Beruflich Dokumente

Kultur Dokumente

Problem Set 3 Financial Statements BS SE S18

Hochgeladen von

Nust RaziCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Problem Set 3 Financial Statements BS SE S18

Hochgeladen von

Nust RaziCopyright:

Verfügbare Formate

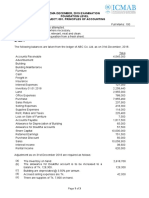

National University of Sciences and Technology

SEECS

BS (SE) 6AB

Problem Set 3

Date: 4th November 2018 Due Date:16th November 2018

Q1: Following is the pre-closing trial balance of ADM & Co on December 31st, 2003

Title of Account Debit Credit

Cash 10,000

Accounts Receivables 24,000

Merchandise Inventory (1-1-03) 20,000

Prepaid Insurance 8,000

Office Equipment 100,000

Allowance for Depreciation 20,000

Accounts Payables 16,000

Capital 104,600

Drawings 12,000

Sales 160,000

Sales Discount 8,000

Purchases 80,000

Purchases return and allowance 10,000

Transportation In 11,600

Advertisement Expense 17,000

Salaries Expense 20,000

310,600 310,600

Data for adjustments on December 31st, 2003

i) Insurance Expired Rs. 5000

ii) Allowance for depreciation on equipment Rs 4000

iii) Unpaid salaries Rs. 4000

iv) Advertisement prepaid Rs. 2400

v) Make allowance for doubtful debts at 10% of accounts receivables at the end of the year

vi) Merchandise inventory on December 31, 2003 Rs 30,000

Required

i) Prepare Income statement for the year ended Dec 31, 2003

ii) Prepare Balance sheet as on Dec 31, 2003

Q2. Following is the pre-closing trial balance of ARK & Co on December 31st, 2001

Title of Account Debit Credit

Cash 28,000

Accounts Receivables 43,200

Merchandise Inventory (1-1-03) 36,000

Prepaid Insurance 14,400

Office Equipment 180,000

Allowance for Depreciation 36,000

Accounts Payables 28,800

Capital 188,280

Drawings 21,600

Sales 288,000

Sales Discount 14,400

Purchases 144,000

Purchases return and allowance 18,000

Transportation In 20,880

Advertisement Expense 30,600

Salaries Expense 36,000

Commission Income 10,000

569,080 569,080

Data for adjustments on December 31st, 2003

i) Insurance unexpired Rs. 5400

ii) Allowance for depreciation on equipment Rs 7200

iii) Accrued salaries Rs. 4000

iv) Advertisement expense for the year was Rs. 26280

v) Make allowance for doubtful debts at 10% of accounts receivables at the end of the year

vi) Merchandise inventory on December 31, 2003 Rs 54,000

vii) Commission income for the year was Rs. 7000 and accrued commission income was

Rs 8500

Required

i) Prepare Income statement for the year ended Dec 31, 2001

ii) Prepare Balance sheet as on Dec 31, 2001

Q3. Following is the pre-closing trial balance of BMQ & Company on June 30th , 2007

Title of Account Debit Credit

Cash 108,000

Accounts Receivables 72,000

Merchandise Inventory 36,000

Prepaid Advertisement 14,400

Accounts Payables 36,000

Unearned Commission 18,000

Capital 90,000

Sales 396,000

Drawing 18,000

Cost of goods sold 252,000

Office supplies expense 5,400

Salaries Expense 19,800

Rent Expense 14,400

540,000 540,000

Supplementary data for adjustments

i) Unused office supplies Rs. 1080

ii) Salaries outstanding Rs. 1800 and prepaid salaries Rs. 3000

iii) Unearned Commission Rs. 5400

iv) Commission receivables Rs. 5040

v) Rent expense for the year Rs. 21600

Required

i) Prepare Income statement for the year ended June 30, 2007

ii) Prepare Balance sheet as on June 30, 2007

Q4. Alpine Expeditions operates a mountain climbing school in Colorado. Some clients pay

in advance for services; others are billed after services have been performed. Advance

payments are credited to an account entitled Unearned Client Revenue. Adjusting entries

are performed monthly. An unadjusted trial balance dated December 31, 2011, follows.

(Bear in mind that adjusting entries have already been made for the first 11 months of 2011,

but not for December.)

