Beruflich Dokumente

Kultur Dokumente

6073q2 Specimen Economics

Hochgeladen von

Troden MukwasiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

6073q2 Specimen Economics

Hochgeladen von

Troden MukwasiCopyright:

Verfügbare Formate

ZIMBABWE SCHOOL EXAMINATIONS COUNCIL

General Certificate of Education Advanced Level

ECONOMICS 6073/2

PAPER 2 Data Response

SPECIMEN PAPER 1 hour 15 minutes

Additional materials:

Answer paper

TIME 1 hour 15 minutes

INSTRUCTIONS TO CANDIDATES

Write your name, centre number and candidate number in the spaces provided on the answer

paper/answer booklet.

Answer both questions.

Write your answers on the separate answer paper provided.

If you use more than one sheet of paper, fasten the sheets together.

Brief answers only are required.

INFORMATION FOR CANDIDATES

The questions in this paper carry equal marks. The number of marks is given in brackets [ ] at the end of

each part question.

You should spend at least five minutes reading through the data for each question before you begin

writing your answers.

This specimen paper consists of 4 printed pages.

Copyright: Zimbabwe School Examinations Council, Specimen Paper.

©ZIMSEC SPECIMEN PAPER [Turn over

2

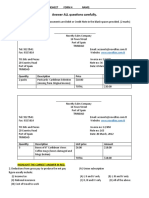

1 Study the extract below and answer the questions that follow.

A rise in demand for raw materials could herald better times for African producers.

The biggest news in the African and global mining sectors is the ongoing recovery in the

price of mining commodities. This generates more income and employment for mining

firms and commodity exporting countries, and also has profound implications for planned

and postponed projects. What began as a rise in demand for coking coal and a modest

improvement in the outlook for the commodity hungry Chinese economy has broadened

out into a more optimistic view of the entire African mining Industry’s prospects.

The recovery has now extended to copper. Prices have risen from $4 300 a tonne in

January 2016 to $5 934 on 15 January this year. Recovering Chinese demand is in large

part responsible for the rise in copper prices. China,which accounts for 45% global

copper consumption, imported a record 16.96m tonnes of copper concentrate in 2016, up

28% from previous year plus 4.95m tonnes of refined copper, a 2.9% rise on the 2015

figure.

Apart from China, the electoral victory of Donald Trump as president of the United

States has also contributed to the recovery in commodity prices. He has drawn up plans

for a $500bn infrastructural programme to create jobs and boost growth in the world’s

biggest economy. This will increase demand for copper as well as many metals.

Source: African Business: February 2017

(a) (i) What is the difference between a rise in demand and an

increase in quantity demanded. [2]

(ii) With reference to the article, explain how America contributed

to a rise in commodity prices. [2]

(b) (i) Calculate the percentage increase in the price of copper between

January 2016 and January 2017. [2]

(ii) Using a diagram, explain how a rise in demand for mining

commodities result in improvement in their prices. [4]

(c) Analyse the effects of an increase in commodity prices to African

economies. [4]

(d) Evaluate the importance of value addition to the mining industry. [6]

6073/2 SPECIMEN PAPER

3

2 Read the passage below and answer the questions that follow:

Foreign Investors to get tax incentives

Government has agreed to offer tax incentives to foreign investors willing to invest in

companies that currently require huge capital injection.

In an interview with the Herald Business yesterday, Finance and Economic Development

Deputy Minister Dr Samuel Undege said a team from different ministries was in Nyanga

discussing the possible incentives that can be rolled out to investors.

“It’s for the country’s benefit if Government comes up with incentives that can promote

foreign direct investment. We need to lure investors into the country and the only way it

can be done is through the creation of an investor-friendly environment.

“A special package of incentives is set to lure investors and help revive the country’s

ailing firms, which are at the heart of the new economic blue-print, the Zimbabwe

Agenda for Sustainable Socio-Economic Transformation (Zim-Asset),” said Dr Undege.

He said efforts to provide tax incentives for investors are at an advanced stage with a

strategic paper set to be presented before Cabinet soon.

Analysts have said the country needs to create a conducive business environment with

lower tax levels and tax breaks than those prevailing within the SADC region, giving the

country an obvious advantage.

“Ireland is one such country that has attracted international corporations because of a low

tax rate of about 12,5 percent. With a favourable tax regime the country is bound to

attract a few corporate head offices or administrative offices for global corporations

targeting Africa. For instance, Facebook is seriously looking into opening an African

office. This in part is job creation (the promised two million jobs under Zim-Asset) and

tax revenue,” said economist MrNyashaHwata.

Dr Undege said giving incentives to investors was in line with plans to establish special

economic zones.

