Beruflich Dokumente

Kultur Dokumente

International Accounting Standard 1 (IAS 1), Presentation of Financial Statements

Hochgeladen von

Heliani sajaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

International Accounting Standard 1 (IAS 1), Presentation of Financial Statements

Hochgeladen von

Heliani sajaCopyright:

Verfügbare Formate

International Accounting

Standard 1 (IAS 1),

Presentation of Financial

Statements

By BRIAN FRIEDRICH, MEd, CGA, FCCA(UK), CertIFR and LAURA FRIEDRICH,

MSc, CGA, FCCA(UK), CertIFR

Updated By STEPHEN SPECTOR, MA, FCGA

This article is part of a series by the Friedrichs and Stephen Spector on the move to

International Financial Reporting Standards to be published on PD Net.

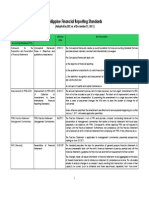

Snapshot Snapshot

Background —

The IASB Framework Latest revision September 6, 2007

Overview of IAS 1 Subsequent amendments February 2008 re: disclosures required

Differences from about puttable instruments; May 2008 re:

Canadian GAAP “Annual Improvements to IFRSs 2007”;

Further resources

April 2009 re: “Annual Improvements to

IFRSs 2008”

Effective date per IASB annual periods beginning on or after

January 1, 2009; annual periods

beginning on or after January 1, 2010 for

2009 amendments

Early adoption Permitted

Effective date per Canadian Standards annual periods beginning on or after

January 1, 2011

Outstanding Exposure Drafts and Project name: Financial Statement

issues under consideration Presentation (Performance Reporting)

Discussion Paper issue October 2008

(Exposure Draft expected mid-2010);

“Annual Improvements to IFRSs 2009”

re: presentation of equity

In this article, we look at the highlights of IAS 1 Presentation of Financial

Statements, beginning with a refresher on the International Accounting Standards

Board (IASB) Framework that sets the conceptual foundation for the rest of the

International Financial Reporting Standards (IFRSs).

© CGA-Canada 2009

Background — The IASB Framework

IAS 1 provides perhaps the clearest link to the IASB Framework for the Preparation and

Presentation of Financial Statements (the Framework). The Framework is not a standard

itself; rather, it sets out the concepts that underlie the preparation and presentation of financial

statements for external users. Further, the Framework provides a common grounding for

national and international standard setters, as well as financial statement preparers, users, and

auditors. In this way, the Framework serves as a point of reference for preparers of financial

statements in cases where no specific guidance is available in the IFRSs or IASs. Moreover,

stakeholders can use the Framework to provide context and understanding, recognizing

however that nothing in the Framework should be interpreted in such a way as to overrule or

contradict any of the IFRSs or IASs (see Framework, paragraphs 1 and 2). (Note that all

references to numbered paragraphs that follow refer to the Framework.)

The key notions of the Framework fall into three categories:1

1. Objective of financial statements.

2. Qualitative characteristics necessary if financial statements are to be useful.

3. Financial statement elements and how those elements should be defined, recognized, and

measured in financial statements. (¶5)

These concepts are certainly not new to Canadian GAAP, and the discussion of concepts in

section 1000 of the Handbook is consistent with those presented in the Framework.

Objective of financial statements

(¶9, 10, 12, 22, and 23)

The users of financial statements include investors and lenders, employees, customers and

suppliers, governments, and the public. Although each of these groups has different reasons

for using the financial information provided in the statements, there are commonalities in the

information that can help to meet those needs.

The main objective of financial statements is to provide information about the financial

position, performance, and changes in financial position of an entity that is useful to a wide

range of users in making economic decisions. There are two key assumptions underlying this

objective. First, statements are prepared using the accrual basis; and second, statements are

normally prepared on the assumption that the entity is a going concern and will continue in

operation for the foreseeable future.

Qualitative characteristics

(¶24, 25, 26, 30, 35–39, and 43–45)

The usefulness of information in financial statements depends on meeting the key attributes

or qualitative characteristics of understandability, relevance, reliability, and comparability:

• Information needs to be understandable by users that have a reasonable knowledge of

business and economic activities and accounting and a willingness to study the information

with reasonable diligence.

• The relevance of financial information relates to its predictive value, as well as its

usefulness in helping users confirm their previous predictions or evaluations. Materiality

1

The Framework also addresses the concepts of capital and capital maintenance, which are not included in

this article.

International Accounting Standard 1 (IAS 1), Presentation of Financial Statements• 2

provides a threshold in determining whether information is relevant to users. Based on the

size and/or nature of the item, judgment is used to determine if the item would influence

the decisions of users.

• Reliability involves providing information that represents transactions or events faithfully,

in accordance with their substance and economic reality rather than their legal form. To be

reliable, information must be neutral (unbiased), prepared with prudence (conservatism),

and complete, taking into account the principles of materiality and cost/benefit.

• Comparability requires consistency in the use and application of accounting policies. This

concept is fundamental if users are to be able to compare the financial statements of an

entity over time (in order to identify trends) or the financial statements of different entities

(in order to evaluate an entity in relation to other entities).

Preparers of financial statements must deal with constraints on relevant and reliable

information, including the need to evaluate issues of costs versus benefits in gathering and

presenting information, and the trade-off between providing information that is both reliable

and timely. Balancing the qualitative characteristics requires professional judgment regarding

the relative importance of the various characteristics in a particular situation.

Financial statement elements and their recognition

(¶47, 49, 70, and 83)

Financial statements portray the financial effects of transactions and other events by grouping

them into elements according to their economic characteristics. The elements directly related

to the measurement of financial position in the balance sheet are assets, liabilities, and equity.

