Beruflich Dokumente

Kultur Dokumente

Taxes and The Statement of Cash Flows

Hochgeladen von

Saddy ButtOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Taxes and The Statement of Cash Flows

Hochgeladen von

Saddy ButtCopyright:

Verfügbare Formate

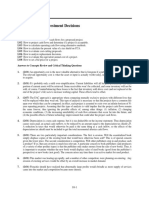

Taxes and the Statement of Cash Flows

• All operating activity line items on the SCF are shown pre-tax

($000's) • All tax effects are

Year ended Dec. 31: 2009 2010 2011 reflected in:

Net Income 1,470 3,028 5,071

Depreciation 2,372 4,537 7,191 – Changes in Deferred

Taxes

Doubtful Accts. 12 48 48

Changes in: – Changes in Income

Accounts Receivable 4,594 (7,357) (660) Tax Payable

Inventories 1,481 (13,179) (7,872)

Deferred Taxes 8 178 587

Prepaid, other (1) 179 14

Accounts Payable (3,927) 5,084 86

Accrued Wages 99 708 232

Other Current Liabs. 110 464 (23)

Taxes Payable (502) 816 278

Cash Flow from Operations 5,716 (5,494) 4,952

KNOWLEDGE FOR ACTION

Taxes and the SCF: Example

• Company increases book Depreciation Expense by $100 in 2011

– Pre-tax income down by $100

• Income Tax Expense down by $35 (100 x .35)

• Net Income down by $65 (100 – 35)

– Tax Depreciation is unaffected

• Taxable Income unaffected; Income Tax Payable unaffected

– Balance these differences with a reduction in Deferred Tax Liability of $35

• Journal entries

Dr. Depreciation Expense (+E) 100

Cr. Accumulated Depreciation (+XA) 100

Dr. Deferred Tax Liability (-L) 35

Cr. Income Tax Expense (-E) 35 (100 x .35)

KNOWLEDGE FOR ACTION

SCF: Cash Flows from Operating Activities

($000's) Old New

Year ended Dec. 31: 2009 2010 2011 2011 Chg.

Net Income 1,470 3,028 5,071 5,006 (65)

Depreciation 2,372 4,537 7,191 7,291 100

Doubtful Accts. 12 48 48 48

Changes in:

Accounts Receivable 4,594 (7,357) (660) (660)

Inventories 1,481 (13,179) (7,872) (7,872)

Deferred Taxes 8 178 587 552 (35)

Prepaid, other (1) 179 14 14

Accounts Payable (3,927) 5,084 86 86

Accrued Wages 99 708 232 232

Other Current Liabs. 110 464 (23) (23)

Taxes Payable (502) 816 278 278 0

Cash Flow from Operations 5,716 (5,494) 4,952 4,952 0

KNOWLEDGE FOR ACTION

Taxes and Marketable Securities

• Gains or losses on Marketable Securities are taxed only when sold

– Tax is based on the difference between the sales price and the purchase price

• Trading Securities

– Unrealized gains/losses from mark-to-market are carried on the Income Statement

• Create a Deferred Tax Asset or Liability

• Available for Sale Securities

– Unrealized gains/losses for AFS securities are stored up in AOCI

– Accumulated Other Comprehensive Income must be carried on an after-tax basis

• Create a DTA or DTL to reflect the tax effect of the unrealized gains/losses in AOCI

KNOWLEDGE FOR ACTION

Example: Mark-to-market on balance sheet date - Trading

• At quarter end, Bott Bank’s investment in TK stock is now worth $129

(Bott bought the stock for $100)

• Journal entries:

Dr. Marketable Securities (+A) 29

Cr. Gain on Investments (+R) 29

Dr. Income Tax Expense (+E) 10 (29 x 0.35)

Cr. Deferred Tax Liability (+L) 10

• Note: No Income Tax Payable because taxes are only paid when the

security is sold

KNOWLEDGE FOR ACTION

Example: Sale of investment - Trading

• After quarter end, Bott Bank sells its TK stock for $109

• Journal entries:

Dr. Cash (+A) 109

Dr. Loss on investment (+E) 20

Cr. Marketable Securities (-A) 129

Dr. Deferred Tax Liability (-L) 10

Cr. Income Tax Expense (-E) 7 (20 x 0.35)

Cr. Income Tax Payable (+L) 3 ((109-100) x 0.35)

• Note: Income Tax Payable is based on the Realized Gain computed

using the original cost (109 – 100)

KNOWLEDGE FOR ACTION

Example: Mark-to-market on balance sheet date - AFS

• At quarter end, Meyer Co.’s investment in TK stock is now worth $129

(Meyer bought the stock for $100)

• Journal entries:

AOCI (SE)

Dr. Marketable Securities (+A) 29

DTL eff 10 29 Qtr end

Cr. AOCI (+SE) 29

Dr. AOCI (-SE) 10

19

Cr. Deferred Tax Liability (+L) 10

• Note: Instead of debiting Income Tax Expense, as we would if this

went on the Income Statement, we debit AOCI

KNOWLEDGE FOR ACTION

Example: Sale of investment - AFS

• After quarter end, Meyer Co. sells its TK stock for $109

• Journal entries:

AOCI (SE)

Dr. Cash (+A) 109

Tax eff 10 29 Qtr end

Dr. AOCI (-SE) 29

Sale 29 10 Sale Tx

Cr. Gain on investment (+R, +SE) 9

0

Cr. Marketable Securities (-A) 129

Dr. Income Tax Expense (+E) 3 (9 x 0.35)

Cr. Income Tax Payable (+L) 3

Dr. Deferred Tax Liability (-L) 10

Cr. AOCI (+SE) 10

KNOWLEDGE FOR ACTION

Das könnte Ihnen auch gefallen

- Group 5 Case of Financial StatementDokument6 SeitenGroup 5 Case of Financial StatementDhomas AgastyaNoch keine Bewertungen

- Chapter 03Dokument29 SeitenChapter 03andi.w.rahardjoNoch keine Bewertungen

- Financial Statement, Cash Flows and TaxesDokument22 SeitenFinancial Statement, Cash Flows and Taxesnumlit1984Noch keine Bewertungen

- Finance For Start Up4Dokument15 SeitenFinance For Start Up4igga d johnNoch keine Bewertungen

- Bài Tập TCDNDokument9 SeitenBài Tập TCDNQuyên NguyễnNoch keine Bewertungen

- D.1. Financial Statement AnalysisDokument4 SeitenD.1. Financial Statement AnalysisCode BeretNoch keine Bewertungen

- Practice Exam - SolutionsDokument12 SeitenPractice Exam - SolutionsSu Suan TanNoch keine Bewertungen

- Lesson 2Dokument5 SeitenLesson 2kabaso jaroNoch keine Bewertungen

- Lesson 25Dokument15 SeitenLesson 25TUẤN TRẦN MINHNoch keine Bewertungen

- CH 02 - Financial Stmts Cash Flow and TaxesDokument32 SeitenCH 02 - Financial Stmts Cash Flow and TaxesSyed Mohib Hassan100% (1)

- HI 5020 Corporate Accounting: Session 8c Intra-Group TransactionsDokument24 SeitenHI 5020 Corporate Accounting: Session 8c Intra-Group TransactionsFeku RamNoch keine Bewertungen

- Residual Income ValuationDokument21 SeitenResidual Income ValuationqazxswNoch keine Bewertungen

- Microsoft Corporation Financial StatementDokument6 SeitenMicrosoft Corporation Financial StatementMega Pop LockerNoch keine Bewertungen

- Session 1 Activity 3 Cob LTDDokument6 SeitenSession 1 Activity 3 Cob LTDSze ChristienyNoch keine Bewertungen

- Financial Accounting: Income Statement StructureDokument16 SeitenFinancial Accounting: Income Statement StructureEdward AbgarNoch keine Bewertungen

- Laporan Keuangan Dan PajakDokument39 SeitenLaporan Keuangan Dan PajakpurnamaNoch keine Bewertungen

- Laporan Keuangan Dan PajakDokument39 SeitenLaporan Keuangan Dan PajakFerry JohNoch keine Bewertungen

