Beruflich Dokumente

Kultur Dokumente

Cv1e SM ch06 PDF

Hochgeladen von

Yu FengOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Cv1e SM ch06 PDF

Hochgeladen von

Yu FengCopyright:

Verfügbare Formate

CHAPTER 6

MEASURING CONTINUING VALUE USING

THE CONSTANT-GROWTH PERPETUITY MODEL

EXERCISES AND PROBLEMS

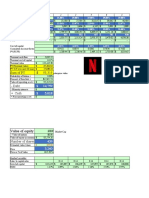

P6.1 Present Value Weighted Average Growth Rate:

a.

Discounted Cash Flow Valuation

Cost of Capital 10.0%

Growth Rate for Free Cash Flow for Continuing Value 3.0%

Millions of Dollars Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 CVFirm

Unlevered Free Cash Flow for Continuing Value $ 494

Discount Factor for Continuing Value 14.286

Unlevered Free Cash Flow and Continuing Value $ 200 $ 240 $ 300 $ 420 $ 480 $ 7,063

Discount Factor 0.909 0.826 0.751 0.683 0.621 0.621

Present Value $ 182 $ 198 $ 225 $ 287 $ 298 $ 4,385

Value of the Firm as of 2011 $ 5,576 FCF1 $200

gr 0.1 6.41%

Present Value Weighted Average Growth Rate 6.41% V0 $5,576

b.

Discounted Cash Flow Valuation

Cost of Capital 10.0%

Growth Rate for Free Cash Flow for Continuing Value -3.0%

Millions of Dollars Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 CVFirm

Unlevered Free Cash Flow for Continuing Value $ 466

Discount Factor for Continuing Value 7.692

Unlevered Free Cash Flow and Continuing Value $ 200 $ 240 $ 300 $ 420 $ 480 $ 3,582

Discount Factor 0.909 0.826 0.751 0.683 0.621 0.621

Present Value $ 182 $ 198 $ 225 $ 287 $ 298 $ 2,224

Value of the Firm as of 2011 $ 3,414

FCF1 $200

gr 0.1 4.14%

Present Value Weighted Average Growth Rate 4.14% V0 $2,884

©Cambridge Business Publishers, 2014

1 Corporate Valuation: Theory, Evidence & Practice, 1st Edition

P6.2 Present Value Weighted Average Growth Rate:

a.

Discounted Cash Flow Valuation

Cost of Capital 10.0%

Growth Rate for Free Cash Flow for Continuing Value 3.0%

Millions of Dollars Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 CVFirm

Unlevered Free Cash Flow for Continuing Value $ 5,150

Discount Factor for Continuing Value 14.286

Unlevered Free Cash Flow and Continuing Value $ 2,000 $ -3,000 $ 3,000 $ 3,900 $ 5,000 $ 73,571

Discount Factor 0.909 0.826 0.751 0.683 0.621 0.621

Present Value $ 1,818 $ -2,479 $ 2,254 $ 2,664 $ 3,105 $ 45,682

Value of the Firm as of 2011 $ 53,043 FCF1 $2,000

gr 0.1 6.23%

Present Value Weighted Average Growth Rate 6.23%

V0 $53, 043

b.

Discounted Cash Flow Valuation

Cost of Capital 10.0%

Growth Rate for Free Cash Flow for Continuing Value -3.0%

Millions of Dollars Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 CVFirm

Unlevered Free Cash Flow for Continuing Value $ 4,850

Discount Factor for Continuing Value 7.692

Unlevered Free Cash Flow and Continuing Value $ 2,000 $ -3,000 $ 3,000 $ 3,900 $ 5,000 $ 37,308

Discount Factor 0.909 0.826 0.751 0.683 0.621 0.621

Present Value $ 1,818 $ -2,479 $ 2,254 $ 2,664 $ 3,105 $ 23,165

Value of the Firm as of 2011 $ 30,526

FCF1 $2,000

gr 0.1 3.45%

Present Value Weighted Average Growth Rate 3.45% V0 $30,526

©Cambridge Business Publishers, 2014

Solutions Manual, Chapter 6 2

P6.3 Present Value Weighted Average Growth Rate:

a. and b.

Discounted Cash Flow Valuation

Cost of Capital 10.0%

Year 0 Free Cash Flow $ 231.0

Growth Rates 60% 20% 10% 5% 5% 3.0%

Millions of Dollars Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 CVFirm

Unlevered Free Cash Flow for Continuing Value $ 554

Discount Factor for Continuing Value 14.286

Unlevered Free Cash Flow and Continuing Value $ 370 $ 444 $ 488 $ 512 $ 538 $ 7,915

Discount Factor 0.909 0.826 0.751 0.683 0.621 0.621

Present Value $ 336 $ 367 $ 367 $ 350 $ 334 $ 4,914

Value of the Firm as of 2011 $ 6,667

FCF1 $231

gr 0.1 4.46%

Present Value Weighted Average Growth Rate 4.46% V0 $6, 667

1 r 1.1

gA 1 1 0.0632

6.32%

FCF0 $231

1 1

VF, 0 $6, 667

P6.4 Two-Stage Growth Rate:

Discount Rate is 9%

g2 after Year 10

g1 (through Year N) -3% 0% 3%

5% 1.4% 2.4% 3.8%

10% 3.3% 4.2% 5.2%

15% 4.8% 5.5% 6.3%

©Cambridge Business Publishers, 2014

3 Corporate Valuation: Theory, Evidence & Practice, 1st Edition

P6.5 Estimating a Perpetual Growth Rate from Comparable Companies:

(Dollars in millions)

Expected Unlevered Free Cash Flow Firm Growth

WACC Year 1 Year 2 Year 3 Value Rate

Comparable Company 1 10.50% $2,000.0 $2,400.0 $2,600.0 $30,000.0 2.38%

Comparable Company 2 10.20% $340.0 $350.0 $360.0 $4,200.0 1.97%

Comparable Company 3 10.10% $200.0 $210.0 $240.0 $2,800.0 2.00%

Comparable Company 4 9.80% $1,200.0 $1,400.0 $1,500.0 $20,000.0 2.79%

Comparable Company 5 9.50% $260.0 $250.0 $250.0 $2,870.0 0.90%

25th Percentile 1.97%

Median 2.00%

75th Percentile 2.38%

Calculation for Company 5

FCFT 9.50%

g = rWACC

FCFt $ 250.0

(1+ rWACC ) T-1× VF, t-1 t=1

T-1

t

(1+rWACC )

$250

#VALUE!

g .095 0.009 #VALUE!

2 $260 $250

(1.095) × $2,870

(1.095)1 (1.095) 2

#VALUE!

©Cambridge Business Publishers, 2014

Solutions Manual, Chapter 6 4

P6.6 Lumpy Capital Expenditures:

We calculate the capital expenditure annuity as follows. The schedules below provide

the solution to the remaining questions.

$3, 200 $1, 200 $1, 200

PVCAPEX,0 3

A 1.12 1.122 1.121 $1, 792.7

1 1 1 1 1 1

r r 1 r 3

.12 .12 1.123

Income Statement, Balance Sheet, and Free Cash Flow Forecasts

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Revenue $ 1,600 $ 2,200 $ 2,800 $ 2,800 $ 2,800 $ 2,800

Depreciation Expense -1,067 -1,467 -1,867 -1,867 -1,867 -1,867

Income Before Taxes $ 533 $ 733 $ 933 $ 933 $ 933 $ 933

Income Tax Expense (Provision) -213 -293 -373 -373 -373 -373

Net Income $ 320 $ 440 $ 560 $ 560 $ 560 $ 560

Total Assets = Fixed Asset $ 3,200 $ 3,333 $ 3,067 $ 4,400 $ 3,733 $ 3,067 $ 4,400

Shareholders' Equity $ 3,200 $ 3,333 $ 3,067 $ 4,400 $ 3,733 $ 3,067 $ 4,400

Earnings Before Interest and Taxes $ 533 $ 733 $ 933 $ 933 $ 933 $ 933

Income Taxes Paid on EBIT -213 -293 -373 -373 -373 -373

Earnings Before Interest and After Taxes $ 320 $ 440 $ 560 $ 560 $ 560 $ 560

Depreciation 1,067 1,467 1,867 1,867 1,867 1,867

Unlevered Cash Flow from Operations 1,387 1,907 2,427 2,427 2,427 2,427

Capital Expenditures -3,200 -1,200 -1,200 -3,200 -1,200 -1,200 -3,200

Unlevered Free Cash Flow = Equity FCF $ 187 $ 707 $ -773 $ 1,227 $ 1,227 $ -773

Property, Plant and Equipment and Accumulated Depreciation Forecasts

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5 Year 6

Beginning Property, Plant & Equipment $ 3,200 $ 4,400 $ 5,600 $ 5,600 $ 5,600 $ 5,600

Capital Expenditures 3,200 1,200 1,200 3,200 1,200 1,200 3,200

Retirements -3,200 -1,200 -1,200 -3,200

Ending Property, Plant & Equipment $ 3,200 $ 4,400 $ 5,600 $ 5,600 $ 5,600 $ 5,600 $ 5,600

Beginning Accumulated Depreciation $ 0 $ 1,067 $ 2,533 $ 1,200 $ 1,867 $ 2,533

Depreciation Expense 1,067 1,467 1,867 1,867 1,867 1,867

Retirements 0 0 -3,200 -1,200 -1,200 -3,200

Ending Accumulated Depreciation $ 0 $ 1,067 $ 2,533 $ 1,200 $ 1,867 $ 2,533 $ 1,200

Net Property, Plant and Equipment $ 3,200 $ 3,333 $ 3,067 $ 4,400 $ 3,733 $ 3,067 $ 4,400

©Cambridge Business Publishers, 2014

5 Corporate Valuation: Theory, Evidence & Practice, 1st Edition

Discounted Cash Flow Valuation Using Actual Free Cash Flows

Year (t) 0 1 2 3 4 5 6

Free Cash Flow $ 187 $ 707 $ -773 $ 1,227 $ 1,227 $ -773

Continuing Value at Year 0 $ 5,258 $ -5,137 $ 7,276 $ 6,496 $ -3,657

Present Value of FCF Year +1 to t Correct $ 167 $ 730 $ 180 $ 959 $ 1,655

Value of the Firm at Year 0 $ 3,940 $ 5,425 $ -4,407 $ 7,456 $ 7,456 $ -2,002

Error in the Valuation 38% -212% 89% 89% -151%

Discounted Cash Flow Valuation Using Adjusted Free Cash Flows, Adjusted for Annuity Capital

