Beruflich Dokumente

Kultur Dokumente

Fadlli Rahman - Acct6128 - TK1

Hochgeladen von

spesialistikunganOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Fadlli Rahman - Acct6128 - TK1

Hochgeladen von

spesialistikunganCopyright:

Verfügbare Formate

FADLLI RAHMAN / 1901504745

D3 COMPUTERIZED ACCOUNTING

Tugas Kelompok ke-1

(Minggu 2/ Sesi 4)

Tugas kelompok 1 minggu 2 ini diambil dari buku wajib:

Weygandt, Kimmel, Kieso. (2013). Financial Accounting, IFRS Edition. 2nd edition.

John Wiley & Sons. Inc. New Jersey. ISBN: 978-1-118-28590-9.

Buatlah soal-soal berikut ini:

Chapter 10:

E10 – 3 dan E10 – 4 halaman 502

E10-3

KEMER COMPANY

Apr 10 Cash .................................................................... 31,650

Sales Revenue ............................................ 30,000

Sales Taxes Payable .................................... 1,650

BODRUM COMPANY

Apr 15 Cash ................................................................... 20,330

Sales Revenue (20,330 : 107%) ................... 19,000

Sales Taxes Payable (19,000 x 7%) ............. 1,330

ACCT6128 – Introduction to Accounting II

FADLLI RAHMAN / 1901504745

D3 COMPUTERIZED ACCOUNTING

E10-4

(a) Nov 30 Cash ................................................................. 216,000

Unearned Subscription Revenue ............. 216,000

(12,000 x 18)

(b) Dec 31 Unearned Subscription Revenue ...................... 18,000

Subscription Revenue .............................. 18,000

(216,000 x 1/12)

(c) Mar 31 Unearned Subscription Revenue ...................... 54,000

Subscription Revenue .............................. 54,000

(216,000 x 3/12)

E10 – 5 halaman 503

E10-5

(a) Current ratio

2010 12,215 : 6,089 = 2.01 : 1

2009 10,795 : 4,897 = 2.20 : 1

Working Capital

2010 12,215 - 6,089 = 6,126 million

2009 10,795 - 4,897 = 5,898 million

(b) Current Ratio

12,015 : 5,889 = 2.04 : 1

Working Capital

12,015 - 5,889 = 6,126 million

ACCT6128 – Introduction to Accounting II

FADLLI RAHMAN / 1901504745

D3 COMPUTERIZED ACCOUNTING

P10 – 1A dan P10 – 2A halaman 506

P10-1A

(a) Jan 5 Cash ............................................................... 22,470

Sales Revenue (22,470 : 107%) ............ 21,000

Sales Taxes Payable ............................. 1,470

(22,470 - 21,000)

Jan 12 Unearned Service Revenue ............................ 10,000

Service Revenue ................................... 10,000

Jan 14 Sales Taxes Payable ...................................... 5,800

Cash ...................................................... 5,800

Jan 20 Account Receivable ........................................ 32,100

Sales Revenue ...................................... 30,000

Sales Taxes Payable ............................. 2,100

(600 x 50 x 7%)

Jan 21 Cash ............................................................... 14,000

Notes Payable ....................................... 14,000

Jan 25 Cash ............................................................... 12,947

Sales Revenue (12,947 : 107%) ............ 12,100

Sales Taxes Payable ............................. 847

(12,947 - 12,100)

(b) Jan 31 Interest Expense ............................................. 31

Interest Payable .................................... 31

(14,000 x 8% x 1/12)

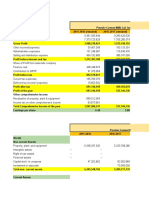

(c) Current liabilities

Notes payable ................................................ 14,000

Account payable ............................................. 52,000

Unearned service revenue (14,000 - 10,000)... 4,000

Sales taxes payable (1,470 : 2,100 : 847) ....... 4,417

Interest payable .............................................. 31

Total current liabilities ............................ 74,448

ACCT6128 – Introduction to Accounting II

FADLLI RAHMAN / 1901504745

D3 COMPUTERIZED ACCOUNTING

P10-2A

(a) Jan 2 Inventory ........................................................ 30,000

Accounts Payable .................................. 30,000

Feb 1 Accounts Payable ........................................... 30,000

Notes Payable ....................................... 30,000

Mar 31 Interest Expense (30,000 x 6% x 2/12) ........... 300

Interest Payable .................................... 300

Apr 1 Notes Payable ................................................ 30,000

Interest Payable .............................................. 300

Cash ...................................................... 30,300

July 1 Equipment ...................................................... 48,000

Cash ...................................................... 8,000

Notes Payable ....................................... 40,000

Sept 30 Interest Expense (40,000 x 7% x 3/12) ............ 700

Interest Payable .................................... 700

Oct 1 Notes Payable ................................................ 40,000

Interest Payable .............................................. 700

Cash ...................................................... 40,700

Dec 1 Cash ............................................................... 15,000