The elements directly related to the measurement of performance in the income statement are

income and expenses. (¶47)

The definitions of these elements from paragraphs 49 and 70 are as follows:

• An asset is a resource controlled by the entity as a result of past events and from which

future economic benefits are expected to flow to the entity.

• A liability is a present obligation of the entity arising from past events, the settlement of

which is expected to result in an outflow from the entity of resources embodying economic

benefits.

• Equity is the residual interest in the assets of the entity after deducting all its liabilities.

• Income is increases in economic benefits during the accounting period in the form of

inflows or enhancements of assets or decreases of liabilities that result in increases in

equity, other than those relating to contributions from equity participants.

• Expenses are decreases in economic benefits during the accounting period in the form of

outflows or depletions of assets or incurrences of liabilities that result in decreases in

equity, other than those relating to distributions to equity participants.

Paragraph 83 deals with recognition, stating that an item that meets the definition of an

element should be recognized if

a) it is probable that any future economic benefit associated with the item will flow to or

from the entity; and

b) the item has a cost or value that can be measured with reliability.

These concepts are clearly reflected in the requirements of IAS 1, as we see in the next section.

International Accounting Standard 1 (IAS 1), Presentation of Financial Statements• 3

Overview of IAS 1

Objective and scope

IAS 1 prescribes the basis for presentation of general-purpose financial statements, defined as

“(statements) intended to meet the needs of users who are not in a position to require an entity

to prepare reports tailored to their particular information needs.” (¶3 and 7) The definition

includes both consolidated and separate financial statements. IAS 1 does not specifically apply

to the form, structure, and content of interim financial statements (which are covered in

IAS 34 Interim Financial Reporting), but many of the overall considerations (such as the

need for fair presentation and consistency) do apply to interim statements. Reports and

statements that are not part of financial statements (for example, environmental reports,

management reviews, and value-added statements) are outside the scope of IFRSs.

A prescribed basis of presentation is necessary in order to ensure comparability, both with

previous financial statements issued by the entity, and with the financial statements of other

entities. To achieve this goal of comparability, IAS 1 sets out overall requirements for the

presentation of financial statements, guidelines for their structure, and minimum requirements

for their content.

IAS 1 uses terminology that is suitable for profit-oriented entities, and cautions that entities

with not-for-profit activities may need to amend the descriptions of statements or line items if

applying IAS 1.

Highlights of the standard

Purpose of financial statements

IAS 1 outlines the purpose or objective of general-purpose financial statements. As a structured

representation of the financial position and financial performance of an entity, the financial

statements “provide information about the financial position, financial performance and cash

flows of an entity that is useful to a wide range of users in making economic decisions.

Financial statements also show the results of the management’s stewardship of the resources

entrusted to it.” (¶9)

This ties back to the Framework’s discussion on the needs of users of financial statements. To

meet this objective, financial statements provide information about an entity’s

a) assets

b) liabilities

c) equity

d) income and expenses, including gains and losses

e) contributions by and distributions to owners in their capacity as owners

f) cash flows

This information, along with other information in the notes, assists users of financial statements

in predicting the entity’s future cash flows and, in particular, their timing and certainty. (¶9)

Complete set of financial statements

Paragraph 10 defines the items to be included in a complete set of financial statements as

(a) a statement of financial position as at the end of the period

(b) a statement of comprehensive income for the period

(c) a statement of changes in equity for the period

International Accounting Standard 1 (IAS 1), Presentation of Financial Statements• 4

(d) a statement of cash flows for the period

(e) notes, comprising a summary of significant accounting policies and other explanatory

information

(f) a statement of financial position as at the beginning of the earliest comparative period

when an entity applies an accounting policy retrospectively or makes a retrospective

restatement of items in its financial statements, or when it reclassifies items in its

financial statements

All statements in the complete set are to be presented with equal prominence.

The titles presented in Paragraph 10 reflect the standard titles used in IFRSs (existing

Standards and Interpretations are being updated to reflect these titles), but financial statement

preparers are allowed to use other statement titles if they choose.

An entity is allowed to present all components of comprehensive income (that is, the components

of profit and loss for the period along with the components of other comprehensive income)

in a single statement. Alternatively, the entity can present the components of comprehensive

income in two statements: an income statement showing the components of profit and loss,

and a statement of comprehensive income that begins with profit or loss and incorporates all

other non-owner changes in equity. If a separate income statement is used, it must be presented

immediately before the statement of comprehensive income.

General features

IAS 1 specifies the following general features that are required of financial statements. These

features tie closely to the Framework, particularly with respect to the objectives of financial

statements and the qualitative characteristics of financial information that make it useful for

decision-making purposes.

i) Fair presentation and compliance with IFRSs

IAS 1 requires that financial statements present fairly the financial position, financial

performance, and cash flows of an entity. Fair presentation requires the faithful

representation of the effects of transactions, other events, and conditions in accordance

with the definitions and recognition criteria for assets, liabilities, income, and expenses

set out in the Framework. (¶15)

IAS 1 presumes that the application of IFRSs, with additional disclosure when

necessary, results in financial statements that achieve a fair presentation.

An entity whose financial statements comply with IFRSs is required (in Paragraph 16)

to make an explicit and unreserved statement of such compliance in the notes to financial

statements. In order to make this statement, however, the financial statements must

comply with all of the requirements of IFRSs. Complying with some of the IFRSs or

IASs only does not give an entity the right to claim that their statements are compliant.