- Cash FlowDokument12 SeitenCash FlowalguienNoch keine Bewertungen

- Solution For The Analysis and Use of Financial Statements White G ch03Dokument48 SeitenSolution For The Analysis and Use of Financial Statements White G ch03twinkle goyalNoch keine Bewertungen

- Financial Ratios-Hamna RizwanDokument5 SeitenFinancial Ratios-Hamna RizwanHamna RizwanNoch keine Bewertungen

- Investment VI FINC 404 Company ValuationDokument52 SeitenInvestment VI FINC 404 Company ValuationMohamed MadyNoch keine Bewertungen

- Laforge Company SolDokument3 SeitenLaforge Company SolPanini KNoch keine Bewertungen

- Cash Flow Solutions2Dokument6 SeitenCash Flow Solutions2mithun mohanNoch keine Bewertungen

- Solution For The Analysis and Use of Financial Statements White G Ch03Dokument50 SeitenSolution For The Analysis and Use of Financial Statements White G Ch03Tamim Rahman0% (1)

- Problem 7 AlkDokument8 SeitenProblem 7 AlkAldi HerialdiNoch keine Bewertungen

- 01 - Exercises Session 1 - EmptyDokument4 Seiten01 - Exercises Session 1 - EmptyAgustín RosalesNoch keine Bewertungen

- Ch02 ShowDokument44 SeitenCh02 ShowardiNoch keine Bewertungen

- Financial Statements, Cash Flow, and TaxesDokument44 SeitenFinancial Statements, Cash Flow, and TaxesMahmoud Abdullah100% (1)

- Financial Statements, Cash Flow, and TaxesDokument45 SeitenFinancial Statements, Cash Flow, and TaxesFridolin Belnovando Abditomo PrakosoNoch keine Bewertungen

- Financial Statements, Cash Flow, and TaxesDokument43 SeitenFinancial Statements, Cash Flow, and TaxesshimulNoch keine Bewertungen

- Corporate Finance Solution Chapter 6Dokument9 SeitenCorporate Finance Solution Chapter 6Kunal KumarNoch keine Bewertungen

- CH 01 Review and Discussion Problems SolutionsDokument11 SeitenCH 01 Review and Discussion Problems SolutionsArman BeiramiNoch keine Bewertungen

- Eflatoun Company: Financial Statements For The Year Ended 31 December 2009Dokument10 SeitenEflatoun Company: Financial Statements For The Year Ended 31 December 2009shazNoch keine Bewertungen

- Income Taxes By: Damtew Mengesha (Acca, Dipifrs)Dokument32 SeitenIncome Taxes By: Damtew Mengesha (Acca, Dipifrs)Eshetie Mekonene Amare100% (1)

- Chapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Dokument26 SeitenChapter 22 - Gripping IFRS ICAP 2008 (Solution of Graded Questions)Falah Ud Din Sheryar100% (1)

- Financial Accounting 3a Assignment 2 2022Dokument9 SeitenFinancial Accounting 3a Assignment 2 2022sartynaftalNoch keine Bewertungen

- Febbinia Dwigna P - Week7 AKL 1Dokument5 SeitenFebbinia Dwigna P - Week7 AKL 1febbiniaNoch keine Bewertungen

- Hls Fy2010 Fy Results 20110222Dokument14 SeitenHls Fy2010 Fy Results 20110222Chin Siong GohNoch keine Bewertungen

- Cfas Ias 1 Presentation of FS For StudentsDokument15 SeitenCfas Ias 1 Presentation of FS For StudentsFreja del CastilloNoch keine Bewertungen

- Investment Analysis and Portfolio Management 2012Dokument61 SeitenInvestment Analysis and Portfolio Management 2012Nelson Ivan Acosta100% (1)

- Statement of Cash Flows Lecture Questions and AnswersDokument9 SeitenStatement of Cash Flows Lecture Questions and AnswersSaaniya AbbasiNoch keine Bewertungen

- InfraDokument11 SeitenInfrakdoshi23Noch keine Bewertungen

- 6 - Capital Budgeting in PracticeDokument21 Seiten6 - Capital Budgeting in PracticeJosh AckmanNoch keine Bewertungen

