Beruflich Dokumente

Kultur Dokumente

Asset Acc in s4

Hochgeladen von

moorthyOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Asset Acc in s4

Hochgeladen von

moorthyCopyright:

Verfügbare Formate

2018

New Asset Accounting in S4 HANA

Moorthy Esakky

[S4 HANA CHAGES TO CONCEPTS COLECTION]

S4 HANA FINANCIALS

New Asset Accounting in S4 HANA.

1. What are the Features in New Asset Accounting?

2. What are the advantages in New Asset Accounting

3. What are the Technical Changes to the Tables in New Asset Accounting?

4. What are Configuration changes with reference to New Asset Accounting?

5. What are the Changes and deleted functions in New Asset Accounting?

6. What are the New BAPI ‘s Associated with New Asset Accounting?

7. Explain the Concept of Technical Clearing Account? What is the purpose of it?

8. Explain the Ledger approach wrt New Asset Accounting?

9. Explain the Account approach wrt New Asset Accounting?

10. What are the Sequence of the Migration steps?X

11. What are the Migration of legacy data upload process Changes wrt New AA?

12. What are the Transaction changes wrt New AA?

1 What are the Features in New Asset Accounting?

1. Using new AA is mandatory

2. ACDOCA now includes fields like Dep Area, Transaction type Asset value date and Asset number

3. FI-AA reconciliation (ABST2)is abolished

4. Asset balance (AJAB) carry forward with the GL balances

5. Depreciation posting program is simplified and performance improved

6. Depreciation posting is made per Asset

7. Each depreciation area must be assigned to a ledger grp

8. Multiple depreciation areas can post in real time( each accounting principle can have its own ledger grp)

9. Delta depreciation postings are no longer needed (only one depreciation area per accounting principle)

10. Periodic posting (ASKBN) is now obsolete

11. Assignment of posting indicators to depreciation areas simplified

12. For each parallel currency in FI, a corresponding depreciation must exist

13. Smoothing of depreciation over remaining periods is now obsolete

14. New Asset APC posting logic introduced. Separate for each accounting principle

15. Settlement of AUC at depreciation area level

16. New posting logic in AA requires Technical clearing account for Assets acquisition posting

17. Postings are divided into Operation view and valuation view

18. Both multiple valuation approaches are possible: Ledger approach and Account approach. But a mixture

of two is not supported (Ledger with accounts approach)

19. Legacy upload GL account is part of Configuration

20. Legacy upload document type is part of configuration

21. Technical clearing account is part of configuration

2|Page MOORTHY ESAKKY

2 Advantages in New Asset Accounting

Instant Access to Correct Up-to-Date Values

When a change is made to an asset, its planned depreciation (used to post actual depreciation) is

immediately updated, and all reports show up-to date values.

Single Source of Truth

• FI and Asset Reconciliation is by design

Simplification of Posting Logic

New transactions and accounts have been introduced that allow you to post independently to individual

depreciation areas, accounting principles, or ledger groups, if required.

• Transparency

A separate line item is produced for each asset posting, including the acquisition and retirement values,

the depreciation P&L charge, and the accumulated depreciation, which allows full visibility in FI.

• No Redundancy of Data

New Asset Accounting no longer requires the use of delta depreciation areas in addition to normal

depreciation areas.

• Smart Migration

Compatibility views in SAP S/4 HANA have the same name as previous tables to allow custom reports

when migrating from SAP to S/4 HANA and certain program to continue as earlier.

• Easy reporting structure

Because of Universal general reporting is easy to fetch the data

• Smooth Period end closing

03 What are the Technical Changes to the Tables in New Asset Accounting?

3|Page MOORTHY ESAKKY

04 What are Configuration changes with reference to New Asset Accounting?

Depreciation area with accounting principles

Technical clearing account at account determination level

Setting depreciation for Quantity update in case of collective low value Assets

Define alternative document type for ledger postings

For every additional currency type defined on the company code a corresponding depreciation

area needs to be set up

Define revenue distribution for fixed Asset retirement

In new Asset Accounting, it is not possible and also not necessary to restrict transaction types to

depreciation areas.

Smoothing is no more available

Post NBV instead of Gain/Loss

• Unilateral Assets

Depending on the legal requirements, it may be necessary to manage a fixed asset in one

accounting principle (such as local valuation) as an asset, but in a different accounting principle

(for example, IFRS) not to manage it as an asset, but post the costs directly to profit and loss

instead.

