Beruflich Dokumente

Kultur Dokumente

Chapter 4 (4A-1 To 4A-2)

Hochgeladen von

SohailAKram100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

933 Ansichten4 Seiten1) The document provides adjusting journal entries for the Alta Sequoia Resort and the Law Office of Pat Hamilton for the month ended April 30, 1994.

2) Entries include recording accrued expenses such as salaries, rent, interest, and depreciation expenses as well as deferred revenues such as unearned rent and retainer fees.

3) After all adjustments, total revenue earned for the Law Office of Pat Hamilton was $9,060 with net income of $1,030 after deducting all expenses.

Originalbeschreibung:

Financial Accounting

Originaltitel

Chapter 4 (4A-1 to 4A-2)

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden1) The document provides adjusting journal entries for the Alta Sequoia Resort and the Law Office of Pat Hamilton for the month ended April 30, 1994.

2) Entries include recording accrued expenses such as salaries, rent, interest, and depreciation expenses as well as deferred revenues such as unearned rent and retainer fees.

3) After all adjustments, total revenue earned for the Law Office of Pat Hamilton was $9,060 with net income of $1,030 after deducting all expenses.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

100%(1)100% fanden dieses Dokument nützlich (1 Abstimmung)

933 Ansichten4 SeitenChapter 4 (4A-1 To 4A-2)

Hochgeladen von

SohailAKram1) The document provides adjusting journal entries for the Alta Sequoia Resort and the Law Office of Pat Hamilton for the month ended April 30, 1994.

2) Entries include recording accrued expenses such as salaries, rent, interest, and depreciation expenses as well as deferred revenues such as unearned rent and retainer fees.

3) After all adjustments, total revenue earned for the Law Office of Pat Hamilton was $9,060 with net income of $1,030 after deducting all expenses.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

Financial Accounting

ASSIGNMENT

CHAPTER # 4 (Problem 4A-1 to 4A-2)

Registration: 2018-(Fall)-EMBA-004

Semester - 1 (MBA Executive)

Submitted to: Prof. Dr. Raza Saeed

Submitted by: Sohail Akram

Sohail Akram (EMBA) Page 1 of 4 Chapter 4 (4A-1 to 4A-2)

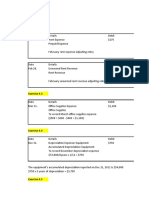

Problem 4A-1

ADJUSTING JOURNAL ENTRIES (Alta Sequoia Resort)

Entry Account Name & Discription Ref Debit Credit

a Salaries Expense $ 7,900

Salaries Payable $ 7,900

Record Salary Expense Accrued for december

Explanation: Salaries expense will appear in income statement of Alta Sequoia Resort

December 31; The Salaries payable is the laibility that will be paid in following year will appear

in balance sheet laibility side.

b Rent Receivable $ 11,075

Rental revenue earned $ 11,075

Record Rent earned accrued

Explanation: Rent receivable appear in balance sheet Asset Side ; The credit side Rent Revenue

Earned shown in Income Statement as a revenue.

c Unearned Rental Revenue $ 6,400

Rental revenue earned $ 6,400

Record two month rental revenue

Explanation: Unearned rental Revenue will be go down from $6,400 in Balance Sheet Laibility

Side; and Credit entry shown in Income Statement Revenue.

d Limousine Rental Expense $ 1,560

Limousine Rent Payable $ 1,560

Record limousine rental expense accrued for 13 days

Explanation: Limousine Rental Expense will appear in income statement of Alta Sequoia Resort

December 31; The Limousine Rent payable is the laibility that will be paid in following year will

appear in balance sheet laibility side.

e Interest Expense $ 375

Interest Payable $ 375

Record one month Interest accrued

Explanation: Interest Expense will appear in income statement of Alta Sequoia Resort

December 31; The Interest payable is the laibility that will be paid in following year will appear

in balance sheet laibility side.

f Depreciation Expense ; Building $ 58,500

Accumulated Depreciation; Building $ 58,500

To Record one year Depreciation Expense

Explanation: Depreciation Expense will appear in income statement of Alta Sequoia Resort

December 31; The Accumulated Depreciation will appear in balance sheet and deducted from

building value.

g NO ENTRY

Explanation: Agreements have no any treatment for fair maintaining books of Accounts

h Unexpired Insurance $ 2,400

Insurance Expense $ 2,400

Record Insurance Expense Accrued for Four month

Explanation: Unexpired Insurance is the asset of Alta Sequoia Resort so appear in Balance

Sheet; Insurance Expense is the part of income Statement.

