Beruflich Dokumente

Kultur Dokumente

4th Quarterly Report 074-75-Statement

Hochgeladen von

DamodarCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

4th Quarterly Report 074-75-Statement

Hochgeladen von

DamodarCopyright:

Verfügbare Formate

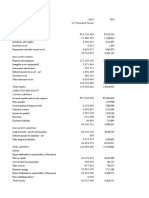

Schedule - 1

Nepal Telecom

(Nepal Doorsanchar Company Limited)

Unaudited Financial Results of Forth Quarter of Financial Year 2074/75 (Shrawan 2074 - Ashadh 2075)

Statement of Financial Position

As at Ashadh 32, 2075 As at Chaitra 30, 2074 As at Ashadh 31, 2074

Rs(Unaudited) Rs(Unaudited) Rs(Audited)

Assets

Non- Current Assets

Intangible assets 99,262,899 115,447,149 163,999,899

Property, Plant and Equipment 38,833,342,156 37,144,574,929 37,143,110,564

Capital Work-in-Progress 4,367,226,520 5,908,327,030 6,131,524,342

Investments 10,009,764,905 9,652,368,215 8,156,708,029

Deferred Tax Asset 5,052,400,245 4,678,494,643 4,347,506,855

58,361,996,725 57,499,211,966 55,942,849,689

Current Assets

Inventory 327,484,443 489,621,375 459,033,801

Prepayments and Advance Tax 1,491,679,800 2,140,649,275 1,180,592,652

Loan, Advance & Others 2,831,493,137 2,258,130,535 2,705,565,030

Trade Receivable 2,828,504,506 3,438,221,255 2,673,822,703

Investments 41,270,740,000 41,697,640,000 34,389,750,000

Cash & Cash Equivalents 22,613,255,046 22,379,446,554 24,255,209,290

71,363,156,932 72,403,708,994 65,663,973,476

Total Assets 129,725,153,657 129,902,920,960 121,606,823,165

Equity and Liabilities

Share Capital 15,000,000,000 15,000,000,000 15,000,000,000

Reserve and Surplus 83,474,723,657 79,690,515,236 76,330,848,229

Total Equity 98,474,723,657 94,690,515,236 91,330,848,229

Non-Current Liabilities

Post Employment Benefits 10,653,362,365 10,184,761,676 9,180,167,297

Subscriber Deposit 1,983,675,990 1,971,852,260 2,037,519,310

GSM License Fee 1,958,161,866 2,454,307,016 3,942,742,468

Non-Current Liabilities 14,595,200,221 14,610,920,952 15,160,429,075

Current Liabilities and Provisions

Taxation Liabilities - - -

Provisions 4,885,450,309 2,140,880,483 2,109,700,681

Current Liabilities 11,769,779,470 18,460,604,289 13,005,845,180

16,655,229,779 20,601,484,772 15,115,545,861

Total Equity and Liabilities 129,725,153,657 129,902,920,960 121,606,823,165

Statement of Profit or Loss

Shrawan 2074 - Ashadh 2075 Shrawan 2074 - Chaitra 2074 Shrawan 2073 - Ashadh 2074

Rs(Unaudited) Rs(Unaudited) Rs(Audited)

INCOME

Income from Services 39,320,406,408 29,392,137,852 40,346,817,951

Other Income 6,245,463,678 4,461,133,043 4,242,171,171

Total Income 45,565,870,086 33,853,270,895 44,588,989,122

EXPENDITURE

Personnel Costs 6,234,013,528 4,745,981,340 5,328,759,586

VRS Expenses - - -

Operation and Maintenance Costs 6,711,923,359 4,981,440,791 6,533,320,864

Sales Channel, Marketing and Promotion Costs 1,647,309,368 1,172,170,293 1,593,405,851

Administrative Costs 1,344,974,123 1,024,597,427 1,289,039,635

Regulatory Fees, Charges and Renewals 3,647,476,837 2,647,999,953 3,495,780,251

Finance Costs 513,309,460 379,887,483 810,278,845

Depreciation 4,678,177,015 3,203,408,247 4,372,057,500

Impairment Loss 249,504,564 - 157,531,918

Equity Loss in Associate 8,618,000 - 8,618,802

Exchange Loss/(Gain) (383,045,255) (71,239,579) 424,340,522

Total Expenditure 24,652,260,998 18,084,245,955 24,013,133,774

Net Profit Before Tax 20,913,609,088 15,769,024,939 20,575,855,348

Provision for Income Tax 5,246,108,561 3,912,618,466 (5,203,091,224)

