Beruflich Dokumente

Kultur Dokumente

Assailed Provisions Petitioner's Contentions Ruling of The Court

Hochgeladen von

Nicole PT0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

20 Ansichten3 Seiten.

Originaltitel

2. Abakada v. Ermita

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

20 Ansichten3 SeitenAssailed Provisions Petitioner's Contentions Ruling of The Court

Hochgeladen von

Nicole PT.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

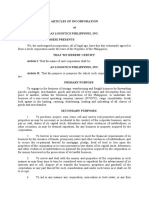

ABAKADA v.

ERMITA

The case tackles the constitutionality of RA 9337 or the E-VAT Law.

Assailed Provisions Petitioner’s Contentions Ruling of the Court

• Sec. 4 — imposes a 10% ABAKADA’s contention: • No undue delegation of power but only discretion as

VAT on sale of goods • This is in violation of the exclusive authority to the execution of a law.

and properties of the Congress to fix the rate of taxes under o Legislature may delegate to executive officers or

• Sec. 5 — imposes a 10% the Constitution. bodies the power to determine certain facts or

VAT on importation of • VAT is a tax levied on the sale, barter or conditions, or the happening of contingencies, on

goods exchange of goods and properties as well as which the operation of a statute, is by its terms, made

• Sec. 6 — imposes a 10% on the sale or exchange of services which to depend, but the legislature must prescribe

VAT on sale of services cannot be included within the purview of sufficient standards on their authority.

and use or lease of tariffs under the exempted delegation. o What is delegated to the Executive in this case is the

properties ascertainment of facts upon which enforcement and

Pimentel’s contention: administration of the increase rate under the law is

Stand-by authority: The assailed provisions violates the due process contingent.

These provisions also include clause as it imposes an unfair and additional tax o The legislature has made the operation of the 12%

a uniform proviso authorizing burden on the people: rate contingent upon a specified fact or condition.

the President, upon • the increase to 12% is ambiguous because it o No discretion would be exercised by the President; it

recommendation of the DOF does not state if the rate would be returned to the is simply a ministerial duty to impose the 12% rate

Sec. to raise the VAT rate to original 10% if the conditions are no longer upon the existence of any of the conditions specified

12%, effective 1 January satisfied by Congress.

2006, after any of the following • the rate is unfair and unreasonable, as the people o The DOF Sec. is acting as an agent of the legislative

conditions have been are unsure of the applicable VAT rate from year to department to determine and declare the event upon

satisfied: year which it is expressed will is to take effect.

• VAT/GDP Ratio of the • the increase in VAT rate should only be based on • The 12% increase in VAT Rate does not impose an

previous year exceeds fiscal adequacy unfair and unnecessary additional tax burden.

2 4/5% or; o In the absence of any provision for a return to the

• National government Escudero’s contention: 10% rate, thus there is no fluctuating VAT rate.

deficit/GDP Ratio of • The DOF Sec. is not mandated to give a o Fiscal adequacy — sources of revenues must be

the previous year recommendation. adequate to meet gov’t expenditures and their

exceeds 1 ½% • No standards are provided in the law on what variations.

basis and as to how he will make the o The present condition when the law was passed

recommendation. show that majority of the revenue went to debt

service and the GDP level is low compared to

neighboring countries. Thus there was a dire need to

respond to the needs.

Assailed Provisions Petitioner’s Contentions Ruling of the Court

• Sec. 8 — requiring that Association of Pilipinas Shell’s contentions: • No violation of equal protection clause and due

input tax on depreciable Input tax partakes the nature of a property that may process

goods shall be amortized not be confiscated, appropriated, or limited without o Input Tax — VAT due from or paid by a VAT-

over a 60-month period, if due process of law. registered person on the importation of goods or local

the acquisition excluding It viotales the equal protection of the as the limitation purchase of goods and services from a VAT-

the VT compents, exceeds on the creditable input tax if: registered person

P1M; imposing a 70% limit • the entity has a high ratio of input tax; o Output Tax— VAT due on the sale or lease of

on the amount of input tax • the entity invests in capital equipment taxable goods or properties or services by any

to be credited against the • the entity has several transactions with the person registered or required to register under the

output tax gov’t is not based on real and substantial law

• Sec. 12 — authorizing the differences to meet a valid classification o The law states that if the input tax is less than 70% of

Gov’t or any of its political the output tax, then 100% of such input tax is still

subdivisions, The limitation on the creditable input tax in effect creditable.

