Beruflich Dokumente

Kultur Dokumente

Honda Management

Hochgeladen von

Meenakshi ThakurOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Honda Management

Hochgeladen von

Meenakshi ThakurCopyright:

Verfügbare Formate

Corporate Governance

Companies listed on the New York Stock Exchange (the “NYSE”) The following table shows the significant differences between

must comply with certain standards regarding corporate govern- the corporate governance practices followed by U.S. listed compa-

ance under Section 303A of the NYSE Listed Company Manual. nies under Section 303A of the NYSE Listed Company Manual and

However, listed companies that are foreign private issuers, such those followed by Honda.

as Honda, are permitted to follow home-country practice in lieu of

certain provisions of Section 303A.

Corporate Governance Practices Followed by NYSE- Corporate Governance Practices Followed by Honda

Listed U.S. Companies

An NYSE-listed U.S. company must have a majority of directors meeting the For Japanese companies that employ a corporate governance system based on a

independence requirements under Section 303A of the NYSE Listed Company board of corporate auditors (the “board of corporate auditors system”),

Manual. including Honda, Japan’s Company Law has no independence requirement with

respect to directors. The task of overseeing management and, together with the

accounting audit firm, accounting is assigned to the corporate auditors, who are

separate from the company’s management and meet certain independence

requirements under Japan’s Company Law. In the case of Japanese companies

that employ the board of corporate auditors system, including Honda, at least

half of the corporate auditors must be “outside” corporate auditors who must

meet additional independence requirements under Japan’s Company Law. An

outside corporate auditor is defined as a corporate auditor who has not served

as a director, accounting councilor, executive officer, manager, or any other

employee of the company or any of its subsidiaries. Currently, Honda has three

outside corporate auditors which constitute 60% of Honda’s five corporate

auditors.

An NYSE-listed U.S. company must have an audit committee composed entirely Like a majority of Japanese listed companies, Honda employs the board of

of independent directors, and the audit committee must have at least three corporate auditors system as described above. Under this system, the board of

members. corporate auditors is a legally separate and independent body from the board of

directors. The main function of the board of corporate auditors is similar to that

of independent directors, including those who are members of the audit

committee, of a U.S. company: to monitor the performance of the directors, and

review and express an opinion on the method of auditing by the company’s

accounting audit firm and on such accounting audit firm’s audit reports, for the

protection of the company’s shareholders.

Japanese companies that employ the board of corporate auditors system,

including Honda, are required to have at least three corporate auditors.

Currently, Honda has five corporate auditors. Each corporate auditor has a four-

year term. In contrast, the term of each director of Honda is one year.

With respect to the requirements of Rule 10A-3 under the U.S. Securities

Exchange Act of 1934 relating to listed company audit committees, Honda relies

on an exemption under that rule which is available to foreign private issuers with

boards of corporate auditors meeting certain criteria.

An NYSE-listed U.S. company must have a nominating/corporate governance Honda’s directors are elected at a meeting of shareholders. Its Board of Directors

committee composed entirely of independent directors. does not have the power to fill vacancies thereon. Honda’s corporate auditors

are also elected at a meeting of shareholders. A proposal by Honda’s Board of

Directors to elect a corporate auditor must be approved by a resolution of its

Board of Corporate Auditors. The Board of Corporate Auditors is empowered to

request that Honda’s directors submit a proposal for election of a corporate

auditor to a meeting of shareholders. The corporate auditors have the right to

state their opinion concerning election of a corporate auditor at the meeting of

shareholders.

An NYSE-listed U.S. company must have a compensation committee composed Maximum total amounts of compensation for Honda’s directors and corporate

entirely of independent directors. auditors are proposed to, and voted on, by a meeting of shareholders. Once the

proposals for such maximum total amounts of compensation are approved at

the meeting of shareholders, each of the Board of Directors and Board of

Corporate Auditors determines the compensation amount for each member

within the respective maximum total amounts.

