Beruflich Dokumente

Kultur Dokumente

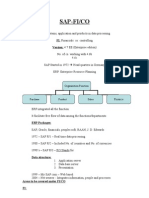

FICO Real Time Project

Hochgeladen von

sowmyanavalCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FICO Real Time Project

Hochgeladen von

sowmyanavalCopyright:

Verfügbare Formate

D1007AIP 24/06/2000

/FICO

Financial Accounting & Controlling

AS IS document for

KBL e-MAD

L&T Information Technology Limited

1.0

PH021T/1.0/15.09.99

DOCUMENT RECORD LIST

Ver/Rel. Release Mod.By Rev. By Auth By Remarks

No Date Mod. Dt Rev. Dt. Auth Dt.

1.0 24/06/2000 VRK, MRR, MGL, RSG MMN

RRK,SSK 23/06/2000 24/06/2000

22/06/2000

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Table of Contents

INTRODUCTION ......................................................................................................................................... 4

ORGANIZATION STRUCTURE................................................................................................................ 5

ORGANIZATION STRUCTURE OF KIRLOSKAR BROTHERS LIMITED (KBL) ................................................. 5

ORGANIZATION STRUCTURE OF ACCOUNTS DEPARTMENT ...................................................................... 5

MASTER DATA ........................................................................................................................................... 6

GENERAL LEDGER MASTER ....................................................................................................................... 6

CUSTOMER MASTER .................................................................................................................................. 6

VENDOR MASTER ....................................................................................................................................... 7

DEPOTS LEDGER MASTER ......................................................................................................................... 8

ADVANCES (EMPLOYEE) MASTER.............................................................................................................. 8

BANK MASTER ............................................................................................................................................ 9

COST CENTERS MASTER ........................................................................................................................... 9

GENERAL LEDGER ..................................................................................................................................10

CONSOLIDATION PROCESS .......................................................................................................................10

CASH AND BANK ACCOUNTING .................................................................................................................11

PAYROLL ACCOUNTING .............................................................................................................................13

ASSET ACCOUNTING .................................................................................................................................15

BUDGETING ...............................................................................................................................................17

YEAR-END / PERIOD END CLOSING OPERATIONS. ...................................................................................18

ACCOUNTS RECEIVABLE ......................................................................................................................23

DOMESTIC SALES ......................................................................................................................................23

Kirloskarvadi ........................................................................................................................... 23

Dewas..................................................................................................................................... 31

Shirwal .................................................................................................................................... 35

Area Offices ............................................................................................................................ 38

PROJECT SALES .......................................................................................................................................42

EXPORTS ...................................................................................................................................................48

AFTER SALES SERVICE .............................................................................................................................53

Kirloskarvadi ........................................................................................................................... 53

Dewas..................................................................................................................................... 56

Shirval..................................................................................................................................... 58

STOCK TRANSFER CORRECTIONS ............................................................................................................60

RECEIVABLE MANAGEMENT (COLLECTIONS)............................................................................................62

Kirloskarvadi – Domestic & Export and Dewas Export ........................................................ 62

Dewas , Shirwal and Area Offices - Domestic ....................................................................... 68

Projects................................................................................................................................... 71

SALES RETURN / CREDIT NOTES .............................................................................................................74

Kirloskarvadi ........................................................................................................................... 74

Dewas & Area Offices ............................................................................................................ 77

Shirval..................................................................................................................................... 79

Projects................................................................................................................................... 81

BUSINESS DEPOSITS , ADVANCES FROM CUSTOMERS ............................................................................83

Kirloskarvadi ........................................................................................................................... 83

Dewas / Shirval / Area Offices................................................................................................ 86

Projects................................................................................................................................... 88

L&T Information Technology Limited 2 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

ACCOUNTS PAYABLE ............................................................................................................................90

PURCHASE ACCOUNTING ..........................................................................................................................90

Kirloskarvadi ........................................................................................................................... 90

Dewas / Shirval / Area Offices................................................................................................ 94

Projects................................................................................................................................... 96

COST CENTER ACCOUNTING ............................................................................................................100

INTERNAL ORDER ACCOUNTING .....................................................................................................102

INFORMATION SYSTEM .......................................................................................................................104

L&T Information Technology Limited 3 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Introduction

Kirloskar Group is one of the India’s Premier and more than a Century

old engineering group. The group turnover is around Rs. 20 Billion. The

group is known for largest distribution network and excellence in

manufacturing. The group consists of 20 companies including joint

ventures.

Kirloskar Brothers Limited (KBL) is flagship company of the group having

turnover of around Rs. 3.7 Billion for the financial year 1999-2000. The Company

was incorporated in the year 1920. At present Company is having manufacturing

facilities at Kirloskarvadi, Shirwal and Dewas. The company’s operations are

divided into seven SBUs. The Company’s distribution network comprises of 16

regional offices in India and 8 overseas offices. Product range includes industrial

and agricultural pumps, hydro-turbines, valves, machine tools, industrial coatings

etc.. The Company also executes turnkey projects mainly in the areas of water

supply for irrigation scheme, municipalities and power stations.

Mission Statement

"Seek continuously, appropriate technology and systems to enhance stakeholder

value through increased customer focus leveraging on engineering skills and

recognized Brand Image."

Future Direction

To become a focussed player in engineering products, shift focus from top line to

bottom line and aggressive cost cutting & increasing productivity of capital and

human resources.

Project e-MAD

This project is a SAP R/3 implementation project. The scope of the project covers

the business processes related to Marketing And Distribution (MAD) Division of

KBL, which is providing services to all SBUs for their Domestic & International

Market. The entire factory operations are out of the scope of the project.

Manufacturing set up and external vendors are the sources of Products to

Marketing Division. The modules covered in this project are:

1. Sales & Distribution (SD)

2. Service Management (SM)

3. Materials Management (MM)

4. Financial Accounting (FI)

5. Controlling (CO)

L&T Information Technology Limited 4 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Organization Structure

Organization Structure of Kirloskar Brothers Limited (KBL)

KBL is divided into seven strategic business units (SBU) on the basis of product

groups for the purpose of proper control and accountability. These cover both

manufacturing and marketing activities of particular product. These are supported

by Central Corporate Function at Pune for common services such as

international marketing, taxation, accounts, finance, internal audit, information

technology, public relations etc.

Organization Structure of Accounts Department

Finance and Accounts Department as part of corporate function, renders

services to all SBUs. Accounts Departments are situated at Factories viz.

Kirloskarvadi, Dewas, Shirwal and Pune (Press), at Projects Division, Pune and

at all Area Offices.

Manpower strength of Accounts Department is about 130, as detailed herein

below.

Corporate 13

Kirloskarvadi 51

Projects 8

Shirwal 1

Press 1

Dewas 23

Area Offices 33

Present organization structure of the Company and accounts department in

particular is depicted in FC-OrgStructure.xls file in different sheets as stated against

each chart.

