Beruflich Dokumente

Kultur Dokumente

SBI AbridgedProfitnLoss

Hochgeladen von

Rohitt Mutthoo0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

20 Ansichten1 SeiteState Bank of India Comparison of Performance (abridged profit and loss a / c) - FY 09-10 Interest on Advances Interest on Deposits Interest on Borrowings Others sundry interest Total interest Expenses Net Interest Income Commission, Exc. Brokerage Profit on Sale / Rev of Investments Forex Income Dividend Income From Leasing Others other income total non-interest income total operating income Total operating income Payment to Employees Contribution for Employees Total staff expenses Rent, taxes, lighting depreciation standard assets

Originalbeschreibung:

Originaltitel

SBI-AbridgedProfitnLoss

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenState Bank of India Comparison of Performance (abridged profit and loss a / c) - FY 09-10 Interest on Advances Interest on Deposits Interest on Borrowings Others sundry interest Total interest Expenses Net Interest Income Commission, Exc. Brokerage Profit on Sale / Rev of Investments Forex Income Dividend Income From Leasing Others other income total non-interest income total operating income Total operating income Payment to Employees Contribution for Employees Total staff expenses Rent, taxes, lighting depreciation standard assets

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

20 Ansichten1 SeiteSBI AbridgedProfitnLoss

Hochgeladen von

Rohitt MutthooState Bank of India Comparison of Performance (abridged profit and loss a / c) - FY 09-10 Interest on Advances Interest on Deposits Interest on Borrowings Others sundry interest Total interest Expenses Net Interest Income Commission, Exc. Brokerage Profit on Sale / Rev of Investments Forex Income Dividend Income From Leasing Others other income total non-interest income total operating income Total operating income Payment to Employees Contribution for Employees Total staff expenses Rent, taxes, lighting depreciation standard assets

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

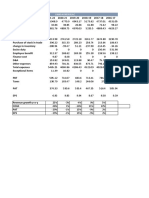

State Bank of India

Comparison of Performance (Abridged Profit and Loss A/c) - FY 09-10

Growth Q4FY 10 Growth FY10 Over

2007-08 2008-09 2009-10 Over Q4FY 09 FY09

FY Q4 FY 09 Q4 FY Amount % Amount %

Interest on Advances 35228.11 12083.61 46404.71 12967.32 50632.64 883.71 7.31 4227.92 9.11

Int on Resources Operations 13144.24 5088.16 16973.73 4669.99 19248.22 -418.17 -8.22 2274.49 13.40

Others Sundry Interest 577.96 170.62 409.99 328.28 1113.06 157.66 92.41 703.08 171.49

Total Interest Income 48950.31 17342.39 63788.43 17965.59 70993.92 623.20 3.59 7205.49 11.30

Interest on Deposits 27072.58 11387.49 37936.85 10297.05 43334.29 -1090.44 -9.58 5397.44 14.23

Interest on Borrowings 2938.43 91.57 2555.01 288.14 1228.05 196.57 214.65 -1326.96 -51.94

Others Sundry Interest 1918.06 1021.39 2423.44 658.95 2760.14 -362.44 -35.48 336.71 13.89

Total Interest Expenses 31929.07 12500.45 42915.29 11244.14 47322.48 -1256.31 -10.05 4407.18 10.27

Net Interest Income 17021.24 4841.94 20873.14 6721.45 23671.44 1879.51 38.82 2798.30 13.41

Commission, Exc. Brokerage 5914.25 3391.87 7617.24 3485.80 9640.86 93.93 2.77 2023.62 26.57

Profit on Sale / Rev of Investments 946.34 1508.87 2567.29 425.59 2116.79 -1083.27 -71.79 -450.50 -17.55

Forex Income 692.70 382.79 1179.25 189.48 1587.14 -193.31 -50.50 407.89 34.59

Dividend 197.41 7.57 409.60 47.11 573.48 39.54 522.62 163.88 40.01

Income From Leasing 31.86 1.83 26.67 -4.83 9.19 -6.67 -363.54 -17.48 -65.56

Others Other Income 912.36 -574.70 890.75 365.38 1040.70 940.08 163.58 149.95 16.83

Total Non-Interest Income 8694.92 4718.23 12690.79 4508.53 14968.15 -209.70 -4.44 2277.36 17.94

Total Operating Income 25716.16 9560.17 33563.93 11229.98 38639.59 1669.81 17.47 5075.66 15.12