An NYSE-listed U.S. company must generally obtain shareholder approval with Currently, Honda does not adopt stock option compensation plans. If Honda

respect to any equity compensation plan. were to adopt such a plan, Honda must obtain shareholder approval for stock

options only if the stock options are issued with specifically favorable conditions

or price concerning the issuance and exercise of the stock options.

33

Das könnte Ihnen auch gefallen

- Corporate Governance Framework in India By: Vaish Associates Advocates Vinay Vaish Hitender MehtaDokument28 SeitenCorporate Governance Framework in India By: Vaish Associates Advocates Vinay Vaish Hitender Mehtaeric grimsonNoch keine Bewertungen

- Role of Sebi in Corporate Governance and Finance - (Essay Example), 2973 Words GradesFixerDokument10 SeitenRole of Sebi in Corporate Governance and Finance - (Essay Example), 2973 Words GradesFixerAbid ZaidiNoch keine Bewertungen

- Independent Directors, SatyamDokument14 SeitenIndependent Directors, SatyamRishabh Jain100% (4)

- Corporate Governance NotesDokument6 SeitenCorporate Governance NotesSunayana GuptaNoch keine Bewertungen

- Independent DirectorsDokument20 SeitenIndependent DirectorsSri VarshiniNoch keine Bewertungen

- Corporate Governance: (CII) in 2009Dokument7 SeitenCorporate Governance: (CII) in 2009Meghna TripathiNoch keine Bewertungen

- Financial Statements 30 Jun 2020-49-99Dokument51 SeitenFinancial Statements 30 Jun 2020-49-99Amna NaseerNoch keine Bewertungen

- TOYOTADokument16 SeitenTOYOTAShakeela NazNoch keine Bewertungen

- Corporate GovernaDokument9 SeitenCorporate GovernaDivyansh SinghNoch keine Bewertungen

- Naresh Chandra Committee Report On Corporate Audit andDokument20 SeitenNaresh Chandra Committee Report On Corporate Audit andHOD CommerceNoch keine Bewertungen

- Auditors & Board of DirectorsDokument18 SeitenAuditors & Board of Directorsvrushali06Noch keine Bewertungen

- Dai-Ichi Life HoldingsDokument11 SeitenDai-Ichi Life HoldingsEmadeldin ArafaNoch keine Bewertungen

- Corporate Governance: Recommendations For Voluntary AdoptionDokument25 SeitenCorporate Governance: Recommendations For Voluntary AdoptionVikas VickyNoch keine Bewertungen

- Chapter 5Dokument19 SeitenChapter 5JacindaNoch keine Bewertungen

- What Is Corporate GovernanceDokument4 SeitenWhat Is Corporate GovernanceKritika SinghNoch keine Bewertungen

- Regulatory Framework - AuditingDokument20 SeitenRegulatory Framework - AuditingDayal SinghNoch keine Bewertungen

- Blue Ribbon CommitteeDokument15 SeitenBlue Ribbon CommitteeMadhav KesarNoch keine Bewertungen

- Corporate Governance Internal Control ComplianceDokument4 SeitenCorporate Governance Internal Control ComplianceArmantoCepongNoch keine Bewertungen

- Code On Corporate GovernanceDokument63 SeitenCode On Corporate GovernanceVishwas JorwalNoch keine Bewertungen

- C P R C G N I: Onsultative Aper On Eview of Orporate Overnance Orms in NdiaDokument54 SeitenC P R C G N I: Onsultative Aper On Eview of Orporate Overnance Orms in NdiaPradyoth C JohnNoch keine Bewertungen

- Corp Gov - SlidesDokument128 SeitenCorp Gov - SlidesTroeeta BhuniyaNoch keine Bewertungen

- Becg Unit-4.Dokument12 SeitenBecg Unit-4.Bhaskaran Balamurali100% (2)

