Beruflich Dokumente

Kultur Dokumente

Finance Assignment Sheet 2007-2008 John PDF

Hochgeladen von

Prince Digital ComputersOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Finance Assignment Sheet 2007-2008 John PDF

Hochgeladen von

Prince Digital ComputersCopyright:

Verfügbare Formate

Page 1

Affiliated with the University of Western Ontario, London, Canada N6A 2M3

2007/2008 ASSIGNMENT SHEET FOR FINANCE

BUSINESS 020-571

John Siambanopoulos, Monday – Wednesday 4:30 – 6:00

NOTE: As we work through the theory, the noted exercise for each class is to be completed

before that class, for discussion during class unless otherwise noted (in some classes, the

exercises will be done in class). Any handouts (if any were given out) will be available on-

line for you to print or outside my office door, DLH-222, as noted.

Monday, September 10

Lecture: Introduction to Business 020

: The Statement of Earnings

Read : Introduction to the Case Method, text, page 1 – 8

: Introduction to Financial Statements, text, pages 9 – 16

Wednesday, September 12

Lecture: The Balance Sheet

The Statement of Retained Earnings

Read : Introduction to Financial Statements, text, pages 16 – 31

To be done for today:

1. Exercise 2, Buckner Department Store Ltd. text, page 40

2. Exercise 2, J. Crawford Retail Sales, Inc. text, page 40

Monday, September 17

Lecture: Determining Cost of Goods Sold

Integrating the Statement of Earnings and Balance Sheet

To be done for today:

1. Paul Webster Retail Florist, text, page 43

2. Thomas Hardware Store Ltd. text, page 43

NOTE: A take-home quiz will be given out today to practice Financial Statements to be

handed in next Monday.

2007-2008 jsiamba2@uwo.ca Business 020 571

Page 2

Wednesday, September 19

To be done for today: Put the I/S, B/S and SRE together for:

1. Kelly Automotive Parts Wholesaler Inc. (casebook)

2. Glenn’s Glue Stick (casebook)

3. Lisa’s Waterbed Emporium (casebook) (if time is available)

Financial Management

Special Note from John: This section is very heavy. TRY to look over the material and do the

readings before the class in which we discuss the topics. It will make your life much easier.

Monday, September 24 – Take-home test due today!!!

Lecture: Welcoming Finance Into Our Class

Statement of Cash Flow (SCF) (slides)

Ratios: Basic Training (slides)

Read: Note on the Statement of Cash Flow (casebook)

Introduction to Financial Management, text, pages 63-104

To be done for today

1. In-class exercise and general lecture – No preparation required but doing the reading (text

and slides) WILL help. Note: We will not be covering how the Statement of Cash Flow is

put together in class. The procedure is in the Case Package. We will only look at its

interpretation. You will be able to assess how a company uses their money to run the

business in relation to cash from a) operating, b) financing and c) investing activities. You

will be evaluated on how well you think on the exam. ☺

Wednesday, September 26

Read : Introduction to Financial Management, pp. 63 – 84

We’ll be walking through the material and exercise today. Do the reading and attempt the exercise.

To be done for today

1. Do Exercise 2, and calculate the selected ratios for ABC Distribution Co. Ltd., pages 107 – 109 using

John’s Template on his website.

2. Along with the Exercise, John will also be bringing in examples from real companies for interpretation.

Monday, October 1

Lecture: Preparing Projected Statements: Making Assumptions and the “Plug” (slides)

: Term of Loan and Seasonality (slides)

Read : Introduction to Financial Management, page 84 – 92

John will be walking through the material and exercise today. Try not to miss this class.

