Beruflich Dokumente

Kultur Dokumente

01 Installment Sales

Hochgeladen von

Patríck LouieCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

01 Installment Sales

Hochgeladen von

Patríck LouieCopyright:

Verfügbare Formate

1 bit.

ly/AFAR-POL-01

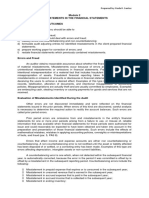

INSTALLMENT SALES

1. Under IAS 18, what is the measurement of sales revenue from

installment sales?

a. Book value of the consideration received or receivable

b. Fair value of the consideration received or receivable

c. Cost of the consideration received or receivable

d. Carrying amount of the consideration received or receivable

2. Under IAS 18, if the company receives long-term non-interest

bearing note receivable as consideration for the sale of its

inventories on an installment basis, what is the measurement of

sales revenue from installment sales?

a. Face value of the note receivable

b. Maturity value of the note receivable

c. Present value of the note receivable

d. Undiscounted value of the note receivable

3. How shall the difference between the fair value and nominal amount

of the long-term note received as consideration in an installment

sale be accounted for?

a. It shall be recognized as expense on the date of sale.

b. It shall be recognized as gain on exchange on the date of sale.

c. It shall be recognized as interest revenue over the term of the

note using effective interest method.

d. It shall be recognized as interest revenue over the term of the

note using straight line method.

4. In an installment sales, if the collection of the note receivable

is not remote and not reasonably assured, how shall the gross profit

be recognized?

a. It shall be fully recognized on the date of sale using accrual

basis.

b. It shall be recognized in proportion to the amount of collection

under installment method.

c. It shall not be recognized.

d. It shall be recognized fully only on the year the receivable

is completely collected.

5. Under generally accepted accounting principles, what is the proper

presentation of deferred gross profit from installment sales?

a. It shall be presented as current liability.

b. It shall be presented as equity.

c. It shall be presented as deferred revenue.

d. It shall be presented as contra-installment receivable account.

6. If the fair value of the repossessed inventory cannot be estimated

reliably at the date of repossession, what shall be the basis of

initial measurement of repossessed inventory?

a. Estimated selling price less reconditioning costs less costs

to sell

b. Estimated selling price less reconditioning costs

c. Estimated selling price less costs to sell

d. Estimated selling price less reconditioning costs less costs

to sell less normal profit

COMPILED BY: PATRICK LOUIE E. REYES, CTT, MICB, RCA, CPA

2 bit.ly/AFAR-POL-01

7. If the initial measurement of repossessed inventory is lower than

the net of defaulted installment receivable and its corresponding

deferred gross profit, the difference shall be recognized as

a. Loss on repossession to be presented as part of income from

continuing operation before tax

b. Deferred loss on repossession to be presented as current asset

c. Gain on repossession to be presented as part of other

comprehensive income

d. Deferred gain on repossession to be presented as current

liability

Item 8

The ABC Company recognizes profit on credit sales on installment basis.

At the end of 2021, before the accounts are adjusted, the ledger shows

the following:

Installment Accounts Receivable 2020 337,500

Installment Accounts Receivable 2021 525,000

Deferred Gross Profit 2020 185,000

Deferred Gross Profit 2021 272,500

Regular Sales 1,500,000

Cost of Regular Sales 960,000

Each year, the gross profit on installment sales was 8% lower than the

regular sales. In 2021, the gross profit on installment sales was 4%

higher than 2020.