KBL Organization Chart SBU structure and corporate functions (CH0)

KBL Corporate Organization Chart for Accounts and finance department

(CH1)

Corporate Organization Chart for Accounts and finance department at

Pune (CH2)

Organization Chart for Accounts Department at Kirloskarvadi (SBU 1,3,4

and 7) (CH3)

Organization Chart for Accounts Department at Dewas and Shirwal

(SBU5) (CH4)

Organization Chart for Accounts department at Pune (SBU2 – Project and

Engg Pumps) (CH5)

Note: Organization Chart for SBU 6 (Press) is not provided as activity of this

SBU is not material with respect to company’s overall activity and not within

the scope of the project.

L&T Information Technology Limited 5 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Master Data

General Ledger Master

The General Ledger Master records are maintained in in-house developed

Financial Accounting Software of KBL in Foxpro language. G/L account numbers

are stored as 6 digit numeric field with grouping of numbers as stated below.

Nature of From To

Accounts

Liabilities 100000 199999

Assets 200000 299999

Income 300000 399999

Expenses. 400000 499999

Coding Structure: 1st digit indicates the nature of account as tabulated above. In

case G/L master ends with 00, this account balance is depicted in financial

statements.

Opening of new account in General Ledger is controlled centrally by Corporate

Finance and Accounts Department, Pune.

Description of Account is the only information stored in Master Data record.

The details of all the G/L master records are stated in Data-GL.xls.

Customer Master

The Customer Master records are maintained in in-house developed Financial

Accounting Software of KBL in Foxpro language. Customer account numbers

are stored as 5 digit numeric field with grouping of numbers as stated below.

Customer Accounts From To

Normal transactions 10001 19999

Security (business) 20001 29999

deposit

Advances 50001 59999

The customer number starts from 10001 to 19999. There are no further sub-

groupings of customer master records based on certain criteria such as

associate concerns, export customers etc. All the customers created between

aforesaid range are automatically (built in Accounting Package and not in

customer master) assigned to control account 240100 in General Ledger. In case

of customers at Kirloskarvadi, if transactions are in the nature of sale on

L&T Information Technology Limited 6 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

acceptance basis and the dealer does not sell it within 180 days, the same is

returned to Kirloskarvadi. Such transactions are posted to control account

240150 in General Ledger.

In case of security (business) deposit taken from the dealer it is accounted in

customer master record ranging from 20001 to 29999. The last four digits of

customer master and customer master for security deposit will always be same

for easy retrieval of summed information. To illustrate if a customer master

record number is 11126, its security deposit account will be 21126. This linkage

is followed only at Kirloskarvadi. All the customers (security deposit) created

between aforesaid range are automatically (built in Accounting Package and not

in customer master) assigned to control account 240200 in General Ledger.

In case of advances received from the dealer it is accounted in customer master

record ranging from 50001 to 59999. This series is available only for

Kirloskarvadi operations. The last four digits of customer master and customer

master for advances received will always be same for easy retrieval of summed

information. To illustrate if a customer master record number is 11126, its

security deposit account will be 51126. All the customers (advances) created

between aforesaid range are automatically (built in Accounting Package and not

in customer master) assigned to control account 234310 in General Ledger. This

range is operated only at Kirloskarvadi.

Coding Structure: Accounts in these ledgers are prefixed with a code in 4 digit.

First two digits indicate Region to which the customer belongs and the last two

digits indicate class of buyer i.e. dealer, stray customer, OEM etc. To illustrate,

customers master number 0901010011, means Pune Region (09), Dealer (01),

Ramchangra & Company (10011).

Authority of opening of new customer is vested with respective accounts

department. This results into different account number for the same customer at

different locations.

The name and complete postal address of the customer is stored in master

record. The master data does not contain information of Sales Tax Registration

Numbers, Excise Control Code, Permanent Account Number etc. of customer.

The details of customers at Pune Area Office are stated in Data-Cust.xls.

Vendor Master

The Vendor Master records are maintained in in-house developed Financial

Accounting Software of KBL in Foxpro language. Vendor account numbers are

stored as 5 digit numeric field with grouping of numbers as stated below.

L&T Information Technology Limited 7 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Vendor Accounts From To

Normal transactions 70001 89999

There are no further sub-groupings of Vendor master records based on certain

criteria such as associate concerns, foreign Vendors etc. All the Vendors created

between aforesaid range are automatically (built in Accounting Package and not

in Vendor master) assigned to control account 240500 in General Ledger.

Authority of opening of new Vendor is vested with respective accounts

department. This results into different account number for the same Vendor at

different locations.

The name and complete postal address of the Vendor is stored in master record.

The master data does not contain information of Sales Tax Registration

Numbers, Excise Control Code, Permanent Account Number etc. of Vendor.

Class of vendor i.e. manufacturer, trader, SSI etc. cannot be ascertained from

the present system.

Depots Ledger Master

The Depots Ledger ( area office / branch / regional office / factory ) Master

records are maintained in in-house developed Financial Accounting Software of

KBL in Foxpro language. Depots Ledger account numbers are stored as 5 digit

numeric field with grouping of numbers as stated below.

Particulars From To

Depots Ledger 30001 39999

All the Depots Ledger Masters created between aforesaid range are

automatically (built in Accounting Package) assigned to control account 240300

in General Ledger.

The details of Depots Ledger are stated in Data-Depot.xls.

Advances (Employee) Master

The Advances (Employees) Master records are maintained in in-house

developed Financial Accounting Software of KBL in Foxpro language. Advances

(Employees) Master numbers are stored as 5 digit numeric field with grouping of

numbers as stated below.

Particulars From To

L&T Information Technology Limited 8 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Advances to Employees 40001 49999

All the Advances (Employees) Master created between aforesaid range are

automatically (built in Accounting Package) assigned to control account 240400

in General Ledger.

Coding Structure: Last four digits are ticket number (Personnel number) of the

employee. This logic is not strictly followed.

The detail of Advances (Employees) Master at HO is stated in Data-Empl.xls.

Bank Master

Separate bank master is not maintained in the existing system. Account

numbers in General Ledger are allotted to banks depending upon the nature of

account such as current account or cash credit account. Account numbers are

allotted on the basis of Name of the Bank and not on the basis of address of the

branch.

Address of the bank / branch of the bank does not appear on the master.

Similarly, borrowing limit, rate of interest, nature of security / hypothecation,

names of authorized signatories etc. does not form a part of the master.

The details of Bank Master is stated in Data-Bank.xls.

Cost Centers Master

Separate master of cost centers is not maintained in the existing system. Each

cost center is given a department number in 3 digits and entries in books of

accounts are passed with reference to Department Number, wherever possible

but it is not mandatory.

The details of Cost Centers are stated in Data-Cctr.xls.

