Beruflich Dokumente

Kultur Dokumente

Lesson On Financial Analysis

Hochgeladen von

cassie0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

62 Ansichten3 SeitenFinancial Management

Originaltitel

Lesson on Financial Analysis

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenFinancial Management

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

62 Ansichten3 SeitenLesson On Financial Analysis

Hochgeladen von

cassieFinancial Management

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

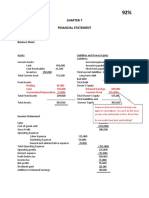

LESSON ON FINANCIAL ANALYSIS

1. Current ratio 2.1

Quick ratio 1.9

Current liabilities 1,950,000.0

Compute for the amount of inventories.

Assume current assets is only composed of cash,

short term investments, receivables, and inventories.

2. Quick ratio 1.7

Cash ratio 1.4

Current liabilities 2,350,000.0

Receivables amount is 40% more than short term investments.

Compute for the amount of short term investments.

Assume current assets is only composed of cash,

short term investments, receivables, and inventories.

3. ARTO 19.5

Receivables, beginning 11,250,000.0

Receivables, ending 12,478,000.0

Compute for net annual sales.

4. ARTO 15.4

Receivables, beginning 10,983,000.0

Receivables, ending 11,473,000.0

Sales returns and allowances 450,000.0

Sales discounts 630,000.0

Compute for the gross sales.

5. Gross sales 12,250,000.0

Sales returns and allowances 250,000.0

Sales discounts 179,520.0

Average receivables 5,350,000.0

Compute for the days sales outstanding

6. Inventory Turnover 6.5

Inventory, beginning 985,000.0

Inventory, end 1,011,000.0

Compute for the COGS

7. Inventory Turnover 7.1

Inventory, beginning 1,014,000.0

Inventory, end 1,124,000.0

Compute for the purchases

8. Gross sales 14,785,000.0

Sales returns and allowances 356,000.0

Sales discounts 189,741.0

Average receivables 6,987,452.0

Inventory, beginning 1,147,000.0

Inventory, end 1,165,452.0

Purchases 9,654,125.0

Freight in 785,410.0

Payables, beginning 1,598,741.0

Payables, end 1,011,236.0

Compute for the cash conversion cycle

9. Total asset turnover 2.2

Fixed asset turnover 3.1

Gross sales 11,254,000.0

Sales returns and allowances 2,258,000.0

Sales discounts 1,269,000.0

Compute for the amount of net current assets

10. Total asset turnover 1.8

Total equity turnover 2.3

Compute for the debt ratio

11. Total asset turnover 1.5

Total equity turnover 2.6

Fixed asset turnover 2.1

Net sales 11,250,000.0

Current ratio 1.1

Compute for the current liabilities

12. Return on Equity 15%

Total assets 9,500,000.0

Total asset turnover 1.4

Net income ratio 9%

Compute for the equity

13. Gross profit margin 29%

EBITDA margin 18%

EBIT margin 14%

Cost of goods sold 6,782,000.00

Compute for depreciation & amortization expense

14. Total assets 9,500,000.0

Debt ratio 40%

Capital infusion for new investment project 7,500,000.0

Compute for the optimal funding mix to maintain current debt level

15. Total equity turnover 2.4

EBITDA margin 16%

Cost of goods sold 17,842,000.0

Total equity 15,123,000.0

Compute for the Operating expenses (except ITDA)

Das könnte Ihnen auch gefallen

- Equity Valuation: Models from Leading Investment BanksVon EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNoch keine Bewertungen

- Test 2 Financial MGTDokument4 SeitenTest 2 Financial MGTBervie RondonuwuNoch keine Bewertungen

- Solution Key To Problem Set 1Dokument6 SeitenSolution Key To Problem Set 1Ayush RaiNoch keine Bewertungen

- Test 2 Financial - Analysis (Bervie Rondonuwu)Dokument5 SeitenTest 2 Financial - Analysis (Bervie Rondonuwu)Bervie RondonuwuNoch keine Bewertungen

- Hira Karim Malik Section B - Financial Ratios Practice AssignmentDokument7 SeitenHira Karim Malik Section B - Financial Ratios Practice AssignmenthirakmalikNoch keine Bewertungen