Following is the unadjusted trial balance of Alpine Expedition on December 31st, 2011

Title of Account Debit Credit

Cash $13,900

Accounts Receivables 78,000

Unexpired Insurance 18,000

Prepaid Advertisement 2,200

Climbing Supplies 4,900

Climbing Equipment 57,600

Allowance for Depreciation $ 38,400

Accounts Payable 1,250

Notes Payable 10,000

Interest Payable 150

Income tax Payable 1,200

Unearned Client revenue 9,600

Capital Stock 17,000

Retained Earnings 62,400

Client Revenue Earned 188,000

Advertising Expense 7,400

Insurance Expenses 33,000

Rent Expenses 16,500

Climbing Supplies Expense 8,400

Salaries Expense 57,200

Interest Expense 150

Repair Expense 4,800

Income taxes expense 12,750

Depreciation Expense 13,200

$ 328,000 328,000

Data for adjustments on December 31st, 2011

i) Accrued but unrecorded fees earned as of December 31 amount to $6,400.

ii) Records show that $6,600 of cash receipts originally recorded as unearned client

revenue had been earned as of December 31.

iii) The company purchased a 12-month insurance policy on June 1, 2011, for $36,000.

iv) On December 1, 2011, the company paid $2,200 for numerous advertisements in

several climbing magazines. Half of these advertisements have appeared in print as of

December 31.

v) Climbing supplies on hand at December 31amount to $2,000.

vi) All climbing equipment was purchased when the business first formed. The estimated

life of the equipment at that time was four years (or 48 months).

vii) On October 1, 2011 the company borrowed $10,000 by signing an eight-month, 9

percent note payable. The entire note, plus eight months’ accrued interest, is due on

June 1, 2012.

viii) Accrued but unrecorded salaries at March 31 amount to $3,100.

ix) Estimated income taxes expense for the entire year totals $14,000. Taxes are due in

the first quarter of 2012.

Required

i) Prepare Income statement for the year ended March 31, 2009

ii) Prepare Balance sheet as on March 31, 2009

Q5. Following balances were taken from the ledger of Gulistan & Co. on Dec 31st, 2010

Title of Account Debit Credit

Cash 5,000

Accounts Receivables 10,000

Merchandise Inventory (1-1-10) 8,000

Prepaid Rent 5,000

Sales Equipment 30,000

Purchases 24,000

Carriage Inward 500

Advertisement Expenses 2,500

Miscellaneous Expenses 1,500

Office Supplies Expenses 2,000

Delivery Expenses 500

Salaries Expense 18,000

Sales return and allowance 500

Allowance for bad debt 500

Sales Revenue 68,000

Purchases discount 1,000

Commission Income 3,000

Capital 30,000

Accounts Payables 6,000

Data for adjustments on December 31st, 2010

i) Prepaid shop rent Rs. 1000

ii) Office supplies unused Rs. 400

iii) Allowance for bad debt was estimated at Rs 500

iv) Accrued salaries Rs. 5000

v) Allowance for depreciation on sales equipment was estimated at Rs. 2000

vi) Merchandise inventory on December 31, 2010 Rs 10,000

vii) Commission Unearned Rs 1000

Required

i) Prepare Income statement for the year ended Dec 31, 2010

ii) Prepare Balance sheet as on Dec 31, 2010

Q6. Following balances were taken pre-closing trial balance prepared from the ledger of

Patiwala Book Depot on Dec 31st, 2003

Title of Account Debit Credit

Cash 6,000

Accounts Receivables 10,000

Merchandise Inventory (1-1-03) 4,500

Prepaid Rent 2,000

Sales Equipment 8,500

Purchases 20,000

Transportation In 2,000

Sales Salaries Expenses 6,000

Office Salaries Expenses 5,000

Drawings 1,000

Sales return and allowance 800

Allowance for bad debt 1,500

Allowance for depreciation 2,500

Sales Revenue 40,000

Purchases discount 1,600

Purchases return and allowance 1,400

Capital 12,300

Accounts Payables 6,500

Data for adjustments on December 31st, 2003

i) Increase the allowance for bad debt Rs. 500

ii) Prepaid office rent expired Rs. 800

iii) Provide depreciation on sales equipment for the year Rs 1000

iv) Accrued office salaries Rs. 900

v) Sales salaries were prepaid to the extent of Rs. 800

vi) Merchandise inventory on December 31, 2003 Rs 6,200

vii) A purchase of merchandise of Rs 500 wrongly charged to Sales Equipment Account

viii) Salaries to a sales person for the last week of December Rs 400 was paid by the owner

from business cash, which was mistakenly debited to his Drawing account.