- Module 3 N.R Narayan Murthy Committee Report On CorporateDokument4 SeitenModule 3 N.R Narayan Murthy Committee Report On CorporatehitarthsarvaiyaNoch keine Bewertungen

- SEBI-Amendments To Clause 49 of The Listing Agreement BackgroundDokument11 SeitenSEBI-Amendments To Clause 49 of The Listing Agreement Backgroundsunilsinilsunil007Noch keine Bewertungen

- Company Name: Ultratech Cements Limited Entity Type: Public LimitedDokument6 SeitenCompany Name: Ultratech Cements Limited Entity Type: Public LimitedBaalNoch keine Bewertungen

- Cii CodeDokument6 SeitenCii Codetanmayjoshi969315100% (1)

- Kumar Mangalam Birla CommitteeDokument24 SeitenKumar Mangalam Birla CommitteeParas Gupta100% (1)

- Handout 2 - CE, CG & CSRDokument30 SeitenHandout 2 - CE, CG & CSRBalachandran RamachandranNoch keine Bewertungen

- Role of Independent Directors in CompaniesDokument15 SeitenRole of Independent Directors in CompaniesSiddharthaChowdaryNoch keine Bewertungen

- SESI 2 - ch11 - Introduction To Corporate GovernanceDokument32 SeitenSESI 2 - ch11 - Introduction To Corporate GovernanceSiti AtikahNoch keine Bewertungen

- GovernanceDokument15 SeitenGovernanceChristlyn Joy BaralNoch keine Bewertungen

- CommitteeDokument22 SeitenCommitteeshankarinadarNoch keine Bewertungen

- Corporate Governance Report - Confederation of Indian IndustryDokument6 SeitenCorporate Governance Report - Confederation of Indian IndustryNeha GuptaNoch keine Bewertungen

- FinalDokument22 SeitenFinalPrajwalAgarwalNoch keine Bewertungen

- 8 Company Auditor: JectivesDokument6 Seiten8 Company Auditor: JectivesRishabh GuptaNoch keine Bewertungen

- Corporate Governance 08Dokument17 SeitenCorporate Governance 08Gaurav SinhaNoch keine Bewertungen

- Corporate Governance Report 2023Dokument22 SeitenCorporate Governance Report 2023Munna Kumar YadavNoch keine Bewertungen

- Legal Service - Independence of Independent Directors in IndiaDokument8 SeitenLegal Service - Independence of Independent Directors in IndiaExtreme TronersNoch keine Bewertungen

- Rights and Privileges of ShareholdersDokument40 SeitenRights and Privileges of Shareholdersswatantra.s887245Noch keine Bewertungen

- Tutorial 4 - LE TRAN KHANH PHUONGDokument3 SeitenTutorial 4 - LE TRAN KHANH PHUONGPhương Lê Trần KhánhNoch keine Bewertungen

- Corporate GovernanceDokument13 SeitenCorporate GovernanceSahilNoch keine Bewertungen

- Corporate Governance Voluntary Guidelines 2009Dokument6 SeitenCorporate Governance Voluntary Guidelines 2009Payel JainNoch keine Bewertungen

- Lms SFM CGDokument10 SeitenLms SFM CGKanishka ChhabriaNoch keine Bewertungen

- Massei Assignment: Case Study IiDokument9 SeitenMassei Assignment: Case Study IiAnandita RayNoch keine Bewertungen

- C. Board Committees: 1. Audit CommitteeDokument4 SeitenC. Board Committees: 1. Audit CommitteeHarshita RanjanNoch keine Bewertungen

- Role - Board of DirectorsDokument5 SeitenRole - Board of DirectorsAtif RehmanNoch keine Bewertungen

- University of Western Sydney, Paramatta Campus. Course: Accounting TheoryDokument61 SeitenUniversity of Western Sydney, Paramatta Campus. Course: Accounting Theoryromy13000Noch keine Bewertungen