- Chapter 8Dokument14 SeitenChapter 8Kanton FernandezNoch keine Bewertungen

- Chapter 7 Financial Statement and RatiosDokument2 SeitenChapter 7 Financial Statement and RatiosChara etangNoch keine Bewertungen

- Quiz-FS AnalysisDokument3 SeitenQuiz-FS AnalysisVergel MartinezNoch keine Bewertungen

- Chapter 1 Part IIDokument42 SeitenChapter 1 Part IIworkiemelkamu400Noch keine Bewertungen

- 04 Edu91 FM Practice Sheets FM Solution (Not To Print)Dokument154 Seiten04 Edu91 FM Practice Sheets FM Solution (Not To Print)Krutarth VyasNoch keine Bewertungen

- M1 C2 Case Study WorkbookDokument25 SeitenM1 C2 Case Study WorkbookfenixaNoch keine Bewertungen

- Solution For FM Extra QuestionsDokument130 SeitenSolution For FM Extra Questionsdeepu deepuNoch keine Bewertungen

- Name of RatioDokument4 SeitenName of RatioRianna Reham UsmanNoch keine Bewertungen

- Afm ReportDokument4 SeitenAfm ReportSarvagya ChaturvediNoch keine Bewertungen

- Financial ASSI 1Dokument7 SeitenFinancial ASSI 1Karim YousryNoch keine Bewertungen

- Assignment - Financial Statement Analysis GROUP 1Dokument2 SeitenAssignment - Financial Statement Analysis GROUP 1Keana Cassandra Tobias100% (1)

- Ratio AnalysisDokument11 SeitenRatio AnalysisAna Marie EscoridoNoch keine Bewertungen

- MS04Dokument34 SeitenMS04Varun MandalNoch keine Bewertungen

- DifferenceDokument10 SeitenDifferencethalibritNoch keine Bewertungen

- Horizontal and Vertical Analysis of Financial StatementsDokument3 SeitenHorizontal and Vertical Analysis of Financial StatementsJazzy CozyNoch keine Bewertungen

- HO No. 1 - Financial Statements AnalysisDokument3 SeitenHO No. 1 - Financial Statements AnalysisJOHANNANoch keine Bewertungen

- ch09-Inventories-Additional Valuation IssuesDokument50 Seitench09-Inventories-Additional Valuation IssuesrenandanfNoch keine Bewertungen

- Case Ratios and Financial Planning at EaDokument6 SeitenCase Ratios and Financial Planning at EaAgus E. SetiyonoNoch keine Bewertungen

- Bhieee Company Statement of Financial Position 31-Dec-19Dokument6 SeitenBhieee Company Statement of Financial Position 31-Dec-19Ace ClarkNoch keine Bewertungen

- Chapter 7. Student CH 7-14 Build A Model: AssetsDokument5 SeitenChapter 7. Student CH 7-14 Build A Model: Assetsseth litchfieldNoch keine Bewertungen

- Work Sheet RatiosDokument4 SeitenWork Sheet Ratiosmohammad mueinNoch keine Bewertungen

- Section A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesDokument7 SeitenSection A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesgeofreyNoch keine Bewertungen

- Mini Case: Ratio and Financial Planning at East Coast YachtsDokument9 SeitenMini Case: Ratio and Financial Planning at East Coast YachtsricaNoch keine Bewertungen

- Financial Statement Analysis QuizDokument1 SeiteFinancial Statement Analysis QuizJoeNoch keine Bewertungen

- Comparative Financial Statements: Heritage Antiquing Services Comparative Balance Sheet (Dollars in Thousands)Dokument2 SeitenComparative Financial Statements: Heritage Antiquing Services Comparative Balance Sheet (Dollars in Thousands)Rose BaynaNoch keine Bewertungen

- Casos Analisis de PerformanceDokument4 SeitenCasos Analisis de PerformanceJohan UsecheNoch keine Bewertungen

- Learning Activity 1 - Analysis of Financial StatementsDokument3 SeitenLearning Activity 1 - Analysis of Financial StatementsAra Joyce PermalinoNoch keine Bewertungen

- DBA401 - CS221051: Balance Sheet AssetsDokument10 SeitenDBA401 - CS221051: Balance Sheet AssetsAian Kit Jasper SanchezNoch keine Bewertungen