- Financial Statements, Cash Flow, and TaxesDokument29 SeitenFinancial Statements, Cash Flow, and TaxesHooriaKhanNoch keine Bewertungen

- Consolidated Statement of Cash Flows (MFRS 107)Dokument41 SeitenConsolidated Statement of Cash Flows (MFRS 107)Sing YeeNoch keine Bewertungen

- FM204Dokument8 SeitenFM204Vinoth KumarNoch keine Bewertungen

- Project 1 - FCF Intel Example - DirectionsDokument27 SeitenProject 1 - FCF Intel Example - Directionsअनुशा प्रसादम्Noch keine Bewertungen

- D.1. Financial Statement AnalysisDokument3 SeitenD.1. Financial Statement AnalysisIrfan PoonawalaNoch keine Bewertungen

- 0976 Module 10 RossFCF9ce SM Ch10 FINALDokument21 Seiten0976 Module 10 RossFCF9ce SM Ch10 FINALYuk SimNoch keine Bewertungen

- FSA Case Study SolutionDokument6 SeitenFSA Case Study SolutionConnor CooperNoch keine Bewertungen

- Key Chapter 1Dokument4 SeitenKey Chapter 1duyanh.vinunihanoiNoch keine Bewertungen

- Analysis of Financial StatementDokument9 SeitenAnalysis of Financial StatementSums Zubair MoushumNoch keine Bewertungen

- Practice Questions For Ratio Analysis2Dokument13 SeitenPractice Questions For Ratio Analysis2Crazy FootballNoch keine Bewertungen

- Lectorial 3 Part ADokument19 SeitenLectorial 3 Part AAhmad RazaNoch keine Bewertungen

- Practice Questions For Ratio AnalysisDokument11 SeitenPractice Questions For Ratio AnalysisFaria AlamNoch keine Bewertungen

- Practice Solution 2Dokument4 SeitenPractice Solution 2Luigi NocitaNoch keine Bewertungen

- SMChap 006Dokument22 SeitenSMChap 006Anonymous mKjaxpMaLNoch keine Bewertungen

- F1 November 2010 AnswersDokument11 SeitenF1 November 2010 AnswersmavkaziNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Dropshipping Hunting SheetDokument488 SeitenDropshipping Hunting SheetSaddy ButtNoch keine Bewertungen

- Partnership Deed-Zarqa PharmaDokument3 SeitenPartnership Deed-Zarqa PharmaSaddy ButtNoch keine Bewertungen

- Writ Petition (Contempt Criminal Matter) Mst. Asia Nabeela (ADV Mian Muhammad Yasin)Dokument6 SeitenWrit Petition (Contempt Criminal Matter) Mst. Asia Nabeela (ADV Mian Muhammad Yasin)Saddy ButtNoch keine Bewertungen

- In The Lahore High Court, Lahore: Ghani Distirct Mohammad AgencyDokument3 SeitenIn The Lahore High Court, Lahore: Ghani Distirct Mohammad AgencySaddy ButtNoch keine Bewertungen

- Supplementory Lease Deed!!!Dokument2 SeitenSupplementory Lease Deed!!!Saddy Butt67% (3)

- Declaration by Banking CourtDokument28 SeitenDeclaration by Banking CourtSaddy ButtNoch keine Bewertungen

- SEc 9 (3) FIODokument14 SeitenSEc 9 (3) FIOSaddy ButtNoch keine Bewertungen

- Auction ProclamationDokument81 SeitenAuction ProclamationSaddy ButtNoch keine Bewertungen

- Mutual Fund Report Oct-19Dokument40 SeitenMutual Fund Report Oct-19muddasir1980Noch keine Bewertungen

- Chapter 12 QuestionsDokument8 SeitenChapter 12 QuestionsJames AguilarNoch keine Bewertungen

- Master Sheet - BootcampDokument144 SeitenMaster Sheet - BootcampJeniffer RayenNoch keine Bewertungen

