Beruflich Dokumente

Kultur Dokumente

Arcelor Mittal

Hochgeladen von

kailas134Originalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Arcelor Mittal

Hochgeladen von

kailas134Copyright:

Verfügbare Formate

The Challenges of Integrating Steel Giants Arcelor and Mittal:-

Realizing Projected Financial Returns Due Diligence Data Revalidation: Verify Assumptions

The Impact of Employee Turnover Performance Benchmarking

Acquisition-Related Customer Attrition Integrating Manufacturing Operations

Rapid Integration Does Not Mean Doing Everything at the Same Pace Integrating Information Technology

Viewing Integration as a Process Integrating Finance

Integration Planning Integrating Mechanisms

Postmerger Integration Organization: Put in Place before Closing Robert Porter Lynch suggests six integration mechanisms to apply to

Postmerger Integration Organization: Composition and Responsibilities business alliances:

Institutionalizing the Integration Process (1) Leadership, (2) teamwork and role clarification, (3) control by

Developing Communication Plans: Talking to Key Stakeholders coordination, (4) policies and values, (5) consensus decision

Customers: Under commit and Over deliver making, and (6) resource commitments.

The merger of Arcelor and Mittal into Arcelor Mittal in June 2006 resulted in the creation of the world’s largest steel company. With 2007 revenues of $105 billion and its steel

production accounting for about 10 percent of global output, the behemoth has 320,000employees in 60 countries, and it is a global leader in all its target markets. Arcelor was

a product of three European steel companies (Arbed, Aceralia, and Usinor). Similarly, Mittal resulted from a series of international acquisitions. The two firms’ downstream

(raw material) and upstream (distribution) operations proved to be highly complementary, with Mittal owning much of its iron ore and coal reserves and Arcelor having

extensive distribution and service center operations. Like most mergers, Arcelor-Mittal faced the challenge of integrating management teams; sales, marketing, and product

functions; production facilities; and purchasing operations. Unlike many mergers involving direct competitors, a relatively small portion of cost savings would come from

eliminating duplicate functions and operations. This case study relies upon information provided in an interview with Jerome Ganboulan (formerly of Arcelor) and William A.

Scotting (formerly of Mittal), the two executives charged with directing the postmerger integration effort.1 The focus in the case study is on the formation of the integration

team, the importance of communications, and the realization of anticipated synergies.

Top Management Sets Expectations

Arcelor Mittal’s top management set three driving objectives before undertaking the postmerger integration effort: (1) achieve rapid integration, (2) manage daily operations

effectively, and (3) accelerate revenue and profit growth. The third objective was viewed as the primary motivation for the merger. The goal was to combine what were viewed

as entities having highly complementary assets and skills. This goal was quite different from the way Mittal had grown historically, which was a result of acquisitions of

turnaround targets focused on cost and productivity improvements.

Developing the Integration Team

The formal phase of the integration effort was to be completed in six months. Consequently, it was crucial to agree on the role of the management integration team (MIT); key

aspects of the integration process, such as how decisions would be made; and the roles and responsibilities of team members. Activities were undertaken in parallel rather than

sequentially. Teams consisted of employees from the two firms. People leading taskforces came from the business units. For example, commercial integration issues were

resolved by the commercial business units. The teams were then asked to propose a draft organization to the MIT, including the profiles of the people who were to become

senior managers. Once the senior managers were selected, they were to build their own teams to identify the synergies and create action plans for realizing the synergies.

Teams were formed before the organization was announced and implementation of certain actions began before detailed plans had been developed fully. Progress to plan was

monitored on a weekly basis, enabling the MIT to identify obstacles facing the 25 decentralized task forces and, when necessary, resolve issues.