8. How much is the total realized gross profit in 2021?

a. 229,500

b. 769,500

c. 181,000

d. 721,000

Items 9 and 10

Appliance Company reports gross profit on the installment basis. The

following data are available:

2018 2019 2020

Installment Sales 240,000 250,000 300,000

Cost of goods – installment sales 180,000 181,250 216,000

Gross profit 60,000 68,750 84,000

Collections

2018 installment contracts 45,000 75,000 72,500

2019 installment contracts 47,500 80,000

2020 installment contracts 62,500

Defaults

Unpaid balance of 2018 installment contracts 12,500 15,000

Value assigned to repossessed merchandise 6,500 6,000

Unpaid balance of 2019 installment contracts 16,000

Value assigned to repossessed merchandise 9,000

9. What is the realized gross profit before loss on repossession for

2020?

a. 49,775

b. 57,625

c. 48,975

d. 56,625

COMPILED BY: PATRICK LOUIE E. REYES, CTT, MICB, RCA, CPA

3 bit.ly/AFAR-POL-01

10. What is the loss on repossession for 2020

a. 5,250

b. 2,600

c. 7,850

d. 9,000

Item 11

Davao Company uses the installment method of income recognition. The

entity provided the following pertinent data:

2018 2019 2020

Installment sales 300,000 375,000 360,000

Cost of goods sold 225,000 285,000 252,000

Balance of Deferred Gross Profit at year-end

2018 52,500 15,000 -

2019 54,000 9,000

2020 72,000

11. What is the total balance of the Installment Accounts Receivable

on December 31, 2020?

a. 270,000

b. 277,500

c. 279,000

d. 300,000

Item 12

Nikko Company, which began operations on January 5, 2018, appropriately

uses the installment method of revenue recognition. The following

information pertains to the operations for 2018 and 2019:

2018 2019

Sales 300,000 450,000

Collections from

2018 sales 100,000 50,000

2019 sales - 150,000

Accounts written off from

2018 sales 25,000 75,000

2019 sales - 150,000

Gross profit rates 30% 40%

12. What amount should be reported as deferred gross profit on December

31, 2019?

a. 75,000

b. 80,000

c. 112,000

d. 125,000

Item 13

On November 1, 2020, Speed Motor, which maintains a perpetual inventory

record, sold a new automobile to Rapids for P6,800,000. The cost of the

car to the seller was P5,205,000.

The buyer paid 30% down payment and received P640,000 allowance on an

old car traded, the balance being payable in equal monthly installment

payments commencing the month of sale.

The monthly amortization was P240,000 inclusive of 12% interest on the

unpaid amount of the obligation.

COMPILED BY: PATRICK LOUIE E. REYES, CTT, MICB, RCA, CPA

4 bit.ly/AFAR-POL-01

The car traded-in has a wholesale value of P960,000 after expending

reconditioning costs of P180,000.

After paying three installments, the buyer defaulted and the car was

subsequently repossessed. When reacquired, the car was appraised to have

a fair value of P2,400,000.

13. How much is the realized gross profit on installment sales during

2020?

a. 820,596

b. 855,596

c. 885,000

d. 804,897

Items 14 and 15

On January 1, 2018, an entity sold a car to a customer at a price of

P400,000 with a production cost of P300,000. It is the entity’s policy

to employ installment method to recognize gross profit from installment

sales.

At the time of sale, the entity received cash amounting to 25% of the

selling price and old car with trade-in allowance of P50,000. The said

old car has fair value of P150,000. The customer issued a 5-year note

for the balance to be payable in equal annual installments every December

31 starting 2018. The note payable is interest-bearing with 10% rate due

on the remaining balance of the note.

The customer was able to pay the first annual installment and

corresponding interest due. However, after the payment of the second

interest due, the customer defaulted on the second annual installment

which resulted to the repossession of the car sold with appraised value

of P110,000. On December 31, 2019, the repossessed car was resold for

140,000 after reconditioning cost of P10,000.