L&T Information Technology Limited 9 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

General Ledger

Consolidation Process

AS-IS Document

For KBL e-MAD Project

Date : June 24, 2000

Business Unit : Kirloskar Brothers Limited

Module : Finance and Controlling Chapter: FI-GL

Name of Business Process : Consolidation Process

Flow Chart of Business Process : attached

Details of Business Process: Area Offices raise advice on concerned SBUs

and head office for transfer of income / expenditure relating to them together with

associated balance sheet accounts. Accounts of Dewas factory include

consolidation of Dewas, Shirwal and Area Office accounts. Accounts of

Kirloskarvadi include consolidation of Kirloskrvadi and Projects Division

Accounts. Accounts of Corporate Office include consolidation of Head Office

Accounts, Dewas, Kirloskarvadi and Printing Division accounts.

Concern Areas, if any :

Whether modification of current business process required? (If yes, give

details) :

Any reports related to current business process: Trial balance of Corporate

Accounts showing consolidation of Kirloskarvadi, Dewas, Printing Division is

enclosed.

Whether copy of such report is attached : Yes

Purpose of the report :

Any document/output is printed for this business process: Yes

If yes. Document/output is attached: KBL Balance sheet and Profit and Loss

account.

The data/records of current business process is stored in: Present financial

accounting software in Foxpro language.

Output from this business process sent to other functions :

Sign-off (Approval) for this document :

Name of Team member Organization/Bus. Unit Signature

M M Naik KBL - Kirloskarvadi

S Shreekrishnan KBL - Dewas

V R Kulkarni KBL - Pune Head Office

M R Rajwade KBL - Pune Projects

R R Kittur KBL - Pune Area Office

L&T Information Technology Limited 10 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Cash and Bank Accounting

AS-IS Document

For KBL e-MAD Project

Date : June 24, 2000

Business Unit : Kirloskar Brothers Limited

Module : Finance and Controlling Chapter: FI-GL

Name of Business Process : Cash and Bank Accounting

Flow Chart of Business Process : FC-Cash Bank.Doc

Details of Business Process:

Basis of Payment

We prepare vouchers for receipt and payment of cash and bank for payment to

and from vendors, employees, area offices, customers, factories, Corporate

Office etc. depending upon the nature of transaction.

Generation of Vouchers / Cheques

These vouchers are prepared by Accounts Department manually on the basis of

instructions, memos, bills, agreements, expenses sheets etc. All the vouchers

are signed by authorized signatory and then sent to cashier for receiving /

disbursing cash and issuing / depositing cheques. Cheques are prepared

manually and signed by Authorized Signatories.

Accounting

After making / receiving the payment, the cashier defaces the vouchers by

putting rubber stamp. The cashier maintains a cash scroll and accounts for the

vouchers through Cash / bankbook. He takes out daily print out of the cashbook

and tallies the cash on hand.

At the end of the month all the cash / bank cash vouchers are incorporated in

Finance System and ledgers are processed.

Expenses of C.I.D.

Routine administration expenses of C.I.D. (i.e. Salaries, Travelling, Conveyances

etc) are accounted in the books of Corporate Finance and Accounts Department,

Pune. Similarly, expenses of overseas offices also are accounted in the books of

Corporate Finance and Accounts Department, Pune. Product specific expenses

(such as advertisement, exhibition, sales promotion, remuneration,

reimbursement of trucking expenses, bank guarantee expenses, inspection

charges etc) incurred by C.I.D. are accounted in the books of Kirloskarvadi /

Dewas factories as the case may be. Sometimes, the expenses are paid through

EEFC Account also. Expenses of this / similar kind not paid as on the date of

Balance Sheet are provided for in the books of accounts. All these expenses are

shown under Expenditure in Foreign Currencies in the Notes to Final Accounts.

L&T Information Technology Limited 11 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Expenses incurred on advertisement / exhibition etc. must be ascertained

separately so as to include those in Tax Audit Report. Similarly, we need all

expenses incurred on Exports Activity for their inclusion in Tax Audit Report.

Concern Areas, if any : Present system does not facilitate automatic processing

of vouchers, remittance letters & cheques.

Whether modification of current business process required? (If yes, give

details). Yes

Any reports related to current business process :

a) Daily and monthly cash / bankbook.

b) Bank code-wise listing.

Whether copy of such report is attached : yes

Purpose of the report : Statutory / Audit / Information

Any document/output is printed for this business process: Cash Flow ,

Books of Accounts

If yes. Document/output is attached : No

The data/records of current business process is stored in : Present

Financial Accounting System in FOXPRO Language

Output from this business process sent to other functions : Internal users.

Sign-off (Approval) for this document :

Name of Team member Organization/Bus. Unit Signature

M M Naik KBL - Kirloskarvadi

S Shreekrishnan KBL - Dewas

V R Kulkarni KBL - Pune Head Office

M R Rajwade KBL - Pune Projects

R R Kittur KBL - Pune Area Office

L&T Information Technology Limited 12 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Payroll Accounting

AS-IS Document

For KBL e-MAD Project

Date : June 24, 2000

Business Unit : Kirloskar Brothers Limited

Module : Finance and Controlling Chapter: FI-GL

Name of Business Process: Payroll Accounting

Flow Chart of Business Process :

Details of Business Process:

Except for Pune, Nagpur and Mumbai area offices and Projects Division,

processing of pay takes place at respective locations. Pay roll is processed

through our present Pay Processing System in Foxpro language.

Following accounting entries are passed in books of accounts :

Wherever the payments are made by way of cheque, the entry is passed for net

amount.

For difference between gross amount and amount paid through bank, the entry is

passed with cash code.

Debit : Wages and Salaries,

Debit : Production Bonus,

Debit : Leave Travel Assistance,

Debit : Provision for Annual Bonus,

Debit : Company’s contribution to Provident Fund,

Debit : Company’s contribution to E S I,

Debit :Company’s contribution to Employees Deposit Linked Insurance

Scheme

Credit : Cash Account

Credit : Bank Account

Credit: Accounts for respective deductions like own contribution to provident

fund, Life Insurance Premium etc.

Concern Areas, if any: Since this activity is not under SAP, comments are not

offered.

Whether modification of current business process required? (if yes, give

details). Not Applicable.

Any reports related to current business process : NA

Whether copy of such report is attached : No

L&T Information Technology Limited 13 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Purpose of the report :

Any document/output is printed for this business process: Books of

Accounts , Pay Slips, Pay Master, Form no 16 & 24

If yes. Document/output is attached : No

The data/records of current business process is stored in : Present

Financial Accounting System in FOXPRO Language

Output from this business process sent to other functions: Internal users.

