Beruflich Dokumente

Kultur Dokumente

Quiz - Act 07A: I. Theories: Problems

Hochgeladen von

Shawn OrganoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Quiz - Act 07A: I. Theories: Problems

Hochgeladen von

Shawn OrganoCopyright:

Verfügbare Formate

Name: the variable costs associated with the order.

B. excess capacity exists and the revenue exceeds all

variable costs associated with the order.

Section and Course: C. excess capacity exists and the revenue exceeds

Date: allocated fixed costs.

Professor: Prof. Jason Radam D. the revenue exceeds total costs, regardless of available

capacity.

Remarks: E. the revenue exceeds variable costs, regardless of

Score: %: available capacity.

8. Occidental is studying whether to drop a product because of

ongoing losses. Costs that would be relevant in this situation would

QUIZ – ACT 07A include variable manufacturing costs as well as:

A. factory depreciation.

B. avoidable fixed costs.

C. unavoidable fixed costs.

NOTE: Strictly NO erasures in any form! Use permanent D. allocated corporate administrative costs.

ball pen only. E. general corporate advertising.

I. Theories: (Write the capital letter of the correct answer

beside each number; 2 pts. each) Problems: (Write the correct amount and decisions being

asked; 3 pts. each)

1. Which of the following best defines the concept of a relevant

cost?

A. A past cost that is the same among alternatives. 1. Oso Interiors provides design services to residential and

B. A past cost that differs among alternatives. commercial clients. The residential services produce a contribution

margin of P450,000 and have traceable fixed operating costs of

C. A future cost that is the same among alternatives.

P480,000. Management is studying whether to drop the residential

D. A future cost that differs among alternatives.

operation. If closed, the fixed operating costs will fall by P370,000.

E. A cost that is based on past experience.

How much is the increase (decrease) in Oso's net income?

2. When deciding whether to sell a product at the split-off point or (P80,000)

process it further, joint costs are not usually relevant because:

A. such amounts do not help to increase sales revenue. For Nos. 2 - 3

B. such amounts only slightly increase a company's sales Hanep Company manufactures two products: Regular and Super.

margin. The results of operations for 2018 follow.

C. such amounts are sunk and do not change with the

decision.

D. the sales revenue does not decrease to the extent that it

should, if compared with separable processing.

E. such amounts reflect opportunity costs.

3. Consider the following costs and decision-making situations:

I. The cost of existing inventory, in a keep vs. disposal decision.

II. The cost of special electrical wiring, in an equipment acquisition

decision.

III. The salary of a supervisor who will be transferred elsewhere in

the organization, in a department-closure decision. Fixed manufacturing costs included in cost of goods sold amount to

$3 per unit for Regular and $20 per unit for Super. Variable selling

Which of the above costs is (are) relevant to the decision situation expenses are $4 per unit for Regular and $20 per unit for Super;

noted? remaining selling amounts are fixed.

A. I only.

B. II only.

Hanep wants to drop the Regular product line. If the line is dropped,

C. III only. company-wide fixed manufacturing costs would fall by 10% because

D. I and II. there is no alternative use of the facilities.

E. II and III.

2. What would be the increase (decrease) in operating income if

4. The book value of equipment currently owned by a company is an Regular is discontinued?

example of a(n):

A. future cost. ($39,600)

B. differential cost.

C. comparative cost. 3. Disregard the information in the previous question. If Hanep

D. opportunity cost. eliminates Regular and uses the available capacity to produce and

E. sunk cost. sell an additional 1,500 units of Super, what would be the impact on

operating income?