14. What is the entity’s realized gross profit for the year ended

December 31, 2018?

a. 50,000

b. 120,000

c. 108,000

d. 128,000

15. What is the loss on repossession for the year ended December 31,

2019?

a. 30,000

b. 20,000

c. 10,000

d. 40,000

COMPILED BY: PATRICK LOUIE E. REYES, CTT, MICB, RCA, CPA

5 bit.ly/AFAR-POL-01

Items 16 and 17

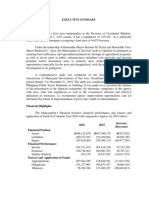

The chief accountant of Sony Appliances, Inc. provided the following

balances from its unadjusted trial balance for the year ended December

31, 2023:

01/01/2023 12/31/2023

Installment receivable – 2021 contract P 2,000,000 P 500,000

Installment receivable – 2022 contract 3,000,000 1,000,000

Installment receivable – 2023 contract 5,000,000

Deferred gross profit – 2021 contract 800,000

Deferred gross profit 2022 contract 1,800,000

New inventory 200,000 300,000

Net purchases (excluding freight-in) 5,000,000

Freight-in 100,000

Cash sales for the year 2023 2,000,000

Installment sales for the year 2023 8,000,000

The following additional notes are provided for the year ended December

31, 2023:

The gross profit rate for 2023 installment sales is the average of

previous years’ gross profit rate on installment sales.

On July 1, 2023, Sony wrote off 2021 installment receivable with

account balance of P300,000 because of the bankruptcy of the

customer. Sony records its impairment loss of installment

receivable using the direct write off method.

On October 1, 2023, a 2022 contract customer defaulted on the

installment due which resulted to repossession of the inventory

with fair value of P100,000. The defaulted account has a balance

of P600,000.

On November 1, 2023, the repossessed inventory was sold at a cash

price of P150,000 after reconditioning it at a cost of P20,000.

The sale of repossessed inventory is not yet reflected on the cash

sales stated above.

The total operating expenses, exclusive of impairment loss and loss

on repossession, of Sony for the year ended December 31, 2023

amount to P400,000.

16. What is the net income to be reported by Sony, Inc. for the year

ended December 31, 2023?

a. 2,840,000

b. 3,130,000

c. 3,520,000

d. 2,980,000

17. What is the total adjusted deferred gross profit as of December

31, 2023, respectively?

a. 3,200,000

b. 3,300,000

c. 3,100,000

d. 3,400,000

COMPILED BY: PATRICK LOUIE E. REYES, CTT, MICB, RCA, CPA

Das könnte Ihnen auch gefallen

- Installment ExercisesDokument2 SeitenInstallment ExercisesalyssaNoch keine Bewertungen

- Partnership Formation and OperationDokument12 SeitenPartnership Formation and OperationDevine Grace A. MaghinayNoch keine Bewertungen

- Seatwork - Advacc1Dokument2 SeitenSeatwork - Advacc1David DavidNoch keine Bewertungen

- NU - Correction of Errors Single Entry Cash To AccrualDokument8 SeitenNU - Correction of Errors Single Entry Cash To AccrualJem ValmonteNoch keine Bewertungen

- PAS 11: Long-term construction contractsDokument5 SeitenPAS 11: Long-term construction contractsLester John Mendi0% (1)

- Benjo Lopez CoDokument2 SeitenBenjo Lopez Conovy0% (1)

- LongTermConstructionContractsDokument2 SeitenLongTermConstructionContractsRes GosanNoch keine Bewertungen

- MODULE 2 CVP AnalysisDokument8 SeitenMODULE 2 CVP Analysissharielles /Noch keine Bewertungen

- Pre Week NewDokument30 SeitenPre Week NewAnonymous wDganZNoch keine Bewertungen

- Dr. Lee's patient service revenue calculation under accrual basisDokument6 SeitenDr. Lee's patient service revenue calculation under accrual basisAndrea Lyn Salonga CacayNoch keine Bewertungen

- ATDokument15 SeitenATSamanthaNoch keine Bewertungen

- DLSA AP Intangibles For DistributionDokument7 SeitenDLSA AP Intangibles For DistributionJan Renee EpinoNoch keine Bewertungen

- MA2E Relevant Cost ExercisesDokument6 SeitenMA2E Relevant Cost ExercisesRolan PalquiranNoch keine Bewertungen

