Beruflich Dokumente

Kultur Dokumente

BUS502 Summer11 Examtypeq2-6

Hochgeladen von

mehdiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BUS502 Summer11 Examtypeq2-6

Hochgeladen von

mehdiCopyright:

Verfügbare Formate

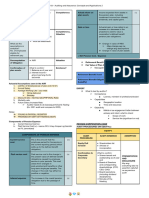

Chapter 10

17. Campbell Co. is trying to estimate its weighted average cost of capital (WACC). Which

of the following statements is most correct?

a. The after-tax cost of debt is generally cheaper than the after-tax cost of equity. *

b. Since retained earnings are readily available, the cost of retained earnings is

generally lower than the cost of debt.

c. The after-tax cost of debt is generally more expensive than the before-tax cost of

debt.

d. Statements a and c are correct.

18. Wyden Brothers has no retained earnings. The company uses the CAPM to calculate

the cost of equity capital. The company’s capital structure consists of common stock,

preferred stock, and debt. Which of the following events will reduce the company’s

WACC?

a. A reduction in the market risk premium. *

b. An increase in the flotation costs associated with issuing new common stock.

c. An increase in the company’s beta.

d. An increase in expected inflation.

Statement a is true; the other statements are false. If RPM

decreases, the cost of equity will be reduced. Answers b through e

will all increase the company’s WACC.

19. Dick Boe Enterprises, an all-equity firm, has a corporate beta coefficient of 1.5. The

financial manager is evaluating a project with an expected return of 21 percent,

before any risk adjustment. The risk-free rate is 10 percent, and the required rate of

return on the market is 16 percent. The project being evaluated is riskier than Boe’s

average project, in terms of both beta risk and total risk. Which of the following

statements is most correct?

a. The project should be accepted since its expected return (before risk adjustment)

is greater than its required return.

b. The project should be rejected since its expected return (before risk adjustment) is

less than its required return.

c. The accept/reject decision depends on the risk-adjustment policy of the firm. If

the firm’s policy were to reduce a riskier-than-average project’s expected return

by 1 percentage point, then the project should be accepted. *

d. Riskier-than-average projects should have their expected returns increased to

reflect their added riskiness. Clearly, this would make the project acceptable

regardless of the amount of the adjustment.

ks = 10% + (16% - 10%)1.5 = 10% + 9% = 19%.

Expected return = 21%. 21% - Risk adjustment 1% = 20%.

Risk-adjusted return = 20% > ks = 19%. Thus, the project should be

selected.

20. Conglomerate Inc. consists of 2 divisions of equal size, and Conglomerate is 100

percent equity financed. Division A’s cost of equity capital is 9.8 percent, while

Das könnte Ihnen auch gefallen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Net Present Value and Other Investment Criteria-12Dokument1 SeiteNet Present Value and Other Investment Criteria-12mehdiNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- GBUS502 Summer11 Examtypeq2-3Dokument1 SeiteGBUS502 Summer11 Examtypeq2-3mehdiNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- GBUS502 Summer11 Examtypeq2-11Dokument1 SeiteGBUS502 Summer11 Examtypeq2-11mehdiNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Net Present Value and Other Investment Criteria-10Dokument1 SeiteNet Present Value and Other Investment Criteria-10mehdiNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Net Present Value and Other Investment Criteria-9Dokument1 SeiteNet Present Value and Other Investment Criteria-9mehdiNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Inventoreconomic Order Quantity Model: Results - Sorted by Dollar VolumeDokument5 SeitenInventoreconomic Order Quantity Model: Results - Sorted by Dollar VolumemehdiNoch keine Bewertungen

- Chapter One Instructor QuestionsDokument9 SeitenChapter One Instructor QuestionsmehdiNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Sample Midterm1 9Dokument1 SeiteSample Midterm1 9mehdiNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Chapter 12Dokument8 SeitenChapter 12mehdiNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Chapter 13Dokument12 SeitenChapter 13mehdiNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Summer11 Examtypeq2-9Dokument1 SeiteSummer11 Examtypeq2-9mehdiNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Sample Midterm1 7Dokument1 SeiteSample Midterm1 7mehdiNoch keine Bewertungen

- Chapter 13Dokument12 SeitenChapter 13mehdiNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Sample Midterm1 6Dokument1 SeiteSample Midterm1 6mehdiNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Sample Midterm 1: Shareholders Are OwnersDokument1 SeiteSample Midterm 1: Shareholders Are OwnersmehdiNoch keine Bewertungen

- QUIZ 5 AnswersDokument1 SeiteQUIZ 5 AnswersmehdiNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Midterm3 Answer 2Dokument1 SeiteMidterm3 Answer 2mehdiNoch keine Bewertungen

- Sample Exam Ch1 5Dokument5 SeitenSample Exam Ch1 5mehdiNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Midterm3 Answer 3Dokument1 SeiteMidterm3 Answer 3mehdiNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- 財務管理 傅冶天Dokument16 Seiten財務管理 傅冶天mehdiNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Midterm3 AnswerDokument1 SeiteMidterm3 AnswermehdiNoch keine Bewertungen

- Mgo403 Quiz 1 AnswersDokument5 SeitenMgo403 Quiz 1 AnswersmehdiNoch keine Bewertungen

- 9471128Dokument6 Seiten9471128mehdiNoch keine Bewertungen

- Quizzes 1-7Dokument14 SeitenQuizzes 1-7mehdiNoch keine Bewertungen

- Sample Exam Ch1 5Dokument5 SeitenSample Exam Ch1 5mehdiNoch keine Bewertungen

- Exam 2 MPDokument2 SeitenExam 2 MPmehdiNoch keine Bewertungen

- Corporate Finance ExamDokument10 SeitenCorporate Finance Exammehdi100% (2)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (120)