“As you can see companies like the National Railways of Zimbabwe require huge capital

injection, therefore all interested investors are certainly going to get incentives,” Dr

Undege said.

6073/2 SPECIMEN PAPER

[Turn over

4

Government plans to set up special economic zones in the country with Bulawayo and

Manicaland set to be conferred with the status.

Setting up a SEZ would entail implementation of enabling or attractive policy in the form

of tax exemptions or tax holidays for companies operating in certain industries, e.g.

manufacturing sector or real estate, tax exemptions on export profits for companies

operating within the zone and tariff reduction or subsidies. Such provisions would then

attract investors to set up shop in an area and consequently revive the industry landscape

there.

In pursuit of this goal a Cabinet update paper has been prepared by the Ministry of

Finance and Economic Development to be presented before the Cabinet on the progress

done so far.

Source: The Business Herald; 15 May 2014, Page B1

(a) (i) What is meant by “foreign direct investment”?

[2]

(ii) Explain the relationship between taxation and investment.

[2]

(b) (i) Explain the immediate impact of tax exemptions on government

budget.

[2]

(ii) With reference to the extract, explain two ways the society can benefit

from a favourable tax regime.

[4]

(c) Analyse any two non-fiscal policy measures government can pursue to

attract foreign investors. [4]

(d) Discuss the possible consequences of foreign direct investment on the

Zimbabwean economy. [6]

6073/2 SPECIMEN PAPER

Das könnte Ihnen auch gefallen

- A' Level Economics P2 Nov 2002-1Dokument3 SeitenA' Level Economics P2 Nov 2002-1Remy DeezNoch keine Bewertungen

- 4001q 1specimen PDFDokument8 Seiten4001q 1specimen PDFtino higaNoch keine Bewertungen

- O-Levels Mathematics 2020 PDFDokument19 SeitenO-Levels Mathematics 2020 PDFPrethee HlongwaneNoch keine Bewertungen

- ICT - Infant - ECD A - GRADE 2 PDFDokument28 SeitenICT - Infant - ECD A - GRADE 2 PDFShalom CharambaNoch keine Bewertungen

- Natural Regions of ZimDokument2 SeitenNatural Regions of Zimmsamala0950% (2)

- Zimbabwe: NumberDokument7 SeitenZimbabwe: NumberShingie We ArsenalNoch keine Bewertungen

- Economics Blue BookDokument12 SeitenEconomics Blue BookDuncan MadzvaraNoch keine Bewertungen

- APA Business Enterprise F2 SampleDokument42 SeitenAPA Business Enterprise F2 SampleMalcolm CharidzaNoch keine Bewertungen

- Commerce SS2Dokument17 SeitenCommerce SS2adesuwaNoch keine Bewertungen

- General Paper UACEDokument5 SeitenGeneral Paper UACEArthur FredovicNoch keine Bewertungen

- ECOP101B - Exam M - 1-2019 - Economic Principles 1Dokument9 SeitenECOP101B - Exam M - 1-2019 - Economic Principles 1Gift Simau100% (1)

- O-Levels Mathematics 2014Dokument74 SeitenO-Levels Mathematics 2014sandieletasNoch keine Bewertungen

- Population Distribution Dodoma Region 2012Dokument505 SeitenPopulation Distribution Dodoma Region 2012Steven Kisamo AmbroseNoch keine Bewertungen

- Accounting PP2 June 2014Dokument18 SeitenAccounting PP2 June 2014Marcelyn MagumiseNoch keine Bewertungen

- ICT hardware debrisDokument8 SeitenICT hardware debrisMuramCoNoch keine Bewertungen

- 4050Q2 Specimen EconomicsDokument4 Seiten4050Q2 Specimen EconomicsBrãñdøn DzîñgáíNoch keine Bewertungen

- Zimsec Nov 2003 Paper 1 and 2-1Dokument9 SeitenZimsec Nov 2003 Paper 1 and 2-1Emily Ncube0% (1)

- Business Studies NotesDokument328 SeitenBusiness Studies Notesjungleman marandaNoch keine Bewertungen

- CBZ Holdings 2019 Annual Report PDFDokument160 SeitenCBZ Holdings 2019 Annual Report PDFWebSter NyandoroNoch keine Bewertungen

- Growth Points in Zimbabwe: A Compendium of Infrastructure ProvisionDokument28 SeitenGrowth Points in Zimbabwe: A Compendium of Infrastructure ProvisiontongaiNoch keine Bewertungen

- Farm Structures in Tropical Climates - Ch1Dokument11 SeitenFarm Structures in Tropical Climates - Ch1Kevin YaptencoNoch keine Bewertungen

