Beruflich Dokumente

Kultur Dokumente

Nishat Mills Standalone Annual Earnings Increased Sep 14, 2010

Hochgeladen von

noorpuri1Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Nishat Mills Standalone Annual Earnings Increased Sep 14, 2010

Hochgeladen von

noorpuri1Copyright:

Verfügbare Formate

September 14, 2010

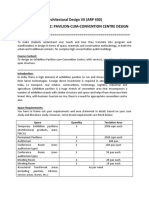

Nishat Mills’s standalone annual earnings increased by 1.3times FIPI Update* (USD mn)

Gross Buy 13.73

Nishat Mills (NML) export sales is nearly 2% of Pakistan exports… Gross Sell 13.96

Net Buy/ (0.23)

NML reported superb FY10 standalone earnings of Rs 2,915.4 mn (diluted EPS: Rs 8.29) as *Source NCCPL website

against Rs 1,268 mn (diluted EPS: Rs 3.61) reported last year. NML also reported cash

Total Foreign portfolio update** 2,209

dividend of Rs 2.5/sh thus spelling annual dividend yield of 5.3%.

** Source SBP website

NML is undervalued in our universe (our TP Rs 73 – 75/sh based on various valuation

methods) and we remain positive based on FY12 outlook in the company. ‘BUY’ KSE 100 Index

Massive sales jump is behind 1.3times increase in profitability KSE 100 Index (Sep 9, 2010) 9,879.33

Change (11.80)

This indeed is a terrific show by NML in the wake of 32% y-o-y increase in sales that

Volume (mn) 50.45

reached all time high of Rs 31.5 bn mark equivalent to US$ 367mn (nearly 2% of Pakistan’s

total exports). However, gross margins are still lagging behind at 9% given host of factors. KSE Market Capitalization (bn) 2,754.85

KSE Market Capitalization (USD) 32.29

Even though, NML gets benefit of local currency weakness plus 25% - 30% increase in SCRA (8-September-10) (USD) (30.83)

product value in international market.

Benefit of higher sales quantum may wane in FY11 GDR Update (USD)

MCB (1GDR=2Shares) 2.60

The benefit of voluminous sales is likely to wane given exacerbating increase in cotton lint

(last year NML’s average cotton pickings were below Rs 4000/maund). This year this OGDC (1GDR=10Shares) 16.75

average of around Rs 6500/maund may mean that NML may not enjoy bout of increased UBL (1GDR=4Shares) 2.00

profitability. Moreover, we see sluggish growth in international home textiles may keep LUCK (1GDR=4Shares) 1.70

NML earnings depressed within the proximity of Rs 6 – 7/sh EPS. HUBC (1GDR=25Shares) 9.78

These earnings may be devoid of a possible dividend payout from new acquisitions of two

South Punjab based IPPs AES Lalpir & AES Gen. Key Financial Market Update

CPI Inflation % 12.79

As per our discussion with NML management, there is no likelihood that cash dividend FX Reserves (USD) 16.07

from these newly acquired IPPs to yield dividend in the coffers of NML at least in FY11. Trade Balance (USD) (2.69)

However, NML’s FY12 earnings may shoot up due to spat of dividends from these old IPP 6-Months KIBOR % 12.91

projects.

PKR-USD parity 85.95

Valuation

We cover NML on sum of parts based methodology wherein we have assigned previous Volume Leaders Vol (mn)

valuations of Rs 73 – Rs 75/sh cumulative fair value. However, with the change of new JSCL 5.56

fiscal we will come up with updated call once detailed accounts published. FCIBL 4.62

NML 4.15

However, we remain positive on NML given economy of scale, higher yarn prices and

prospects of developing huge niche in China and diversification into the power sector for FFBL 4.05

possible dividends. BUY NPL 3.58

AKSL 3.29

Disclaimer: This report has been prepared by Standard Capital Securities (Pvt) Ltd and is provided for information purposes only. The information and data on which this report is based are obtained from

sources which we believe to be reliable but we do not guarantee that it is accurate or complete. Standard Capital Securities (Pvt) Ltd accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents. Investors are advised to take professional advice before making investments and Standard Capital Securities (Pvt) Ltd does not take

Any responsibility and shall not be held liable for undue reliance on this report. This report may not be reproduced, distributed or published by any recipient for any purpose.

www.scstrade.com | info@scstrade.com | 111-111-721

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Beginners Guide To SalesDokument19 SeitenBeginners Guide To SalesJoannaCamyNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Getting Paid Math 2.3.9.A1 PDFDokument3 SeitenGetting Paid Math 2.3.9.A1 PDFLyndsey BridgersNoch keine Bewertungen