To be done for today

1. Exercises 1, 2, 3, DEF Co. Ltd., page 110, use the Bank Loan as the “plug” figure.

2007-2008 jsiamba2@uwo.ca Business 020 571

Page 3

Wednesday, October 3

Topic: Analyzing Ratios, SCF and Preparing Projected Statements

To be done for today:

1. Cases: Gardiner Wholesalers A & B. Check the website for the learning aids.

a. Analyze the cashflow statement for each firm. What is happening?

b. Analyze the ratios for each firm. Comment on each firm.

c. Prepare a set of Projected Financial Statements for Elegance Jewellers for the

year ended June 30, 2003. Use information from both Gardiner A & B.

Monday, October 8

Thanksgiving – No Class

Wednesday, October 10

Lecture: Determining Financial Requirements for a company

4 Cs of Credit - Capacity to Repay, Collateral, Character, Conditions (slides)

Read : Introduction to Financial Management, pages 96 - 97.

Case : Maple Leaf Hardware, text, page 161.

To be done for today

1. As Stuart Foreman, assess the financial position of Maple Leaf Hardware Ltd. given the

Statement of Cash Flow (casebook) and financial ratio information

2. Prepare projected financial statements for the years ending as of December 31, 2002 and 2003.

3. We will most likely begin the topic of the 4 Cs of Credit and push part of the projections to the

next class. We’ll probably get through the projected income statements today so try to have

those done at the very least. ☺

Monday, October 15

Case : Maple Leaf Hardware, text, page 161. (continued from last day)

To be done for today

1. How much money does Maple Leaf need?

2. Discuss the appropriateness of the term of the loan and any seasonality effects on the

company’s financing requirements.

3. Analyze the 4 Cs. Should the loan request be granted? Why or why not?

Wednesday, October 17

Case : Dr. Jay Stephenson, text, page 112

To be done for today

1. Analyze the Statement of Cash Flow (casebook) and financial ratios.

2. Prepare a set of projected statements for the years ended December 31, 2001 and 2002.

2007-2008 jsiamba2@uwo.ca Business 020 571

Page 4

Monday, October 22

Case : Dr. Jay Stephenson, text, page 161

To be done for today

1. Analyze the 4 Cs for the company and determine how this will affect your decision.

2. Would you give the loan? Why or why not? How much would you lend?

Wednesday, October 24

Case : Lawsons, text, page 154 (Note: Age of Payables is 17 days for non-overdue accounts)

To be done for today

1. Analyze the Statement of Cash Flow (casebook).

2. Analyze and interpret the selected financial ratios

3. Prepare a set of projected statements for the years ending January 31, 2004 and January 31, 2005.

Monday, October 29

Case : Lawsons

To be done for today:

1 Interpret the required financing amount. What is your PLUG? What adjustment needs to be made

for seasonality?

2 Conduct a sensitivity analysis on days of inventory, A/R and A/P.

3 Assess the capacity to repay, collateral character and business conditions for Lawsons

4. What alternatives should you consider? What is your decision? Provide support for your

reasoning.

Wednesday, October 31

Topics : Comprehensive case and review

Case : Studio Tessier Ltée, text, page 194 (this was a former Finance test)

To be done for today:

1. As Monique Lavoie, make whatever analysis and decisions you deem appropriate

2. Bring any outstanding questions from this section on any topic. Today we’ll also discuss some

exam writing strategies.

Extra Cases for Practice: GE Capital (text)

Miami Car Care Centre (casebook)

These cases may be handed in for practice. My policy is that “if you make the effort, so will I”. Do them

in a four hour sitting (just like the exam) and hand them in to me, if you have the time, desire, need etc. I

will mark them as an “exam”, meet with you and give you feedback. There are absolutely no marks for

these extra cases whatsoever. They are for your own benefit and completely voluntary.

The Finance Exam is on Saturday, November 3, from 1:00 to 5:00 pm

Location to be announced in class.