- CMPC312 QuizDokument19 SeitenCMPC312 QuizNicole ViernesNoch keine Bewertungen

- An SME Prepared The Following Post Closing Trial Balance at YearDokument1 SeiteAn SME Prepared The Following Post Closing Trial Balance at YearRaca DesuNoch keine Bewertungen

- 1 - Installment Sales Accounting - Docx, Francise, Constarction ContractDokument8 Seiten1 - Installment Sales Accounting - Docx, Francise, Constarction ContractJason BautistaNoch keine Bewertungen

- Problem 17-1, ContinuedDokument6 SeitenProblem 17-1, ContinuedJohn Carlo D MedallaNoch keine Bewertungen

- Chapter 09Dokument16 SeitenChapter 09FireBNoch keine Bewertungen

- AFAR - Revenue Recognition, JointDokument3 SeitenAFAR - Revenue Recognition, JointJoanna Rose DeciarNoch keine Bewertungen

- Consignment Accounting EntriesDokument9 SeitenConsignment Accounting EntriesAnjo Amiel SantosNoch keine Bewertungen

- StratCost CVP 1Dokument65 SeitenStratCost CVP 1Vrix Ace MangilitNoch keine Bewertungen

- Central Plain University income tax calculationDokument3 SeitenCentral Plain University income tax calculationLFGS Finals0% (1)

- REVENUE RECOGNITION LONG TERM CONSTRUCTIONDokument4 SeitenREVENUE RECOGNITION LONG TERM CONSTRUCTIONCee Gee BeeNoch keine Bewertungen

- Hakdog PDFDokument18 SeitenHakdog PDFJay Mark AbellarNoch keine Bewertungen

- Installment Sales DayagDokument11 SeitenInstallment Sales DayagJAP100% (1)

- Assignment Transfer Tax ComputationDokument3 SeitenAssignment Transfer Tax ComputationAngelyn SamandeNoch keine Bewertungen

- Sol Q3Dokument4 SeitenSol Q3hanaNoch keine Bewertungen

- Franchise Accounting FundamentalsDokument24 SeitenFranchise Accounting FundamentalsJao FloresNoch keine Bewertungen

- Sample Midterm PDFDokument9 SeitenSample Midterm PDFErrell D. GomezNoch keine Bewertungen

- Auditing Problems1Dokument45 SeitenAuditing Problems1Ronnel TagalogonNoch keine Bewertungen

- Reporting Segment InformationDokument8 SeitenReporting Segment InformationGlen JavellanaNoch keine Bewertungen

- Chapter 11-Investments in Noncurrent Operating Assets-Utilization and RetirementDokument33 SeitenChapter 11-Investments in Noncurrent Operating Assets-Utilization and RetirementYukiNoch keine Bewertungen

- Past CPA Board On MASDokument5 SeitenPast CPA Board On MASzee abadillaNoch keine Bewertungen

- 2nd Quizzer 1st Sem SY 2020-2021 - AKDokument6 Seiten2nd Quizzer 1st Sem SY 2020-2021 - AKMitzi WamarNoch keine Bewertungen

- Baggayao WACC PDFDokument7 SeitenBaggayao WACC PDFMark John Ortile BrusasNoch keine Bewertungen

- FAR-04 Share Based PaymentsDokument3 SeitenFAR-04 Share Based PaymentsKim Cristian Maaño0% (1)

- Tactical DecisionDokument2 SeitenTactical DecisionLovely Del MundoNoch keine Bewertungen

- MAS Product Costing Part IDokument2 SeitenMAS Product Costing Part IMary Dale Joie BocalaNoch keine Bewertungen

- JV ProbDokument3 SeitenJV ProbShara ValleserNoch keine Bewertungen

- Seatwork in Audit 2-3Dokument8 SeitenSeatwork in Audit 2-3Shr BnNoch keine Bewertungen