instrumentalities or allows VAT-registered establishments to retain a o The excess input tax, if any, is retained in a business

agencies to deduct a 5% portion of the taxes they collect, thus violating the books of accounts and remains creditable in the

final withholding tax on principe that tax collection and revenue should be succeeding quarters.

gross payments of goods solely allocated for public purposes and o If at the end of a taxable quarter, the output taxes

and services, which are expenditures. charged by the seller are equal to the input taxes that

subject to 10% VAT he paid and passed on by the suppliers, no payment

is required.

o When the output taxes exceed the input taxes, the

person shall be liable for the excess which has to be

paid to the BIR

o If the input taxes exceed the output taxes, the excess

shall be carried over to the succeeding quarter or

quarters

o A VAT-registered persons entitlement to the

creditable input tax is a mere statutory privilige

Other Matters Discussed by the Court: J. PANGANIBAN, Separate Opinion

• Definitions: • The standyby authority granted to the President is valid.

o VAT — a form of indirect tax ; tax on spending or However, the DOF Sec. remains to be an alter ego of the

consumption; the burden is intended to fall on the immediate President and conducts an administrative function.

buyers • Since the unutilized input VAT can be carried over to

o Direct tax — for which a taxpayer is directly liable on the succeeding quarters, there is no undue deprivation of

transaction or business it engages in property. Alternatively, it can be passed on to the

• On the Uniformity and Equitability of Taxation consumers;

o Uniformity – all taxable articles or kinds of property of the • The deferred input tax account -- which accumulates the

same class shall be taxed at the same rate unutilized input VAT -- remains an asset in the accounting

o The tax law is uniform as it provides a standard rate on all records of a business. It is not at all confiscated by the

goods and services; there is no distinction as to the type of government.

industry or trade that will bear the 70% limitation on the • The matter of business establishments shouldering 30

creditable input tax percent of output tax and remitting the amount, as computed,

o It is also equitable as it is equipped with a threshold margin. to the government is in effect imposing a tax that is

o Basic marine and agricultural food products in their original equivalent to a maximum of 3 percent of gross sales or

state are still not subject to the tax. revenues. This imposition is arguably another tax on gross --

o There are mitigating measures such as reduction on excise not net -- income and thus a deviation from the concept of

tax on petroleum gases and natural gases. VAT as a tax on consumption; it also assumes that sales or

o Increased tax rates of corporation — 35% revenues are on cash basis or, if on credit, given credit terms

o PAGCOR is not exempt anymore shorter than a quarter of a year.

• On Progressive Taxation • The reduction of tax credits is a question of economic policy.

o Progressive — rate goes up depending on the resources of Its determination is vested in Congress, not in this Court.

the person affected Since the purpose of the law is to raise revenues, it cannot

o VAT is regressive; it is the lower income group which is be denied that the means employed is reasonably related to

always hardest hit the achievement of that purpose.

o The Constitution does not prohibit the imposition of indirect • With the imposition of the 70 percent cap, there will be an

taxes like the VAT assurance of a steady cash flow to the government, which

can be translated to the production of improved goods,

rendition of better services, and construction of better

facilities for the people, including all private enterprises.

• The advantages and disadvantages of the E-VAT Law, as

well as its long-term effects on the economy, are beyond the

reach of judicial review.

Das könnte Ihnen auch gefallen

- Final Tax and Creditable Withholding TaxesDokument3 SeitenFinal Tax and Creditable Withholding Taxesarrianemartinez100% (4)

- L2 Certificate in Bookkeeping and Accounting PDFDokument26 SeitenL2 Certificate in Bookkeeping and Accounting PDFKhin Zaw HtweNoch keine Bewertungen

- Fort Bonifacio Development Corp. vs. Commissioner of Internal Revenue, 679 SCRA 566, September 04, 2012Dokument3 SeitenFort Bonifacio Development Corp. vs. Commissioner of Internal Revenue, 679 SCRA 566, September 04, 2012anajuanitoNoch keine Bewertungen

- Fort Bonifacio Devt Corp V CIRDokument3 SeitenFort Bonifacio Devt Corp V CIRBettina Rayos del SolNoch keine Bewertungen

- CIR Vs SolidbankDokument3 SeitenCIR Vs SolidbankJoel MilanNoch keine Bewertungen

- Value Added TaxDokument29 SeitenValue Added TaxSNLTNoch keine Bewertungen

- Impuesto A La Renta EmpresarialDokument88 SeitenImpuesto A La Renta EmpresarialJohn Perez PachasNoch keine Bewertungen