- BusFin PT 4Dokument2 SeitenBusFin PT 4Nadjmeah AbdillahNoch keine Bewertungen

- Zach Industries Financial Ratio AnalysisDokument2 SeitenZach Industries Financial Ratio AnalysisCarla RománNoch keine Bewertungen

- Exercises For Chapter 23 EFA2Dokument13 SeitenExercises For Chapter 23 EFA2tuananh leNoch keine Bewertungen

- Scrap 5Dokument14 SeitenScrap 5Bryent GawNoch keine Bewertungen

- Fin 621Dokument3 SeitenFin 621animations482047Noch keine Bewertungen

- Financial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDDokument10 SeitenFinancial Modeling and Pro Forma Analysis: © 2019 Pearson Education LTDLeanne TehNoch keine Bewertungen

- Wa0035.Dokument5 SeitenWa0035.Barack MikeNoch keine Bewertungen

- Managerial Finance - Midterm ExamDokument4 SeitenManagerial Finance - Midterm ExamNerissaNoch keine Bewertungen

- Spring 2009 NBA 5060 Lectures 9 - Pro Forma Financial Statements & Forecasting IIDokument10 SeitenSpring 2009 NBA 5060 Lectures 9 - Pro Forma Financial Statements & Forecasting IIbat0oNoch keine Bewertungen

- Working Cap - MGMT Questions SolutionDokument13 SeitenWorking Cap - MGMT Questions Solutioncmverma8250% (4)

- PpoDokument60 SeitenPpoyovitaNoch keine Bewertungen

- Working Cap MGMT Questions SolutionDokument13 SeitenWorking Cap MGMT Questions SolutionElin SaldañaNoch keine Bewertungen

- Installment Sales Consignment Sales Construction ContractsDokument4 SeitenInstallment Sales Consignment Sales Construction ContractsShaene GalloraNoch keine Bewertungen

- Finman ProblemDokument16 SeitenFinman ProblemKatrizia FauniNoch keine Bewertungen

- Ch02 P14 Build A Model SolutionDokument6 SeitenCh02 P14 Build A Model SolutionSeee OoonNoch keine Bewertungen

- CH 09Dokument32 SeitenCH 09huu nguyenNoch keine Bewertungen

- Finance Quiz 3Dokument43 SeitenFinance Quiz 3Peak ChindapolNoch keine Bewertungen

- Management Accounting Final ExamDokument4 SeitenManagement Accounting Final Examacctg2012Noch keine Bewertungen

- Income Statement TaskDokument5 SeitenIncome Statement Taskiceman2167Noch keine Bewertungen

- Quiz 1Dokument2 SeitenQuiz 1jevieconsultaaquino2003Noch keine Bewertungen

- Tugas 4 MK 1Dokument2 SeitenTugas 4 MK 1Blebeblep LandNoch keine Bewertungen

- Financial Statement Analysis and Ratio CalculationsDokument3 SeitenFinancial Statement Analysis and Ratio CalculationsUrooj MustafaNoch keine Bewertungen

- Chapter 6 Financial Analysis 2Dokument6 SeitenChapter 6 Financial Analysis 2Syrill CayetanoNoch keine Bewertungen

- Inventories Notes2 170419181823Dokument28 SeitenInventories Notes2 170419181823Ebsa AdemeNoch keine Bewertungen

- For Students - Interpretation of FS - Ratio Analysis - Example, ExercisesDokument10 SeitenFor Students - Interpretation of FS - Ratio Analysis - Example, ExercisesdimniousNoch keine Bewertungen

- Neale Corp Financials & RatiosDokument4 SeitenNeale Corp Financials & RatioskerryNoch keine Bewertungen

- Accounting principles and financial statements quizDokument5 SeitenAccounting principles and financial statements quizKaan SuersanNoch keine Bewertungen

- Abington-Hill Toys Financial Ratio Analysis Reveals High Risk ConditionDokument6 SeitenAbington-Hill Toys Financial Ratio Analysis Reveals High Risk ConditionYafei Zhang100% (1)

- AccountingDokument3 SeitenAccountingVirginia Concepcion JobliNoch keine Bewertungen

- Statement of Comprehensive Income Cost of Goods Sold and Operating Expenses Problem 4-1 (AICPA Adapted)Dokument11 SeitenStatement of Comprehensive Income Cost of Goods Sold and Operating Expenses Problem 4-1 (AICPA Adapted)Clarisse PelayoNoch keine Bewertungen

