Beruflich Dokumente

Kultur Dokumente

PNB vs. CA Batch 2 Digest Final With Court Ruling and Doctrine

Hochgeladen von

mastaacaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PNB vs. CA Batch 2 Digest Final With Court Ruling and Doctrine

Hochgeladen von

mastaacaCopyright:

Verfügbare Formate

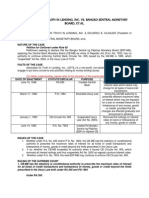

PHILIPPINE NATIONAL BANK, petitioner, G.R. No.

98382

vs. May 17, 1993

THE COURT OF APPEALS and EPIFANIO DE LA CRUZ, respondents.

Facts:

Two parcels of land under the common names of the respondent Epifanio dela

Cruz, his brother and sister were mortgaged to the Petitioner Philippine National Bank.

The lots were mortgaged to guarantee the by three promissory notes. The first two were

not paid by the respondent. The third is disputed by the respondent who claims that the

correct date is June 30, 1961; however, in the bank records, the note was really

executed on June 30, 1958.PNB presented under Act No. 3135 a foreclosure petition of

the mortgaged lots. The lots were sold or auctioned off with PNB as the highest bidder.

A Final Deed of Sale and a Certificate of Sale was executed in favor of the petitioner.

The final Deed of Sale was registered in Registry of Property. Inasmuch as the

respondent did not buy back the lots from PNB, Unsold on the same in a "Deed of

Conditional Sale". The Notices of Sale of foreclosed properties were published on

March 28, April 11 and April 12, 1969 in a newspaper.

Respondent brought a complaint for the reconveyance of the lands, which the

petitioner allegedly unlawfully foreclosed. The petitioner states on the other hand that

the extrajudicial foreclosure, consolidation of ownership, and subsequent sale were all

valid. The CFI rendered its Decision; the complaint against the petitioner was

dismissed. Unsatisfied with the judgment, respondent interposed an appeal that the

lower court erred in holding that there was a valid compliance in regard to the required

publication under Sec. 3 of Act. 3135. Respondent court reversed the judgment

appealed from by declaring void, inter alia, the auction sale of the foreclosed pieces of

realty, the final deed of sale, and the consolidation of ownership. Hence, the petition

with SC for certiorari and intervention.

Issue:

WON the required publication of The Notices of Sale on the foreclosed properties

under Sec. 3 of Act 3135 was complied.

Court Ruling and Doctrine:

No. The first date falls on a Friday while the second and third dates are on a

Friday and Saturday, respectively. Section 3 of Act No. 3135 requires that the notice of

auction sale shall be "published once a week for at least three consecutive weeks".

Evidently, petitioner bank failed to comply with this legal requirement. The Supreme

Court held that: The rule is that statutory provisions governing publication of notice of

mortgage foreclosure sales must be strictly complied with, and those even slight

deviations therefrom will invalidate the notice and render the sale at least voidable.

WHEREFORE, the petitions for certiorari and intervention are hereby dismissed and the

decision of the Court of Appeals is hereby affirmed in toto.

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- NKDokument1 SeiteNKRachit GoyalNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- CIR v. Santos Rules on RTC Authority to Review Tax PolicyDokument1 SeiteCIR v. Santos Rules on RTC Authority to Review Tax PolicyKeith Balbin100% (3)

- Reimbursement Rate Update MemoDokument2 SeitenReimbursement Rate Update MemoBrad AndersonNoch keine Bewertungen

- Evangelista & Co. Et - Al. v. Estrella Abad Santos Digest 2Dokument2 SeitenEvangelista & Co. Et - Al. v. Estrella Abad Santos Digest 2mastaaca100% (1)

- Caltex (Philippines) Inc. vs. CA GR 97753, 10 August 1992 - NegotiabilityDokument5 SeitenCaltex (Philippines) Inc. vs. CA GR 97753, 10 August 1992 - Negotiabilitykitakattt100% (1)

- Advocates of Til vs. BSPDokument3 SeitenAdvocates of Til vs. BSPIrene RamiloNoch keine Bewertungen

- DBP vs COA Philippine Development Bank Audit RulingDokument3 SeitenDBP vs COA Philippine Development Bank Audit RulingmastaacaNoch keine Bewertungen

