Beruflich Dokumente

Kultur Dokumente

508-Financial Institutions and Markets

Hochgeladen von

IrfanCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

508-Financial Institutions and Markets

Hochgeladen von

IrfanCopyright:

Verfügbare Formate

Institute Of Business Administration

Allama I.I. Kazi Campus, Jamshoro

University Of Sindh

Phone Numbers: +92-22-9213200, +92-22-9213181-90 Ext. 2009, Web Site:http//cba.usindh.edu.pk/Email:dir_iba@cba.usindh.edu.pk

Curriculum of BBA (Hons) P-I

Course Details

Course Name: Financial Institutions and Markets

Course Code: 508

Credit Hours: 3 Credit Hours (per week)

Course Description/Objective

This course will cover the overview and procedural knowledge of financial markets, institutions,

mechanisms and instruments. The course will emphasize on the nature and operational variety among

various financial institutions and markets in order to develop financial insights. These financial

institutions and markets constitute banking sector, non-banking financial institutions, debt & equity

market, foreign exchange market and derivative market.

Learning Outcomes

After the completion of this course students will be able to:

Have clear understanding about financial markets and institutions

Understand interest rates and its impact in the economy

Know the types of major financial markets

Understand use of Financial instruments

Understand Role of regulators in financial markets

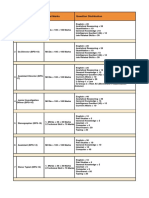

Course Contents (Plan)

Introduction, Functions of the financial system, Financial

Week Overview of the Financial Instruments, Financial Markets, Globalization, Financial

01 System Institutions

Introduction, Main activities of banking, Sources and Uses of

Week The Banking Industry funds, Off-balance-sheet business, Prudential Regulations

02

Introduction, Investment & Merchant banks, Life & General

Week Non-bank Institutions Insurance, Superannuation funds, Finance companies,

03 Building societies, Cooperatives, Export Finance

Introduction, Nature of the corporation, Stock exchange,

Week Equity Markets Share markets

04

Week Share Market and Introduction, Investment Decision: Capital Budgeting,

05 Corporations Financing Decision: Equity, Debt & Risk, IPO, Listed

Businesses, Alternative Equity Funding

Introduction, Investment, Buying & Selling, Taxation, Fin.

Week Share Market and Investors Performance Indicators, Pricing, Stock Market Indices

06

Introduction, Trade Credit, Bank OD, Commercial Bills,

Week Debt Markets: Discount Securities, Promissory Notes, Negotiable Deposit,

07 Short-Term Debt Advance Cash facility, Inventory Loans, Account receivables

Week Mid Term

08

Introduction, Fully-drawn Advances, Mortgage Finance,

Week Debentures, Unsecured debt, Fixed interest securities,

Medium to Long-Term Debt

09 Leasing and its types, Direct Credit

Government Debt and

Introduction, Govt. borrowing requirement, Government

Week securities, Monetary Policy, Payment System

Monetary Policy

10

Introduction, Macroeconomic context of interest rate, interest

Week Interest Rate Determination rate of loanable funds, Interest rate term, Risk structure

11

Introduction, Forex Market Players, Operation of FX market,

Foreign Exchange Market Spot and Forward transactions, Spot and Forward quotations

Week12

Introduction, Equilibrium exchange rate, Factors affecting

exchange rate, Sensitivity of exchange rate, Economic

Week13 Valuing Currency

variables, Purchasing power parity

Introduction, General principles of hedging, Futures

Derivative Market: Futures transaction, Futures instruments, Futures participants,

Week14

Contracts Hedging & risk management, Forward rate agreements

Week15 Project Presentations

Recommended Text Book

Financial Markets & Institutions, Frederic S. Mishkin and Stanley G. Eakins, (Latest) Edition,

Reference Book

Financial Institutions and Markets, Jeff Madura , latest Edition,

Financial Market & Institutions, LM Bhole, latest Edition,

Das könnte Ihnen auch gefallen

- Model Paper Business FinanceDokument7 SeitenModel Paper Business FinanceMuhammad Tahir NawazNoch keine Bewertungen

- Chapter 11 - Cost of Capital - Text and End of Chapter QuestionsDokument63 SeitenChapter 11 - Cost of Capital - Text and End of Chapter QuestionsSaba Rajpoot50% (2)

- Role or Importance of State Bank of Pakistan in Economic Development of PakistanDokument3 SeitenRole or Importance of State Bank of Pakistan in Economic Development of PakistanMohammad Hasan100% (1)