2007-2008 jsiamba2@uwo.ca Business 020 571

Das könnte Ihnen auch gefallen

- HomeworkDokument7 SeitenHomeworkcodejonaNoch keine Bewertungen

- Fin 653Dokument6 SeitenFin 653adhi_nub0% (1)

- Econ 90-190 Syllabus Win10 0Dokument11 SeitenEcon 90-190 Syllabus Win10 0Chaucer19Noch keine Bewertungen

- ACC561 AccountingDokument21 SeitenACC561 AccountingG JhaNoch keine Bewertungen

- Cases in Strategic Financial ManagementDokument7 SeitenCases in Strategic Financial ManagementWaseem KhanNoch keine Bewertungen

- 237 - 120131 - 1003041 - Yesa Sda Fas Asf Asf Asa Fs Fasafs Applesauce and Oranges For The Best Time!hDokument20 Seiten237 - 120131 - 1003041 - Yesa Sda Fas Asf Asf Asa Fs Fasafs Applesauce and Oranges For The Best Time!hnickNoch keine Bewertungen

- 237 120091 1003041 HDokument16 Seiten237 120091 1003041 HAayush SuriNoch keine Bewertungen

- Financial Management: Theory and Practice, 10th EditionDokument7 SeitenFinancial Management: Theory and Practice, 10th EditionsajidNoch keine Bewertungen

- Course Outline - University of Washington Foster School of BusinessDokument10 SeitenCourse Outline - University of Washington Foster School of BusinessFirdausNoch keine Bewertungen

- BDokument26 SeitenBgreym111Noch keine Bewertungen

- AF617 Syl Update 6.25.11Dokument3 SeitenAF617 Syl Update 6.25.11落海无潮Noch keine Bewertungen

- ACC561 CompleteDokument25 SeitenACC561 CompleteG JhaNoch keine Bewertungen

- UT Dallas Syllabus For Aim6201.556.08f Taught by Ashiq Ali (Axa042200)Dokument6 SeitenUT Dallas Syllabus For Aim6201.556.08f Taught by Ashiq Ali (Axa042200)UT Dallas Provost's Technology GroupNoch keine Bewertungen

- FNCE3477 S17 SyllabusDokument5 SeitenFNCE3477 S17 SyllabusJavkhlangerel BayarbatNoch keine Bewertungen

- Banking Master Thesis TopicsDokument7 SeitenBanking Master Thesis Topicswcldtexff100% (1)

- Fase 3 Contabilidad, Respuesta de Ejercicios PracticosDokument3 SeitenFase 3 Contabilidad, Respuesta de Ejercicios PracticosjorgeNoch keine Bewertungen

- Kasus Kasus AuditDokument4 SeitenKasus Kasus Auditfaldy331Noch keine Bewertungen

- Term Paper For EconomicsDokument4 SeitenTerm Paper For Economicsaebvqfzmi100% (1)

- Foundations of Entrepreneurship - Okun - Nyu SternDokument12 SeitenFoundations of Entrepreneurship - Okun - Nyu SternaakashchandraNoch keine Bewertungen

- ABM - BF12 IIIb 7Dokument6 SeitenABM - BF12 IIIb 7Raffy Jade SalazarNoch keine Bewertungen

- Advanced Corporate Finance (Moon) SP2016Dokument7 SeitenAdvanced Corporate Finance (Moon) SP2016darwin12100% (1)

- MGMT 2020 Fall 11fDokument7 SeitenMGMT 2020 Fall 11fYunasis AesongNoch keine Bewertungen

- LB160 Book2 Session 2Dokument27 SeitenLB160 Book2 Session 2فهد محمد سليمان النمرNoch keine Bewertungen

- Okun - MGMT - GB.2327.20 - Managing Growing CompaniesDokument10 SeitenOkun - MGMT - GB.2327.20 - Managing Growing CompaniesaakashchandraNoch keine Bewertungen

- BUsiness FinanceDokument9 SeitenBUsiness FinancePaul ManalotoNoch keine Bewertungen

- UT Dallas Syllabus For Aim6201.mim.09u Taught by Ashiq Ali (Axa042200)Dokument10 SeitenUT Dallas Syllabus For Aim6201.mim.09u Taught by Ashiq Ali (Axa042200)UT Dallas Provost's Technology GroupNoch keine Bewertungen

