Beruflich Dokumente

Kultur Dokumente

Financial Review (2008-2009)

Hochgeladen von

Christabella Pingkan0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten2 SeitenThis document contains financial highlights from several years for a group including total revenue, expenditures, operating profit, profit after taxation, earnings per share, equity attributable to shareholders, net asset value, total debt to equity ratio, and return on equity and assets. For the period 2007-2008, revenue increased 10.2% while expenditures rose 5.1% and operating profit grew 61.6%. However, profit after taxation fell 3.0% and earnings per share declined 2.4%.

Originalbeschreibung:

tugas kuliah

Originaltitel

Analisis Rasio

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document contains financial highlights from several years for a group including total revenue, expenditures, operating profit, profit after taxation, earnings per share, equity attributable to shareholders, net asset value, total debt to equity ratio, and return on equity and assets. For the period 2007-2008, revenue increased 10.2% while expenditures rose 5.1% and operating profit grew 61.6%. However, profit after taxation fell 3.0% and earnings per share declined 2.4%.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

8 Ansichten2 SeitenFinancial Review (2008-2009)

Hochgeladen von

Christabella PingkanThis document contains financial highlights from several years for a group including total revenue, expenditures, operating profit, profit after taxation, earnings per share, equity attributable to shareholders, net asset value, total debt to equity ratio, and return on equity and assets. For the period 2007-2008, revenue increased 10.2% while expenditures rose 5.1% and operating profit grew 61.6%. However, profit after taxation fell 3.0% and earnings per share declined 2.4%.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

ANALISIS RASIO

Financial Review (2007-2008)

Highlights of the Group’s Performance

Keterangan 2007 - 2008

Total revenue $15,973 million (↑ 10.2 per cent)

Total expenditure $13,848 million (↑ 5.1 per cent)

Operating profit $2,125 million (↑ 61.6 per cent)

Profit after taxation $2,137 million (↓ 3.0 per cent)

Profit attributable to equity $2,049 million (↓ 3.7 per cent)

holders of the Company

Basic earnings per share 168.5 cents (↓ 2.4 per cent)

Equity attributable to equity $15,125 million (↑ 0.2 per cent)

holders of the Company

$12.77 per share (↑ 5.5 per cent)

Net asset value

0.11 times (↓ 0.01 times)

Total debt equity ratio

FINANCIAL REVIEW (2008-2009)

HIGHLIGHTS OF THE GROUP’S PERFORMANCE

• Total revenue $15,996 million (+0.1 per cent)

• Total expenditure $15,092 million (+9.0 per cent)

• Operating profi t $904 million (-57.5 per cent)

• Profi t after taxation $1,147 million (-46.3 per cent)

• Profi t attributable to equity holders of the Company $1,062 million (-48.2 per cent)

• Basic earnings per share 89.6 cents (-46.8 per cent)

• Equity attributable to equity holders of the Company $13,931 million (-7.9 per cent)

• Net asset value $11.78 per share (-7.8 per cent)

• Total debt equity ratio 0.12 times (+0.01 times)

HIGHLIGHTS OF THE GROUP’S PERFORMANCE (2009-2010)

• Total revenue $12,707 million (-20.6 per cent)

• Operating profit $63 million (-93.0 per cent)

Profit attributable to equity holders of the Company $216 million (-79.7 per cent)

Key Financial Highlights

2009-10 2008-09 R1 % Change

Earnings For The Year ($ million)

Revenue 12,707.3 15,996.3 - 20.6

Expenditure 12,644.1 15,092.7 - 16.2

Operating profit 63.2 903.6 - 93.0

Profit attributable to equity holders of the Company 215.8 1,061.5 R2 - 79.7

Per Share Data (cents)

Earnings per share – basic 18.2 89.6 - 79.7

Dividends per share 12.0 40.0 - 70.0

Ratios (%)