Developing Communication Plans

Considerable effort was spent in getting line managers involved in the planning process and selling the merger to their respective operating teams. Initial communication efforts

included the launch of a top-management “road show.” The new company also established a website and introduced Web TV. Senior executives reported two- to three-minute

interviews on various topics, giving everyone with access to a personal computer the ability to watch the interviews onscreen. Owing to the employee duress resulting from the

merger, uncertainty was high, as employees with both firms wondered how the merger would affect them. To address employee concerns, managers were given a well-

structured message about the significance of the merger and the direction of the new company. Furthermore, the new brand, Arcelor Mittal, was launched in a meeting attended

by 500 of the firm’s top managers during the spring of 2007. This meeting marked the end of the formal integration process. Finally, all communication of information

disseminated throughout the organization was focused rather than of a general nature. External communication was conducted in several ways. Immediately following closing,

senior managers traveled to all the major cities and sites of operations, talking to local management and employees in these sites. Typically, media interviews were also

conducted around these visits, providing an opportunity to convey the Arcelor Mittal message to the communities through the press. In March 2007, the new firm held a media

day in Brussels, which involved presentations on the status of the merger. Journalists were invited to go to the different businesses and review the progress themselves. Within

the first three months following closing; customers were informed about the advantages of the merger for them, such as enhanced R&D capabilities and wider global coverage.

The sales forces of the two organizations were charged with the task of creating a single “face” to the market.

Creating a New Organization

Arecelor Mittal’s management viewed the merger as an opportunity to conduct interviews and surveys with employees to gain an understanding of their views about the two

companies. Employees were asked about the combined firm’s strengths and weaknesses and how the new firm should present itself to its various stakeholder groups. This

process resulted in a complete rebranding of the combined firms.

Achieving Operational and Functional Integration

Arcelor Mittal management set a target for annual cost savings of $1.6 billion, based on experience with earlier acquisitions. The role of the task forces was first to validate this

number from the bottom up then to tell the MIT how the synergies would be achieved. As the merger progressed, it was necessary to get the business units to assume

ownership of the process to formulate the initiatives, timetables, and key performance indicators that could be used to track performance against objectives. In some cases, the

synergy potential was larger than anticipated while smaller in other situations. The expectation was that the synergy could be realized by mid-2009. The integration objectives

were included in the 2007 annual budget plan. As of the end of 2007, the combined firms were on track to realize their goal with annualized cost savings running $1.4 billion.

Concluding Formal Integration Activities

The integration was deemed complete when the new organization, the brand, the “one face to the customer” requirement, and the synergies were finalized. This occurred within

eight months of the closing. However, integration would continue for some time to achieve cultural integration. Cultural differences within the two firms are significant. In

effect, neither company was homogeneous from a cultural perspective. Arcelor Mittal management viewed this diversity as an advantage, in that it provided an opportunity to

learn new ideas.

Things to Remember

Postclosing integration is a critical phase of the M&A process. Integration itself can be viewed in terms of a process consisting of six activities: integration planning,

developing communication plans, creating a new organization, developing staffing plans, functional integration, and integrating corporate cultures. Both communication and

cultural integration extend beyond what normally is considered the conclusion of the integration period. Combining companies must be done quickly (i.e., 6–12 months) to

achieve proper staffing levels, eliminate redundant assets, and generate the financial returns expected by shareholders. Delay contributes to employee anxiety and accelerates

the loss of key talent and managers; delay also contributes to the deterioration of employee morale among those that remain. The loss of key talent and managers often is

viewed as the greatest risk associated with the integration phase. Nevertheless, although speed is important to realize cost savings and retain key employees, highly complex

operations must be integrated in a more deliberate and systematic fashion to minimize long-term problems. Successfully integrated M&As are those that demonstrate

leadership by candidly and continuously communicating a clear vision, a set of values, and clear priorities to all employees. Successful integration efforts are those that are well

planned, appoint an integration manager and a team with clearly defined lines of authority, and make the tough decisions early in the process. These decisions include

organizational structure, reporting relationships, spans of control, people selection, roles and responsibilities, and workforce reduction. During integration, the focus should be

on those issues having the greatest near-term impact. Unlike M&As, the integration of business alliances tends to be phased. Resources are contributed at the outset to enable

the formation of the alliance. Subsequent resource contributions are subject to a lengthy negotiation process in which the partners are trying to get the most favorable terms.

