Beruflich Dokumente

Kultur Dokumente

Taxation Security Against Oppressive Taxation - The Power To Impose Taxes Is One So

Hochgeladen von

Ayana Dela CruzOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Taxation Security Against Oppressive Taxation - The Power To Impose Taxes Is One So

Hochgeladen von

Ayana Dela CruzCopyright:

Verfügbare Formate

WHAT IS TAXATION youth for civic efficiency and the development of moral character and promote their

physical, intellectual, and social well-being;

Tio v. Videogram Regulatory Board 8. WHEREAS, in the face of these grave emergencies corroding the moral values of

Doctrines: the people and betraying the national economic recovery program, bold emergency

Taxation; security against oppressive taxation – The power to impose taxes is one so measures must be adopted with dispatch; (emphasis supplied and certain passages

unlimited in force and so searching in extent, that the courts scarcely venture to declare omitted)

that it is subject to any restrictions whatever, except such as rest in the discretion of

the authority which exercises it. In imposing a tax, the legislature acts upon its ISSUES:

constituents. This is, in general, a sufficient security against erroneous and oppressive The petioner, among others, raised the following issues:

taxation. 1. Whether or not the imposition of the 30% tax is a rider and the same is not germane

Taxation as a revenue and regulatory measure – The tax imposed by the DECREE is to the subject matter of the law.

not only a regulatory but also a revenue measure prompted by the realization that 2. Whether or not there is undue delegation of power and authority; and

earnings of videogram establishments of around P600 million per annum have not

been subjected to tax, thereby depriving the Government of an additional source of HELD:

revenue. . . . The levy of the 30% tax is for a public purpose. It was imposed primarily 1. No, the tax is not a rider and is germane to the purpose and subject of the law.

to answer the need for regulating the video industry, particularly because of the The Constitutional requirement that "every bill shall embrace only one subject which

rampant film piracy, the flagrant violation of intellectual property rights, and the shall be expressed in the title thereof" is sufficiently complied with if the title be

proliferation of pornographic video tapes. And while it was also an objective of the comprehensive enough to include the general purpose which a statute seeks to achieve.

DECREE to protect the movie industry, the tax remains a valid imposition. It is not necessary that the title express each and every end that the statute wishes to

accomplish. The requirement is satisfied if all the parts of the statute are related, and

FACTS: Valentin Tio is a videogram establishment operator adversely affected by are germane to the subject matter expressed in the title, or as long as they are not

Presidential Decree No. 1987 entitled "An Act Creating the Videogram Regulatory inconsistent with or foreign to the general subject and title.

Board". Reading section 10 of P.D. No. 1987 closely, one can see that the foregoing provision

P.D. No. 1987 provides for the levy of a tax over each cassette sold (Sec. 134) and a is allied and germane to, and is reasonably necessary for the accomplishment of, the

30% tax on the gross receipts of a videogram establishment, payable to the local general object of the law, which is the regulation of the video industry through the

government (Sec. 10). The rationale for this decree is set forth in its Videogram Regulatory Board as expressed in its title. The tax provision is not

preambulatory/whereas clauses to wit: inconsistent with, nor foreign to that general subject and title. As a tool for regulation

1. WHEREAS, the proliferation and unregulated circulation of videograms including, it is simply one of the regulatory and control mechanisms scattered throughout the

among others, videotapes, discs, cassettes ... have greatly prejudiced the operations of decree.

moviehouses and theaters, and have caused a sharp decline in theatrical attendance by Aside from revenue collection, tax laws may also be enacted for the purpose of

at least forty percent (40%) and a tremendous drop in the collection of [taxes] thereby regulating an activity. At the same time, the videogram industry is also an untapped

resulting in substantial losses estimated at P450 Million annually in government source of revenue which the government may validly tax. All of this is evident from

revenues; preambulatory clauses nos. 2, 5, 6 and 8, quoted in part above.

2. WHEREAS, videogram(s) establishments collectively earn around P600 Million The levy of the 30% tax is also for a public purpose. It was imposed primarily to

per annum from rentals, sales and disposition of videograms, and such earnings have answer the need for regulating the video industry, particularly because of the rampant

not been subjected to tax, thereby depriving the Government of approximately P180 film piracy, the flagrant violation of intellectual property rights, and the proliferation

Million in taxes each year; of pornographic video tapes. And while it was also an objective of the law to protect

3. WHEREAS, the unregulated activities of videogram establishments have also the movie industry, the tax remains a valid imposition.

affected the viability of the movie industry, ...;

5. WHEREAS, proper taxation of the activities of videogram establishments will not 2. No. There was no undue delegation of law making authority.

only alleviate the dire financial condition of the movie industry ..., but also provide an Petitioner was concerned that Section 11 of P.D. No. 1987 stating that the videogram

additional source of revenue for the Government, and at the same time rationalize the board (Board) has authority to "solicit the direct assistance of other agencies and units

heretofore uncontrolled distribution of videograms; of the government and deputize, for a fixed and limited period, the heads or personnel

6. WHEREAS, the rampant and unregulated showing of obscene videogram features of such agencies and units to perform enforcement functions for the Board" is an undue

constitutes a clear and present danger to the moral and spiritual well-being of the youth delegation of legislative power.

and impairs the mandate of the Constitution for the State to support the rearing of the

This is not a delegation of the power to legislate but merely a conferment of authority ·During the intervening period, the warrant was premature and could therefore not be

or discretion as to its execution, enforcement, and implementation. "The true served.