- Chapter 24-Professional Money Management, Alternative Assets, and Industry EthicsDokument10 SeitenChapter 24-Professional Money Management, Alternative Assets, and Industry Ethicsrrrr110000Noch keine Bewertungen

- By: Anjali KulshresthaDokument18 SeitenBy: Anjali KulshresthaAnjali KulshresthaNoch keine Bewertungen

- FINN 341A-Financial Institutions and Markets - Fall 2011Dokument8 SeitenFINN 341A-Financial Institutions and Markets - Fall 2011BurakNoch keine Bewertungen

- Banking CompaniesDokument68 SeitenBanking CompaniesKiran100% (2)

- Chapter 24 - Professional Money Management, Alternative Assets, and Industry EthicsDokument48 SeitenChapter 24 - Professional Money Management, Alternative Assets, and Industry Ethicsrrrr110000Noch keine Bewertungen

- Formulae Sheets: Ps It Orp S It 1 1Dokument3 SeitenFormulae Sheets: Ps It Orp S It 1 1Mengdi ZhangNoch keine Bewertungen

- Recall The Flows of Funds and Decisions Important To The Financial ManagerDokument27 SeitenRecall The Flows of Funds and Decisions Important To The Financial ManagerAyaz MahmoodNoch keine Bewertungen

- Foundations of Finance: An Introduction To The Foundations of Financial Management - The Ties That BindDokument35 SeitenFoundations of Finance: An Introduction To The Foundations of Financial Management - The Ties That BindManish MahajanNoch keine Bewertungen

- pp04Dokument83 Seitenpp04sadiaNoch keine Bewertungen

- Management Accounting-Nature and ScopeDokument13 SeitenManagement Accounting-Nature and ScopePraveen SinghNoch keine Bewertungen

- Chapter 4 Risk and ReturnDokument19 SeitenChapter 4 Risk and Returnvaghela_jitendra8Noch keine Bewertungen

- Financial MarketDokument10 SeitenFinancial MarketLinganagouda PatilNoch keine Bewertungen

- Prisoner DilemmaDokument2 SeitenPrisoner DilemmaRakhee ChatterjeeNoch keine Bewertungen

- Functions' of State Bank of PakistanDokument12 SeitenFunctions' of State Bank of PakistanSaher Imtiaz100% (1)

- Advanced Bond ConceptsDokument8 SeitenAdvanced Bond ConceptsEllaine OlimberioNoch keine Bewertungen

- Digital Notes Financial ManagementDokument89 SeitenDigital Notes Financial ManagementDHARANI PRIYANoch keine Bewertungen

- Exam 1 LXTDokument31 SeitenExam 1 LXTphongtrandangphongNoch keine Bewertungen

- Overview of Comparative Financial SystemDokument16 SeitenOverview of Comparative Financial Systemarafat alamNoch keine Bewertungen

- Cost of Capital ExplainedDokument18 SeitenCost of Capital ExplainedzewdieNoch keine Bewertungen

- IF Problems Arbitrage OpportunityDokument11 SeitenIF Problems Arbitrage OpportunityChintakunta PreethiNoch keine Bewertungen

- Chapter 12 Test BankDokument49 SeitenChapter 12 Test BankMariA YAGHINoch keine Bewertungen

- Types Functions Financial InstitutionsDokument27 SeitenTypes Functions Financial InstitutionsTarun MalhotraNoch keine Bewertungen

- 35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc MsDokument90 Seiten35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc Msmysorevishnu75% (8)

- Chapter 3 Valuation and Cost of CapitalDokument92 SeitenChapter 3 Valuation and Cost of Capitalyemisrach fikiruNoch keine Bewertungen

- Gurukripa’s Guide to Nov 2014 CA Final SFM ExamDokument12 SeitenGurukripa’s Guide to Nov 2014 CA Final SFM ExamShashank SharmaNoch keine Bewertungen

- 0.1. Introduction To International Trade FinancingDokument11 Seiten0.1. Introduction To International Trade Financingphillip HaulNoch keine Bewertungen

- Download the original attachment - The complete basics of accountingDokument32 SeitenDownload the original attachment - The complete basics of accountingvijayNoch keine Bewertungen

- ACCOUNTING FOR MANAGEMENT MCQDokument14 SeitenACCOUNTING FOR MANAGEMENT MCQEr. THAMIZHMANI MNoch keine Bewertungen