Return on equity holders’ funds 1.6 7.3 - 5.7 pts

Return on total assets 1.2 4.5 - 3.3 pts

FINANCIAL REVIEW (2010-2011)

HIGHLIGHTS OF THE GROUP’S PERFORMANCE

• Total revenue $14,525 million (+$1,817 million)

• Operating profit $1,271 million (+$1,208 million)

• Profit attributable to owners of the Parent $1,092 million (+$876 million)

Total expenditure 971.2 896.0 + 8.4

Operating profit 135.7 110.4 + 22.9

Profit attributable to owners of the Parent 258.5 236.1 + 9.5

Earnings For The Year ($ million)

Revenue 14,524.8 12,707.3 + 14.3

Expenditure 13,253.5 12,644.1 + 4.8

Operating profit 1,271.3 63.2 n.m.

Profit attributable to owners of the Parent 1,092.0 215.8 n.m.

Per Share Data (cents)

Earnings per share – basic 91.4 18.2 n.m.

Ordinary dividend per share 60.0 12.0 n.m.

Special dividend per share 80.0 - n.m.

Ratios (%)

Return on equity holders’ funds 7.9 1.6 + 6.3 points

Return on total assets 4.9 1.2 + 3.7 points

HIGHLIGHTS OF THE GROUP’S PERFORMANCE (2011-2012)

• Total revenue $14,858 million (+$333 million, +2.3%)

• Operating profit $286 million (-$985 million, -77.5%)

• Profit attributable to owners of the Parent $336 million (-$756 million, -69.2%)

Expenditure 14,571.9 13,253.5 + 9.9

Operating profit 285.9 1,271.3 - 77.5

Profit attributable to owners of the Parent 335.9 1,092.0 - 69.2

Per Share Data (cents)

Earnings per share – basic 28.3 91.4 - 69.0

Ordinary dividend per share 20.0 60.0 - 66.7

Special dividend per share - 80.0 n.m.

Ratios (%)

Return on equity holders’ funds 2.5 7.9 - 5.4 points

Return on total assets 1.7 4.9 - 3.2 points

Das könnte Ihnen auch gefallen

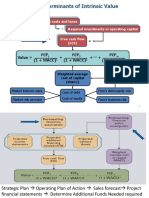

- Value + + + FCF FCF FCF (1 + WACC) (1 + WACC) (1 + WACC) ..Dokument33 SeitenValue + + + FCF FCF FCF (1 + WACC) (1 + WACC) (1 + WACC) ..Manabendra DasNoch keine Bewertungen

- Basic Analisa FundamentalDokument23 SeitenBasic Analisa FundamentalThomasNailNoch keine Bewertungen

- EFM2e, CH 03, SlidesDokument36 SeitenEFM2e, CH 03, SlidesEricLiangtoNoch keine Bewertungen

- P47 Company Financial Matrix (20064246 박지열 Park Ji Yeol) - individualDokument3 SeitenP47 Company Financial Matrix (20064246 박지열 Park Ji Yeol) - individualPark Ji YeolNoch keine Bewertungen

- PP For Chapter 6 - Financial Statement Analysis - FinalDokument67 SeitenPP For Chapter 6 - Financial Statement Analysis - FinalSozia TanNoch keine Bewertungen

- companyfinacialmatrix 20093931 송호용 individual work.Dokument4 Seitencompanyfinacialmatrix 20093931 송호용 individual work.GoldRogNoch keine Bewertungen

- Growth Analysis 2Dokument57 SeitenGrowth Analysis 2Katty MothaNoch keine Bewertungen

- Sears Vs Walmart - v01Dokument37 SeitenSears Vs Walmart - v01chansjoy100% (1)

- Evercore Partners 8.6.13 PDFDokument6 SeitenEvercore Partners 8.6.13 PDFChad Thayer VNoch keine Bewertungen

- Corporate Finance - Exercises Session 1 - SolutionsDokument5 SeitenCorporate Finance - Exercises Session 1 - SolutionsLouisRemNoch keine Bewertungen

