Beruflich Dokumente

Kultur Dokumente

19 ST Lukes Vs CIR

Hochgeladen von

Anonymous MikI28PkJcOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

19 ST Lukes Vs CIR

Hochgeladen von

Anonymous MikI28PkJcCopyright:

Verfügbare Formate

TITLE : 018 CIR vs Phil Health Care Providers, Inc.

, 522 SCRA 131

FACTS : EO 273 imposed VAT on sale of goods and services. CIR subsequently issued VAT ruling that

respondent as provider of medical services was exempth from VAT coverage. Tax code was adopted and

adopted provsion of EO 273 and RA 7716 on E-VAT.

On January 27, 2000, the respondent CIR sent petitioner assessment of deficiency taxes, both Value-

Added Tax (VAT) and documentary stamp tax (DST) in the total amount of P224,702,641.18 for taxable

years 1996 and 1997.

Petitioner protested such assessment in a letter, but the respondent did not act on the protest which led the

petitioner to file a petition in the Court of Tax Appeals (CTA) seeking the cancellation of said

assessments. CTA partially granted the petition wherein the Phil Health is ordered to pay the deficiency

VAT and set aside the DST deficiency tax.

Respondent appealed in Court of Appeals (CA) with regard to the cancellation of DST assessment. CA

granted the petition. The Court affirmed CA’s decision that DST under Sec 185 is not a tax on the

business transacted but an excise on the privilege, opportunity or facility for the transaction of business

and petitioner be subject to DST being primarily on a business of Indemnity. Hence, petitioner filed a

motion for reconsideration

ISSUE : Whether or not the petitioner is liable to pay the DST on its health care agreement pursuant to

Sec.185 of the National Internal Revenue Code of 1997

HELD : Petition granted. Petitioner is not contemplated to be included in “or other branch insurance”

covered by Section 185 of NIRC because it is a Health Maintenance Organization (HMO) and not an

insurance company. Even if a contract contains all the elements of an insurance contract, HMO’s primary

purpose is rendering service to its member by lowering prices and reducing the cost rather than the risk of

medical health. On the other hand, insurance businesses undertakes for a consideration to indemnify its

clients against loss, damage or liability arising from unknown or contingent event. The term “indemnify”

therein presuppose that a liability or claim has already been incurred. In HMOs, there is no indemnity

precisely because the member merely avails of medical services to be paid or already paid in advance at a

pre-agreed price under the agreements.

Moreover, HMOs play an important role in society as partners of the State in achieving its constitutional

mandate of providing citizens with affordable health services.

Also, the DST assessment of the petitioner for the years 1996 and 1997 became moot and academic since

it availed tax amnesty under RA 9480 on December 10, 2007. Thus, petitioner is entitled to immunity

from payment of taxes for taxable year 2005 and prior years.

Alan A Gultia

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- ADR Law of 2004Dokument8 SeitenADR Law of 2004Anonymous MikI28PkJcNoch keine Bewertungen

- Reckless Imprudence Rsulting To Multiple HomicideDokument10 SeitenReckless Imprudence Rsulting To Multiple HomicideAnonymous MikI28PkJcNoch keine Bewertungen

- What Happens at The End of A Fixed Term ContractDokument3 SeitenWhat Happens at The End of A Fixed Term ContractAnonymous MikI28PkJcNoch keine Bewertungen

- WorldwidetaxvsterritorialDokument2 SeitenWorldwidetaxvsterritorialAnonymous MikI28PkJcNoch keine Bewertungen

- Nestle CasesDokument10 SeitenNestle CasesAnonymous MikI28PkJcNoch keine Bewertungen

- Sarasola v. Trinidad, 40 Phil. 252Dokument58 SeitenSarasola v. Trinidad, 40 Phil. 252Anonymous MikI28PkJcNoch keine Bewertungen

- Sarasola and Philippine Rabbit CaseDokument2 SeitenSarasola and Philippine Rabbit CaseMRose Serrano50% (2)

- Cyber-Bullying Via Social Media Seen As Crime: DJ Yap @deejayapinqDokument4 SeitenCyber-Bullying Via Social Media Seen As Crime: DJ Yap @deejayapinqAnonymous MikI28PkJcNoch keine Bewertungen

- RA 8504 AIDS Prevention and Control Act of 1998Dokument10 SeitenRA 8504 AIDS Prevention and Control Act of 1998Anonymous MikI28PkJcNoch keine Bewertungen

- Extend Martial LawDokument3 SeitenExtend Martial LawAnonymous MikI28PkJcNoch keine Bewertungen

- Explanatory Notes NIRC 1-30 Part 1 Aug2018Dokument23 SeitenExplanatory Notes NIRC 1-30 Part 1 Aug2018Anonymous MikI28PkJcNoch keine Bewertungen

- Estafa or BP 22Dokument2 SeitenEstafa or BP 22Anonymous MikI28PkJcNoch keine Bewertungen

- Revenue Regulations No 3-98Dokument9 SeitenRevenue Regulations No 3-98Anonymous MikI28PkJcNoch keine Bewertungen

- BP 68Dokument35 SeitenBP 68Anonymous MikI28PkJcNoch keine Bewertungen

- Be It Enacted by The Batasang Pambansa in Session AssembledDokument35 SeitenBe It Enacted by The Batasang Pambansa in Session AssembledAnonymous MikI28PkJcNoch keine Bewertungen