Required

i) Prepare Income statement for the year ended Dec 31, 2003

ii) Prepare Balance sheet as on Dec 31, 2003

Q7. Tutors for Rent, Inc., performs adjusting entries every month, but closes its accounts

only at year-end. The company’s year-end adjusted trial balance dated December 31, 2011,

was:

Title of Account Debit Credit

Cash $91,100

Accounts Receivables 4,500

Supplies 300

Equipment 12,000

Allowance for Depreciation $ 5,000

Accounts Payable 1,500

Income tax Payable 3,500

Capital Stock 25,000

Retained Earnings 45,000

Dividends 2,000

Tutoring Revenue Earned 96,000

Advertising Expense 300

Salaries Expenses 52,000

Supply Expenses 1,200

Income taxes expense 11,600

Depreciation Expense 1,000

$ 176,000 176,000

Required

i) Prepare an income statement and statement of retained earnings for the year

ended December 31, 2011. Also prepare the company’s balance sheet dated

December 31, 2011.

ii) Does the company appear to be liquid? Defend your answer.

iii) Has the company been profitable in the past? Explain

Das könnte Ihnen auch gefallen

- Tugas Personal 1 - Diaz Hesron Deo Simorangkir - 2602202526Dokument6 SeitenTugas Personal 1 - Diaz Hesron Deo Simorangkir - 2602202526Diaz Hesron Deo SimorangkirNoch keine Bewertungen

- TMA 1 BA2 Jan 2015 RevisionDokument4 SeitenTMA 1 BA2 Jan 2015 RevisionHamshavathini YohoratnamNoch keine Bewertungen

- Beechy 7e Tif Ch09Dokument20 SeitenBeechy 7e Tif Ch09mashta04Noch keine Bewertungen

- PP&E Depreciation Schedule AuditDokument3 SeitenPP&E Depreciation Schedule AuditThermen DarenNoch keine Bewertungen

- Calculate Income Tax for Individual TaxpayersDokument4 SeitenCalculate Income Tax for Individual TaxpayersKenneth Pimentel100% (1)

- SIDCO Application For Allotment OldDokument7 SeitenSIDCO Application For Allotment OldnagsankarNoch keine Bewertungen

- Management Accounting - NationalDokument13 SeitenManagement Accounting - NationalYOGESH KUMARNoch keine Bewertungen

- Module 1 - Corp (Share Issuance) PDFDokument1 SeiteModule 1 - Corp (Share Issuance) PDFretchiel love calinogNoch keine Bewertungen

- Maf Mock 01 Q& ADokument31 SeitenMaf Mock 01 Q& ASahan Randheera Perera100% (1)

- Pamantasan ng Cabuyao Accounting Review III - Practical Accounting I (ACCTG100C) investment in associatesDokument2 SeitenPamantasan ng Cabuyao Accounting Review III - Practical Accounting I (ACCTG100C) investment in associatesQuid DamityNoch keine Bewertungen

- Governmental and Not-for-Profit Accounting: Indion, Edrian Nichole ADokument8 SeitenGovernmental and Not-for-Profit Accounting: Indion, Edrian Nichole Ajerald james montgomeryNoch keine Bewertungen

- Cost accounting concepts and techniquesDokument12 SeitenCost accounting concepts and techniquessanjay sahooNoch keine Bewertungen

- IcebreakerDokument5 SeitenIcebreakerRyan MagalangNoch keine Bewertungen

- STP 204-21 Density Test for Asphalt MixesDokument5 SeitenSTP 204-21 Density Test for Asphalt MixesAkshay TikooNoch keine Bewertungen

- 218A - Management AccountingDokument22 Seiten218A - Management AccountingshakthivelNoch keine Bewertungen