- Section 19 Business Combination and Goodwill 1Dokument17 SeitenSection 19 Business Combination and Goodwill 1AdrianneNoch keine Bewertungen

- CKCFinanceLeaseQuizDokument2 SeitenCKCFinanceLeaseQuizMannuelle GacudNoch keine Bewertungen

- ACC16 - HO 2 Installment Sales 11172014Dokument7 SeitenACC16 - HO 2 Installment Sales 11172014Marvin James Cho0% (2)

- Advanced Accounting Drill ProblemsDokument6 SeitenAdvanced Accounting Drill ProblemsiajycNoch keine Bewertungen

- (AP) 05 InvestmentsDokument6 Seiten(AP) 05 InvestmentsCykee Hanna Quizo LumongsodNoch keine Bewertungen

- Translation of FC FSDokument5 SeitenTranslation of FC FSDeo CoronaNoch keine Bewertungen

- Installment Sales Problems Solutions 2021-2022Dokument44 SeitenInstallment Sales Problems Solutions 2021-2022Roland CatubigNoch keine Bewertungen

- FinAcc 1 Quiz 6Dokument10 SeitenFinAcc 1 Quiz 6Kimbol Calingayan100% (1)

- Quiz - Act 07A: I. Theories: ProblemsDokument2 SeitenQuiz - Act 07A: I. Theories: ProblemsShawn Organo0% (1)

- CL Cup 2018 (AUD, TAX, RFBT)Dokument4 SeitenCL Cup 2018 (AUD, TAX, RFBT)sophiaNoch keine Bewertungen

- ACELEC 331 MIDTERM EXAM MCQs and ProblemsDokument7 SeitenACELEC 331 MIDTERM EXAM MCQs and Problemshwo0% (1)

- Construction Contract Percentage Completion QuizDokument4 SeitenConstruction Contract Percentage Completion QuizJason GubatanNoch keine Bewertungen

- Partnership Accounting QuestionsDokument15 SeitenPartnership Accounting QuestionsNhel AlvaroNoch keine Bewertungen

- Installment Sales (1) aDVACDokument28 SeitenInstallment Sales (1) aDVACAdrian Roxas100% (2)

- Midterm - Set ADokument8 SeitenMidterm - Set ACamille GarciaNoch keine Bewertungen

- Module 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSDokument7 SeitenModule 2 MISSTATEMENTS IN THE FINANCIAL STATEMENTSNiño Mendoza MabatoNoch keine Bewertungen

- Sol Man - MC PTXDokument5 SeitenSol Man - MC PTXiamjan_101Noch keine Bewertungen

- Instalment DISDokument4 SeitenInstalment DISRenelyn David100% (1)

- 8908 - Installment Consignment SalesDokument5 Seiten8908 - Installment Consignment Salesxara mizpahNoch keine Bewertungen

- 8506 - Installment Sales - 113910598Dokument4 Seiten8506 - Installment Sales - 113910598Ryan CornistaNoch keine Bewertungen

- Correct Answer Answer Correct Answer Correct AnswerDokument3 SeitenCorrect Answer Answer Correct Answer Correct AnswerPatríck LouieNoch keine Bewertungen

- Philsat April 2019 Complete List of PassersDokument223 SeitenPhilsat April 2019 Complete List of PassersBuknoy PinedaNoch keine Bewertungen

- Brief History of the ChurchDokument52 SeitenBrief History of the ChurchPatríck LouieNoch keine Bewertungen

- IA 3 - BVPS and EPS - SolutionsDokument22 SeitenIA 3 - BVPS and EPS - SolutionsPatríck LouieNoch keine Bewertungen

- SanJose OccMdo ES2016Dokument8 SeitenSanJose OccMdo ES2016Patríck LouieNoch keine Bewertungen

- Laboratory Quality Management SystemDokument17 SeitenLaboratory Quality Management SystemPatríck LouieNoch keine Bewertungen