- DBP vs COA Philippine Development Bank Audit RulingDokument3 SeitenDBP vs COA Philippine Development Bank Audit RulingmastaacaNoch keine Bewertungen

- PAL VS. HEALD LUMBER Batch 2 Digest Final With Court Ruling and DoctrineDokument2 SeitenPAL VS. HEALD LUMBER Batch 2 Digest Final With Court Ruling and Doctrinemastaaca100% (2)

- PAL VS. HEALD LUMBER Batch 2 Digest Final With Court Ruling and DoctrineDokument2 SeitenPAL VS. HEALD LUMBER Batch 2 Digest Final With Court Ruling and Doctrinemastaaca100% (2)

- Fernandez vs. Dela RosaDokument2 SeitenFernandez vs. Dela RosaCeCe Em50% (4)

- CAEZO vs. ROJAS Batch 2 Digest Final With Court Ruling and DoctrineDokument2 SeitenCAEZO vs. ROJAS Batch 2 Digest Final With Court Ruling and DoctrinemastaacaNoch keine Bewertungen

- CAEZO vs. ROJAS Batch 2 Digest Final With Court Ruling and DoctrineDokument2 SeitenCAEZO vs. ROJAS Batch 2 Digest Final With Court Ruling and DoctrinemastaacaNoch keine Bewertungen

- UN Doc FinalDokument12 SeitenUN Doc FinalmastaacaNoch keine Bewertungen

- How The Court WorksDokument1 SeiteHow The Court WorksmastaacaNoch keine Bewertungen

- Advisory ProceedingsDokument1 SeiteAdvisory ProceedingsmastaacaNoch keine Bewertungen

- Lava RulesDokument14 SeitenLava Rulesace_fortune100% (1)

- VDA - de ESCONDE vs. CA Batch 2 Digest Final With Court Ruling and DoctrineDokument2 SeitenVDA - de ESCONDE vs. CA Batch 2 Digest Final With Court Ruling and DoctrinemastaacaNoch keine Bewertungen

- ABELLANA vs. PONCE Batch 2 Digest Final With Court Ruling and DoctrineDokument1 SeiteABELLANA vs. PONCE Batch 2 Digest Final With Court Ruling and DoctrinemastaacaNoch keine Bewertungen

- ABELLANA vs. PONCE Batch 2 Digest Final With Court Ruling and DoctrineDokument1 SeiteABELLANA vs. PONCE Batch 2 Digest Final With Court Ruling and DoctrinemastaacaNoch keine Bewertungen

- How The Court WorksDokument1 SeiteHow The Court WorksmastaacaNoch keine Bewertungen

- ABELLANA vs. PONCE Batch 2 Digest Final With Court Ruling and DoctrineDokument1 SeiteABELLANA vs. PONCE Batch 2 Digest Final With Court Ruling and DoctrinemastaacaNoch keine Bewertungen

- Advisory ProceedingsDokument1 SeiteAdvisory ProceedingsmastaacaNoch keine Bewertungen

- RaytheonDokument4 SeitenRaytheonR.A. GregorioNoch keine Bewertungen

- In Re Decker, 295 F. Supp. 501Dokument16 SeitenIn Re Decker, 295 F. Supp. 501mastaacaNoch keine Bewertungen

- Estrado Vs CADokument2 SeitenEstrado Vs CAmastaacaNoch keine Bewertungen

- Estrado Vs CADokument2 SeitenEstrado Vs CAmastaacaNoch keine Bewertungen

- Evangelista & Co. Et - Al. v. Estrella Abad Santos Digest 2Dokument2 SeitenEvangelista & Co. Et - Al. v. Estrella Abad Santos Digest 2mastaacaNoch keine Bewertungen

- Evangelista & Co. Et - Al. v. Estrella Abad Santos Digest 2Dokument2 SeitenEvangelista & Co. Et - Al. v. Estrella Abad Santos Digest 2mastaacaNoch keine Bewertungen

- Tai Tong Chuache & Co. v. Insurance CommissionDokument1 SeiteTai Tong Chuache & Co. v. Insurance CommissionmastaacaNoch keine Bewertungen

- Evangelista Co v Abad Santos partnership disputeDokument2 SeitenEvangelista Co v Abad Santos partnership disputemastaacaNoch keine Bewertungen