Sohail Akram (EMBA) Page 2 of 4 Chapter 4 (4A-1 to 4A-2)

Problem 4A-2 (a)

ADJUSTING JOURNAL ENTRIES (LAW OFFICE of PAT HAMILTON)

Entry Account Name & Discription Ref Debit Credit

a Interest Expense $ 200

Interest Payable $ 200

Record Interest Expense Accrued for April

b Salaries Expense $ 970

Salaries Payable $ 970

Record payable salaries expense

c Unearned Retainer Fee $ 4,700

Legal Fee Earned $ 4,700

Record legal fee earned accrued

d Legal Fees Receivable $ 2,780

Legal Fee Earned $ 2,780

Record on Credit Legal Fee Earned in April

e Insurance Expense $ 500

Unexpired Insurance $ 500

Record one month Insurance Expense

f Office Rent Expense $ 1,600

Prepaid Office Rent $ 1,600

To Record office rent for the month April

g Office Supplies Expense $ 660

Office Supplies $ 660

To Record Utilised office Supplies in April

h Depreciation Expense ; Office Equipment $ 220

Accumulated Depreciation; Office Equipment $ 220

To Record one month Depreciation Expense

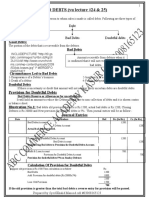

Problem 4A-2 (b)

As above adjusting Journal Entries and given Trail Balance Total revenue earned as in account

Legal fees earned is "$9,060/-" and after deduction of all Expense Net Income is "$1,030/-"

Sohail Akram (EMBA) Page 3 of 4 Chapter 4 (4A-1 to 4A-2)

LAW OFFICE OF PAT HAMILTON

WORK SHEET

FOR THE MONTH ENDED APRIL 30, 1994

Trail Balance Adjustments Adjusted Trail Balance Income Statement Balance Sheet

Dr Cr Dr Cr Dr Cr Dr Cr Dr Cr

Balance Sheet Accounts:

Cash 10,060 10,060 - 10,060

Legal fees Receivable 2,780 2,780 - 2,780

Unexpired Insurance 3,000 500 2,500 - 2,500

Prepaid office rent 4,800 1,600 3,200 - 3,200

Office Supplies 1,460 660 800 - 800

Office Equipment 26,400 26,400 - 26,400

Accumulated depreciation: Office Equipment 220 - 220 220

Notes Payable 16,000 - 16,000 16,000

Interest Payable 200 - 200 200

Salaries Payable 970 - 970 970

Unearned retainer fees 15,020 4,700 - 10,320 10,320

Pat Hamilton, Capital 20,000 - 20,000 20,000

Pat Hamilton, Drawing 3,000 3,000 - 3,000

Income Statement Accounts: - -

1,580 4,700 -

Legal fees earned 9,060 9,060

2,780

Salaries expense 2,680 970 3,650 - 3,650

Miscellaneous Expense 1,200 1,200 - 1,200

Office rent Expense 1,600 1,600 - 1,600

Office Supplies Expense 660 660 - 660

depreciation Expense: Office Equipment 220 220 - 220

Interest Expense 200 200 - 200

Insurance Expense 500 500 - 500

Total 52,600 52,600 11,630 11,630 56,770 56,770 8,030 9,060 48,740 47,710

Net Income 1,030 1,030

9,060 9,060 48,740 48,740

Sohail Akram (EMBA) Page 4 of 4 Chapter 4 (4A-1 to 4A-2)

Das könnte Ihnen auch gefallen

- Intermediate Accounting II Problem SetDokument4 SeitenIntermediate Accounting II Problem SetM Sul100% (1)

- Adjusting Entries & Adjusted Trial Balance-1 - 94Dokument9 SeitenAdjusting Entries & Adjusted Trial Balance-1 - 94Zubair Jutt100% (1)

- Journalizing Merchandising TransactionsDokument3 SeitenJournalizing Merchandising TransactionsMarian Augelio PolancoNoch keine Bewertungen

- Chapter 6 Solutions AllDokument41 SeitenChapter 6 Solutions AllDennis JeonNoch keine Bewertungen

- Chap 5 Accounting For Merchandising OperationDokument71 SeitenChap 5 Accounting For Merchandising OperationtamimNoch keine Bewertungen

- CFAS Chapter 4 - Cash and Cash EquivalentsDokument3 SeitenCFAS Chapter 4 - Cash and Cash EquivalentsAngelaMariePeñarandaNoch keine Bewertungen