Net Profit After Tax 15,667,500,527 11,856,406,473 15,372,764,124

Other Comprehensive Income:

Remeasurements of defined benefit plans - -

Total Comprehensive Income for the Year 15,667,500,527 11,856,406,473 15,372,764,124

Ratios as at Forth Quarter Ended Ashadh 32, 2075

As at Ashadh 32, 2075 As at Chaitra 30, 2074 As at Ashadh 31, 2074

Rs(Unaudited) Rs(Unaudited) Rs(Audited)

Earnings Per Share(Rs.) 104.45 105.39 102.49

Closing Market Price of Share (Rs.) 721 733 675

P/E Ratio 6.90 6.96 6.59

Net Worth Per Share(Rs.) 656.50 631.27 608.87

Current Ratio 4.28 3.51 4.34

Note:

1 Above presented figures are subject to change as per the directions, if any, of Statutory Auditor

2 The issue of quantification of the GSM license fee that expired on 2071.01.28 is still not settled within the regulatory authority. So, the company renewed its

license fee by paying Rs. 18.90 crores and has amortized the cost accordingly based on its validity period. The fee liability, if confirmed and quantified, may result

in further cost to the company and hence, net profit after tax will be adjusted by that extent.

3 Finance costs comprises of the unwinding of the GSM License fee liability carried at fair value using the applicable discount rates. These are non-cash

expenditures charged to Statement of Profit or Loss to comply with requirement of NFRS.

4 The company follows requirement of Security Exchange Board of Nepal (SEBON), Nepal Stock Exchange (NEPSE) and the requirement of Companies Act, 2063 for

publishing interim financial reporting. Condensed Financial Statements prepared as per Nepal Accounting Standard 34 "Interim Financial Reporting" is published

in the website "www.ntc.net.np" of the Company

5 Previous quarters' figures have been regrouped and rearranged whereever necessary

Das könnte Ihnen auch gefallen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- NEA Statement of Financial Position Upto 2020Dokument2 SeitenNEA Statement of Financial Position Upto 2020Sushil PoudelNoch keine Bewertungen

- Accounting ProjectDokument16 SeitenAccounting Projectnawal jamshaidNoch keine Bewertungen

- Gma FSDokument13 SeitenGma FSMark Angelo BustosNoch keine Bewertungen

- Financial Analysis 2015Dokument5 SeitenFinancial Analysis 2015Walter NyakwakaNoch keine Bewertungen

- Seven Up Bottling Co PLC: For The Ended 31 March, 2014Dokument4 SeitenSeven Up Bottling Co PLC: For The Ended 31 March, 2014Gina FelyaNoch keine Bewertungen

- Excel Proyeksi KeuanganDokument26 SeitenExcel Proyeksi KeuanganMeliana WandaNoch keine Bewertungen

- FS-Consolidated 84Dokument6 SeitenFS-Consolidated 84trollilluminati123Noch keine Bewertungen

- SIRA1H11Dokument8 SeitenSIRA1H11Inde Pendent LkNoch keine Bewertungen

- UBL Annual Report 2018-128Dokument1 SeiteUBL Annual Report 2018-128IFRS LabNoch keine Bewertungen

- MPCLDokument4 SeitenMPCLRizwan Sikandar 6149-FMS/BBA/F20Noch keine Bewertungen

- Royal Ceramics Lanka PLC: Interim Financial Statements For The Period Ended 30Th September 2022Dokument12 SeitenRoyal Ceramics Lanka PLC: Interim Financial Statements For The Period Ended 30Th September 2022kasun witharanaNoch keine Bewertungen

- Balance Sheet & P & LDokument3 SeitenBalance Sheet & P & LSatish WagholeNoch keine Bewertungen

- Hira Textile Mill Horizontal Analysis 2014-13 1Dokument8 SeitenHira Textile Mill Horizontal Analysis 2014-13 1sumeer shafiqNoch keine Bewertungen

