Beruflich Dokumente

Kultur Dokumente

Roxas Vs CTA

Hochgeladen von

hanabi_13Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Roxas Vs CTA

Hochgeladen von

hanabi_13Copyright:

Verfügbare Formate

1.

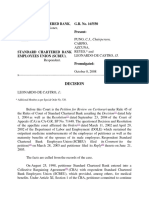

ROXAS VS CTA

On June 17, 1958, the CIR demanded from the Roxas brothers the payment of deficiency

income taxes resulting from the inclusion as income of Roxas of unreported net profits for

1953 – 1955 derived from the sale of the Nasugbu farm lands to the tenants. The CIR

considered them as a partnership engaged in real estate business, thus, 100% of the profits

derived from the sale of the farm lands were taxed.

The Roxas brothers protested the assessment but inasmuch as said protest was denied,

they instituted an appeal in the Court of Tax Appeals on January 9, 1961. The Tax Court

heard the appeal and rendered judgment on July 31, 1965 sustaining the assessment.

ISSUE: WON the Roxas brothers are liable for the payment of deficiency income tax for the

sale of the farm lands

RULING:

NO. They are not liable for the sale of the farm lands.

The sale of the of the Nasugbu farm lands to the very farmers who tilled them for

generations was not only in consonance with, but more in obedience to the request and

pursuant to the policy of our Government to allocate lands to the landless. It was the

bounden duty of the Government to pay the agreed compensation after it had persuaded

Roxas y Cia. to sell its haciendas, and to subsequently subdivide them among the farmers

at very reasonable terms and prices. However, the Government could not comply with its

duty for lack of funds. Obligingly, Roxas y Cia. shouldered the Government's burden, went

out of its way and sold lands directly to the farmers in the same way and under the same

terms as would have been the case had the Government done it itself.

In fine, Roxas y Cia. cannot be considered a real estate dealer for the sale in question.

Hence, pursuant to Section 34 of the Tax Code the lands sold to the farmers are capital

assets, and the gain derived from the sale thereof is capital gain

Das könnte Ihnen auch gefallen

- Income Tax AustraliaDokument9 SeitenIncome Tax AustraliaAbdul HadiNoch keine Bewertungen

- Bank Statement Template 16 PDFDokument2 SeitenBank Statement Template 16 PDFBara Creatives50% (2)

- Merchant Accounts Are Bank Accounts That Allow Your Business To Accept Card Payments From CustomersDokument43 SeitenMerchant Accounts Are Bank Accounts That Allow Your Business To Accept Card Payments From CustomersRohit Kumar Baghel100% (1)

- Forum Non ConveniensDokument3 SeitenForum Non Convenienshanabi_13Noch keine Bewertungen

- TaxRev TaxRemediesDokument178 SeitenTaxRev TaxRemediesJeunaj Lardizabal100% (1)

- Certificate of Title DiscussionDokument14 SeitenCertificate of Title Discussionhanabi_13Noch keine Bewertungen

- Property Memory AidDokument31 SeitenProperty Memory AidMae Sntg OraNoch keine Bewertungen

- Motion For New Trial or ReconsiderationDokument8 SeitenMotion For New Trial or Reconsiderationhanabi_13Noch keine Bewertungen

- Multiple Choice QuizDokument3 SeitenMultiple Choice QuizZekria Noori Afghan100% (3)

- Credit Transactions DigestsDokument3 SeitenCredit Transactions Digestshanabi_13Noch keine Bewertungen

- Case: Marcos Ii vs. CaDokument1 SeiteCase: Marcos Ii vs. CaRaquel DoqueniaNoch keine Bewertungen

- Lascona Land Co., Inc. vs. CIR, G.R. No. 171251, March 5, 2012 DoctrineDokument1 SeiteLascona Land Co., Inc. vs. CIR, G.R. No. 171251, March 5, 2012 DoctrineHoreb FelixNoch keine Bewertungen

- Rules On RedemptionDokument3 SeitenRules On Redemptionhanabi_13Noch keine Bewertungen

- Corpo Midterm CoverageeeeDokument30 SeitenCorpo Midterm CoverageeeeRedd ClosaNoch keine Bewertungen

- Law Review NotesDokument16 SeitenLaw Review NotesBai Matarintis Manisan100% (1)

- Sec of Finance v. LazatinDokument10 SeitenSec of Finance v. Lazatinana abayaNoch keine Bewertungen

- Labor CasesDokument14 SeitenLabor Caseshanabi_13Noch keine Bewertungen

- Anti Dummy Law Commonwealth Act 108Dokument5 SeitenAnti Dummy Law Commonwealth Act 108JoyceMendozaNoch keine Bewertungen

- Casa Filipina Devt Corp VS Deputy Exec SecretaryDokument2 SeitenCasa Filipina Devt Corp VS Deputy Exec Secretaryhanabi_13Noch keine Bewertungen