Expenditures

Year (t) 0 1 2 3 4 5 6

Actual Capital Expenditure $ 1,200 $ 1,200 $ 3,200 $ 1,200 $ 1,200 $ 3,200

Annuity for Capital Expenditures 1,793 1,793 1,793 1,793 1,793 1,793

Adjustment to Free Cash Flow $ -593 $ -593 $ 1,407 $ -593 $ -593 $ 1,407

Actual Free Cash Flow 187 707 -773 1,227 1,227 -773

Adjusted Free Cash Flow $ -406 $ 114 $ 634 $ 634 $ 634 $ 634

Continuing Value at Year 0 $ 848 $ 4,212 $ 3,760 $ 3,357 $ 2,998

Present Value of FCF Year +1 to t Correct $ -363 $ -272 $ 180 $ 582 $ 942

Value of the Firm at Year 0 $ 3,940 $ 485 $ 3,940 $ 3,940 $ 3,940 $ 3,940

Error in the Valuation -88% 0% 0% 0% 0%

P6.7 Growth and Value Creation:

Discount Rate 15.00%

FCF0 $ 12,000.00

Inflation 3.0%

% Change

-1

I% ROI Inlation (i) FCF1 gFCF [r - gFCF] V0 in V0

0% 3.0% $ 12,360.0 3.0% 8.33 $ 103,000.0 Base

20% 10.0% 3.0% $ 9,888.0 4.4% 9.43 $ 93,283.0 -9.4%

20% 15.0% 3.0% $ 9,888.0 5.4% 10.42 $ 103,000.0 0.0%

20% 20.0% 3.0% $ 9,888.0 6.4% 11.63 $ 114,976.7 11.6%

40% 10.0% 3.0% $ 7,416.0 5.8% 10.87 $ 80,608.7 -21.7%

40% 15.0% 3.0% $ 7,416.0 7.8% 13.89 $ 103,000.0 0.0%

40% 20.0% 3.0% $ 7,416.0 9.8% 19.23 $ 142,615.4 38.5%

FCF0 1 i 1 I% 1.03 1 .2 $9,888

V0 $12, 000 $93, 283

r I% ROI i 1 I% .15 .2 .1 .03 1 .2 .106

©Cambridge Business Publishers, 2014

Solutions Manual, Chapter 6 6

P6.8 Growth Rates and Continuing Value – Ed Kaplan, Inc.:

a. The analyst incorrectly

(i) Used Year 3 FCF and should have used Year 4 FCF, which will be larger

because the revenue growth rate decreased. And then should have

assumed the Year 4 cash flow would grow in perpetuity.

(ii) Used Year 3 ITS and should have used Year 4 ITS, which happens to be

the same as Year 3.

(iii) Did not use a growth rate to measure the value of the interest tax shields.

b. through f. See the schedules below.

Ed Kaplan, Inc. - Income Statement and Balance Sheet Forecasts

Year -1 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Income Statement

Revenue $ 10,000.0 $ 11,000.0 $ 13,200.0 $ 15,840.0 $ 19,008.0 $ 19,578.2 $ 20,165.6

Cost of Goods Sold -2,000.0 -2,200.0 -2,640.0 -3,168.0 -3,801.6 -3,915.6 -4,033.1

Gross Margin $ 8,000.0 $ 8,800.0 $ 10,560.0 $ 12,672.0 $ 15,206.4 $ 15,662.6 $ 16,132.5

Selling, General & Administrative -1,200.0 -1,320.0 -1,584.0 -1,900.8 -2,281.0 -2,349.4 -2,419.9

Operating Income $ 6,800.0 $ 7,480.0 $ 8,976.0 $ 10,771.2 $ 12,925.4 $ 13,313.2 $ 13,712.6

Interest Expense -640.0 -800.0 -800.0 -800.0 -800.0 -800.0 -824.0

Income Before Taxes $ 6,160.0 $ 6,680.0 $ 8,176.0 $ 9,971.2 $ 12,125.4 $ 12,513.2 $ 12,888.6

Income Tax Expense -2,464.0 -2,672.0 -3,270.4 -3,988.5 -4,850.2 -5,005.3 -5,155.4

Net Income $ 3,696.0 $ 4,008.0 $ 4,905.6 $ 5,982.7 $ 7,275.3 $ 7,507.9 $ 7,733.2

Balance Sheet

Cash Balance $ 250.0 $ 275.0 $ 330.0 $ 396.0 $ 475.2 $ 489.5 $ 504.1

Accounts Receivable 1,666.7 1,833.3 2,200.0 2,640.0 3,168.0 3,263.0 3,360.9

Inventory 388.9 427.8 513.3 616.0 739.2 761.4 784.2

Total Current Assets $ 2,305.6 $ 2,536.1 $ 3,043.3 $ 3,652.0 $ 4,382.4 $ 4,513.9 $ 4,649.3