- Bhebu Lero TransactionDokument5 SeitenBhebu Lero TransactionLeo Marbeda FeigenbaumNoch keine Bewertungen

- ACC 121 Answer Key Account ClassificationDokument10 SeitenACC 121 Answer Key Account ClassificationKerby Gail RulonaNoch keine Bewertungen

- ADDU Worksheet, FS, CJE and EtcDokument67 SeitenADDU Worksheet, FS, CJE and EtcKen BorjaNoch keine Bewertungen

- LatihanDokument7 SeitenLatihanDeny WilyartaNoch keine Bewertungen

- Activity No. 3 - Activity J, K and LDokument3 SeitenActivity No. 3 - Activity J, K and LAlansalon JamelNoch keine Bewertungen

- FAR Course GuideDokument4 SeitenFAR Course GuideMariel BombitaNoch keine Bewertungen

- Activity - Preparation of Financial StatementsDokument4 SeitenActivity - Preparation of Financial StatementsJoy ValenciaNoch keine Bewertungen

- Acctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemDokument15 SeitenAcctg. Ed 1 - Unit2 Module 5 Books of Accounts and Double-Entry SystemAngel Justine BernardoNoch keine Bewertungen

- 10-Column Worksheet FormDokument1 Seite10-Column Worksheet Formobrie diazNoch keine Bewertungen

- Financial Accounting and ReportingDokument1 SeiteFinancial Accounting and ReportingPaula BautistaNoch keine Bewertungen

- Module 2 - Completing The Accounting CycleDokument45 SeitenModule 2 - Completing The Accounting CycleShane TorrieNoch keine Bewertungen

- Maputim ProblemDokument2 SeitenMaputim ProblemRowel Dela CruzNoch keine Bewertungen

- Journal-Entry AssignmentsDokument2 SeitenJournal-Entry AssignmentsRieven BaracinasNoch keine Bewertungen

- Acctg 1 PS 1Dokument3 SeitenAcctg 1 PS 1Aj GuanzonNoch keine Bewertungen

- Cash Flow Statement-ShortDokument27 SeitenCash Flow Statement-ShortSam ONiNoch keine Bewertungen

- Substance Over FormDokument2 SeitenSubstance Over Formsimson singawahNoch keine Bewertungen

- Accounting EquationDokument55 SeitenAccounting EquationRahul VermaNoch keine Bewertungen

- AccountingDokument6 SeitenAccountingIshiangreatNoch keine Bewertungen

- ACC 205 Complete Class HomeworkDokument41 SeitenACC 205 Complete Class HomeworkAvicciNoch keine Bewertungen

- FundAcc Exercise WorkbookDokument33 SeitenFundAcc Exercise WorkbookJosef SamoranosNoch keine Bewertungen

- Spoiled Units/Loss Units OF ProductionDokument15 SeitenSpoiled Units/Loss Units OF ProductionClaire Barba100% (1)

- Seatwork #6Dokument5 SeitenSeatwork #6Jasmine Maningo100% (1)

- FAR 1st Monthly AssessmentDokument5 SeitenFAR 1st Monthly AssessmentCiena Mae AsasNoch keine Bewertungen

- Partnership Operations - Problems A-DDokument19 SeitenPartnership Operations - Problems A-DJasmine ActaNoch keine Bewertungen

- Accounting ReviewerDokument21 SeitenAccounting ReviewerAdriya Ley PangilinanNoch keine Bewertungen

- Examination 1Dokument2 SeitenExamination 1trinhNoch keine Bewertungen

- JournalDokument3 SeitenJournalAnonymous RPGElS100% (1)

- Financial Accounting & Reporting 1 Chapter 1-Accounting and Its Environment Answer Sheet Assignment 1 Name: Bsa 1 Section: BDokument1 SeiteFinancial Accounting & Reporting 1 Chapter 1-Accounting and Its Environment Answer Sheet Assignment 1 Name: Bsa 1 Section: BAnonn100% (1)

- Assignment 3Dokument8 SeitenAssignment 3jhouvanNoch keine Bewertungen

- Mr. Lindbergh Lendl S. Soriano Practice Set 2Dokument33 SeitenMr. Lindbergh Lendl S. Soriano Practice Set 2Kevin MagdayNoch keine Bewertungen

- Chapter 9.docpart 1 FinalDokument15 SeitenChapter 9.docpart 1 FinalRabie HarounNoch keine Bewertungen