Paragraphs 18 to 20 deal with situations where an entity applies policies or procedures

that are not compliant with IFRSs or IASs. If an entity chooses an accounting policy

that is inappropriate, disclosing the inappropriate accounting policies used by notes or

explanatory material does not rectify the matter. In other words, adding a disclaimer

regarding the policy does not make the policy acceptable.

IAS 1 does, however, acknowledge that there may be extremely rare circumstances

where management may conclude that compliance with an IFRS requirement would be

so misleading that it would conflict with the objective of financial statements set out in

the Framework. In such situations, the entity is required to depart from the IFRS

requirement, as long as the relevant regulatory framework requires, or otherwise does

not prohibit, such a departure.

International Accounting Standard 1 (IAS 1), Presentation of Financial Statements• 5

Obviously, any such departure necessitates detailed disclosures, including the rationale

for the decision, the treatment required versus the treatment adopted, and the nature

and financial effect of the departure. (¶19 and 20)

Some refer to this as the “true and fair view override” notion. This idea does not exist

in Canadian GAAP, and is expected to slowly be eliminated from IFRS, as other

harmonizing countries also remove it from their own GAAP.

ii) Going concern

The remainder of the general features outlined in IAS 1 are the same as the

fundamental concepts in Sections 1000 and 1400.

IAS 1 requires management to assess the entity’s ability to continue as a going

concern. Further, management is to prepare financial statements on a going-concern

basis unless they either intend to liquidate the entity or to cease trading, or they have no

realistic alternative but to do so. Disclosures are required if there are significant doubts

about the entity’s ability to continue as a going concern, or if the financial statements

are not prepared on a going-concern basis. (¶25)

iii) Accrual basis of accounting

Paragraph 27 requires that the accrual basis of accounting be used in preparing

financial statements, except for cash flow information.

iv) Materiality and aggregation

Paragraph 29 requires that each material class of similar items be presented separately.

Items of a dissimilar nature or function can be aggregated only if they are immaterial.

An item that is not sufficiently material to warrant separate presentation in those

statements may warrant separate presentation in the notes. (¶30)

v) Offsetting

An entity cannot offset assets and liabilities or income and expenses, unless required or

permitted by an IFRS. (¶32)

vi) Frequency of reporting

Entities have to present a complete set of financial statements (including comparative

information) at least on an annual basis. If financial statements are presented for a

period longer or shorter than one year, this is disclosed, along with the rationale and a

caution regarding the potential lack of comparability (¶36).

vii) Comparative information

Previous-period comparative information is to be disclosed for all amounts reported in

the current period’s financial statements. (¶38) Comparative amounts are reclassified to

reflect the current presentation and disclosures are required regarding the nature,

amounts, and reasons for reclassifying (or not reclassifying if impracticable, and the

adjustments that would have resulted). (¶41 and 42)

viii) Consistency of presentation

Entities are required to be consistent in their presentation and classification of items in

the financial statements from one period to the next unless a change is required by an

IFRS or another presentation or classification would be more appropriate (based on the

criteria for the selection and application of accounting policies in IAS 8 Accounting

Policies, Changes in Accounting Estimates and Errors). (¶45)

Structure and content

The balance of IAS 1 deals with the structure and content required in the various financial

statements (including the notes to the financial statements). IAS 1 deals with the statement of

financial position (balance sheet), the income statement (if presented separately) and statement

International Accounting Standard 1 (IAS 1), Presentation of Financial Statements• 6

of comprehensive income, and the statement of changes in equity. Requirements regarding

the statement of cash flows are in IAS 7 Statement of Cash Flows.

It should be noted that IAS 1 uses the term “disclosure” in a broad sense to mean presentation

in either the statements or in the notes; IAS 1 views the notes as part of the complete set of

statements.

With respect to its statements, the entity must clearly identify (¶49 and 51)

• the financial statements (distinguishing them from other information in the same published

document)

• the reporting entity

• whether the statements are for the individual entity or for a consolidated group

• the date or period covered

• the currency used for presentation

• the level of rounding used (thousands or millions of dollars, and so on)

Statement of financial position (balance sheet)

As a minimum, the statement of financial position must include line items that present the

following amounts (¶54):

a) property, plant, and equipment

b) investment property

c) intangible assets

d) financial assets [excluding amounts shown under (e), (h), and (i)]

e) investments accounted for using the equity method

f) biological assets

g) inventories

h) trade and other receivables

i) cash and cash equivalents

j) the total of assets classified as held for sale and assets included in disposal groups

classified as held for sale in accordance with IFRS 5 Non-current Assets Held for Sale

and Discontinued Operations

k) trade and other payables

l) provisions

m) financial liabilities [excluding amounts shown under (k) and (l)]

n) liabilities and assets for current tax, as defined in IAS 12 Income Taxes

o) deferred tax liabilities and deferred tax assets, as defined in IAS 12

p) liabilities included in disposal groups classified as held for sale in accordance with IFRS 5

q) minority interest, presented within equity

r) issued capital and reserves attributable to owners of the parent

Additional line items, headings, and subtotals are needed if relevant to the understanding of

the entity’s financial position, and further sub-classifications are required in the statements or

notes, appropriate to the entity’s operations. (¶77)

International Accounting Standard 1 (IAS 1), Presentation of Financial Statements• 7

IAS 1 requires separation of current and non-current assets and liabilities except when a

presentation based on liquidity provides information that is reliable and is more relevant

(¶60). However, IAS 1 does not prescribe the order of presentation; for example, current

assets can be presented before or after non-current assets. This allows flexibility for

presentation and accommodates the preferred approach of different jurisdictions.