05 What are the Changes and deleted functions in New Asset Accounting?

You enter post-capitalization both gross and net in the same transaction (transaction ABNAL).

The system always calculates the depreciation values, meaning in the standard system it

assumes that you are entering gross values.

A revaluation is always posted accounting principle-specific.

The Accounting Principle field in transaction ABAWL is therefore a required entry field.

With a partial retirement it is no longer possible to adjust the retirement amount manually, for

example for cost-accounting areas.

Instead you must perform an adjustment posting in an extra step for the cost-accounting area.

Errors with individual assets do not necessarily need to be corrected before period-end closing;

period-end closing can still be performed.

You have to make sure that all assets are corrected by the end of the year only so that

depreciation can be posted completely.

Insurance Values

Until now there were two ways to map insurable values in the system:

o 1. Defining specific information for insuring the complex fixed asset in the asset master

record

o 2. Managing insurance values in a dedicated depreciation area.

In SAP S/4HANA only the second option

The leasing opening entry from the asset master record is not supported in SAP S/4HANA.

It is no longer necessary (or possible) to restrict the transaction types to individual depreciation

areas.

The user exit APCF_DIFFERENT_AMOUNTS_GET is no longer supported.

The reload program for archiving RAARCH03 is no longer supported.

Archived documents of Asset Accounting can only be written but not reloaded.

4|Page MOORTHY ESAKKY

06 What are the New BAPI ‘s Associated with New AA?

07 Explain the Concept of Technical Clearing Account? What is the purpose of it?

The purpose of Technical Clearing Account is to post multiple ledgers at the same time, it is

necessary to split the postings into operational and valuated document.

It is a Reconciliation account

5|Page MOORTHY ESAKKY

Ledger Approach

Because we’ve left the Ledger Group field blank when posting, all ledger groups were posted to,

producing a separate document for each accounting principle/ledger group.

Account Approach

A separate range of accounts has been set up for the second accounting principle, named Group

Accounting with a Ledger Group of A1, but in the same ledger. The accounts are similar but two digits

shorter

6|Page MOORTHY ESAKKY

10 What are the Sequence of the Migration steps?

1. Create prerequisites for the use of new Asset

2. Installation of SAP Simple Finance Add-on

3. Set up customizing for new Asset Accounting (Request)

4. Migrate the COD (Request)

5. Additional customizing in case this is missing in step 3 (Request)

6. Check prerequisites for Activating new Asset Accounting

7. Activate the customizing switch (Request) – Asset Accounting (New) is active

8. Migration data to SAP Simple Finance Add-on

Note: • Pre-check of prerequisites for Asset Accounting (New) is very important before starting installing of

the Add-on

• Periodic APC postings are deleted in Simple finance, you must have completed periodic postings in the

system before installing the add-on

• Postings are not possible (including in FI-AA) after installation of add-on until migration has been

finished.

11 What are the Migration of legacy data upload process Changes wrt New AA?

Earlier • Through AS91 Asset Master data and Asset balances are uploading

• This results Balance update in Asset table

• OASV Transaction code is using to update Asset balance by GL wise

• Document type is an manual input

• This leads mismatching between GL and Asset Balance (ABST2)

• Legacy upload through LSMW

• Batch input, Business Object Method (BAPI) and Direct input recording

In New Asset • Asset Master data will created by using AS91 Transaction code

Accounting • Transaction balances will update through ABLDT

• This results Asset and GL initial balance upload

• Document type is part of configuration

• Legacy data during the FY will upload through T code AB01

• AUC/WIP Balance will upload through ABLDT_OI by line item wise.

• If wrong transfer values were posted, you must reverse the journal entry and then recreate it.

• ABST2 is obsolete

• Legacy upload through LSMW

• Only direct object method supports – BAPi-(BAPI_FIXEDASSET_OVRTAKE_CREATE)

• Legacy data transfer using Microsoft Excel Transaction AS100 is still available

• This corresponds with choosing method CREATEINCLVALUES of business object

BUS1022 in transaction LSMW.