Sign-off (Approval) for this document :

Name of Team member Organization/Bus. Unit Signature

M M Naik KBL - Kirloskarvadi

S Shreekrishnan KBL - Dewas

V R Kulkarni KBL - Pune Head Office

M R Rajwade KBL - Pune Projects

R R Kittur KBL - Pune Area Office

L&T Information Technology Limited 14 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Asset Accounting

AS-IS Document

For KBL e-MAD Project

Date : June 24, 2000

Business Unit : Kirloskar Brothers Limited

Module : Finance and Controlling Chapter: FI-GL

Name of Business Process: Assets Accounting

Flow Chart of Business Process :

Details of Business Process:

Purchase Order

Purchase Orders are placed after getting Board Approval.

Receipt of assets

Store Memo is issued for receipt of asset.

Invoice Verification and Accounting

After connecting freight, octroi, installation charges etc., the purchase bill is

passed through Journal by debiting the asset account and crediting vendor

account.

Entry is made in the Register for Fixed Assets.

Sale / Disposal of assets

Assets are disposed off after getting Board approval.

Cash Memo / Invoice is prepared in case of sale of asset and in case of

scrapping of asset, entry is passed through Journal.

Transfer of assets

In case there are transfers of asset from one place to another, debit / credit

advice are raised on receiving office for transfer of cost and accumulated

depreciation.

Closing operations

Physical inventory of assets is taken on periodic intervals.

Depreciation is charged in books of accounts at the year-end as per rates

applicable to each class of asset on Straight Line Method.

Other Information

We have following accounts for asset accounting :

Opening Block for various assets,

Additions A/c for various assets,

Deductions A./c for various assets,

Opening Depreciation for various assets,

L&T Information Technology Limited 15 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Depreciation for the year for various assets,

Recouped on deductions A/c for various assets.

Machinery Pending Installation

Capital Work in Progress

Depreciation for the year,

Loss on sale / scrapping of fixed assets,

Profit on Sale of Fixed Assets,

Sale of Fixed Assets (Group A/c) which is nullified at the year-end.

Concern Areas, if any: Since this activity is not under SAP, comments are not

offered.

Whether modification of current business process required? (if yes, give

details). Not Applicable.

Any reports related to current business process : NA

Whether copy of such report is attached : No

Purpose of the report : Statutory / Audit / Information

Any document/output is printed for this business process: Books of

Accounts , Machine/Depreciation Master.

If yes. Document/output is attached : No

The data/records of current business process is stored in : Present

Financial Accounting System in FOXPRO Language

Output from this business process sent to other functions: Internal users.

Sign-off (Approval) for this document :

Name of Team member Organization/Bus. Unit Signature

M M Naik KBL - Kirloskarvadi

S Shreekrishnan KBL - Dewas

V R Kulkarni KBL - Pune Head Office

M R Rajwade KBL - Pune Projects

R R Kittur KBL - Pune Area Office

L&T Information Technology Limited 16 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Budgeting

AS-IS Document

For KBL e-MAD Project

Date : June 24, 2000

Business Unit : Kirloskar Brothers Limited

Module : Finance and Controlling Chapter: FI-GL

Name of Business Process : Budgeting

Flow Chart of Business Process :

Details of Business Process: At present this activity is carried out at factory

level.

Concern Areas, if any : Since this activity is not under SAP, comments are not

offered.

Whether modification of current business process required? (if yes, give

details). Not Applicable.

Any reports related to current business process : NA

Whether copy of such report is attached : No

Purpose of the report : Information

Any document/output is printed for this business process: Annual Operating

/ Long Range Plan

If yes. Document/output is attached : No

The data/records of current business process is stored in :

Output from this business process sent to other functions: Internal users.

Sign-off (Approval) for this document :

Name of Team member Organization/Bus. Unit Signature

M M Naik KBL - Kirloskarvadi

S Shreekrishnan KBL - Dewas

V R Kulkarni KBL - Pune Head Office

M R Rajwade KBL - Pune Projects

R R Kittur KBL - Pune Area Office

L&T Information Technology Limited 17 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Year-end / Period end Closing Operations.

AS-IS Document

For KBL e-MAD Project

Date : June 24, 2000

Business Unit : Kirloskar Brothers Limited

Module : Finance and Controlling Chapter: FI-GL

Name of Business Process: Year-end / Period-end Closing Operations

Flow Chart of Business Process :

Details of Business Process:

General Processing of ledgers in parts at the end of each quarter and three parts

at the time of year-end.

Preparation of inventory sheets.

Valuation of inventory.

Provisions for income / expenses

Quantitative Information.

Calculation of depreciation.

Merging of subsidiary ledgers.

Preparation of statements required for final accounts.

Export / Import Transactions

At the end of each quarter, we scrutinize Account No. 19999 and transfer the

amount of difference in exchange accounted (either short or excess) to

respective income accounts. This is done with reference to product code, by

preparing a dummy invoice in 02 series, numbering from 10001 onwards (if

excess amount is received) and by issuing a credit note in 06 series, numbering

from 01 onwards (if short amount is received).

At the year-end, outstanding export debtors are updated with exchange rate

prevailing on the date of Balance Sheet by preparing a journal voucher.

Similarly, credit balance to overseas supplier’s account is updated with exchange

rate prevailing on the date of Balance Sheet by preparing a Journal Voucher.

Sundry Debtors Group account Dr/ Cr.

Purchase Account Dr / Cr

Sales account Dr/ Cr.

Creditors on Purchases Account Dr / Cr

This aforesaid journal voucher is reversed in next financial year. The entry

passed is :

Sundry Debtors Group A/c Dr / Cr

Difference in Exchange Account Dr / Cr

Similarly, advances received from customers pending adjustments are also

L&T Information Technology Limited 18 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

updated at the end of the year at exchange rate prevailing on the date of Balance

Sheet by preparing a journal voucher.

Advance against Order (Customer) account Dr./Cr.

Exchange Difference accounts Dr./Cr.

At year-end, we prepare a statement to arrive at the difference in exchange

included in the income / expenses accounts on account of transactions of sale.

This is arrived at as under:

a) Difference between invoice amount realized / outstanding and amount as per

rate prevailing on date of bill of lading.

b) Difference between invoice amount outstanding and amount as per rate

prevailing on date of balance sheet.

c) Difference between amount of advances adjusted and amount at which the

advance is accounted in books of account.

d) Difference between amount of advance accounted in books of account and

amount as per rate prevailing on date of balance sheet.

In case of transaction for import, the same is arrived at as under :

a) Difference between invoice amount paid / outstanding and amount as per rate

prevailing on date of bill of lading and

b) Difference between invoice amount outstanding and amount as per rate

prevailing on the date of Balance Sheet.

At the time of year-end, we also prepare a statement showing CIF value of

imports of Raw Materials. In case the imported material is lying in custom

warehouse on the date of Balance Sheet, we account for the purchases at the

exchange rate prevailing on the date of Balance Sheet by debiting respective

purchases account and crediting provision account. We also include the said

material in Closing Stocks at the value at which the purchases are booked for but

without demurrage. The entry for provision made for such purchases are

reversed in next financial year. In case the imported material has not reached

India on the date of Balance Sheet, we do not provide for the liability. Customs

duty payable on material lying in Custom warehouse is calculated and shown

under Contingent Liabilities in the Notes to Final Account. This practice will now

change in view of guidelines issued by the Institute.