Because alliances involve shared control, the integration process requires good working relationships with the other participants. Successful integration also requires leadership

capable of defining a clear sense of direction and well-defined priorities and managers who accomplish their objectives as much by coordinating activities through effective

communication as by unilateral decision making. Like M&As, cross-functional teams are used widely to achieve integration. Finally, the successful integration of business

alliances, as well as M&As, demands that the necessary resources, in terms of the best people, the appropriate skills, and sufficient capital, be committed to the process.

Das könnte Ihnen auch gefallen

- Arcelor Mittal Post Merger Marketing IntegrationDokument7 SeitenArcelor Mittal Post Merger Marketing IntegrationAkhil BangiaNoch keine Bewertungen

- Stream Theory: An Employee-Centered Hybrid Management System for Achieving a Cultural Shift through Prioritizing Problems, Illustrating Solutions, and Enabling EngagementVon EverandStream Theory: An Employee-Centered Hybrid Management System for Achieving a Cultural Shift through Prioritizing Problems, Illustrating Solutions, and Enabling EngagementNoch keine Bewertungen

- Aligning Strategies With Institutional in Uences For Internationalization: Evidences From A Chinese SOEDokument15 SeitenAligning Strategies With Institutional in Uences For Internationalization: Evidences From A Chinese SOEKhanh Linh HoangNoch keine Bewertungen

- Enterprise ArchitectureDokument18 SeitenEnterprise ArchitectureIsai Jesse CastellanosNoch keine Bewertungen

- Issn 1653-0187 / IsDokument1 SeiteIssn 1653-0187 / IsPoonam ShindeNoch keine Bewertungen

- 4d. Ross 2005 PDFDokument4 Seiten4d. Ross 2005 PDFBernie ClintonNoch keine Bewertungen

- M&M Case StudyDokument6 SeitenM&M Case Studyvicky3230Noch keine Bewertungen

- SCM ASSIGNMENT - EditedDokument22 SeitenSCM ASSIGNMENT - EditedImran AlamNoch keine Bewertungen

- Case Analysis Report - Edited.editedDokument9 SeitenCase Analysis Report - Edited.editedBrian ochiengNoch keine Bewertungen

- Post Merger People IntegrationDokument28 SeitenPost Merger People IntegrationDebasish Chakraborty100% (4)

- PWC Delivering Client Value Jaguar Land RoverDokument8 SeitenPWC Delivering Client Value Jaguar Land RoverCarlos PastorNoch keine Bewertungen

- Cis Mergers and AcquisitionsDokument20 SeitenCis Mergers and AcquisitionsAnonymous nTxB1EPvNoch keine Bewertungen

- In November 199-WPS OfficeDokument2 SeitenIn November 199-WPS Officepenaverdemarilou.8Noch keine Bewertungen

- A Study On Reengineering Process at Hero Motor Corp LTD OKDokument10 SeitenA Study On Reengineering Process at Hero Motor Corp LTD OKthasarathanr1993_9390% (1)

- A Case Study of Acquisition of Spice Communications by Isaasdaddea Cellular LimitedDokument13 SeitenA Case Study of Acquisition of Spice Communications by Isaasdaddea Cellular Limitedsarge1986Noch keine Bewertungen

- Reshaping The IT Governance in Octo Telematics To Gain IT-business AlignmentDokument17 SeitenReshaping The IT Governance in Octo Telematics To Gain IT-business AlignmentPriyanka AzadNoch keine Bewertungen

- Proctor and GambleDokument10 SeitenProctor and Gamblevipaelita90Noch keine Bewertungen

- LDS7002 - Final Project Change Leadership TitoneDokument19 SeitenLDS7002 - Final Project Change Leadership Titonetat4pNoch keine Bewertungen