- Laboratory Quality Management SystemDokument17 SeitenLaboratory Quality Management SystemPatríck LouieNoch keine Bewertungen

- Candidates For S.Y. 2020-2021 Graduation Masteral: Master of EngineeringDokument4 SeitenCandidates For S.Y. 2020-2021 Graduation Masteral: Master of EngineeringPatríck LouieNoch keine Bewertungen

- Orca Share Media1620826805664 6798240354305244905Dokument2 SeitenOrca Share Media1620826805664 6798240354305244905Patríck LouieNoch keine Bewertungen

- Niña Cosmetics Description of Products To Be OfferedDokument3 SeitenNiña Cosmetics Description of Products To Be OfferedPatríck LouieNoch keine Bewertungen

- Orca Share Media1620826805664 6798240354305244905Dokument2 SeitenOrca Share Media1620826805664 6798240354305244905Patríck LouieNoch keine Bewertungen

- Tax DecDokument3 SeitenTax DecPatríck LouieNoch keine Bewertungen

- Orca Share Media1620826805664 6798240354305244905Dokument2 SeitenOrca Share Media1620826805664 6798240354305244905Patríck LouieNoch keine Bewertungen

- Orca Share Media1620826805664 6798240354305244905Dokument2 SeitenOrca Share Media1620826805664 6798240354305244905Patríck LouieNoch keine Bewertungen

- Resource Material on Crime Prevention in the 21st CenturyDokument255 SeitenResource Material on Crime Prevention in the 21st CenturyPatríck LouieNoch keine Bewertungen

- QC 00010Dokument32 SeitenQC 00010Patríck LouieNoch keine Bewertungen

- Auditing Theory Comprehensive ReviewerDokument37 SeitenAuditing Theory Comprehensive ReviewerElaine ALdovinoNoch keine Bewertungen

- Correction of Error PDFDokument1 SeiteCorrection of Error PDFPatríck LouieNoch keine Bewertungen

- AASC Aud Case Study CompetitionDokument4 SeitenAASC Aud Case Study CompetitionJaymee Andomang Os-agNoch keine Bewertungen

- Guidelines For SBAA Debate Cup 2015Dokument3 SeitenGuidelines For SBAA Debate Cup 2015Patríck LouieNoch keine Bewertungen

- SanJose OccMdo ES2016Dokument8 SeitenSanJose OccMdo ES2016Patríck LouieNoch keine Bewertungen

- Epson Inkjet Printers: Printers & Cartridges Compatibility ChartDokument3 SeitenEpson Inkjet Printers: Printers & Cartridges Compatibility ChartAlberto VelascoNoch keine Bewertungen

- 2014 Civil Service Exam CalendarDokument1 Seite2014 Civil Service Exam CalendarpurpletagNoch keine Bewertungen

- 1Dokument2 Seiten1Patríck LouieNoch keine Bewertungen

- Philippines Code of ConductDokument31 SeitenPhilippines Code of Conductjadestopa100% (1)

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Law+107 Credit Reviewer DigestsDokument22 SeitenLaw+107 Credit Reviewer DigestsPatríck LouieNoch keine Bewertungen

- Accounting For Consigned GoodsDokument6 SeitenAccounting For Consigned GoodsHumphrey OdchigueNoch keine Bewertungen

- Reimers Finacct03 Sm04Dokument46 SeitenReimers Finacct03 Sm04Maxime HinnekensNoch keine Bewertungen

- Ae 15 Intermediate Accounting 1: (Problem 2-1 Ia 1 2019 Edition)Dokument4 SeitenAe 15 Intermediate Accounting 1: (Problem 2-1 Ia 1 2019 Edition)Mae Ann RaquinNoch keine Bewertungen

- Chapter 8 Question Review SolutionsDokument13 SeitenChapter 8 Question Review SolutionsCris ComisarioNoch keine Bewertungen