Notes Payable ....................................... 15,000

Dec 31 Interest Expense (15,000 x 6% x 1/12) ........... 75

Interest Payable .................................... 75

(b) Post to Accounts

Notes Payable

4/1 30,000 2/1 30,000

10/1 40,000 7/1 40,000

12/1 15,000

12/31 Bal. 15,000

ACCT6128 – Introduction to Accounting II

FADLLI RAHMAN / 1901504745

D3 COMPUTERIZED ACCOUNTING

Interest Payable

4/1 300 3/31 300

10/1 700 9/30 700

12/31 75

12/31 Bal. 75

Interest Expense

3/31 300

9/30 700

12/31 75

12/31 Bal. 1,075

(c) Current liabilities

Notes Payable ................................................ 15,000

Interest Payable .............................................. 75

Total ...................................................... 15,075

(d) Total interest is 1,075

P10 – 3A halaman 506

P10-3A

2014

(a) May 1 Cash ............................................................... 720,000

Bonds Payable ...................................... 720,000

(b) Dec 31 Interest Expense ............................................. 8,400

Interest Payable .................................... 8,400

(CHF720,000 x 7% x 2/12)

(c) Non-current Liabilities

Bonds Payable , due 2019 .............................. CHF 720,000

Current Liabilities

Interest Payable .............................................. CHF 8,400

ACCT6128 – Introduction to Accounting II

FADLLI RAHMAN / 1901504745

D3 COMPUTERIZED ACCOUNTING

2015

(d) May 1 Interest Payable .............................................. 8,400

Interest Expense ............................................. 16,800

(CHF 720,000 x 7% x 4/12)

Cash ...................................................... 25,200

(e) Nov 1 Interest Expense ............................................. 25,200

Cash ...................................................... 25,200

(f) Nov 1 Bonds Payable ............................................... 720,000

Loss on Bonds Redemption ............................ 14,400

Cash (CHF720,000 x 1.02) .................... 734,400

P10 – 6B, P10 – 7B dan P10 – 8B halaman 510

P10-6B

2014

(a) Jul 1 Cash ............................................................... 4,311,783

Bonds Payable ...................................... 4,311,783

Dec 31 Interest Expense ............................................. 107,795

(4,311,783 x 2.5%)

Bonds Payable ............................................... 12,205

Interest Payable .................................... 120,000

(4,000,000 x 3%)

2015

Jul 1 Interest Expense ............................................. 107,489

[(4,311,783 - 12,205) x 2.5%]

Bonds Payable ............................................... 12,511

Cash ...................................................... 120,000

ACCT6128 – Introduction to Accounting II

FADLLI RAHMAN / 1901504745

D3 COMPUTERIZED ACCOUNTING

Dec 31 Interest Expense ............................................. 107,177

[(4,299,578-12,511) x 2.5%)]

Bonds Payable ............................................... 12,823

Interest Payable .................................... 120,000

(b) Bonds Payable ............................................................. 4,274,244

(4,311,783 - 12,2015 - 12,511 - 12,823)

(c) 1. The amount of interest expense reported for 2015 related to these bonds is $214,666

($107,489 + $107,177)

2. When the bonds are sold at a premium, the effective-interest method will result in

more interest expense reported than the straight-line method in 2015. Straight-line

interest expense for 2015 is $208,822 [$120,000 + $120,000 – ($15,589 + $15,589)].

3. The total cost of borrowing is as shown below:

Semiannual interest payments

($4,000,000 X 6% X 1/2) = $120,000 X 20 ...... $2,400,000

Less: Bond premium ($4,311,783 – $4,000,000) .. 311,783

Total cost of borrowing ................................... $2,088,217

4. The total bond interest expense over the life of the bonds is the same under

either method of amortization.