distinction is between the delegation of power to make the law, which necessarily ·Originally, CIR claimed that the 75K promotional fees to be personal holding

involves a discretion as to what it shall be, and conferring authority or discretion as to company income, but later on conformed to the decision of CTA

its execution to be exercised under and in pursuance of the law. The first cannot be ·There is no dispute that the payees duly reported their respective shares of the fees in

done; to the latter, no valid objection can be made." Besides, in the very language of their income tax returns and paid the corresponding taxes thereon. CTA also found,

the decree, the authority of the Board to solicit such assistance is for a "fixed and after examining the evidence, that no distribution of dividends was involved

limited period" with the deputized agencies concerned being "subject to the direction ·CIR suggests a tax dodge, an attempt to evade a legitimate assessment by involving

and control of the Board." an imaginary deduction

The petition was DISMISSED. ·Algue Inc. was a family corporation where strict business procedures were not applied

and immediate issuance of receipts was not required. at the end of the year, when the

CIR v. Algue Inc. books were to be closed, each payee made an accounting of all of the fees received by

Facts: him or her, to make up the total of P75,000.00. This arrangement was understandable

·Algue Inc. is a domestic corp engaged in engineering, construction and other allied in view of the close relationship among the persons in the family corporation

activities ·The amount of the promotional fees was not excessive. The total commission paid by

·On Jan. 14, 1965, the corp received a letter from the CIR regarding its delinquency the Philippine Sugar Estate Development Co. to Algue Inc. was P125K. After

income taxes from 1958-1959, amtg to P83,183.85 deducting the said fees, Algue still had a balance of P50,000.00 as clear profit from

·A letter of protest or reconsideration was filed by Algue Inc on Jan 18 the transaction. The amount of P75,000.00 was 60% of the total commission. This was

·On March 12, a warrant of distraint and levy was presented to Algue Inc. thru its a reasonable proportion, considering that it was the payees who did practically

counsel, Atty. Guevara, who refused to receive it on the ground of the pending protest everything, from the formation of the Vegetable Oil Investment Corporation to the

·Since the protest was not found on the records, a file copy from the corp was produced actual purchase by it of the Sugar Estate properties.

and given to BIR Agent Reyes, who deferred service of the warrant ·Sec. 30 of the Tax Code: allowed deductions in the net income – Expenses - All the

·On April 7, Atty. Guevara was informed that the BIR was not taking any action on ordinary and necessary expenses paid or incurred during the taxable year in carrying

the protest and it was only then that he accepted the warrant of distraint and levy earlier on any trade or business, including a reasonable allowance for salaries or other

sought to be served compensation for personal services actually rendered xxx

·On April 23, Algue filed a petition for review of the decision of the CIR with the ·the burden is on the taxpayer to prove the validity of the claimed deduction

Court of Tax Appeals ·In this case, Algue Inc. has proved that the payment of the fees was necessary and

·CIR contentions: reasonable in the light of the efforts exerted by the payees in inducing investors and

-the claimed deduction of P75,000.00 was properly disallowed because it was not an prominent businessmen to venture in an experimental enterprise and involve

ordinary reasonable or necessary business expense themselves in a new business requiring millions of pesos.

-payments are fictitious because most of the payees are members of the same family ·Taxes are what we pay for civilization society. Without taxes, the government would

in control of Algue and that there is not enough substantiation of such payments be paralyzed for lack of the motive power to activate and operate it. Hence, despite the

·CTA: 75K had been legitimately paid by Algue Inc. for actual services rendered in natural reluctance to surrender part of one's hard earned income to the taxing

the form of promotional fees. These were collected by the Payees for their work in the authorities, every person who is able to must contribute his share in the running of the

creation of the Vegetable Oil Investment Corporation of the Philippines and its government. The government for its part, is expected to respond in the form of tangible

subsequent purchase of the properties of the Philippine Sugar Estate Development and intangible benefits intended to improve the lives of the people and enhance their

Company. moral and material values

·Taxation must be exercised reasonably and in accordance with the prescribed

Issue: W/N the Collector of Internal Revenue correctly disallowed the P75,000.00 procedure. If it is not, then the taxpayer has a right to complain and the courts will then

deduction claimed by Algue as legitimate business expenses in its income tax returns come to his succor

Algue Inc.’s appeal from the decision of the CIR was filed on time with the CTA in

Ruling: accordance with Rep. Act No. 1125. And we also find that the claimed deduction by

·Taxes are the lifeblood of the government and so should be collected without Algue Inc. was permitted under the Internal Revenue Code and should therefore not

unnecessary hindrance, made in accordance with law. have been disallowed by the CIR

·RA 1125: the appeal may be made within thirty days after receipt of the decision or

ruling challenged NATURE OF TAXATION

Luzon Stevedoring Corp. v. CTA SIMBIOTIC RELATIONSHIP DOCTRINE

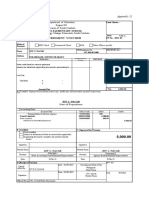

FACTS: Luzon Stevedoring Corp imported various engine parts and other equipment

for tugboat repair and maintenance in 1961 and 1962. It paid the assessed BENEFITS PROTECTION THEORY

compensation tax under protest. Unable to secure a tax refund from the Commissioner

for the amount of P33,442.13, it filed a petition for review with the Court of Tax Vera v. Fernandez

Appeals. The CTA denied the petition as well as the motion for reconsideration filed FACTS: The motion for allowance of claim and for payment of taxes dated May 28,

thereafter. Hence, this petition. 1969 was filed on June 3, 1969 for the collection of the indebtedness to the government

of the late Luis D. Tongoy for deficiency income taxes in the total sum of P3,254.80.