5. The City of Miami is about to replace an old fire truck with a new

vehicle in an effort to save maintenance and other operating costs. $55,00 increase

Which of the following items, all related to the transaction, would

not be considered in the decision? 4. Tigre Corporation manufactures A and B from a joint process (cost

= P160,000). Five thousand pounds of A can be sold at split-off for

P40 per pound or processed further at an additional cost of P40,000

A. Purchase price of the new vehicle.

and then sold for P50. Ten thousand pounds of B can be sold at

B. Purchase price of the old vehicle.

split-off for P30 per pound or processed further at an additional cost

C. Savings in operating costs as a result of the new vehicle.

of P40,000 and later sold for P32. If Tigre decides to process B

D. Proceeds from disposal of the old vehicle. beyond the split-off point, how much is the increase (decrease) in

E. Future depreciation on the new vehicle. operating income?

6. An opportunity cost may be described as: (P20,000)

A. a forgone benefit.

B. an historical cost. 5. Pihikan Company which has experienced excess production

C. a specialized type of variable cost. capacity received a special offer for its product at P78 per unit for

D. a specialized type of fixed cost. 100,000 units. It has been using the variable costing method and

E. a specialized type of semi-variable cost. has been pricing its product at P96 per unit based on a mark-up of

60% as follows:

7. A special order generally should be accepted if: Direct Materials P30

A. its revenue exceeds allocated fixed costs, regardless of Direct Labor 20

Variable Overhead 6

Variable Selling and Administrative 4

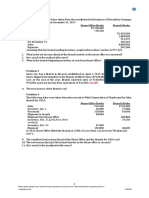

Total Variable Expenses P60 Sales $205,000

60% Mark-up 36 Cost of sales 67,900

Selling Price P96 Building occupancy costs:

Rent 36,500

Assuming that this special offer will not affect the market for the Utilities 15,000

product, should the company accept the special offer and how much Supplies used 5,600

is the increase (decrease) in net income if the special offer is Wages 77,700

accepted? Miscellaneous 2,400

Allocated corporate overhead 16,800

Yes, P1.8 million

All employees except the store manager would be discharged. The

6. Mael Industries, Inc. has an opportunity to acquire a new manager, who earns $27,000 annually, would be transferred to store

equipment to replace one of its existing equipments. The new no. 8 in a neighboring city. Also, no. 7's furnishings and equipment

equipment would cause P900,000 and has a five-year useful life, are fully depreciated and would be removed and transported to Papa

with a zero terminal disposal price. Variable operating costs would Fred's warehouse at a cost of $2,800.

be P1 million per year. The present equipment has a book value of

P500,000 and a remaining life of five years. It’s disposal price now is Should the store no. 7 be closed and how much is the increase

P50,000 but would be zero after five years. Variable operating costs (decrease) in net income if it will be closed?

would be P1,250,000 per year. Considering the five years in total but

ignoring the time value of money, should Mael replace or not replace No, decrease of $29,700

the old equipment and how much is the net advantage

(disadvantage) of replacing the old equipment? ** End of Quiz **

Replace, P400,000 advantage

7. Gawgaw Industries is a multi product company that currently “For we brought nothing into this world, and it is certain

manufactures 30,000 units of Part 143V each month for use in we can carry nothing out.” - 1 Timothy 6:7-8

production. The facilities now being used to produce Part 143V have

a fixed cost of P150,000 and a capacity to produce 84,000 units per

month. If Gawgaw were to buy Part 143V from an outside supplier,

the facilities would be idle, but it’s fixed costs would continue at 40%

of their present amount. The variable production costs of Part 143V

are P11 per unit. If Gawgaw Industries is able to obtain Part 143V

from an outside supplier at a unit price of P12.875, what is the

monthly usage at which it will be indifferent between purchasing and

making Part 143V?

48,000 units

For Nos. 8 – 9

Howard Robinson builds custom homes in Cincinnati. Robinson was

approached not too long ago by a client about a potential project,

and he submitted a bid of $483,800, derived as follows:

Land $ 80,000

Construction materials 100,000

Subcontractor labor costs 120,000

$300,000

Construction overhead: 25% of 75,000

direct costs

Allocated corporate overhead 35,000

Total cost $410,000

Robinson adds an 18% profit margin to all jobs, computed on the

basis of total cost. In this client's case the profit margin amounted to

$73,800 ($410,000 x 18%), producing a bid price of $483,800.

Assume that 70% of construction overhead is fixed.

