Beruflich Dokumente

Kultur Dokumente

Nama: Rama Tri Sakria (27) Kelas: 3-31 D III Akuntansi

Hochgeladen von

ramaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Nama: Rama Tri Sakria (27) Kelas: 3-31 D III Akuntansi

Hochgeladen von

ramaCopyright:

Verfügbare Formate

Nama : Rama Tri Sakria (27)

Kelas : 3-31 D III Akuntansi

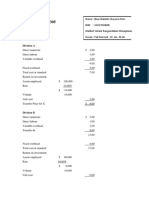

E6-1

A) Equivalent units for each element of cost in Department B

Cost Prior Depart Materials Labor FOH

equivalent unit transferred out $ 20.000,00 $ 20.000,00 $ 20.000,00 $ 20.000,00

equivalent unit in ending inventory

Cost from preciding department $ 5.000,00

Materials $ 5.000,00

Labor $ 4.000,00

FOH $ 3.000,00

total equivalent unit $ 25.000,00 $ 25.000,00 $ 24.000,00 $ 23.000,00

B) Cost per equivalent unit for each element of cost in Department B

Cost Prior Depart Materials Labor FOH

Cost in beginning inventory $ - $ - $ - $ -

Cost added during current period $ 40.000,00 $ 15.000,00 $ 9.600,00 $ 16.330,00

total cost to be accounted for $ 40.000,00 $ 15.000,00 $ 9.600,00 $ 16.330,00

divided by equivalent unit $ 25.000,00 $ 25.000,00 $ 24.000,00 $ 23.000,00

cost per equivalent unit $ 1,60 $ 0,60 $ 0,40 $ 0,71

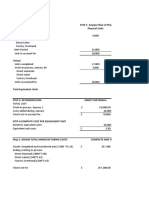

E6-2

Work in Process - Department X $ 50.000,00

Work in Process - Department Y $ 40.000,00

Materials $ 90.000,00

Work in Process - Department X $ 80.000,00

Work in Process - Department Y $ 70.000,00

Payroll $ 150.000,00

Work in Process - Department X $ 180.000,00

Work in Process - Department Y $ 70.000,00

Aplied Overhead $ 250.000,00

Work in Process - Department Y $ 300.000,00

Work in Process - Department X $ 300.000,00

Finished goods $ 448.000,00

Work in Process - Department Y $ 448.000,00

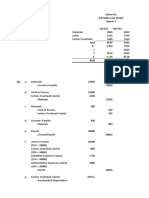

E6-6

Cost of Poduction Statement

Quantity schedule Material A Labor FOH Quantity

Beginning Inventory $ 400,00

Received from Cutting Department $ 2.100,00

$ 2.500,00

Transferred to finishing department $ 2.000,00

Ending inventory 80% 60% 60% $ 500,00

$ 2.500,00

Cost Charge to Department Total Cost Equivalent Unit * Unit Cost

Beginning Inventory

Cost from preciding department $ 11.800,00

Materials $ 4.000,00

Labor $ 1.200,00

FOH $ 2.400,00

Total cost in beginning inventory $ 19.400,00

Adding during current period

Cost from preciding department $ 63.200,00 $ 2.500,00 $ 30,00

Materials $ 21.200,00 $ 2.400,00 $ 10,50

Labor $ 17.660,00 $ 2.300,00 $ 8,20

FOH $ 35.320,00 $ 2.300,00 $ 16,40

Total cost added during current period $ 137.380,00

Total Cost Charge to Department $ 156.780,00 $ 65,10

Cost Accounted for as follow : Unit Complete Unit Cost Total Cost

Trasferred to finished goods $ 2.000,00 100% $ 65,10 $ 130.200,00

work in process, ending inventory

Cost from preciding department $ 500,00 100% $ 30,00 $ 15.000,00

Materials $ 500,00 80% $ 10,50 $ 4.200,00

Labor $ 500,00 60% $ 8,20 $ 2.460,00

FOH $ 500,00 60% $ 16,40 $ 4.920,00 $ 26.580,00

Total cost accounted for $ 156.780,00

*The number of equivalent unit required in the cost accounted

Cost Prior Depart Materials Labor FOH

equivalent unit transferred out $ 2.000,00 $ 2.000,00 $ 2.000,00 $ 2.000,00

equivalent unit in ending inventory $ 500,00 $ 400,00 $ 300,00 $ 300,00