- Anyway, EPS Is An Important Element of InvestmentDokument5 SeitenAnyway, EPS Is An Important Element of Investmentzhangshuang327Noch keine Bewertungen

- ARCO - 4Q18 ReleaseDokument19 SeitenARCO - 4Q18 ReleaseAndrew ShimadaNoch keine Bewertungen

- Financial Planning and Forecasting Financial StatementsDokument49 SeitenFinancial Planning and Forecasting Financial StatementsWaseem AkramNoch keine Bewertungen

- Latihan Soal AF 2Dokument11 SeitenLatihan Soal AF 2Reza MuhammadNoch keine Bewertungen

- Financial Statements Analysis Case StudyDokument15 SeitenFinancial Statements Analysis Case StudyNelly Yulinda50% (2)

- Finance Final Pitch General ElectricDokument8 SeitenFinance Final Pitch General Electricbquinn08Noch keine Bewertungen

- EFM2e, CH 02, SlidesDokument19 SeitenEFM2e, CH 02, SlidesEricLiangtoNoch keine Bewertungen

- Financial Statements Analysis Case StudyDokument15 SeitenFinancial Statements Analysis Case Studyดวงยี่หวา จิระวงศ์สันติสุขNoch keine Bewertungen

- Course Code: Fn-550Dokument25 SeitenCourse Code: Fn-550shoaibraza110Noch keine Bewertungen

- HL Case StudyDokument27 SeitenHL Case StudyJorgeNoch keine Bewertungen

- SEx 11Dokument32 SeitenSEx 11Amir Madani60% (5)

- ICI Pakistan AnalysisDokument19 SeitenICI Pakistan AnalysisAffan AnwarNoch keine Bewertungen

- 6886 Valuation 2Dokument25 Seiten6886 Valuation 2api-3699305100% (1)

- Financial Statements, Cash Flow, and TaxesDokument23 SeitenFinancial Statements, Cash Flow, and TaxesSaad KhanNoch keine Bewertungen

- Macabus DCF AnalysisDokument6 SeitenMacabus DCF AnalysisNikolas JNoch keine Bewertungen

- Excel Spreadsheet For Mergers and Acquisitions ValuationDokument6 SeitenExcel Spreadsheet For Mergers and Acquisitions ValuationRenold DarmasyahNoch keine Bewertungen

- Vol 3 Santangel S Review Gotham Asset Management PDFDokument11 SeitenVol 3 Santangel S Review Gotham Asset Management PDFtjl84Noch keine Bewertungen

- Financial Statement, Cash Flows and TaxesDokument22 SeitenFinancial Statement, Cash Flows and Taxesnumlit1984Noch keine Bewertungen

- Enron Case Study - So What Is It WorthDokument20 SeitenEnron Case Study - So What Is It WorthJohn Aldridge ChewNoch keine Bewertungen

- Chapter 14 SolutionDokument9 SeitenChapter 14 Solutionbellohales0% (1)

- Companyfinacialmatrix of The BombsDokument4 SeitenCompanyfinacialmatrix of The BombsXiaoyan huangNoch keine Bewertungen

- Team Work 2-2Dokument4 SeitenTeam Work 2-2Song Song 송송Noch keine Bewertungen

- Analysis of Financial StatementsDokument46 SeitenAnalysis of Financial StatementssiddharthrajNoch keine Bewertungen

- Amazon ValuationDokument22 SeitenAmazon ValuationDr Sakshi SharmaNoch keine Bewertungen

- Answers: Operating Income Changes in Net Operating AssetsDokument6 SeitenAnswers: Operating Income Changes in Net Operating AssetsNawarathna KumariNoch keine Bewertungen

- Budgeting, Capital Structure, and Working Capital ManagementDokument11 SeitenBudgeting, Capital Structure, and Working Capital Managementritu paudelNoch keine Bewertungen

