Beruflich Dokumente

Kultur Dokumente

Simulated Mock Midterm Exam 2018

Hochgeladen von

Bhosx KimCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Simulated Mock Midterm Exam 2018

Hochgeladen von

Bhosx KimCopyright:

Verfügbare Formate

Polytechnic University of the Philippines

College of Accountancy and Finance

Junior Philippine Institute of Accountants

Simulated Midterm Examination for Freshmen

AY: 2018-2019, 1st Semester

THEORIES

1. It is known as the language of business

A. Accounting C. Financial Statements

B. English D. All of these

2. Which of the following describes “Credit”?

I. It always decreases asset accounts

II. It is always on the right side of the T-account, regardless when the account is an asset, liability

or equity

III. It is the normal balance of all contra accounts

IV. It is used to close all revenue accounts for the period

A. I only

D. I, II, II

B. II only

E. All of these

C. I, II

3. Select the incorrect equation. If Assets= Liabilities + Capital, then

A. Assets- Liabilities = Net Assets

B. Net Increase in Capital = Increase in Assets - Increase in Liabilities - Drawings

C. Change in Capital = Additional Investments ± Net Income/loss for the period - Drawings

D. Assets=Liabilities + Owner’s Investments + Drawing + Net Income

E. Choices A and D are correct

4. If a company uses special journals, purchases of merchandise should be recorded using

A. Purchase journal only

B. Purchase journal or Cash payments journal

C. Cash payments journal only

D. Voucher register

E. General journal

5. They encompass the conventions, rules and procedures necessary to define what is accepted

accounting practice

A. Generally Accepted Accounting Principles

B. Accounting Constraints

C. Conceptual Framework

D. Accounting Assumptions

6. Which type of accounts needs to be closed at the end of the accounting period?

A. Real accounts C. Mixed accounts E. Adjunct accounts

B. Nominal accounts D. Contra accounts

7. What do function do general ledgers serve in the accounting process?

A. Classifying C. Reporting E. Communicating

B. Summarizing D. Recording

1|Mock Midterm Examination

Polytechnic University of the Philippines

College of Accountancy and Finance

Junior Philippine Institute of Accountants

Simulated Midterm Examination for Freshmen

AY: 2018-2019, 1st Semester

8. Under the “income method”, the adjusting entry for income not yet earned but already collected or

recorded will

A. Increase asset, increase in revenue

B. Decrease asset, increase in liability

C. Increase liability, decrease in revenue

D. Increase liability, increase in expenses

E. Increase in Cash, increase in revenue

9. After the accounts have been closed,

A. all the accounts will have zero balance

B. the real accounts will have zero balances

C. the revenue, expense, income summary and retained earnings accounts will have zero

balances

D. the revenue, expense and income summary accounts will have zero balances

E. adjusting entries will have to be journalized

10. Which of the following account titles appear in the Income Statement columns of the worksheet?

A. Unearned Fees C. Accumulated Depreciation E. Owner, Drawing

B. Freight-out D. Accrued Expenses

11. Adjusting entries are dated in the journal as of:

A. First day of the accounting period

B. Middle of the accounting period

C. Last day of the accounting period

D. Date they are actually journalized

E. First day of the next accounting period

12. An entry to recognize accrued income in a partnership business involves

A. A debit to Cash C. A debit to Accounts Receivable E. A credit to Drawing

B. A credit to Cash D. A credit to partners’ Capital accounts

13. To arrive at Cost of Sales,

A. sales discounts and sales returns and allowances must be deducted from gross sales net

of VAT

B. sales discounts and sales returns and allowances must be added back to net sales

C. Add beginning inventory balance and purchases for the period and freight-in

D. Deduct cost of ending inventory from the sum of beginning inventory and net purchases

for the period

E. Correct answer not given

14. The major expense of a merchandising business is

A. Purchases C. Selling Expense E. Cost of Goods Sold

B. Delivery Expense D. Advertising Expense

2|Mock Midterm Examination

Polytechnic University of the Philippines

College of Accountancy and Finance

Junior Philippine Institute of Accountants

Simulated Midterm Examination for Freshmen

AY: 2018-2019, 1st Semester

15. Which of the following statements regarding trade discounts and sales discounts is incorrect?

A. Trade discounts are presented as deductions from sales price in Statement of

Comprehensive Income.

B. Trade discounts are usually offered to customers who buy in large volumes.

C. Sales discounts are usually offered to regular customers on credit only.

D. Sales discounts reduce the risk of uncollectibility of receivables because it encourages

early payment of accounts.