total equivalent unit $ 2.500,00 $ 2.400,00 $ 2.300,00 $ 2.300,00

E6-7

Cost of Poduction Statement

Quantity schedule Material A Material B Labor FOH Quantity

Beginning Inventory $ 600,00

Received from Cutting Department $ 3.900,00

$ 4.500,00

Transferred to finishing department $ 4.100,00

Ending inventory $ 1,00 $ - $ 0,30 $ 0,30 $ 400,00

$ 4.500,00

Cost Charge to Department Total Cost Equivalent Unit * Unit Cost

Beginning Inventory

Cost from preciding department $ 4.422,00

Materials A $ 2.805,00

Materials B $ -

Labor $ 1.250,00

FOH $ 1.875,00

Total cost in beginning inventory $ 10.352,00

Adding during current period

Cost from preciding department $ 29.328,00 $ 4.500,00 $ 7,50

Materials A $ 19.695,00 $ 4.500,00 $ 5,00

Materials B $ 10.250,00 $ 4.100,00 $ 2,50

Labor $ 15.630,00 $ 4.220,00 $ 4,00

FOH $ 23.445,00 $ 4.220,00 $ 6,00

Total cost added during current period $ 98.348,00

Total Cost Charge to Department $ 108.700,00 $ 25,00

Cost Accounted for as follow : Unit Complete Unit Cost Total Cost

Trasferred to finished goods $ 4.100,00 $ 1,00 $ 25,00 $ 102.500,00

work in process, ending inventory

Cost from preciding department $ 400,00 $ 1,00 $ 7,50 $ 3.000,00

Materials A $ 400,00 $ 1,00 $ 5,00 $ 2.000,00

Materials B $ - $ -

Labor $ 400,00 $ 0,30 $ 4,00 $ 480,00

FOH $ 400,00 $ 0,30 $ 6,00 $ 720,00 $ 6.200,00

Total cost accounted for $ 108.700,00

*The number of equivalent unit required in the cost accounted

Cost Prior Depart Materials A Materials B Labor FOH

equivalent unit transferred out $ 4.100,00 $ 4.100,00 $ 4.100,00 $ 4.100,00 $ 4.100,00

equivalent unit in ending inventory $ 400,00 $ 400,00 $ 120,00 $ 120,00

total equivalent unit $ 4.500,00 $ 4.500,00 $ 4.100,00 $ 4.220,00 $ 4.220,00

Das könnte Ihnen auch gefallen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- KASUS 6-1 Hal 305: Nomor. 1 PerhitunganDokument21 SeitenKASUS 6-1 Hal 305: Nomor. 1 PerhitunganjnNoch keine Bewertungen

- C1C022025 FebbyanaAndra AkuntansiBiaya 3DDokument6 SeitenC1C022025 FebbyanaAndra AkuntansiBiaya 3DdarlaaNoch keine Bewertungen

- Cordova, Alexander JR - Individual TaskDokument6 SeitenCordova, Alexander JR - Individual TaskAlexander CordovaNoch keine Bewertungen

- Tugas Sistem Pengendalian Manajemen Transfer Pricing: Disusun Oleh: Reza Afrisal CB / 115020301111038Dokument13 SeitenTugas Sistem Pengendalian Manajemen Transfer Pricing: Disusun Oleh: Reza Afrisal CB / 115020301111038Maulida insNoch keine Bewertungen

- Tugas SPM 6-1Dokument13 SeitenTugas SPM 6-1Reza Afrisal33% (3)

- COSTCO Section 1Dokument11 SeitenCOSTCO Section 1Paula BautistaNoch keine Bewertungen

- 6.4 ProductionDokument25 Seiten6.4 ProductionScribdTranslationsNoch keine Bewertungen

- Kasus 6-1 - Jihan NabilahDokument21 SeitenKasus 6-1 - Jihan Nabilahalesha nindyaNoch keine Bewertungen

- Cost AccountingDokument8 SeitenCost AccountingHenny FaustaNoch keine Bewertungen

- Chapter 1-Test Material 3Dokument9 SeitenChapter 1-Test Material 3Marcus MonocayNoch keine Bewertungen

- 2018 4083 3rd Evaluation ExamDokument7 Seiten2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- De Guzman, Kyla (Act. Cost)Dokument4 SeitenDe Guzman, Kyla (Act. Cost)kyla deguzmanNoch keine Bewertungen