- 3rd Quarter 15Dokument4 Seiten3rd Quarter 15TanayNoch keine Bewertungen

- Financial Position 2019 2020Dokument1 SeiteFinancial Position 2019 2020Anacristina PincaNoch keine Bewertungen

- Interim Financial Statements - English q2Dokument12 SeitenInterim Financial Statements - English q2yanaNoch keine Bewertungen

- Shezan Company of Pakistan Balance Sheet As On Dec 31, .: Assets Non-Current AssetsDokument5 SeitenShezan Company of Pakistan Balance Sheet As On Dec 31, .: Assets Non-Current AssetsM Bilal KNoch keine Bewertungen

- Spyder Student ExcelDokument21 SeitenSpyder Student ExcelNatasha PerryNoch keine Bewertungen

- Hira Textile Mill Horizontal Analysis 2015-13Dokument9 SeitenHira Textile Mill Horizontal Analysis 2015-13sumeer shafiqNoch keine Bewertungen

- Buxly Paint: Balance SheetDokument33 SeitenBuxly Paint: Balance SheetJarhan AzeemNoch keine Bewertungen

- Shell Pakistan: Total Non Current Assets Current AssetsDokument17 SeitenShell Pakistan: Total Non Current Assets Current AssetsshamzanNoch keine Bewertungen

- Maple Leaf Cement Factory Limited.Dokument17 SeitenMaple Leaf Cement Factory Limited.MubasharNoch keine Bewertungen

- FMOD PROJECT Ouijhggfffe5Dokument97 SeitenFMOD PROJECT Ouijhggfffe5Omer CrestianiNoch keine Bewertungen

- UBL Annual Report 2018-129Dokument1 SeiteUBL Annual Report 2018-129IFRS LabNoch keine Bewertungen

- 1609913324.QCI Financials FY 2019-20 Final SignedDokument14 Seiten1609913324.QCI Financials FY 2019-20 Final SignedHari OmNoch keine Bewertungen

- Fauji Food 30 June 2023Dokument3 SeitenFauji Food 30 June 2023mrordinaryNoch keine Bewertungen

- Avenue SuperDokument19 SeitenAvenue Superanuda29102001Noch keine Bewertungen

- Balance Sheet: Total Assets Total EquityDokument6 SeitenBalance Sheet: Total Assets Total EquityDeepak MatlaniNoch keine Bewertungen

- Globe PLDT 2014 Financial RatiosDokument6 SeitenGlobe PLDT 2014 Financial RatiosSamNoch keine Bewertungen

- Spreadsheet-Company A - Quiz 2Dokument6 SeitenSpreadsheet-Company A - Quiz 2BinsiboiNoch keine Bewertungen

- Consolidated Statement of Financial Position: Beximco Pharmaceuticals Limited and Its Subsidiaries As at June 30, 2019Dokument4 SeitenConsolidated Statement of Financial Position: Beximco Pharmaceuticals Limited and Its Subsidiaries As at June 30, 2019palashndcNoch keine Bewertungen

- Askari Bank Limited Financial Statement AnalysisDokument16 SeitenAskari Bank Limited Financial Statement AnalysisAleeza FatimaNoch keine Bewertungen

- Dersnot 1372 1684245035Dokument6 SeitenDersnot 1372 1684245035Murat SiyahkayaNoch keine Bewertungen

- Pakistan Petroleum LTDDokument43 SeitenPakistan Petroleum LTDMuheeb AhmadNoch keine Bewertungen

- Interim Financial Statement Ashwin End 2077Dokument37 SeitenInterim Financial Statement Ashwin End 2077Manoj mahatoNoch keine Bewertungen

- FMOD PROJECT WeefervDokument13 SeitenFMOD PROJECT WeefervOmer CrestianiNoch keine Bewertungen

- Pran Company Ratio AnalysisDokument6 SeitenPran Company Ratio AnalysisAhmed Afridi Bin FerdousNoch keine Bewertungen

- Exide Pakistan Limited: Five Year Financial AnalysisDokument13 SeitenExide Pakistan Limited: Five Year Financial AnalysisziaNoch keine Bewertungen

- 4.analisisdeestadosfinancieros, CocaCola (Rodriguez Aleman 2022040)Dokument4 Seiten4.analisisdeestadosfinancieros, CocaCola (Rodriguez Aleman 2022040)Jose Arturo Rodriguez AlemanNoch keine Bewertungen