- General Ledger - Adrianne, Mendoza-BSBA-1 BLK BDokument6 SeitenGeneral Ledger - Adrianne, Mendoza-BSBA-1 BLK BJaks ExplorerNoch keine Bewertungen

- 2021 FAR Straight Problem - Hyc2Dokument2 Seiten2021 FAR Straight Problem - Hyc2Mariecris BatasNoch keine Bewertungen

- ACCTGDokument2 SeitenACCTGGrace Anne AlaptoNoch keine Bewertungen

- I. Learning Activities: Sum of Weights (3+2+1) 6Dokument6 SeitenI. Learning Activities: Sum of Weights (3+2+1) 6Valdez AlyssaNoch keine Bewertungen

- S. Roces (Closing)Dokument11 SeitenS. Roces (Closing)Jesseric RomeroNoch keine Bewertungen

- Financial Preparation For Entrepreneurial VenturesDokument37 SeitenFinancial Preparation For Entrepreneurial VenturesCzarina MichNoch keine Bewertungen

- YVONNE MerchandisingDokument1 SeiteYVONNE Merchandisingart50% (2)

- Effects of Transactions Instructions: Indicate The Effects of Each Transaction by Writing The ChoicesDokument1 SeiteEffects of Transactions Instructions: Indicate The Effects of Each Transaction by Writing The ChoicesHessiel Mae Jumalon Garcines100% (1)

- Name of Examinee: - : Prepare The FollowingDokument15 SeitenName of Examinee: - : Prepare The FollowingNoel CarpioNoch keine Bewertungen

- Adjusting Entries ExampleDokument5 SeitenAdjusting Entries ExampleSiak Ni LynnLadyNoch keine Bewertungen

- Del Mundo Landscape SpecialistDokument4 SeitenDel Mundo Landscape SpecialistKendall JennerNoch keine Bewertungen

- ABM 1 Adjustments and WorksheetDokument4 SeitenABM 1 Adjustments and WorksheetChelsie Coliflores100% (1)

- Pequit Company Chart of Accounts For The Year Ended December 31, 2019 Account No. Description Account TypeDokument41 SeitenPequit Company Chart of Accounts For The Year Ended December 31, 2019 Account No. Description Account TypePia Suril0% (1)

- Adjusting Entries QuizDokument2 SeitenAdjusting Entries QuizOfelia YanosNoch keine Bewertungen

- Revised - Approved (With Reminders) CAE-BSA BSMA BSAIS BSIA-2ND SEM-ACC 213 Strategic Cost ManagementDokument149 SeitenRevised - Approved (With Reminders) CAE-BSA BSMA BSAIS BSIA-2ND SEM-ACC 213 Strategic Cost ManagementCabatingan Alecza JadeNoch keine Bewertungen

- Chapter 6 Corporate Social ResponsibilityDokument11 SeitenChapter 6 Corporate Social ResponsibilityKaye Joy TendenciaNoch keine Bewertungen

- Intermediate Accounting IDokument35 SeitenIntermediate Accounting ICrystal AlcantaraNoch keine Bewertungen

- MACCDokument7 SeitenMACCGerry SajolNoch keine Bewertungen

- Partnership LiquidationDokument5 SeitenPartnership LiquidationChristian PaulNoch keine Bewertungen

- ch04.ppt - Income Statement and Related InformationDokument68 Seitench04.ppt - Income Statement and Related InformationAmir ContrerasNoch keine Bewertungen

- Chapter 10Dokument16 SeitenChapter 10Charlene LeynesNoch keine Bewertungen

- Financial Accounting CH 4Dokument21 SeitenFinancial Accounting CH 4Israel MoraNoch keine Bewertungen

- Chapter 4 Question ReviewDokument11 SeitenChapter 4 Question ReviewUyenNoch keine Bewertungen

- Hands-On Exercise No. 3 Batch-06 Quickbooks Total Marks: 10 Due Date: 16/04/2020Dokument3 SeitenHands-On Exercise No. 3 Batch-06 Quickbooks Total Marks: 10 Due Date: 16/04/2020SohailAKramNoch keine Bewertungen

- Clients Transactions Summary - Bo Side: All With Net EffectsDokument1 SeiteClients Transactions Summary - Bo Side: All With Net EffectsSohailAKramNoch keine Bewertungen

- Batch-06 QKB101 2 PDFDokument4 SeitenBatch-06 QKB101 2 PDFMuhammad TaimoorNoch keine Bewertungen