ISSUE: Is the Corporation exempt from compensation tax? The administrator opposed the motion solely on the ground that the claim was barred

under Section 5, Rule 86 of the Rules of Court. Jose Fernandez dismissed the motion

RULING: No. As the power of taxation is a high prerogative of sovereignty, the for allowance of claim filed by the Regional director of the BIR, being the judge of

relinquishment of such is never presumed and any reduction or diminution thereof the Court of First Instance.

with respect to its mode or its rate, must be strictly construed, and the same must be

couched in clear and unmistakable terms in order that it may be applied. The ISSUE: Whether the statute of non-claims Section 5, Rule 86 of the Rule of Court bars

corporation’s tugboats do not fall under the categories of passenger or cargo vessels claim of the government for unpaid taxes, still within the period of limitation

to avail of the exemption from compensation tax in Section 190 of the Tax Code. It prescribed in Section 331 and 332 of the National Internal Revenue Code

may be further noted that the amendment of Section 190 of Republic Act of 3176 was

intended to provide incentives and inducements to bolster the shipping industry and RULING: No. Section 5, Rule 86 of the Rules of Curt makes no mention of claims for

not in the business of stevedoring, in which the corporation is engaged in. monetary obligation of the decedent created by law, such as taxes which is entirely of

Thus, Luzon Stevedoring Corp is not exempt from compensation tax under Section different character from the claims enumerated, such as “all claims for money against

190, and is thus not entitled to refund. the decedent arising from contract, express or implied, whether the same be due, or

contingent, all claim for funeral expenses and expenses for the last sickness of the

THEORIES/BASIS OF TAXATION decedent and judgment for money against the decedent.” Under the familiar rule of

statutory construction, the mention of one thing implies the exclusion of another thing

CIR v. Pineda not mentioned.

FACTS: BIR investigated the income tax liability of Anastacio Pineda’s estate for the

years 1945, 1946, 1947, and 1948 and it found that the corresponding income tax Lutz v. Araneta

return were not filed. This resulted to a P760.28 deficiency income tax for 1945 and FACTS: Appelant in this case Walter Lutz in his capacity as the Judicial Administrator

1946 and real estate dealer’s fixed tax for the 4th quarter of 1946 and for the whole of the intestate of the deceased Antonio Jayme Ledesma, seeks to recover from the

year 1947. Manuel Pineda, eldest son of Anastacio, received the assessment. He Collector of the Internal Revenue the total sum of fourteen thousand six hundred sixty

contested the same alleging that only a proportionate part should be his liability. CTA six and forty cents (P 14, 666.40) paid by the estate as taxes, under section 3 of

ruled that Pineda is liable only for taxes corresponding to his share in the estate. Hence, Commonwealth Act No. 567, also known as the Sugar Adjustment Act, for the crop

the present petition. years 1948-1949 and 1949-1950. Commonwealth Act. 567 Section 2 provides for an

increase of the existing tax on the manufacture of sugar on a graduated basis, on each

ISSUE: Whether the Government can require Manuel Pineda to pay the full amount picul of sugar manufacturer; while section 3 levies on the owners or persons in control

of the tax assessed of the land devoted tot he cultivation of sugarcane and ceded to others for

consideration, on lease or otherwise - "a tax equivalent to the difference between the

RULING: Yes. As a holder of property belonging to the estate, Pineda is liable for the money value of the rental or consideration collected and the amount representing 12

tax up to the amount of the property in his possession. The BIR is given the discretion per centum of the assessed value of such land. It was alleged that such tax is

to avail of the most expeditious way to collect the tax. This is, of course, without unconstitutional and void, being levied for the aid and support of the sugar industry

prejudice to Pineda’s right of contribution for his co-heirs. Put simply, the Supreme exclusively, which in plaintiff's opinion is not a public purpose for which a tax may

Court held that the rule on solidarity applies to taxes because it is not an ordinary be constitutionally levied. The action was dismissed by the CFI thus the plaintiff

contract. Two persons liable for payment of estate tax: appealed directly to the Supreme Court.

Executor or administrator;

Heirs up to the extent of their inheritance.

ISSUE: Whether or not the tax imposition in the Commonwealth Act No. 567 are The ordinance is valid.

unconstitutional.

STAGES IN THE PROCESS OF TAXATION

RULING: Yes, the Supreme Court held that the fact that sugar production is one of

the greatest industry of our nation, sugar occupying a leading position among its export Tolentino v. Sec. of Finance

products; that it gives employment to thousands of laborers in the fields and factories; Facts:

that it is a great source of the state's wealth, is one of the important source of foreign - House of Rep. filed House Bill 11197 (An Act Restructuring the VAT System to

exchange needed by our government and is thus pivotal in the plans of a regime Widen its Tax Base and Enhance its Admin., Amending for these Purposes…)

committed to a policy of currency stability. Its promotion, protection and - Upon receipt of Senate, Senate filed another bill completely different from that of

advancement, therefore redounds greatly to the general welfare. Hence it was the House Bill

competent for the legislature to find that the general welfare demanded that the sugar - Senate finished debates on the bill and had the 2nd and 3rd reading of the Bill on the

industry be stabilized in turn; and in the wide field of its police power, the law-making same day

body could provide that the distribution of benefits therefrom be readjusted among its - Bill was deliberated upon in the Conference Committee and become enrolled bill

components to enable it to resist the added strain of the increase in taxes that it had to which eventually became the EVAT law.

sustain.