- Philippines - Prohibited & Restricted Imports Philippines - Prohibited ImportsDokument14 SeitenPhilippines - Prohibited & Restricted Imports Philippines - Prohibited ImportsAnonymous MikI28PkJcNoch keine Bewertungen

- Be It Enacted by The Batasang Pambansa in Session AssembledDokument35 SeitenBe It Enacted by The Batasang Pambansa in Session AssembledAnonymous MikI28PkJcNoch keine Bewertungen

- AssignmentDokument1 SeiteAssignmentAnonymous MikI28PkJcNoch keine Bewertungen

- Crac Method SampleDokument14 SeitenCrac Method SampleAnonymous MikI28PkJcNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- NARQ40007-PROCESS - Beauty Parlor ManagementDokument3 SeitenNARQ40007-PROCESS - Beauty Parlor ManagementYogesh ThakurNoch keine Bewertungen

- Core CompetencyDokument9 SeitenCore CompetencyCharm BarinosNoch keine Bewertungen

- Superficial FatsDokument29 SeitenSuperficial FatsCatalina Soler LioiNoch keine Bewertungen

- Viroguard Sanitizer SDS-WatermartDokument7 SeitenViroguard Sanitizer SDS-WatermartIshara VithanaNoch keine Bewertungen

- Concept PaperDokument2 SeitenConcept PaperAngel CoNoch keine Bewertungen

- SES Presentation FinalDokument65 SeitenSES Presentation FinalCurtis YehNoch keine Bewertungen

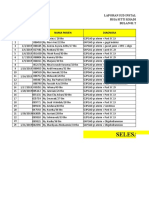

- Laporan Iud 2019Dokument91 SeitenLaporan Iud 2019Yuli AntiNoch keine Bewertungen

- Free Psa PDFDokument4 SeitenFree Psa PDFJimboreanu György PaulaNoch keine Bewertungen

- Community Outreach ProgramDokument31 SeitenCommunity Outreach ProgramAngelo PaulinoNoch keine Bewertungen

- Local Government Financial Statistics England #23-2013Dokument222 SeitenLocal Government Financial Statistics England #23-2013Xavier Endeudado Ariztía FischerNoch keine Bewertungen

- Diabetic Foot Ulcer Assessment and Management Algorithm - 0Dokument11 SeitenDiabetic Foot Ulcer Assessment and Management Algorithm - 0Herlan BelaNoch keine Bewertungen

- Lecture #3 - Carbohydrates & LipidsDokument23 SeitenLecture #3 - Carbohydrates & Lipidsogangurel100% (3)

- Chapter 12 Rev QuestionsDokument3 SeitenChapter 12 Rev QuestionsLidia DominguezNoch keine Bewertungen

- Craniofacial SyndromesDokument101 SeitenCraniofacial SyndromesSaranya MohanNoch keine Bewertungen

- Mms Health Recovery Guidebook 1 October 2016Dokument346 SeitenMms Health Recovery Guidebook 1 October 2016omar hazard94% (50)

- 429-Article Text-1894-2-10-20210715Dokument12 Seiten429-Article Text-1894-2-10-20210715Ziya AstgaNoch keine Bewertungen

- Tano Vs SocratesDokument3 SeitenTano Vs SocratesNimpa PichayNoch keine Bewertungen

- Ifosfamide Nephrotoxicity - UpToDateDokument7 SeitenIfosfamide Nephrotoxicity - UpToDateZurya UdayanaNoch keine Bewertungen

- CircCircuit Protection in Health Care Facilitiesuit Protection in Health Care FacilitiesDokument43 SeitenCircCircuit Protection in Health Care Facilitiesuit Protection in Health Care FacilitiesMenaNoch keine Bewertungen

- Nahom ShewangizawDokument38 SeitenNahom Shewangizawawel centerNoch keine Bewertungen

- Safety Management System in The PhilippinesDokument6 SeitenSafety Management System in The PhilippinesDen PotxszNoch keine Bewertungen

- South Asian AnthropologistDokument8 SeitenSouth Asian AnthropologistVaishali AmbilkarNoch keine Bewertungen

- Health Beliefs and PracticesDokument7 SeitenHealth Beliefs and Practicesapi-283426681Noch keine Bewertungen

- Chapter 3 Definition - DisabilityDokument12 SeitenChapter 3 Definition - DisabilityAnimesh KumarNoch keine Bewertungen

- The Rating Scale Is As FollowsDokument3 SeitenThe Rating Scale Is As Followscarollim1008Noch keine Bewertungen

- 2022 Projects City of BethlehemDokument17 Seiten2022 Projects City of BethlehemLVNewsdotcomNoch keine Bewertungen

- ProVari ManualDokument16 SeitenProVari ManualPatrickNoch keine Bewertungen

- Summarised Clinchers Created For The Exam - Credits - Audi Maglalang-ReedDokument9 SeitenSummarised Clinchers Created For The Exam - Credits - Audi Maglalang-ReedflashjetNoch keine Bewertungen

- COSWPDokument7 SeitenCOSWPjquanNoch keine Bewertungen

- Bkerzay Wellness BrochureDokument1 SeiteBkerzay Wellness BrochureSandra Abou JaoudehNoch keine Bewertungen