Classification of current versus non-current

(¶66 and 69)

Current assets include cash and cash equivalents (unless restricted); assets expected to be

realized, sold, or consumed within the normal operating cycle or within 12 months after the

reporting period; and assets held primarily for trading. All other assets are non-current.

Current liabilities are those expected to be settled in the normal operating cycle or due

within 12 months after the reporting period; liabilities held primarily for trading; and

liabilities for which the entity does not have an unconditional right to defer settlement for at

least 12 months after the reporting period. All other liabilities are non-current. IAS 1 was

amended in 2009 to clarify that even if the entity could be compelled by the holder of the

liability to settle the obligation by the issue of equity instruments, it would not affect the

underlying substance — a liability exists.

Note that deferred tax assets (liabilities) are classified as non-current (¶56), which differs

from the treatment under Canadian GAAP (Handbook Section 3465 requires that the tax

asset/liability be split into current and non-current portions).

Under IAS 1, long-term debt that is due within the next year, but is expected to be refinanced at

the discretion of the entity under an existing loan facility, is treated the same as under Canadian

GAAP — as non-current (¶73). However, some differences exist: unlike Canadian GAAP,

long-term debt that has become payable on demand because of a violation of a debt provision

would be classified as current, even if the lender has agreed to refinance or reschedule payments

on a long-term basis after the reporting period and before the financial statements are authorized

for issue. In order for the debt to be non-current, the lender must have agreed, by the end of

the reporting period, to provide a period of grace ending at least 12 months after the reporting

period, during which the lender cannot demand immediate repayment. (¶74 and 75)

With respect to share capital and reserves, an entity must disclose the following, either in the

statement of financial position or the statement of changes in equity, or in the notes (¶79):

• the number of each class of shares authorized, issued and fully paid, and issued but not

fully paid

• the par value per share, or that the shares have no par value

• a reconciliation of the number of shares outstanding at the beginning and at the end of the

period

• the rights, preferences, and restrictions attaching to that class including restrictions on the

distribution of dividends and the repayment of capital

• treasury shares and shares held by the entity’s subsidiaries or associates

• shares reserved for issue under options and contracts, including terms

• amounts

• a description of the nature and purpose of each reserve within equity

Statement of comprehensive income

As noted previously, an entity is allowed to present all components of comprehensive income in a

single statement or split between an income statement and a statement of comprehensive income.

International Accounting Standard 1 (IAS 1), Presentation of Financial Statements• 8

As a minimum, the statement of comprehensive income (including the income statement, if

separate) is required to include line items that present the following amounts for the period (¶82):

a) revenue

b) finance costs

c) share of the profit or loss of associates and joint ventures accounted for using the equity

method

d) tax expense

e) a single amount comprising the total of:

i) the post-tax profit or loss of discontinued operations and

ii) the post-tax gain or loss recognised on the measurement to fair value less costs to sell

or on the disposal of the assets or disposal group(s) constituting the discontinued

operation

f) profit or loss

g) each component of other comprehensive income classified by nature [excluding amounts

in (h)]

h) share of the other comprehensive income of associates and joint ventures accounted for

using the equity method

i) total comprehensive income

As we saw with the balance sheet, additional line items, headings, and subtotals are needed if

relevant.

The statement of comprehensive income must also disclose allocations of profit or loss and

total comprehensive income for the period attributable to minority interest and to owners of

the parent (¶83). This differs from Canadian GAAP, where minority interests are currently

excluded on the statement of comprehensive income.

Another difference from Canadian GAAP is that IAS 1 disallows extraordinary items (¶87).

This stems from the IASB’s view that “items treated as extraordinary result from the normal

business risks faced by an entity and do not warrant presentation in a separate component of

the income statement.”2

All items of income and expense recognized in a period are included in profit or loss unless

an IFRS requires or permits otherwise (¶88). Further, IAS 1 requires separate disclosure (in

the statements or notes to the financial statements) of material income and expense items,

such as inventory write-downs, discontinued operations, restructuring, litigation settlement,

and so on (¶97).

An entity is also required to present an analysis of expenses using a classification based on

either the nature of expenses (for example, depreciation, purchases of materials, transport

costs, employee benefits, and advertising costs) or their function within the entity (for

example, costs of sales, selling and administrative expenses), whichever provides information

that is reliable and more relevant (¶99, 102, and 103). There is no requirement for this type of

classification by nature or function under Canadian GAAP.

2

IAS 1 Basis of Conclusions, paragraph BC63

International Accounting Standard 1 (IAS 1), Presentation of Financial Statements• 9

Statement of changes in equity

An entity must present a statement of changes in equity showing in the statement (¶106)

a) total comprehensive income for the period, showing separately the total amounts

attributable to owners of the parent and to minority interest;

b) for each component of equity, the effects of retrospective application or retrospective

restatement recognised in accordance with IAS 8;

c) the amounts of transactions with owners in their capacity as owners, showing separately

contributions by and distributions to owners; and

d) for each component of equity, a reconciliation between the carrying amount at the

beginning and the end of the period, separately disclosing each change.

Note again the requirement to include minority interest, which is currently excluded under

Canadian GAAP.

Both the amount of dividends recognized as distributions to owners during the period and the

related amount per share are required to be disclosed, either in the statement of changes in

equity or in the notes (¶106).

Notes to the financial statements

IAS 1 provides guidance on both the general structure of the notes as well as specific

disclosures required. Notes are to be presented systematically and cross-referenced to the

relevant statements. Furthermore, the notes should contain any required disclosures that have

not been made directly in the statements themselves (¶112 and 113).