The subject tax is levied with a regulatory purpose, to provide means for the Procedural Issue:

rehabilitation and stabilization of the threatened sugar industry. In other words, the act (1) WoN RA 7716 originated exclusively from the House of Rep. in accordance with

is primarily a valid exercise of police power. sec 24, art 6 of Consti

(2) WoN the Senate bill violated the “three readings on separate days” requirement of

OBJECTIVE/PURPOSESS OF TAXATION the Consti

(3) WoN RA 7716 violated sec 26(1), art 6 - one subject, one title rule.

Bagatsing v. Ramirez NOTE: This case was filed by PAL because before the EVAT Law, they were exempt

FACTS: In 1974, the Municipal Board of Manila enacted Ordinance 7522, regulating from taxes. After the passage of EVAT, they were already included. PAL contended

the operation of public markets and prescribing fees for the rentals of stalls and that neither the House or Senate bill provided for the removal of the exemption from

providing penalties for violation thereof. The Federation of Manila Market Vendors taxes of PAL and that it was inly made after the meeting of the Conference Committee

Inc. assailed the validity of the ordinance, alleging among others the noncompliance w/c was not expressed in the title of RA 7166

to the publication requirement under the Revised Charter of the City of Manila. CFI-

Manila declared the ordinance void. Thus, the present petition. Held:

(1) YES. Court said that it is not the law which should originate from the House of

ISSUE: What law should govern the publication of a tax ordinance, the Revised City Rep, but the revenue bill which was required to originate from the House of Rep. The

Charter, which requires publication of the ordinance before its enactment and after its inititiative must ocme from the Lower House because they are elected in the district

approval, or the Local Tax Code, which only demands publication after approval? Is level – meaning they are expected to be more sensitive to the needs of the locality.

the ordinance valid? Also, a bill originating from the Lower House may undergo extensive changes while

in the Senate. Senate can introduce a separate and distinct bill other than the one the

RULING: Lower House proposed. The Constitution does not prohibit the filing in the Senate of

The Local Tax Code prevails. There is no question that the Revised Charter of the City a substitute bill in anticipation of its receipt of the House bill, so long as action by

of Manila is a special act since it relates only to the City of Manila whereas the Local Senate is withheld pending the receipt of the House bill.

Tax Code is a general law because it applies universally to all local governments. The (2) NO. The Pres. certified that the Senate bill was urgent. Presidential certification

fact that one is special and the other general creates a presumption that the special is dispensed the requirement not only of printing but also reading the bill in 3 separate

to be considered as remaining an exception of the general, one as a general law of the days. In fact, the Senate accepted the Pres. certification

land, the other as the law of a particular case. However, the rule readily yields to a (3) No. Court said that the title states that the purpose of the statute is to expand the

situation where the special statute refers to a subject in general, which the general VAT system and one way of doing this is to widen its base by withdrawing some of

statute treats in particular. The Revised Charter of the City prescribes a rule for the the exemptions granted before. It is also in the power of Congress to amend, alter,

publication of “ordinance” in general, while the Local Tax Code establishes a rule for repeal grant of franchises for operation of public utility when the common good so

the publication of “ordinance levying or imposing taxes fees or other charges” in requires.

particular.

One subject rule is intended to prevent surprise upon Congress members and inform provincial government. Napocor opposed alleging that it was immune from taxes

people of pending legislation. In the case of PAL, they did not know of their situation citing Resolution 17-87 of the Fiscal Incentives Review Board (FIRB).

not because of any defect in title but because they might have not noticed its

publication until some event calls attention to its existence. ISSUE: Whether the granting of exemption by the FIRB constituted undue delegation

of taxing power

CANONS OF TAXATION

RULING: Yes, it is undue delegation. It has no authority to impose taxes or revoke

PRINCIPLES OF A GOOD TAX SYSTEM existing ones, which, after all, under the constitution, only the legislature may

accomplish.

DIFFERENCE BETWEEN POWER TO TAX AND THE 2 INHERENT

POWERS OF THE STATE Maceda v. Macaraig

FACTS: On November 3, 1986, Commonwealth Act No. 120 created the NPC as a

Sison v. Ancheta public corporation to undertake the development of hydraulic power and the

Facts: Batas Pambansa 135 was enacted. Sison, as taxpayer, alleged that its provision production of power from other sources.

(Section 1) unduly discriminated against him by the imposition of higher rates upon Effective March 10, 1987, Executive Order No. 93 once again withdrew all tax and

his income as a professional, that it amounts to class legislation, and that it transgresses duty incentives granted to government and private entities which had been restored

against the equal protection and due process clauses of the Constitution as well as the under Presidential Decree Nos. 1931 and 1955 but it gave the authority to FIRB to

rule requiring uniformity in taxation. restore, revise the scope and prescribe the date of effectivity of such tax and/or duty

exemptions.