- Difference Between Home Trade and Foreign TradeDokument4 SeitenDifference Between Home Trade and Foreign TradenicolaNoch keine Bewertungen

- Lease vs Buy Decision for Virtual Learning EquipmentDokument2 SeitenLease vs Buy Decision for Virtual Learning Equipmentngoniwessy0% (1)

- Lesson 2, SHONA vocabulary and grammarDokument7 SeitenLesson 2, SHONA vocabulary and grammarhilton magagadaNoch keine Bewertungen

- BF 120Dokument11 SeitenBF 120Dixie Cheelo100% (1)

- 2nd Term s3 EconomicsDokument22 Seiten2nd Term s3 EconomicsFaith OzuahNoch keine Bewertungen

- Practical Questions Fro Both Ordinary and Advanced Level by Nkoyoyo EdwardDokument188 SeitenPractical Questions Fro Both Ordinary and Advanced Level by Nkoyoyo EdwardnkoyoyoedwardNoch keine Bewertungen

- Future Step PitchdeckDokument10 SeitenFuture Step PitchdeckParimal B ShahNoch keine Bewertungen

- Beef Production For Smallholder Farmers in Zimbabwe (Shona)Dokument101 SeitenBeef Production For Smallholder Farmers in Zimbabwe (Shona)Nyasha VincentNoch keine Bewertungen

- BBFH209Dokument152 SeitenBBFH209Tawanda Tatenda HerbertNoch keine Bewertungen

- PlusOne Mathematics Grade 7 SampleDokument60 SeitenPlusOne Mathematics Grade 7 Sampletme8806 tkNoch keine Bewertungen

- Kwekwe Polytechnic: CANDIDATE NUMBER: 0771741280 HND May Information Technology (2018-2019)Dokument1 SeiteKwekwe Polytechnic: CANDIDATE NUMBER: 0771741280 HND May Information Technology (2018-2019)lastmadanhireNoch keine Bewertungen

- Export IncentivesDokument42 SeitenExport Incentivespriya2210Noch keine Bewertungen

- Term 1 - Paper 1 Grade 6Dokument8 SeitenTerm 1 - Paper 1 Grade 6sandhya srinivasanNoch keine Bewertungen

- CRE S.4 NCDC Simplified Guide Notes SampleDokument16 SeitenCRE S.4 NCDC Simplified Guide Notes Samplejamesdrichi999100% (1)

- O Maths J 2017 2 1Dokument30 SeitenO Maths J 2017 2 1EvansNoch keine Bewertungen

- Docs 20220817-StatisticsDokument7 SeitenDocs 20220817-StatisticsPeaarson GuveyaNoch keine Bewertungen

- BBFH405Dokument165 SeitenBBFH405LeslieNoch keine Bewertungen

- BBFH202Dokument196 SeitenBBFH202Tawanda Tatenda Herbert100% (1)

- Firms & Individuals in Product & Factor MarketsDokument32 SeitenFirms & Individuals in Product & Factor MarketsEswar Sai VenkatNoch keine Bewertungen

- SS3 Subject Notes On Geography For SS3Dokument9 SeitenSS3 Subject Notes On Geography For SS3samuel joshuaNoch keine Bewertungen

- Opportunities For The Private Sector in The Climate Sector in TanzaniaDokument3 SeitenOpportunities For The Private Sector in The Climate Sector in TanzaniaAnonymous FnM14a0Noch keine Bewertungen

- Quizesfm 2Dokument2 SeitenQuizesfm 2Prince MalabaNoch keine Bewertungen

- GCE ADVANCED LEVEL ECONOMICS PAST PAPER QUESTIONSDokument8 SeitenGCE ADVANCED LEVEL ECONOMICS PAST PAPER QUESTIONSRichard Eyong100% (1)

- O-Levels Commerce 2020Dokument4 SeitenO-Levels Commerce 2020Kelly.R MadziviridzeNoch keine Bewertungen

- Quiz 2Dokument9 SeitenQuiz 2yuvita prasadNoch keine Bewertungen

- QT Comprehensive Assignment - Paul MDokument26 SeitenQT Comprehensive Assignment - Paul MDaniel Kariuki0% (1)

- Sample Marketing Research ReportDokument124 SeitenSample Marketing Research ReportSonakshi BehlNoch keine Bewertungen

- ZIE Matabeleland AGM MinutesDokument3 SeitenZIE Matabeleland AGM MinutesRobert MadhlopaNoch keine Bewertungen

- PlusOne ICT Grade 6 SampleDokument38 SeitenPlusOne ICT Grade 6 SampleTafadzwa MakuweNoch keine Bewertungen