- Citra Dewi - 4112001008 - AM 4A Pagi - Study Case Chapter 4Dokument16 SeitenCitra Dewi - 4112001008 - AM 4A Pagi - Study Case Chapter 4Citra DewiNoch keine Bewertungen

- Cost of Goods ManufacturedDokument26 SeitenCost of Goods ManufacturedAb.Rahman AfghanNoch keine Bewertungen

- Cost Accounting #2Dokument34 SeitenCost Accounting #2Adil AnwarNoch keine Bewertungen

- KASUS 6-1: Nomor. 1 PerhitunganDokument21 SeitenKASUS 6-1: Nomor. 1 PerhitunganMeita PutriNoch keine Bewertungen

- Anjani Risa Pratiwi - 1801035213 - SPM AK-A-dikonversiDokument14 SeitenAnjani Risa Pratiwi - 1801035213 - SPM AK-A-dikonversiAnjani RisaNoch keine Bewertungen

- MARY GRACE PANGANIBAN - 045 Process and Activity-Based CostingDokument9 SeitenMARY GRACE PANGANIBAN - 045 Process and Activity-Based CostingMary Grace PanganibanNoch keine Bewertungen

- Chap 03Dokument10 SeitenChap 03Farooq HaiderNoch keine Bewertungen

- Quiz 1 SDokument4 SeitenQuiz 1 SAmmu SandhuNoch keine Bewertungen

- Fifo MethodDokument3 SeitenFifo MethodCleah WaskinNoch keine Bewertungen

- Maceda Glass and Aluminum Supply Job Order Cost SheetDokument8 SeitenMaceda Glass and Aluminum Supply Job Order Cost SheetWarren CabunyagNoch keine Bewertungen

- Akuntansi BiayaDokument18 SeitenAkuntansi Biayarani karinaNoch keine Bewertungen

- Yolla Ervira - 4112101105 - Tugas3Dokument6 SeitenYolla Ervira - 4112101105 - Tugas3advokesmahmmbNoch keine Bewertungen

- Problem-2.28 - & - 3.32 HMDokument8 SeitenProblem-2.28 - & - 3.32 HMCorry MargarethaNoch keine Bewertungen

- Prelim Exam-Boticario D. (SBA)Dokument5 SeitenPrelim Exam-Boticario D. (SBA)Dominic E. BoticarioNoch keine Bewertungen

- LEC 2 Additions, Spoilage, Rework, and ScrapDokument37 SeitenLEC 2 Additions, Spoilage, Rework, and ScrapKelvin CulajaráNoch keine Bewertungen

- Chapter 9.1 Process CostingDokument9 SeitenChapter 9.1 Process CostingdoomageddonsplinterlandNoch keine Bewertungen

- Process CostingDokument16 SeitenProcess CostingvijayNoch keine Bewertungen

- Tugas Individu Akmen Materi ABC PDFDokument3 SeitenTugas Individu Akmen Materi ABC PDFtutiNoch keine Bewertungen

- Jawaban Soal Kasus 4.2 Bab 17 Akmen LJT Dari Laptop AnasDokument9 SeitenJawaban Soal Kasus 4.2 Bab 17 Akmen LJT Dari Laptop AnasMaksi angkatan35Noch keine Bewertungen

- CostaccDokument4 SeitenCostaccjaringanlimagNoch keine Bewertungen

- Questions Fifo AverageDokument4 SeitenQuestions Fifo AverageClaire BarbaNoch keine Bewertungen

- Marietta Veluz Problem 3.2 Comprehensive Problem One DepartmentDokument2 SeitenMarietta Veluz Problem 3.2 Comprehensive Problem One DepartmentmariettaveluzNoch keine Bewertungen

- Traditional Costing Vs AB CostingDokument8 SeitenTraditional Costing Vs AB CostingWinda WidayantiNoch keine Bewertungen

- 39 and 37Dokument5 Seiten39 and 37Vincent Luigil AlceraNoch keine Bewertungen

- Total Costs For October 2017Dokument4 SeitenTotal Costs For October 2017mohitgaba19Noch keine Bewertungen

- Raw Materials InventoryDokument4 SeitenRaw Materials InventoryMikias DegwaleNoch keine Bewertungen