Issue: Whether BP 135 violates the due process and equal protection clauses, and the On June 24, 1987 the FIRB issued Resolution No. 17-87 restoring NPC's tax and duty

rule on uniformity in taxation. exemption privileges effective March 10, 1987. On October 5, 1987, the President,

through respondent Executive Secretary Macaraig, Jr., confirmed and approved FIRB

Held: There is a need for proof of such persuasive character as would lead to a Resolution No. 17-87.

conclusion that there was a violation of the due process and equal protection clauses. Though the issues raised was resolved by the Supreme Court in G.R. No. 88291, the

Absent such showing, the presumption of validity must prevail. Equality and issues was again brought to the Supreme Court for the second time by the petitioner

uniformity in taxation means that all taxable articles or kinds of property of the same in G.R. No. 88291.

class shall be taxed at the same rate. The taxing power has the authority to make

reasonable and natural classifications for purposes of taxation. Where the ISSUE: Whether or not the powers conferred upon the FIRB by Section 2(a), (b), and

differentitation conforms to the practical dictates of justice and equity, similar to the (c) and (4) of Executive Order No. 93 "constitute undue delegation of legislative power

standards of equal protection, it is not discriminatory within the meaning of the clause and is, therefore, unconstitutional.”

and is therefore uniform. Taxpayers may be classified into different categories, such

as recipients of compensation income as against professionals. Recipients of RULING: No.

compensation income are not entitled to make deductions for income tax purposes as With the growing complexities of modern life and the many technical fields of

there is no practically no overhead expense, while professionals and businessmen have governmental functions, as in matters pertaining to tax exemptions, delegation of

no uniform costs or expenses necessaryh to produce their income. There is ample legislative powers has become the rule and non-delegation the exception. The

justification to adopt the gross system of income taxation to compensation income, legislature may not have the competence, let alone the interest and the time, to provide

while continuing the system of net income taxation as regards professional and direct and efficacious solutions to many problems attendant upon present day

business income. undertakings. The legislature could not be expected to state all the detailed situations

wherein the tax exemption privilege would be restored. The task may be assigned to

Tio v. Videogram an administrative body like the Fiscal Incentives Review Board (FIRB).

When E.O No. 93 (S'86) was issued, President Aquino was exercising both Executive

Bagatsing v. Ramirez and Legislative powers. Thus, there was no power delegated to her, rather it was she

who was delegating her power. She delegated it to the FIRB, which, for purposes of

NAPOCOR v. Province of Albay E.O No. 93 (S'86), is a delegate of the legislature. Clearly, she was not sub-delegating

FACTS: The province of Albay sought to sell Napocor properties in order for the her power.

proceeds to be applied to the real property taxes Napocor allegedly owned the Albay

And E.O. No. 93 (S'86), as a delegating law, was complete in itself — it set forth the There is no double taxation. The argument of the Municipality is well taken. Further,

policy to be carried out 85 and it fixed the standard to which the delegate had to Pepsi Cola’s assertion that the delegation of taxing power in itself constitutes double

conform in the performance of his functions, 86 both qualities having been enunciated taxation cannot be merited. It must be observed that the delegating authority specifies

by this Court in Pelaez vs. Auditor General. 87 the limitations and enumerates the taxes over which local taxation may not be

For delegation to be constitutionally valid, the law must be complete in itself and must exercised. The reason is that the State has exclusively reserved the same for its own

set forth sufficient standards. prerogative. Moreover, double taxation, in general, is not forbidden by our

Certain aspects of the taxing process that are not really legislative in nature are vested fundamental law unlike in other jurisdictions. Double taxation becomes obnoxious

in administrative agencies. In this case, there really is no delegation, to wit: a) power only where the taxpayer is taxed twice for the benefit of the same governmental entity

to value property; b) power to assess and collect taxes; c) power to perform details of or by the same jurisdiction for the same purpose, but not in a case where one tax is

computation, appraisement or adjustment; among others. imposed by the State and the other by the city or municipality.

Pepsi Cola Bottling Company v. Municipality of Tanauan CONSTITUTIONAL LIMITATIONS

FACTS: Pepsi Cola has a bottling plant in the Municipality of Tanauan, Leyte. In *see reviewer

September 1962, the Municipality approved Ordinance No. 23 which levies and

collects “from soft drinks producers and manufacturers a tai of one-sixteenth (1/16) of

a centavo for every bottle of soft drink corked.”

In December 1962, the Municipality also approved Ordinance No. 27 which levies and

collects “on soft drinks produced or manufactured within the territorial jurisdiction of

this municipality a tax of one centavo P0.01) on each gallon of volume capacity.”

Pepsi Cola assailed the validity of the ordinances as it alleged that they constitute

double taxation in two instances: a) double taxation because Ordinance No. 27 covers

the same subject matter and impose practically the same tax rate as with Ordinance

No. 23, b) double taxation because the two ordinances impose percentage or specific

taxes.

Pepsi Cola also questions the constitutionality of Republic Act 2264 which allows for

the delegation of taxing powers to local government units; that allowing local

governments to tax companies like Pepsi Cola is confiscatory and oppressive.

The Municipality assailed the arguments presented by Pepsi Cola. It argued, among

others, that only Ordinance No. 27 is being enforced and that the latter law is an

amendment of Ordinance No. 23, hence there is no double taxation.

ISSUE: Whether or not there is undue delegation of taxing powers. Whether or not

there is double taxation.

HELD: No. There is no undue delegation. The Constitution even allows such

delegation. Legislative powers may be delegated to local governments in respect of

matters of local concern. By necessary implication, the legislative power to create

political corporations for purposes of local self-government carries with it the power

to confer on such local governmental agencies the power to tax. Under the New

Constitution, local governments are granted the autonomous authority to create their

own sources of revenue and to levy taxes. Section 5, Article XI provides: “Each local

government unit shall have the power to create its sources of revenue and to levy taxes,

subject to such limitations as may be provided by law.” Withal, it cannot be said that

Section 2 of Republic Act No. 2264 emanated from beyond the sphere of the legislative

power to enact and vest in local governments the power of local taxation.