With respect to specific disclosures required, the notes must present information about

• the basis of preparation of the financial statements and the specific accounting policies

used (¶112)

• the judgments, apart from those involving estimations, that management has made in the

process of applying the entity’s accounting policies and that have the most significant

effect on the amounts recognized in the financial statements (¶122)

• the key assumptions concerning the future, and other key sources of estimation uncertainty

that have a significant risk of causing a material adjustment to the carrying amounts of

assets and liabilities within the next fiscal year (¶125)

• information that enables users of its financial statements to evaluate the entity’s objectives,

policies, and processes for managing capital (¶134)

Specific guidance is given in each of these areas. Final additional disclosures relate to dividends

that were proposed or declared before the financial statements were authorized but that were

not recognized during the period, and also to disclosures about the entity and its operations.

Differences from Canadian GAAP

It should be noted that, when discussing differences between IFRS and Canadian GAAP,

many of these items will turn out to be “temporary in nature” since the transition to IFRSs

will eliminate most (if not all) of the differences. Recall that, in order for an entity to state that

it complies with IFRS, it must comply with all of IFRS. As a result, in order for Canadian

standards to be compliant with IFRS when the change to IFRS comes (that is, for the effective

date of January 1, 2011), there cannot be any substantial differences remaining at that time. In

other words, many of the differences outlined below between current Canadian GAAP and

IFRSs will disappear or no longer be an issue:

International Accounting Standard 1 (IAS 1), Presentation of Financial Statements• 10

• IFRSs emphasize fair values to an extent that is not reflected in current Canadian GAAP.

Notwithstanding, it is important to note that IFRSs permit but don’t require fair value for

many items.

• The concept of a true and fair view override (¶19 and 20) is not found in Canadian GAAP;

notwithstanding, the latter’s overriding notion of fair presentation is substantively the

same. However, there is no override provision: either an entity complies with Canadian

GAAP or it does not.

• Although IFRSs do not provide specific exemptions for non-publicly accountable entities,

the IASB’s SME project (determining standards for small and medium-sized entities) will

provide relief for non-publicly accountable entities. On the other hand, Canadian GAAP

will embrace a complete self-contained set of generally accepted accounting principles for

private enterprises.

• In the balance sheet, deferred tax assets and liabilities must be classified as non-current (¶56).

• IAS 1 requires an analysis of expenses either by nature or by function, in the statements or

in the notes (¶99, 102, and 103).

• Income and expense items are not allowed to be presented as “extraordinary items” (¶87).

• Unlike Canadian GAAP, IFRSs do not contain any specific standards or exemptions for

rate-regulated operations (although the IASB does have an on-going project related to such

entities).

• Unlike IFRSs, Canadian GAAP permits presentation of comprehensive income in a

statement of equity. On the other hand, Canadian GAAP does not require a statement of

changes in equity although the entity must disclose the changes in the notes to the financial

statements.

• IFRSs provide guidance on determining when the entity’s functional currency is that of a

hyperinflationary economy; Canadian GAAP is silent. Moreover, Canadian GAAP does

not require price-level adjustments to be made in such circumstances; IFRSs do.

Further resources

Ongoing IFRS updates and references on PD Net

Deloitte summaries and updates on the standards

KPMG resources and newsletters

Model Financial Statements prepared under IFRS:

Deloitte IAS PLUS

PriceWaterhouseCoopers, Part 1

PriceWaterhouseCoopers, Part 2

Articles in this series will discuss:

IFRS 1 First-time Adoption of IFRS

IFRS 3 Business Combinations

IFRS 7 Financial Instruments: Disclosures

IAS 1 Presentation of Financial Statements

IAS 16 Property, Plant and Equipment

IAS 27 Consolidated and Separate Financial Statements

IAS 32 Financial Instruments: Presentation

International Accounting Standard 1 (IAS 1), Presentation of Financial Statements• 11

IAS 36 Impairment of Assets

IAS 37 Provisions, Contingent Liabilities and Contingent Assets

IAS 38 Intangible Assets

IAS 39 Financial Instruments: Recognition and Measurement

For a more comprehensive introduction to the adoption of IFRSs, see the online course

IAS 1/IFRS 1, available on PD Net. You must be registered to access and purchase the course.

If you are not registered on PD Net, register now — it’s fast, easy, and free.

Brian and Laura Friedrich are the principals of friedrich & friedrich corporation, an

accounting research, standards, and education firm. The firm provides policy, procedure, and

governance guidance; develops courses, examinations, and other assessments; and supports

the development of regional public accounting standards in Canada and internationally. Both

Brian and Laura have served as authors, curriculum developers, lecturers, exam developers,

and markers for numerous CGA and university courses in Canada, China, and the Caribbean

and have also presented at IFRS conferences in Ecuador. Their volunteer involvement with

the Association has earned them CGA-BC’s inaugural Ambassador of Distinction Award

(2004) and the JM Macbeth Award for service at the chapter level (Brian in 2006 and Laura

in 2007).

Stephen Spector is a Lecturer currently teaching Financial and Managerial Accounting at

Simon Fraser University. He became a CGA in 1985 after obtaining his Master of Arts in

Economics from SFU in 1982. In 1997, CGA-BC presented him with the Harold Clarke

Award of Merit for recognition of his service to the By-Laws Committee for 1990-1996. In

1999, Stephen received the Fellow Certified General Accountant (FCGA) award for

distinguished service to the Canadian accounting profession. He has been on SFU’s Faculty

of Business Administration’s Teaching Honour Roll for May 2004 to April 2005 and May

2006 to April 2007. In August 2008, he was one of the two annual winners of the Business

Faculty’s TD Canada Trust Distinguished Teaching Award. Stephen has held a number of

volunteer positions with CGA-BC; he currently sits on CGA-BC’s board of governors where

he is CGA-BC’s President.