- Corporate Governance-Tools For Making CG Work: - By-Dr G.RamasuramanianDokument12 SeitenCorporate Governance-Tools For Making CG Work: - By-Dr G.RamasuramanianRathin BanerjeeNoch keine Bewertungen

- Samsung C&T Corporate Governance Charter: PreambleDokument6 SeitenSamsung C&T Corporate Governance Charter: PreambleANkushNoch keine Bewertungen

- Initiatives On Corporate Governance by The Indian GovernmentDokument2 SeitenInitiatives On Corporate Governance by The Indian GovernmentRamesh BaglaNoch keine Bewertungen

- Chapter 2Dokument16 SeitenChapter 2Sakhawat HossainNoch keine Bewertungen

- Independent DirectorDokument8 SeitenIndependent DirectorprabhatmailNoch keine Bewertungen

- Corporate Governance Through Audit Committees: Corporate and Allied LawsDokument10 SeitenCorporate Governance Through Audit Committees: Corporate and Allied LawsRidhi ChoudharyNoch keine Bewertungen

- Moa & AoaDokument12 SeitenMoa & AoaAshish Kumar MahapatraNoch keine Bewertungen

- Joint Stock Companies: Rganisational Structures - Shareholders' Rights and ObligationDokument47 SeitenJoint Stock Companies: Rganisational Structures - Shareholders' Rights and ObligationThuỷ VươngNoch keine Bewertungen

- Kumar Mangalam Birla CommitteeDokument24 SeitenKumar Mangalam Birla CommitteeRoshni Bhatia100% (1)

- Project Made by Tybms Student.: Joyoson MathaiDokument19 SeitenProject Made by Tybms Student.: Joyoson MathaiUmang WarudkarNoch keine Bewertungen

- Clause - 49Dokument18 SeitenClause - 49Manish AroraNoch keine Bewertungen

- MCS Group 3Dokument37 SeitenMCS Group 3Siti Nuranisa AziarNoch keine Bewertungen

- Final Exam RevisionDokument4 SeitenFinal Exam RevisionKirat GillNoch keine Bewertungen

- BRF GDCDokument1 SeiteBRF GDCTenten PonceNoch keine Bewertungen

- Mayer Steel Pipe Corporation and Hongkong Government Supplies DepartmentDokument1 SeiteMayer Steel Pipe Corporation and Hongkong Government Supplies DepartmentJeru SagaoinitNoch keine Bewertungen

- Motor Vehicle schedule for TPL Insurance (vehicle/s) (ﻣ ﺮ ﻛ ﺒ ﺎ ت) ا ﻟ ﻐ ﯿ ﺮ ﺗ ﺠ ﺎ ه ا ﻟ ﻤ ﺪ ﻧ ﯿ ﺔ ا ﻟ ﻤ ﺴ ﺆ و ﻟ ﯿ ﺔ ﺗ ﺄ ﻣ ﯿ ﻦ و ﺛ ﯿ ﻘ ﺔ ﺟ ﺪ و لDokument8 SeitenMotor Vehicle schedule for TPL Insurance (vehicle/s) (ﻣ ﺮ ﻛ ﺒ ﺎ ت) ا ﻟ ﻐ ﯿ ﺮ ﺗ ﺠ ﺎ ه ا ﻟ ﻤ ﺪ ﻧ ﯿ ﺔ ا ﻟ ﻤ ﺴ ﺆ و ﻟ ﯿ ﺔ ﺗ ﺄ ﻣ ﯿ ﻦ و ﺛ ﯿ ﻘ ﺔ ﺟ ﺪ و لGcvffNoch keine Bewertungen

- Name - Rounak Jain ROLL NO - 20194442 Business Law Assignment - 1Dokument2 SeitenName - Rounak Jain ROLL NO - 20194442 Business Law Assignment - 1NAMAN PRAKASHNoch keine Bewertungen

- Extinguishment BLRDokument8 SeitenExtinguishment BLRDJAN IHIAZEL DELA CUADRANoch keine Bewertungen