- Ian Marcouse - Marie Brewer - Andrew Hammond - AQA Business Studies For AS - Revision Guide-Hodder Education (2010)Dokument127 SeitenIan Marcouse - Marie Brewer - Andrew Hammond - AQA Business Studies For AS - Revision Guide-Hodder Education (2010)Talisson BonfimNoch keine Bewertungen

- ANZ Bank StatementDokument5 SeitenANZ Bank StatementWenjie65100% (2)

- Applied Auditing 2017 Answer Key PDFDokument340 SeitenApplied Auditing 2017 Answer Key PDFcezyyyyyy50% (2)

- Jeffrey HealthcareServicesDokument77 SeitenJeffrey HealthcareServicesPiyush JainNoch keine Bewertungen

- (Outstanding) (DDI) 9 Talent Management Best Practices - DDIDokument12 Seiten(Outstanding) (DDI) 9 Talent Management Best Practices - DDINguyen Thanh-LoanNoch keine Bewertungen

- Hedonistic Sustainability - Natural HabitatsDokument2 SeitenHedonistic Sustainability - Natural HabitatsPavithra SuparamanianNoch keine Bewertungen

- Corporate Governance StatementDokument15 SeitenCorporate Governance StatementRahul PagariaNoch keine Bewertungen

- Introduction To Predictive Analytics: FICO Solutions EducationDokument51 SeitenIntroduction To Predictive Analytics: FICO Solutions EducationSumit RampuriaNoch keine Bewertungen

- Chapter 4 - Review Questions Accounting Information SystemDokument2 SeitenChapter 4 - Review Questions Accounting Information SystemBeny MoldogoNoch keine Bewertungen

- Latur Water Supply ProjectDokument14 SeitenLatur Water Supply ProjectMehul TankNoch keine Bewertungen

- MKT Assignment Factory ReportDokument7 SeitenMKT Assignment Factory ReportTsadik Hailay100% (2)

- Problem 29.2Dokument2 SeitenProblem 29.2Arian AmuraoNoch keine Bewertungen

- HR Analytics - Assignment 7Dokument4 SeitenHR Analytics - Assignment 7Bismah AhmedNoch keine Bewertungen

- Pavilion-cum-Convention Centre DesignDokument5 SeitenPavilion-cum-Convention Centre DesignHarman VirdiNoch keine Bewertungen

- Minor Project ReportDokument53 SeitenMinor Project ReportVishlesh 03014901819Noch keine Bewertungen

- Certificado #01 100 822 1632965 - CertipediaDokument1 SeiteCertificado #01 100 822 1632965 - CertipediaNancy CruzNoch keine Bewertungen

- Current Macroeconomic and Financial Situation Tables Based On Five Months Data of 2021.22Dokument84 SeitenCurrent Macroeconomic and Financial Situation Tables Based On Five Months Data of 2021.22Mohan PudasainiNoch keine Bewertungen

- Demand TheoryDokument10 SeitenDemand TheoryVinod KumarNoch keine Bewertungen

- Chapter - 6 Findings, Suggestions Andconclusion Findings From Financial AnalysisDokument2 SeitenChapter - 6 Findings, Suggestions Andconclusion Findings From Financial AnalysisTinku KumarNoch keine Bewertungen

- Module 4 - Public Fiscal AdministrationDokument10 SeitenModule 4 - Public Fiscal AdministrationAngel BNoch keine Bewertungen

- Administrative Theory by Henry FayolDokument6 SeitenAdministrative Theory by Henry FayolKaycee GaranNoch keine Bewertungen

- BSBA in Financial ManagementDokument4 SeitenBSBA in Financial ManagementJOCELYN NUEVONoch keine Bewertungen

- Higher Pension As Per SC Decision With Calculation - Synopsis1Dokument13 SeitenHigher Pension As Per SC Decision With Calculation - Synopsis1hariveerNoch keine Bewertungen

- Act May20 - Full LRDokument52 SeitenAct May20 - Full LREnoc MoralesNoch keine Bewertungen

- IloiloVs PPADokument2 SeitenIloiloVs PPACheryl QueniahanNoch keine Bewertungen

- Siddhartha Gurgaon SiddharthaDokument2 SeitenSiddhartha Gurgaon Siddharthakamalnayan1Noch keine Bewertungen

- The IMC PlanDokument76 SeitenThe IMC PlanNoha KandilNoch keine Bewertungen

- ECON20063 TemplateDokument6 SeitenECON20063 TemplateKristel LacaNoch keine Bewertungen