Beruflich Dokumente

Kultur Dokumente

Income Taxation and MCIT Rules

Hochgeladen von

MJ0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

117 Ansichten4 Seitenmm

Originaltitel

Blt 134 Chapter 4

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenmm

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

117 Ansichten4 SeitenIncome Taxation and MCIT Rules

Hochgeladen von

MJmm

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

Blt 134 chapter 4

1. 1. INCOME TAXATION Chapter 4 - Ballada

2. 2. CHAPTER IV – MINIMUM CORPORATE INCOME TAX, IAET AND GITMINIMUM CORPORATE INCOME TAX (MCIT) Two percent (2%) of the gross income as of the end of the

taxable year is imposed upon any domestic corporation beginning the fourth (4th) taxable year (whether calendar or fiscal yea, depending on the accounting periodemployed)

immediately following the taxable year in which such corporation commenced its business operations. The MCIT shall be imposed whenever:a. Such corporation has zero or

negative taxable income; orb. The amount of minimum corporateincome tax is greater than the normal income tax due from such corporation.Relief from MCIT under Certain

ConditionsThe Secretary of Finance, upon recommendation of the Commissioner,may suspend the imposition of MCIT upon submission of proof by the applicant-corporation, duly

verified by the Commissioner’s authorized representative, that the corporation sustained substantial losses on account of a prolonged labor dispute or because of “force majeure” or

because of legitimate business reverses.

3. 3. PERIOD SUBJECT TO MCITFor purposes of the MCIT, the taxable year in which business operations commenced shall be the year in which the domestic registered with the

BIR. Firms which were registered with BIR in 1994 and earlier years shall be covered by the MCIT beginning Jan. 1, 1998. Firms which were registered with BIR in any month in

1998 shall be covered by the MCIT in 2002 after the lapse of three calendar years from 1998.The reckoning point for firms using the fiscal year shall also be 1998. For example, a

firm which registered with the BIR on July 1, 1998 shall be subject to MCIT on his gross income earned for the entire fiscal year ending in the year 2002.

4. 4. ACCOUNTING TREATMENT OF EXCESS MCIT PAIDAny amount paid as excess MCIT shall be recorded in the corporation’s books as an asset under account title “Deferred

Charges – MCIT”. This asset account shall be carried forward and may be credited against the normal income tax due for a period not exceeding three (3) taxable years immediately

succeeding the taxable year/s in which the same has been paid.Any amount of the excess MCIT which has not or cannot be credited against the normal income taxes due for the 3-

year reglementary period shall lose its creditability. Such amount shall be removed and deducted from “Deferred charges – MCIT” account by a debit entry to “Retained Earnings”

account and a credit entry to “Deferred Charges-MCIT” account since this tax is not allowable as deduction from gross income it being an income tax.

5. 5. LA PAGAYO CORPORATIONYEAR JOURNAL ENTRIES DR. CR. 2003 a Provision for Income Tax 25,000.00 Income Tax Tapayable 25,000.00 b Deferred Charges - MCIT

75,000.00 Income Tax Payable 75,000.00 c Income Tax Payable 100,000.00 Cash In Bank 100,000.00

6. 6. Deferred Charges - MCIT2003(b) 75,000.00 Income Tax Payable2003(c) 100,000.00 25,000.00 2003(a) 75,000.00 2003(b) 100,000.00 100,000.00

7. 7. YEAR JOURNAL ENTRIES DR. CR. 2004 a Provision for Income Tax 130,000.00 Income Tax Tapayable 130,000.00 b Deferred Charges - MCIT 20,000.00 Income Tax Payable

20,000.00 c Income Tax Payable 150,000.00 Cash In Bank 150,000.00

8. 8. Deferred Charges - MCITBB 75,000.002004(b) 20,000.00 95,000.00 Income Tax Payable2004(c) 150,000.00 130,000.00 2004(a) 20,000.00 2004(b) 150,000.00 150,000.00

9. 9. YEAR JOURNAL ENTRIES DR. CR. 2005 a Provision for Income Tax 200,000.00 Income Tax Tapayable 200,000.00 b Income Tax Payable 95,000.00 Deferred Charges - MCIT

95,000.00 c Income Tax Payable 105,000.00 Cash In Bank 105,000.00

10. 10. Deferred Charges - MCITBB 95,000.00 95,000.00 2005(b) Income Tax Payable2004(b) 95,000.00 200,000.00 2005(a)2004(c) 105,000.00 200,000.00 200,000.00

11. 11. YEAR JOURNAL ENTRIES DR. CR. 2006 a Deferred Charges - MCIT 300,000.00 Income Tax Payable 300,000.00 b Income Tax Payable 300,000.00 Cash In Bank 300,000.00

12. 12. Deferred Charges - MCIT2006(a) 300,000.00 Income Tax Payable2006(b) 300,000.00 300,000.00 2006(a)

13. 13. YEAR JOURNAL ENTRIES DR. CR. 2007 a Provision for Income Tax 10,000.00 Income Tax Tapayable 10,000.00 b Deferred Charges - MCIT 40,000.00 Income Tax Payable