Compilation of FOB Value of Exports: We compile this information out of the

system at present. F O B Value of exports is arrived at as under, for export of

products as well as services:

Amount of invoice actually realized less actual freight charges and insurance

charges and Amount of outstanding invoice updated as per rate prevailing on

date of Balance Sheet less actual freight charges and insurance charges.

L&T Information Technology Limited 19 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

For the purpose of published accounts, Exports to Bhutan and Nepal etc. in

Indian currencies are considered. However, for the purpose of Tax Audit, those

ignored.

Quantity Statement: C.I.D. requires a statement showing product-wise quantities

and FOB values of goods exported, country-wise and product-wise quantities

and FOB values of goods exported and any other similar statement as per

requirements of time. These statements are prepared manually as at present.

Similarly, at the end of each quarter, C.I.D. requires a statement showing FOB

value of realized exports. This statement also is prepared manually as of now.

In case of export of compressors, we do not claim any export benefit. The same

are claimed by the supplier viz. Kirloskar Copeland Ltd. In order to enable them

to claim the benefits, we give a disclaimer certificate to them every year.

We pass entries in respect of short payment received from customers,

deductions made by customers towards liquidated damages for late supplies

etc., after getting written approval from CID.

We prepare a list of doubtful debtors at the time of year-end after discussions

with CID and statutory Auditors.

We also pass entries for write off of debtors where we have received approval

from Reserve Bank of India.

We require a statement showing aging of export debtors specifically old more

than 180 days for attaching to Tax Audit Report.

We process TDS Certificates once in a quarter for taxes deducted at source.

We process form No. 26 C once in a year, preferably in every May.

Stocks with clearing house agent / for exhibition purpose

In case of stocks lying with clearing house agent as well as at the place of

exhibition, we request C.I.D. to get a certificate from respective authorities and

send to concerned factories for the purpose of valuation.

We have maintained a register at Bills Section, Kirloskarvadi to record following:

Delivery note number and date for dispatch of material for export,

Destination of dispatch,

Commercial Invoice Number and date,

Purpose (i.e. whether exhibition)

L&T Information Technology Limited 20 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Reference of having received the material back at Kirloskarvadi.

This acts as internal check on the certificate given by Clearing House Agent.

Domestic Sales

Send letters to all the customers for confirmation of balance.

Calculation of interest on business deposit.

Processing of credit advices

Accounting of credit advices

Calculation of interest on advances received from customers

Deduction of Income Tax at source

Processing of TDS Certificate

Return in prescribed format

We pass entries in respect of short payments received from customers,

deductions made by customers towards liquidated damages for late supplies

etc. after getting written approvals from the Marketing Department.

We prepare a list of doubtful debtors at the time of year-end after discussions

with Marketing Department and statutory auditors.

We also pass entries for write off of debtors where we have received approval

from Vice President.

Project

At year-end, the Area Offices transfer the Sales, Purchases, Debtors, Creditors,

Advances received from customers, and Advances given to suppliers and stock

received account to Project Pune. These accounts are transferred by drawing

necessary debit or credit advice. Project Pune records these advices by crediting

the particular product sale and purchases account, debiting sundry debtors

account for debtors, crediting creditors on purchases account for creditors,

advances received from customers for advances from customers and Advances

account for advances given to suppliers. The individual debtors or creditors

accounts are not transferred by the Area Officer but only controlling accounts are

given effects. These debtors, creditors and advances account are reversed to the

concerned area offices in next year.

Project accounts merges these entries in its Trial Balance. Transfers expenses

pertaining to other SBUs to respective SBU accounting departments. Completes

its year ending activities and sends the Trial Balance to Kirloskarvadi accounts

department for merging purpose.

Concern Areas, if any: This activity is highly manual.

Whether modification of current business process required? (if yes, give

L&T Information Technology Limited 21 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

details). Yes

Any reports related to current business process : NA

Whether copy of such report is attached : No

Purpose of the report : Statutory / Audit / Information

Any document/output is printed for this business process: Reports as per

requirements of management.

If yes. Document/output is attached : No

The data/records of current business process is stored in :

Output from this business process sent to other functions: Internal users.

Sign-off (Approval) for this document :

Name of Team member Organization/Bus. Unit Signature

M M Naik KBL - Kirloskarvadi

S Shreekrishnan KBL - Dewas

V R Kulkarni KBL - Pune Head Office

M R Rajwade KBL - Pune Projects

R R Kittur KBL - Pune Area Office

L&T Information Technology Limited 22 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Accounts Receivable

Domestic Sales

Kirloskarvadi

AS-IS Document

For KBL e-MAD Project

Date : June 24, 2000

Business Unit : Kirloskar Brothers Limited

Module : Finance and Controlling Chapter: FI-AR

Name of Business Process : Domestic Sales (kirloskarvadi)

Flow Chart of Business Process : FC-Sales-KOV.Doc

Details of Business Process:

Pre-sales activity and Acceptance of Order

The Order Acceptances ( O.As. ) are issued by Marketing Departments of SBU

1, 2, 3, 4 and 7 after completion of all the pre-sales activities.

Procurement / Production / Packing / Delivery

Wherever possible, the O.A. is converted into Bill of Material through present

MRP system.

Based on the output of MRP system and non-MRP requisitions, required raw

materials are procured.

Ordered products are manufactured and handed over to Composite Section.

Composite Section prepares packing list, packs the products and hand over the

consignment to Dispatch Section by preparing a Consignment Note.

Dispatch Section arranges for the dispatch by completing Excise formalities.

Dispatch Section prepares delivery note (consignment note) and forwards to Bills

Section for raising invoice.

Invoicing

Bills Section starts the billing activity on receipt of delivery note (Consignment

Note) from Dispatch Section.

Kirloskarvadi Accounts Department raises bills for domestic sales of SBU 1, 2, 3,

4 and 7.

Following series are allotted for raising invoices :

SBU1 SBU2 SBU 3 SBU 4 SBU 7

Inland sale of

Complete

Articles & Set 01 21 41 61 81

Exports 02 22 42 62 82

Spare Parts 03 23 43 63 83

Service Charges 04 24 44 64 84

L&T Information Technology Limited 23 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Sale in Transit 05 25 45 65 85

180 days credit 06 26 46 66 86

Additional

Invoice 07 27 47 67 87

Free Supply 08 28 48 68 88

Job Work 09 29 49 69 89

Stock Trans-

Fer to Aos 10 30 50 70 90

GSD * 11 31 51 71 91

Tool Room

(Captive Use) 12 32 52 72

PSC for Reje-

Cted Casting 13 33 53 73

Leasing 14 34 54 74 94

Sale of Asset 15 35 55 75 95

Spares – Manual

(Cr note reversal)16 36 56 76 96

Rectification

Voucher Inland

DR 17 37 57 77 92

CR 18 38 58 78 93

GSD from

Prod. Divn. 19

Rectification

Voucher Export

DR 98

CR 99

* ( Serial Numbers in this series are : 00001 to 01000 General Stores, 01001 to

02000 Cast Iron Foundry, 02001 to 03000 Heavy Foundry and 03001 to 04000

Non Ferrous Foundry ).