E. None of the above

16. A certain VAT-registered grocery store uses Point-of-Sale (POS) terminals (with barcode reader

and cash register) in its cash sale of merchandise. The machines keep a database of all sales

transactions “punched”. At the end of every business day, the cashier prepares a report of all sale

transactions during the day. Assuming the company uses special journals, the information reported

on POS daily summaries will most properly make its way to

A. Sales journal C. Cash receipts journal E. Choices A and C are correct

B. General journal D. Cash payments journal

17. All of these are terms of shipment except

A. FOB Shipping Point

B. FOB Seller

C. Free Along Side (FAS)

D. Cost, Insurance, Freight (CIF)

E. Express Delivery

18. In performing an aging of receivables, the resulting amount computed by multiplying the

receivable balance classified by age by the probability of collection is

A. Bad Debts Expense to be presented in the period’s Income Statement

B. Required ending balance of Allowance for Bad Debts

C. Required adjustment for Allowance for Bad Debts account

D. Net Accounts Receivable balance to be presented in the Balance Sheet

E. It serves no meaningful amount

19. When a company issues a credit memorandum, it means that

A. The company sold merchandise on credit to a customer

B. The company credited “Cash” account

C. The company credited customer’s “Accounts Receivable” account

D. The supplier credited customer’s “Accounts Payable” account

E. The company is informing the bank that there is an erroneous bank charge

20. Select the Incorrect statement

A. The Balance Sheet has two forms, account form and report form.

B. Friar Luca Pacioli discovered the use of double-entry bookkeeping in 1494.

C. A merchandise shipped through FOB Shipping Point, transfer the legal title from the

seller to the buyer at point of receipt of goods.

D. In a merchandising business, Output VAT minus Input VAT is equals to VAT Payable

E. One of the advantages of a Sole Proprietorship is easy to establish a dissolve

3|Mock Midterm Examination

Polytechnic University of the Philippines

College of Accountancy and Finance

Junior Philippine Institute of Accountants

Simulated Midterm Examination for Freshmen

AY: 2018-2019, 1st Semester

21. Accountants prepare financial statements at arbitrary points in time during the lifetime of an entity.

This is in accordance with which basic accounting concept?

A. Going concern

B. Periodicity

C. Unit of measure

D. Accrual

22. Which of the following is an adjunct account?

A. Cash

B. Accounts Receivable

C. Premium on bonds payable

D. Allowance for bad debts

23. The correct order of the following steps of the accounting cycle is

A. Posting, closing, adjusting, reversing

B. Posting, adjusting, closing, reversing

C. Posting, reversing, adjusting, closing

D. Adjusting, posting, closing, reversing

24. What is the purpose of nominal accounts?

A. To provide temporary accumulations of certain account balances for a meaningful period of

time

B. To facilitate accounting for small amounts

C. To correct errors as they are detected

D. To record all transactions initially

25. The purchase of office equipment on account will

increase an asset and increase owner’s

A C increase an asset and increase a liability

equity

increase one asset and decrease another

B D increase an asset and decrease a liability

asset

26. The performance of service for a customer or client and immediate receipt of cash will

increase one asset and decrease another decrease an asset and decrease a

A C

asset liability

increase an asset and increase owner’s

B D increase an asset and increase a liability

equity

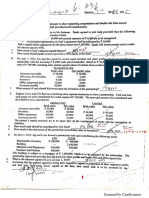

27. Regarding one purchase of merchandise, the following entries were made by Z Company.

Purchases 17,000

Accounts Payable - Supplier 17,000

Transportation - in 1,900

Accounts Payable - Supplier 1,900

What are the shipping terms regarding this transaction?

A FOB destination, freight prepaid C FOB destination, freight collect

B FOB shipping point, freight prepaid D FOB shipping point, freight collect

4|Mock Midterm Examination

Polytechnic University of the Philippines

College of Accountancy and Finance

Junior Philippine Institute of Accountants

Simulated Midterm Examination for Freshmen

AY: 2018-2019, 1st Semester

28. Failing to post the transaction of purchasing P 600 of office supplies on account would have what

effect on the trial balance?

A debit total would equal the credit total

B debit total would be P 600 greater than the credit total

C debit total would be P 1,200 greater than the credit total

D debit total would be P 600 less than the credit total

29. A company declared a cash dividend on its common stock on December 15, 2013, payable on

January 12,2014. How would this dividend affect stockholder’s equity on the following dates?

