Beruflich Dokumente

Kultur Dokumente

Problem 9.2

Hochgeladen von

SamerOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Problem 9.2

Hochgeladen von

SamerCopyright:

Verfügbare Formate

Problem 9.

2 Siam Cement

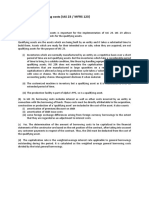

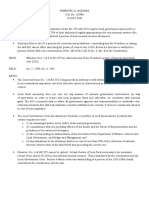

Siam Cement, the Bangkok-based cement manufacturer, suffered enormous losses with the coming of the

Asian crisis in 1997. The company had been pursuing a very aggressive growth strategy in the mid-1990s,

taking on massive quantities of foreign currency denominated debt (primarily U.S. dollars). When the

Thai baht (B)was devalued from its pegged rate of B25.0/$ in July 1997, Siam’s interest payments alone

were over $900 million on its outstanding dollar debt (with an average interest rate of 8.40% on its U.S.

dollar debt at that time). Assuming Siam Cement took out $50 million in debt in June 1997 at 8.40%

interest, and had to repay it in one year when the spot exchange rate had stabilized at B42.0/$, what was

the foreign exchange loss incurred on the transaction?

Assumptions Value

US dollar debt taken out in June 1997 $ 50,000,000

US dollar borrowing rate on debt 8.400%

Initial spot exchange rate, baht/dollar, June 1997 25.00

Average spot exchange rate, baht/dollar, June 1998 42.00

Calculation of Foreign Exhange Loss on Repayment of Loan

At the time the loan was acquired, the scheduled repayment of dollar

and baht amounts would have been as follows:

Scheduled Repayment:

Repayment of US dollar debt: Principal $ 50,000,000

Repayment of US dollar debt: Interest 4,200,000

Total repayment $ 54,200,000

Exchange rate at time of repayment, baht/dollar 25.00

Total repayment in Thai baht 1,355,000,000

Total proceeds from loan, up-front, in Thai baht 1,250,000,000

Net interest to be paid, in Thai baht 105,000,000

Actual Repayment:

Repayment of US dollar debt: Principal $ 50,000,000

Repayment of US dollar debt: Interest 4,200,000

Total repayment $ 54,200,000

Exchange rate at time of repayment, baht/dollar 42.00

Total repayment in Thai baht 2,276,400,000

Less what Siam had EXPECTED or SCHEDULED to be repaid (1,355,000,000)

Amount of foreign exchange loss on debt 921,400,000

Das könnte Ihnen auch gefallen

- Tutorial 6 Solutions Chap10 3a14.xlsmDokument5 SeitenTutorial 6 Solutions Chap10 3a14.xlsmKesarapu Venkata ApparaoNoch keine Bewertungen

- Chapter 8Dokument22 SeitenChapter 8mark leeNoch keine Bewertungen

- Chap 10 IfmDokument17 SeitenChap 10 IfmNguyễn Gia Phương Anh100% (1)

- Problem 10.2 Siam CementDokument17 SeitenProblem 10.2 Siam CementRimpy SondhNoch keine Bewertungen

- MBF14e Chap10 Transaction PbmsDokument19 SeitenMBF14e Chap10 Transaction PbmsQurratul Asmawi100% (2)

- New Microsoft Excel WorksheetDokument2 SeitenNew Microsoft Excel WorksheetKeresha WilliamsNoch keine Bewertungen

- CH 8Dokument7 SeitenCH 8Juan Oliver OndeNoch keine Bewertungen

- FI 3300 Midterm I Practice Test SolutionsDokument3 SeitenFI 3300 Midterm I Practice Test SolutionsSerin SiluéNoch keine Bewertungen

- Fin Exam 1Dokument14 SeitenFin Exam 1tahaalkibsiNoch keine Bewertungen

- FI 3300 Final Exam Spring 02Dokument9 SeitenFI 3300 Final Exam Spring 02John Brian D. SorianoNoch keine Bewertungen

- C. Wolken Issued New Common Stock in 2013Dokument4 SeitenC. Wolken Issued New Common Stock in 2013Talha JavedNoch keine Bewertungen

- Latihan Currency Derivative V.01Dokument27 SeitenLatihan Currency Derivative V.01Favian Maraville YadisaputraNoch keine Bewertungen

- Problem Sets Finacc Chapter 9Dokument19 SeitenProblem Sets Finacc Chapter 9Reg LagartejaNoch keine Bewertungen

- Tutorial 1 Suggested SolutionsDokument4 SeitenTutorial 1 Suggested SolutionsVeronica MishraNoch keine Bewertungen

- Chapter 10 Translation of Foreign Currency Financial Statements PDFDokument28 SeitenChapter 10 Translation of Foreign Currency Financial Statements PDFdanikadolorNoch keine Bewertungen