ACCT6128 – Introduction to Accounting II

FADLLI RAHMAN / 1901504745

D3 COMPUTERIZED ACCOUNTING

P10-7B

2014

(a) Jan 1 Cash (5,000,000 x 97%) .................................. 4,850,000

Bonds Payable ...................................... 4,850,000

2014

(c) Jul 1 Interest Expense ............................................. 203,750

Bonds Payable (150,000:40) ................. 3,750

Cash (5,000,000 x 8% x 1/12) ............... 200,000

Dec 31 Interest Expense ............................................. 203,750

Bonds Payable ...................................... 3,750

Interest Payable .................................... 200,000

2015

Jan 1 Interest Payable .............................................. 200,000

Cash ...................................................... 200,000

Jul 1 Interest Expense ............................................. 203,750

Bonds Payable ...................................... 3,750

Cash (5,000,000 x 8% x 1/12) ............... 200,000

Dec 31 Interest Expense ............................................. 203,750

Bonds Payable ...................................... 3,750

Interest Payable .................................... 200,000

(d) Non-current liabilities

Bonds Payable ............................................... 4,865,000

Current liabilities

Interest Payable .............................................. 200,000

P10-8B

(a) Jan 1 Cash (6,000,000 x 102%) ............................... 6,120,000

Bonds Payable ...................................... 6,120,000

Jul 1 Interests Expense ........................................... 264,000

Bonds Payable (120,000 : 20) ......................... 6,000

Cash (6,000,000 x 9% x ½) ................... 270,000

Dec 31 Interest Expense ............................................. 264,000

Bonds Payable ............................................... 6,000

Interest Payable .................................... 270,000

(b) Jan 1 Cash (6,000,000 x 96%) ................................. 5,760,000

Bonds Payable ...................................... 5,760,000

Jul 1 Interests Expense ........................................... 282,000

Bonds Payable (240,000 : 20) ................ 12,000

Cash (6,000,000 x 9% x ½) ................... 270,000

Dec 31 Interest Expense ............................................. 282,000

Bonds Payable ...................................... 12,000

Interest Payable .................................... 270,000

ACCT6128 – Introduction to Accounting II

FADLLI RAHMAN / 1901504745

D3 COMPUTERIZED ACCOUNTING

(c) Premium

Non Current liabilities

Bonds Payable, due 2024 ............................... 6,108,000

Current liabilities

Interest payable .............................................. 270,000

Discount

Non-current liabilities

Bonds payable ................................................ 5,784,000

Current liabilities

Interest payable .............................................. 270,000

BYP10 – 4 halaman 514

BYP10-4

(a) Face value of bonds ..................................................... 2,400,000

Proceeds from sale of bonds ........................................ 2,304,000

(2,400,000 x 0.96)

Discount on bonds payable .......................................... 96,000

Bond discount amortization per year :

96,000 : 5 = 19,200

Face value of bonds ..................................................... 2,400,000

Amount of original discount .......................................... 96,000

Less : amortization through Jan 1, 2014 (2-year) ......... 38,400 57,600

Carrying value of bonds, Jan 1, 2014 ............................ 2,342,400

(b) 1. Bonds payable ................................................ 2,342,400

Gain on bon redemption ........................ 342,400

(2,342,000-2,000,000)

Cash ...................................................... 2,000,000

(record redemption of 7% bonds)

ACCT6128 – Introduction to Accounting II

FADLLI RAHMAN / 1901504745

D3 COMPUTERIZED ACCOUNTING

2. Cash ............................................................... 2,000,000

Bonds Payable ...................................... 2,000,000

(reord sale of 10-year, 10% bonds at par)

(c) The early redemption of the 7%, 5-year bonds results in recognizing a gain of $342,400

that increases current year net income by the after-tax effect of the gain. The amount

of the liabilities on the statement of financial position will be lowered by the issuance

of the new bonds and retirement of the 5-year bonds.

1. The cash flow of the company as it relates to bonds payable will be adversely

affected as follows:

Annual interest payments on the new issue .... 200,000

(2,000,000 x 10%)

Annual interest payments on the 5-year bonds (168,000)

(2,400,000 x 7%)

Additional cash outflows per year ................... 32,000

2. The amount of interest expense shown on the income statement will be

higher as a result of the decision to issue new bonds:

Annual interest expense on new bonds .......... 200,000

Annual interest expense on 7% bonds :

Interest payment .................................... 168,000

Discount amortization ............................ 19,200 (187,200)

Additional interest expense per year ............... 12,800

These comparisons hold for only the 3-year remaining life of the 7%, 5-year bonds. The

company must acknowledge either redemption of the 7% bonds at maturity, January

1, 2017, or refinancing of that issue at that time and consider what in terest rates will

be in 2017 in evaluating a redemption and issuance in 2014.