- Project On Merger and AcquisitionDokument8 SeitenProject On Merger and Acquisitionaashish0128Noch keine Bewertungen

- Mergers & Acquisitions Role of Human ResourceDokument5 SeitenMergers & Acquisitions Role of Human Resourcenisarg_Noch keine Bewertungen

- Balanced Scorecard For Telecoms in PakistanDokument28 SeitenBalanced Scorecard For Telecoms in PakistanSohail AusafNoch keine Bewertungen

- 3 Four Big Moves Finance Should Make Now EbookDokument12 Seiten3 Four Big Moves Finance Should Make Now EbookErdem EnustNoch keine Bewertungen

- ILM As A JourneyDokument11 SeitenILM As A JourneyquocircaNoch keine Bewertungen

- MO - Project Report - Group1Dokument16 SeitenMO - Project Report - Group1Mohanapriya JayakumarNoch keine Bewertungen

- Industry Determinations of "Merger Versus Alliance" DecisionDokument26 SeitenIndustry Determinations of "Merger Versus Alliance" DecisionSachin SharmaNoch keine Bewertungen

- Global IT ManagementDokument7 SeitenGlobal IT ManagementHernando Antonio Mazó PozueloNoch keine Bewertungen

- Implications of M&As:: Is There A Case For Human ValuesDokument29 SeitenImplications of M&As:: Is There A Case For Human ValuesPankaj SharmaNoch keine Bewertungen

- Changing Business Environment-SMADokument42 SeitenChanging Business Environment-SMAShreya PatelNoch keine Bewertungen

- Chapter OneDokument6 SeitenChapter OneYUSUF DABONoch keine Bewertungen

- Bicc White Paper 1 2012 1486911Dokument15 SeitenBicc White Paper 1 2012 1486911hjcruzNoch keine Bewertungen

- Mahindra & Mahindra - Implementing BPRDokument13 SeitenMahindra & Mahindra - Implementing BPRAshwin Kumar Mohan100% (2)

- Redesign The IT Operating Model To Accelerate Digital BusinessDokument56 SeitenRedesign The IT Operating Model To Accelerate Digital Businessdqvn2002Noch keine Bewertungen

- 1 SMDokument8 Seiten1 SMtswNoch keine Bewertungen

- Conceptual Framework For Successful IT Governance and BSC For Service IndustryDokument5 SeitenConceptual Framework For Successful IT Governance and BSC For Service IndustryInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- GEDokument23 SeitenGENamrataNaikNoch keine Bewertungen

- Sample Dissertation On Working Capital ManagementDokument8 SeitenSample Dissertation On Working Capital Managementticwsohoress1974Noch keine Bewertungen

- Information SystemDokument15 SeitenInformation SystemSudip BaruaNoch keine Bewertungen

- A Leader's Role When A Potential Crisis Becomes ActualDokument7 SeitenA Leader's Role When A Potential Crisis Becomes ActualfoodfoxaNoch keine Bewertungen

- Implementation Six SigmaDokument9 SeitenImplementation Six Sigmaanon_256380863Noch keine Bewertungen

- Post Merger People Integration PDFDokument28 SeitenPost Merger People Integration PDFcincinatti159634Noch keine Bewertungen

- Australian Banks IT Business Alignment Leads To New Product and System Development ProcessDokument7 SeitenAustralian Banks IT Business Alignment Leads To New Product and System Development ProcessChandan ThakurNoch keine Bewertungen

- Assignment II: Maple Case Study: Strategic ChoicesDokument4 SeitenAssignment II: Maple Case Study: Strategic ChoicesSudan KhadgiNoch keine Bewertungen

- The ST Gallen Business Model NavigatorDokument18 SeitenThe ST Gallen Business Model NavigatorOscar ManriqueNoch keine Bewertungen