- Gage College School of Graduate Studies Mba Program: FMA - Ethical Mini Case 01 - Assigned To Group 1 StudentsDokument12 SeitenGage College School of Graduate Studies Mba Program: FMA - Ethical Mini Case 01 - Assigned To Group 1 StudentsEyasu JaworNoch keine Bewertungen

- Finance II Materials McNeil 2020Dokument43 SeitenFinance II Materials McNeil 2020Atharva ManjrekarNoch keine Bewertungen

- ACC220 Course SyllabusDokument8 SeitenACC220 Course Syllabuskayd08Noch keine Bewertungen

- B40Dokument7 SeitenB40ambujg0% (1)

- Business Writing Skills-MMSDokument43 SeitenBusiness Writing Skills-MMSSweta DoshiNoch keine Bewertungen

- IB Interview Guide Case Studies PDFDokument9 SeitenIB Interview Guide Case Studies PDFEthan StarkNoch keine Bewertungen

- Investment Banking Case Studies: The Unreleased Interview GuideDokument9 SeitenInvestment Banking Case Studies: The Unreleased Interview GuideKartheek Chowdary100% (1)

- UT Dallas Syllabus For Mas6v06.x29.08f Taught by David Springate (Spring8)Dokument3 SeitenUT Dallas Syllabus For Mas6v06.x29.08f Taught by David Springate (Spring8)UT Dallas Provost's Technology GroupNoch keine Bewertungen

- PDF BelgesiDokument5 SeitenPDF BelgesiSoner YıldızNoch keine Bewertungen

- 6 TH Edition Final Exam Study SuggestionsDokument3 Seiten6 TH Edition Final Exam Study SuggestionsilovebusNoch keine Bewertungen

- Financial & Managerial Acct-Group Ass-01Dokument12 SeitenFinancial & Managerial Acct-Group Ass-01Noah GunnNoch keine Bewertungen

- Syla F552Dokument7 SeitenSyla F552Aiman Maimunatullail RahimiNoch keine Bewertungen

- Case TeuerDokument1 SeiteCase Teuergorkemkebir0% (1)

- Basic Economic Ideas-MinDokument7 SeitenBasic Economic Ideas-MinShenal De SilvaNoch keine Bewertungen

- MGT 701 Strategic Management Mumbai Jan 2021Dokument9 SeitenMGT 701 Strategic Management Mumbai Jan 2021Sumeet MadwaikarNoch keine Bewertungen

- PHD Corp Fin Syllabus - 2015 PDFDokument11 SeitenPHD Corp Fin Syllabus - 2015 PDFMacarenaAntonioNoch keine Bewertungen

- Courses Given in English at Seoul Campus07-2Dokument86 SeitenCourses Given in English at Seoul Campus07-2A.N.M. neyaz MorshedNoch keine Bewertungen

- MODULE 09 FABM2 Bank ReconciliationDokument9 SeitenMODULE 09 FABM2 Bank ReconciliationJm JuanillasNoch keine Bewertungen

- Case Analysis Report (30 Points)Dokument4 SeitenCase Analysis Report (30 Points)Michael MilsterNoch keine Bewertungen

- FIN 575 MART Expect Success Fin575martdotcomDokument10 SeitenFIN 575 MART Expect Success Fin575martdotcomwillam52Noch keine Bewertungen

- Assignment #4 - Historical Financial Statements - InstructionsDokument1 SeiteAssignment #4 - Historical Financial Statements - InstructionsHasan HrvyNoch keine Bewertungen

- 831 Syllabus Fall 2014Dokument8 Seiten831 Syllabus Fall 2014dchristensen5Noch keine Bewertungen

- Term Paper AccountingDokument6 SeitenTerm Paper Accountingc5r08vf7100% (1)

- BSBFIM501 Assessment V3 1216Dokument13 SeitenBSBFIM501 Assessment V3 1216paris0t67% (3)