December 15,2013 December 31,2013 January 12,2014

A. Decrease No effect Decrease

B. Decrease No effect No effect

C. No effect Decrease No effect

D. No effect No effect Decrease

30. To arrive at the book value of a PPE, you should:

Divide the cost of the PPE by its estimated useful life and not deducting a trade-in value,

A

if there is a given amount

B Multiply the semi-annual depreciation by two, then multiply that amount by the useful life

C Deduct the salvage value and the accumulated depreciation to the cost of PPE

Add all depreciation expense from prior years and current years, then deduct the sum to

D

the cost of PPE

PROBLEMS

31. A business received cash of P30,000 in advance for service that will be provided later. The cash

received entry debited Cash and credited Unearned Revenue for P30,000. At the end of the

period, P11,000 is still unearned. The adjusting entry in this situation is

A. debit Unearned Revenue and credit Revenue for P19,000

B. debit Unearned Revenue and credit Revenue for P11,000

C. debit Revenue and credit Unearned Revenue for P19,000

D. debit Revenue and credit Unearned Revenue for P11,000

32. At December 31, 2015, the JPIA Company had P990,000 balance in its Advertising Expense

account before any year-end adjustments relating to the following:

• Radio advertising spots broadcast during December 2015 were billed to JPIA on January 4,

2016. The invoice cost of P50,000 was paid on January 15, 2016.

• Included in the amount reported as expense is P60,000 for newspaper advertising for a

January 2016 sales promotional campaign.

JPIA’s advertising expense for the year ended December 31, 2015 should be:

A. P1,040,000 B. P1,000,000 C. P980,000 D. P930,000

5|Mock Midterm Examination

Polytechnic University of the Philippines

College of Accountancy and Finance

Junior Philippine Institute of Accountants

Simulated Midterm Examination for Freshmen

AY: 2018-2019, 1st Semester

33. MOMOLAND Company recorded accrued salaries of P25,000 at December 31, 2014. During 2015,

the company paid salaries of P872,000. Unpaid salaries at December 31, 2015 amounted to

P34,000. Eagle prepares adjustments for the year-ended only on the first working day of the

following period and journalizes the adjusting entries as of December 31 and reversing entries are

dated January 1. The balance of Salaries Expense account that would appear in the post-closing

trial balance at December 31, 2015 is

A. P881,000 B. P34,000 C. P847,000 D. -0-

34. Finest Enterprises failed to accrue interest on its Note Receivable on December 31, 2015. The note

was dated August 11, 2015, matures in six months and had a face value of P13,000. Interest rate

stipulated is 10%. As a result, 2015 net income is __________. Round off the dates to the nearest

fifteen days and assume a 360-day year.

A. P1,300 understated C. P487.50 understated E. P487.50 overstated

B. P975 understated D. P975 overstated

35. On April 8, 2015, Ela Trading purchased goods from a supplier for an invoice price of P113,600

with credit terms 2/10, 1/15, n/30; shipment terms FOB shipping point, freight prepaid. Freight

charges amounted to P1,530. On April 21, Ela settled its account in full. On Ela’s cash payments

journal, how much should appear as credit to “Cash” relating to the transaction?

A. P113,600 B. P115,130 C. P113,978.30 D. P112,464 E. P113,994

36. Daphne Co., a VAT-registered company sold merchandise at invoice price of P185,000, inclusive

of 12% VAT, to James Co., another VAT-registered company on credit. Trade discounts granted

are 5% and 10%. Credit terms are 2/10, n/30; shipment terms FOB seller, freight collect. Freight

charge is P2,500. In Daphne’s books, Sales amounts to:

A. P185,000 B. P165,179 C. P158,175 D. P141,228 E. P139,194

37. Use the same information in #6. Assuming James Co. uses periodic inventory system, the debit to

Purchases based on foregoing transaction is:

A. P185,000 B. P165,179 C. P167,679 D. P141,228 E. -0-

38. How much is the monthly depreciation expense considering the following: Trade-in value-P3,500;

Est. Useful Life – 5 years; Depreciable amount P69,500

a. P13,900 c. P13,200

b. P1,158.33 d. P1,100

39. At the end of the first month of operations, St. Jude Co.’s bookkeeper prepared financial statements

which showered assets of P4,000,000 liabilities of P1,500,000 and net income of P500,000. In

preparing the statements, the bookkeeper overlooked the accrued wages at month-end of P30,000.

The correct owner’s equity at month-end is

a. P2,970,000 b. P2,350,000 c. P2,470,000 d. P1,970,000

6|Mock Midterm Examination

Polytechnic University of the Philippines

College of Accountancy and Finance

Junior Philippine Institute of Accountants

Simulated Midterm Examination for Freshmen

AY: 2018-2019, 1st Semester

40. A business received cash of P300,000 in advance for service that will be provided later. The cash

receipt entry debited cash and credited unearned revenue for P300,000. At the end of the period,

P110,000 is still unearned.

The adjusting entry for this situation will

a. Debit Unearned Revenue and Credit Revenue for P190,000

b. Debit Unearned Revenue and Credit Revenue for P110,000

c. Debit Revenue and Unearned Credit Revenue for P190,000

d. Debit Revenue and Unearned Credit Revenue for P110,000

41. Ed Sheeran paid P170,400 on June 1,2013, for a two-year insurance policy and recorded the

entire amount as Insurance Expense.