International Accounting Standard 1 (IAS 1), Presentation of Financial Statements• 12

Das könnte Ihnen auch gefallen

- FA - Financial Accounting: Chapter 2 - Regulatory FrameworkDokument23 SeitenFA - Financial Accounting: Chapter 2 - Regulatory FrameworkSumiya YousefNoch keine Bewertungen

- Written Assignment Unit 4Dokument9 SeitenWritten Assignment Unit 4Mike StevenNoch keine Bewertungen

- Test Bank - Financial Accounting and Reporting Theory (Volume 1, 2 and 3)Dokument17 SeitenTest Bank - Financial Accounting and Reporting Theory (Volume 1, 2 and 3)Kimberly Etulle Celona100% (1)

- IFRS Conceptual FrameworkDokument7 SeitenIFRS Conceptual FrameworkhemantbaidNoch keine Bewertungen

- IAS O LevelDokument4 SeitenIAS O Levelmeelas1230% (1)

- Financial Reporting Subject Outline 2Dokument6 SeitenFinancial Reporting Subject Outline 2Gurinder SinghNoch keine Bewertungen

- Conceptual Framework For Financial Reporting: BackgroundDokument6 SeitenConceptual Framework For Financial Reporting: Backgroundbakhtawar soniaNoch keine Bewertungen

- Advanced Financial Accounting Under IFRS - Lecture Notes - final.2019-2020CuSol PDFDokument118 SeitenAdvanced Financial Accounting Under IFRS - Lecture Notes - final.2019-2020CuSol PDFSorin GabrielNoch keine Bewertungen

- Conceptual Framework For Financial Reporting: Student - Feedback@sti - EduDokument4 SeitenConceptual Framework For Financial Reporting: Student - Feedback@sti - Eduwaeyo girlNoch keine Bewertungen

- Handouts 4 The Mid Term ExamDokument5 SeitenHandouts 4 The Mid Term ExamJamil Hassan KhattakNoch keine Bewertungen

- W2 Module 3 Conceptual Framework Andtheoretical Structure of Financial Accounting and Reporting Part 1Dokument6 SeitenW2 Module 3 Conceptual Framework Andtheoretical Structure of Financial Accounting and Reporting Part 1Rose RaboNoch keine Bewertungen

- Pertemuan 1-Financial Reporting Standards Conceptual FrameworkDokument61 SeitenPertemuan 1-Financial Reporting Standards Conceptual Frameworkanggi anythingNoch keine Bewertungen

- Advanced Financial Accounting Under IFRSDokument57 SeitenAdvanced Financial Accounting Under IFRSAlexandra Mihaela TanaseNoch keine Bewertungen

- IFRS Illustrative Financial StatementsDokument306 SeitenIFRS Illustrative Financial Statementsjohnthorrr100% (1)

- Financial Accounting and Reporting 03Dokument6 SeitenFinancial Accounting and Reporting 03Nuah SilvestreNoch keine Bewertungen

- Financial ReportingDokument23 SeitenFinancial ReportingHandayani Mutiara Sihombing100% (1)

- Lecture 1Dokument24 SeitenLecture 1Brenden KapoNoch keine Bewertungen

- Conceptual Framework For Financial Reporting 2018Dokument6 SeitenConceptual Framework For Financial Reporting 2018Maaz QaisraniNoch keine Bewertungen

- ACF 1101 Financial Accounting: Revised Conceptual FrameworkDokument12 SeitenACF 1101 Financial Accounting: Revised Conceptual FrameworkKogularamanan NithiananthanNoch keine Bewertungen

- The Conceptual Framework For Financial: ReportingDokument32 SeitenThe Conceptual Framework For Financial: Reportingmoynul islamNoch keine Bewertungen

- Ey Devel 138 PD Amends November2018Dokument3 SeitenEy Devel 138 PD Amends November2018Ridhi PrasadNoch keine Bewertungen

- Chapter 3 - Financial Reporting StandardsDokument9 SeitenChapter 3 - Financial Reporting StandardsFardin Ahmed 2011823630Noch keine Bewertungen

- Framework FOR Preparation AND Presentation OF Financial StatementsDokument34 SeitenFramework FOR Preparation AND Presentation OF Financial Statementssamartha umbareNoch keine Bewertungen

- Chapter 2 - Framework For Preparation and Presentation of Financial StatementsDokument34 SeitenChapter 2 - Framework For Preparation and Presentation of Financial StatementsSumit PattanaikNoch keine Bewertungen

- RBV2013 Conceptual FrameworkDokument32 SeitenRBV2013 Conceptual FrameworkhemantbaidNoch keine Bewertungen

- IFRS Illustrative Financial Statements (Dec 2019) FINALDokument290 SeitenIFRS Illustrative Financial Statements (Dec 2019) FINALPaddireddySatyamNoch keine Bewertungen

- Apc 316Dokument6 SeitenApc 316Md Jonayed HossainNoch keine Bewertungen

- Lecture 1 - Concepts and EthicsDokument10 SeitenLecture 1 - Concepts and EthicsNikki MathysNoch keine Bewertungen

- Sitasi Internasional Kintan 1Dokument13 SeitenSitasi Internasional Kintan 1irham khoirulNoch keine Bewertungen

- Conceptual Framework - DiscussionDokument7 SeitenConceptual Framework - DiscussionAi MelNoch keine Bewertungen