- Modul Lab Akuntansi Lanjutan Ii - P 21.22Dokument34 SeitenModul Lab Akuntansi Lanjutan Ii - P 21.22christin melinaNoch keine Bewertungen

- Sia 1.bonds PayableDokument13 SeitenSia 1.bonds PayableYasmin MamugayNoch keine Bewertungen

- Speculation Based On Expected Appreciation: AnswerDokument7 SeitenSpeculation Based On Expected Appreciation: Answerইয়াসিন খন্দকার রাতুলNoch keine Bewertungen

- PRELIM Quiz 1 Cash, CE, PCF, Bank ReconDokument8 SeitenPRELIM Quiz 1 Cash, CE, PCF, Bank ReconApril Faye de la CruzNoch keine Bewertungen

- Essendon Project 3Dokument4 SeitenEssendon Project 3matthew.epark29Noch keine Bewertungen

- Chapter 11 The Banking System and The Money Supply: Review QuestionsDokument5 SeitenChapter 11 The Banking System and The Money Supply: Review QuestionsRo NaNoch keine Bewertungen

- (TEST BANK and SOL) Bonds PayableDokument6 Seiten(TEST BANK and SOL) Bonds PayableJhazz DoNoch keine Bewertungen

- (TEST BANK and SOL) Bonds PayableDokument6 Seiten(TEST BANK and SOL) Bonds PayableJhazz DoNoch keine Bewertungen

- Dita Eka Nur Sakina - Tugas P14Dokument8 SeitenDita Eka Nur Sakina - Tugas P14Dita EnsNoch keine Bewertungen

- Financial Accounting Assignment: Withholding?Dokument2 SeitenFinancial Accounting Assignment: Withholding?KhalidNoch keine Bewertungen

- Name: Solution Problem: P14-2, Issuance and Retirement of Bonds Course: DateDokument8 SeitenName: Solution Problem: P14-2, Issuance and Retirement of Bonds Course: DateRegina PutriNoch keine Bewertungen

- Beams AdvAcc11 Chapter12 PDFDokument9 SeitenBeams AdvAcc11 Chapter12 PDFBellaNovindraNoch keine Bewertungen

- Please Refer To Table 4-1 For The Following Questions. Table 4-1Dokument1 SeitePlease Refer To Table 4-1 For The Following Questions. Table 4-1Megana PunithNoch keine Bewertungen

- Liabilities Are Classified On The Balance Sheet As Either:: Chapter 10 SummaryDokument6 SeitenLiabilities Are Classified On The Balance Sheet As Either:: Chapter 10 SummaryAreeba QureshiNoch keine Bewertungen

- InvestmentsHull2022 03Dokument25 SeitenInvestmentsHull2022 03Barna OsztermayerNoch keine Bewertungen

- Question - FS and FADokument6 SeitenQuestion - FS and FANguyễn Thùy LinhNoch keine Bewertungen

- Financial Undertaking of Ly My Phuong (Checking)Dokument2 SeitenFinancial Undertaking of Ly My Phuong (Checking)hop100% (1)

- Afar 2 Module CH 11 12Dokument16 SeitenAfar 2 Module CH 11 12Joyce Anne MananquilNoch keine Bewertungen

- Conceptual Framework: & Accounting StandardsDokument62 SeitenConceptual Framework: & Accounting StandardsAmie Jane MirandaNoch keine Bewertungen

- Hutang JK PanjangDokument24 SeitenHutang JK PanjangYoan88Noch keine Bewertungen

- Answers Part1Dokument1 SeiteAnswers Part1Jamaica DavidNoch keine Bewertungen

- Intermediate Accounting 1 Quiz 1Dokument4 SeitenIntermediate Accounting 1 Quiz 1Manuel MagadatuNoch keine Bewertungen

- Finals-Business CombiDokument5 SeitenFinals-Business Combijhell de la cruzNoch keine Bewertungen

- Debt Restructure - SIM - 0Dokument14 SeitenDebt Restructure - SIM - 0lilienesieraNoch keine Bewertungen

- Withholding?Dokument2 SeitenWithholding?FahadNoch keine Bewertungen

- t7 Borrowing CostDokument3 Seitent7 Borrowing CostShirley VunNoch keine Bewertungen

- Question - BS and FADokument6 SeitenQuestion - BS and FANguyễn Thùy LinhNoch keine Bewertungen

- LatihanDokument12 SeitenLatihanSurameto HariyadiNoch keine Bewertungen

- Translation QuestionsDokument6 SeitenTranslation QuestionsVeenal BansalNoch keine Bewertungen

- A. All of The AboveDokument11 SeitenA. All of The AbovetikaNoch keine Bewertungen