The December 31, 2013, adjusting entry is

A. Debit Prepaid Insurance and Credit Insurance Expense, P49,700

B. Debit Insurance Expense and Credit Prepaid Insurance, P49,700

C. Debit Insurance Expense and Credit Prepaid Insurance, P120,700

D. Debit Prepaid Insurance and Credit Insurance Expense, P120,700

42. The Supplies on Hand account balance at the beginning of the period was P66,000, Supplies

totaling P128,250, were purchased during the period and debited to Supplies on Hand. A physical

count shows P38,250 of the Supplies on Hand at the end of the period.

The proper journal entry at the end of the period

A. Debit Supplies on Hand and Credit Supplies Expense for P90,000

B. Debit Supplies Expense and Credit Supplies on Hand for P128,250

C. Debit Supplies on Hand and Credit Supplies Expense for P156,000

D. Debit Supplies Expense and Credit Supplies on Hand for P156,000

43. On December 31 of current year, Claire Company’s bookkeeper made an entry debiting Supplies

Expense and Crediting Supplies on Hand for P126,000. The Supplies on Hand account had a

P153,000 debit balance on January 1. The December 31 balance sheet showed Supplies on Hand

of P114,000. Only one purchase of supplies was made during the month, on account.

The entry for that purchase was

A. Debit Supplies on Hand, P87,000 and Credit Cash, P87,000

B. Debit Supplies Expense, P87,000 and Credit Accounts Payable, P87,000

C. Debit Supplies on Hand, P87,000 and Credit Accounts Payable, P87,000

D. Debit Supplies on Hand, P165,000 and Credit Accounts Payable, P165,000

44. A trial balance has debit and credit totals of P 7,000. The purchase of P 4,000 of office supplies on

account was omitted from the original journal entries. After recording and posting this transaction,

the new debit and credit totals for the trial balance would be

A P 11,000 C P 9,000

B P 7,000 D P 3,000

45. From this list of account balances, calculate the total credit column for the post-closing trial balance:

Cash, P 15,000; Accounts Receivable, P 3,000; Prepaid Rent, P 2,000; Building, P 30,000;

Accumulated Depreciation, P 13,000; Accounts Payable, P 6,000; Unearned Revenue, P 1,000;

Jiyeon Park, Capital, P 30,000.

A P 69,000 C P 45,000

B P 50,000 D P 20,000

7|Mock Midterm Examination

Polytechnic University of the Philippines

College of Accountancy and Finance

Junior Philippine Institute of Accountants

Simulated Midterm Examination for Freshmen

AY: 2018-2019, 1st Semester

46. The Balance Sheet of You Are My World Company shows that capital is P 540,000 that is equal to

1/3 of its total assets. How much are the total liabilities?

A P 180,000 C P 1,080,000

B P 720,000 D P 1,620,000

47. The assets of Sharmaine Company amounted to P 810,000 on December 31, 2008, but increased

to P 1,305,000 by December 31, 2009. During the same period, liabilities increased by P 270,000.

Owner’s equity on December 31, 2008 amounted to P 495,000. What was the amount of the

Owner’s Equity on December 31, 2009?

A P 585,000 C P 1,035,000

B P 720,000 D P 1,080,000

48. Peter Pan Child Care Center paid P 9,000 for three months of rent in advance. The Prepaid Rent

account had a remaining balance of P 3,000 at the end of the accounting period. The adjusting

entry to reflect this must have been

A debit Rent Expense and credit Prepaid Rent for P 3,000

B debit Rent Expense and credit Prepaid Rent for P 6,000

C debit Prepaid Rent and credit Rent Expense for P 12,000

D debit Prepaid Rent and credit Cash for P 9,000

49. The balance in the capital account of Holy Spirit Co, at the beginning of the year was P650,000.

During the year, the company earned revenue of P4,300,000, incurred expenses of P3,600,000,

the owner withdrew P500,000 in assets and the balance in the cash account increased by

P100,000.

At year-end, the company’s net income and the year-end balance in the capital account were,

respectively:

a. P200,000 and P950,000 c. P600,000 and P750,000

b. P700,000 and P950,000 d. P700,000 and P850,000

50. Before the month-end adjustments are made, the January 31, trial balance of Jessmar Company

contains revenues of P580,000 and expenses of P178,000. Adjustments are necessary for the

following items: a) depreciation for January, P48,000; b) portion of fees collected in advance in

January, P110,000; c) fees earned in January, not yet billed to customers P65,000; d) portion of

prepaid rent applicable to January, P90,000.