Das könnte Ihnen auch gefallen

- Tax Digest Part3Dokument6 SeitenTax Digest Part3bcarNoch keine Bewertungen

- Tio v. Videogram Regulatory Board, G.R. No. 75697, 1987Dokument3 SeitenTio v. Videogram Regulatory Board, G.R. No. 75697, 1987JMae MagatNoch keine Bewertungen

- Tio vs. Videogram Regulatory BoardDokument5 SeitenTio vs. Videogram Regulatory BoardMay Marie Ann Aragon-Jimenez WESTERN MINDANAO STATE UNIVERSITY, COLLEGE OF LAWNoch keine Bewertungen

- Tio Vs Videogram Regulatory BoardDokument8 SeitenTio Vs Videogram Regulatory BoardReaderTim5Noch keine Bewertungen

- Nelson Y. NG For Petitioner. The City Legal Officer For Respondents City Mayor and City TreasurerDokument17 SeitenNelson Y. NG For Petitioner. The City Legal Officer For Respondents City Mayor and City TreasurerJacqueline AnnNoch keine Bewertungen

- Valentin Tio v. Videogram Regulatory Board, DigestDokument7 SeitenValentin Tio v. Videogram Regulatory Board, DigestRonnie Garcia Del RosarioNoch keine Bewertungen

- Tax 1 Sttopicpart 1 Midterms 20162Dokument87 SeitenTax 1 Sttopicpart 1 Midterms 20162Gladys Bustria OrlinoNoch keine Bewertungen

- Valentin Tio v. Videogram Regulatory Board, 151 Scra 208Dokument17 SeitenValentin Tio v. Videogram Regulatory Board, 151 Scra 208Ronnie Garcia Del RosarioNoch keine Bewertungen

- Taxation Fulltxt-2nd BatchDokument68 SeitenTaxation Fulltxt-2nd BatchNovie AmorNoch keine Bewertungen

- Nelson Y. NG For Petitioner. The City Legal Officer For Respondents City Mayor and City TreasurerDokument7 SeitenNelson Y. NG For Petitioner. The City Legal Officer For Respondents City Mayor and City TreasurerLeslie LernerNoch keine Bewertungen

- Nelson Y. NG For Petitioner. The City Legal Officer For Respondents City Mayor and City TreasurerDokument11 SeitenNelson Y. NG For Petitioner. The City Legal Officer For Respondents City Mayor and City TreasurerdingNoch keine Bewertungen

- Taxation 1Dokument147 SeitenTaxation 1GGT InteriorsNoch keine Bewertungen

- Admin III Part 2 WordDokument22 SeitenAdmin III Part 2 WordCGNoch keine Bewertungen

- Tio V VideogramDokument9 SeitenTio V VideogramVan CazNoch keine Bewertungen

- Tio vs. Videogram Regulatory Board, 151 Scra 208 (1987)Dokument6 SeitenTio vs. Videogram Regulatory Board, 151 Scra 208 (1987)Julian Paul CachoNoch keine Bewertungen

- Tax 1 Cases 2015 Page 1-2 SyllabusDokument177 SeitenTax 1 Cases 2015 Page 1-2 SyllabusRichard BakerNoch keine Bewertungen

- Taxation1 Case Digest Under Atty LampacanDokument28 SeitenTaxation1 Case Digest Under Atty LampacanSapphireNoch keine Bewertungen

- Tio vs. Videogram Regulatory Board, 151 SCRA 208Dokument5 SeitenTio vs. Videogram Regulatory Board, 151 SCRA 208Chino Sison100% (1)

- Tio v. VideogR. No. L-75697, June 18, 1987.Dokument5 SeitenTio v. VideogR. No. L-75697, June 18, 1987.Emerson NunezNoch keine Bewertungen

- Valentin Tio Vs Videogram Regulatory Board GR No. L-75697: FactsDokument3 SeitenValentin Tio Vs Videogram Regulatory Board GR No. L-75697: FactsJf Maneja100% (1)

- Taxation 1 Digests PDFDokument206 SeitenTaxation 1 Digests PDFHanston BalonanNoch keine Bewertungen

- Tax 1 Cases 2015 Page 1-2 SyllabusDokument146 SeitenTax 1 Cases 2015 Page 1-2 SyllabusRichard BakerNoch keine Bewertungen

- Tio v. Videogram Regulatory Board (1987)Dokument1 SeiteTio v. Videogram Regulatory Board (1987)Kat Dela PazNoch keine Bewertungen

- 21 0 Supreme Court Reports Annotated: Tio vs. Videogram Regulatory BoardDokument6 Seiten21 0 Supreme Court Reports Annotated: Tio vs. Videogram Regulatory BoardKenmar NoganNoch keine Bewertungen

- Cases Under CodicilDokument7 SeitenCases Under CodicilAdi LimNoch keine Bewertungen

- Case Digest - TaxDokument11 SeitenCase Digest - TaxRejean EscalonaNoch keine Bewertungen

- Tio v. Videogram Regulatory BoardDokument1 SeiteTio v. Videogram Regulatory Boardromelamiguel_2015100% (1)

- Taxation 1 Case Note ReviewerDokument69 SeitenTaxation 1 Case Note ReviewerMarvin DiegoNoch keine Bewertungen

- Taxation Midterm DigestDokument29 SeitenTaxation Midterm DigestRaymarc Elizer AsuncionNoch keine Bewertungen

- TIO Vs Videogram Reg BoardDokument3 SeitenTIO Vs Videogram Reg BoardLGU PadadaNoch keine Bewertungen

- 04 - TIO V. VIDEOGRAM REGULATORY BOARD (GR No. L-75697)Dokument7 Seiten04 - TIO V. VIDEOGRAM REGULATORY BOARD (GR No. L-75697)Sherlyn SabarNoch keine Bewertungen