- MCIAA Vs Marcos Case DigestDokument3 SeitenMCIAA Vs Marcos Case DigestLuigi JaroNoch keine Bewertungen

- PNOC vs. CADokument2 SeitenPNOC vs. CACaliNoch keine Bewertungen

- Strikes, Lockouts and PicketingDokument8 SeitenStrikes, Lockouts and Picketinghanabi_13100% (1)

- Tottenham CaseDokument19 SeitenTottenham Casekranilrai75% (8)

- Case Digests and Reviewer: Taxation 1 (General Taxation) PageDokument98 SeitenCase Digests and Reviewer: Taxation 1 (General Taxation) PageAstrid Gopo BrissonNoch keine Bewertungen

- A9 COCOFED vs. PCGG, 178 SCRA 236 (1989) PDFDokument8 SeitenA9 COCOFED vs. PCGG, 178 SCRA 236 (1989) PDFceilo coboNoch keine Bewertungen

- Tax 1 Chapter 1Dokument9 SeitenTax 1 Chapter 1De Guzman E AldrinNoch keine Bewertungen

- Roxas vs. CTA, 23 SCRA 276Dokument10 SeitenRoxas vs. CTA, 23 SCRA 276Machida AbrahamNoch keine Bewertungen

- Partnership-Case Digests and CodalDokument16 SeitenPartnership-Case Digests and CodalaliahNoch keine Bewertungen

- Acquisition of PossessionDokument18 SeitenAcquisition of PossessionFroilan Villafuerte FaurilloNoch keine Bewertungen

- Pantranco V PSCDokument2 SeitenPantranco V PSCKaren AbellaNoch keine Bewertungen

- Espiritu Vs JovellanosDokument2 SeitenEspiritu Vs Jovellanoshanabi_13Noch keine Bewertungen

- British American Tobacco V CamachoDokument12 SeitenBritish American Tobacco V CamachoPatatas Sayote100% (1)

- Reviewer: Agrarian Law (Part 1)Dokument6 SeitenReviewer: Agrarian Law (Part 1)Jaimie Paz AngNoch keine Bewertungen

- Place of Incorporation Test PDFDokument6 SeitenPlace of Incorporation Test PDFNarciso Reyes Jr.Noch keine Bewertungen

- Transfer TaxesDokument8 SeitenTransfer TaxesMikee TanNoch keine Bewertungen

- Lutz v. AranetaDokument2 SeitenLutz v. AranetaKyle Dionisio100% (1)

- SSS V City of BacolodDokument2 SeitenSSS V City of BacolodChery Sheil ValenzuelaNoch keine Bewertungen

- Lita Enterprises Vs IACDokument1 SeiteLita Enterprises Vs IAChanabi_13Noch keine Bewertungen

- Case Digest 4 5 PropertyDokument3 SeitenCase Digest 4 5 PropertyEsmeralda De GuzmanNoch keine Bewertungen

- Tax N (2) DigestsDokument10 SeitenTax N (2) DigestsJulius Geoffrey TangonanNoch keine Bewertungen

- Soriano-vs.-Secretary-of-Finance-G.R.-No.-184450-January-24-2017Dokument38 SeitenSoriano-vs.-Secretary-of-Finance-G.R.-No.-184450-January-24-2017Darrel John SombilonNoch keine Bewertungen

- Radiowealth Finance Co. vs. Spouses Del RosarioDokument2 SeitenRadiowealth Finance Co. vs. Spouses Del RosarioSalie VillafloresNoch keine Bewertungen

- Duty Free v. COADokument1 SeiteDuty Free v. COALizzy Way100% (1)

- Degrees of Negligence Proof of Negligence Section 1, Rule 131 of The Revised Rules of CourtDokument7 SeitenDegrees of Negligence Proof of Negligence Section 1, Rule 131 of The Revised Rules of CourtcrisNoch keine Bewertungen

- Labor Notes (Pre-Employment)Dokument11 SeitenLabor Notes (Pre-Employment)Glyza Kaye Zorilla PatiagNoch keine Bewertungen

- Roxas Vs CIR DigestDokument1 SeiteRoxas Vs CIR DigestJoshua Erik Madria100% (1)

- Prohibition Against Taxation of Religious and Charitable InstitutionsDokument2 SeitenProhibition Against Taxation of Religious and Charitable InstitutionsBruno GalwatNoch keine Bewertungen

- Meralco vs. Province of Laguna, 306 SCRA 750Dokument6 SeitenMeralco vs. Province of Laguna, 306 SCRA 750Machida AbrahamNoch keine Bewertungen

- G.R. No. 174156 FIlcar Transport Vs Espinas Registered OwnerDokument13 SeitenG.R. No. 174156 FIlcar Transport Vs Espinas Registered OwnerChatNoch keine Bewertungen