8. Suppose that business is presently very slow, and the client

countered with an offer on this home of $390,000. Should Robinson

accept the client's offer and how much is the increase (decrease) in

operating income if accepted?

Yes, increase of $67,500

9. If Robinson has more business than he can handle, how much

should he be willing to accept for the home?

$483,800

10. Bush Manufacturing has 31,000 labor hours available for

producing M and N. Consider the following information:

Product M Product N

Required labor time per unit (hours) 2 3

Maximum demand (units) 6,500 8,000

Contribution margin per unit P50 P57

Contribution margin P25 P19

per labor hour

If Bush follows proper managerial accounting practices in terms of

setting a production schedule, how much contribution margin would

the company expect to generate?

P667,000

11. Papa Fred's Pizza store no. 7 has fallen on hard times and is

about to be closed. The following figures are available for the period

just ended:

Das könnte Ihnen auch gefallen

- Perez Long Quiz Auditing and Assurance Concepts and ApplicationDokument7 SeitenPerez Long Quiz Auditing and Assurance Concepts and ApplicationMitch MinglanaNoch keine Bewertungen

- Auditing Appplications PrelimsDokument5 SeitenAuditing Appplications Prelimsnicole bancoroNoch keine Bewertungen

- HB Quiz 2018-2021Dokument3 SeitenHB Quiz 2018-2021Allyssa Kassandra LucesNoch keine Bewertungen

- Jun Zen Ralph Yap BSA - 3 Year Let's CheckDokument2 SeitenJun Zen Ralph Yap BSA - 3 Year Let's CheckJunzen Ralph Yap100% (1)

- Pinnacle in House CPA Review Tuition Fee UpdatedDokument1 SeitePinnacle in House CPA Review Tuition Fee UpdatedRaRa SantiagoNoch keine Bewertungen

- Cost 2 - Quiz5 PDFDokument7 SeitenCost 2 - Quiz5 PDFshengNoch keine Bewertungen

- Module 5&6Dokument29 SeitenModule 5&6Lee DokyeomNoch keine Bewertungen

- EXAM About INTANGIBLE ASSETS 2Dokument3 SeitenEXAM About INTANGIBLE ASSETS 2BLACKPINKLisaRoseJisooJennieNoch keine Bewertungen

- ACCOUNTING FOR SPECIAL TRANSACTIONS Final ExamDokument8 SeitenACCOUNTING FOR SPECIAL TRANSACTIONS Final ExamMariefel OrdanezNoch keine Bewertungen

- Accounting For Liabilities Part 1Dokument5 SeitenAccounting For Liabilities Part 1방탄트와이스 짱Noch keine Bewertungen

- Colegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityDokument5 SeitenColegio de La Purisima Concepcion: School of The Archdiocese of Capiz Roxas CityJhomel Domingo GalvezNoch keine Bewertungen

- Cordillera Career Development College Income Taxation Final Examination InstructionDokument7 SeitenCordillera Career Development College Income Taxation Final Examination InstructionRoldan Hiano Manganip0% (1)

- Sycip Gorres Velayo & Co.: HistoryDokument5 SeitenSycip Gorres Velayo & Co.: HistoryYonko ManotaNoch keine Bewertungen

- Finals Quiz 2 Buscom Version 2Dokument3 SeitenFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNoch keine Bewertungen

- Related Psas: Psa 700, 710, 720, 560, 570,: Auditing TheoryDokument13 SeitenRelated Psas: Psa 700, 710, 720, 560, 570,: Auditing TheoryMay RamosNoch keine Bewertungen

- Acai Chapter 17 QuestionnairesDokument5 SeitenAcai Chapter 17 QuestionnairesKathleenCusipagNoch keine Bewertungen

- Dayag Notes Partnership DissolutionDokument3 SeitenDayag Notes Partnership DissolutionGirl Lang AkoNoch keine Bewertungen

- Performance Measurement To Support Business Strategy: True / False QuestionsDokument149 SeitenPerformance Measurement To Support Business Strategy: True / False QuestionsElaine GimarinoNoch keine Bewertungen