- Chapter 2 Buiness FinanxceDokument38 SeitenChapter 2 Buiness FinanxceShajeer HamNoch keine Bewertungen

- Lecture 28Dokument34 SeitenLecture 28Riaz Baloch NotezaiNoch keine Bewertungen

- CH 02 - Financial Stmts Cash Flow and TaxesDokument32 SeitenCH 02 - Financial Stmts Cash Flow and TaxesSyed Mohib Hassan100% (1)

- McDonalds Financial AnalysisDokument11 SeitenMcDonalds Financial AnalysisHooksA01Noch keine Bewertungen

- Starwood Hotels Resorts Worldwide Inc FinancialsDokument48 SeitenStarwood Hotels Resorts Worldwide Inc FinancialsAgarwal SaranshNoch keine Bewertungen

- YHOO Q110EarningsPresentation FinalDokument23 SeitenYHOO Q110EarningsPresentation Finalhblodget6728Noch keine Bewertungen

- 1Q14 Earnings Conference Call: A Leader in Alternative Investments in Latin AmericaDokument22 Seiten1Q14 Earnings Conference Call: A Leader in Alternative Investments in Latin AmericaPedro Cabral RovieriNoch keine Bewertungen

- FM Math 1Dokument17 SeitenFM Math 1Md Shahrier Jaman AyonNoch keine Bewertungen

- Mini CaseDokument4 SeitenMini CaseHesham MansourNoch keine Bewertungen

- Revision - Income Stat and BS - V3Dokument4 SeitenRevision - Income Stat and BS - V3betyibtihal03Noch keine Bewertungen

- New Heritage DoolDokument9 SeitenNew Heritage DoolVidya Sagar KonaNoch keine Bewertungen

- Business Unit Performance Measurement: Mcgraw-Hill/IrwinDokument17 SeitenBusiness Unit Performance Measurement: Mcgraw-Hill/Irwinimran_chaudhryNoch keine Bewertungen

- Top Glove 140618Dokument5 SeitenTop Glove 140618Joseph CampbellNoch keine Bewertungen

- FY14 HPQ Salient Points 20141125Dokument2 SeitenFY14 HPQ Salient Points 20141125Amit RakeshNoch keine Bewertungen

- Financial Management 2 - BirminghamDokument21 SeitenFinancial Management 2 - BirminghamsimuragejayanNoch keine Bewertungen

- Brand Company Input Value of Brand Name Sales 21962 81724.529647631 Ebitda 7760 45823.824919442 Capital Invested 16406 71821.556358009Dokument9 SeitenBrand Company Input Value of Brand Name Sales 21962 81724.529647631 Ebitda 7760 45823.824919442 Capital Invested 16406 71821.556358009José Manuel EstebanNoch keine Bewertungen

- I. Income StatementDokument27 SeitenI. Income StatementNidhi KaushikNoch keine Bewertungen

- Ambev Tabelas 4TRI16Dokument82 SeitenAmbev Tabelas 4TRI16Deyverson CostaNoch keine Bewertungen

- Aci Reuters BuyDokument6 SeitenAci Reuters BuysinnlosNoch keine Bewertungen

- McDonald's (MCD) - Earnings Quality ReportDokument1 SeiteMcDonald's (MCD) - Earnings Quality ReportInstant AnalystNoch keine Bewertungen

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosVon EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNoch keine Bewertungen

- List of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosVon EverandList of the Most Important Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Key Financial RatiosNoch keine Bewertungen

- ANSWERS To CHAPTER 6 (Interest Rates and Bond Valuation)Dokument7 SeitenANSWERS To CHAPTER 6 (Interest Rates and Bond Valuation)Jhayzon Ocampo0% (1)

- Analysis On Annual ReportDokument3 SeitenAnalysis On Annual ReportNg Suet YeeNoch keine Bewertungen