- Corporate Finance Syllabus and Outline Spring 2011: Aswath DamodaranDokument19 SeitenCorporate Finance Syllabus and Outline Spring 2011: Aswath Damodaransondi325Noch keine Bewertungen

- Business FinanceDokument5 SeitenBusiness FinancePrincess Charmee Bernas100% (1)

- Assessment of The 'Accounting Cycle': Test Tools For The Accounting ProfessorDokument45 SeitenAssessment of The 'Accounting Cycle': Test Tools For The Accounting ProfessorKasthuri MohanNoch keine Bewertungen

- Financial Reporting and Analysis: Fall 2015 Course SyllabusDokument5 SeitenFinancial Reporting and Analysis: Fall 2015 Course SyllabusManjur Hossain ShovonNoch keine Bewertungen

- Syllabus Financial ManagemDokument8 SeitenSyllabus Financial ManagemNour LyNoch keine Bewertungen

- Penn State Econ 104 HomeworkDokument4 SeitenPenn State Econ 104 Homeworkafeuvytuu100% (1)

- Mental Models Columbia Gbs 2012 SyllabusDokument5 SeitenMental Models Columbia Gbs 2012 Syllabushkm_gmat4849Noch keine Bewertungen

- Mastering Corporate Finance Essentials: The Critical Quantitative Methods and Tools in FinanceVon EverandMastering Corporate Finance Essentials: The Critical Quantitative Methods and Tools in FinanceNoch keine Bewertungen

- Prospectus PDFDokument19 SeitenProspectus PDFPrince Digital ComputersNoch keine Bewertungen

- Prospectus PDFDokument68 SeitenProspectus PDFPrince Digital ComputersNoch keine Bewertungen

- Functions of A DSS PDFDokument6 SeitenFunctions of A DSS PDFPrince Digital Computers100% (1)

- Finance Assignment Sheet 2007-2008 John PDFDokument4 SeitenFinance Assignment Sheet 2007-2008 John PDFPrince Digital ComputersNoch keine Bewertungen

- English Language and Linguistics Notes: RatingDokument1 SeiteEnglish Language and Linguistics Notes: RatingPrince Digital ComputersNoch keine Bewertungen

- Welcome Sumandeep SinghDokument1 SeiteWelcome Sumandeep SinghPrince Digital ComputersNoch keine Bewertungen

- Maenglishsemestersystemexaminations2017 18Dokument38 SeitenMaenglishsemestersystemexaminations2017 18Prince Digital ComputersNoch keine Bewertungen

- Marks of Candidates Registered in June 2013 UGC NET: Results Marks e Certificate Previous Question Papers ArchiveDokument1 SeiteMarks of Candidates Registered in June 2013 UGC NET: Results Marks e Certificate Previous Question Papers ArchivePrince Digital ComputersNoch keine Bewertungen

- Goods and Service Tax (GST)Dokument29 SeitenGoods and Service Tax (GST)Prince Digital ComputersNoch keine Bewertungen

- Electronic Ticket Receipt, April 12 For SAPRA PARMINDER S MRDokument2 SeitenElectronic Ticket Receipt, April 12 For SAPRA PARMINDER S MRPrince Digital ComputersNoch keine Bewertungen

- Chapter 2 Activity 2 1Dokument3 SeitenChapter 2 Activity 2 1Wild RiftNoch keine Bewertungen

- JMR PH 3Dokument1 SeiteJMR PH 3kuldeep singh rathoreNoch keine Bewertungen

- 10 Extinction DLPDokument5 Seiten10 Extinction DLPLouise Meara SeveroNoch keine Bewertungen

- QTN No 213468Dokument4 SeitenQTN No 213468ZakNoch keine Bewertungen

- Etis ToolkitDokument36 SeitenEtis ToolkitPatricia Dominguez SilvaNoch keine Bewertungen

- A3. Political, Governmental and Legal ForcesDokument5 SeitenA3. Political, Governmental and Legal ForcesAleezah Gertrude RegadoNoch keine Bewertungen