- Practice Problems Corporate LiquidationDokument2 SeitenPractice Problems Corporate LiquidationAllira OrcajadaNoch keine Bewertungen

- AC 3101 Discussion ProblemDokument1 SeiteAC 3101 Discussion ProblemYohann Leonard HuanNoch keine Bewertungen

- Chapter 16 AnsDokument7 SeitenChapter 16 AnsDave Manalo100% (5)

- Assignment 7 1Dokument1 SeiteAssignment 7 1Eilen Joyce BisnarNoch keine Bewertungen

- CE On Agriculture T1 AY2020-2021Dokument2 SeitenCE On Agriculture T1 AY2020-2021Luna MeowNoch keine Bewertungen

- Forex ProblemDokument3 SeitenForex ProblemJAMES SANGARIOSNoch keine Bewertungen

- 3 4Dokument5 Seiten3 4RenNoch keine Bewertungen

- Morales, Jonalyn M.Dokument7 SeitenMorales, Jonalyn M.Jonalyn MoralesNoch keine Bewertungen

- Assessment Activities Module 1: Intanible AssetsDokument16 SeitenAssessment Activities Module 1: Intanible Assetsaj dumpNoch keine Bewertungen

- Sales Chapter 13 Part II REPORTDokument50 SeitenSales Chapter 13 Part II REPORTJeane Mae BooNoch keine Bewertungen

- Practical Accounting 1 First Pre-Board ExaminationDokument14 SeitenPractical Accounting 1 First Pre-Board ExaminationKaren EloisseNoch keine Bewertungen

- Buscom Quiz 2 MidtermDokument2 SeitenBuscom Quiz 2 MidtermRafael Capunpon VallejosNoch keine Bewertungen

- CMPC131Dokument15 SeitenCMPC131Nhel AlvaroNoch keine Bewertungen

- Solution Chapter 6Dokument10 SeitenSolution Chapter 6Clarize R. MabiogNoch keine Bewertungen

- Practice Final PB PartialDokument25 SeitenPractice Final PB PartialBenedict BoacNoch keine Bewertungen

- Define Fraud, and Explain The Two Types of Misstatements That Are Relevant To Auditors' Consideration of FraudDokument3 SeitenDefine Fraud, and Explain The Two Types of Misstatements That Are Relevant To Auditors' Consideration of FraudSomething ChicNoch keine Bewertungen

- 5134649879operating Segment FinalDokument8 Seiten5134649879operating Segment FinalGlen JavellanaNoch keine Bewertungen

- Quiz On Audit Report and DocumentationDokument6 SeitenQuiz On Audit Report and DocumentationTrisha Mae AlburoNoch keine Bewertungen

- Mas Drills Weeks 1 5Dokument28 SeitenMas Drills Weeks 1 5Hermz ComzNoch keine Bewertungen

- A Government Employee May Claim The Tax InformerDokument3 SeitenA Government Employee May Claim The Tax InformerYuno NanaseNoch keine Bewertungen

- Operating Segment StudentsDokument4 SeitenOperating Segment StudentsAG VenturesNoch keine Bewertungen

- Coursehero 12Dokument2 SeitenCoursehero 12nhbNoch keine Bewertungen

- Taxation Final Preboard CPAR 92 PDFDokument17 SeitenTaxation Final Preboard CPAR 92 PDFomer 2 gerdNoch keine Bewertungen

- Chapter 13 Audit of Long LiDokument37 SeitenChapter 13 Audit of Long LiKaren Balibalos100% (1)

- Unit 1 Audit of Property PLant and EquipmentDokument5 SeitenUnit 1 Audit of Property PLant and EquipmentJustin SolanoNoch keine Bewertungen

- Audit of InvestmentsDokument3 SeitenAudit of InvestmentsJasmine Marie Ng Cheong50% (2)

- Auditing Problems SOLUTION v.1 - 2018Dokument12 SeitenAuditing Problems SOLUTION v.1 - 2018Ramainne RonquilloNoch keine Bewertungen

- AFAR Question PDFDokument16 SeitenAFAR Question PDFNhel AlvaroNoch keine Bewertungen