- The Question That Need To Be Answered: What Should Be The Price of The IPO?Dokument3 SeitenThe Question That Need To Be Answered: What Should Be The Price of The IPO?Bebila Singh50% (2)

- Banking SectorDokument7 SeitenBanking SectorPreyas GursalNoch keine Bewertungen

- Spain TradeDokument15 SeitenSpain Tradelockleong93Noch keine Bewertungen

- Vaibhav GlobalDokument10 SeitenVaibhav Globalalwaysforu19844Noch keine Bewertungen

- A Case Study On Ketan Parekh ScamDokument5 SeitenA Case Study On Ketan Parekh ScamManish Singh100% (1)

- Accounting and Management Problems at Freddie MacDokument6 SeitenAccounting and Management Problems at Freddie MacgihoyitNoch keine Bewertungen

- VBM Assignment GRP 2Dokument7 SeitenVBM Assignment GRP 2Rajab DachiNoch keine Bewertungen

- Mini Case: Answer: ANSWER: A Bond Has A Specific Cash Flow Pattern Consisting of A Stream ofDokument16 SeitenMini Case: Answer: ANSWER: A Bond Has A Specific Cash Flow Pattern Consisting of A Stream ofkegnataNoch keine Bewertungen

- São Paulo Stock Exchange and The Brazilian Capital Market: SurveillanceDokument36 SeitenSão Paulo Stock Exchange and The Brazilian Capital Market: SurveillanceAbhimanyu SisodiaNoch keine Bewertungen

- Stock AstroDokument3 SeitenStock AstroashankarNoch keine Bewertungen

- TermSukuk App Form Individual E Mrs ANISHADokument2 SeitenTermSukuk App Form Individual E Mrs ANISHAsunij.chackoNoch keine Bewertungen

- Angel Tax On Start-UpsDokument35 SeitenAngel Tax On Start-UpsAkash MehtaNoch keine Bewertungen

- Madura FMI9e IM Ch14Dokument15 SeitenMadura FMI9e IM Ch14Stanley HoNoch keine Bewertungen

- Pricing Model Definitions Be 156670Dokument14 SeitenPricing Model Definitions Be 156670Jayasankar NairNoch keine Bewertungen

- PSE - Ateneo CCE - 9th CSSC - Overview of Advanced Market Products - DerivativesDokument19 SeitenPSE - Ateneo CCE - 9th CSSC - Overview of Advanced Market Products - DerivativesAllene Leyba Sayas-TanNoch keine Bewertungen

- Sample Final Exam QuestionsDokument28 SeitenSample Final Exam QuestionsHuyNoch keine Bewertungen

- MPT PaperDokument13 SeitenMPT PaperAna ShehuNoch keine Bewertungen

- Arthayantra - Group 1, Section BDokument19 SeitenArthayantra - Group 1, Section BAbhi SangwanNoch keine Bewertungen

- 10 BDokument16 Seiten10 BAin SyawatiNoch keine Bewertungen

- Annual Report-2018 PDFDokument226 SeitenAnnual Report-2018 PDFjagadeeshyogiNoch keine Bewertungen

- Lecture 1Dokument70 SeitenLecture 1rajabushabani321Noch keine Bewertungen

- Bitcoin Bank America BCBA - About Us - Business PlanDokument2 SeitenBitcoin Bank America BCBA - About Us - Business Planmalik_saleem_akbarNoch keine Bewertungen

- Start File DCF ExerciseDokument13 SeitenStart File DCF ExerciseshashankNoch keine Bewertungen

- Chapter 4 PDFDokument24 SeitenChapter 4 PDFShoayebNoch keine Bewertungen

- Break Even PointDokument2 SeitenBreak Even PointJunaid SiddiquiNoch keine Bewertungen

- TB Chapter11Dokument77 SeitenTB Chapter11CGNoch keine Bewertungen

- Fire InsuranceDokument36 SeitenFire Insurancean8_cheenathNoch keine Bewertungen