- 9471128Dokument6 Seiten9471128mehdiNoch keine Bewertungen

- Corporate Finance Exam 2014Dokument4 SeitenCorporate Finance Exam 2014mehdiNoch keine Bewertungen

- Corporate Finance - Project Report - Capital Structure TrendsDokument18 SeitenCorporate Finance - Project Report - Capital Structure TrendsNikhil PathakNoch keine Bewertungen

- Assignment 1 - BEC325Dokument6 SeitenAssignment 1 - BEC325stanely ndlovuNoch keine Bewertungen

- Chapter 4: Liquidation Based Valuation MC Problems 1 WW IncDokument153 SeitenChapter 4: Liquidation Based Valuation MC Problems 1 WW IncKim BihagNoch keine Bewertungen

- The Complete Guide To Donchian Channel Indicator PDFDokument19 SeitenThe Complete Guide To Donchian Channel Indicator PDFDiky Arifin100% (7)

- TechStars Bridge Term Sheet-2Dokument3 SeitenTechStars Bridge Term Sheet-2Josh WestermanNoch keine Bewertungen

- Financial Markets and InstrumentDokument30 SeitenFinancial Markets and InstrumentAbdul Fattaah Bakhsh 1837065Noch keine Bewertungen

- Renewable Volume ObligationDokument9 SeitenRenewable Volume ObligationHieu NgoNoch keine Bewertungen

- Capital Budgeting Decisions: Accepting Projects That Yields A Return Higher Than The Hurdle RateDokument19 SeitenCapital Budgeting Decisions: Accepting Projects That Yields A Return Higher Than The Hurdle RateGaurav JainNoch keine Bewertungen

- Šuvak GoranDokument59 SeitenŠuvak GoranSeminarski RadoviNoch keine Bewertungen

- Chapter 8 Prob SolutionsDokument9 SeitenChapter 8 Prob SolutionsManoj GirigoswamiNoch keine Bewertungen

- Asset Classes and Financial InstrumentsDokument36 SeitenAsset Classes and Financial InstrumentsAnis KefiNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- CHAPTER 5 - Portfolio TheoryDokument58 SeitenCHAPTER 5 - Portfolio TheoryKabutu ChuungaNoch keine Bewertungen

- Tata Capital - July 2023Dokument4 SeitenTata Capital - July 2023Krishna GoyalNoch keine Bewertungen

- The Market Maker's MatrixDokument72 SeitenThe Market Maker's Matrixjlaudirt100% (4)

- Forex Experts Secrets-1Dokument10 SeitenForex Experts Secrets-1malick komlanNoch keine Bewertungen

- Lecture 10 - CAPMDokument19 SeitenLecture 10 - CAPMroBinNoch keine Bewertungen

- Investment ProjectDokument28 SeitenInvestment ProjectYashiNoch keine Bewertungen

- Crypto Wall Crypto Snipershot OB Strategy - Day Trade SwingDokument29 SeitenCrypto Wall Crypto Snipershot OB Strategy - Day Trade SwingArete JinseiNoch keine Bewertungen

- SourceDokument27 SeitenSourceAnonymous kwi5IqtWJNoch keine Bewertungen

- Steampunk Settlement: Cover Headline Here (Title Case)Dokument16 SeitenSteampunk Settlement: Cover Headline Here (Title Case)John DeeNoch keine Bewertungen

- Answers For Chapter 5Dokument2 SeitenAnswers For Chapter 5Wan MP WilliamNoch keine Bewertungen

- Aec64 Audit 2 Notes-22-24Dokument3 SeitenAec64 Audit 2 Notes-22-24Althea RubinNoch keine Bewertungen

- Yield Curve Analysis: Rahul Chhabra MBA, 3 SemDokument21 SeitenYield Curve Analysis: Rahul Chhabra MBA, 3 SemRushmiS100% (2)

- Siyaram Silk Mills LTD: 19BM63122 Spandan Kumar Nanda 19BM63140 Vignesh VDokument3 SeitenSiyaram Silk Mills LTD: 19BM63122 Spandan Kumar Nanda 19BM63140 Vignesh VHarshit Kumar SinghNoch keine Bewertungen

- Capital Budgeting: Complete This Problem.) When These Tables Are Insufficient For CompletionDokument30 SeitenCapital Budgeting: Complete This Problem.) When These Tables Are Insufficient For CompletionJane Michelle EmanNoch keine Bewertungen

- Cash Management and Profitability of Corporate Firms. A Case of MTN Uganda Limited Mbarara BranchDokument96 SeitenCash Management and Profitability of Corporate Firms. A Case of MTN Uganda Limited Mbarara BranchromanNoch keine Bewertungen

- Audit ProbDokument2 SeitenAudit ProbZvioule Ma Fuentes0% (1)

- Econ - An Afternoon With Jim Rogers - 2009!02!04 Maybank-IB ETDokument3 SeitenEcon - An Afternoon With Jim Rogers - 2009!02!04 Maybank-IB ETwonderwNoch keine Bewertungen

- China's Energy OFDI Trends and CompositionDokument18 SeitenChina's Energy OFDI Trends and CompositionAILEN KREIZERNoch keine Bewertungen

- What Is BootstrappingDokument3 SeitenWhat Is BootstrappingCharu SharmaNoch keine Bewertungen

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindVon EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindBewertung: 5 von 5 Sternen5/5 (231)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Von EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- Getting to Yes: How to Negotiate Agreement Without Giving InVon EverandGetting to Yes: How to Negotiate Agreement Without Giving InBewertung: 4 von 5 Sternen4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Von EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (13)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaVon EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaBewertung: 4.5 von 5 Sternen4.5/5 (14)