- Auditing Theories and Problems Quiz WEEK 2Dokument16 SeitenAuditing Theories and Problems Quiz WEEK 2Van MateoNoch keine Bewertungen

- AUD CIS CH 1-6Dokument25 SeitenAUD CIS CH 1-6Bela BellsNoch keine Bewertungen

- Activity #1Dokument5 SeitenActivity #1Lyka Nicole DoradoNoch keine Bewertungen

- Chapter 4 Multiple ChoicesDokument11 SeitenChapter 4 Multiple ChoicesAurcus JumskieNoch keine Bewertungen

- Consolidated Statement Formula02 PDFDokument3 SeitenConsolidated Statement Formula02 PDFNiña Rica PunzalanNoch keine Bewertungen

- BUSCOM ActivityDokument14 SeitenBUSCOM ActivityLerma MarianoNoch keine Bewertungen

- Exercise 2 Estate Tax pt1.5Dokument4 SeitenExercise 2 Estate Tax pt1.5Maristella GatonNoch keine Bewertungen

- Audit of Receivable Wit Ans KeyDokument19 SeitenAudit of Receivable Wit Ans Keyalexis pradaNoch keine Bewertungen

- Consolidated Net IncomeDokument1 SeiteConsolidated Net IncomePJ PoliranNoch keine Bewertungen

- Finma Group 5 Capital Budgeting - Part 1-12-14Dokument4 SeitenFinma Group 5 Capital Budgeting - Part 1-12-14jovibonNoch keine Bewertungen

- PDF Rq1 With AnswersDokument9 SeitenPDF Rq1 With AnswersCaleb GetubigNoch keine Bewertungen

- Deptals ActDokument10 SeitenDeptals ActGenalin Muaña EbonNoch keine Bewertungen

- Relevant Costing ReviewerDokument4 SeitenRelevant Costing Reviewerdaniellejueco1228Noch keine Bewertungen

- Quiz - Relevant CostingDokument2 SeitenQuiz - Relevant CostingLing ApatanNoch keine Bewertungen

- Beauty Products Available InsideDokument2 SeitenBeauty Products Available InsideShawn OrganoNoch keine Bewertungen

- Color WheelDokument1 SeiteColor WheelShawn OrganoNoch keine Bewertungen

- Business Ethics (Shawn)Dokument2 SeitenBusiness Ethics (Shawn)Shawn OrganoNoch keine Bewertungen

- 2 Corporate GovernanceDokument23 Seiten2 Corporate GovernanceShawn OrganoNoch keine Bewertungen

- Final Exam Advance Accounting WADokument5 SeitenFinal Exam Advance Accounting WAShawn OrganoNoch keine Bewertungen

- What Is Governance PDFDokument3 SeitenWhat Is Governance PDFamirq4Noch keine Bewertungen

- 2nd MMBL QuizDokument3 Seiten2nd MMBL QuizShawn OrganoNoch keine Bewertungen

- SG Inquizitive 2018 ScorecardDokument1 SeiteSG Inquizitive 2018 ScorecardShawn OrganoNoch keine Bewertungen

- Art CritiqueDokument1 SeiteArt CritiqueShawn OrganoNoch keine Bewertungen

- 2nd MMBL QuizDokument3 Seiten2nd MMBL QuizShawn OrganoNoch keine Bewertungen

- The Input Tools Require Strategists To Quantify Subjectivity During Early Stages of The Strategy-Formulation ProcessDokument24 SeitenThe Input Tools Require Strategists To Quantify Subjectivity During Early Stages of The Strategy-Formulation ProcessHannah Ruth M. GarpaNoch keine Bewertungen

- Module 12. Worksheet - Hypothesis TestingDokument3 SeitenModule 12. Worksheet - Hypothesis TestingShauryaNoch keine Bewertungen

- Credit Card ConfigurationDokument5 SeitenCredit Card ConfigurationdaeyongNoch keine Bewertungen