Invoices are raised in accordance with Order Acceptances received from

above SBUs as well as on the basis of Purchase Orders from clients and

memos received from various departments.

In case of SBU 1, the Order Acceptance is created through KBL’s OA package

(KOASP or web-based).

In case of SBU 2, Order Acceptances for spare parts are through KBL’s OA

package as well as manual and those for supply of complete product, erection

and commissioning activity, civil activity etc. are only manual.

In case of SBU 3, 4 and 7, the Order Acceptances are manual only.

Bills Section at Accounts Department, Kirloskarvadi has access to above

documents.

L&T Information Technology Limited 24 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

The activity of raising of invoice is as under :

Dispatch Section, after receipt of material from Composite Section, prepares a

Delivery Note and sends to Bills Section. Bills Section relates this Delivery

Note to Order Acceptance and prepares invoice. Bills Section puts Sales Tax

Codes, Codes for terms of payment and amount of deduction of advance.

After taking out print-out of these invoices, those are sent to Dispatch Section

for mentioning dispatch particulars. After putting in dispatch particulars, the

invoices are received at Bills Section.

While raising invoice on the customer, we show deduction of advance received

in the invoice itself. The advance is deducted as per the terms mentioned in

the Order Acceptance. At the time of accounting the invoice, entry is passed

in books of account for adjustment of advance by debiting the account of the

customer in Advance Received Against Order Ledger and crediting his current

account in Debtors Ledger. This happens automatically through the present

system.

We raise following types of invoices :

a) Commercial invoices for domestic sale of products and services. These are

accounted for in books of accounts. These invoices are raised in the series

as mentioned above depending upon the product and the selling SBU. The

invoices are raised through computerized system as well as manually. The

invoices which are raised through computerized system, get automatically

incorporated into Finance Data at the time of processing books of account.

The invoices raised manually require to be fed into the computer in the

Financial Accounting System for the purpose of recording into books of

accounts.

In case of manually raised invoice, at the first instance, the invoice is

prepared by hand ( this is called as valuation ). Then it is got typed,

checked, signed and circulated.

Entry to Debtors Ledger Account appears with reference to Invoice Series,

Invoice Serial Number, Date of Invoice, Gross Amount of invoice,

Reference of Order Acceptance, Credit period allowed and due date of

payment.

There is no written down policy for offering terms of payment. The terms of

payment differ from client to client and case to case. We put terms of

payment on invoices, which are mentioned in the Order Acceptance.

Entry to General Ledger Account appears as summary entry of the invoice

series.

L&T Information Technology Limited 25 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Dr. Customer account / Area Office Account ( in case of stock transfer )

Cr. Various Income / Expense Accounts / Stock Transfer Account ( in case

of stock transfer )

In case of computerized Order Acceptance, the amendment memo is

keyed in the system only. In case of manual Order Acceptance, the

amendment memo also is issued by hand. It is pasted to the original Order

Acceptance after its receipt at Bills Section. All the amendment memos are

referred to while raising invoices manually. In case of computerized Order

Acceptance, rarely the amendment memo is issued manually.

b) Submission invoices for collecting payment. These are not accounted for in

books of accounts. Many times, the terms of payment committed to the

customer are of deferred nature i.e. 90 % payment against proof of

dispatch and balance 5 % after receipt of material at site and balance 5 %

after erection / commissioning / alignment. In our present system, we

cannot raise more than one invoice for one supply / consignment note.

Therefore, such invoices are required to be raised. These invoices are

raised through a separate computer package after raising of commercial

bill for the supply. Therefore, the activity of raising this invoice gets

secondary priority and there is delay in raising the invoice and sending it to

area office, which ultimately results in late realization of sale proceeds.

There is a problem from Sales Tax angle too. The customer gives Sales

Tax declaration with reference to the submission invoices as those are

accounted for in his books of accounts, whereas we show our commercial

invoice to the assessing authority. In the event that when there are two

financial years involved in these transactions, it becomes difficult to satisfy

the assessing authorities.

c) Direct Sales Bills ( for trading material directly delivered by the vendor to

customer’s place ). These are accounted for in books of accounts as

mentioned at item No. (a) above. These are raised for sale in course of

transit. We receive lorry way bill and other documents from the vendor and

on the basis thereof, raise Sale Invoice on the customer which is called as

Direct Sale Bill. We cannot process such bills from our present finance

system. However, we have developed a tailor made package for this

activity.

d) Stock Transfer bills ( for movement of material from factory to area offices /

Dewas). These are accounted for in books of accounts as mentioned at

Item No. (a) above.

e) Pro-forma bills ( before supply of material but as per customer’s

requirement ). These are not accounted for in books of accounts. These

L&T Information Technology Limited 26 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

are raised manually as there is no provision in the present system to raise

those automatically.

Disposal of invoices

Bills Section disposes off the invoices in accordance with terms of Order

Acceptances along with required documentation.

Exclusions

Invoices raised in SBU 2 series i.e. 21 to 40, are not accounted in the books

of accounts of Kirloskarvadi but are sent for accounting to Projects Division,

Pune. For the purpose of Sales Tax compliance, we raise a debit advice for

stock transfer on Projects Division for supplies covered under such invoices

on month to month basis. The stock transfer invoice is raised at 92.5 % of the

product value.

Updating customer master

In case of new customer, the Sales Ledger Master is created by Customer

Support Cell at Kirloskarvadi and Sales Ledger Section.

The logic applied while giving account numbers is as under :

10001 – account of XYZ in Debtors Ledger,

20001 – account of XYZ in Business Deposit Ledger and

50001 – account of XYZ in Advance Received Against Order Ledger.