- Property Cases II Full Text 10 Waite vs. Peterson To 17 Lagazo vs. SorianoDokument46 SeitenProperty Cases II Full Text 10 Waite vs. Peterson To 17 Lagazo vs. SorianomastaacaNoch keine Bewertungen

- Lumia Windows Phone 8-1 Update UG en GBDokument130 SeitenLumia Windows Phone 8-1 Update UG en GBmastaacaNoch keine Bewertungen

- Pasani Loan Terms & Condition For Baloyi Wisani CydrickDokument6 SeitenPasani Loan Terms & Condition For Baloyi Wisani CydrickClint AnthonyNoch keine Bewertungen

- HSC Commerce March 2018 Board Question Paper SPDokument2 SeitenHSC Commerce March 2018 Board Question Paper SPAnushka VishwakarmaNoch keine Bewertungen

- Lifting of The Corporate VeilDokument6 SeitenLifting of The Corporate VeilRishabh DubeyNoch keine Bewertungen

- BR - PAL - HAL and PDYLDokument2 SeitenBR - PAL - HAL and PDYLZahed IbrahimNoch keine Bewertungen

- Order in Respect of Vee Realties India LimitedDokument26 SeitenOrder in Respect of Vee Realties India LimitedShyam SunderNoch keine Bewertungen

- General Credit Corporation v. Alsons DevelopmentDokument5 SeitenGeneral Credit Corporation v. Alsons DevelopmentbearzhugNoch keine Bewertungen

- Annual Report 2011 Eitzen ChemicalsDokument88 SeitenAnnual Report 2011 Eitzen Chemicals1991anuragNoch keine Bewertungen

- NCLC Brief (Hyperlinks)Dokument44 SeitenNCLC Brief (Hyperlinks)Chesss44Noch keine Bewertungen

- SME Internationalization: Importance and Development in MalaysiaDokument20 SeitenSME Internationalization: Importance and Development in MalaysiaHelloNoch keine Bewertungen

- SAP in House CashDokument3 SeitenSAP in House Cashpaiashok0% (1)

- Reyes V Sierra DigestDokument1 SeiteReyes V Sierra DigestRZ ZamoraNoch keine Bewertungen

- OBLICON Cannu V GalangDokument10 SeitenOBLICON Cannu V GalangCzarina Victoria L. CominesNoch keine Bewertungen

- Peter ContiDokument289 SeitenPeter ContiRaul BarnaNoch keine Bewertungen

- Dublin House Prices, A History of Boom and Bust From 1708-1949Dokument17 SeitenDublin House Prices, A History of Boom and Bust From 1708-1949karldeeterNoch keine Bewertungen

- Rent AgreementDokument4 SeitenRent Agreementservant13Noch keine Bewertungen

- BSP Circular 425Dokument3 SeitenBSP Circular 425G Ant Mgd100% (1)

- AUS Backpay Tax TbleDokument6 SeitenAUS Backpay Tax TbleBunda MollyNoch keine Bewertungen

- Green BankingDokument16 SeitenGreen BankingRahSamNoch keine Bewertungen

- Urban Co-Operative Banks (Ucbs) in India Problems and ProspectsDokument11 SeitenUrban Co-Operative Banks (Ucbs) in India Problems and ProspectsnilyemdeNoch keine Bewertungen

- October 15, 2010 Strathmore TimesDokument35 SeitenOctober 15, 2010 Strathmore TimesStrathmore TimesNoch keine Bewertungen

- Case 23Dokument5 SeitenCase 23joiNoch keine Bewertungen

- Audit procedures for purchase transaction assertionsDokument7 SeitenAudit procedures for purchase transaction assertionsnajaneNoch keine Bewertungen

- NOMINAL vs EFFECTIVE INTEREST RatesDokument4 SeitenNOMINAL vs EFFECTIVE INTEREST RatesLarry NocesNoch keine Bewertungen

- Business News Letter: Siva Sivani Institute of ManagementDokument12 SeitenBusiness News Letter: Siva Sivani Institute of ManagementSai KiranNoch keine Bewertungen

- IMF and World Bank: Institutions for Economic CooperationDokument2 SeitenIMF and World Bank: Institutions for Economic CooperationLucas QuarNoch keine Bewertungen