Payment to Employees 7212.25 1861.88 8213.31 2826.61 10688.60 964.73 51.81 2475.28 30.14

Contribution for Employees 573.61 487.72 1534.00 765.15 2066.05 277.43 56.88 532.05 34.68

Total Staff Expenses 7785.86 2349.60 9747.31 3591.76 12754.65 1242.16 52.87 3007.33 30.85

Rent, Taxes, Lighting 993.42 391.17 1295.14 433.96 1589.57 42.79 10.94 294.44 22.73

Depreciation on Property 679.98 234.06 763.14 347.31 932.66 113.25 48.39 169.52 22.21

Others 3149.35 1308.27 3843.11 1663.06 5041.80 354.78 27.12 1198.68 31.19

Total Overhead Expenses 4822.75 1933.51 5901.39 2444.33 7564.03 510.83 26.42 1662.64 28.17

Total Operating Expenses 12608.61 4283.11 15648.70 6036.09 20318.68 1752.98 40.93 4669.98 29.84

Operating Profit 13107.55 5277.05 17915.23 5193.88 18320.91 -83.17 -1.58 405.68 2.26

Income Tax Provisions 3709.78 1157.08 5059.42 977.88 4760.04 -179.20 -15.49 -299.38 -5.92

Loan Loss Provisions 2000.94 1296.25 2474.97 2186.77 5147.84 890.52 68.70 2672.87 108.00

Investment Depreciation -88.68 -127.55 707.17 35.56 -968.60 163.11 127.88 -1675.77 -236.97

Standard Assets Provision 566.97 16.57 234.82 72.46 80.06 55.89 337.28 -154.76 -65.91

Other Provisions 189.42 192.39 317.61 54.61 135.52 -137.78 -71.61 -182.09 -57.33

Total Provisions 6378.43 2534.74 8793.99 3327.29 9154.87 792.55 31.27 360.88 4.10

Net Profit 6729.12 2742.31 9121.24 1866.60 9166.05 -875.71 -31.93 44.81 0.49

Financial Ratios (In Percentages) / Rs. In Crore

Return on Average Assets 1.01 1.04 0.88

Return on Equity 17.82 15.07 14.84

Capital Adequacy Ratio (Basel I) 13.54 12.97 12.01

Tier I Capital Adequacy Ratio 9.14 8.53 8.46

Capital Adequacy Ratio (Basel II) 14.25 13.39

Tier I Capital Adequacy Ratio 9.38 9.45

Earning per Share (Annualised in Rs.) 126.62 143.77 144.37

Cost of Deposits 5.59 6.30 5.80

Yield on Advances 9.90 10.15 9.66

Yield on Res.Dep 6.92 7.10 6.52

Net Interest Margin 3.07 2.93 2.66

Cost to Income Ratio 49.03 46.62 52.59

Non-Interest Income / Op. Inc. 33.81 37.81 38.74

Gross NPA Ratio 3.04 2.86 3.05

Net NPA Ratio 1.78 1.79 1.72

Gross NPAs 12837 15714 19535

Net NPAs 7424 9677 10870

Provision Cover (Excl AUCA) 42.17% 38.42% 44.36%

Provision Cover (Incl. AUCA) 56.98% 59.23%

Deposits 537405 742073 804116

Gross Advances 422308 548540 641480

Net Advances 416895 542144 631914

Das könnte Ihnen auch gefallen

- Schaum's Outline of Basic Business Mathematics, 2edVon EverandSchaum's Outline of Basic Business Mathematics, 2edBewertung: 5 von 5 Sternen5/5 (1)

- Balance Sheet ACC LTDDokument5 SeitenBalance Sheet ACC LTDVandita KhudiaNoch keine Bewertungen

- CEAT Financial Statement AnalysisDokument10 SeitenCEAT Financial Statement AnalysisYugant NNoch keine Bewertungen

- CEAT Financial Statement AnalysisDokument10 SeitenCEAT Financial Statement AnalysisClasherNoch keine Bewertungen

- ITC LTDDokument27 SeitenITC LTDSneha BhartiNoch keine Bewertungen

- Abridged Statement - Sheet1 - 2Dokument1 SeiteAbridged Statement - Sheet1 - 2KushagraNoch keine Bewertungen

- Adani Port P&L, BS, CF - IIMKDokument6 SeitenAdani Port P&L, BS, CF - IIMKabcdefNoch keine Bewertungen

- United Breweries Holdings LimitedDokument7 SeitenUnited Breweries Holdings Limitedsalini sasiNoch keine Bewertungen