- Fort Bonifacio Development Corporation vs. Commissioner of Internal RevenueDokument28 SeitenFort Bonifacio Development Corporation vs. Commissioner of Internal RevenueAriel AbisNoch keine Bewertungen

- Cases of and of Multinational Corporation: Tax Avoidance Tax EvasionDokument47 SeitenCases of and of Multinational Corporation: Tax Avoidance Tax EvasionHoàng Anh NguyễnNoch keine Bewertungen

- PWC DTC 2010 SnapshotDokument7 SeitenPWC DTC 2010 SnapshotGs ShikshaNoch keine Bewertungen

- Both Statements Are False (4) The First Statement Is True and The Second Is FalseDokument4 SeitenBoth Statements Are False (4) The First Statement Is True and The Second Is FalseNoreen NombsNoch keine Bewertungen

- Value Added Tax2Dokument28 SeitenValue Added Tax2biburaNoch keine Bewertungen

- Tax Rate For EntityDokument5 SeitenTax Rate For EntitySantosh ChhetriNoch keine Bewertungen

- DTC ProvisionsDokument3 SeitenDTC ProvisionsrajdeeppawarNoch keine Bewertungen

- CIR vs Benguet Corp: Retroactive application of tax rulings prejudicialDokument9 SeitenCIR vs Benguet Corp: Retroactive application of tax rulings prejudicialFrancise Mae Montilla MordenoNoch keine Bewertungen

- VAT Important DoctrinesDokument7 SeitenVAT Important DoctrineskaiaceegeesNoch keine Bewertungen

- Cir Vs Bank of Commerce DigestDokument3 SeitenCir Vs Bank of Commerce Digestwaws20Noch keine Bewertungen

- Air Canada Tax Case Rules Carrier Not Liable for GPB Tax Under PH-Canada TreatyDokument1 SeiteAir Canada Tax Case Rules Carrier Not Liable for GPB Tax Under PH-Canada TreatyY P Dela PeñaNoch keine Bewertungen

- Facts:: Book ValueDokument2 SeitenFacts:: Book Valueultra gayNoch keine Bewertungen

- Withholding and Presumptive Taxes: Group 5Dokument9 SeitenWithholding and Presumptive Taxes: Group 5Rumbidzaishe MunyanyiNoch keine Bewertungen

- Taxation Law DoctrinesDokument5 SeitenTaxation Law DoctrinesĽeońard ŮšitaNoch keine Bewertungen

- Bank of America Vs CADokument2 SeitenBank of America Vs CAPretzel TsangNoch keine Bewertungen

- Finance Bill 2021 proposes key amendments to Pakistan's tax lawsDokument12 SeitenFinance Bill 2021 proposes key amendments to Pakistan's tax lawsAnam IqbalNoch keine Bewertungen

- Fort Bonifacio Vs CIRDokument2 SeitenFort Bonifacio Vs CIRCessy Ciar KimNoch keine Bewertungen

- GR No. 125704 PHILEX MINING CORP V COMMISSIONER OF INTERNAL REVENUE, CTADokument3 SeitenGR No. 125704 PHILEX MINING CORP V COMMISSIONER OF INTERNAL REVENUE, CTAtanniebangbang882Noch keine Bewertungen

- TaxationDokument90 SeitenTaxationChow GalanNoch keine Bewertungen

- M2 - Taxes, Tax Laws and Tax AdministrationDokument31 SeitenM2 - Taxes, Tax Laws and Tax AdministrationTERRIUS AceNoch keine Bewertungen

- VAT 12 Fort Bonifacio Dev. Corp. Vs CIRDokument2 SeitenVAT 12 Fort Bonifacio Dev. Corp. Vs CIRMarivic EspiaNoch keine Bewertungen

- Fort Bonifacio Development Corporation Vs CIR GR 173425 September 4, 2012Dokument3 SeitenFort Bonifacio Development Corporation Vs CIR GR 173425 September 4, 2012GraceNoch keine Bewertungen

- 4 Revenue 30 QuestionsDokument5 Seiten4 Revenue 30 QuestionsEzer Cruz BarrantesNoch keine Bewertungen

- General PrinciplesDokument15 SeitenGeneral PrinciplesattywithnocaseyetNoch keine Bewertungen

- Knowing Your PenaltiesDokument3 SeitenKnowing Your PenaltiesOmar Jayson Siao VallejeraNoch keine Bewertungen