- Name: ID Number:: Prepared By: Nur Liyana Mohamed YousopDokument2 SeitenName: ID Number:: Prepared By: Nur Liyana Mohamed YousopNabila MasriNoch keine Bewertungen

- Full PFRS Illustrative Financial Statements 2018Dokument126 SeitenFull PFRS Illustrative Financial Statements 2018Jake Aseo BertulfoNoch keine Bewertungen

- Finance Project ReportDokument7 SeitenFinance Project Reporthamzaa mazharNoch keine Bewertungen

- Merchandising Accounting Cycle: Periodic: Subject-Descriptive Title Subject - CodeDokument22 SeitenMerchandising Accounting Cycle: Periodic: Subject-Descriptive Title Subject - CodeRose LaureanoNoch keine Bewertungen

- CapstoneDokument3.306 SeitenCapstoneVan Sj TYnNoch keine Bewertungen

- Issues in Partnership Accounts: Basic ConceptsDokument40 SeitenIssues in Partnership Accounts: Basic Conceptsjsus22Noch keine Bewertungen

- Financial Accounting: Volume 3 Summary ValixDokument10 SeitenFinancial Accounting: Volume 3 Summary ValixPrincess KayNoch keine Bewertungen

- Problem Set A SolutionsDokument17 SeitenProblem Set A SolutionsJack ThuanNoch keine Bewertungen

- FABM1 Q4 Module 1Dokument23 SeitenFABM1 Q4 Module 1Earl Christian BonaobraNoch keine Bewertungen

- Fundamentals of Accounting 1Dokument15 SeitenFundamentals of Accounting 1Estacio B. Iraida Juna100% (1)

- Pangasinan Executive Summary 2021Dokument5 SeitenPangasinan Executive Summary 2021luibrilNoch keine Bewertungen

- FAR139 FAR 139 Cash and Accrual BasisDokument4 SeitenFAR139 FAR 139 Cash and Accrual BasisJuniah MyreNoch keine Bewertungen

- (Fabm 2) - m1 - Lolo-GatesDokument6 Seiten(Fabm 2) - m1 - Lolo-GatesCriestefiel LoloNoch keine Bewertungen

- Mother Molly Childcare 1Dokument13 SeitenMother Molly Childcare 1Kashém0% (1)

- Financial Reporting & AnalysisDokument6 SeitenFinancial Reporting & AnalysisrakeshNoch keine Bewertungen

- Klabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Dokument66 SeitenKlabin S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Klabin_RINoch keine Bewertungen

- Bsa Midterm Graded Exercises From Worksheet To Financial Statements FinalDokument4 SeitenBsa Midterm Graded Exercises From Worksheet To Financial Statements FinalGarp BarrocaNoch keine Bewertungen

- Lupin, 4th February, 2013Dokument11 SeitenLupin, 4th February, 2013Angel BrokingNoch keine Bewertungen

- Teresita Buenaflor shoes journal entriesDokument18 SeitenTeresita Buenaflor shoes journal entriesCyruz Jared RamosNoch keine Bewertungen

- 14Dokument9 Seiten14Rudine Pak MulNoch keine Bewertungen

- Accounting 2Dokument157 SeitenAccounting 2Christian Terens AblangNoch keine Bewertungen

- Accounting Practice MCQ Set 1Dokument3 SeitenAccounting Practice MCQ Set 1Waseem YousfNoch keine Bewertungen

- Management Accounting Mcqs First ModuleDokument86 SeitenManagement Accounting Mcqs First ModuleBhavik RathodNoch keine Bewertungen

- Introduction to Basic AccountingDokument6 SeitenIntroduction to Basic AccountingJon Nell Laguador Bernardo100% (1)

- Advanced Accounting - Partnership DissolutionDokument13 SeitenAdvanced Accounting - Partnership DissolutionJamaica May Dela Cruz100% (3)

- Safal Niveshak Stock Analysis Excel Ver 50 How To Use This Spreadsheet PDF FreeDokument49 SeitenSafal Niveshak Stock Analysis Excel Ver 50 How To Use This Spreadsheet PDF Freeraj110Noch keine Bewertungen