- Progress at A Glance For Last 10 YearsDokument1 SeiteProgress at A Glance For Last 10 YearsAbhishek KumarNoch keine Bewertungen

- Balance Sheet (2009-2003) of TCS (US Format)Dokument15 SeitenBalance Sheet (2009-2003) of TCS (US Format)Girish RamachandraNoch keine Bewertungen

- Indian Oil 17Dokument2 SeitenIndian Oil 17Ramesh AnkithaNoch keine Bewertungen

- Dion Global Solutions LimitedDokument10 SeitenDion Global Solutions LimitedArthurNoch keine Bewertungen

- Stock Cues: Amara Raja Batteries Ltd. Company Report Card-StandaloneDokument3 SeitenStock Cues: Amara Raja Batteries Ltd. Company Report Card-StandalonekukkujiNoch keine Bewertungen

- Ultratech Cement LTD.: Total IncomeDokument36 SeitenUltratech Cement LTD.: Total IncomeRezwan KhanNoch keine Bewertungen

- Profit and Loss AccountDokument4 SeitenProfit and Loss AccountprajapatisunilNoch keine Bewertungen

- HUL FinancialsDokument5 SeitenHUL FinancialstheNoch keine Bewertungen

- P&L AccountDokument2 SeitenP&L AccountArpita GuptaNoch keine Bewertungen

- Icici Bank CMP: Rs. 956.05: Result UpdateDokument6 SeitenIcici Bank CMP: Rs. 956.05: Result UpdatemahasagarNoch keine Bewertungen

- Revenue, Costs, and Profits Over TimeDokument19 SeitenRevenue, Costs, and Profits Over TimeELIF KOTADIYANoch keine Bewertungen

- COMPANY/FINANCE/PROFIT AND LOSS/175/Nestle IndiaDokument1 SeiteCOMPANY/FINANCE/PROFIT AND LOSS/175/Nestle IndiabhuvaneshkmrsNoch keine Bewertungen

- All Numbers Are in INR and in x10MDokument6 SeitenAll Numbers Are in INR and in x10MGirish RamachandraNoch keine Bewertungen

- UFS AssignmentDokument10 SeitenUFS AssignmentTrishika ShettyNoch keine Bewertungen

- Value Metrics Tata SteelDokument15 SeitenValue Metrics Tata Steel07anshumanNoch keine Bewertungen

- TataDokument113 SeitenTataGunjan KaulNoch keine Bewertungen

- Ashok Leyland DCF TempletDokument9 SeitenAshok Leyland DCF TempletSourabh ChiprikarNoch keine Bewertungen

- Shree Cement Financial Model Projections BlankDokument10 SeitenShree Cement Financial Model Projections Blankrakhi narulaNoch keine Bewertungen

- Financial performance and ratios of manufacturing companyDokument6 SeitenFinancial performance and ratios of manufacturing companyShubham RankaNoch keine Bewertungen

- HUL CapitalineDokument25 SeitenHUL CapitalineOMANSHU YADAVNoch keine Bewertungen

- Sree Lakshimi Organic Cotton Industry Balance Sheet Balance Sheet Particulars 2010-2011 2011-2012 2012-2013 2013-2014 2014-2015Dokument5 SeitenSree Lakshimi Organic Cotton Industry Balance Sheet Balance Sheet Particulars 2010-2011 2011-2012 2012-2013 2013-2014 2014-2015ananthakumarNoch keine Bewertungen

- Du Pont AnalysisDokument5 SeitenDu Pont Analysisbhavani67% (3)

- Balancesheet - Tata Motors LTDDokument9 SeitenBalancesheet - Tata Motors LTDNaveen KumarNoch keine Bewertungen

- Ashok Leyland Limited: RatiosDokument6 SeitenAshok Leyland Limited: RatiosAbhishek BhattacharjeeNoch keine Bewertungen

- Supreme Annual Report 15 16Dokument104 SeitenSupreme Annual Report 15 16adoniscalNoch keine Bewertungen

- Amit Icici Bank LimitedDokument25 SeitenAmit Icici Bank LimitedAmit JainNoch keine Bewertungen

- Punjab National BankDokument7 SeitenPunjab National BankSandeep PareekNoch keine Bewertungen

- Fsa Colgate - AssignmentDokument8 SeitenFsa Colgate - AssignmentTeena ChandwaniNoch keine Bewertungen

- Institute Program Year Subject Project Name Company Competitor CompanyDokument37 SeitenInstitute Program Year Subject Project Name Company Competitor CompanyEashaa SaraogiNoch keine Bewertungen