- Capital Budgeting Techniques ComparisonDokument30 SeitenCapital Budgeting Techniques ComparisonAnasChihabNoch keine Bewertungen

- Financial Institution & Market (Modified)Dokument12 SeitenFinancial Institution & Market (Modified)Aboi BoboiNoch keine Bewertungen

- Chapter 6 International Banking and Money Market 4017Dokument23 SeitenChapter 6 International Banking and Money Market 4017jdahiya_1Noch keine Bewertungen

- Chapter 3 - Tutorial - With Solutions 2023Dokument34 SeitenChapter 3 - Tutorial - With Solutions 2023Jared Herber100% (1)

- Investment ManagementDokument38 SeitenInvestment ManagementPranjit BhuyanNoch keine Bewertungen

- Group and Module Schedules for Money and Banking CourseDokument3 SeitenGroup and Module Schedules for Money and Banking Coursetripathi.shantanu3778Noch keine Bewertungen

- CF B21 TVDokument33 SeitenCF B21 TVSoumya KhatuaNoch keine Bewertungen

- CAPM GuideDokument15 SeitenCAPM GuideEnp Gus AgostoNoch keine Bewertungen

- Ch.10 - The Statement of Cash Flows - MHDokument59 SeitenCh.10 - The Statement of Cash Flows - MHSamZhao100% (1)

- KLCI Futures Contracts AnalysisDokument63 SeitenKLCI Futures Contracts AnalysisSidharth ChoudharyNoch keine Bewertungen

- Lecture 2 Behavioural Finance and AnomaliesDokument15 SeitenLecture 2 Behavioural Finance and AnomaliesQamarulArifin100% (1)

- Corporate Finance: Laurence Booth - W. Sean ClearyDokument136 SeitenCorporate Finance: Laurence Booth - W. Sean Clearyatif41Noch keine Bewertungen

- CA IPCC Costing & FM Quick Revision NotesDokument21 SeitenCA IPCC Costing & FM Quick Revision NotesChandreshNoch keine Bewertungen

- Gitmanjoeh 238702 Im08Dokument23 SeitenGitmanjoeh 238702 Im08trevorsum123Noch keine Bewertungen

- Eco-10 em PDFDokument11 SeitenEco-10 em PDFAnilLalvaniNoch keine Bewertungen

- Chapter 7 Exercise Stock ValuationDokument3 SeitenChapter 7 Exercise Stock ValuationShaheera Suhaimi100% (3)

- Case Study On Exchange Rate RiskDokument2 SeitenCase Study On Exchange Rate RiskUbaid DarNoch keine Bewertungen

- Solution Manual To Lectures On Corporate Finance Second EditionDokument80 SeitenSolution Manual To Lectures On Corporate Finance Second Editionwaleedtanvir100% (2)

- SFM Theory BookDokument33 SeitenSFM Theory BookvishnuvermaNoch keine Bewertungen

- Answwr of Quiz 5 (MBA)Dokument2 SeitenAnswwr of Quiz 5 (MBA)Wael_Barakat_3179Noch keine Bewertungen

- Capital Asset Pricing Model and Modern Portfolio TheoryDokument12 SeitenCapital Asset Pricing Model and Modern Portfolio TheorylordaiztrandNoch keine Bewertungen

- CH 6 Cost Volume Profit Revised Mar 18Dokument84 SeitenCH 6 Cost Volume Profit Revised Mar 18beccafabbriNoch keine Bewertungen

- Portfolio Selection Using Sharpe, Treynor & Jensen Performance IndexDokument15 SeitenPortfolio Selection Using Sharpe, Treynor & Jensen Performance Indexktkalai selviNoch keine Bewertungen

- Af-302 - Financial Markets and InstitutionsDokument2 SeitenAf-302 - Financial Markets and InstitutionsFuadNoch keine Bewertungen

- Financial Markets and InstitutionsDokument5 SeitenFinancial Markets and InstitutionsEng Abdikarim WalhadNoch keine Bewertungen

- Banking and InsuranceDokument100 SeitenBanking and InsuranceB I N O D ツNoch keine Bewertungen

- 01.08.2022 FIM Outline 3 CreditDokument3 Seiten01.08.2022 FIM Outline 3 CreditRAUSHAN KUMARNoch keine Bewertungen