Land 20,000.0 22,000.0 26,400.0 31,680.0 38,016.0 39,156.5 40,331.2

Total Assets $ 22,305.6 $ 24,536.1 $ 29,443.3 $ 35,332.0 $ 42,398.4 $ 43,670.4 $ 44,980.5

Accounts Payable $ 166.7 $ 183.3 $ 220.0 $ 264.0 $ 316.8 $ 326.3 $ 336.1

Other Current Operating Liabilities 350.0 385.0 462.0 554.4 665.3 685.2 705.8

Total Current Liabilities 516.7 568.3 682.0 818.4 982.1 1,011.5 1,041.9

Debt 10,000.0 10,000.0 10,000.0 10,000.0 10,000.0 10,300.0 10,609.0

Total Liabilities $ 10,516.7 $ 10,568.3 $ 10,682.0 $ 10,818.4 $ 10,982.1 $ 11,311.5 $ 11,650.9

Common Stock $10,419.3 $10,419.3 $10,419.3 $10,419.3 $10,419.3 $10,419.3 $10,419.3

Retained Earnings 1,369.6 3,548.5 8,342.0 14,094.3 20,997.0 21,939.5 22,910.3

Total Shareholders Equity $ 11,788.9 $ 13,967.8 $ 18,761.3 $ 24,513.6 $ 31,416.3 $ 32,358.8 $ 33,329.6

Total Liabilities and Equities $ 22,305.6 $ 24,536.1 $ 29,443.3 $ 35,332.0 $ 42,398.4 $ 43,670.4 $ 44,980.5

©Cambridge Business Publishers, 2014

7 Corporate Valuation: Theory, Evidence & Practice, 1st Edition

Ed Kaplan, Inc. - Free Cash Flow Forecasts

Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Earnings Before Interest and Taxes (EBIT) $ 7,480.0 $ 8,976.0 $ 10,771.2 $ 12,925.4 $ 13,313.2 $ 13,712.6

- Income Taxes Paid on EBIT -2,992.0 -3,590.4 -4,308.5 -5,170.2 -5,325.3 -5,485.0

Earnings Before Interest and After Taxes $ 4,488.0 $ 5,385.6 $ 6,462.7 $ 7,755.3 $ 7,987.9 $ 8,227.6

- Change in Accounts Receivable -166.7 -366.7 -440.0 -528.0 -95.0 -97.9

- Change in Inventory -38.9 -85.6 -102.7 -123.2 -22.2 -22.8

+ Change in Accounts Payable 16.7 36.7 44.0 52.8 9.5 9.8

+ Change in Current Other Liabilities 35.0 77.0 92.4 110.9 20.0 20.6

- Change in Required Cash Balance -25.0 -55.0 -66.0 -79.2 -14.3 -14.7

Unlevered Cash Flow from Operations $ 4,309.1 $ 4,992.0 $ 5,990.5 $ 7,188.5 $ 7,885.9 $ 8,122.5

- Capital Expenditures -2,000.0 -4,400.0 -5,280.0 -6,336.0 -1,140.5 -1,174.7

Unlevered Free Cash Flow $ 2,309.1 $ 592.0 $ 710.5 $ 852.5 $ 6,745.4 $ 6,947.8

- Interest Paid -800.0 -800.0 -800.0 -800.0 -800.0 -824.0

+ Interest Tax Shield 320.0 320.0 320.0 320.0 320.0 329.6

Free Cash Flow Before Changes in Financing $1,829.1 $112.0 $230.5 $372.5 $6,265.4 $6,453.4

+ Change in Debt Financing 0.0 0.0 0.0 0.0 300.0 309.0

Free Cash Flow to Common Equity $ 1,829.1 $ 112.0 $ 230.5 $ 372.5 $ 6,565.4 $ 6,762.4

CV

Year 0 Year 1 Year 2 Year 3 Year 3

Value of the Unlevered Firm:

Unlevered Free Cash Flow for Continuing Value $

6,745

Discount Factor for Continuing Value 10.000

Unlevered Free Cash Flow and Continuing Value $ 592 $ 710 $ 853 $ 67,454

Discount Factor 0.885 0.783 0.693 0.693

Discounted Value $ 524 $ 556 $ 591 $ 46,749

Value of the Unlevered Firm $ 48,420

Value of the Interest Tax Shields:

Interest Tax Shield for Continuing Value $ 320

Discount Factor for Continuing Value 10.000

Interest Tax Shield and Continuing Value of the $ 320 $ 320 $ 320 $ 3,200

Discount Factor 0.885 0.783 0.693 0.693

Present Value $ 283 $ 251 $ 222 $ 2,218

Value of the Interest Tax Shields $ 2,973

Value of the Firm $ 51,394 $ 807 $ 807 $ 813 $ 48,967

Continuing Value $ 70,654

©Cambridge Business Publishers, 2014

Solutions Manual, Chapter 6 8

Ed Kaplan, Inc. - Income Statement and Balance Sheet Forecasts

Year -1 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Revenue 10.0% 20.0% 20.0% 20.0% 3.0% 3.0%