- Solutions: Chapter 08 - Location Planning and AnalysisDokument7 SeitenSolutions: Chapter 08 - Location Planning and AnalysisCodeSeekerNoch keine Bewertungen

- Fin Midterm 1 PDFDokument6 SeitenFin Midterm 1 PDFIshan DebnathNoch keine Bewertungen

- Class 15 ReviewDokument2 SeitenClass 15 ReviewNestor LimNoch keine Bewertungen

- Practical Accounting Problems SolutionsDokument11 SeitenPractical Accounting Problems SolutionsjustjadeNoch keine Bewertungen

- Products Based On The Survey Occupancy Assumption Person Per Batch No. of Batch Persons/ Day Operating Days Batches Number of OrdersDokument8 SeitenProducts Based On The Survey Occupancy Assumption Person Per Batch No. of Batch Persons/ Day Operating Days Batches Number of OrdersRose Ann De GuzmanNoch keine Bewertungen

- WMSU Chapter 4 Costing SystemsDokument12 SeitenWMSU Chapter 4 Costing Systemschelsea kayle licomes fuentesNoch keine Bewertungen

- Stracos Module 1 Quiz Cost ConceptsDokument12 SeitenStracos Module 1 Quiz Cost ConceptsGemNoch keine Bewertungen

- Intangibles, Wasting A, ImpairmentDokument4 SeitenIntangibles, Wasting A, ImpairmentJobelle Candace Flores AbreraNoch keine Bewertungen

- ACEINT1 Intermediate Accounting 1 Final Exam SY 2021-2022Dokument10 SeitenACEINT1 Intermediate Accounting 1 Final Exam SY 2021-2022Marriel Fate Cullano100% (1)

- BLAW PrefinalsDokument5 SeitenBLAW PrefinalsWyn DignosNoch keine Bewertungen

- Answer Guidance For c6Dokument13 SeitenAnswer Guidance For c6thicknhinmaykhoc100% (1)

- Accounting for Budgetary AccountsDokument11 SeitenAccounting for Budgetary AccountsFred Michael L. Go100% (1)

- Assignment - Doc - GE02 - Management Accounting - 16022016121047Dokument13 SeitenAssignment - Doc - GE02 - Management Accounting - 16022016121047mahedi hasan100% (1)

- Chapter 4 Accounting For Partnership AnswerDokument17 SeitenChapter 4 Accounting For Partnership AnswerTan Yilin0% (1)

- Chapter 1 Quiz ExampleDokument10 SeitenChapter 1 Quiz ExampleVictor GarciaNoch keine Bewertungen

- Chapter FourDokument18 SeitenChapter Fourmubarek oumerNoch keine Bewertungen

- Pas 2 - Inventories (Continuation of Part 1)Dokument3 SeitenPas 2 - Inventories (Continuation of Part 1)Michelle Wing San TsangNoch keine Bewertungen

- Unit 7 QuizDokument2 SeitenUnit 7 QuizKimberly A AlanizNoch keine Bewertungen

- Chapter 2Dokument23 SeitenChapter 2Abrha636100% (1)

- Multiple Choice Questions Questions 1-6 Reflect The Fact Pattern in The Essay QuestionsDokument2 SeitenMultiple Choice Questions Questions 1-6 Reflect The Fact Pattern in The Essay QuestionsAshley DanielleNoch keine Bewertungen

- Cost Estimation and Analysis TechniquesDokument9 SeitenCost Estimation and Analysis TechniquesPATRICIA PEREZNoch keine Bewertungen

- Quiz BeeDokument15 SeitenQuiz Beejoshua100% (1)

- Toa 123Dokument13 SeitenToa 123fredeksdiiNoch keine Bewertungen

- CH 4 Job Order CostingDokument20 SeitenCH 4 Job Order CostingNivin mNoch keine Bewertungen

- Final Exam Advance Accounting WADokument5 SeitenFinal Exam Advance Accounting WAShawn OrganoNoch keine Bewertungen

- Midterm Exams ReviewDokument5 SeitenMidterm Exams ReviewJeanette LampitocNoch keine Bewertungen

- CPA firm considerations accepting new clientsDokument19 SeitenCPA firm considerations accepting new clientsNathalie PadillaNoch keine Bewertungen