- Direct Tax CodeDokument10 SeitenDirect Tax Codejgaurav80Noch keine Bewertungen

- VAT GUIDE - ITC Accounting and Tax ConsultancyDokument15 SeitenVAT GUIDE - ITC Accounting and Tax ConsultancymarketingNoch keine Bewertungen

- Chartered Accountants Union Budget 2018 and recent developments in regulatory frameworkDokument44 SeitenChartered Accountants Union Budget 2018 and recent developments in regulatory frameworks k shettyNoch keine Bewertungen

- To 10,000 Taxpayers To Be Expanded To 20,000Dokument1 SeiteTo 10,000 Taxpayers To Be Expanded To 20,000macyaelNoch keine Bewertungen

- 3 CIR Vs FILINVESTDokument40 Seiten3 CIR Vs FILINVESTLouise Nicole AlcobaNoch keine Bewertungen

- IrsDokument64 SeitenIrsYogesh KumarNoch keine Bewertungen

- Nigeria Tax & Fiscal RegulationsDokument9 SeitenNigeria Tax & Fiscal RegulationsAparna SinghNoch keine Bewertungen

- Budget Briefing 2015Dokument63 SeitenBudget Briefing 2015Noor AliNoch keine Bewertungen

- CIR v. Bank of Commerce (2005) Case DigestDokument2 SeitenCIR v. Bank of Commerce (2005) Case DigestShandrei GuevarraNoch keine Bewertungen

- GNotes2 VAT 2018 With TRAIN AmendmentsDokument31 SeitenGNotes2 VAT 2018 With TRAIN AmendmentsKristine Bucu100% (4)

- Gruba - Vat With TrainDokument31 SeitenGruba - Vat With TrainPrincess Trisha Joy UyNoch keine Bewertungen

- Fort Bonifacio vs CIR Case Digest on Transitional Input Tax CreditDokument3 SeitenFort Bonifacio vs CIR Case Digest on Transitional Input Tax Creditminri72150% (4)

- e-SCRA COM IR vs. Solid BankDokument42 Seitene-SCRA COM IR vs. Solid Bankflordelei hocateNoch keine Bewertungen

- Economic Update 17th May-1Dokument2 SeitenEconomic Update 17th May-1mNoch keine Bewertungen

- TaxreviewerDokument3 SeitenTaxreviewerVincent NifasNoch keine Bewertungen

- October 12,: Vat Zero-Rated Sale of Service (Labor Aspect)Dokument6 SeitenOctober 12,: Vat Zero-Rated Sale of Service (Labor Aspect)LaBron JamesNoch keine Bewertungen

- Advanced Taxation & Fiscal Policy Nov 2011Dokument7 SeitenAdvanced Taxation & Fiscal Policy Nov 2011Samuel DwumfourNoch keine Bewertungen

- Ease of Paying TaxDokument3 SeitenEase of Paying TaxjhnplmcsNoch keine Bewertungen

- Cir V. Solidbank Corporation: FactsDokument3 SeitenCir V. Solidbank Corporation: FactsJustine Jay Casas LopeNoch keine Bewertungen

- DTTL Tax Vietnamhighlights 2018 PDFDokument4 SeitenDTTL Tax Vietnamhighlights 2018 PDFhung789Noch keine Bewertungen

- Held:: of Makati vs. CA, G.R. Nos. 89898-99, October 1, 1990)Dokument5 SeitenHeld:: of Makati vs. CA, G.R. Nos. 89898-99, October 1, 1990)charmagne cuevasNoch keine Bewertungen

- Supreme Court Rules 20% FWT Forms Part of Gross Receipts for GRT CalculationDokument2 SeitenSupreme Court Rules 20% FWT Forms Part of Gross Receipts for GRT CalculationMarj CenNoch keine Bewertungen

- CIR v. Bank of CommerceDokument6 SeitenCIR v. Bank of Commerceamareia yapNoch keine Bewertungen

- With Holding Tax-CompressedDokument8 SeitenWith Holding Tax-CompressedNGANJANI WALTERNoch keine Bewertungen

- Problem Exercises in TaxationDokument38 SeitenProblem Exercises in TaxationSHeena MaRie ErAsmoNoch keine Bewertungen

- Tax 1 Midterms AnswerDokument3 SeitenTax 1 Midterms AnswerCacapablen GinNoch keine Bewertungen

- Landlord Tax Planning StrategiesVon EverandLandlord Tax Planning StrategiesNoch keine Bewertungen

