:

CONCLUSION

Greater uncertainty and loss of sentiment around the CB Richard Ellis

Research & Consulting

economic outlook contributed to a loss of momentum in

the property investment market. Added to this, Zoltan Moricz, Senior Director

uncertainty over tax changes prior to the 2010 budget zoltan.moricz@cbre.co.nz

made many buyers hold back. With commercial Craig Wong, Senior Research Analyst

property being less adversely impacted than many craig.wong@cbre.co.nz

expected by the tax changes, some of the prior hurdles in AUCKLAND HAMILTON

the investment market have waned. However, a large Level 14, 21 Queen Street Cnr Te Rapa Road & Forest

Auckland 1010 Lake Road

proportion of the properties offered on the investment PO Box 2723 Hamilton 3200

market are of weak fundamentals and most potential Auckland 1140 PO Box 1330

T 64 9 355 3333 Hamilton 3240

buyers have not been prepared to take on the risk these F 64 9 355 3330 T 64 7 850 3333

properties carry. Sales of larger assets remains difficult F 64 7 850 3330

WELLINGTON

as indicated by the lack of concluded sales for a number ASB Bank Tower SOUTH AUCKLAND

Level 12, 2 Hunter Street 7A Pacific Rise

of properties marketed since 2009. On the other hand,

Wellington 6011 Mt Wellington

cashed up private individuals with preferences for certain PO Box 5053 Auckland 1060

Wellington 6145 PO Box 11 2241 Penrose

property types in lower price stratums are willing to pay a T 64 4 499 8899 Auckland 1060

premium at yields which only provide slightly better F 64 4 499 8889 T 64 9 573 3333

F 64 9 573 3330

returns than risk free alternatives to property. The CHRISTCHURCH

proportion of mortgagee sales has been relatively stable PwC Centre NORTH AUCKLAND

Level 6, 119 Armagh Street Unit 8, 35 Apollo Drive

at around 5% of total transaction volumes for each of the Christchurch 8011 Mairangi Bay

PO Box 13643 Auckland 1080

last three 6 month periods. This may increase as

Christchurch 8141 PO Box 33 1080

receivers work through the complexities of some larger T 64 3 374 9889 Takapuna

F 64 3 374 9884 T 64 9 984 3333

holdings and portfolios. Also, with the seasonal trend of F 64 9 984 3330

more activity in the latter part of the year we could see

the number of sales increase in the second half of 2010.

PLEASE NOTE

•This report covers the sale of physical assets and excludes the

purchase of equity stakes in holding companies.

•Due to the complexity and confidentiality of large

transactions, details of transactions will often surface months

after they take place, therefore transaction details will be

historically adjusted when new details surface.

•For our analysis, transaction date reflects the unconditional

date announced by the parties concerned.

•All detailed sales analysis is based on total sales volumes,

apart from analysis of price stratum, which is based on sales

numbers.

This publication is intended for general guidance only and no responsibility is accepted by CB Richard Ellis for any omissions or errors. The

information contained herein should not be relied upon to replace professional advice on specific matters. This publication is the subject of

copyright protection. All rights reserved. No part of this publication may in any form or by any means (electronic, mechanical, photocopying,

recording or otherwise), be reproduced, stored in a retrieval system or transmitted to any other person, without our specific written

September 2010

permission.

© 2010, CB Richard Ellis, Inc.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- TPA Deals Only With Immovable Property'Dokument17 SeitenTPA Deals Only With Immovable Property'Prachi Verma0% (1)

- The Role of ESG Scoring and Greenwashing Risk in Explaining The Yields of Green Bonds - A Conceptual Framework and An Econometric AnalysisDokument16 SeitenThe Role of ESG Scoring and Greenwashing Risk in Explaining The Yields of Green Bonds - A Conceptual Framework and An Econometric AnalysisEdna AparecidaNoch keine Bewertungen

- ALCO For A BankDokument66 SeitenALCO For A BankHarsh Monga100% (1)

- Oman Issues Executive Regulations for Income Tax LawDokument44 SeitenOman Issues Executive Regulations for Income Tax LawavineroNoch keine Bewertungen