Sales from Area Offices

In case of Kirloskarvadi ( i.e. SBU 1, 3, 4 and 7 ), sale takes place from Area

Offices in respect of SBU 3 and 7. However, the volume of sale as well as

number of sale invoices is not significant. Normally, sale invoices from area

offices are required to be raised in order to comply with requirements of Works

Contract Tax Act. The activity is as under :

a) Transfer of stock from Kirloskarvadi to area offices – Such transfer is

made by raising an invoice in stock transfer series. Entry passed at

Kirloskarvadi : Debit : the account of respective area office in Depot

Ledger and Credit : Stock sent to that area office account in General

Ledger, through Sales Journal.

b) On receipt of material at area office, a store memo is taken out, entry of

material received is recorded in Stock Ledger and Kirloskarvadi’s stock

transfer bill is accounted for by debiting Stock Received from Kirloskarvadi

Account in General Ledger and Crediting Kirloskarvadi Account in Depot

Ledger.

c) After sale of the material, area office raises sale invoice on the customer

and accounts for in their books of account through Sales Journal by

L&T Information Technology Limited 27 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

debiting customer’s account in Sales Ledger and crediting respective

income / expenses accounts.

d) At the time of year end, balance appearing to Stock Received from

Kirloskarvadi Account, balance appearing to the sale account of that

product, debit / credit balance appearing to the account of respective

customer are transferred by the area office to Kirloskarvadi through

journal.

e) Corresponding entries are passed at Kirloskarvadi to nullify Stock Sent to

area office account and account for the sale, debtors and creditors in the

books through Journal.

f) In case there are discrepancies in stock transfer transaction i.e. non /

short receipt of material at area office, rectification to stock transfer invoice

is done at Kirloskarvadi either by issuing a credit note or by journal

voucher.

At the time of year end, Area Office prepares a physical inventory statement of

products of Kirloskarvadi lying in stock at their end and sends it to Kirloskarvadi

for the purpose of valuation and incorporation in books of accounts.

Exclusions

The activity of raising invoices for sale of scrap, stores material, capital goods,

goods for captive consumption, cash sales etc. is excluded as the said sale does

not form a part of Marketing and Distribution Activity.

Concern Areas, if any: Serial numbers of the products do not appear on the

invoice. Documentation required along with invoicing does not come as OAMISI.

Performa invoice and submission invoice can not be generated from the system.

Verification of purchase with sales and vice versa is not possible.

Whether modification of current business process required? (if yes, give

details). Yes

Any reports related to current business process :

After putting in all the above data into the present finance system, we process

the ledgers on month to month basis. We get following print-outs for above

activities :

Invoice,

Check runs for verifying the accuracy of the data keyed in. In case errors are

found, necessary corrections are made, control totals are tallied,

Mis-match report ( unadjusted credit against debit or vice versa ),

Sales Journal,

Credit Notes Journal,

Debtors Ledger ( Outstanding ) ( account serial number wise, region wise ),

Dues / overdues statement,

L&T Information Technology Limited 28 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Business Deposit Ledger,

Advance Received Against Order Ledger,

Advance Received Against Order Ledger Outstanding,

Trial balances for all the above ledgers consolidate for Kirloskarvadi and

SBUwise,

Discounted Draft Register,

Productwise listing of quantities and values for domestic invoices, export

invoices, credit notes and total on monthly as well as cumulative basis,

Schedule code wise Sales Tax List and

Schedule code wise Sales Tax Register

A copy of the ledger extract is sent to concerned customer on month to month

basis.

In case need be, the accounts are reconciled.

Set of Books of Accounts in Operation

Sales Invoices,

Credit Notes,

Voucher for rectification of errors in invoices and credit notes ( These are

accounted like invoice and credit note ),

Journal Voucher ( Debit Advice ) in J 4 series for debit to customer’s account (

e. g. rectification of wrong credit, debiting bank charges, cost of sales literature

sold etc. ) and

Journal Voucher ( Credit Advice ) in J 5 series for credit to customer’s account

( e.g. rectification of wrong debit, crediting cash discount, advertisement

expenses, sales promotion expenses etc. )

Whether copy of such report is attached: (Refer attachments to Dewas).

Purpose of the report : Statutory / Audit / Information

Any document/output is printed for this business process:

Books of Accounts

Invoice file for accounting to SBU 2 at Pune.

Daily SBUwise Invoicing information

Monthly regionwise , SBUwise invoicing information,

Reasonwise credit notes issued,

If yes. Document/output is attached : No

The data/records of current business process is stored in : Present

Financial Accounting System in FOXPRO Language.

Output from this business process sent to other functions : Customers and

L&T Information Technology Limited 29 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Internal users.

Sign-off (Approval) for this document :

Name of Team member Organization/Bus. Unit Signature

M M Naik KBL - Kirloskarvadi

S Shreekrishnan KBL - Dewas

V R Kulkarni KBL - Pune Head Office

M R Rajwade KBL - Pune Projects

R R Kittur KBL - Pune Area Office

L&T Information Technology Limited 30 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Dewas

AS-IS Document

For KBL e-MAD Project

Date : June 20, 2000

Business Unit : Kirloskar Brothers Limited

Module : Finance and Controlling Chapter: FI-AR

Name of Business Process : Domestic Sales (Dewas)

Flow Chart of Business Process : FC-Sales-Dewas.Doc

Details of Business Process:

Pre-sales activity and Order Acceptance

At present, there are 14 area offices having there own godowns and also operate

through C&F agents.

In case of make to stock products, Area Offices issue stock indents to factory on

fortnightly basis. Here the products are dispatched by Stock and Dispatch

Department to stocking points (AO godowns /C&F).

In case of make to order products, orders are directly placed by the dealers on

factory and the product is dispatched directly to the destination of the dealer/

customer.

Production Planning

In case of make to stock products, at factory level the production plan is taken on

forecasting basis as well as on the basis of indents received from Area Offices.

In case of made to order products the production is made on the basis of orders

placed directly and the dispatches are made according to the terms of contract.

Invoicing

In case of make to stock products, factory raises stock transfer invoices under 54

series for dispatches to Area Offices /C & F agents. Stock transfers are effected

at dealer price (i.e list price less standard discount). In case of material directly

dispatched to dealer excise / commercial invoice is raised on the basis of

delivery challan issued by Stock & Dispatch Department. Pricing of invoices are

done on the basis of commercial policy. As regards sales tax the same is

charged as per prevailing tax rules/act. Specific codification for tax rate is given

in the invoice.

In case of Works Contract Order, the products are supplied from Dewas to

customer’s location directly or through Area Office and the sale invoice is raised

from the delivering point (Dewas/Area Office). The incidental activities like

installation, erection etc. are carried out by way of subcontracting. Sub

Contractors’ invoices are accounted at Dewas on the basis of order placed on

subcontractor and is co-related with invoice raised on tendering authority.

Following types of invoices are raised from Dewas

1) Commercial Invoice

L&T Information Technology Limited 31 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

2) Traders Invoice under excise rules

Regular transaction for sale of scrap to outsiders is routed through same invoice

series. Amount of such sale is credited to Misc. Stores Sales.

Accounting Entries

a) Stock Transfer / Sale Invoice

1) Stock Transfer – Dr. Current account of AO (Depot Ledger)

Cr. Stock Sent to AO A/C (General Ledger)

2) Sale Invoice - Dr. Dealer / Customer A/C (Debtors Ledger)

Cr. Sale of Respective Product (General Ledger)

Cr Taxes / Duties Recovered (General Ledger)

Cr Cash Discount (General Ledger)

b) Short /Excess/Wrong Dispatch

In case of excess / short / wrong dispatch of products to area office / C&F agent,

accounting entry for the same is passed in factory books on the basis of credit or

debit advises received from area office.