- Solutions For Bubble and BeeDokument12 SeitenSolutions For Bubble and BeeMavin Jerald100% (6)

- Projected Financial StatementsDokument2 SeitenProjected Financial StatementsRobert Dominic GonzalesNoch keine Bewertungen

- Business Plan - Manila Broadcasting Company Andaya, Bagcal, Chy, Navato, Pili, Viernes Projected Financial StatementsDokument2 SeitenBusiness Plan - Manila Broadcasting Company Andaya, Bagcal, Chy, Navato, Pili, Viernes Projected Financial StatementsRobert Dominic GonzalesNoch keine Bewertungen

- Business Plan - Manila Broadcasting Company Andaya, Bagcal, Chy, Navato, Pili, Viernes Projected Financial StatementsDokument2 SeitenBusiness Plan - Manila Broadcasting Company Andaya, Bagcal, Chy, Navato, Pili, Viernes Projected Financial StatementsRobert Dominic GonzalesNoch keine Bewertungen

- Unaudited Second Quarter 2022 - 23Dokument42 SeitenUnaudited Second Quarter 2022 - 23Mahan KhanalNoch keine Bewertungen

- Renata Limited - Conso Accounts 2013Dokument139 SeitenRenata Limited - Conso Accounts 2013kakoli akterNoch keine Bewertungen

- Financial Statements-Ceres Gardening CompanyDokument9 SeitenFinancial Statements-Ceres Gardening CompanyHarshit MalviyaNoch keine Bewertungen

- Excel File SuzukiDokument18 SeitenExcel File SuzukiMahnoor AfzalNoch keine Bewertungen

- Balance SheetDokument2 SeitenBalance SheetMuazzam AliNoch keine Bewertungen

- Assets Non-Current Assets: Equity and Liabilities Share Capital and ReservesDokument10 SeitenAssets Non-Current Assets: Equity and Liabilities Share Capital and ReservesM Bilal KNoch keine Bewertungen

- Swisstek (Ceylon) PLC Swisstek (Ceylon) PLCDokument7 SeitenSwisstek (Ceylon) PLC Swisstek (Ceylon) PLCkasun witharanaNoch keine Bewertungen

- Interim Financial StatementsDokument22 SeitenInterim Financial StatementsShivam KarnNoch keine Bewertungen

- Galadari PDFDokument7 SeitenGaladari PDFRDNoch keine Bewertungen

- 04 LBP2015 Financial PositionDokument1 Seite04 LBP2015 Financial PositionHermione Eyer - TanNoch keine Bewertungen

- Sir Sarwar AFSDokument41 SeitenSir Sarwar AFSawaischeemaNoch keine Bewertungen

- Eswatini 2020 Formulation External BudgetFramework NatGov COMESASADC EnglishDokument240 SeitenEswatini 2020 Formulation External BudgetFramework NatGov COMESASADC EnglishPanda CoinNoch keine Bewertungen

- 4 MIS - March 2013Dokument129 Seiten4 MIS - March 2013kr__santoshNoch keine Bewertungen

- Balance Sheet: Glaxosmithkline Pakistan LimitedDokument15 SeitenBalance Sheet: Glaxosmithkline Pakistan LimitedMuhammad SamiNoch keine Bewertungen

- Oil & Gas Development Company Limited: Equity and LiabilitiesDokument56 SeitenOil & Gas Development Company Limited: Equity and LiabilitiesFariaFaryNoch keine Bewertungen

- Balance Sheet: Particulars 2014 2015 AssetsDokument11 SeitenBalance Sheet: Particulars 2014 2015 AssetsTaiba SarmadNoch keine Bewertungen

- VlsiDokument216 SeitenVlsisenthil_5Noch keine Bewertungen

- Mark Scheme Big Cat FactsDokument3 SeitenMark Scheme Big Cat FactsHuyền MyNoch keine Bewertungen

- Roman Catholic of Aklan Vs Mun of Aklan FULL TEXTDokument33 SeitenRoman Catholic of Aklan Vs Mun of Aklan FULL TEXTDessa Ruth ReyesNoch keine Bewertungen

- G12 PR1 AsDokument34 SeitenG12 PR1 Asjaina rose yambao-panerNoch keine Bewertungen