40,000.00 c Income Tax Payable 50,000.00 Cash In Bank 50,000.00

14. 14. Deferred Charges - MCITBB 300,000.002007(B) 40,000.00 340,000.00 Income Tax Payable2007(c) 50,000.00 10,000.00 2007(a) 40,000.00 2007(b) 50,000.00 50,000.00

15. 15. YEAR JOURNAL ENTRIES DR. CR. 2007 a Provision for Income Tax 10,000.00 Income Tax Tapayable 10,000.00 b Deferred Charges - MCIT 40,000.00 Income Tax Payable

40,000.00 c Income Tax Payable 50,000.00 Cash In Bank 50,000.00

16. 16. Deferred Charges - MCITBB 300,000.002007(B) 40,000.00 340,000.00 Income Tax Payable2007(c) 50,000.00 10,000.00 2007(a) 40,000.00 2007(b) 50,000.00 50,000.00

17. 17. YEAR JOURNAL ENTRIES DR. CR. 2008 a Provision for Income Tax 15,000.00 Income Tax Tapayable 15,000.00 b Deferred Charges - MCIT 45,000.00 Income Tax Payable

45,000.00 c Income Tax Payable 60,000.00 Cash In Bank 60,000.00

18. 18. Deferred Charges - MCITBB 340,000.002008(B) 45,000.00 385,000.00 Income Tax Payable2008(c) 60,000.00 15,000.00 2008(a) 45,000.00 2008(b) 60,000.00 60,000.00

19. 19. YEAR JOURNAL ENTRIES DR. CR. 2009 a Provision for Income Tax 8,000.00 Income Tax Tapayable 8,000.00 b Deferred Charges - MCIT 32,000.00 Income Tax Payable

32,000.00 c Income Tax Payable 40,000.00 Cash In Bank 40,000.00 d Retained Earnings 300,000.00 Deferred Charges - MCIT 300,000.00

20. 20. Deferred Charges - MCITBB 385,000.00 300,000.00 2009(d)2009(B) 32,000.00 417,000.00 300,000.00 117,000.00 Income Tax Payable2009(c) 40,000.00 8,000.00 2009(a)

32,000.00 2009(b) 40,000.00 40,000.00

21. 21. YEAR JOURNAL ENTRIES DR. CR. 2010 a Provision for Income Tax 1,000.00 Income Tax Tapayable 1,000.00 b Deferred Charges - MCIT 49,000.00 Income Tax Payable

49,000.00 c Income Tax Payable 50,000.00 Cash In Bank 50,000.00

22. 22. Deferred Charges - MCITBB 117,000.00 2010(a)2010(B) 49,000.00 166,000.00 Income Tax Payable2010(c) 50,000.00 1,000.00 2010(a) 49,000.00 2010(b) 50,000.00

50,000.00

23. 23. QUARTERLY NORMAL INCOME TAX VS. MCITExcess MCIT is allowed to be credited against normal income tax only when normal income tax is greater than MCIT.However,

if in the computation of the annual income tax due, the computed annual MCIT due appears to be highe than the annual normal income tax due, what may be credited against the

annual MCIT due shall only be the quarterly MCIT payments of the current taxable quaters, the quarterly normal income tax payments in the quarters of the current taxable year, the

expanded withholding taxes in the current year and excess expanded withholding taxes in the prior years. Excess MCIT from the previous taxable year/s shall not be allowed to be

credited therefrom as the same can only be appied against normal income tax. (Revenue regulations 12-2007, Oct. 10, 2007)

24. 24. IMPROPERLY ACCUMULATED EARNINGS TAX (IAET)

Blt 134 chapter 3

1. 1. TAXATION OF CORPORATION Chapter 3 - Ballada

2. 2. DEFINITION OF TERMSCORPORATION – it includes partnerships, no matter how created or organized, joint- stock companies, joint accounts (cuentas en participacion),

associations, or insurance companies, but does not include general professional partneships and a joint venture or consortium formed for the purpose of undetaking construction

projects or engaging in petroleum, coal, geothermal and other energy operations pursuant to an operating or consortium agreement under a service contract with the Government.

3. 3. DEFINITION OF TERMSDOMESTIC CORPORATION – means created or organized in the Philippines or under its laws.FOREIGN CORPORATION – means a coporation which

is not domestic.RESIDENT FOREIGN CORPORATION – applies to a foreign corporation engaged in trade or business within the Philippines.NON-RESIDENT FOREIGN

CORPORATION – applies to a foreign corporation not engaged in trade or business within the Philippines.

4. 4. SOURCES OF INCOME Corporation Sources of Income Within the Phils. Without the Phils.1. Domestic √ √2. Foreign √

5. 5. CATEGORIES OF INCOME AND TAX RATES1. Business Income – generally, business income earned by a corporation is taxd at the following rates (Sections 27(A), 28(A)(1)

and 28(B)(1)): Year Tax Rate 1997 35% 1998 34% 1999 33% 2000-Oct. 2005 32% Nov. 2005-2008 35% 2009 30%2. Passive Income – passive income is subject to separate and

final tax. These are taxed at fixed rates ranging from 5% to 20%. Passive income is not to be included in the gross income computation.