- 1040 Exam Prep Module XI: Circular 230 and AMTVon Everand1040 Exam Prep Module XI: Circular 230 and AMTBewertung: 1 von 5 Sternen1/5 (1)

- Fit and Proper RuleDokument2 SeitenFit and Proper RuleNicole PTNoch keine Bewertungen

- Political Law Review Doctrines 8 Arts. VIII Secs. 55 11 and IX A Secs. 5 7Dokument23 SeitenPolitical Law Review Doctrines 8 Arts. VIII Secs. 55 11 and IX A Secs. 5 7Nicole PTNoch keine Bewertungen

- IRR RA 11057 RRD Pages 35 42Dokument8 SeitenIRR RA 11057 RRD Pages 35 42Nicole PTNoch keine Bewertungen

- 1 - BOI-Advisory - Dated March 20 20Dokument2 Seiten1 - BOI-Advisory - Dated March 20 20Nicole PTNoch keine Bewertungen

- Political Law Review Doctrines 1 Arts. I II and VI Secs. 1 11Dokument27 SeitenPolitical Law Review Doctrines 1 Arts. I II and VI Secs. 1 11Nicole PTNoch keine Bewertungen

- Civ NotesDokument20 SeitenCiv NotesNicole PTNoch keine Bewertungen

- Evidence CAse Matrix 2Dokument17 SeitenEvidence CAse Matrix 2Nicole PTNoch keine Bewertungen

- Corp Gov - Class HandoutsDokument9 SeitenCorp Gov - Class HandoutsNicole PTNoch keine Bewertungen

- FishBowl SectionsDokument8 SeitenFishBowl SectionsNicole PTNoch keine Bewertungen

- Political Law Review Doctrines 2 Art. VI Secs. 13 17Dokument28 SeitenPolitical Law Review Doctrines 2 Art. VI Secs. 13 17Nicole PTNoch keine Bewertungen

- Crim II Title X NotesDokument10 SeitenCrim II Title X NotesNicole PTNoch keine Bewertungen

- Poli DoctrinesDokument13 SeitenPoli DoctrinesNicole PTNoch keine Bewertungen

- Evidence CAse Matrix 2Dokument16 SeitenEvidence CAse Matrix 2Nicole PTNoch keine Bewertungen

- Corp Gov Presentation - TorresDokument12 SeitenCorp Gov Presentation - TorresNicole PTNoch keine Bewertungen

- Political Law NotesDokument24 SeitenPolitical Law NotesNicole PTNoch keine Bewertungen

- Comm Emergency DigestsDokument7 SeitenComm Emergency DigestsNicole PTNoch keine Bewertungen

- 2C 2019 Part 2-2Dokument26 Seiten2C 2019 Part 2-2Nicole PTNoch keine Bewertungen

- Ang Paghahanap Sa Tamang Tama Ni Buddhadasa BikkhuDokument3 SeitenAng Paghahanap Sa Tamang Tama Ni Buddhadasa BikkhuNicole PTNoch keine Bewertungen

- Tax I Digest CompilationDokument9 SeitenTax I Digest CompilationNicole PTNoch keine Bewertungen

- Pp. 764 To 777Dokument3 SeitenPp. 764 To 777Nicole PTNoch keine Bewertungen

- Political Law Review Doctrines 2 Art. VI Secs. 13 17Dokument28 SeitenPolitical Law Review Doctrines 2 Art. VI Secs. 13 17Nicole PTNoch keine Bewertungen

- Tax I Digest CompilationDokument2 SeitenTax I Digest CompilationNicole PTNoch keine Bewertungen

- CLVDokument11 SeitenCLVNicole PTNoch keine Bewertungen

- P L P: J V: Hilippine Aw and Ractice On Oint Entures I. N J V P S 1. J V A P G C L PDokument16 SeitenP L P: J V: Hilippine Aw and Ractice On Oint Entures I. N J V P S 1. J V A P G C L PNicole PTNoch keine Bewertungen

- Finals 2c ReviewerDokument60 SeitenFinals 2c ReviewerIya AnonasNoch keine Bewertungen

- 1 OutlineDokument4 Seiten1 OutlineNicole PTNoch keine Bewertungen

- 1 OutlineDokument4 Seiten1 OutlineNicole PTNoch keine Bewertungen

- SpecPro Doctrines 7 Rules 103 and 108Dokument17 SeitenSpecPro Doctrines 7 Rules 103 and 108Nicole PTNoch keine Bewertungen

- Labor Cases March 2018Dokument3 SeitenLabor Cases March 2018Nicole PTNoch keine Bewertungen