Net income of Jessmar Co. in January is

b. P569,000 b. P439,000 c. P352,000 d. P259,000

8|Mock Midterm Examination

Das könnte Ihnen auch gefallen

- Lecture 5 - Donor - S TaxDokument4 SeitenLecture 5 - Donor - S TaxBhosx KimNoch keine Bewertungen

- Employee DiscountDokument1 SeiteEmployee DiscountHailey Patrick100% (1)

- 28560550Dokument29 Seiten28560550Hanabusa Kawaii IdouNoch keine Bewertungen

- VCMDokument19 SeitenVCMBhosx Kim100% (1)

- Additional Exam Practice QUESTIONSDokument8 SeitenAdditional Exam Practice QUESTIONSShaunny BravoNoch keine Bewertungen

- I - M Only A Stepmother But My Daughter Is Just So Cute! - Volume 1Dokument279 SeitenI - M Only A Stepmother But My Daughter Is Just So Cute! - Volume 1Bhosx KimNoch keine Bewertungen

- I - M Only A Stepmother But My Daughter Is Just So Cute! - Volume 1Dokument279 SeitenI - M Only A Stepmother But My Daughter Is Just So Cute! - Volume 1Bhosx KimNoch keine Bewertungen

- Fedai - Quiz RemittanceDokument37 SeitenFedai - Quiz RemittanceKIRAN REDDY100% (1)

- Financiero Glosario BilingueDokument110 SeitenFinanciero Glosario BilingueLudoxNoch keine Bewertungen

- Basic Accounting: Multiple ChoiceDokument38 SeitenBasic Accounting: Multiple ChoiceErika GambolNoch keine Bewertungen

- Chapter 1 - An Introduction To Audit and Other Assurance ServicesDokument10 SeitenChapter 1 - An Introduction To Audit and Other Assurance ServicesCharry May DelaCruz GalvanFaustinoNoch keine Bewertungen

- Financial Accounting and Reporting-Preliminary ExamDokument7 SeitenFinancial Accounting and Reporting-Preliminary Examromark lopezNoch keine Bewertungen

- Toy World CaseDokument9 SeitenToy World Casesaurabhsaurs100% (1)

- Texas uninsured motorist and personal injury protection coverages rejection formDokument1 SeiteTexas uninsured motorist and personal injury protection coverages rejection formKarthik VadlapatlaNoch keine Bewertungen

- Other Percentage TaxDokument42 SeitenOther Percentage TaxBhosx KimNoch keine Bewertungen

- CFAS.101 - Diagnostic Test Part 2Dokument2 SeitenCFAS.101 - Diagnostic Test Part 2Mika MolinaNoch keine Bewertungen

- Comprehensive QuizDokument4 SeitenComprehensive QuizBea LadaoNoch keine Bewertungen

- Deutsche Bank NTC - Internal MemoDokument10 SeitenDeutsche Bank NTC - Internal Memothe_rufsNoch keine Bewertungen

- 15 KRM Om10 Tif ch12Dokument35 Seiten15 KRM Om10 Tif ch12Dingyuan OngNoch keine Bewertungen

- Elfili CHDokument2 SeitenElfili CHLynne Rodri45% (11)

- Accounting For Merchandising Part 2 - 129 Pages Q and ADokument107 SeitenAccounting For Merchandising Part 2 - 129 Pages Q and Ahsjhs100% (1)

- Nfjpia R11 Cup 1 - Fundamentals of Accounting EasyDokument9 SeitenNfjpia R11 Cup 1 - Fundamentals of Accounting EasyBlessy Zedlav LacbainNoch keine Bewertungen

- Intermediate Accounting Exam QuestionsDokument2 SeitenIntermediate Accounting Exam QuestionsBLACKPINKLisaRoseJisooJennieNoch keine Bewertungen

- Chapter 15 - Test BankDokument27 SeitenChapter 15 - Test Bankjuan50% (2)

- Junior Philippine Institute of Accountants BA 99.1 First Long Exam ReviewDokument6 SeitenJunior Philippine Institute of Accountants BA 99.1 First Long Exam ReviewMelissa FelicianoNoch keine Bewertungen

- Cpa Review School of The Philippines Manila Financial Accounting and Reporting 6725 Accounting ProcessDokument5 SeitenCpa Review School of The Philippines Manila Financial Accounting and Reporting 6725 Accounting ProcessJane ValenciaNoch keine Bewertungen

- Seeds of The Nations Review-MidtermsDokument9 SeitenSeeds of The Nations Review-MidtermsMikaela JeanNoch keine Bewertungen

- RFBT Q1Q2Dokument9 SeitenRFBT Q1Q2Mojan VianaNoch keine Bewertungen

- The Urban Giantism ProblemDokument10 SeitenThe Urban Giantism ProblemAdliana ColinNoch keine Bewertungen