- Forex&Derivative HODokument7 SeitenForex&Derivative HOMarielle SidayonNoch keine Bewertungen

- Z00330010220164013Installment SalesDokument19 SeitenZ00330010220164013Installment SalesLinna GuinarsoNoch keine Bewertungen

- Bonds Payable Effective Interest Method and Compound Financial InstrumentsDokument7 SeitenBonds Payable Effective Interest Method and Compound Financial Instrumentskris mNoch keine Bewertungen

- ACT1106 - Midterm Quiz No. 2 With AnswerDokument8 SeitenACT1106 - Midterm Quiz No. 2 With AnswerPj Dela VegaNoch keine Bewertungen

- 4 Borrowing CostDokument16 Seiten4 Borrowing CostHafizur RahmanNoch keine Bewertungen

- KasdanPiutang 4B Kelompok1Dokument11 SeitenKasdanPiutang 4B Kelompok1Estin TasyaNoch keine Bewertungen

- Memorandum: Lehman BrothersDokument10 SeitenMemorandum: Lehman BrothersRobertNoch keine Bewertungen

- Exercise 3 - Long-Term Liabilities - Jeremy MichaelDokument12 SeitenExercise 3 - Long-Term Liabilities - Jeremy MichaelJeremy Michael HariantoNoch keine Bewertungen

- Working With Financial StatementsDokument50 SeitenWorking With Financial StatementsAbinet Hailu100% (1)

- IA2 Worksheet-BONDS PAYABLE - 101010Dokument11 SeitenIA2 Worksheet-BONDS PAYABLE - 101010aehy lznuscrfbjNoch keine Bewertungen

- MBF13e Chap10 Pbms - FinalDokument17 SeitenMBF13e Chap10 Pbms - FinalYee Cheng80% (5)

- Real Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsVon EverandReal Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsNoch keine Bewertungen

- Treasury Finance and Development Banking: A Guide to Credit, Debt, and RiskVon EverandTreasury Finance and Development Banking: A Guide to Credit, Debt, and RiskNoch keine Bewertungen

- Anscombe's Data WorkbookDokument5 SeitenAnscombe's Data WorkbookSamerNoch keine Bewertungen

- Example Paired SamplesDokument3 SeitenExample Paired SamplesSamerNoch keine Bewertungen

- Argentine InfoDokument1 SeiteArgentine InfoSamerNoch keine Bewertungen

- Argentine InfoDokument1 SeiteArgentine InfoSamerNoch keine Bewertungen

- Example Selecting Cases in SPSSDokument1 SeiteExample Selecting Cases in SPSSSamerNoch keine Bewertungen

- Example One Sample T TestDokument1 SeiteExample One Sample T TestSamerNoch keine Bewertungen

- Monetary and Fiscal Policies in 2008Dokument7 SeitenMonetary and Fiscal Policies in 2008SamerNoch keine Bewertungen

- ECN 2020 Syllabus-FALL 2020Dokument4 SeitenECN 2020 Syllabus-FALL 2020SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 07-01Dokument4 SeitenNeedlesPOA 12e - P 07-01SamerNoch keine Bewertungen

- Example Independent SamplesDokument3 SeitenExample Independent SamplesSamerNoch keine Bewertungen

- NeedlesPOA 12e - P 3-16Dokument8 SeitenNeedlesPOA 12e - P 3-16SamerNoch keine Bewertungen

- NeedlesPOA12e - P 02-05Dokument9 SeitenNeedlesPOA12e - P 02-05SamerNoch keine Bewertungen

- Needles POA 12e - P 12-07Dokument4 SeitenNeedles POA 12e - P 12-07SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 07-06Dokument4 SeitenNeedlesPOA 12e - P 07-06SamerNoch keine Bewertungen

- NeedlesPOA12e - P 05-03Dokument6 SeitenNeedlesPOA12e - P 05-03SamerNoch keine Bewertungen

- NeedlesPOA12e - P 14-04Dokument4 SeitenNeedlesPOA12e - P 14-04SamerNoch keine Bewertungen

- NeedlesPOA12e - P 05-03Dokument6 SeitenNeedlesPOA12e - P 05-03SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 07-02Dokument6 SeitenNeedlesPOA 12e - P 07-02SamerNoch keine Bewertungen

- NeedlesPOA12e - P 14-05Dokument2 SeitenNeedlesPOA12e - P 14-05SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 07-02Dokument6 SeitenNeedlesPOA 12e - P 07-02SamerNoch keine Bewertungen

- NeedlesPOA12e - P 05-06Dokument4 SeitenNeedlesPOA12e - P 05-06SamerNoch keine Bewertungen

- NeedlesPOA12e - P 14-08Dokument4 SeitenNeedlesPOA12e - P 14-08SamerNoch keine Bewertungen