- Articles of IncorporationDokument4 SeitenArticles of IncorporationRuel FernandezNoch keine Bewertungen

- Notes in Term Bonds and Serial Bonds (Discount or Premium)Dokument12 SeitenNotes in Term Bonds and Serial Bonds (Discount or Premium)Jae GrandeNoch keine Bewertungen

- AccountingDokument2 SeitenAccountingMerielle Medrano100% (2)

- Unit - Ii Entrepreneurial Idea and InnovationDokument49 SeitenUnit - Ii Entrepreneurial Idea and InnovationAkriti Sonker0% (1)

- Introduction To Insurance IndustriesDokument37 SeitenIntroduction To Insurance IndustriesNishaTambeNoch keine Bewertungen

- Commercial Studies: Fiji Year 9 Final Examination 2019Dokument14 SeitenCommercial Studies: Fiji Year 9 Final Examination 2019Nathan Salato Prasad100% (1)

- Chapter IX-Companies Act, 2013Dokument57 SeitenChapter IX-Companies Act, 2013Aman GuptaNoch keine Bewertungen

- Biz Cafe Operations Excel - Assignment - UIDDokument3 SeitenBiz Cafe Operations Excel - Assignment - UIDJenna AgeebNoch keine Bewertungen

- Harshad Mehta CaseDokument16 SeitenHarshad Mehta Casegunjan67% (3)

- Donor's Tax QuizDokument2 SeitenDonor's Tax Quizsujulove foreverNoch keine Bewertungen

- Risk Identification and Mitigation StrategiesDokument5 SeitenRisk Identification and Mitigation StrategiesnishthaNoch keine Bewertungen

- Chapter 5 Bank Credit InstrumentsDokument5 SeitenChapter 5 Bank Credit InstrumentsMariel Crista Celda Maravillosa100% (2)

- Anand RathiDokument3 SeitenAnand RathiShilpa EdarNoch keine Bewertungen

- INV2001082Dokument1 SeiteINV2001082Bisi AgomoNoch keine Bewertungen

- Investment Decision MakingDokument16 SeitenInvestment Decision MakingDhruvNoch keine Bewertungen

- Daily Current Affairs: 20 January 2024Dokument17 SeitenDaily Current Affairs: 20 January 2024YASH PANDEYNoch keine Bewertungen

- MSU-CBA Receivables Financing Pre-Review ProgramDokument2 SeitenMSU-CBA Receivables Financing Pre-Review ProgramAyesha RGNoch keine Bewertungen

- Financial Management Chapter 1Dokument11 SeitenFinancial Management Chapter 1Ruiz, CherryjaneNoch keine Bewertungen

- Macroeconomic Effects of Banking TaxesDokument35 SeitenMacroeconomic Effects of Banking TaxesAlan Dennis Martínez SotoNoch keine Bewertungen

- Foreign Exchange Risk Management Practices - A Study in Indian ScenarioDokument11 SeitenForeign Exchange Risk Management Practices - A Study in Indian ScenariobhagyashreeNoch keine Bewertungen

- Reinsurance Contract Nature and Original Insured InterestDokument2 SeitenReinsurance Contract Nature and Original Insured InterestFlorena CayundaNoch keine Bewertungen

- 1234449Dokument19 Seiten1234449Jade MarkNoch keine Bewertungen

- CPA Exam Questions on FASB Conceptual FrameworkDokument26 SeitenCPA Exam Questions on FASB Conceptual FrameworkTerry GuNoch keine Bewertungen

- New Income Tax Law 2018.1 NewDokument87 SeitenNew Income Tax Law 2018.1 NewDamascene100% (1)

- Dissolution and Incorporation of a PartnershipDokument26 SeitenDissolution and Incorporation of a PartnershipJohn LouiseNoch keine Bewertungen

- JPM Fact Fiction and Momentum InvestingDokument19 SeitenJPM Fact Fiction and Momentum InvestingmatteotamborlaniNoch keine Bewertungen

- USC EDRES Committee Proposal by USC Councilor Jules GuiangDokument14 SeitenUSC EDRES Committee Proposal by USC Councilor Jules GuiangJules GuiangNoch keine Bewertungen

- Analysis and Correction of Errors WorksheetDokument3 SeitenAnalysis and Correction of Errors WorksheetDaphneNoch keine Bewertungen

- Exhibits and Student TemplateDokument7 SeitenExhibits and Student Templatesatish.evNoch keine Bewertungen