- H01. Conceptual Framework and Financial StatementsDokument14 SeitenH01. Conceptual Framework and Financial StatementsMaryrose SumulongNoch keine Bewertungen

- Acc 219 Notes Mhaka CDokument62 SeitenAcc 219 Notes Mhaka CfsavdNoch keine Bewertungen

- Conceptual Framework: BFACCR3: Financial Accounting and Reporting Part-3Dokument30 SeitenConceptual Framework: BFACCR3: Financial Accounting and Reporting Part-3Shiela Marie Sta AnaNoch keine Bewertungen

- Revised AccountingDokument46 SeitenRevised AccountingAli NasarNoch keine Bewertungen

- Chapter 1 AnswerDokument11 SeitenChapter 1 Answerelainelxy2508Noch keine Bewertungen

- Summary of New CF 2018Dokument23 SeitenSummary of New CF 2018Ashraf Uz ZamanNoch keine Bewertungen

- Toa Iasb Conceptual FrameworkDokument11 SeitenToa Iasb Conceptual FrameworkreinaNoch keine Bewertungen

- CH 01Dokument30 SeitenCH 01laiveNoch keine Bewertungen

- A Common Framework For Accounting StandardsDokument6 SeitenA Common Framework For Accounting StandardsedjotherNoch keine Bewertungen

- QUESTION 1.bacc 2 BDokument2 SeitenQUESTION 1.bacc 2 Bmussa waziriNoch keine Bewertungen

- Just To LoadDokument20 SeitenJust To LoadkhairejoNoch keine Bewertungen

- The Conceptual Framework For Financial ReportingDokument10 SeitenThe Conceptual Framework For Financial ReportingRobbie CruzNoch keine Bewertungen

- CFASDokument19 SeitenCFASKuroko TetsuyaNoch keine Bewertungen

- A Project ON: (Impact On Banking Sector)Dokument21 SeitenA Project ON: (Impact On Banking Sector)Akshay BhandeNoch keine Bewertungen

- Philippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Dokument27 SeitenPhilippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Ana Liza MendozaNoch keine Bewertungen

- Accounting Standard-1 and Its Legal Implications in The Corporate WorldDokument32 SeitenAccounting Standard-1 and Its Legal Implications in The Corporate Worldlove_djNoch keine Bewertungen

- PFRS Adopted by SEC As of December 31, 2011 PDFDokument27 SeitenPFRS Adopted by SEC As of December 31, 2011 PDFJennybabe PetaNoch keine Bewertungen

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDokument21 SeitenACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNoch keine Bewertungen

- FA2A - Study GuideDokument67 SeitenFA2A - Study GuideHasan EvansNoch keine Bewertungen

- Diff Betn Us Gaap - IfrsDokument9 SeitenDiff Betn Us Gaap - IfrsVimal SoniNoch keine Bewertungen

- Intermediate Accounting I - Chapter 1Dokument35 SeitenIntermediate Accounting I - Chapter 1Wijdan Saleem EdwanNoch keine Bewertungen

- ACCT 372 Lecture 6 Normative Theories Conceptual Framework NotesDokument36 SeitenACCT 372 Lecture 6 Normative Theories Conceptual Framework NotesDustin SmytheNoch keine Bewertungen

- CFM02 FAR2 2018 Conceptual FrameworkDokument7 SeitenCFM02 FAR2 2018 Conceptual FrameworkAnime LoverNoch keine Bewertungen

- Conceptual Framework of Financial Reporting-2021-MbaDokument22 SeitenConceptual Framework of Financial Reporting-2021-MbasurangauorNoch keine Bewertungen

- Unit3 CFAS PDFDokument12 SeitenUnit3 CFAS PDFhellokittysaranghaeNoch keine Bewertungen

- Conceptual FrameworkDokument4 SeitenConceptual Frameworkmarlou mNoch keine Bewertungen

- Financial Performance Measures and Value Creation: the State of the ArtVon EverandFinancial Performance Measures and Value Creation: the State of the ArtNoch keine Bewertungen

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018Von EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Noch keine Bewertungen

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18Von EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18Noch keine Bewertungen

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsVon EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNoch keine Bewertungen

- Presentation Title: Your Company InformationDokument3 SeitenPresentation Title: Your Company InformationHeliani sajaNoch keine Bewertungen

- Presentation Title: My Name Contact Information or Project DescriptionDokument2 SeitenPresentation Title: My Name Contact Information or Project DescriptionHeliani sajaNoch keine Bewertungen

- Analytics Powerpoint Template: Subtitle HereDokument4 SeitenAnalytics Powerpoint Template: Subtitle HereHeliani sajaNoch keine Bewertungen

- Presentation Title: Your Company NameDokument4 SeitenPresentation Title: Your Company NameSi Nyonya CubicleNoch keine Bewertungen

- Free PPT Templates: Insert The Title of Your Presentation HereDokument3 SeitenFree PPT Templates: Insert The Title of Your Presentation HereHeliani sajaNoch keine Bewertungen

- Free PPT Templates: Insert The Title of Your Presentation HereDokument3 SeitenFree PPT Templates: Insert The Title of Your Presentation HereputeraagusNoch keine Bewertungen

- Presentation Title: Subheading Goes HereDokument2 SeitenPresentation Title: Subheading Goes HereHeliani sajaNoch keine Bewertungen

- Presentation Title: My Name My Position, Contact Information or Project DescriptionDokument2 SeitenPresentation Title: My Name My Position, Contact Information or Project DescriptionHeliani sajaNoch keine Bewertungen

- Presentation Title: My Name Contact Information or Project DescriptionDokument2 SeitenPresentation Title: My Name Contact Information or Project DescriptionHeliani sajaNoch keine Bewertungen