- Balance Sheet (2009-2000) in US Format For Tata Motors: All Numbers Are in INR and in x10MDokument16 SeitenBalance Sheet (2009-2000) in US Format For Tata Motors: All Numbers Are in INR and in x10MGirish RamachandraNoch keine Bewertungen

- Allahabad Bank Sep 09Dokument5 SeitenAllahabad Bank Sep 09chetandusejaNoch keine Bewertungen

- AttachmentDokument19 SeitenAttachmentSanjay MulviNoch keine Bewertungen

- Trent Ltd. Balance Sheet and Profit & Loss AnalysisDokument6 SeitenTrent Ltd. Balance Sheet and Profit & Loss AnalysisVandit BatlaNoch keine Bewertungen

- Full Yr IndexingDokument1 SeiteFull Yr IndexingbhuvaneshkmrsNoch keine Bewertungen

- Statement of Profit and Loss and Balance Sheet for Leading CompanyDokument9 SeitenStatement of Profit and Loss and Balance Sheet for Leading CompanyAkanksha MalhotraNoch keine Bewertungen

- Dabur's P&L statement shows rising profits over 5 yearsDokument20 SeitenDabur's P&L statement shows rising profits over 5 yearsAkshay Yadav Student, Jaipuria LucknowNoch keine Bewertungen

- M&M Standalone Profit & Loss and Balance Sheet AnalysisDokument9 SeitenM&M Standalone Profit & Loss and Balance Sheet AnalysisAscharya DebasishNoch keine Bewertungen

- Financial Forecasting: Revenue, Costs, Profits, EPSDokument54 SeitenFinancial Forecasting: Revenue, Costs, Profits, EPSRonakk MoondraNoch keine Bewertungen

- 1 - Abhinav - Raymond Ltd.Dokument5 Seiten1 - Abhinav - Raymond Ltd.rajat_singlaNoch keine Bewertungen

- FSA GroupDokument87 SeitenFSA GroupSanjib Kumar RamNoch keine Bewertungen

- BAV Final ExamDokument27 SeitenBAV Final ExamArrow NagNoch keine Bewertungen

- State Bank Group Financial Highlights 2005 09Dokument5 SeitenState Bank Group Financial Highlights 2005 09abhi2shek2003Noch keine Bewertungen

- Omaxe Ltd. Executive Summary under 40 charactersDokument2 SeitenOmaxe Ltd. Executive Summary under 40 charactersShreemat PattajoshiNoch keine Bewertungen

- FM WK 5 PmuDokument30 SeitenFM WK 5 Pmupranjal92pandeyNoch keine Bewertungen

- Statement of Profit and Loss: ExpensesDokument2 SeitenStatement of Profit and Loss: ExpensesVishal KumarNoch keine Bewertungen

- Kirloskar Institute of Management Financial HighlightsDokument3 SeitenKirloskar Institute of Management Financial HighlightsSiddharth YadiyapurNoch keine Bewertungen

- FM 2 AssignmentDokument337 SeitenFM 2 AssignmentAvradeep DasNoch keine Bewertungen

- Ten Years Performance For The Year 2006-07Dokument1 SeiteTen Years Performance For The Year 2006-07api-3795636Noch keine Bewertungen

- Revenue and Cost Analysis 2007-2020Dokument38 SeitenRevenue and Cost Analysis 2007-2020Latisha UdaniNoch keine Bewertungen

- Asian P & L CapitaTemplate1Dokument1 SeiteAsian P & L CapitaTemplate1vinoth_kannan149058Noch keine Bewertungen

- Maruti Suzuki: Submitted byDokument17 SeitenMaruti Suzuki: Submitted byMukesh KumarNoch keine Bewertungen

- Tata SteelDokument66 SeitenTata SteelSuraj DasNoch keine Bewertungen

- 8 11470164 00 00 100151Dokument15 Seiten8 11470164 00 00 100151Rohitt MutthooNoch keine Bewertungen

- A Simple Example of Process CostingDokument7 SeitenA Simple Example of Process CostingfatimamominNoch keine Bewertungen

- Smarter: Motorola Milestone™ Xt720Dokument56 SeitenSmarter: Motorola Milestone™ Xt720Rohitt MutthooNoch keine Bewertungen

- SBI AbridgedProfitnLossDokument1 SeiteSBI AbridgedProfitnLossRohitt MutthooNoch keine Bewertungen