- CORDILLERA CAREER DEVELOPMENT COLLEGE Accounting 201A Final ExamsDokument7 SeitenCORDILLERA CAREER DEVELOPMENT COLLEGE Accounting 201A Final ExamsYameteKudasaiNoch keine Bewertungen

- Afar302 A - PF 1Dokument4 SeitenAfar302 A - PF 1Nicole TeruelNoch keine Bewertungen

- Book Value Per Share Basic Earnings PerDokument61 SeitenBook Value Per Share Basic Earnings Perayagomez100% (1)

- IcebreakerDokument5 SeitenIcebreakerRyan MagalangNoch keine Bewertungen

- Income Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Dokument4 SeitenIncome Taxation Term Assessment 2 SEM SY 2019 - 2020: Coverage: Chapter 8 - 11Nhel AlvaroNoch keine Bewertungen

- UCP: CVP Analysis and ExercisesDokument10 SeitenUCP: CVP Analysis and ExercisesDin Rose GonzalesNoch keine Bewertungen

- Managing Accounts Receivable & Inventory MCQsDokument20 SeitenManaging Accounts Receivable & Inventory MCQsNorman DelirioNoch keine Bewertungen

- 207A Midterm ExaminationDokument5 Seiten207A Midterm ExaminationAldyn Jade Guabna100% (1)

- PRINT Final Exam in Managerial Accounting 3Dokument2 SeitenPRINT Final Exam in Managerial Accounting 3Rhan JoNoch keine Bewertungen

- Intermediate 1Dokument11 SeitenIntermediate 1Mary Anne ManaoisNoch keine Bewertungen

- Practical Accounting Problems SolutionsDokument11 SeitenPractical Accounting Problems SolutionsjustjadeNoch keine Bewertungen

- Bank Reconciliation and Cash Accounts QuizDokument3 SeitenBank Reconciliation and Cash Accounts QuizMarizMatampaleNoch keine Bewertungen

- JPIA CA5101 MerchxManuf Reviewer PDFDokument7 SeitenJPIA CA5101 MerchxManuf Reviewer PDFmei angelaNoch keine Bewertungen

- Chapter 23 - SCF - Aug 2012Dokument11 SeitenChapter 23 - SCF - Aug 2012bebo3usaNoch keine Bewertungen

- Name: - Section: - Schedule: - Class Number: - DateDokument7 SeitenName: - Section: - Schedule: - Class Number: - DateKath DeguzmanNoch keine Bewertungen

- Accounting For Special Transactions Midterm Examination: Use The Following Information For The Next Two QuestionsDokument13 SeitenAccounting For Special Transactions Midterm Examination: Use The Following Information For The Next Two QuestionsAndrew wigginNoch keine Bewertungen

- DocxDokument5 SeitenDocxAsdfghjkl LkjhgfdsaNoch keine Bewertungen

- Accounting For Partnership and Corporation (3 Trimester - CY 2016-2017)Dokument56 SeitenAccounting For Partnership and Corporation (3 Trimester - CY 2016-2017)Gumafelix, Jose Eduardo S.Noch keine Bewertungen

- Accounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 3Dokument18 SeitenAccounting For Partnership and Corporation Solman Baysa Lupisan 2014 Chapter 3Eric BaquirNoch keine Bewertungen

- Ais The Expenditure Cycle Purchasing To Cash Disbursements Test BankDokument29 SeitenAis The Expenditure Cycle Purchasing To Cash Disbursements Test Bankgutlaysophia06Noch keine Bewertungen

- LOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepDokument4 SeitenLOPEZ, ELLA MARIE - QUIZ 2 FinAnaRepElla Marie LopezNoch keine Bewertungen

- Financial Accounting and Reporting PartDokument6 SeitenFinancial Accounting and Reporting PartLalaine De JesusNoch keine Bewertungen

- Act 171 5.1-1 Midterm Exam 2021 NoneDokument3 SeitenAct 171 5.1-1 Midterm Exam 2021 NoneAngeliePanerioGonzagaNoch keine Bewertungen

- Far - QuizDokument3 SeitenFar - QuizRitchel CasileNoch keine Bewertungen

- MULTIPLE CHOICE: Write Your Answer On The Space Provided Before Each Number. Write CAPITAL LETTER. ErasureDokument2 SeitenMULTIPLE CHOICE: Write Your Answer On The Space Provided Before Each Number. Write CAPITAL LETTER. ErasurewivadaNoch keine Bewertungen

- Intermediate Accounting 1 WeekDokument32 SeitenIntermediate Accounting 1 Weekimsana minatozakiNoch keine Bewertungen

- Accounting Achievement Test ReviewDokument7 SeitenAccounting Achievement Test ReviewAldi HerialdiNoch keine Bewertungen

- Far Reviewer 1Dokument4 SeitenFar Reviewer 1MARK JAYSON MANABATNoch keine Bewertungen