- Perpetual Help: University of System DaltaDokument2 SeitenPerpetual Help: University of System DaltaFroilan Arlando BandulaNoch keine Bewertungen

- D. Anticipate Before Performing Any Fieldwork Whether An Unqualified Opinion Can Be ExpressedDokument5 SeitenD. Anticipate Before Performing Any Fieldwork Whether An Unqualified Opinion Can Be ExpressedAllyssa Mae DelaRosa UchihaNoch keine Bewertungen

- Cash Equivalents Financial ReportingDokument4 SeitenCash Equivalents Financial ReportingKeanna Denise GonzalesNoch keine Bewertungen

- UWI DOMS ACCT 1005 - Financial Accounting WorksheetDokument10 SeitenUWI DOMS ACCT 1005 - Financial Accounting WorksheetAndre' King100% (1)

- Property Midterms - ConsoDokument77 SeitenProperty Midterms - ConsoAnonymous iScW9lNoch keine Bewertungen

- Accounting Multiple Choice QuestionDokument4 SeitenAccounting Multiple Choice QuestionDanish RehmanNoch keine Bewertungen

- Ex-08 - Comprehensive Review 2.0Dokument14 SeitenEx-08 - Comprehensive Review 2.0Jedidiah Smith0% (1)

- Gelinas-Dull 8e Chapter 11 Billing & ReceivableDokument30 SeitenGelinas-Dull 8e Chapter 11 Billing & Receivableleen mercado100% (1)

- Accounts PayableDokument5 SeitenAccounts Payablesamsam9095Noch keine Bewertungen

- CHAPTER - 5 Capital Budgeting & Investment DecisionDokument40 SeitenCHAPTER - 5 Capital Budgeting & Investment Decisionethnan lNoch keine Bewertungen

- CFAS-MC Ques - Review of The Acctg. ProcessDokument5 SeitenCFAS-MC Ques - Review of The Acctg. ProcessKristine Elaine RocoNoch keine Bewertungen

- Finacct Mock Exam 1Dokument7 SeitenFinacct Mock Exam 1Joseph Gerald M. ArcegaNoch keine Bewertungen

- Management Advisory Services by Agamata Answer KeyDokument11 SeitenManagement Advisory Services by Agamata Answer KeyLeon Genaro Naraga0% (1)

- 2174r02 Us Busaidpricelist FinalDokument1 Seite2174r02 Us Busaidpricelist Finalapi-307674357Noch keine Bewertungen

- 01.correction of Errors - 245038322 PDFDokument4 Seiten01.correction of Errors - 245038322 PDFMaan CabolesNoch keine Bewertungen

- 201.AFA IP.L II December 2020Dokument4 Seiten201.AFA IP.L II December 2020leyaketjnuNoch keine Bewertungen

- ACC 281 SEMINAR QUESTIONS Version 2Dokument8 SeitenACC 281 SEMINAR QUESTIONS Version 2Joel SimonNoch keine Bewertungen

- 2019-12 ICMAB FL 001 PAC Year Question December 2019Dokument3 Seiten2019-12 ICMAB FL 001 PAC Year Question December 2019Mohammad ShahidNoch keine Bewertungen

- Mock 1 Mid-Term Exam AcountabilityDokument6 SeitenMock 1 Mid-Term Exam AcountabilityJhon WickNoch keine Bewertungen

- Accounting Principles Pilot TestDokument6 SeitenAccounting Principles Pilot TestNguyễn Thị Ngọc AnhNoch keine Bewertungen

- NonameDokument1 SeiteNonameNust RaziNoch keine Bewertungen

- Us History 4Dokument34 SeitenUs History 4Nust RaziNoch keine Bewertungen

- 2025 2Dokument2 Seiten2025 2Nust RaziNoch keine Bewertungen

- Pakistan Water & Power Development Authority (Job Opportunities)Dokument2 SeitenPakistan Water & Power Development Authority (Job Opportunities)salman khattakNoch keine Bewertungen

- Roll No Slip For Etea Gat (General) Test 2020Dokument6 SeitenRoll No Slip For Etea Gat (General) Test 2020Nust RaziNoch keine Bewertungen

- Newsletter With Civil PicturesDokument48 SeitenNewsletter With Civil PicturesNust RaziNoch keine Bewertungen