- Maharashtra Tourism Policy 2016: Department of Tourism & Culture AffairsDokument46 SeitenMaharashtra Tourism Policy 2016: Department of Tourism & Culture AffairsAyesha Khan100% (1)

- Business Studies Form 1Dokument7 SeitenBusiness Studies Form 1Godfrey Muchai100% (1)

- Assignment 2 Submit PDFDokument2 SeitenAssignment 2 Submit PDFRobert ChitsuroNoch keine Bewertungen

- Economics Exam PaperDokument7 SeitenEconomics Exam Papersuurekha vaishliNoch keine Bewertungen

- Sample Business Proposal Impact of Microfinance in KenyaDokument64 SeitenSample Business Proposal Impact of Microfinance in Kenyayedinkachaw shferawNoch keine Bewertungen

- O-Levels English Language ExemplarDokument17 SeitenO-Levels English Language ExemplarSain100% (1)

- University of Kisubi Management Accounting Coursework 1Dokument2 SeitenUniversity of Kisubi Management Accounting Coursework 1Akello SuzanNoch keine Bewertungen

- Upper and Lower Bounds With Answers PDFDokument2 SeitenUpper and Lower Bounds With Answers PDFameliaNoch keine Bewertungen

- Book-Keeping Form TwoDokument109 SeitenBook-Keeping Form TwoChizani Mnyifuna100% (1)

- Cambridge International General Certificate of Secondary EducationDokument8 SeitenCambridge International General Certificate of Secondary EducationUzma TahirNoch keine Bewertungen

- OmarDokument350 SeitenOmarTroden MukwasiNoch keine Bewertungen

- Annuity Product Valuation and Risk Measurement Under Correlated FDokument74 SeitenAnnuity Product Valuation and Risk Measurement Under Correlated FTroden MukwasiNoch keine Bewertungen

- Advanced Cost Accounting Lectures 2017: Janne Järvinen Professor, Management Accounting and Control SystemsDokument54 SeitenAdvanced Cost Accounting Lectures 2017: Janne Järvinen Professor, Management Accounting and Control SystemsTroden MukwasiNoch keine Bewertungen

- EY Credit Risk ManagementDokument10 SeitenEY Credit Risk ManagementTroden MukwasiNoch keine Bewertungen

- An Analysis of Factors Affecting The Performance of Insurance Companies in ZimbabweDokument21 SeitenAn Analysis of Factors Affecting The Performance of Insurance Companies in ZimbabweTroden MukwasiNoch keine Bewertungen

- GlobalDokument38 SeitenGlobalkathyboothNoch keine Bewertungen

- Hunting and GatheringDokument4 SeitenHunting and GatheringTroden Mukwasi0% (1)

- Actuaries Excel: But What About Their Software?: 1.1 The SurveyDokument39 SeitenActuaries Excel: But What About Their Software?: 1.1 The SurveyTroden MukwasiNoch keine Bewertungen

- Ballotta Savelli PresentationDokument21 SeitenBallotta Savelli PresentationTroden MukwasiNoch keine Bewertungen

- A Comparison Between The Egarch Model and Multifactor Risk Modelin Predicting VarDokument1 SeiteA Comparison Between The Egarch Model and Multifactor Risk Modelin Predicting VarTroden MukwasiNoch keine Bewertungen

- Internal Model Techniques of Premium and Reserve Risk For Non-Life InsurersDokument14 SeitenInternal Model Techniques of Premium and Reserve Risk For Non-Life InsurersTroden MukwasiNoch keine Bewertungen

- A Comparison Between The Egarch Model and Multifactor Risk Modelin Predicting VarDokument1 SeiteA Comparison Between The Egarch Model and Multifactor Risk Modelin Predicting VarTroden MukwasiNoch keine Bewertungen

- Actuarial Product Specialist - Wealth PDFDokument1 SeiteActuarial Product Specialist - Wealth PDFTroden MukwasiNoch keine Bewertungen

- Undergraduate Research in Actuarial Science and Financial Mathematics at The University of IllinoisDokument1 SeiteUndergraduate Research in Actuarial Science and Financial Mathematics at The University of IllinoisTroden MukwasiNoch keine Bewertungen

- Assignment 2: What Do You Mean by Portfolio Investment Process, How Does Is Co Relate With Fundamental Analysis?Dokument2 SeitenAssignment 2: What Do You Mean by Portfolio Investment Process, How Does Is Co Relate With Fundamental Analysis?Naveen RecizNoch keine Bewertungen