6. 6. DOMESTIC AND RESIDENT FOREIGN CORPORATIONSPRO-FORMA COMPUTATION OF NORMAL INCOME TAX: Gross Income P xxx Less: Allowable Deductions xxx Net

income P xxx Multiply by tax rate (2009) 30% Tax Due P xxx

7. 7. DOMESTIC CORPORATION, IN PARTICULARPROPRIETARY EDUCATIONAL INSTITUTIONS AND NON-PROFIT HOSPITALS - The 10% tax on the taxable income is subject

to limitation. If the gross income from unrelated trade, business or other activity exceeds fifty percent (50%) of the total gross income derived from all sources, the tax prescribed

under Section 27(A) shall be imposed on the entire taxable income.Unrelated trade, business or other activity – means any activity which are not subtantially related to the exercise

or performance by such educational institution or hosital of its primary purpose or function.

8. 8. ILLUSTRATIONS 1:SGB University, a proprietary educational institution, has a gross income for the taxable year 2009 of P15M. Of the gross income, P5 million was derived from

unrelated trade or business. Total deductions amount to P3million. Gross Income 15,000,000 Less: Deductions 3,000,000 Net Income 12,000,000 Multiply by tax rate 10% Tax Due

1,200,000

9. 9. ILLUSTRATIONS 2:SGB University, a proprietary educational institution, has a gross income for the taxable year 2009 of P15M. Of the gross income, P9 million was derived from

unrelated trade or business. Total deductions amount to P3million. Gross Income 15,000,000 Less: Deductions 3,000,000 Net Income 12,000,000 Multiply by tax rate 30% Tax Due

3,600,000

10. 10. GOVERNMENT-OWNED OR –CONTROLLED CORPORATIONS, AGENCIES OR INSTRUMENTALITIESSubject to the provisions of existing special laws or general laws, all

corporations, agencies, or instrumentalities owned or controlled by the Government shall pay such rate of tax upon their taxable income as are imposed by the Code upon

corporations or associations engaged in a similar business, industry or activity. The following are exempted: 1. GSIS 2. SSS 3. PHIC 4. LWD 5. PCSO

11. 11. MUTUAL LIFE INSURANCE COMPANIESThese Companies are now subject to the regular corporate income tax rates.

12. 12. RESIDENT FOREIGN CORPORATIONS, IN PARTICULARINTERNATIONAL SHIPPING - Gross Philippine Billings – 2.50%OBUs – income authorized by BSP from foreign

currency transactions rest income derived from with local commercial banks, including branches of foreign banks that may may be authorized by BSP, including any interest from

foreign currency loans granted to residents, shall be subject to a final income tax at ten percent (10%) of such income.BRANCH PROFITS REMITTANCES – any profit remitted by a

branch to its head office shall be subject to a tax of fifteen percent (15%) which shall be based on the total profits applied or earmarked for remittances without deduction for the tax

component thereof (except those activities which are registered with PEZA).

13. 13. RESIDENT FOREIGN CORPORATIONS, IN PARTICULARREGIONAL OPERATING HEADQUARTERS – shall mean a branch established in the Philippines by multinational

comanies which are engaged in various services. TEN PERCENT (10%) OF TAXABLE INCOMEREGIONAL OR AREA HEADQUARTERS – shall mean a branch established in the

Philippines by multinational companies and which headquarters do not earn or derive income from the Philippines and which act as supervisory, communications and coordinating

center for their affiliates, subsidiaries, or branches in the Asia-Pacific Region and other foreign markets. EXEMPT FROM INCOME TAX

14. 14. RESIDENT FOREIGN CORPORATIONS, IN PARTICULARINTERNATIONAL AIR CARRIER refer to a foreign airline corporation doing business in the Philippines having been

granted landing rights in any Philippine port to perform international air transportation services/ activities or flight operations anywhere in the world.Generally, subject to GROSS

PHILIPPINE BILLING TAX of 2.50% unless subject to a different tax rate under the applicable treaty to which the Philippines is a signatory.

15. 15. DETERMINATION OF GROSS PHILIPPINE BILLINGSIn computing for gross Philippine billings, the following should be included: a. Gross revenue deerived from passage of

persons b. Excess baggage c. Cargo and/or mail originating from the Philippines in a continuous and uninterrupted flight, irrespective of the place of sale or issue and the place of

payment of passage documents.