- Documents Required for Registration as Professional Engineer (PEDokument6 SeitenDocuments Required for Registration as Professional Engineer (PEAsm KhanNoch keine Bewertungen

- CombinepdfDokument8 SeitenCombinepdfNust RaziNoch keine Bewertungen

- GAT Sample Test 02 Section 1 Verbal ReasoningDokument24 SeitenGAT Sample Test 02 Section 1 Verbal ReasoningAmjad bbsulk67% (6)

- Employers Data of Students 2015 BatchDokument10 SeitenEmployers Data of Students 2015 BatchNust RaziNoch keine Bewertungen

- Pavement DesignDokument61 SeitenPavement DesignMayuresh Kudve100% (1)

- Pakistan Water & Power Development Authority (Job Opportunities)Dokument2 SeitenPakistan Water & Power Development Authority (Job Opportunities)salman khattakNoch keine Bewertungen

- Cms Id NameDokument1 SeiteCms Id NameNust RaziNoch keine Bewertungen

- Murad Shahzad: Khayaban-e-Sir-Syed Near Govt Middle School Rawalpindi, PakistanDokument2 SeitenMurad Shahzad: Khayaban-e-Sir-Syed Near Govt Middle School Rawalpindi, PakistanNust RaziNoch keine Bewertungen

- Lab 11Dokument2 SeitenLab 11Nust RaziNoch keine Bewertungen

- Department of Software Engineering: Course Code: CS332 Class: BESE6AB Lab 12: MPI (Part 2)Dokument2 SeitenDepartment of Software Engineering: Course Code: CS332 Class: BESE6AB Lab 12: MPI (Part 2)Nust RaziNoch keine Bewertungen

- A) Dozer D7G-7SDokument11 SeitenA) Dozer D7G-7SNust RaziNoch keine Bewertungen

- Negative Reinforcment: 12" Drop Sunken SlabDokument1 SeiteNegative Reinforcment: 12" Drop Sunken SlabNust RaziNoch keine Bewertungen

- Mechanistic Empirircal Pavement DesignDokument80 SeitenMechanistic Empirircal Pavement DesignNust RaziNoch keine Bewertungen

- CE 355 Lecture - 01Dokument24 SeitenCE 355 Lecture - 01Nust RaziNoch keine Bewertungen

- Parapet and Roof Level HeightsDokument1 SeiteParapet and Roof Level HeightsNust RaziNoch keine Bewertungen

- Razi-II May 2018Dokument271 SeitenRazi-II May 2018Nust RaziNoch keine Bewertungen

- CE 444 Week 1 IntroductionDokument16 SeitenCE 444 Week 1 IntroductionNust RaziNoch keine Bewertungen

- Haalim Episode 13Dokument93 SeitenHaalim Episode 13Nust Razi100% (7)

- CE-807 Traffic Engineering (Fall 10) : Intelligent Transportation Systems (ITS) : An OverviewDokument59 SeitenCE-807 Traffic Engineering (Fall 10) : Intelligent Transportation Systems (ITS) : An OverviewNust RaziNoch keine Bewertungen

- ColorDokument1 SeiteColorNust RaziNoch keine Bewertungen

- ARCH 1 SectionDokument1 SeiteARCH 1 SectionNust RaziNoch keine Bewertungen

- Construction document analysisDokument29 SeitenConstruction document analysisNust RaziNoch keine Bewertungen

- Item Code Item Description Unit Length (FT) Width (FT) Height (FT) Area (SFT) Volum e Quantit y TotalDokument10 SeitenItem Code Item Description Unit Length (FT) Width (FT) Height (FT) Area (SFT) Volum e Quantit y TotalNust RaziNoch keine Bewertungen

- Bread Burn Bahasa Inggris 22Dokument13 SeitenBread Burn Bahasa Inggris 22adiastomoNoch keine Bewertungen

- XXXXDokument1 SeiteXXXXravinakhanhifiNoch keine Bewertungen

- Asuncion Escala Ngina Applied Auditing 1 2015Dokument219 SeitenAsuncion Escala Ngina Applied Auditing 1 2015Jacel ManaloNoch keine Bewertungen