Cost of Goods Sold 10.0% 20.0% 20.0% 20.0% 3.0% 3.0%

Gross Margin 10.0% 20.0% 20.0% 20.0% 3.0% 3.0%

Selling, General & Administrative 10.0% 20.0% 20.0% 20.0% 3.0% 3.0%

Operating Income 10.0% 20.0% 20.0% 20.0% 3.0% 3.0%

Interest Expense 25.0% 0.0% 0.0% 0.0% 0.0% 3.0%

Income Before Taxes 8.4% 22.4% 22.0% 21.6% 3.2% 3.0%

Income Tax Expense 8.4% 22.4% 22.0% 21.6% 3.2% 3.0%

Net Income 8.4% 22.4% 22.0% 21.6% 3.2% 3.0%

Cash Balance 10.0% 20.0% 20.0% 20.0% 3.0% 3.0%

Accounts Receivable 10.0% 20.0% 20.0% 20.0% 3.0% 3.0%

Inventory 10.0% 20.0% 20.0% 20.0% 3.0% 3.0%

Total Current Assets 10.0% 20.0% 20.0% 20.0% 3.0% 3.0%

Land 10.0% 20.0% 20.0% 20.0% 3.0% 3.0%

Total Assets 10.0% 20.0% 20.0% 20.0% 3.0% 3.0%

Accounts Payable 10.0% 20.0% 20.0% 20.0% 3.0% 3.0%

Other Current Operating Liabilities 10.0% 20.0% 20.0% 20.0% 3.0% 3.0%

Total Current Liabilities 10.0% 20.0% 20.0% 20.0% 3.0% 3.0%

Debt 0.0% 0.0% 0.0% 0.0% 3.0% 3.0%

Total Liabilities 0.5% 1.1% 1.3% 1.5% 3.0% 3.0%

Common Stock 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

Retained Earnings 159.1% 135.1% 69.0% 49.0% 4.5% 4.4%

Total Shareholders Equity 18.5% 34.3% 30.7% 28.2% 3.0% 3.0%

Total Liabilities and Equities 10.0% 20.0% 20.0% 20.0% 3.0% 3.0%

Ed Kaplan, Inc. - Free Cash Flow Forecasts

Year -1 Year 0 Year 1 Year 2 Year 3 Year 4 Year 5

Earnings Before Interest and Taxes (EBIT) 20.0% 20.0% 20.0% 3.0% 3.0%

- Income Taxes Paid on EBIT 20.0% 20.0% 20.0% 3.0% 3.0%

Earnings Before Interest and After Taxes 20.0% 20.0% 20.0% 3.0% 3.0%

- Change in Accounts Receivable 120.0% 20.0% 20.0% -82.0% 3.0%

- Change in Inventory 120.0% 20.0% 20.0% -82.0% 3.0%

+ Change in Accounts Payable 120.0% 20.0% 20.0% -82.0% 3.0%

+ Change in Current Other Liabilities 120.0% 20.0% 20.0% -82.0% 3.0%

- Change in Required Cash Balance 120.0% 20.0% 20.0% -82.0% 3.0%

Cash Flow Before Capital Expenditures 15.8% 20.0% 20.0% 9.7% 3.0%

- Capital Expenditures 120.0% 20.0% 20.0% -82.0% 3.0%

Unlevered Free Cash Flow -74.4% 20.0% 20.0% 691.2% 3.0%

- Interest Paid 0.0% 0.0% 0.0% 0.0% 3.0%

+ Interest Tax Shield 0.0% 0.0% 0.0% 0.0% 3.0%

Free Cash Flow Before Changes in Financing -93.9% 105.7% 61.7% 1581.8% 3.0%

+ Change in Debt Financing 3.0%

Free Cash Flow to Common Equity -93.9% 105.7% 61.7% 1662.3% 3.0%

D

P S

rE rUA + rUA rD × + r r × (3.12)

E

UA P S

E

©Cambridge Business Publishers, 2014

9 Corporate Valuation: Theory, Evidence & Practice, 1st Edition

Below appears the year-by-year APV valuation, annual discount rates, then WACC and E-DCF:

CV

Year 0 Year 1 Year 2 Year 3 Year 3

Value of Unlevered Firm:

Unlevered Free Cash Flow for Continuing Value $ 6,745

Discount Factor for Continuing Value 10.000

Unlevered Free Cash Flow $ 592 $ 710 $ 853

Value of the Unlevered Firm at Year End $ 54,123 $ 60,449 $ 67,454

Unlevered Value at Year End Plus Unlevered Free $ 54,715 $ 61,159 $ 68,307

Discount Factor for one Year 0.885 0.885 0.885

Value of Unlevered Firm at Beginning of Year $ 48,420 $ 54,123 $ 60,449 $ 67,454

Value of the Interest Tax Shields:

Interest Tax Shield for Continuing Value $ 320

Discount Factor for Continuing Value 10.000

Interest Tax Shields $ 320 $ 320 $ 320

Value of the Interest Tax Shields at Year End $ 3,040 $ 3,115 $ 3,200

Value of the Interest Tax Shields at End of Year $ 3,360 $ 3,435 $ 3,520

Discount Factor for one Year 0.885 0.885 0.885

Beginning of Year ITS $ 2,973 $ 3,040 $ 3,115 $ 3,200

Beginning of Year VF $ 0 $ 51,394 $ 57,163 $ 63,564 $ 70,654

As of the End of Year Year 0 Year 1 Year 2 Year 3

Value of the Firm (VF) $ 51,394 $ 57,163 $ 63,564 $ 70,654

Value of Debt (D) $ 10,000 $ 10,000 $ 10,000 $ 10,000

Value of Equity (E) $ 41,394 $ 47,163 $ 53,564 $ 60,654

D PS

rE rUA + rUA rD × + rUA rPS × Beg of Beg of Beg of Beg of

E E Year 1 Year 2 Year 3 Year 4

Unlevered Cost of Capital, rU 13.0% 13.0% 13.0% 13.0%

Cost of Debt, rD 8.0% 8.0% 8.0% 8.0%

Debt to Common Equity 0.2416 0.2120 0.1867 0.1649

Equity Cost of Capital, rE 14.21% 14.06% 13.93% 13.82%

CVEquity

Discounted Equity Flow Valuation Year 0 Year 1 Year 2 Year 3 Year 3

Free Cash Flow to Common Equity for Continuing $ 6,565

Discount Factor for Continuing Value 9.238

Common Equity Free Cash Flow and Common $ 112 $ 230 $ 373 $ 60,654

Equity Cost of Capital Discount Factor 0.876 0.768 0.674 0.674

Present Value $ 98 $ 177 $ 251 $ 40,868

Common Equity Value $ 41,394

©Cambridge Business Publishers, 2014

Solutions Manual, Chapter 6 10

Das könnte Ihnen auch gefallen

- Small Business Finance and Valuation (2021)Dokument185 SeitenSmall Business Finance and Valuation (2021)Andreea Bianca NeacșuNoch keine Bewertungen

- Macroeconomic: Policy EnvironmentDokument350 SeitenMacroeconomic: Policy Environmentavnish kanojiaNoch keine Bewertungen

- Conclusion+Deck-+Makings+of+a+MultiBagger Compressed+ PDFDokument645 SeitenConclusion+Deck-+Makings+of+a+MultiBagger Compressed+ PDFKrishnadev C.S100% (1)

- Tradingsimplified Episode 56 LowresDokument24 SeitenTradingsimplified Episode 56 LowresĐỗ SơnNoch keine Bewertungen

- Gaussians, PV, and Execution JournalDokument56 SeitenGaussians, PV, and Execution Journallilli-pilliNoch keine Bewertungen

- Hindu astrology - key elements and historyDokument8 SeitenHindu astrology - key elements and historyDeroy GarryNoch keine Bewertungen

- The Key to Know-How CompaniesDokument137 SeitenThe Key to Know-How Companiessidiqi2009Noch keine Bewertungen

- 1 CA K.G.AcharyaDokument40 Seiten1 CA K.G.AcharyaMurthyNoch keine Bewertungen

- Investment Strategy: Bad Trade?!Dokument6 SeitenInvestment Strategy: Bad Trade?!marketfolly.comNoch keine Bewertungen

- Famous Figures and Diagrams in Economics PDFDokument2 SeitenFamous Figures and Diagrams in Economics PDFLeslieNoch keine Bewertungen

- Brand Building Compiled NotesDokument8 SeitenBrand Building Compiled NotesAditi ThakareNoch keine Bewertungen

- Candlestick Charting and Technical Analysis (PDFDrive)Dokument39 SeitenCandlestick Charting and Technical Analysis (PDFDrive)Rathod arvinNoch keine Bewertungen

- Akira Takayama Analytical Methods in EconomicsDokument693 SeitenAkira Takayama Analytical Methods in EconomicsJoel GonzalesNoch keine Bewertungen

- SM CMM RevDokument168 SeitenSM CMM Revprafulvg100% (2)

- Comparative Analysis of Various Financial Institution in The Market 2011Dokument120 SeitenComparative Analysis of Various Financial Institution in The Market 2011Binay TiwariNoch keine Bewertungen

- Money: Theory and Practice: Jin Cao Gerhard IllingDokument412 SeitenMoney: Theory and Practice: Jin Cao Gerhard IllingBálint GrNoch keine Bewertungen

- Outlook Business - 4 March 2016Dokument124 SeitenOutlook Business - 4 March 2016Vinu DNoch keine Bewertungen

- CAT 2009-Update PercentilesDokument62 SeitenCAT 2009-Update Percentileskapil240788Noch keine Bewertungen

- Investor Diary Beginner Stock Analysis Excel (V-1) : How To Use This Spreadsheet?Dokument56 SeitenInvestor Diary Beginner Stock Analysis Excel (V-1) : How To Use This Spreadsheet?SumitNoch keine Bewertungen

- Asan InvestingDokument64 SeitenAsan InvestingPrashant KumarNoch keine Bewertungen

- Founders Guide To Financial Modeling Dave LishegoDokument117 SeitenFounders Guide To Financial Modeling Dave Lishegomitu lead01Noch keine Bewertungen

- 1598156714-Prasenjit Paul Screener Excel - Alkyl AminesDokument15 Seiten1598156714-Prasenjit Paul Screener Excel - Alkyl AminesANIRU ZZAMANNoch keine Bewertungen