- Process Costing-FifoDokument8 SeitenProcess Costing-FifoMang OlehNoch keine Bewertungen

- Cost Acct Control Chp3 Multiple Choice ProblemDokument4 SeitenCost Acct Control Chp3 Multiple Choice ProblemGen HugoNoch keine Bewertungen

- Problem 5Dokument1 SeiteProblem 5gazer beamNoch keine Bewertungen

- Asistensi Akmen Ch.8Dokument12 SeitenAsistensi Akmen Ch.8Irham SistiasyaNoch keine Bewertungen

- Fill Y According To X Fill Y According To XDokument14 SeitenFill Y According To X Fill Y According To XAgna AegeanNoch keine Bewertungen

- 642389Dokument6 Seiten642389mohitgaba19Noch keine Bewertungen

- Dente SW2Dokument7 SeitenDente SW2hanna fhaye denteNoch keine Bewertungen

- 2020-10-12 - ACCT Test Practice ExercisesDokument146 Seiten2020-10-12 - ACCT Test Practice ExercisesAlenne FelizardoNoch keine Bewertungen

- Master BudgetDokument8 SeitenMaster BudgetScribdTranslationsNoch keine Bewertungen

- Soal Process Costing 3Dokument3 SeitenSoal Process Costing 3Mita PutryanaNoch keine Bewertungen

- Pencampuran Penyelesaian: CalculationDokument6 SeitenPencampuran Penyelesaian: Calculationyola yufitanNoch keine Bewertungen

- COST ACC CPRDokument2 SeitenCOST ACC CPRArissa Macapato DimangadapNoch keine Bewertungen

- Midterm - Ch. 17Dokument7 SeitenMidterm - Ch. 17Cameron BelangerNoch keine Bewertungen

- Mymie B. Maandig MBA-1 Dr. Marco Ilano Problem 4-13A RequiredDokument9 SeitenMymie B. Maandig MBA-1 Dr. Marco Ilano Problem 4-13A RequiredMymie MaandigNoch keine Bewertungen

- Panganiban, Mary Grace S. OMGT 3101Dokument12 SeitenPanganiban, Mary Grace S. OMGT 3101Mary Grace PanganibanNoch keine Bewertungen

- Q & Soln - Process CostingDokument6 SeitenQ & Soln - Process CostingAbhay SahuNoch keine Bewertungen

- Answer To Exercises To AnswerDokument9 SeitenAnswer To Exercises To AnswerLEONNA BEATRIZ LOPEZNoch keine Bewertungen

- WP Assignment Week 3 HM 73.9 & Soal EmasDokument5 SeitenWP Assignment Week 3 HM 73.9 & Soal EmasIndahna SulfaNoch keine Bewertungen

- Baking DepartmentDokument6 SeitenBaking DepartmentkmarisseeNoch keine Bewertungen

- Managerial Accounting - Invidual Task 4Dokument7 SeitenManagerial Accounting - Invidual Task 4Alexander CordovaNoch keine Bewertungen

- PDF Learning Journal Manajemen Asn CompressDokument2 SeitenPDF Learning Journal Manajemen Asn CompressramaNoch keine Bewertungen

- 5a Comparative AnalyisDokument2 Seiten5a Comparative AnalyisramaNoch keine Bewertungen

- 5a Comparative AnalyisDokument3 Seiten5a Comparative AnalyisramaNoch keine Bewertungen

- P5-4, 6 Dan 8Dokument18 SeitenP5-4, 6 Dan 8ramaNoch keine Bewertungen

- P5-2 Dan 3Dokument5 SeitenP5-2 Dan 3ramaNoch keine Bewertungen

- P5-6 Dan P5-8Dokument13 SeitenP5-6 Dan P5-8rama100% (1)

- P5 4Dokument2 SeitenP5 4ramaNoch keine Bewertungen

- App eDokument14 SeitenApp emorry123Noch keine Bewertungen

- Juarez Inc Job Order Cost Sheets (1) March 1 Job 621 Job 622Dokument3 SeitenJuarez Inc Job Order Cost Sheets (1) March 1 Job 621 Job 622ramaNoch keine Bewertungen

- Synopsis Anurag Modified 12-1-2023Dokument24 SeitenSynopsis Anurag Modified 12-1-2023tito valverdeNoch keine Bewertungen