- Consti - Tio Vs Videogram Regulatory BoardDokument6 SeitenConsti - Tio Vs Videogram Regulatory BoardPaul Christian Balin CallejaNoch keine Bewertungen

- Tio vs. Videogram Regulatory BoardDokument2 SeitenTio vs. Videogram Regulatory BoardAnge DinoNoch keine Bewertungen

- G.R. No. L-75697Dokument9 SeitenG.R. No. L-75697Klein CarloNoch keine Bewertungen

- PAL To KAP Vs TANDokument45 SeitenPAL To KAP Vs TANPaulo SantosNoch keine Bewertungen

- Tio v. Videogram Regulatory BoardDokument3 SeitenTio v. Videogram Regulatory BoardAila AmpNoch keine Bewertungen

- Tax Case 1Dokument2 SeitenTax Case 1ChiiNoch keine Bewertungen

- 1st Set Tax 1Dokument51 Seiten1st Set Tax 1dnel13Noch keine Bewertungen

- Tio v. Videogram Regulatory Commission: KMDB - 1Dokument2 SeitenTio v. Videogram Regulatory Commission: KMDB - 1Kreizel BojeroNoch keine Bewertungen

- Tio v. Videogram Regulatory BoardDokument10 SeitenTio v. Videogram Regulatory BoardJune Steve BarredoNoch keine Bewertungen

- Commissioner of Internal Revenue vs. Algue Inc. GR No. L-28896 - Feb. 17, 1988Dokument12 SeitenCommissioner of Internal Revenue vs. Algue Inc. GR No. L-28896 - Feb. 17, 1988Helen Joy Grijaldo JueleNoch keine Bewertungen

- Tio v. Videogram Regulatory Board DIGESTDokument3 SeitenTio v. Videogram Regulatory Board DIGESTkathrynmaydevezaNoch keine Bewertungen

- G.R. No. 118702 March 16, 1995Dokument2 SeitenG.R. No. 118702 March 16, 1995Angelo FabianNoch keine Bewertungen

- Facts: The Case Is A Petition Filed by Tio On Behalf of Videogram Operators Adversely Affected byDokument11 SeitenFacts: The Case Is A Petition Filed by Tio On Behalf of Videogram Operators Adversely Affected byChugsNoch keine Bewertungen

- Tio V. Videogram Regulatory Board 151 SCRA 208 Facts: IssuesDokument14 SeitenTio V. Videogram Regulatory Board 151 SCRA 208 Facts: IssuesJason ToddNoch keine Bewertungen

- Tio Vs Videogram CasedigestDokument2 SeitenTio Vs Videogram CasedigestAaron BurkeNoch keine Bewertungen

- Taxation - DigestDokument6 SeitenTaxation - DigestJeggersonNoch keine Bewertungen

- Tio v. Videogram Regulatory Board, G.R. No. 75697, June 18, 1987, 151 SCRA 208Dokument2 SeitenTio v. Videogram Regulatory Board, G.R. No. 75697, June 18, 1987, 151 SCRA 208DenneNoch keine Bewertungen

- 02 Tio Vs Videogram Regulatory BoardDokument14 Seiten02 Tio Vs Videogram Regulatory BoardYaz CarlomanNoch keine Bewertungen

- Taxation I Cases 1Dokument98 SeitenTaxation I Cases 1LaurenNoch keine Bewertungen

- Case Digest On Taxation IDokument65 SeitenCase Digest On Taxation IAndrew MarfilNoch keine Bewertungen

- Purposes of Taxation: What Is BIR?Dokument2 SeitenPurposes of Taxation: What Is BIR?joyNoch keine Bewertungen

- Police Power PDFDokument150 SeitenPolice Power PDFRenceNoch keine Bewertungen

- TAXATION1 1st Batch CasesDokument7 SeitenTAXATION1 1st Batch CasesKobe BullmastiffNoch keine Bewertungen

- Tio VS Videogram Regulatory BoardDokument1 SeiteTio VS Videogram Regulatory BoardJenNoch keine Bewertungen

- Tax Guide Justice DimaampaoDokument36 SeitenTax Guide Justice DimaampaoJon Vincent Barlaan DiazdeRivera100% (1)

- Creba vs. Romulo - Cir vs. LingayenDokument6 SeitenCreba vs. Romulo - Cir vs. LingayenBea Dominique AbeNoch keine Bewertungen

- Digest TaxDokument24 SeitenDigest TaxWarly PabloNoch keine Bewertungen

- Naval v. COMELECDokument29 SeitenNaval v. COMELECAyana Dela CruzNoch keine Bewertungen

- Valles v. COMELECDokument15 SeitenValles v. COMELECAyana Dela CruzNoch keine Bewertungen

- PNB V San MiguelDokument1 SeitePNB V San MiguelAyana Dela CruzNoch keine Bewertungen

- SAUDIA v. CADokument2 SeitenSAUDIA v. CAAyana Dela CruzNoch keine Bewertungen

- Aileen - Meal Plan Week 1 & 2Dokument3 SeitenAileen - Meal Plan Week 1 & 2Ayana Dela CruzNoch keine Bewertungen

- G.R. No. 211140. January 12, 2016. LORD ALLAN JAY Q. VELASCO, Petitioner, Belmonte, JR., Secretary General Marilyn B. Barua Yap and REGINA ONGSIAKO REYES, RespondentsDokument112 SeitenG.R. No. 211140. January 12, 2016. LORD ALLAN JAY Q. VELASCO, Petitioner, Belmonte, JR., Secretary General Marilyn B. Barua Yap and REGINA ONGSIAKO REYES, RespondentsAyana Dela CruzNoch keine Bewertungen