12 What are the Transaction changes wrt New AA?

Transactions are no longer ABST, ABST2, ABSTL , ABUB, AW01_AFAR,ABF1 and ABF1L, AJRW,OASV,AB02,ASKB

available: and ASKBN,ABB1,ABMW,ABCO

Programs are no longer RAALTD01, RAALTD11, RAALTD11_UNICODE RAPERB2000, RAPOST2000 RAABST01,

available: RAABST02, FAA_GL_RECON RAJAWE00

7|Page MOORTHY ESAKKY

Das könnte Ihnen auch gefallen

- Configuration Example: SAP Electronic Bank Statement (SAP - EBS)Von EverandConfiguration Example: SAP Electronic Bank Statement (SAP - EBS)Bewertung: 3 von 5 Sternen3/5 (1)

- SAP New GL Migration PhasesDokument7 SeitenSAP New GL Migration PhasesTani ShabNoch keine Bewertungen

- S - 4 HANA - New Asset Accounting - Considering Key Aspects - SAP BlogsDokument15 SeitenS - 4 HANA - New Asset Accounting - Considering Key Aspects - SAP BlogsgirijadeviNoch keine Bewertungen

- Parallel Accounting in New General LedgerDokument7 SeitenParallel Accounting in New General Ledgerfylee74100% (1)

- New LedgerDokument42 SeitenNew LedgerMADHURA RAULNoch keine Bewertungen

- Asset Closing in SAP FICODokument12 SeitenAsset Closing in SAP FICOFrank JeanNoch keine Bewertungen

- S4 Hana Asset AccountingDokument12 SeitenS4 Hana Asset AccountingAkash100% (2)

- SAP New GL FunctionalityDokument7 SeitenSAP New GL FunctionalitypaiashokNoch keine Bewertungen

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungVon EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungBewertung: 4 von 5 Sternen4/5 (1)

- Migrating From Classic GL To NewGLDokument8 SeitenMigrating From Classic GL To NewGLtifossi6665Noch keine Bewertungen

- Reconcile FI-AA & FI-GL After Fixed Asset Data Takeover in SAPDokument17 SeitenReconcile FI-AA & FI-GL After Fixed Asset Data Takeover in SAPRavi Kumar KotniNoch keine Bewertungen

- Asset Accounting IssueDokument17 SeitenAsset Accounting IssueAtulWalvekarNoch keine Bewertungen

- SAP FICO Interview Question and Answers Series OneDokument67 SeitenSAP FICO Interview Question and Answers Series OneSAP allmoduleNoch keine Bewertungen

- Narayan Jyotiraditya Bala Banik Configuration Steps: Main Customizing ActivitiesDokument20 SeitenNarayan Jyotiraditya Bala Banik Configuration Steps: Main Customizing ActivitiesJyotiraditya BanerjeeNoch keine Bewertungen

- FI Configuration-S - 4 Hana 1809Dokument43 SeitenFI Configuration-S - 4 Hana 1809SUDIPTADATTARAYNoch keine Bewertungen

- Interview Q & A - Accenture, Wipro, Ibm, Etc.,-01.05.2018Dokument9 SeitenInterview Q & A - Accenture, Wipro, Ibm, Etc.,-01.05.2018Mohamedgous TahasildarNoch keine Bewertungen

- Account Based Copa AnilDokument8 SeitenAccount Based Copa Anilmoorthy100% (1)

- 7 Steps For Sap Fixed Assets MigrationDokument5 Seiten7 Steps For Sap Fixed Assets MigrationBhargav Raam0% (1)

- Cross Company Code IssueDokument12 SeitenCross Company Code IssueSATYANARAYANA MOTAMARRINoch keine Bewertungen

- Parallel Ledgers in AssetDokument35 SeitenParallel Ledgers in AssetSharad TiwariNoch keine Bewertungen

- Top 20 SAP FICO Interview Questions and Answers PDF - SVRDokument10 SeitenTop 20 SAP FICO Interview Questions and Answers PDF - SVRManas Kumar SahooNoch keine Bewertungen

- SAP Internal Order: Conceptual Background and Usage For Harvey NormanDokument15 SeitenSAP Internal Order: Conceptual Background and Usage For Harvey NormanDeepesh100% (1)

- Sap R/3 Financials: Accrual EngineDokument21 SeitenSap R/3 Financials: Accrual Engineramakrishna4p100% (1)

- New GL Configuration in Sap Ecc6Dokument29 SeitenNew GL Configuration in Sap Ecc6Tani ShabNoch keine Bewertungen

- Cross-Company - Inter-Company Transactions - SAP BlogsDokument26 SeitenCross-Company - Inter-Company Transactions - SAP Blogspuditime100% (1)

- Cost Center Splitting ConceptsDokument32 SeitenCost Center Splitting Conceptsamulya_kathi100% (2)