- Law MidtermDokument13 SeitenLaw MidtermJoylyn CombongNoch keine Bewertungen

- Corporate Reconstruction VII SemesterDokument5 SeitenCorporate Reconstruction VII SemesterAstik Tripathi0% (1)

- GRR - APRR - 2021 (Singapore 84-99)Dokument120 SeitenGRR - APRR - 2021 (Singapore 84-99)chloeNoch keine Bewertungen

- Clearing and Settlement PPT: Financial DerivativesDokument24 SeitenClearing and Settlement PPT: Financial DerivativesAnkush SheeNoch keine Bewertungen

- Greentree Servicing Llc. P.O. BOX 94710 PALATINE IL 60094-4710Dokument4 SeitenGreentree Servicing Llc. P.O. BOX 94710 PALATINE IL 60094-4710Andy Craemer100% (1)

- Indonesia Business LawDokument2 SeitenIndonesia Business Lawaldira jasmineNoch keine Bewertungen

- Contract of AgencyDokument37 SeitenContract of AgencyPHILLIP MADZIYANoch keine Bewertungen

- 12 Rural Bank of Caloocan Vs Courts of AppealsDokument1 Seite12 Rural Bank of Caloocan Vs Courts of AppealsMarianne Hope VillasNoch keine Bewertungen

- Concept of InsuranceDokument4 SeitenConcept of InsuranceNazrul HoqueNoch keine Bewertungen

- Letter of Credit AmityDokument33 SeitenLetter of Credit AmitySudhir Kochhar Fema AuthorNoch keine Bewertungen

- Rules Regarding Implied ConditionsDokument7 SeitenRules Regarding Implied ConditionsSoumya Ranjan SahooNoch keine Bewertungen

- Chapter 10Dokument26 SeitenChapter 10IstikharohNoch keine Bewertungen

- Escrow With Civil Law Notary in The Netherlands July 2014Dokument2 SeitenEscrow With Civil Law Notary in The Netherlands July 2014Ger PetersNoch keine Bewertungen

- Chapter Two 0Dokument28 SeitenChapter Two 0Laura StephanieNoch keine Bewertungen

- Edu Spring Ltam QuesDokument245 SeitenEdu Spring Ltam QuesEricNoch keine Bewertungen

- Arpia Lovely Rose Quiz Chapter 7 Leases Part 1Dokument3 SeitenArpia Lovely Rose Quiz Chapter 7 Leases Part 1Lovely ArpiaNoch keine Bewertungen

- CA Foundation Business Law Suggested Answers Dec 2020Dokument11 SeitenCA Foundation Business Law Suggested Answers Dec 2020M.K Tech100% (3)

- LIC New Endowment Plus 9 Inch X 8 Inch EngDokument20 SeitenLIC New Endowment Plus 9 Inch X 8 Inch EngMexico EnglishNoch keine Bewertungen

- Company LawDokument21 SeitenCompany LawEkta ChaudharyNoch keine Bewertungen

- Case No# 155 - Shrimp v. FujiDokument2 SeitenCase No# 155 - Shrimp v. Fujijon jonNoch keine Bewertungen

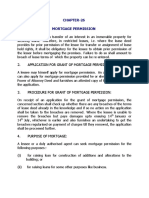

- Chapter-26: 2. Application For Grant of Mortgage PermissionDokument5 SeitenChapter-26: 2. Application For Grant of Mortgage PermissionRAJESH KALRANoch keine Bewertungen

- 09 Chapter6 PDFDokument32 Seiten09 Chapter6 PDFG MadhaviNoch keine Bewertungen

- IBT3Dokument47 SeitenIBT3Arif Wijaya HambaliNoch keine Bewertungen

- Company Law: Meaning and DefinitionDokument6 SeitenCompany Law: Meaning and DefinitionkimsNoch keine Bewertungen