- Presentation Title: My Name Contact Information or Project DescriptionDokument2 SeitenPresentation Title: My Name Contact Information or Project DescriptionHeliani sajaNoch keine Bewertungen

- Presentation Title: Subheading Goes HereDokument2 SeitenPresentation Title: Subheading Goes HereHeliani sajaNoch keine Bewertungen

- Presentation Title: Subtitle or Company InfoDokument3 SeitenPresentation Title: Subtitle or Company InfoHeliani sajaNoch keine Bewertungen

- Accounting For ReceivableDokument2 SeitenAccounting For ReceivableHeliani sajaNoch keine Bewertungen

- Contoh Form CutiDokument1 SeiteContoh Form CutiHeliani sajaNoch keine Bewertungen

- Seng Fixed Asset RevaluationsDokument33 SeitenSeng Fixed Asset RevaluationsFairuz AbadiNoch keine Bewertungen

- Business CombinationDokument47 SeitenBusiness CombinationHeliani sajaNoch keine Bewertungen

- Ifrs Psak Comparison 2014Dokument28 SeitenIfrs Psak Comparison 2014x-thopNoch keine Bewertungen

- Excel - Situatii Financiare Consolidate-Consolidated Financial StatementsDokument3 SeitenExcel - Situatii Financiare Consolidate-Consolidated Financial StatementsCristina Maria DeneşanNoch keine Bewertungen

- Last Assignment of PRC-04 December 2022Dokument94 SeitenLast Assignment of PRC-04 December 2022mudassar saeedNoch keine Bewertungen

- P2 2aDokument3 SeitenP2 2aSakib Ul-abrarNoch keine Bewertungen

- Intp LK TW Iv 2019Dokument141 SeitenIntp LK TW Iv 2019Davila RANoch keine Bewertungen

- Chapter 2Dokument35 SeitenChapter 2Kate ManalansanNoch keine Bewertungen

- Goodwill Questions and Their SolutionsDokument8 SeitenGoodwill Questions and Their SolutionsAMIN BUHARI ABDUL KHADERNoch keine Bewertungen

- Statement of Cash FlowsDokument34 SeitenStatement of Cash FlowsFahd RizwanNoch keine Bewertungen

- 2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Dokument4 Seiten2018 April MGU Cbcss 4th Semester Corporate Accounting Question Paper Goodwill Tuition Centre 9846710963 9567902805Rainy Goodwill0% (1)

- Emaar Properties PJSC and Its Subsidiaries: Unaudited Interim Condensed Consolidated Financial StatementsDokument52 SeitenEmaar Properties PJSC and Its Subsidiaries: Unaudited Interim Condensed Consolidated Financial StatementssafSDgSggNoch keine Bewertungen

- Out Marriott PDFDokument35 SeitenOut Marriott PDFemigdio contrerasNoch keine Bewertungen

- ACC2002 Practice 1Dokument9 SeitenACC2002 Practice 1Đan LêNoch keine Bewertungen

- Topic 1 - Overview of Working Capital ManagementDokument80 SeitenTopic 1 - Overview of Working Capital ManagementTâm ThuNoch keine Bewertungen

- Peachtree ProjectDokument2 SeitenPeachtree ProjectAmyn AhmedNoch keine Bewertungen

- Accounting TermsDokument25 SeitenAccounting TermsLavina NachlaniNoch keine Bewertungen

- B2Dokument14 SeitenB2marathi techNoch keine Bewertungen

- Acct 301 WorksheetDokument3 SeitenAcct 301 Worksheetapi-355720477Noch keine Bewertungen

- Teamprtc Mock Board Oct 2020 Afar PDFDokument16 SeitenTeamprtc Mock Board Oct 2020 Afar PDFBryle EscosaNoch keine Bewertungen

- Journal Entries For JulyDokument5 SeitenJournal Entries For JulyGwendolyn PansoyNoch keine Bewertungen

- 12 Accounts ch6 tp1Dokument11 Seiten12 Accounts ch6 tp1Pawan TalrejaNoch keine Bewertungen

- Translation of Foreign Currency Financial Statements: Multiple Choice QuestionsDokument154 SeitenTranslation of Foreign Currency Financial Statements: Multiple Choice QuestionsMarwa HassanNoch keine Bewertungen

- The Recording Process: Weygandt - Kieso - KimmelDokument68 SeitenThe Recording Process: Weygandt - Kieso - Kimmelatia fariaNoch keine Bewertungen

- Prelim 2 Financial ManagementDokument17 SeitenPrelim 2 Financial Managementyenyenreyes222Noch keine Bewertungen

- Acctg ch05 2ppgDokument25 SeitenAcctg ch05 2ppgwtfNoch keine Bewertungen

- Accounting Tutorial: Partnership Accounting - Part IIIDokument25 SeitenAccounting Tutorial: Partnership Accounting - Part IIIsalamat lang akinNoch keine Bewertungen

- Sess 1 & 2 Basic AccountingDokument48 SeitenSess 1 & 2 Basic Accountingdilshan jayawardanaNoch keine Bewertungen

- Retail Book Chap06Dokument21 SeitenRetail Book Chap06Harman Gill100% (1)

- Practical Accounting 2: Topic: Home Office and Branch AccountingDokument11 SeitenPractical Accounting 2: Topic: Home Office and Branch AccountingJoel Christian MascariñaNoch keine Bewertungen

- Ke Toan Quoc Te Excel Bai TapDokument115 SeitenKe Toan Quoc Te Excel Bai TapLê NaNoch keine Bewertungen