- CBSE Class11 Maths Notes 13 Limits and DerivativesDokument7 SeitenCBSE Class11 Maths Notes 13 Limits and DerivativesRoy0% (1)

- Adult Consensual SpankingDokument21 SeitenAdult Consensual Spankingswl156% (9)

- Reflection (The We Entrepreneur)Dokument2 SeitenReflection (The We Entrepreneur)Marklein DumangengNoch keine Bewertungen

- Lolita Enrico Vs Heirs of Spouses Eulogio Medinaceli and Trinidad MedinaceliDokument3 SeitenLolita Enrico Vs Heirs of Spouses Eulogio Medinaceli and Trinidad Medinacelichatmche-06Noch keine Bewertungen

- Timing Light Schematic or DiagramDokument2 SeitenTiming Light Schematic or Diagramprihharmanto antokNoch keine Bewertungen

- Fsi GreekBasicCourse Volume1 StudentTextDokument344 SeitenFsi GreekBasicCourse Volume1 StudentTextbudapest1Noch keine Bewertungen

- Pitch PDFDokument12 SeitenPitch PDFJessa Mae AnonuevoNoch keine Bewertungen

- LESSON 1: What Is Social Studies?: ObjectivesDokument15 SeitenLESSON 1: What Is Social Studies?: ObjectivesRexson Dela Cruz Taguba100% (1)

- May Be From Interval (1,100) .The Program Output May Be One of The Following (Scalene, Isosceles, Equilateral, Not A Triangle) - Perform BVADokument3 SeitenMay Be From Interval (1,100) .The Program Output May Be One of The Following (Scalene, Isosceles, Equilateral, Not A Triangle) - Perform BVAsourabh_sanwalrajputNoch keine Bewertungen

- Bragg Waveguide and Its DescriptionDokument22 SeitenBragg Waveguide and Its DescriptionPratibha Karki RawatNoch keine Bewertungen

- Art of Data ScienceDokument159 SeitenArt of Data Sciencepratikshr192% (12)

- TLG 82201Dokument7 SeitenTLG 82201beatmymeat100% (2)

- MathTextbooks9 12Dokument64 SeitenMathTextbooks9 12Andrew0% (1)

- Lee Gwan Cheung Resume WeeblyDokument1 SeiteLee Gwan Cheung Resume Weeblyapi-445443446Noch keine Bewertungen

- FBFBFDokument13 SeitenFBFBFBianne Teresa BautistaNoch keine Bewertungen

- Quantile Regression (Final) PDFDokument22 SeitenQuantile Regression (Final) PDFbooianca100% (1)

- Resume UngerDokument2 SeitenResume UngerMichelle ClarkNoch keine Bewertungen

- Ant Colony AlgorithmDokument11 SeitenAnt Colony Algorithmjaved765Noch keine Bewertungen

- 400 Series Turbo App Chart 2Dokument5 Seiten400 Series Turbo App Chart 2Abi ZainNoch keine Bewertungen

- Young Entrepreneurs of IndiaDokument13 SeitenYoung Entrepreneurs of Indiamohit_jain_90Noch keine Bewertungen

- ECON266 Worksheet 8Dokument4 SeitenECON266 Worksheet 8Oi OuNoch keine Bewertungen

- Kepimpinan BerwawasanDokument18 SeitenKepimpinan BerwawasanandrewanumNoch keine Bewertungen

- Unit 1 - Identifying A Problem PDFDokument16 SeitenUnit 1 - Identifying A Problem PDFZanko FitnessNoch keine Bewertungen

- Course-Outline EL 102 GenderAndSocietyDokument4 SeitenCourse-Outline EL 102 GenderAndSocietyDaneilo Dela Cruz Jr.Noch keine Bewertungen

- APARICIO Frances Et Al. (Eds.) - Musical Migrations Transnationalism and Cultural Hybridity in Latino AmericaDokument218 SeitenAPARICIO Frances Et Al. (Eds.) - Musical Migrations Transnationalism and Cultural Hybridity in Latino AmericaManuel Suzarte MarinNoch keine Bewertungen

- Modern Prometheus Editing The HumanDokument399 SeitenModern Prometheus Editing The HumanHARTK 70Noch keine Bewertungen