16. 16. NON-RESIDENT FOREIGN CORPORATION, IN GENERALThe basis of tax for non-resident foreign corporations is gross income from sources within the Philippines, such as

interests, dividends, rents, royalties, salaries, premiums (except reinsurance premiums), annuities, emoluments or othe fixed or determinable annual, periodic or casual gains, profits

and income, and capital gains. Gross Income P xxx Multiply by tax rate 2009 30% Tax Due P xxx

17. 17. NON-RESIDENT FOREIGN CORPORATION, IN PARTICULARCINEMATOGRAPHIC FILM OWNER, LESSOR OR DISTRIBUTOR – 25% of GROSS INCOMEOWNER OR

LESSOR OF VESSELS CHARTERED BY PHILIPPINE NATIONS - 4.5% of GOSS RENTALS, LEASE OR CHARTER FEES FROM LEASES OR CHARTERS TO FILIPINO

CITIZENS OR CORPORATIONS, AS APPROVED BY THE MARTIME INDUSTRY AUTHORITY.OWNER OR LESSOR OF AIRCRAFT, MACHINERY AND OTHER EQUIPMENT –

7.5% OF GROSS RENTALS, CHARTERS AND OTHER FEES.

18. 18. PASSIVE INCOME OF NON-RESIDENT FOREIGN CORPORATIONS1. Interest on foreign loans contracted on or after August 1, 1986 are taxed at 20%.2. Income derived by a

depository bank under the exanded foreign currency deposit system from foreign currency transaction with local commercial banks, including branches of foreign that may be

authorized by the BSP, incuding interest income from foreign currency loans are EXEMPT.3. Dividends received from a domestic corporation – final withholding tax at 15% on the

condition that the country in which the non-resident foreign corporation is domiciled, shall allow a credit against the tax due from the non-resident foreign corporation taxes deemded

to have been paid in the Philippines equivalent to: 2009 – 15%

19. 19. PASSIVE INCOME OF NON-RESIDENT FOREIGN CORPORATIONS4. CAPITAL GAINS from sale of shares of stock not traded in the stock exchange. A final taxt at the rates

prescribed below is imposed upon the net caita gains realized during the taxable year from the sale, barter, exchange or other disposition of shares of stock in a domestic

corporation, except shares sold, or disposed of through the stock exchange: Not over P100,000 5% On any amount in excess of P100,00 10%

20. 20. ALLOWABLE DEDUCTIONSAllowable deductions are items or amounts which the law allows to be deducted from gross income in order to arrive at the taxable income. A

domestic or resident foreign corporation may dduct from its business income, itemized deductions under the Tax Code, or, these corporations may elect a standard deduction in an

amount not exceeding forty percent (40%) of its gross income (RA 9504). Non-resident foreign corporations are not allowed deductions from gross income.

21. 21. TAXABLE INCOME AND TAX DUEIn case of corporations, TAXABLE INCOME is th pertinent items of gross income less the deductions authorized for such types of income.

Taxable income is the amount or tax base uon which tax rate is applied to arrive at the tax due. Depending on the taxpayer involved and for purposes of computing the income tax

liability of a cororation, taxable income may refer to either one of the following:1. NET INCOME – the income arrived at after subtracting from the gross income the deductions of the

taxayer. For domestic and resident foreign corporations, in genera; and other corporations from whose gross income deductions are allowed:

22. 22. PRO-FORMA COMPUTATIONSales/Revenues/Receipts/Fees xxxLess: Cost of Sales/services xxxGross Income from Operation xxxAdd: Non-Operating and Taxable Other

Income xxxTotal Gross Income xxxLess: Deductions Optional Standard Deduction or Itemized Deduction xxxTaxable Income xxxMultiply by: Tax Rate %Tax Due xxx

23. 23. TAXABLE INCOME AND TAX DUE2. GROSS INCOME – the entire or gross income from business without any deductions for either optional standard deduction or itemized

deduction. For domestic and resident foreign corporations subject to the MCIT; and non- resident foreign corporation not subject to the normal income tax rate (section 28(B)(1)).

Gross Income xxx Multiply by: Tax Rate x% Tax Due xxx

24. 24. CORPORATIONS EXEMPT FROM INCOME TAX (Sec. 30, NIRC)GENERALLY , CORPORATIONS ESTABLISHED NOT FOR PROFIT ARE EXEMPTED FROM INCOME

TAX. PLEASE REFER TO PAGE 3-14 – 3-17

25. 25. TAXATION FOR COOPERATIVESCooperatives with accumulated reserves and undivided net savings of not more than TEN MILLION PESOS (P10M) – EXEMPT FROM ALL

NATIONAL INTERNAL REVENUE TAXES FOR HICH THESE COOPRATIVES ARE LIABLE.Cooperatives with accumulated reserves and undivided net savings of more than TEN

MILLION PESOS (P10M) – please refer to page 3-19-20

26. 26. DECLARATION OF QUARTERLY INCOME TAXEvery corporation shall file in duplicate a quarterly summary declaration of its gross income and deductions on a cumulative

basis for the preceding quarter or quarters upon which the income tax shall be levied, collected and paid. The income tax computed decreased by the amount of tax previously paid

or assessed during the preceding quarters shall be paid and the return filed not later than sixty (60) days from the close of each of the first three (3) quarters of the taxable year,

whether calendar or fiscal .A return showing the cumulative income and deductions shall still be filed even if the operations for the quarter and the preceding quarters yielded no tax

due.