- Sap SCM Features Functions Modules List - 6389aba9Dokument16 SeitenSap SCM Features Functions Modules List - 6389aba9Mohd AbideenNoch keine Bewertungen

- Role of Commercial BanksDokument10 SeitenRole of Commercial BanksKAAVIYAPRIYA K (RA1953001011009)Noch keine Bewertungen

- Reflection - HR For Managers MBA 305Dokument5 SeitenReflection - HR For Managers MBA 305Mikaela SeminianoNoch keine Bewertungen

- LearnEnglish Reading B2 The Sharing Economy PDFDokument4 SeitenLearnEnglish Reading B2 The Sharing Economy PDFKhaled MohmedNoch keine Bewertungen

- Fire in A Bangladesh Garment FactoryDokument6 SeitenFire in A Bangladesh Garment FactoryRaquelNoch keine Bewertungen

- Mini CaseDokument18 SeitenMini CaseZeeshan Iqbal0% (1)

- MG 201 Assignment 1 s11145116Dokument4 SeitenMG 201 Assignment 1 s11145116sonam sonikaNoch keine Bewertungen

- International Taxation OutlineDokument138 SeitenInternational Taxation OutlineMa FajardoNoch keine Bewertungen

- Sustainable Development Statement Arupv-2023Dokument1 SeiteSustainable Development Statement Arupv-2023James CubittNoch keine Bewertungen

- Applichem Case SolutionDokument9 SeitenApplichem Case Solutiondebjyoti77Noch keine Bewertungen

- Auditing and The Public Accounting ProfessionDokument12 SeitenAuditing and The Public Accounting ProfessionYebegashet AlemayehuNoch keine Bewertungen

- Beyond Vertical Integration The Rise of The Value-Adding PartnershipDokument17 SeitenBeyond Vertical Integration The Rise of The Value-Adding Partnershipsumeet_goelNoch keine Bewertungen

- IFRS Lease Accounting HSBC 2.19.2019 PDFDokument76 SeitenIFRS Lease Accounting HSBC 2.19.2019 PDFmdorneanuNoch keine Bewertungen

- CBSE Class 8 Social Science Chapter 3 Ruling the CountrysideDokument4 SeitenCBSE Class 8 Social Science Chapter 3 Ruling the CountrysideTTP GamerNoch keine Bewertungen

- L2M2-Slide-deck V2Dokument48 SeitenL2M2-Slide-deck V2deepak0% (1)

- SWOT ANALYSIS of Telecom CompaniesDokument8 SeitenSWOT ANALYSIS of Telecom CompaniessurajitbijoyNoch keine Bewertungen

- MKT Definitions VaranyDokument15 SeitenMKT Definitions VaranyVarany manzanoNoch keine Bewertungen

- Traders CodeDokument7 SeitenTraders CodeHarshal Kumar ShahNoch keine Bewertungen

- Practical Project Execution Alloy Wheels Manufacturing PlantDokument5 SeitenPractical Project Execution Alloy Wheels Manufacturing PlantSanjay KumarNoch keine Bewertungen

- Iare TKM Lecture NotesDokument106 SeitenIare TKM Lecture Notestazebachew birkuNoch keine Bewertungen

- PopulationDokument22 SeitenPopulationInam Ul HaqNoch keine Bewertungen

- Indian Economy Classified by 3 Main Sectors: Primary, Secondary and TertiaryDokument5 SeitenIndian Economy Classified by 3 Main Sectors: Primary, Secondary and TertiaryRounak BasuNoch keine Bewertungen

- Practice Questions CH08-AnswersDokument3 SeitenPractice Questions CH08-AnswersyuviNoch keine Bewertungen

- Government Budget - A Financial StatementDokument15 SeitenGovernment Budget - A Financial StatementJsmBhanotNoch keine Bewertungen

- 9.2 IAS36 - Impairment of Assets 1Dokument41 Seiten9.2 IAS36 - Impairment of Assets 1Given RefilweNoch keine Bewertungen

- Inequality NotesDokument5 SeitenInequality NotesShivangi YadavNoch keine Bewertungen

- Assignment 1: NPV and IRR, Mutually Exclusive Projects: Net Present Value 1,930,110.40 2,251,795.46Dokument3 SeitenAssignment 1: NPV and IRR, Mutually Exclusive Projects: Net Present Value 1,930,110.40 2,251,795.46Giselle MartinezNoch keine Bewertungen

- London Circular Economy Jobs Report 2015Dokument20 SeitenLondon Circular Economy Jobs Report 2015Matt MaceNoch keine Bewertungen

- Internalization Theory For The Digital EconomyDokument8 SeitenInternalization Theory For The Digital Economyefe westNoch keine Bewertungen