- Property - 493 de Guia VS Ca PDFDokument5 SeitenProperty - 493 de Guia VS Ca PDFXing Keet LuNoch keine Bewertungen

- Heng Tong Textiles Co., Inc. v. CIR (1968) Case DigestDokument2 SeitenHeng Tong Textiles Co., Inc. v. CIR (1968) Case DigestShandrei GuevarraNoch keine Bewertungen

- Philex Mining Corp Vs CIRDokument19 SeitenPhilex Mining Corp Vs CIRJamaika Ina CruzNoch keine Bewertungen

- Tax - Procter & Gamble VS Municipality of JagnaDokument2 SeitenTax - Procter & Gamble VS Municipality of JagnaKath LimNoch keine Bewertungen

- Province of Bulacan v. CADokument2 SeitenProvince of Bulacan v. CACarla Louise Bulacan BayquenNoch keine Bewertungen

- Sison Vs Ancheta FULL TEXTDokument3 SeitenSison Vs Ancheta FULL TEXT001nooneNoch keine Bewertungen

- Roxas Vs CTADokument9 SeitenRoxas Vs CTAVincent OngNoch keine Bewertungen

- Petron vs. Pililla, G.R. No. 90776, June 3, 1991Dokument8 SeitenPetron vs. Pililla, G.R. No. 90776, June 3, 1991Machida AbrahamNoch keine Bewertungen

- Republic v. GonzalesDokument1 SeiteRepublic v. GonzalesfranzadonNoch keine Bewertungen

- Cases On TaxationDokument13 SeitenCases On TaxationPeanutButter 'n JellyNoch keine Bewertungen

- Facts:: REPUBLIC v. REV. CLAUDIO R. CORTEZ, GR No. 197472, 2015-09-07Dokument4 SeitenFacts:: REPUBLIC v. REV. CLAUDIO R. CORTEZ, GR No. 197472, 2015-09-07Sean Pamela BalaisNoch keine Bewertungen

- Tax Review Case DigestsDokument10 SeitenTax Review Case DigestsTina MarianoNoch keine Bewertungen

- Herrera V Quezon City Board of Assessment GR No L-15270Dokument8 SeitenHerrera V Quezon City Board of Assessment GR No L-15270KidMonkey2299Noch keine Bewertungen

- Republic V GonzalesDokument1 SeiteRepublic V GonzalesKen SagumNoch keine Bewertungen

- Cta 00 CV 06533 D 2003may16 Ass PDFDokument15 SeitenCta 00 CV 06533 D 2003may16 Ass PDFAgnes PajilanNoch keine Bewertungen

- Chavez v. OngpinDokument2 SeitenChavez v. OngpinSNLTNoch keine Bewertungen

- DIAZ and TIMBOL Vs Sec of Finance and CIRDokument2 SeitenDIAZ and TIMBOL Vs Sec of Finance and CIRBrylle Deeiah TumarongNoch keine Bewertungen

- Testate Estate of Jose Eugenio Ramirez Vs Marcelle Vda de Ramirez Et Al PDFDokument4 SeitenTestate Estate of Jose Eugenio Ramirez Vs Marcelle Vda de Ramirez Et Al PDFLauren IsabelNoch keine Bewertungen

- Delpher Traders vs. IacDokument3 SeitenDelpher Traders vs. IacKent A. AlonzoNoch keine Bewertungen

- Pepsi Cola vs. Municipality of Tanauan, Leyte)Dokument1 SeitePepsi Cola vs. Municipality of Tanauan, Leyte)Shall PMNoch keine Bewertungen

- Local TaxationDokument240 SeitenLocal TaxationJulia Inez BlandoNoch keine Bewertungen

- Marcos II V CADokument1 SeiteMarcos II V CARegion 6 MTCC Branch 3 Roxas City, CapizNoch keine Bewertungen

- Churchill vs. ConcepcionDokument1 SeiteChurchill vs. ConcepcionMaria Mikaela Nicole JoabanNoch keine Bewertungen

- Caltex V COA DigestDokument3 SeitenCaltex V COA DigestCarlito HilvanoNoch keine Bewertungen

- Philreca Vs SecDokument2 SeitenPhilreca Vs SecBianca Viel Tombo CaligaganNoch keine Bewertungen

- Roxas vs. CTA, GR No. L-25043 Dated April 26, 1968Dokument2 SeitenRoxas vs. CTA, GR No. L-25043 Dated April 26, 1968Hannamae BayganNoch keine Bewertungen

- Roxas Vs CTA (Power To Tax)Dokument1 SeiteRoxas Vs CTA (Power To Tax)Milcah LisondraNoch keine Bewertungen