27. 27. DECLARATION OF QUARTERLY INCOME TAX (cont’d)Every taxable corporation is likewise required to file a final adjustment return covering the total taxable income of the

corporation for the preceding calendar or fiscal year, which is required to be filed and paid on or before April 15, or on or before the 15th day of the 4th month following the close of

the fiscal year, as the case may be. If the sum of the quarterly tax payments made during the said taxable year is not equal to the total tax due on the entire taxable income of that

year, the corporation shall either: 1. Pay the balance of tax still due; or 2. Carry over the excess credit; or 3. Be credited or refunded with the excess amount paid.

28. 28. ILLUSTRATIONThe result of operations of a corporation for 2010 whose taxable year in on a calendar basis is asfollows: Gross Income Deductions Net Income1st Quarter (Jan-

March) 500,000.00 300,000.00 200,000.002nd Quarter (April-June) 600,000.00 350,000.00 250,000.003rd Quarter (July-Sept.) 700,000.00 400,000.00 300,000.004th Quarter (Oct.-

Dec.) 800,000.00 450,000.00 350,000.00 2,600,000.00 1,500,000.00 1,100,000.00Tax credit for overpaid income tax for the preceding year is P50,000.

29. 29. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter TOTALGross Income this quarter 500,000.00 600,000.00 700,000.00 800,000.00 2,600,000.00 previous quarter/s 500,000.00

1,100,000.00 1,800,000.00Total Gross Income 500,000.00 1,100,000.00 1,800,000.00 2,600,000.00 2,600,000.00Less: Deductions this quarter 300,000.00 350,000.00 400,000.00

450,000.00 previous quarter/s 300,000.00 650,000.00 1,050,000.00Total Deductions 300,000.00 650,000.00 1,050,000.00 1,500,000.00 1,500,000.00Taxable Income 200,000.00

450,000.00 750,000.00 1,100,000.00 1,100,000.00Tax Rate 30% 30% 30% 30% 30%Tax Due 60,000.00 135,000.00 225,000.00 330,000.00 330,000.00Less: Previous Tax

Payments/Credits 50,000.00 60,000.00 135,000.00 225,000.00 225,000.00Tax Still Due 10,000.00 75,000.00 90,000.00 105,000.00 105,000.00

30. 30. CHAPTER IV – MINIMUM CORPORATE INCOME TAX, IAET AND GITMINIMUM CORPORATE INCOME TAX (MCIT) Two percent (2%) of the gross income as of the end of

the taxable year is imposed upon any domestic corporation beginning the fourth (4th) taxable year (whether calendar or fiscal yea, depending on the accounting periodemployed)

immediately following the taxable year in which such corporation commenced its business operations. The MCIT shall be imposed whenever:a. Such corporation has zero or

negative taxable income; orb. The amount of minimum corporateincome taxis greater than the normal income tax due from such corporation.Relief from MCIT under Certain

ConditionsThe Secretary of Finance, upon recommendation of the Commissioner,may suspend the imposition of MCIT upon submission of proof by the applicant-corporation, duly

verified by the Commissioner’s authorized representative, that the corporation sustained substantial losses on account of a prolonged labor dispute or because of “force majeure” or

because of legitimate business reverses.

Das könnte Ihnen auch gefallen

- Tax XXXXDokument60 SeitenTax XXXXGerald Bowe ResuelloNoch keine Bewertungen

- 3109 - Taxation of Non-Individual TaxpayersDokument9 Seiten3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNoch keine Bewertungen

- Qau Memo 2021-14. AnnexesDokument16 SeitenQau Memo 2021-14. AnnexesMariene PagsibiganNoch keine Bewertungen

- ACCTG 26 Income Taxation: Lyceum-Northwestern UniversityDokument5 SeitenACCTG 26 Income Taxation: Lyceum-Northwestern UniversityAmie Jane Miranda100% (1)

- CORPORATE INCOME TAX (Answer Key)Dokument5 SeitenCORPORATE INCOME TAX (Answer Key)Rujean Salar AltejarNoch keine Bewertungen

- Deductions From Gross IncomeDokument10 SeitenDeductions From Gross IncomewezaNoch keine Bewertungen

- TAX Preweek Lecture (B42) - December 2021 CPALEDokument16 SeitenTAX Preweek Lecture (B42) - December 2021 CPALEkdltcalderon102Noch keine Bewertungen

- Asifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-10 PDFDokument21 SeitenAsifamin - 3179 - 18893 - 6 - Taxation Pakistan - Session-10 PDFaemanNoch keine Bewertungen

- FAR05 - Accounting For Income and Deferred TaxesDokument4 SeitenFAR05 - Accounting For Income and Deferred TaxesDisguised owlNoch keine Bewertungen