- Management Case: Bharat Petroleum Corporation Limited (BPCL)Dokument14 SeitenManagement Case: Bharat Petroleum Corporation Limited (BPCL)ankit baidNoch keine Bewertungen

- ITC Change Mgmt. ReportDokument27 SeitenITC Change Mgmt. Reportprem_raebareliNoch keine Bewertungen

- Effect of Working Capital Management On Profitability: January 2018Dokument8 SeitenEffect of Working Capital Management On Profitability: January 2018AbelNoch keine Bewertungen

- Delloitte TOMDokument27 SeitenDelloitte TOMDJ100% (5)

- Overview of M&aDokument19 SeitenOverview of M&aDeepak PanwarNoch keine Bewertungen

- Winning Operating Models That Convert Strategy To ResultsDokument12 SeitenWinning Operating Models That Convert Strategy To ResultsiiguitarNoch keine Bewertungen

- Construction Organization Design and Documentation 2Dokument54 SeitenConstruction Organization Design and Documentation 2tonyNoch keine Bewertungen

- Temi Chapter OneDokument50 SeitenTemi Chapter OneItz ShiningstarNoch keine Bewertungen

- Financial Statements Analysis: Wealth Creation and Wealth Maximisation at Telecom Company From 2010 To 2012Dokument11 SeitenFinancial Statements Analysis: Wealth Creation and Wealth Maximisation at Telecom Company From 2010 To 2012IOSRjournalNoch keine Bewertungen

- STRM043 Competitive Strategy & Innovation Anil Kumar Ganessen Chinnapen Adrian Pryce 16444036 2900 GE Case StudyDokument20 SeitenSTRM043 Competitive Strategy & Innovation Anil Kumar Ganessen Chinnapen Adrian Pryce 16444036 2900 GE Case StudyXimena Lucero Gutierrez HurtadoNoch keine Bewertungen

- Good For Business?: Worker Participation On BoardsDokument55 SeitenGood For Business?: Worker Participation On BoardsJustin O'HaganNoch keine Bewertungen

- Towards Improving Sales Operations Planning ProcesDokument6 SeitenTowards Improving Sales Operations Planning ProcesJesus Albeiro Garzon RamirezNoch keine Bewertungen

- Kpit Technologies: Is An Indian Headquartered InDokument11 SeitenKpit Technologies: Is An Indian Headquartered InPooja talrejaNoch keine Bewertungen

- Assignment#1 ByGroup MicrosoftDokument4 SeitenAssignment#1 ByGroup MicrosoftAdliana ColinNoch keine Bewertungen

- Beyond BudgetingDokument7 SeitenBeyond Budgetingantishrillwebdesign100% (1)

- Datapipe Fact SheetDokument1 SeiteDatapipe Fact SheetDeneme Deneme AsNoch keine Bewertungen

- Fuel System: Fuel Tank / Fuel Cock 4-1 Fuel Pump 4 - 2 Carburetor 4 - 3Dokument10 SeitenFuel System: Fuel Tank / Fuel Cock 4-1 Fuel Pump 4 - 2 Carburetor 4 - 3Fabrizio FloresNoch keine Bewertungen

- Mariveles ChlorinatorDokument1 SeiteMariveles ChlorinatorJhn Cbllr BqngNoch keine Bewertungen

- EPSON WF-6090, WF-6530, WF-6590 Series Service Manual Page 121-140Dokument20 SeitenEPSON WF-6090, WF-6530, WF-6590 Series Service Manual Page 121-140Ion IonutNoch keine Bewertungen

- Overheat Freeze Mechanisms of Solar CollectorsDokument5 SeitenOverheat Freeze Mechanisms of Solar CollectorsJuli HasanajNoch keine Bewertungen

- VIOTEK Monitor ManualDokument11 SeitenVIOTEK Monitor ManualJohn Michael V. LegasteNoch keine Bewertungen

- My Lovely ResumeDokument3 SeitenMy Lovely ResumeJanicz BalderamaNoch keine Bewertungen