- ACEINT1 Intermediate Accounting 1 Final Exam SY 2021-2022Dokument10 SeitenACEINT1 Intermediate Accounting 1 Final Exam SY 2021-2022Marriel Fate Cullano100% (1)

- Managerial Accounting Chapter 15 AnalysisDokument175 SeitenManagerial Accounting Chapter 15 AnalysismostfaNoch keine Bewertungen

- Accounting 1 Conceptual Framework and PrinciplesDokument13 SeitenAccounting 1 Conceptual Framework and PrinciplesTatyanna Kaliah0% (1)

- Saviour Exam 1Dokument1 SeiteSaviour Exam 1BLACKPINKLisaRoseJisooJennieNoch keine Bewertungen

- 2nd Year Reviewer Midterms (Compatibility)Dokument11 Seiten2nd Year Reviewer Midterms (Compatibility)Louie De La Torre0% (1)

- MODULE DWCC - Obligation and Contracts Part1 OnlineDokument17 SeitenMODULE DWCC - Obligation and Contracts Part1 OnlineCharice Anne VillamarinNoch keine Bewertungen

- The Value of Common Stocks Multiple Choice QuestionsDokument5 SeitenThe Value of Common Stocks Multiple Choice QuestionsNgọc LêNoch keine Bewertungen

- Chapter 3 Practice Materials-1Dokument17 SeitenChapter 3 Practice Materials-1Freddie Yuan50% (2)

- FarDokument5 SeitenFarMaria Fatima AlambraNoch keine Bewertungen

- Accounting For Business Combination - Quiz 2Dokument1 SeiteAccounting For Business Combination - Quiz 2Hey BuddyNoch keine Bewertungen

- 07 Case StudiesDokument4 Seiten07 Case Studiesravitarun31Noch keine Bewertungen

- Acc 101 Final Exam PrintDokument11 SeitenAcc 101 Final Exam Printchristian garciaNoch keine Bewertungen

- MOCKSQE1stYEAR2015 Questionnairev4Dokument13 SeitenMOCKSQE1stYEAR2015 Questionnairev4Jinky P. RefurzadoNoch keine Bewertungen

- Polytechnic University College Accountancy ExamDokument14 SeitenPolytechnic University College Accountancy ExamEdison San Juan100% (1)

- MAPÚA ACCOUNTANCY MOCK EXAMDokument7 SeitenMAPÚA ACCOUNTANCY MOCK EXAMJamie ToriagaNoch keine Bewertungen

- ACCO 20033 Financial Accounting and Reporting 1 MidtermDokument13 SeitenACCO 20033 Financial Accounting and Reporting 1 MidtermNila FranciaNoch keine Bewertungen

- Control ActivitiesDokument2 SeitenControl ActivitiesBhosx KimNoch keine Bewertungen

- Addtl RRLDokument3 SeitenAddtl RRLBhosx KimNoch keine Bewertungen

- Mis CH 11 ReportDokument8 SeitenMis CH 11 ReportBhosx KimNoch keine Bewertungen

- ADDITIONAL RRLsDokument4 SeitenADDITIONAL RRLsBhosx KimNoch keine Bewertungen

- Tax Incentives in Developing Countries - A Case Study-Singapore and PhilippinesDokument29 SeitenTax Incentives in Developing Countries - A Case Study-Singapore and PhilippinesBhosx KimNoch keine Bewertungen

- Answers To CH 1Dokument3 SeitenAnswers To CH 1Bhosx KimNoch keine Bewertungen

- Effect of Tax Incentives On The Growth of SMEs in RwandaDokument10 SeitenEffect of Tax Incentives On The Growth of SMEs in RwandaBhosx KimNoch keine Bewertungen

- BOI ForDokument5 SeitenBOI ForBhosx KimNoch keine Bewertungen

- COVID-19 Community Quarantines in The PhilippinesDokument7 SeitenCOVID-19 Community Quarantines in The PhilippinesBhosx KimNoch keine Bewertungen

- Avoid The Four Perils of CRMDokument14 SeitenAvoid The Four Perils of CRMBhosx KimNoch keine Bewertungen

- IDIC CRM Model Stages ExplainedDokument12 SeitenIDIC CRM Model Stages ExplainedBhosx KimNoch keine Bewertungen

- CamScanner Scans PDF DocsDokument12 SeitenCamScanner Scans PDF DocsBhosx KimNoch keine Bewertungen

- Customer Relationships Key to Business SuccessDokument6 SeitenCustomer Relationships Key to Business SuccessBhosx KimNoch keine Bewertungen

- Module 2A - CVP AnalysisDokument5 SeitenModule 2A - CVP AnalysisBhosx KimNoch keine Bewertungen