- SAP Year End Closing ProcessDokument10 SeitenSAP Year End Closing ProcesssurendraNoch keine Bewertungen

- Internal Order in S4 HanaDokument6 SeitenInternal Order in S4 HanaAtul Madhusudan100% (1)

- Sap Fico Interview Questions & Answers: How To Clear Each and Every Interview You Give-100 % Success AssuredDokument71 SeitenSap Fico Interview Questions & Answers: How To Clear Each and Every Interview You Give-100 % Success Assuredkrishna1427100% (1)

- SAP Fixed Asset Configuration Presentation Updated 150221Dokument29 SeitenSAP Fixed Asset Configuration Presentation Updated 150221charanNoch keine Bewertungen

- SAP Dunning Configuration Very ImportDokument26 SeitenSAP Dunning Configuration Very Importvittoriojay123Noch keine Bewertungen

- SAP Asset Accounting Interview QuestionsDokument3 SeitenSAP Asset Accounting Interview QuestionsManas Kumar SahooNoch keine Bewertungen

- TRM Template Desc en deDokument4 SeitenTRM Template Desc en deSam KuNoch keine Bewertungen

- SAP Finance NotesDokument131 SeitenSAP Finance NotesMohammed MisbahuddinNoch keine Bewertungen

- SAP New GL Configuration DocumentsDokument17 SeitenSAP New GL Configuration DocumentsansulgoyalNoch keine Bewertungen

- FI - SD IntegrationDokument13 SeitenFI - SD IntegrationchonchalNoch keine Bewertungen

- S4 Hana New Asset AccountingDokument20 SeitenS4 Hana New Asset AccountingSUDIPTADATTARAYNoch keine Bewertungen

- SAP General Controlling Configurationgfdgfdfdgfdsgdsg: Step 1: Define Your Controlling AreaDokument20 SeitenSAP General Controlling Configurationgfdgfdfdgfdsgdsg: Step 1: Define Your Controlling AreaJyotiraditya BanerjeeNoch keine Bewertungen

- Foreign Currency Valuation EXPLAINED With ExampleDokument52 SeitenForeign Currency Valuation EXPLAINED With ExampleSuraj MohapatraNoch keine Bewertungen

- Chapter 24 - Asset Management ConfigurationDokument23 SeitenChapter 24 - Asset Management ConfigurationShine KaippillyNoch keine Bewertungen

- S4 Hana Finance Full Implem Configuration DocumentDokument9 SeitenS4 Hana Finance Full Implem Configuration DocumentMayankNoch keine Bewertungen

- Sap Fi /co Tickets: How Is Integration Testing Done?Dokument1 SeiteSap Fi /co Tickets: How Is Integration Testing Done?Alex LindeNoch keine Bewertungen

- SAP S4hana Profitability Analysis (COPA)Dokument124 SeitenSAP S4hana Profitability Analysis (COPA)Nawair IshfaqNoch keine Bewertungen

- SAP FI (Financial Accounting) - OverviewDokument43 SeitenSAP FI (Financial Accounting) - OverviewishtiaqNoch keine Bewertungen

- FSCM PPTDokument34 SeitenFSCM PPTManohar G Shankar100% (1)

- Change Fiscal Year VariantDokument2 SeitenChange Fiscal Year VariantWalid MetwallyNoch keine Bewertungen

- Valuating of Open Items in Foreign CurrencyDokument15 SeitenValuating of Open Items in Foreign CurrencybhaumikmittalNoch keine Bewertungen

- Chapter 16 Extended Withholding Taxes-1 PDFDokument30 SeitenChapter 16 Extended Withholding Taxes-1 PDFsowmyanaval0% (1)

- Foreign Currency ValuationDokument21 SeitenForeign Currency Valuationneelam618Noch keine Bewertungen

- Open Item Management in SapDokument17 SeitenOpen Item Management in SapSwatantra BarikNoch keine Bewertungen

- New GL Doc SplittingDokument56 SeitenNew GL Doc SplittingSam Kol100% (2)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsVon EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNoch keine Bewertungen

- SAP S/4HANA Central Finance and Group Reporting: Integrate SAP S/4HANA ERP Systems into Your Financial Data and Workflows for More AgilityVon EverandSAP S/4HANA Central Finance and Group Reporting: Integrate SAP S/4HANA ERP Systems into Your Financial Data and Workflows for More AgilityNoch keine Bewertungen