- ContainerDokument12 SeitenContainerlakkekepsuNoch keine Bewertungen

- David Wright Thesis (PDF 1MB) - QUT EPrintsDokument360 SeitenDavid Wright Thesis (PDF 1MB) - QUT EPrintsruin_2832Noch keine Bewertungen

- Andrea BrennanDokument2 SeitenAndrea BrennanAnonymous tGJ2lopsNoch keine Bewertungen

- Qty. Description MG160LB: Company Name: Created By: Phone: DateDokument1 SeiteQty. Description MG160LB: Company Name: Created By: Phone: DateKim Howard CastilloNoch keine Bewertungen

- BTS 84Dokument4 SeitenBTS 84Kiara Ticangan ArgelNoch keine Bewertungen

- Resetting of Computers - A320: Systems That Can Be Reset in The Air or On The GroundDokument8 SeitenResetting of Computers - A320: Systems That Can Be Reset in The Air or On The Groundanarko arsipelNoch keine Bewertungen

- IEPE Connector - 2021Dokument2 SeitenIEPE Connector - 2021Nguyen Ngoc TuanNoch keine Bewertungen

- S A 20190725Dokument4 SeitenS A 20190725krishaNoch keine Bewertungen

- Ultimate Holding Capacity Drag mx5Dokument1 SeiteUltimate Holding Capacity Drag mx5Luana MarchioriNoch keine Bewertungen

- Mercruiser GearcasecomponentsDokument42 SeitenMercruiser GearcasecomponentswguenonNoch keine Bewertungen

- PanasonicBatteries NI-MH HandbookDokument25 SeitenPanasonicBatteries NI-MH HandbooktlusinNoch keine Bewertungen

- BANDITO-PULSE Engl PDFDokument9 SeitenBANDITO-PULSE Engl PDFMario Ariel VesconiNoch keine Bewertungen

- Jill K. Hatanaka: San Joaquin County Office of Education 2707 Transworld Drive Stockton, CA 95206 209-401-2406Dokument3 SeitenJill K. Hatanaka: San Joaquin County Office of Education 2707 Transworld Drive Stockton, CA 95206 209-401-2406api-114772135Noch keine Bewertungen

- Silent Sound Technology Seminar ReportDokument42 SeitenSilent Sound Technology Seminar ReportSrinivas B India79% (14)

- Electric Submersible Pumps (ESP) PDFDokument31 SeitenElectric Submersible Pumps (ESP) PDFFernandoEnriqueCalveteGonzález100% (2)

- Quadcopter Design DocumentDokument23 SeitenQuadcopter Design Documentapi-556772195Noch keine Bewertungen

- Underwater Wireless CommunicationDokument18 SeitenUnderwater Wireless CommunicationNeelasha Baa100% (1)

- Introduction To Turbomachinery Final Exam 1SY 2016-2017Dokument1 SeiteIntroduction To Turbomachinery Final Exam 1SY 2016-2017Paul RodgersNoch keine Bewertungen

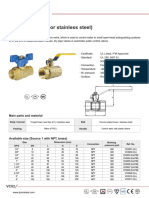

- VC02 Brass Ball Valve Full Port Full BoreDokument2 SeitenVC02 Brass Ball Valve Full Port Full Boremahadeva1Noch keine Bewertungen

- 752 BMW Individual High End Audio SystemDokument2 Seiten752 BMW Individual High End Audio SystemsteNoch keine Bewertungen

- Repair Manual For Claas Mega 202 218 Combine HarvesterDokument382 SeitenRepair Manual For Claas Mega 202 218 Combine Harvesterramunas100% (7)

- Hyster H 60 XL SHOP MANUALDokument273 SeitenHyster H 60 XL SHOP MANUALjacksonholland833583% (6)

- Flyover Construction ThesisDokument4 SeitenFlyover Construction ThesisLeyon Delos Santos60% (5)