- CH 07Dokument41 SeitenCH 07Mrk KhanNoch keine Bewertungen

- Payback PeriodDokument32 SeitenPayback Periodarif SazaliNoch keine Bewertungen

- Southspin FASHION AWARDS-Title SponsorDokument32 SeitenSouthspin FASHION AWARDS-Title SponsorManikanth Raja GNoch keine Bewertungen

- Black White and Teal Minimal Abstract Patterns Finance Report Finance PresentationDokument15 SeitenBlack White and Teal Minimal Abstract Patterns Finance Report Finance PresentationamirulNoch keine Bewertungen

- Alok Kumar Singh Section C WAC I 3Dokument7 SeitenAlok Kumar Singh Section C WAC I 3Alok SinghNoch keine Bewertungen

- Easyjet - A Marketing ProfileDokument28 SeitenEasyjet - A Marketing ProfilecharurastogiNoch keine Bewertungen

- Gujarat Technological University: Comprehensive Project ReportDokument32 SeitenGujarat Technological University: Comprehensive Project ReportDharmesh PatelNoch keine Bewertungen

- BSBMGT517 Manage Operational Plan Template V1.0619Dokument14 SeitenBSBMGT517 Manage Operational Plan Template V1.0619Edward AndreyNoch keine Bewertungen

- Strategic Management Nokia Case AnalysisDokument10 SeitenStrategic Management Nokia Case Analysisbtamilarasan88100% (1)

- Commonwealth Bank 2012 Annual ReportDokument346 SeitenCommonwealth Bank 2012 Annual ReportfebriaaaaNoch keine Bewertungen

- Convergence JournalismDokument34 SeitenConvergence Journalismali3800Noch keine Bewertungen

- Sample Club BudgetsDokument8 SeitenSample Club BudgetsDona KaitemNoch keine Bewertungen

- 2012 Towers Watson Global Workforce StudyDokument24 Seiten2012 Towers Watson Global Workforce StudySumit RoyNoch keine Bewertungen

- Ias 2Dokument29 SeitenIas 2MK RKNoch keine Bewertungen

- Coi D00387Dokument101 SeitenCoi D00387Fazila KhanNoch keine Bewertungen

- Icici BankDokument99 SeitenIcici BankAshutoshSharmaNoch keine Bewertungen

- Capstone Project Final Report - PatanjaliDokument60 SeitenCapstone Project Final Report - PatanjaliSharvarish Nandanwar0% (1)

- Part 3 Toeic WritingDokument33 SeitenPart 3 Toeic WritingNguyen Thi Kim ThoaNoch keine Bewertungen

- Antoine Cited Money LaunderingDokument74 SeitenAntoine Cited Money Launderingcorina_maria_eneNoch keine Bewertungen

- ACT NO. 2031 February 03, 1911 The Negotiable Instruments LawDokument14 SeitenACT NO. 2031 February 03, 1911 The Negotiable Instruments LawRichel Dean SolisNoch keine Bewertungen

- Mohamed Nada - Learn Pivot Tables in One Hour EbookDokument37 SeitenMohamed Nada - Learn Pivot Tables in One Hour EbookEjlm OtoNoch keine Bewertungen

- Investor PDFDokument3 SeitenInvestor PDFHAFEZ ALINoch keine Bewertungen

- 12 Key Result AreasDokument2 Seiten12 Key Result AreasMichelle Quiquino Foliente100% (4)

- Section 114-118Dokument8 SeitenSection 114-118ReiZen UelmanNoch keine Bewertungen

- Lessons 1 and 2 Review IBM Coursera TestDokument6 SeitenLessons 1 and 2 Review IBM Coursera TestNueNoch keine Bewertungen

- "Now 6000 Real-Time Screen Shots With Ten Country Payrolls With Real-Time SAP Blueprint" For Demo Click HereDokument98 Seiten"Now 6000 Real-Time Screen Shots With Ten Country Payrolls With Real-Time SAP Blueprint" For Demo Click Herevj_aeroNoch keine Bewertungen

- Timesheets and Laytime CalculationDokument14 SeitenTimesheets and Laytime CalculationJuan Alfaro100% (1)