- Solutions and Test Bank For Fundamentals of Financial Management 16th Edition 16e by Eugene F BrighamDokument68 SeitenSolutions and Test Bank For Fundamentals of Financial Management 16th Edition 16e by Eugene F BrighamDiệp Phạm HồngNoch keine Bewertungen

- Pfizer Limited - Annual Report 2019-20Dokument89 SeitenPfizer Limited - Annual Report 2019-20aditya saiNoch keine Bewertungen

- Business FinanceDokument21 SeitenBusiness Financechloe frostNoch keine Bewertungen

- Financial StatementDokument6 SeitenFinancial StatementCeddie UnggayNoch keine Bewertungen

- Paper14 PDFDokument94 SeitenPaper14 PDFShilpa Arora NarangNoch keine Bewertungen

- Options and Corporate Finance QuestionsDokument2 SeitenOptions and Corporate Finance QuestionsbigpoelNoch keine Bewertungen

- V Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetDokument3 SeitenV Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetV_Krishna_AnaparthiNoch keine Bewertungen

- AFM Short NotesDokument56 SeitenAFM Short NotesthamiztNoch keine Bewertungen

- Bruner-2004-Journal of Applied Corporate FinanceDokument16 SeitenBruner-2004-Journal of Applied Corporate FinancePablo Natán González CastilloNoch keine Bewertungen

- Fundamentals of Financial AccountingDokument40 SeitenFundamentals of Financial AccountingEYENNoch keine Bewertungen

- Bharti Airtel Ltd. (India) : SourceDokument6 SeitenBharti Airtel Ltd. (India) : SourceDivyagarapatiNoch keine Bewertungen

- Q Test FAR570 Jan 2022Dokument6 SeitenQ Test FAR570 Jan 2022fareen faridNoch keine Bewertungen

- Total Benefit: An Example: Suppose PV0 - 0.7m, and We Have The Following Present ValuesDokument2 SeitenTotal Benefit: An Example: Suppose PV0 - 0.7m, and We Have The Following Present ValuesHello FinesNoch keine Bewertungen

- NFO Leaflet - HDFC Manufacturing Fund - 240422 - 142358Dokument2 SeitenNFO Leaflet - HDFC Manufacturing Fund - 240422 - 142358bitsthechampNoch keine Bewertungen

- Brandon Company: Margin of Safety Is 44.4%Dokument4 SeitenBrandon Company: Margin of Safety Is 44.4%Abdulmajed Unda MimbantasNoch keine Bewertungen

- AC530 Accounting Theory Module 6 AssignmentDokument3 SeitenAC530 Accounting Theory Module 6 AssignmentMCNoch keine Bewertungen

- Level I 2018 2019 Program Changes PDFDokument2 SeitenLevel I 2018 2019 Program Changes PDFMuhammad BurairNoch keine Bewertungen

- School of Accountancy & Management Accounting For Special Transaction Midterm ExaminationDokument11 SeitenSchool of Accountancy & Management Accounting For Special Transaction Midterm ExaminationTasha MarieNoch keine Bewertungen

- Cffinals SolutionDokument121 SeitenCffinals SolutionDavid Lim0% (1)

- Strategy 8 Protective Call or Synthetic Long Put: Name: - Anand BhushanDokument6 SeitenStrategy 8 Protective Call or Synthetic Long Put: Name: - Anand BhushanAnand_Bhushan28Noch keine Bewertungen

- Factors Affecting The Source of FinanceDokument1 SeiteFactors Affecting The Source of FinanceWasa JedidiahNoch keine Bewertungen

- Chapter 4: LeverageDokument15 SeitenChapter 4: LeverageSushant MaskeyNoch keine Bewertungen

- Capital BudgetingDokument33 SeitenCapital BudgetingmoosanipppNoch keine Bewertungen

- Certificate of Increase of Capital StockDokument2 SeitenCertificate of Increase of Capital StockmarkNoch keine Bewertungen

- Supplementary Financial Information (31 December 2020)Dokument71 SeitenSupplementary Financial Information (31 December 2020)YoungRedNoch keine Bewertungen

- Practice Problems - Present Value With AnswersDokument5 SeitenPractice Problems - Present Value With AnswersAyra BernabeNoch keine Bewertungen