- Ayushman Bharat PDFDokument48 SeitenAyushman Bharat PDFBhola DoleyNoch keine Bewertungen

- AMFI Certification Program Mutual Funds Conceptual FrameworkDokument146 SeitenAMFI Certification Program Mutual Funds Conceptual FrameworkPritam PaulNoch keine Bewertungen

- Ta Nism Day1Dokument33 SeitenTa Nism Day1Sachin D SalankeyNoch keine Bewertungen

- Oxford Atlas 35th Edition - UnlockedDokument117 SeitenOxford Atlas 35th Edition - UnlockedAhlam AboobakerNoch keine Bewertungen

- DAFgtRqQ1CGxCpisVyyQ BRITANNIA REPORT PDFDokument4 SeitenDAFgtRqQ1CGxCpisVyyQ BRITANNIA REPORT PDFtummalaajaybabuNoch keine Bewertungen

- Business Finance: Week 1Dokument149 SeitenBusiness Finance: Week 1Joseph Nathaniel Eugenio100% (1)

- Standing Instruction PDFDokument1 SeiteStanding Instruction PDFAbhijith MkNoch keine Bewertungen

- Make in India Opportunities in Food Processing SectorDokument56 SeitenMake in India Opportunities in Food Processing Sectormad killerNoch keine Bewertungen

- Investment Journey and Key Learnings Kumar SaurabhDokument7 SeitenInvestment Journey and Key Learnings Kumar SaurabhAASHAV PATELNoch keine Bewertungen

- 110105121Dokument987 Seiten110105121khushi jaiswal100% (1)

- High Performance Masterclass Part 2 WorksheetDokument2 SeitenHigh Performance Masterclass Part 2 WorksheetarjbakNoch keine Bewertungen

- Nifty, Sensex Will Struggle To Make Fresh Highs: PantherDokument3 SeitenNifty, Sensex Will Struggle To Make Fresh Highs: Panthergirish kumarNoch keine Bewertungen

- Ambit Good and Clean India PMSDokument22 SeitenAmbit Good and Clean India PMSAnkurNoch keine Bewertungen

- CMIE SampleDokument81 SeitenCMIE SampleSanjeevanee Vaidya100% (1)

- Bombay Stock ExchangeDokument70 SeitenBombay Stock ExchangeAnkit Misra100% (1)

- Trading Strategies of Institutional Investors in ADokument4 SeitenTrading Strategies of Institutional Investors in AJames OkramNoch keine Bewertungen

- MCX Silver: 31 July, 2012Dokument2 SeitenMCX Silver: 31 July, 2012arjbakNoch keine Bewertungen

- BS TradingDokument36 SeitenBS TradingAdam AdamsNoch keine Bewertungen

- Futures: Topic 10 I. Futures MarketsDokument48 SeitenFutures: Topic 10 I. Futures Marketslaser544Noch keine Bewertungen

- The Art of PricingDokument1 SeiteThe Art of PricingAtef Mohsen El-BassionyNoch keine Bewertungen

- EconomicsDokument145 SeitenEconomicsSolida VenNoch keine Bewertungen

- 4 5922281635100755097Dokument69 Seiten4 5922281635100755097Kumar Amit Singh0% (1)

- Hedged Strategy CheatsheetDokument2 SeitenHedged Strategy CheatsheetAdam100% (3)

- My STK NotesDokument22 SeitenMy STK Notespammy singhNoch keine Bewertungen

- Equity Valuation Project: GroupDokument20 SeitenEquity Valuation Project: Groupsushilgoyal86100% (1)

- The Warren Buffett Spreadsheet Final-Version - PreviewDokument335 SeitenThe Warren Buffett Spreadsheet Final-Version - PreviewHari ganesh RNoch keine Bewertungen

- Varma Capitals - Modeling TestDokument6 SeitenVarma Capitals - Modeling TestSuper FreakNoch keine Bewertungen

- The Warren Buffett Spreadsheet - PreviewDokument350 SeitenThe Warren Buffett Spreadsheet - PreviewbysqqqdxNoch keine Bewertungen

- Magic Castle Valuation AnalysisDokument4 SeitenMagic Castle Valuation AnalysissrigopNoch keine Bewertungen

- Solution To Case 12: What Are We Really Worth?Dokument4 SeitenSolution To Case 12: What Are We Really Worth?khalil rebato100% (1)

- EZZ Steel Financial AnalysisDokument31 SeitenEZZ Steel Financial Analysismohamed ashorNoch keine Bewertungen

- Valuation - PepsiDokument24 SeitenValuation - PepsiLegends MomentsNoch keine Bewertungen

- Financial Statement Ratio Analysis: Your Company, IncDokument4 SeitenFinancial Statement Ratio Analysis: Your Company, IncPeninahNoch keine Bewertungen

- Tesco Financials - Capital IQDokument48 SeitenTesco Financials - Capital IQÑízãr ÑzrNoch keine Bewertungen

- KR Valuation 28 Sept 2019Dokument54 SeitenKR Valuation 28 Sept 2019ket careNoch keine Bewertungen