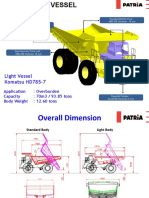

- Patria Light Vessel HD 785-7Dokument9 SeitenPatria Light Vessel HD 785-7bayu enasoraNoch keine Bewertungen

- LIC Guaranteed HNI Pension PlanDokument9 SeitenLIC Guaranteed HNI Pension PlanBhushan ShethNoch keine Bewertungen

- Forbo Marmoleum Click Techn - Specs PDFDokument1 SeiteForbo Marmoleum Click Techn - Specs PDFDoutor InácioNoch keine Bewertungen

- The True Impact of TRIDDokument2 SeitenThe True Impact of TRIDDanRanckNoch keine Bewertungen

- Aramco PDFDokument26 SeitenAramco PDFGanga DaranNoch keine Bewertungen

- Software Development Partnership Agreement: Article I - Formation of The PartnershipDokument3 SeitenSoftware Development Partnership Agreement: Article I - Formation of The PartnershipManeesh KumarNoch keine Bewertungen

- 7 - General Equilibrium Under UncertaintyDokument5 Seiten7 - General Equilibrium Under UncertaintyLuis Aragonés FerriNoch keine Bewertungen

- Daliya Manufacturing Unit PDFDokument2 SeitenDaliya Manufacturing Unit PDFpardeepNoch keine Bewertungen

- Housing Architecture: Literature Case StudiesDokument4 SeitenHousing Architecture: Literature Case StudiesJennifer PaulNoch keine Bewertungen

- Ijcrt1704123 PDFDokument6 SeitenIjcrt1704123 PDFshivanand shuklaNoch keine Bewertungen

- Southeast Asia Thriving in The Shadow of GiantsDokument38 SeitenSoutheast Asia Thriving in The Shadow of GiantsDDNoch keine Bewertungen

- Literature Review of Oil and Gas IndustryDokument8 SeitenLiterature Review of Oil and Gas Industryjcrfwerif100% (1)

- Public GoodDokument48 SeitenPublic GoodPutri IndahSariNoch keine Bewertungen

- BUS 435 AID Professional TutorDokument18 SeitenBUS 435 AID Professional TutorrobertjonesjrNoch keine Bewertungen

- Against Historical MaterialismDokument31 SeitenAgainst Historical MaterialismDimitris Mcmxix100% (1)

- Role of Microfinance in Odisha Marine FisheriesDokument8 SeitenRole of Microfinance in Odisha Marine FisheriesarcherselevatorsNoch keine Bewertungen

- CHAPTER 18 Multiple Choice Answers With ExplanationDokument10 SeitenCHAPTER 18 Multiple Choice Answers With ExplanationClint-Daniel Abenoja75% (4)

- Bhavnath TempleDokument7 SeitenBhavnath TempleManpreet Singh'100% (1)

- Low Floor Bus DesignDokument10 SeitenLow Floor Bus DesignavinitsharanNoch keine Bewertungen

- What Are The Similarities and Differences Between Marshall Ian's and Hicks Ian Demand Functions ?Dokument2 SeitenWhat Are The Similarities and Differences Between Marshall Ian's and Hicks Ian Demand Functions ?Zahra Malik100% (5)

- In The United States Bankruptcy Court For The District of DelawareDokument22 SeitenIn The United States Bankruptcy Court For The District of DelawareChapter 11 DocketsNoch keine Bewertungen

- Anta Tirta Kirana 1Dokument1 SeiteAnta Tirta Kirana 1yosi widianaNoch keine Bewertungen

- Economic Development Democratization and Environmental ProtectiDokument33 SeitenEconomic Development Democratization and Environmental Protectihaimi708Noch keine Bewertungen

- Free Talk SeniorDokument102 SeitenFree Talk SeniorCharmen Joy PonsicaNoch keine Bewertungen