- Hands-On Exercise No. 2 Batch-06 Quickbooks Total Marks: 10 Due Date: 02/04/2020Dokument3 SeitenHands-On Exercise No. 2 Batch-06 Quickbooks Total Marks: 10 Due Date: 02/04/2020SohailAKramNoch keine Bewertungen

- Hands-On Exercise No. 3 Batch-06 Quickbooks Total Marks: 10 Due Date: 16/04/2020Dokument4 SeitenHands-On Exercise No. 3 Batch-06 Quickbooks Total Marks: 10 Due Date: 16/04/2020SohailAKramNoch keine Bewertungen

- Adam Securities Limited Company ProfileDokument22 SeitenAdam Securities Limited Company ProfileSohailAKram100% (1)

- Jenbacher Type 3: Efficient, Durable, Reliable Reference InstallationsDokument2 SeitenJenbacher Type 3: Efficient, Durable, Reliable Reference InstallationsSohailAKramNoch keine Bewertungen

- Hands-On Exercise No. 4 Batch-06 Quickbooks Total Marks: 10 Due Date: 05/05/2020Dokument4 SeitenHands-On Exercise No. 4 Batch-06 Quickbooks Total Marks: 10 Due Date: 05/05/2020SohailAKramNoch keine Bewertungen

- Alternator Data Sheet of 1250kVA Prime Cummins DG SetDokument8 SeitenAlternator Data Sheet of 1250kVA Prime Cummins DG SetSohailAKram100% (1)

- Diesel Generator Set KTA50 Series Engine: Power GenerationDokument4 SeitenDiesel Generator Set KTA50 Series Engine: Power GenerationsdasdNoch keine Bewertungen

- Financial Accounting - Chapter 2Dokument24 SeitenFinancial Accounting - Chapter 2SohailAKramNoch keine Bewertungen

- Hands-On Exercise No. 4 Batch-06 Quickbooks Total Marks: 10 Due Date: 30/04/2020Dokument3 SeitenHands-On Exercise No. 4 Batch-06 Quickbooks Total Marks: 10 Due Date: 30/04/2020SohailAKramNoch keine Bewertungen

- Fuel Consumption Sheet of 1250kVA Prime Cummins DG SetDokument3 SeitenFuel Consumption Sheet of 1250kVA Prime Cummins DG SetSohailAKramNoch keine Bewertungen

- Batch-06 DGM101 1Dokument3 SeitenBatch-06 DGM101 1Arbaz khanNoch keine Bewertungen

- Chapter 2 Integration and The Key Elements of Organizational StrategyDokument30 SeitenChapter 2 Integration and The Key Elements of Organizational StrategySohailAKramNoch keine Bewertungen

- 2019-Jyoti & Rani-Role of Burnout and Mentoring Between High Performance Work SystemDokument11 Seiten2019-Jyoti & Rani-Role of Burnout and Mentoring Between High Performance Work SystemSohailAKramNoch keine Bewertungen

- Title: 18 - Ads Creation Learning ObjectivesDokument1 SeiteTitle: 18 - Ads Creation Learning ObjectivesSohailAKramNoch keine Bewertungen

- Title: 13 - Negotiating With Clients Learning ObjectivesDokument1 SeiteTitle: 13 - Negotiating With Clients Learning ObjectivesAbdulrehmanNoch keine Bewertungen

- Mr. Mohsin Tariq 03525 - 96463Dokument4 SeitenMr. Mohsin Tariq 03525 - 96463SohailAKramNoch keine Bewertungen

- Bachon Ko Zimmedari Kesay SikhainDokument241 SeitenBachon Ko Zimmedari Kesay SikhainSohailAKramNoch keine Bewertungen

- Location StrategyDokument21 SeitenLocation StrategySohailAKramNoch keine Bewertungen

- Financial Accounting - Chapter 3Dokument42 SeitenFinancial Accounting - Chapter 3SohailAKramNoch keine Bewertungen

- A Grounded Theory Examination of Project Managers' AccountabilityDokument9 SeitenA Grounded Theory Examination of Project Managers' AccountabilitySohailAKramNoch keine Bewertungen

- 18 AdsCreationDokument1 Seite18 AdsCreationSohailAKramNoch keine Bewertungen

- Financial Accounting CH# 4Dokument21 SeitenFinancial Accounting CH# 4SohailAKramNoch keine Bewertungen

- Financial Accounting - Chapter 1Dokument44 SeitenFinancial Accounting - Chapter 1SohailAKramNoch keine Bewertungen

- Abu Hubairah BasriDokument1 SeiteAbu Hubairah BasriSohailAKramNoch keine Bewertungen