- Emilio Aguinaldo College - Cavite Campus School of Business AdministrationDokument9 SeitenEmilio Aguinaldo College - Cavite Campus School of Business AdministrationKarlayaanNoch keine Bewertungen

- Salary HP Liability in Special CasesDokument33 SeitenSalary HP Liability in Special CasesPriyanshu tripathiNoch keine Bewertungen

- AFA 716 Chap 2 SolutionsDokument40 SeitenAFA 716 Chap 2 SolutionsMarc ColalilloNoch keine Bewertungen

- Ca5101 Adjusting Entries La 1Dokument13 SeitenCa5101 Adjusting Entries La 1Michael MagdaogNoch keine Bewertungen

- FIN 440 Financial Forecasting, Planning, and Budgeting Chapter Reference - CHP 4Dokument4 SeitenFIN 440 Financial Forecasting, Planning, and Budgeting Chapter Reference - CHP 4the learners club5100% (1)

- Gross Income (Exclusions and Inclusions From Gross Income) - REVISED 2022Dokument34 SeitenGross Income (Exclusions and Inclusions From Gross Income) - REVISED 2022rav dano100% (1)

- Closure Activities-Answer KeyDokument5 SeitenClosure Activities-Answer KeyJohn Mark FernandoNoch keine Bewertungen

- Assessment of Partnership Firm.Dokument9 SeitenAssessment of Partnership Firm.Safa100% (3)

- Financial Accounting Theory Canadian 7th Edition Scott Solutions ManualDokument26 SeitenFinancial Accounting Theory Canadian 7th Edition Scott Solutions ManualCherylHorngjmf100% (54)

- C04-Fundamentals of Business Economics: Sample Exam PaperDokument26 SeitenC04-Fundamentals of Business Economics: Sample Exam PaperLegogie Moses Anoghena100% (1)

- Lesson 6: Functions of One and More VariablesDokument3 SeitenLesson 6: Functions of One and More VariablesBotnaru LaurentiuNoch keine Bewertungen

- Topic 3 Canons of TaxationDokument20 SeitenTopic 3 Canons of TaxationJaved AnwarNoch keine Bewertungen

- Proposed Rule: Legal Assistance Eligibility Maximum Income GuidelinesDokument16 SeitenProposed Rule: Legal Assistance Eligibility Maximum Income GuidelinesJustia.com100% (1)

- XI Commerce Notes CH 1Dokument5 SeitenXI Commerce Notes CH 1Lalit NathNoch keine Bewertungen

- Intro To Econ NotesDokument1 SeiteIntro To Econ NotesLea Bondoc LimNoch keine Bewertungen

- Shark Tank 7 Initial Application PacketDokument16 SeitenShark Tank 7 Initial Application PacketHemalPatelNoch keine Bewertungen

- National Income ConceptsDokument5 SeitenNational Income ConceptskarnadangeNoch keine Bewertungen

- Profit / Loss A/C Month of April 2010: Code No Vehicle Cost Code No Vehicle SoldDokument12 SeitenProfit / Loss A/C Month of April 2010: Code No Vehicle Cost Code No Vehicle SoldzeenathimamNoch keine Bewertungen

- Social Housing PolicyDokument35 SeitenSocial Housing PolicyGrace ZANoch keine Bewertungen

- CLWTAXN MODULE 5 Income Taxation of Individuals Notes v022023-1-1Dokument7 SeitenCLWTAXN MODULE 5 Income Taxation of Individuals Notes v022023-1-1kdcngan162Noch keine Bewertungen

- FABM2 Q2 MOD3 Income and Business Taxation PDFDokument29 SeitenFABM2 Q2 MOD3 Income and Business Taxation PDFJoyce Anne ManzanilloNoch keine Bewertungen

- Notes For Coca Cola PresentationDokument16 SeitenNotes For Coca Cola PresentationAsad AliNoch keine Bewertungen

- An Introduction To Basic Farm Financial Statements: Income StatementDokument11 SeitenAn Introduction To Basic Farm Financial Statements: Income StatementAbdi Aliyi100% (1)

- CHAPTER 3 Financial PlanningDokument7 SeitenCHAPTER 3 Financial Planningflorabel parana0% (1)

- Revision ch3 1thDokument18 SeitenRevision ch3 1thYousefNoch keine Bewertungen