FADLLI RAHMAN / 1901504745

D3 COMPUTERIZED ACCOUNTING

ACCT6128 – Introduction to Accounting II

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Annual Financial Report of Philippine GOCCsDokument479 SeitenAnnual Financial Report of Philippine GOCCsRomel TorresNoch keine Bewertungen

- VRL Logistics LTDDokument80 SeitenVRL Logistics LTDSam Vespa50% (2)

- Unit 3: Answers To ActivitiesDokument10 SeitenUnit 3: Answers To ActivitiesJaved MushtaqNoch keine Bewertungen

- 6-8 Jack and Jill Answer KeyDokument2 Seiten6-8 Jack and Jill Answer KeyAngelica Macaspac100% (1)

- Computers Reseller Business PlanDokument21 SeitenComputers Reseller Business Plantanviruiu12Noch keine Bewertungen

- Chapter 1 5Dokument76 SeitenChapter 1 5John Paulo Samonte59% (29)

- Aviation Rental Business - PlanDokument35 SeitenAviation Rental Business - PlanBoki BorisNoch keine Bewertungen

- Dabur Balance Sheet and Income Statement Analysis 2015-2020Dokument23 SeitenDabur Balance Sheet and Income Statement Analysis 2015-2020xzeekNoch keine Bewertungen

- Week 6 Tutorial SolutionsDokument13 SeitenWeek 6 Tutorial SolutionsFarah PatelNoch keine Bewertungen

- Box Truck Business PlanDokument28 SeitenBox Truck Business PlanDee DawaneNoch keine Bewertungen

- Current Assets Current Liabilties: Tests of LiquidityDokument5 SeitenCurrent Assets Current Liabilties: Tests of LiquidityCesNoch keine Bewertungen

- Clarkson Lumber Cash Flows and Pro FormaDokument6 SeitenClarkson Lumber Cash Flows and Pro FormaArmaan ChandnaniNoch keine Bewertungen

- HeroMotoCorp Reduce BoBCaps 20200814 PDFDokument11 SeitenHeroMotoCorp Reduce BoBCaps 20200814 PDFKiran KudtarkarNoch keine Bewertungen

- CURRENT LIABILITIES SEATWORK QUIZDokument68 SeitenCURRENT LIABILITIES SEATWORK QUIZIris FenelleNoch keine Bewertungen

- Financial Statement AnalysisDokument7 SeitenFinancial Statement AnalysisWaqar HassanNoch keine Bewertungen

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokument3 SeitenFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderNoch keine Bewertungen

- Problem 2-26 (IAA)Dokument19 SeitenProblem 2-26 (IAA)gghyo88Noch keine Bewertungen

- Copy Part 2 Financial Statement Analysis and Liquidity Ratios QsDokument36 SeitenCopy Part 2 Financial Statement Analysis and Liquidity Ratios QsJessa May Mendoza0% (2)

- Unit 1Dokument72 SeitenUnit 1Sumit SoniNoch keine Bewertungen

- ch10 - LiabilitiesDokument89 Seitench10 - Liabilitiessherlyne100% (1)

- Module 3. Part 2 - Current LiabilitiesDokument19 SeitenModule 3. Part 2 - Current LiabilitiesJohn RamasNoch keine Bewertungen

- Statement-Of-Financial-Position-Abm 12Dokument27 SeitenStatement-Of-Financial-Position-Abm 12JerollNoch keine Bewertungen

- Palmer Limited Case Study AnalysisDokument9 SeitenPalmer Limited Case Study AnalysisPrashil Raj MehtaNoch keine Bewertungen

- PT. BHUMI SAPROLITE INDONESIA Financial ProjectionsDokument8 SeitenPT. BHUMI SAPROLITE INDONESIA Financial Projectionsfahbi firnandaNoch keine Bewertungen

- FSA Financial Ratio Benchmarks 2012Dokument28 SeitenFSA Financial Ratio Benchmarks 2012Naga NagendraNoch keine Bewertungen

- Term Paper Excel Calculations-Premier Cement Mills Ltd.Dokument40 SeitenTerm Paper Excel Calculations-Premier Cement Mills Ltd.Jannatul TrishiNoch keine Bewertungen

- Financial Statement Analysis for General AviationDokument10 SeitenFinancial Statement Analysis for General AviationROB101512Noch keine Bewertungen

- Financial Statement Analysis of GlaxosmithklineDokument19 SeitenFinancial Statement Analysis of GlaxosmithklineRaquibul HassanNoch keine Bewertungen

- Fabm 2 Module 1Dokument14 SeitenFabm 2 Module 1Marilyn Nelmida TamayoNoch keine Bewertungen

- Pnadk 970Dokument64 SeitenPnadk 970Kasolo DerrickNoch keine Bewertungen