- Guide To InvestorsDokument50 SeitenGuide To Investorsshirazz_anwar6011Noch keine Bewertungen

- Abu Hubairah BasriDokument9 SeitenAbu Hubairah BasriSohailAKramNoch keine Bewertungen

- Baddebt Recovery PBDDDokument3 SeitenBaddebt Recovery PBDDsubhashis deNoch keine Bewertungen

- Study Guide in Introductory Accounting For Service BusinessDokument84 SeitenStudy Guide in Introductory Accounting For Service BusinessMg GarciaNoch keine Bewertungen

- Agency - EDokument25 SeitenAgency - EvalkyriorNoch keine Bewertungen

- 6.prep of Trial BalanceDokument20 Seiten6.prep of Trial BalanceLouie De La TorreNoch keine Bewertungen

- Financial Ratios of VinamilkDokument6 SeitenFinancial Ratios of VinamilkDương DươngNoch keine Bewertungen

- General Ledger 2 ColmDokument2 SeitenGeneral Ledger 2 ColmMary100% (3)

- Book 1Dokument2 SeitenBook 1mohitgaba19Noch keine Bewertungen

- LU2 Lecturer NotesDokument23 SeitenLU2 Lecturer NotesShweta SinghNoch keine Bewertungen

- MGT 101 SampleDokument9 SeitenMGT 101 SampleWaleed AbbasiNoch keine Bewertungen

- Liabilities With Answer For StudentsDokument29 SeitenLiabilities With Answer For StudentsDivine CuasayNoch keine Bewertungen

- Seatwork #6Dokument5 SeitenSeatwork #6Jasmine Maningo100% (1)

- Fabm 1 ReviewDokument29 SeitenFabm 1 ReviewMelanie Cruz ConventoNoch keine Bewertungen

- Nhóm 4 - In-Class Exercise BOP - 2020Dokument36 SeitenNhóm 4 - In-Class Exercise BOP - 2020Thảo Hoàng PhươngNoch keine Bewertungen

- FA2 Mock Exam 1Dokument10 SeitenFA2 Mock Exam 1smartlearning1977Noch keine Bewertungen

- SOLMANny 7Dokument15 SeitenSOLMANny 7Zi Villar100% (1)

- Dwnload Full College Accounting A Practical Approach 13th Edition Jeffrey Slater Test Bank PDFDokument36 SeitenDwnload Full College Accounting A Practical Approach 13th Edition Jeffrey Slater Test Bank PDFraisable.maugerg07jpg100% (11)

- Home Office and BranchDokument4 SeitenHome Office and BranchRed YuNoch keine Bewertungen

- Adv Acct CH 6 HoyleDokument76 SeitenAdv Acct CH 6 HoyleFatima AL-SayedNoch keine Bewertungen

- FMA Question PackDokument67 SeitenFMA Question PackAhamed NabeelNoch keine Bewertungen

- Qualifying Exam Review Qs Final Answers2Dokument30 SeitenQualifying Exam Review Qs Final Answers2JCGonzales100% (1)

- Cash QuizDokument6 SeitenCash QuizGwen Cabarse PansoyNoch keine Bewertungen

- Balance of PaymentsDokument14 SeitenBalance of Paymentsনীল রহমানNoch keine Bewertungen

- Cambridge O Level: ACCOUNTING 7707/22Dokument20 SeitenCambridge O Level: ACCOUNTING 7707/22AB YUNoch keine Bewertungen

- Financial Statements Non Profit SampleDokument38 SeitenFinancial Statements Non Profit Sampleluve silviaNoch keine Bewertungen

- IbtpacingguideDokument8 SeitenIbtpacingguideapi-377548294Noch keine Bewertungen

- BLD 416 Budgeting and Financial Control 1 Lecture Note 2Dokument9 SeitenBLD 416 Budgeting and Financial Control 1 Lecture Note 2Oluwayomi MalomoNoch keine Bewertungen

- Template - Revision Exercise 1Dokument5 SeitenTemplate - Revision Exercise 1Vimbai NyakudangaNoch keine Bewertungen

- Mcha 05Dokument10 SeitenMcha 05nadaNoch keine Bewertungen

- Gov Acc 2019 JC AbillonarDokument9 SeitenGov Acc 2019 JC AbillonarGabriel PonceNoch keine Bewertungen

- (FABM 2) Interactive Module Week 2Dokument12 Seiten(FABM 2) Interactive Module Week 2Krisha FernandezNoch keine Bewertungen