- Llda V CaDokument3 SeitenLlda V Cahanabi_13Noch keine Bewertungen

- Transportation Law Landmark Cases Part 1Dokument27 SeitenTransportation Law Landmark Cases Part 1hanabi_13Noch keine Bewertungen

- Situs of TaxationDokument3 SeitenSitus of Taxationhanabi_13100% (1)

- PRE-TRIAL (Rule18) Concept of Pre-TrialDokument3 SeitenPRE-TRIAL (Rule18) Concept of Pre-Trialhanabi_13Noch keine Bewertungen

- Standard Chartered Bank Vs StandardDokument12 SeitenStandard Chartered Bank Vs Standardhanabi_13Noch keine Bewertungen

- AFPMBAI Vs SantiagoDokument5 SeitenAFPMBAI Vs Santiagohanabi_13Noch keine Bewertungen

- PNB VS CaDokument1 SeitePNB VS Cahanabi_13Noch keine Bewertungen

- CDDA2002 - Selected ArticlesDokument9 SeitenCDDA2002 - Selected Articleshanabi_13Noch keine Bewertungen

- P MLZ 2 WDWMZ 3 KDIMUDokument7 SeitenP MLZ 2 WDWMZ 3 KDIMUDaniel CookNoch keine Bewertungen

- Annual Report: Fiscal Year 2017/18Dokument207 SeitenAnnual Report: Fiscal Year 2017/18RupEshNoch keine Bewertungen

- Audit of The Payroll and Personnel CycleDokument4 SeitenAudit of The Payroll and Personnel CycleHarryanto TampiNoch keine Bewertungen

- Charges & Its Registration (Residual Provisions of Sec 77) : Continued From Geeta Saar Edition 17Dokument6 SeitenCharges & Its Registration (Residual Provisions of Sec 77) : Continued From Geeta Saar Edition 17Muthu KumaranNoch keine Bewertungen

- RDokument2 SeitenRMona VimlaNoch keine Bewertungen

- Impairment of AssetsDokument4 SeitenImpairment of AssetsNath BongalonNoch keine Bewertungen

- Accounting Entries Under GSTDokument9 SeitenAccounting Entries Under GSTLovaraju RajuNoch keine Bewertungen

- Prediction of Company Bankruptcy Using Statistical Techniques - Case of CroatiaDokument10 SeitenPrediction of Company Bankruptcy Using Statistical Techniques - Case of CroatiaSindhu GNoch keine Bewertungen

- Macroeconomics For Financial Markets ModuleDokument4 SeitenMacroeconomics For Financial Markets ModuleSankalp SinghNoch keine Bewertungen

- MGMT 026 Chapter 09 HW PDFDokument16 SeitenMGMT 026 Chapter 09 HW PDFJm SevallaNoch keine Bewertungen

- $RMIGD97Dokument435 Seiten$RMIGD97sdssd sdsNoch keine Bewertungen

- Sections 54 54B 54D 54E 54EA 54EB 54F 54G 54HDokument44 SeitenSections 54 54B 54D 54E 54EA 54EB 54F 54G 54HBeing HumaneNoch keine Bewertungen

- 2CEXAM Mock Question Mandatory Provident Fund Schemes ExaminationDokument35 Seiten2CEXAM Mock Question Mandatory Provident Fund Schemes ExaminationTsz Ngong KoNoch keine Bewertungen

- TDS - TCSDokument55 SeitenTDS - TCSBeing HumaneNoch keine Bewertungen

- MRSUTRIALQ1G08Dokument2 SeitenMRSUTRIALQ1G08Saurav DashNoch keine Bewertungen

- DKAM ROE Reporter April 2020Dokument8 SeitenDKAM ROE Reporter April 2020Ganesh GuhadosNoch keine Bewertungen

- Tasc - Summer ProjectDokument26 SeitenTasc - Summer ProjectbrhamNoch keine Bewertungen

- Gratuity Withdrawal Form LicDokument2 SeitenGratuity Withdrawal Form LicSarsij MishraNoch keine Bewertungen

- Finance & CreditDokument3 SeitenFinance & Creditel khaiat mohamed amineNoch keine Bewertungen

- Class 11 - Business StudiesDokument26 SeitenClass 11 - Business StudiesSri RaghulNoch keine Bewertungen

- Geeta Saar 21 Register of Members PDFDokument8 SeitenGeeta Saar 21 Register of Members PDFMuthu KumaranNoch keine Bewertungen

- 13.1 Exchange Rates and International TransactionsDokument27 Seiten13.1 Exchange Rates and International Transactionsjandihuyen83% (6)

- Warrants & Certificates: An Introductory GuideDokument32 SeitenWarrants & Certificates: An Introductory GuideFaridNoch keine Bewertungen

- Intermediate Accounting IIDokument10 SeitenIntermediate Accounting IILexNoch keine Bewertungen