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Dokument6 SeitenSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoNoch keine Bewertungen

- Intrinsic Value Discounted Cash Flow CalculatorDokument18 SeitenIntrinsic Value Discounted Cash Flow CalculatorAndrew LeeNoch keine Bewertungen

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachVon EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachBewertung: 3 von 5 Sternen3/5 (3)

- Translation EquivalenceDokument6 SeitenTranslation EquivalenceJamal Anwar TahaNoch keine Bewertungen

- SiBRAIN For PIC PIC18F57Q43 SchematicDokument1 SeiteSiBRAIN For PIC PIC18F57Q43 Schematicivanfco11Noch keine Bewertungen

- Material Safety Data Sheet Lime Kiln Dust: Rev. Date:5/1/2008Dokument6 SeitenMaterial Safety Data Sheet Lime Kiln Dust: Rev. Date:5/1/2008suckrindjink100% (1)

- 5505 SW 138th CT, Miami, FL 33175 ZillowDokument1 Seite5505 SW 138th CT, Miami, FL 33175 Zillowlisalinda29398378Noch keine Bewertungen

- SQL Server 2008 Failover ClusteringDokument176 SeitenSQL Server 2008 Failover ClusteringbiplobusaNoch keine Bewertungen

- Drafting TechnologyDokument80 SeitenDrafting Technologyong0625Noch keine Bewertungen

- Diemberger CV 2015Dokument6 SeitenDiemberger CV 2015TimNoch keine Bewertungen

- Tender34 MSSDSDokument76 SeitenTender34 MSSDSAjay SinghNoch keine Bewertungen

- 5 Important Methods Used For Studying Comparative EducationDokument35 Seiten5 Important Methods Used For Studying Comparative EducationPatrick Joseph63% (8)

- ExpDokument425 SeitenExpVinay KamatNoch keine Bewertungen

- Neuropathology of Epilepsy: Epilepsy-Related Deaths and SUDEPDokument11 SeitenNeuropathology of Epilepsy: Epilepsy-Related Deaths and SUDEPTeuku AvicennaNoch keine Bewertungen

- For Coin & Blood (2nd Edition) - SicknessDokument16 SeitenFor Coin & Blood (2nd Edition) - SicknessMyriam Poveda50% (2)

- Practice Like-Love - Hate and PronounsDokument3 SeitenPractice Like-Love - Hate and PronounsangelinarojascnNoch keine Bewertungen

- Spsi RDokument2 SeitenSpsi RBrandy ANoch keine Bewertungen

- Impact of Bap and Iaa in Various Media Concentrations and Growth Analysis of Eucalyptus CamaldulensisDokument5 SeitenImpact of Bap and Iaa in Various Media Concentrations and Growth Analysis of Eucalyptus CamaldulensisInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Laws of MotionDokument64 SeitenLaws of MotionArnel A. JulatonNoch keine Bewertungen

- EE290 Practice 3Dokument4 SeitenEE290 Practice 3olgaNoch keine Bewertungen

- A General Guide To Camera Trapping Large Mammals in Tropical Rainforests With Particula PDFDokument37 SeitenA General Guide To Camera Trapping Large Mammals in Tropical Rainforests With Particula PDFDiego JesusNoch keine Bewertungen

- Measuring Renilla Luciferase Luminescence in Living CellsDokument5 SeitenMeasuring Renilla Luciferase Luminescence in Living CellsMoritz ListNoch keine Bewertungen

- Antiquity: Middle AgesDokument6 SeitenAntiquity: Middle AgesPABLO DIAZNoch keine Bewertungen

- NameDokument5 SeitenNameMaine DagoyNoch keine Bewertungen

- Rheology of Polymer BlendsDokument10 SeitenRheology of Polymer Blendsalireza198Noch keine Bewertungen

- National Advisory Committee For AeronauticsDokument36 SeitenNational Advisory Committee For AeronauticsSamuel ChristioNoch keine Bewertungen

- Ch07 Spread Footings - Geotech Ultimate Limit StatesDokument49 SeitenCh07 Spread Footings - Geotech Ultimate Limit StatesVaibhav SharmaNoch keine Bewertungen

- Machine Spindle Noses: 6 Bison - Bial S. ADokument2 SeitenMachine Spindle Noses: 6 Bison - Bial S. AshanehatfieldNoch keine Bewertungen

- Urodynamics Griffiths ICS 2014Dokument198 SeitenUrodynamics Griffiths ICS 2014nadalNoch keine Bewertungen

- Problems of Teaching English As A Foreign Language in YemenDokument13 SeitenProblems of Teaching English As A Foreign Language in YemenSabriThabetNoch keine Bewertungen

- NOTE CHAPTER 3 The Mole Concept, Chemical Formula and EquationDokument10 SeitenNOTE CHAPTER 3 The Mole Concept, Chemical Formula and EquationNur AfiqahNoch keine Bewertungen

- Emergency Room Delivery RecordDokument7 SeitenEmergency Room Delivery RecordMariel VillamorNoch keine Bewertungen

- Computer Portfolio (Aashi Singh)Dokument18 SeitenComputer Portfolio (Aashi Singh)aashisingh9315Noch keine Bewertungen