- Problem 13Dokument3 SeitenProblem 13Bhosx KimNoch keine Bewertungen

- Labor Law Memory Aid GuideDokument75 SeitenLabor Law Memory Aid GuideBhosx KimNoch keine Bewertungen

- Acco 2026 Funda Fin Acc 2 (2011)Dokument4 SeitenAcco 2026 Funda Fin Acc 2 (2011)Bhosx KimNoch keine Bewertungen

- Donors TaxDokument29 SeitenDonors TaxBhosx Kim100% (3)

- RA 9194 - Implementing Rules and RegulationsDokument35 SeitenRA 9194 - Implementing Rules and Regulationschitru_chichru100% (1)

- Partnership FormationDokument2 SeitenPartnership FormationBhosx KimNoch keine Bewertungen

- Midterm (08-14-16)Dokument6 SeitenMidterm (08-14-16)Bhosx KimNoch keine Bewertungen

- Final Deptal (10-14-18)Dokument5 SeitenFinal Deptal (10-14-18)Bhosx KimNoch keine Bewertungen

- Lesson 1 1 PDFDokument14 SeitenLesson 1 1 PDFBhosx KimNoch keine Bewertungen

- Intro ValuationDokument13 SeitenIntro ValuationBhosx KimNoch keine Bewertungen

- Vietnam e Conomy Sea 2023 ReportDokument14 SeitenVietnam e Conomy Sea 2023 ReportMitsu BùiNoch keine Bewertungen

- CIA 2004 Principles of Auditing Fraud InvestigationDokument10 SeitenCIA 2004 Principles of Auditing Fraud InvestigationThiya. TtNoch keine Bewertungen

- Statement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceDokument2 SeitenStatement of Account: Date Tran Id Remarks UTR Number Instr. ID Withdrawals Deposits BalanceNAGENDRA SINGH ShekhawatNoch keine Bewertungen

- Nentr 6043Dokument4 SeitenNentr 6043wadagrosNoch keine Bewertungen

- Types of InsuranceDokument22 SeitenTypes of InsuranceamritaNoch keine Bewertungen

- Class 6 InternetDokument13 SeitenClass 6 InternetRahul SinghNoch keine Bewertungen

- Motorcycle Parts Inventory Management System: AbstractDokument8 SeitenMotorcycle Parts Inventory Management System: AbstractFayyaz Gulammuhammad100% (1)

- POS goods carrying package policy summaryDokument4 SeitenPOS goods carrying package policy summaryMurugananthamjkNoch keine Bewertungen

- Dont Pay With Itunes Gift Cards FinalDokument1 SeiteDont Pay With Itunes Gift Cards FinalJack WilliamsNoch keine Bewertungen

- BRS Tax and InstDokument25 SeitenBRS Tax and InstNivedhitha BalajiNoch keine Bewertungen

- CISSP CASE ConceptDokument9 SeitenCISSP CASE Conceptbabu100% (1)

- Citibank's E-Business Strategy For Global BankingDokument35 SeitenCitibank's E-Business Strategy For Global Bankingsafwan87Noch keine Bewertungen

- Document 3Dokument2 SeitenDocument 3MichiOSTNoch keine Bewertungen

- Fco For 300 Kilo Fob 76Dokument3 SeitenFco For 300 Kilo Fob 76Elev8ted MindNoch keine Bewertungen

- Preface: of Public Sector and Private Sector Banks"Dokument47 SeitenPreface: of Public Sector and Private Sector Banks"madhuri100% (1)

- VSP IGW Allocation ReportDokument18 SeitenVSP IGW Allocation ReportJamil SakerNoch keine Bewertungen

- Your Road Map To Financial Freedom 101Dokument14 SeitenYour Road Map To Financial Freedom 101Samuel TeddyNoch keine Bewertungen

- NZ Om Display PRT PDFDokument12 SeitenNZ Om Display PRT PDFVikash Kumar MeenaNoch keine Bewertungen

- Accounting2 Activity1Dokument2 SeitenAccounting2 Activity1devy mar topiaNoch keine Bewertungen

- HealthInsuranceCertificate-Group CPGDHAB303500662021Dokument2 SeitenHealthInsuranceCertificate-Group CPGDHAB303500662021Ruban JebaduraiNoch keine Bewertungen

- Job Advert - Credit OfficerDokument3 SeitenJob Advert - Credit OfficerRashid BumarwaNoch keine Bewertungen

- CHAPTER 6 - The General Structure of Insurance IndustryDokument18 SeitenCHAPTER 6 - The General Structure of Insurance Industryanis abdNoch keine Bewertungen

- Prinsip Aplikasi Jaringan: Merna Baharuddin, PHDDokument12 SeitenPrinsip Aplikasi Jaringan: Merna Baharuddin, PHDSiti NamiraNoch keine Bewertungen