- NeedlesPOA12e - P 05-06Dokument4 SeitenNeedlesPOA12e - P 05-06SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 01-04Dokument3 SeitenNeedlesPOA 12e - P 01-04SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 01-03Dokument2 SeitenNeedlesPOA 12e - P 01-03SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 01-08Dokument2 SeitenNeedlesPOA 12e - P 01-08SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 06-09Dokument3 SeitenNeedlesPOA 12e - P 06-09SamerNoch keine Bewertungen

- NeedlesPOA12e - P 16-01Dokument3 SeitenNeedlesPOA12e - P 16-01SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 06-03Dokument3 SeitenNeedlesPOA 12e - P 06-03SamerNoch keine Bewertungen

- NeedlesPOA 12e - P 01-08Dokument2 SeitenNeedlesPOA 12e - P 01-08SamerNoch keine Bewertungen

- 05 Bdek2203 T1Dokument10 Seiten05 Bdek2203 T1Frizal RahimNoch keine Bewertungen

- Macroeconomic Modeling For SDGs in LeastDokument25 SeitenMacroeconomic Modeling For SDGs in LeastAM operationNoch keine Bewertungen

- Chapter 11 - International TaxationDokument11 SeitenChapter 11 - International TaxationlinaelinaaaNoch keine Bewertungen

- BrittonDokument26 SeitenBrittonNidhin NalinamNoch keine Bewertungen

- Project Report On: Tax Avoidence and Tax EvasionDokument3 SeitenProject Report On: Tax Avoidence and Tax EvasionAnupam BeoharNoch keine Bewertungen

- Case Digest Pimentel Vs AguirreDokument1 SeiteCase Digest Pimentel Vs Aguirrenicole coNoch keine Bewertungen

- DMDokument264 SeitenDMDora Milla HernandezNoch keine Bewertungen

- The Fraser InstituteDokument5 SeitenThe Fraser InstituteRakesh ChagantiNoch keine Bewertungen

- CH 2 GaliDokument33 SeitenCH 2 Galijesua21Noch keine Bewertungen

- Api 119Dokument8 SeitenApi 119hokhmologNoch keine Bewertungen

- DornbuschDokument13 SeitenDornbuschdivyajain2888Noch keine Bewertungen

- 288 33 Powerpoint Slides Chapter 9 Policy Framework International TradeDokument45 Seiten288 33 Powerpoint Slides Chapter 9 Policy Framework International TradeSachin MishraNoch keine Bewertungen

- CF 7523Dokument1 SeiteCF 7523ebgdiac7Noch keine Bewertungen

- Introduction To Imf: International Monetary FundDokument25 SeitenIntroduction To Imf: International Monetary FundJitin BhutaniNoch keine Bewertungen

- Business CycleDokument29 SeitenBusiness Cyclesamrulezzz100% (1)

- Paid Preparer's Earned Income Credit ChecklistDokument4 SeitenPaid Preparer's Earned Income Credit Checklistanon_294216815Noch keine Bewertungen

- RBI Grade B InterviewDokument7 SeitenRBI Grade B InterviewsuprioNoch keine Bewertungen

- CIR Vs Acesite - Taxation 2 DigestDokument2 SeitenCIR Vs Acesite - Taxation 2 DigestGem S. Alegado33% (3)

- Section 112 - Tax On Long-Term Capital GainsDokument2 SeitenSection 112 - Tax On Long-Term Capital GainsParth UpadhyayNoch keine Bewertungen

- RMC 38-2017Dokument21 SeitenRMC 38-2017Mark Lord Morales BumagatNoch keine Bewertungen

- East Asian Miracle PDFDokument11 SeitenEast Asian Miracle PDFDinesh KumarNoch keine Bewertungen

- Quiz 4 VATDokument3 SeitenQuiz 4 VATAsiong Salonga100% (2)

- Day To Day EconomicsDokument12 SeitenDay To Day EconomicsPrateek SinglaNoch keine Bewertungen

- MCDokument127 SeitenMCMadiha AshrafNoch keine Bewertungen

- The Influence of Monetary and Fiscal Policy On Aggregate DemandDokument33 SeitenThe Influence of Monetary and Fiscal Policy On Aggregate DemandNedaabdiNoch keine Bewertungen

- FORM-IIIB (2) .-RemDokument2 SeitenFORM-IIIB (2) .-RemAnonymous pO336tQK0Noch keine Bewertungen

- Fiscal PolicyDokument29 SeitenFiscal Policyjay100% (1)

- Budget Statement-Hon Peya MushelengaDokument13 SeitenBudget Statement-Hon Peya MushelengaAndré Le RouxNoch keine Bewertungen

- MERCANTALISMDokument6 SeitenMERCANTALISMKiran SyedNoch keine Bewertungen

- SMChap 024Dokument35 SeitenSMChap 024testbank67% (3)