- Cfo ListDokument6 SeitenCfo ListmoorthyNoch keine Bewertungen

- Diabetes Awareness CampaignDokument2 SeitenDiabetes Awareness CampaignmoorthyNoch keine Bewertungen

- Crescent Construction Company TC 39/1295, Poojapura, Thiruvananthapuram, Kerala 695012 0471 235 5114Dokument3 SeitenCrescent Construction Company TC 39/1295, Poojapura, Thiruvananthapuram, Kerala 695012 0471 235 5114moorthyNoch keine Bewertungen

- Real - Life Problems: Complete The Pictures, and Then Write The AnswersDokument2 SeitenReal - Life Problems: Complete The Pictures, and Then Write The AnswersmoorthyNoch keine Bewertungen

- 1 SAP Migration: 1.1 Solution OverviewDokument6 Seiten1 SAP Migration: 1.1 Solution OverviewmoorthyNoch keine Bewertungen

- Getting Started With Roadmap Viewer PDFDokument16 SeitenGetting Started With Roadmap Viewer PDFmoorthyNoch keine Bewertungen

- Adil Alzarooni PDFDokument5 SeitenAdil Alzarooni PDFmoorthyNoch keine Bewertungen

- ProfileDokument1 SeiteProfilemoorthyNoch keine Bewertungen

- Account Based Copa AnilDokument8 SeitenAccount Based Copa Anilmoorthy100% (1)

- Pa33 Installation enDokument122 SeitenPa33 Installation enmoorthyNoch keine Bewertungen

- SAP Predictive AccessDokument1 SeiteSAP Predictive AccessmoorthyNoch keine Bewertungen

- SAP Predictive Analytics Developer GuideDokument252 SeitenSAP Predictive Analytics Developer GuidemoorthyNoch keine Bewertungen

- SAP Predictive Analytics Developer GuideDokument252 SeitenSAP Predictive Analytics Developer GuidemoorthyNoch keine Bewertungen

- Prabhdeep Singh Baweja: ContactDokument4 SeitenPrabhdeep Singh Baweja: ContactmoorthyNoch keine Bewertungen

- ProfileDokument3 SeitenProfilemoorthyNoch keine Bewertungen

- Details Required For Preparing The ProposalDokument3 SeitenDetails Required For Preparing The ProposalmoorthyNoch keine Bewertungen

- ProfileDokument1 SeiteProfilemoorthyNoch keine Bewertungen

- Epc ContractorsDokument3 SeitenEpc ContractorsmoorthyNoch keine Bewertungen

- Madurai - Chenai TicketDokument2 SeitenMadurai - Chenai TicketmoorthyNoch keine Bewertungen

- Maneesh Rustagi: ContactDokument2 SeitenManeesh Rustagi: ContactmoorthyNoch keine Bewertungen

- Recruitment Agencies in Dubai and Abu DhabiDokument2 SeitenRecruitment Agencies in Dubai and Abu Dhabigrapeshisha.com60% (5)

- Padasalai Net 10th English I Paper Quarterly Exam WorksheetDokument2 SeitenPadasalai Net 10th English I Paper Quarterly Exam WorksheetmoorthyNoch keine Bewertungen

- High-Speed Profitability and Cost AnalysisDokument2 SeitenHigh-Speed Profitability and Cost AnalysismoorthyNoch keine Bewertungen

- SMP Tutorial Windows Object API Application DevelopmentDokument34 SeitenSMP Tutorial Windows Object API Application DevelopmentmoorthyNoch keine Bewertungen

- CA TutorailsDokument10 SeitenCA TutorailsmoorthyNoch keine Bewertungen

- Links To GoodnessDokument194 SeitenLinks To GoodnessKevin Itwaru0% (3)

- Estimating Capital Costs From An Equipment List: A Case StudyDokument8 SeitenEstimating Capital Costs From An Equipment List: A Case StudyWatsonnNoch keine Bewertungen

- Sworn Statement of Assets, Liabilities and Net WorthDokument2 SeitenSworn Statement of Assets, Liabilities and Net WorthFaidah Palawan AlawiNoch keine Bewertungen

- State of The Art Synthesis Literature ReviewDokument7 SeitenState of The Art Synthesis Literature Reviewfvdddmxt100% (2)

- 00 Saip 76Dokument10 Seiten00 Saip 76John BuntalesNoch keine Bewertungen

- BACS2042 Research Methods: Chapter 1 Introduction andDokument36 SeitenBACS2042 Research Methods: Chapter 1 Introduction andblood unityNoch keine Bewertungen