- Chapter 02 - Basic Financial StatementsDokument111 SeitenChapter 02 - Basic Financial Statementsyujia ZhaiNoch keine Bewertungen

- Trial BalanceDokument12 SeitenTrial BalanceMarieNoch keine Bewertungen

- UJIAN AKHIR SEMESTER-pengantar Ilmu AkuntansiDokument4 SeitenUJIAN AKHIR SEMESTER-pengantar Ilmu AkuntansiFEB UNWIMNoch keine Bewertungen

- Summary Acctg 320Dokument3 SeitenSummary Acctg 320Cj ReyesNoch keine Bewertungen

- A. 3c PROBLEM 13Dokument4 SeitenA. 3c PROBLEM 13shuzoNoch keine Bewertungen

- Study of Working Capital On Pepsico.Dokument31 SeitenStudy of Working Capital On Pepsico.Harsh Vardhan50% (2)

- Epicor IScala Financial Highlights FS ENSDokument4 SeitenEpicor IScala Financial Highlights FS ENSMalikNoch keine Bewertungen

- Week 14: Fundamentals of Financial Accounting (FFA)Dokument10 SeitenWeek 14: Fundamentals of Financial Accounting (FFA)DaddyNoch keine Bewertungen

- Updated Audit ChecklistDokument119 SeitenUpdated Audit ChecklistRafi PratamaNoch keine Bewertungen

- 2G - KPI - Peak 3072012 - 85040 - AMDokument316 Seiten2G - KPI - Peak 3072012 - 85040 - AMduchthangNoch keine Bewertungen

- 11 - Working Capital ManagementDokument39 Seiten11 - Working Capital Managementrajeshkandel345Noch keine Bewertungen

- Chapter 7 Internal Control Over CashDokument39 SeitenChapter 7 Internal Control Over Cashtrangalc123Noch keine Bewertungen

- Ch03 SM 9eDokument156 SeitenCh03 SM 9ekmmkmNoch keine Bewertungen

- Canvass Ia QuizDokument32 SeitenCanvass Ia QuizLhowellaAquinoNoch keine Bewertungen

- MGT101 Midterm Past PaperDokument117 SeitenMGT101 Midterm Past PaperKinza LaiqatNoch keine Bewertungen

- Accounting For Business TransactionsDokument8 SeitenAccounting For Business TransactionsKez Max100% (1)

- Intermediate Exam Suggested Answers Dec 2015 Paper 5Dokument25 SeitenIntermediate Exam Suggested Answers Dec 2015 Paper 5Muhammed Nuz-hadNoch keine Bewertungen

- ch05 ReceivablesDokument51 Seitench05 ReceivableszedingelNoch keine Bewertungen

- Coca Cola Project ReportDokument38 SeitenCoca Cola Project ReportBhawna KhandelwalNoch keine Bewertungen

- Dr. Reddys Laboratories LTD.: Company ProfileDokument18 SeitenDr. Reddys Laboratories LTD.: Company ProfileNIHAL KUMARNoch keine Bewertungen

- Financial ShenanigansDokument9 SeitenFinancial ShenaniganswansdfagNoch keine Bewertungen

- Answer Key To Related Multiple Choice Theory Questions:: D. None of TheseDokument81 SeitenAnswer Key To Related Multiple Choice Theory Questions:: D. None of TheseThird YearNoch keine Bewertungen

- Interview Questions On Oracle AR (Account Receivables)Dokument3 SeitenInterview Questions On Oracle AR (Account Receivables)sukruthstar100% (1)

- 2004 MMS Exam and KeyDokument35 Seiten2004 MMS Exam and KeyAnni ZhouNoch keine Bewertungen

- A1 Installment SalesDokument3 SeitenA1 Installment SalesMae0% (1)

- Book Solutions Ch2 To Ch11Dokument45 SeitenBook Solutions Ch2 To Ch11FayzanAhmedKhanNoch keine Bewertungen