- 9 Factors To Consider When Comparing McKinsey - Bain - BCG - Management ConsultedDokument7 Seiten9 Factors To Consider When Comparing McKinsey - Bain - BCG - Management ConsultedTarekNoch keine Bewertungen

- Test Transfer IPV To InventoryDokument17 SeitenTest Transfer IPV To Inventorykallol_panda1Noch keine Bewertungen

- MCQ NpoDokument6 SeitenMCQ NpoSurya ShekharNoch keine Bewertungen

- Managing Costs and Pricing Strategies for a UniversityDokument2 SeitenManaging Costs and Pricing Strategies for a UniversityAdeirehs Eyemarket BrissettNoch keine Bewertungen

- RevenueDokument105 SeitenRevenueanbugobiNoch keine Bewertungen

- ResultsDokument16 SeitenResultsURVASHINoch keine Bewertungen

- Philippine Taxation History and SystemDokument58 SeitenPhilippine Taxation History and SystemThea MallariNoch keine Bewertungen

- Al-Baraka Islamic Bank Internship ReportDokument69 SeitenAl-Baraka Islamic Bank Internship Reportbbaahmad89100% (8)

- This Is A Complete, Comprehensive and Single Document Promulgated by IASB Establishing The Concepts That Underlie Financial ReportingDokument9 SeitenThis Is A Complete, Comprehensive and Single Document Promulgated by IASB Establishing The Concepts That Underlie Financial ReportingFelsie Jane PenasoNoch keine Bewertungen

- Account StatementDokument12 SeitenAccount StatementGajendra Khileri GajrajNoch keine Bewertungen

- Haryana SSC Staff Selection ReceiptDokument1 SeiteHaryana SSC Staff Selection ReceiptAshu BansalNoch keine Bewertungen

- UG BCom Pages DeletedDokument22 SeitenUG BCom Pages DeletedVijeta SinghNoch keine Bewertungen

- Civ Pro Q&ADokument7 SeitenCiv Pro Q&ASGTNoch keine Bewertungen

- 028 Ptrs Modul Matematik t4 Sel-96-99Dokument4 Seiten028 Ptrs Modul Matematik t4 Sel-96-99mardhiah88Noch keine Bewertungen

- BillSTMT 4588260000514267Dokument3 SeitenBillSTMT 4588260000514267Fahad AhmedNoch keine Bewertungen

- Professional Associates The Valuation and Muccadam Company of Asif SahuDokument8 SeitenProfessional Associates The Valuation and Muccadam Company of Asif Sahuasifsahu100% (1)

- Aeropostale Checkout ConfirmationDokument3 SeitenAeropostale Checkout ConfirmationBladimilPujOlsChalasNoch keine Bewertungen

- Cs White Paper Family Office Dynamic Pathway To Successful Family and Wealth Management Part 2 - enDokument36 SeitenCs White Paper Family Office Dynamic Pathway To Successful Family and Wealth Management Part 2 - enKrishna PrasadNoch keine Bewertungen

- 12 Swedish Match Philippines Inc. vs. The Treasurer of The City of ManilaDokument2 Seiten12 Swedish Match Philippines Inc. vs. The Treasurer of The City of ManilaIrene Mae GomosNoch keine Bewertungen

- A Brief History of BankingDokument42 SeitenA Brief History of Bankingtasaduq70% (1)

- Important InfoDokument6 SeitenImportant InfoPraveen BabuNoch keine Bewertungen

- Https WWW - Irctc.co - in Eticketing PrintTicketDokument1 SeiteHttps WWW - Irctc.co - in Eticketing PrintTicketKalyan UppadaNoch keine Bewertungen

- Bank Nizwa Summary Prospectus (English)Dokument13 SeitenBank Nizwa Summary Prospectus (English)Mwangu KibikeNoch keine Bewertungen

- Test 2 FarDokument3 SeitenTest 2 FarMa Jodelyn RosinNoch keine Bewertungen

- Amended Guidelines Abot-Kamay Pabahay Program'Dokument30 SeitenAmended Guidelines Abot-Kamay Pabahay Program'Ge-An Moiseah Salud AlmueteNoch keine Bewertungen