- Page-21-32 Online Shopping: A Study of Consumers Preference For Various Products and E-RetailersDokument18 SeitenPage-21-32 Online Shopping: A Study of Consumers Preference For Various Products and E-RetailersSiddharth Singh TomarNoch keine Bewertungen

- Technical Audit in Apparel IndustryDokument7 SeitenTechnical Audit in Apparel IndustryRongdhonu MasumNoch keine Bewertungen

- Accounting For Manufacturing BusinessDokument1 SeiteAccounting For Manufacturing BusinesswtfenjiNoch keine Bewertungen

- Chapter Five THMDokument12 SeitenChapter Five THMbeth elNoch keine Bewertungen

- Sap IdocDokument12 SeitenSap Idoctarunaggarwal11100% (1)

- Rps Digital MarketingDokument7 SeitenRps Digital Marketingsetiawanputraharianto99Noch keine Bewertungen

- Master Troubleshooting Guide For Payment Process RequestsDokument17 SeitenMaster Troubleshooting Guide For Payment Process RequestsSHOBAKINoch keine Bewertungen

- Marketing Lecture NoteDokument465 SeitenMarketing Lecture NoteJin Lei LeowNoch keine Bewertungen

- Chapter 17Dokument26 SeitenChapter 17Varsha ChotaliaNoch keine Bewertungen

- Taiheiyo Cement Philippines Inc.: Day 1 June 4, 2019Dokument7 SeitenTaiheiyo Cement Philippines Inc.: Day 1 June 4, 2019A Jr Mancao LumansangNoch keine Bewertungen

- NNPC Ms 2012 May Rev1Dokument79 SeitenNNPC Ms 2012 May Rev1idristeekay100% (2)

- Resume - Sanchit GoyalDokument1 SeiteResume - Sanchit GoyaltompaulmarottickalNoch keine Bewertungen

- Consumer Behaviour Impact of Branding OnDokument19 SeitenConsumer Behaviour Impact of Branding OnDonna JudeNoch keine Bewertungen

- Pal Palex VacanciesDokument19 SeitenPal Palex VacanciesAnonymous aZ9ZgPnBbNoch keine Bewertungen

- Marketing Strategy of KURKURE That Led To Success of The BrandDokument13 SeitenMarketing Strategy of KURKURE That Led To Success of The BrandSushant_Sagar_9240100% (1)

- Olivarez College: Learning InsightDokument17 SeitenOlivarez College: Learning InsightTricia JavierNoch keine Bewertungen

- Take The Lead Print 3-18-21Dokument260 SeitenTake The Lead Print 3-18-21Moore Legal TechnologyNoch keine Bewertungen

- Company Introduction Terra Global SalespartnersDokument17 SeitenCompany Introduction Terra Global SalespartnersAlby MilesNoch keine Bewertungen

- Car Concierge Feasibility StudyDokument114 SeitenCar Concierge Feasibility StudyMira RodriguezNoch keine Bewertungen

- BPM Cbok 4.0 PDF - pdf-201-250Dokument50 SeitenBPM Cbok 4.0 PDF - pdf-201-250Eder Morales Cano100% (1)

- Research Model Canvas Interactive - HandoutDokument2 SeitenResearch Model Canvas Interactive - HandoutArdin SupriadinNoch keine Bewertungen

- Module 5 Introduction To Display AdvertisingDokument41 SeitenModule 5 Introduction To Display AdvertisingVMPNoch keine Bewertungen

- EntrepreneurshipByGo Ch3 BusinessModelDokument23 SeitenEntrepreneurshipByGo Ch3 BusinessModelraffy arranguezNoch keine Bewertungen

- Marketing StrategiesDokument10 SeitenMarketing StrategiesAvani PatelNoch keine Bewertungen

- IT-510 Module 3 Part OneDokument5 SeitenIT-510 Module 3 Part Onepetetg5172Noch keine Bewertungen

- APG - Process Review SampleDokument1 SeiteAPG - Process Review SampleDen Te FloresNoch keine Bewertungen

- MKT 460 Midterm Topics and Paper FormatDokument3 SeitenMKT 460 Midterm Topics and Paper FormatRifat ChowdhuryNoch keine Bewertungen

- Báo Cáo PTDokument3 SeitenBáo Cáo PTSang Nguyen QuangNoch keine Bewertungen

- The Production CycleDokument2 SeitenThe Production CycleAmara PrabasariNoch keine Bewertungen