- First Batch CivproDokument5 SeitenFirst Batch CivproAyana Dela CruzNoch keine Bewertungen

- Features of ADR Aboitiz v. Gothong LinesDokument1 SeiteFeatures of ADR Aboitiz v. Gothong LinesAyana Dela CruzNoch keine Bewertungen

- Stairway To Law School (Atty. Loanzon)Dokument1 SeiteStairway To Law School (Atty. Loanzon)Ayana Dela CruzNoch keine Bewertungen

- Stairway To Law School (Atty. Loanzon)Dokument5 SeitenStairway To Law School (Atty. Loanzon)Ayana Dela CruzNoch keine Bewertungen

- LaborDokument112 SeitenLaborAyana Dela CruzNoch keine Bewertungen

- Accounting TheoryDokument32 SeitenAccounting TheoryVicky VijayvargiyaNoch keine Bewertungen

- Statement of Account - ApartmentDokument4 SeitenStatement of Account - ApartmentBryan Jayson BarcenaNoch keine Bewertungen

- Riphah University IslamabadDokument34 SeitenRiphah University IslamabadIrfy MrtNoch keine Bewertungen

- Management Accounting: Student EditionDokument28 SeitenManagement Accounting: Student EditionDinda OktavianiNoch keine Bewertungen

- Account GeneratorDokument3 SeitenAccount Generatorcoolguy0606Noch keine Bewertungen

- Payroll Answer Scheme (Part B)Dokument3 SeitenPayroll Answer Scheme (Part B)Lilian OngNoch keine Bewertungen

- 9692 Saurabh Tupkar FinanceDokument44 Seiten9692 Saurabh Tupkar FinanceGanesh100% (1)

- Assessed Coursework 2 - S2 2020 UpdateDokument7 SeitenAssessed Coursework 2 - S2 2020 UpdateArmaghan Ali MalikNoch keine Bewertungen

- Taxation SituationalDokument113 SeitenTaxation SituationalMartin GragasinNoch keine Bewertungen

- Service Organization Segment ReportingDokument6 SeitenService Organization Segment ReportingAudrey LouelleNoch keine Bewertungen

- Unilag Tax Taxation of Non-Residents in Nigeria-Firs Cir 9302Dokument17 SeitenUnilag Tax Taxation of Non-Residents in Nigeria-Firs Cir 9302IfemideNoch keine Bewertungen

- Ppe TheoriesDokument4 SeitenPpe TheoriesxxyyzzNoch keine Bewertungen

- Operational and Financial Plan FoodDokument17 SeitenOperational and Financial Plan FoodinasNoch keine Bewertungen

- Tax 1 Outline - 1st Sem - 2014-2015Dokument31 SeitenTax 1 Outline - 1st Sem - 2014-2015purplebasketNoch keine Bewertungen

- Principles and Concept 2Dokument21 SeitenPrinciples and Concept 2JeffreyNoch keine Bewertungen

- SPPRA Rules Amended 2010 (Amended Uptodate)Dokument52 SeitenSPPRA Rules Amended 2010 (Amended Uptodate)Hammad ShamsNoch keine Bewertungen

- Disbursement VoucherDokument31 SeitenDisbursement VoucherisoldeNoch keine Bewertungen

- "Indian Tobacco Company Limited": A Project Report OnDokument19 Seiten"Indian Tobacco Company Limited": A Project Report Onsana_chowdhary9205Noch keine Bewertungen

- Business Plan 2024 25Dokument23 SeitenBusiness Plan 2024 25janjantuazon24Noch keine Bewertungen

- Online Lecutre 1Dokument21 SeitenOnline Lecutre 1Dinar HassanNoch keine Bewertungen

- Ahmad Tariq Bhatti: (In Accordance With The Requirements of IAS 17 & FASB Statement 13)Dokument43 SeitenAhmad Tariq Bhatti: (In Accordance With The Requirements of IAS 17 & FASB Statement 13)Ahmad Tariq Bhatti100% (1)

- Sample-Test Bank Contemporary Financial Management 14th 14EDokument16 SeitenSample-Test Bank Contemporary Financial Management 14th 14EMuhammad YahyaNoch keine Bewertungen

- Notes Cost Accounting CertificateDokument29 SeitenNotes Cost Accounting CertificateNalugo LeilahNoch keine Bewertungen

- Taxation 1 NotesDokument15 SeitenTaxation 1 NotesTricia SandovalNoch keine Bewertungen

- Accounting Mid-Term Exam Acct.Dokument3 SeitenAccounting Mid-Term Exam Acct.Ann ButlerNoch keine Bewertungen

- Consolidation of AccountsDokument14 SeitenConsolidation of Accountsram_alaways0% (1)

- Annual and Sustainability ReportDokument94 SeitenAnnual and Sustainability Reportvisutsi100% (1)

- CIR v. Isabela Cultural Corp.Dokument4 SeitenCIR v. Isabela Cultural Corp.kathrynmaydevezaNoch keine Bewertungen

- HDFC Bank Financial AnalysisDokument48 SeitenHDFC Bank Financial AnalysisAbhinandan Bose50% (10)

- Erasmus Project Reports (Interim and Final) : Katia DE SOUSA, Project Adviser Guido DI FIORE, Financial CoordinatorDokument22 SeitenErasmus Project Reports (Interim and Final) : Katia DE SOUSA, Project Adviser Guido DI FIORE, Financial CoordinatorAlokNoch keine Bewertungen