- RFM Lecture 1-Introduction To Fin Mkts-CompleteDokument55 SeitenRFM Lecture 1-Introduction To Fin Mkts-CompleteUmme HaniNoch keine Bewertungen

- Indian Financial System Financial Markets-M-23-to Be Sent PDFDokument106 SeitenIndian Financial System Financial Markets-M-23-to Be Sent PDFYASEEN AKBARNoch keine Bewertungen

- Syllabus For Business Math and StatisticsDokument1 SeiteSyllabus For Business Math and StatisticsIrfanNoch keine Bewertungen

- Business Maths ExcelDokument10 SeitenBusiness Maths ExcelIrfanNoch keine Bewertungen

- Adv 10 2019 PDFDokument4 SeitenAdv 10 2019 PDFIrfanNoch keine Bewertungen

- DhakaResults Computer Hardware QuizDokument3 SeitenDhakaResults Computer Hardware QuizIrfan AliNoch keine Bewertungen

- Statistical Techniques in Business & Economics: Douglas Lind, William Marchal & Samuel WathenDokument14 SeitenStatistical Techniques in Business & Economics: Douglas Lind, William Marchal & Samuel WathensafiqulislamNoch keine Bewertungen

- NAB Test Pattern 2012Dokument2 SeitenNAB Test Pattern 2012saeedpathanNoch keine Bewertungen

- Chapter 1Dokument25 SeitenChapter 1IrfanNoch keine Bewertungen

- Assignment of Business MathsDokument2 SeitenAssignment of Business MathsIrfanNoch keine Bewertungen

- SPSC Jobs 22-02-2019Dokument4 SeitenSPSC Jobs 22-02-2019IrfanNoch keine Bewertungen

- Cost Accounting Quiz 1a Chapter 1 ....Dokument1 SeiteCost Accounting Quiz 1a Chapter 1 ....IrfanNoch keine Bewertungen

- JHKKKKKKKKKKKDokument1 SeiteJHKKKKKKKKKKKIrfanNoch keine Bewertungen

- BPS recruitment exam question distribution and marksDokument2 SeitenBPS recruitment exam question distribution and marksIrfanNoch keine Bewertungen

- BanksDokument27 SeitenBanksIrfanNoch keine Bewertungen

- Calculate Yield to Maturity and Bond Prices Chapter 3Dokument11 SeitenCalculate Yield to Maturity and Bond Prices Chapter 3VoThienTrucNoch keine Bewertungen

- Important Note: Overage CandidatesDokument6 SeitenImportant Note: Overage CandidatesIrfanNoch keine Bewertungen

- Intro To Clauses PDFDokument17 SeitenIntro To Clauses PDFIrfanNoch keine Bewertungen

- FIM CH 04 Equity MarketsDokument1 SeiteFIM CH 04 Equity MarketsIrfanNoch keine Bewertungen

- Advt - No - 4-2017Dokument9 SeitenAdvt - No - 4-2017Shaveeto KhanNoch keine Bewertungen

- Press Note Vacancies CSS-2016Dokument1 SeitePress Note Vacancies CSS-2016IrfanNoch keine Bewertungen

- Bank Reconciliation ExampleDokument2 SeitenBank Reconciliation ExampleIrfanNoch keine Bewertungen

- Ross 7 e CH 01Dokument27 SeitenRoss 7 e CH 01Farhat987Noch keine Bewertungen

- Bank Reconciliation ExampleDokument2 SeitenBank Reconciliation ExampleIrfanNoch keine Bewertungen

- Compensation/wages and Performance Evaluation/appraisal: Group 3Dokument18 SeitenCompensation/wages and Performance Evaluation/appraisal: Group 3Ellen BuddyNoch keine Bewertungen

- FIN20014 Assignment 2015 SP2 - Capital Budgeting AssignmentDokument3 SeitenFIN20014 Assignment 2015 SP2 - Capital Budgeting AssignmentAssignment Consultancy0% (1)

- Pressure Vessel Inspection and Test Plan Sample: WWW - Inspection-For-Industry.c OmDokument4 SeitenPressure Vessel Inspection and Test Plan Sample: WWW - Inspection-For-Industry.c OmMuh FarhanNoch keine Bewertungen

- Accrual Accounting and Financial Statements - 1Dokument35 SeitenAccrual Accounting and Financial Statements - 1luiNoch keine Bewertungen

- HR Metrics and Analytics: Course OutlineDokument6 SeitenHR Metrics and Analytics: Course OutlineO PavithraNoch keine Bewertungen