- Week 6 - ch19Dokument55 SeitenWeek 6 - ch19bafsvideo4Noch keine Bewertungen

- Taxation of CorporationsDokument26 SeitenTaxation of CorporationsjolinaNoch keine Bewertungen

- Corporate Income TaxDokument8 SeitenCorporate Income TaxClaire BarbaNoch keine Bewertungen

- AFF's Tax Memorandum - Changes in Finance Bill, 2023 (Pakistan)Dokument14 SeitenAFF's Tax Memorandum - Changes in Finance Bill, 2023 (Pakistan)salahuddin ahmedNoch keine Bewertungen

- CORPORATE TAX CALCULATORDokument11 SeitenCORPORATE TAX CALCULATORmohanraokp2279Noch keine Bewertungen

- Synthesis - Problem Solving QuizDokument3 SeitenSynthesis - Problem Solving QuizEren CuestaNoch keine Bewertungen

- EY Tax Booklet, 2022Dokument65 SeitenEY Tax Booklet, 2022Sabbir Ahmed PrimeNoch keine Bewertungen

- NIRC V. TRAInDokument11 SeitenNIRC V. TRAInJin De GuzmanNoch keine Bewertungen

- Train Law & Tax UpdatesDokument211 SeitenTrain Law & Tax UpdatesAlicia FelicianoNoch keine Bewertungen

- Accounting For Income Tax QuizDokument5 SeitenAccounting For Income Tax QuizTorico BryanNoch keine Bewertungen

- 10-Practical Questions of Individuals (78-113)Dokument38 Seiten10-Practical Questions of Individuals (78-113)Sajid Saith0% (1)

- Income Tax Expense and Deferred Tax Asset & Liability CalculationsDokument3 SeitenIncome Tax Expense and Deferred Tax Asset & Liability Calculationskrisha millo0% (1)

- Suggested Answers Intermediate Examination - Spring 2013: TaxationDokument7 SeitenSuggested Answers Intermediate Examination - Spring 2013: TaxationMuhammad Usman SaeedNoch keine Bewertungen

- References: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018 RR14-2001Dokument13 SeitenReferences: Philippine Tax Code CREATE Law TRAIN Law Income Taxation, Banggawan RR8-2018 RR14-2001Mark Lawrence YusiNoch keine Bewertungen

- FBRDokument28 SeitenFBRAnonymous ykFLSpIWNoch keine Bewertungen

- Covid 19 Levy 04 Jan 2021Dokument30 SeitenCovid 19 Levy 04 Jan 2021musicals.muNoch keine Bewertungen

- Corporate TaxationDokument6 SeitenCorporate TaxationSachin NairNoch keine Bewertungen

- Full Length of Module 1 Income Taxation On Individuals PDFDokument35 SeitenFull Length of Module 1 Income Taxation On Individuals PDFHermosura ChristineNoch keine Bewertungen

- 17267pcc Sugg Paper June09 5Dokument18 Seiten17267pcc Sugg Paper June09 5nbaghrechaNoch keine Bewertungen

- Determine the income tax payable for 2020 and 2021 and theexcess MCIT carry-overDokument46 SeitenDetermine the income tax payable for 2020 and 2021 and theexcess MCIT carry-overmicaella pasionNoch keine Bewertungen

- Drafting - Dec 2018Dokument119 SeitenDrafting - Dec 2018rk_19881425Noch keine Bewertungen

- RR No. 9-1998Dokument10 SeitenRR No. 9-1998Rhinnell RiveraNoch keine Bewertungen

- Tax At6Dokument11 SeitenTax At6Nerie Joy Mestiola AverillaNoch keine Bewertungen

- Example 1 - Over and Under Provision of Current TaxDokument14 SeitenExample 1 - Over and Under Provision of Current TaxPui YanNoch keine Bewertungen

- Acct 557Dokument5 SeitenAcct 557kihumbae100% (4)

- This Study Resource Was: Revenue Regulations No. 9-98Dokument6 SeitenThis Study Resource Was: Revenue Regulations No. 9-98Cyruss Xavier Maronilla NepomucenoNoch keine Bewertungen

- Module 07 Introduction To Regular Income Tax 3 2Dokument21 SeitenModule 07 Introduction To Regular Income Tax 3 2Joshua BazarNoch keine Bewertungen

- Philippine Taxation Questions GuideDokument36 SeitenPhilippine Taxation Questions GuideShaira BugayongNoch keine Bewertungen

- Philippine Corporate Taxation QuizDokument8 SeitenPhilippine Corporate Taxation QuizPrincessIrishSaludoNoch keine Bewertungen

- Tax 605Dokument5 SeitenTax 605NhajNoch keine Bewertungen

- Principles of Taxation Key ConceptsDokument2 SeitenPrinciples of Taxation Key ConceptsSharif MahmudNoch keine Bewertungen

- RR 12-2007Dokument9 SeitenRR 12-2007Aris Basco DuroyNoch keine Bewertungen

- Group 6 Tax AssignmentDokument14 SeitenGroup 6 Tax Assignmentdianaowani2Noch keine Bewertungen