- SC Circular Re BP 22 Docket FeeDokument2 SeitenSC Circular Re BP 22 Docket FeeBenjamin HaysNoch keine Bewertungen

- MGT 3399: AI and Business Transformati ON: Dr. Islam AliDokument26 SeitenMGT 3399: AI and Business Transformati ON: Dr. Islam AliaymanmabdelsalamNoch keine Bewertungen

- Question BankDokument42 SeitenQuestion Bank02 - CM Ankita AdamNoch keine Bewertungen

- Arvind Textiles Internship ReportDokument107 SeitenArvind Textiles Internship ReportDipan SahooNoch keine Bewertungen

- Teshome Tefera ArticleDokument5 SeitenTeshome Tefera ArticleMagarsa GamadaNoch keine Bewertungen

- Analyzing Sri Lankan Ceramic IndustryDokument18 SeitenAnalyzing Sri Lankan Ceramic Industryrasithapradeep50% (4)

- Class Participation 9 E7-18: Last Name - First Name - IDDokument2 SeitenClass Participation 9 E7-18: Last Name - First Name - IDaj singhNoch keine Bewertungen

- Katalog Bonnier BooksDokument45 SeitenKatalog Bonnier BooksghitahirataNoch keine Bewertungen

- Nitotile LM : Constructive SolutionsDokument2 SeitenNitotile LM : Constructive SolutionsmilanbrasinaNoch keine Bewertungen

- Defensive Driving TrainingDokument19 SeitenDefensive Driving TrainingSheri DiĺlNoch keine Bewertungen

- Blanko Permohonan VettingDokument1 SeiteBlanko Permohonan VettingTommyNoch keine Bewertungen

- The Space Planning Data Cycle With Dynamo - Dynamo BIM PDFDokument6 SeitenThe Space Planning Data Cycle With Dynamo - Dynamo BIM PDFLuiz PessôaNoch keine Bewertungen

- Address All Ifrs 17 Calculations Across The Organization W Ith A Unified PlatformDokument4 SeitenAddress All Ifrs 17 Calculations Across The Organization W Ith A Unified Platformthe sulistyoNoch keine Bewertungen

- David Sm15 Inppt 06Dokument57 SeitenDavid Sm15 Inppt 06Halima SyedNoch keine Bewertungen

- TCO & TCU Series Container Lifting Lugs - Intercon EnterprisesDokument4 SeitenTCO & TCU Series Container Lifting Lugs - Intercon EnterprisesReda ElawadyNoch keine Bewertungen

- Why Is Inventory Turnover Important?: ... It Measures How Hard Your Inventory Investment Is WorkingDokument6 SeitenWhy Is Inventory Turnover Important?: ... It Measures How Hard Your Inventory Investment Is WorkingabhiNoch keine Bewertungen

- CS 252: Computer Organization and Architecture II: Lecture 5 - The Memory SystemDokument29 SeitenCS 252: Computer Organization and Architecture II: Lecture 5 - The Memory SystemJonnahNoch keine Bewertungen

- Unit 1 Notes (Tabulation)Dokument5 SeitenUnit 1 Notes (Tabulation)RekhaNoch keine Bewertungen

- Link Belt Rec Parts LastDokument15 SeitenLink Belt Rec Parts LastBishoo ShenoudaNoch keine Bewertungen

- CPC Project PDFDokument18 SeitenCPC Project PDFsiddharthNoch keine Bewertungen

- Plasticizers For CPE ElastomersDokument8 SeitenPlasticizers For CPE Elastomersbatur42Noch keine Bewertungen

- 10.isca RJCS 2015 106Dokument5 Seiten10.isca RJCS 2015 106Touhid IslamNoch keine Bewertungen

- Artificial Intelligence and Parametric Construction Cost Estimate Modeling State-of-The-Art ReviewDokument31 SeitenArtificial Intelligence and Parametric Construction Cost Estimate Modeling State-of-The-Art ReviewmrvictormrrrNoch keine Bewertungen

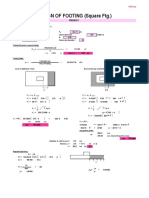

- Design of Footing (Square FTG.) : M Say, L 3.75Dokument2 SeitenDesign of Footing (Square FTG.) : M Say, L 3.75victoriaNoch keine Bewertungen