- Corporate Social Responsibility and Business EthicsDokument17 SeitenCorporate Social Responsibility and Business Ethicskopi 10Noch keine Bewertungen

- Itc GSTDokument27 SeitenItc GSTShivam GoelNoch keine Bewertungen

- Wheel Loader Forklift Thorough Exam ReportDokument2 SeitenWheel Loader Forklift Thorough Exam ReportRanjithNoch keine Bewertungen

- Assignment1 LeeDokument3 SeitenAssignment1 LeeJENNEFER LEENoch keine Bewertungen

- Front Page On Challenges and Prospects of Hotel Industries in IlaroDokument4 SeitenFront Page On Challenges and Prospects of Hotel Industries in IlaropeterNoch keine Bewertungen

- Code of Ethics: Sahara Emirates Group Commits ToDokument2 SeitenCode of Ethics: Sahara Emirates Group Commits TosonalikeniNoch keine Bewertungen

- Etextbook 978-1305574793 Cengage Advantage Books: Business Law Today, The Essentials: Text and Summarized CasesDokument62 SeitenEtextbook 978-1305574793 Cengage Advantage Books: Business Law Today, The Essentials: Text and Summarized Casesnancy.gravely120100% (35)

- 401 Chap13 Flashcards - QuizletDokument8 Seiten401 Chap13 Flashcards - QuizletJaceNoch keine Bewertungen

- The State of Minnesota's Economy: 2020 An Economic Report From Center of The American ExperimentDokument52 SeitenThe State of Minnesota's Economy: 2020 An Economic Report From Center of The American ExperimentFluenceMediaNoch keine Bewertungen

- Topic 1 - Introduction To Economics (Week1)Dokument30 SeitenTopic 1 - Introduction To Economics (Week1)Wei SongNoch keine Bewertungen

- Manimohan Profile 2023Dokument1 SeiteManimohan Profile 2023Manimohan ManickamNoch keine Bewertungen

- Höegh Autoliners AS: Bill of LadingDokument2 SeitenHöegh Autoliners AS: Bill of LadingkNoch keine Bewertungen

- Productivity Improvement in Construction Industry: Sneha Jamadagni, Prof.B.V.BirajdarDokument5 SeitenProductivity Improvement in Construction Industry: Sneha Jamadagni, Prof.B.V.BirajdarShaklain NarmawalaNoch keine Bewertungen

- AS SBM-Business ValuationDokument36 SeitenAS SBM-Business Valuationswarna dasNoch keine Bewertungen

- Business Marketing 12 Abm (ls2 Final Sem)Dokument4 SeitenBusiness Marketing 12 Abm (ls2 Final Sem)Maria Belen GagarNoch keine Bewertungen

- Annex I Contract of Service Between The Dole Regional Office and Tupad WorkersDokument4 SeitenAnnex I Contract of Service Between The Dole Regional Office and Tupad WorkersArcelin LabuguinNoch keine Bewertungen

- Extra Judicial Settlement of Estate With Waiver and Absolute SaleDokument3 SeitenExtra Judicial Settlement of Estate With Waiver and Absolute SaleRose DSNoch keine Bewertungen

- 14.risk Management in Industrial EnterprisesDokument4 Seiten14.risk Management in Industrial EnterprisesMatthew MhlongoNoch keine Bewertungen

- Sap SDokument3 SeitenSap SMiaNoch keine Bewertungen

- The Effect of Organizational Culture On Employee Productivity: - (In Case of Madda Walabu University'S College of Business and Economics)Dokument30 SeitenThe Effect of Organizational Culture On Employee Productivity: - (In Case of Madda Walabu University'S College of Business and Economics)Innallaah Maa AssaabiriinNoch keine Bewertungen

- Economics 1Dokument8 SeitenEconomics 1Kiaren PillayNoch keine Bewertungen

- Accounting ScandalsDokument4 SeitenAccounting Scandalsyatz24Noch keine Bewertungen

- Wallfort - 29 April 2022Dokument24 SeitenWallfort - 29 April 2022Utsav LapsiwalaNoch keine Bewertungen

- Lmi Monitoring AnalysisDokument8 SeitenLmi Monitoring Analysisvicente ferrerNoch keine Bewertungen

- Chapter 01 Accessible PowerPoint PresentationDokument42 SeitenChapter 01 Accessible PowerPoint PresentationHappyNoch keine Bewertungen