- Tax implications of acquiring a spa business in SingaporeDokument11 SeitenTax implications of acquiring a spa business in SingaporenovetanNoch keine Bewertungen

- AIOU Business Taxation Assignment GuideDokument4 SeitenAIOU Business Taxation Assignment GuideUsman Shaukat Khan100% (1)

- Chapter 25 and 26Dokument10 SeitenChapter 25 and 26Sittie Aisah AmpatuaNoch keine Bewertungen

- RR 9-98Dokument5 SeitenRR 9-98matinikkiNoch keine Bewertungen

- 06M Midterm Quiz No. 2 Income Tax On CorporationsDokument4 Seiten06M Midterm Quiz No. 2 Income Tax On CorporationsMarko IllustrisimoNoch keine Bewertungen

- Miscellaneous TopicsDokument93 SeitenMiscellaneous Topicsgean eszekeilNoch keine Bewertungen

- Week 7: Taxation of Individuals (Non Residents and Aliens) and General Professional PartnershipsDokument6 SeitenWeek 7: Taxation of Individuals (Non Residents and Aliens) and General Professional PartnershipsEddie Mar JagunapNoch keine Bewertungen

- Tax Credit 1Dokument18 SeitenTax Credit 1Hani ShehzadiNoch keine Bewertungen

- Income Tax - TRAINDokument27 SeitenIncome Tax - TRAINSteveNoch keine Bewertungen

- Public Finance & Taxation - Chapter 4, PT IIIDokument32 SeitenPublic Finance & Taxation - Chapter 4, PT IIIbekelesolomon828Noch keine Bewertungen

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDokument4 SeitenSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- Module 07 - Introduction To Regular Income TaxDokument25 SeitenModule 07 - Introduction To Regular Income TaxJANELLE NUEZNoch keine Bewertungen

- Module 07 Introduction To Regular Income TaxDokument21 SeitenModule 07 Introduction To Regular Income TaxJeon KookieNoch keine Bewertungen

- Tax RateDokument10 SeitenTax Rateusha chimariyaNoch keine Bewertungen

- Name: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2Dokument3 SeitenName: Santiago II, Cipriano Jeffrey F.: Homework 2 - Tax 1101 - Topic Income Tax - Corporation Part 2うん こ100% (1)

- 18515pcc Sugg Paper Nov09 5 PDFDokument16 Seiten18515pcc Sugg Paper Nov09 5 PDFGaurang AgarwalNoch keine Bewertungen

- COMLAW TAX Atty GuideDokument6 SeitenCOMLAW TAX Atty GuideMarco Alejandro IbayNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- DLL - MTB 1 - Q1 - W6Dokument7 SeitenDLL - MTB 1 - Q1 - W6MJNoch keine Bewertungen

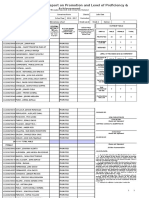

- The Effects of Continuing Professional Development on Rural Teacher QualityDokument92 SeitenThe Effects of Continuing Professional Development on Rural Teacher QualityMJ100% (1)

- CPD Step 1-6 - 23jan2017Dokument13 SeitenCPD Step 1-6 - 23jan2017MJNoch keine Bewertungen

- DLL - MTB 1 - Q1 - W6Dokument6 SeitenDLL - MTB 1 - Q1 - W6MJNoch keine Bewertungen

- SF5 - 2016 - Grade 1 - 5Dokument3 SeitenSF5 - 2016 - Grade 1 - 5MJNoch keine Bewertungen

- Ratios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)Dokument3 SeitenRatios Used To Evaluate Short Term Financial Position (Short Term Solvency and Liquidity)MJNoch keine Bewertungen

- DLL - MTB 1 - Q1 - W6Dokument6 SeitenDLL - MTB 1 - Q1 - W6MJNoch keine Bewertungen

- GRADES 1 To 12 Daily Lesson Log: Isulat Ang Code NG Bawat KasanayanDokument5 SeitenGRADES 1 To 12 Daily Lesson Log: Isulat Ang Code NG Bawat KasanayanMJNoch keine Bewertungen

- DLL - MTB 1 - Q1 - W4Dokument6 SeitenDLL - MTB 1 - Q1 - W4Secon IniegoNoch keine Bewertungen

- SF5 - 2016 - Grade 1 - 5Dokument3 SeitenSF5 - 2016 - Grade 1 - 5MJNoch keine Bewertungen

- Distinguish Between Horizontal and Vertical AnalysisDokument1 SeiteDistinguish Between Horizontal and Vertical AnalysisMJNoch keine Bewertungen

- 2015 AugustDokument8 Seiten2015 AugustMJNoch keine Bewertungen

- Distinguish Between Horizontal and Vertical AnalysisDokument1 SeiteDistinguish Between Horizontal and Vertical AnalysisMJNoch keine Bewertungen

- IntroDokument15 SeitenIntroMJNoch keine Bewertungen

- Maslow's Hierarchy of Needs ExplainedDokument8 SeitenMaslow's Hierarchy of Needs ExplainedMJNoch keine Bewertungen

- School Form 1 (SF 1) School RegisterDokument6 SeitenSchool Form 1 (SF 1) School RegisterMJNoch keine Bewertungen

- JPIA MC Chapter EventDokument7 SeitenJPIA MC Chapter EventMJNoch keine Bewertungen

- Residential Status & Scope of Total IncomeDokument23 SeitenResidential Status & Scope of Total IncomeKartikNoch keine Bewertungen

- Chapter 13-A Capital Budgeting: Edited May 25, 2011Dokument68 SeitenChapter 13-A Capital Budgeting: Edited May 25, 2011dianne caballeroNoch keine Bewertungen

- Nykaa EDokument7 SeitenNykaa EAditya KumarNoch keine Bewertungen

- Falanx Interim ResultsDokument12 SeitenFalanx Interim Resultsmontegue.sykesNoch keine Bewertungen

- ACC 12 - Entrepreneurial Accounting Course Study GuideDokument66 SeitenACC 12 - Entrepreneurial Accounting Course Study GuideHannah Jean MabunayNoch keine Bewertungen

- Tugas Rutin Makro WawaDokument5 SeitenTugas Rutin Makro WawaSuhairo Nasuha Sitorus100% (1)

- Module 1 - Introduction To TaxationDokument7 SeitenModule 1 - Introduction To TaxationASHLEY NICOLE DELA VEGANoch keine Bewertungen

- Taxation On Individuals - ReviewerDokument2 SeitenTaxation On Individuals - ReviewerLouiseNoch keine Bewertungen

- PECDokument25 SeitenPECkonan jauresNoch keine Bewertungen

- CPA ECONOMICS SECTION 2Dokument267 SeitenCPA ECONOMICS SECTION 2Sharon AmondiNoch keine Bewertungen

- Acc140 NotesDokument72 SeitenAcc140 NotesSalim Yusuf BinaliNoch keine Bewertungen

- Instant Download Ebook PDF Federal Income Taxation Concepts and Insights 14th Edition PDF ScribdDokument41 SeitenInstant Download Ebook PDF Federal Income Taxation Concepts and Insights 14th Edition PDF Scribdotis.zahn448100% (38)

- Lesson Materials and Activity Sheets in Applied Economics - Week 7Dokument11 SeitenLesson Materials and Activity Sheets in Applied Economics - Week 7Willie Cientos GantiaNoch keine Bewertungen

- Trade Wars and Trade Talks With DataDokument57 SeitenTrade Wars and Trade Talks With DataunkownNoch keine Bewertungen

- Acc101 - 5Dokument13 SeitenAcc101 - 5Nguyen Thi My Ngan (K17CT)Noch keine Bewertungen

- Dlp-Epp 6 - Week 1 - Day 3 - 3rd QuarterDokument1 SeiteDlp-Epp 6 - Week 1 - Day 3 - 3rd QuarterSHARON MAY CRUZNoch keine Bewertungen

- Chapter One Class of 2019Dokument24 SeitenChapter One Class of 2019Kidu Yabe0% (1)

- Assessing financial performance of AEON and PARKSONDokument27 SeitenAssessing financial performance of AEON and PARKSONPK LNoch keine Bewertungen

- Assignment On Pakistan EconomyDokument14 SeitenAssignment On Pakistan EconomySabeen khalidi88% (8)

- Financial Statement Analysis Questions ExplainedDokument4 SeitenFinancial Statement Analysis Questions ExplainedRisha OsfordNoch keine Bewertungen

- Inflation AccountingDokument34 SeitenInflation AccountingUnbeatable 9503Noch keine Bewertungen

- Going Concern Annual Report 2018Dokument322 SeitenGoing Concern Annual Report 2018jabbar akbarNoch keine Bewertungen

- (Aa35) Corporate and Personal Taxation: Association of Accounting Technicians of Sri LankaDokument8 Seiten(Aa35) Corporate and Personal Taxation: Association of Accounting Technicians of Sri LankaSujan SanjayNoch keine Bewertungen

- R17 - Understanding Income Statements - 2022Dokument57 SeitenR17 - Understanding Income Statements - 2022Ihuomacumeh100% (1)

- National Income: Submitted byDokument85 SeitenNational Income: Submitted byShrutiNoch keine Bewertungen

- Topic 6Dokument2 SeitenTopic 6mengsuanNoch keine Bewertungen

- Econ Notes: Monetary Policy GoalsDokument30 SeitenEcon Notes: Monetary Policy GoalsAzaan KaulNoch keine Bewertungen

- KISIAKMDokument1 SeiteKISIAKMhgoenNoch keine Bewertungen

- El FMI Sobre La Inteligencia ArtificialDokument42 SeitenEl FMI Sobre La Inteligencia ArtificialCronista.comNoch keine Bewertungen

- Fin2001 Pset4Dokument10 SeitenFin2001 Pset4Valeria MartinezNoch keine Bewertungen