1) For short qty. Dr . Stock sent to AO (General Ledger)

Cr . Current Account of AO (Depot Ledger)

2) For Excess qty. Dr Current Account of AO (Depot Ledger)

Cr Stock Sent to AO A/C (General Ledger)

3) In case of dealer / customer - Short /excess/wrong supply is accounted for by

issuing credit note or by raising invoice as the case may be.

Discounts

Cash discount is parted through sales invoice considering payment will be

realized within 4 banking days from date of invoice by way of local cheque or by

D/D in case of outstation dealer. Cash Discount is reverted if the payment is not

received as per above terms by raising debit advice on the dealer and is

accounted through journal. Cash Discount is allowed @3% on product value (list

price less std. Discount)

In addition to cash discount additional discount of 1% is allowed on product value

in the invoice itself if value of single invoice is as under.

Value of single invoice = Previous year’s off-take x Rate of growth /30 or

Rs.25000/- (for new dealer) whichever is higher. The growth rate is fixed on the

L&T Information Technology Limited 32 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

basis of off-take during last year. This differs from dealer to dealer.

At every month end, data of sales invoice is transferred to accounts dept from

the invoice package and monthly trial balance is processed.

Incentive

In order to encourage the dealers, growth incentive is introduced this year. The

calculation of incentive is based on last years off-take and rate of growth given in

the commercial policy. The incentive @3% on net product value (list price less

standard discount less stock discount) is to be allowed by way of credit note at

the year end. The amount of incentive should be debited to Sales Promotional

Expenses.

The data/records of current business process is stored in invoice package

developed in FOXPRO and are operated by store keeper/marketing personnel,

for billing purpose.

Concern Areas, if any :

Whether modification of current business process required? (if yes, give

details).

Any reports related to current business process :

a) Debtors Ledger Trial Balance

b) Sales Journal

c) Credit Note Journal

d) Schedule code wise Sales Tax Register

e) Set-off Register

f) Product Code Listing (Monthly & Cumulative)

g) Dealer Code-wise Listing

h) Product-wise stock Summary Report (for own products excluding spares)

i) Report on CST Transactions

Whether copy of such report is attached : Yes

Purpose of the report : Statutory / Audit / Information

Any document/output is printed for this business process: Books of

Accounts

If yes. Document/output is attached : No

The data/records of current business process is stored in : Present

Financial System in FOXPRO Language

L&T Information Technology Limited 33 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Output from this business process sent to other functions : Customer and

other Internal users

Sign-off (Approval) for this document :

Name of Team member Organization/Bus. Unit Signature

M M Naik KBL - Kirloskarvadi

S Shreekrishnan KBL - Dewas

V R Kulkarni KBL - Pune Head Office

M R Rajwade KBL - Pune Projects

R R Kittur KBL - Pune Area Office

L&T Information Technology Limited 34 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Shirwal

AS-IS Document

For KBL e-MAD Project

Date : June 24, 2000

Business Unit : Kirloskar Brothers Limited

Module : Finance and Controlling Chapter: FI-AR

Name of Business Process : Domestic Sales (Shirwal)

Flow Chart of Business Process : FC-Sales-Shirval.Doc

Details of Business Process:

Pre-sales Activity

Indents for stock to sale material is placed on fortnightly basis by area offices

except area offices located in Maharashtra. As of today 14 area offices have

their godowns and they are also operating through C&F agents. In case of

indents placed by area offices the material is dispatched by stock and dispatch

dept to stocking point (AO godowns /C&F). In case of order placed by dealer on

factory the material is dispatched directly to the destination of the dealer/

customer.

Production Planning

At the factory level the production plan is taken on forecasting basis as also on

the basis of indents received from various area offices.

Invoicing Activity

Factory raises stock transfer invoice under 54 series for dispatches to area

offices and in case of material directly dispatched to dealer excise / commercial

invoice is raised. Stock transfer are effected at pre determined standard price.

Accounting entries for these transactions are passed as under.

1) Stock Transfer – Dr . Current account of AO (Depot Ledger)

Cr. Stock Send to AO A/C (General Ledger)

2) Sale Invoice - Dr. Dealer / Customer A/C (Debtors Ledger)

Cr. Sale of Respective Product (General Ledger)

Cr. Taxes / Duties Recovered (General Ledger)

Cr. Cash Discount (General Ledger)

Short /Excess/Wrong Dispatch

1) For short qty. Dr. Stock sent to AO (General Ledger)

Cr. Current Account of AO (Depot Ledger)

2) For excess qty. Dr. Current Account of AO (Depot Ledger)

L&T Information Technology Limited 35 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Cr. Stock Sent to AO A/C (General Ledger)

3) In case of dealer / customer - Short /excess/wrong supply is accounted for by

issuing credit note or by raising invoice as the case may be.

Regular transaction for sale of scrap to outsiders is routed through same invoice

series. Amount of such sale is credited to Misc. Stores Sales

Discount Structure

Standard Discount varies from area office to area office for stock transfer.

Cash discount is parted through sales invoice considering payment will be

realized within 4 banking days from date of invoice by way of local cheque or by

D/D in case of outstation dealer. Cash Discount is reverted if the payment is not

received as per above terms by raising debit advice on the dealer / customer

which is accounted through journal. Cash Discount is allowed @3% on product

value (list price less std. Discount).

We have separate invoice package built in FOXPRO , and the same is operated

by store keeper/marketting personnel/Accountant.

At every month end data of sales invoice is transferred to accounts dept from the

invoice package and monthly trial balance is processed.

Sales Tax

Shirwal Unit has been granted exemption certificate by Sales Tax authorities,

and has been given eligibility certificate by SICOM in 1999. The limit of

exemption is 1.34 crores. This certificate is valid up to Jan 2005 or utilizing limit

of 1.34 crore whichever is earlier.

Concern Areas, if any :

Whether modification of current business process required? (if yes, give

details).

Any reports related to current business process :

a) Debtors Ledger Trial Balance

b) Sales Journal

c) Credit Note Journal

d) Schedule code wise Sales Tax Register

e) Set-off Register

f) Product Code Listing (Monthly & Cumulative)

g) Dealer Code-wise Listing

L&T Information Technology Limited 36 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

h) Product-wise stock Summary Report (for own products excluding spares)

i) Report on CST Transactions

Whether copy of such report is attached : Refer attachments - Dewas.

Purpose of the report : Statutory / Audit / Information

Any document/output is printed for this business process: Books of

Accounts

If yes. Document/output is attached : No

The data/records of current business process is stored in: Present Financial

Accounting System in FOXPRO Language.

Output from this business process sent to other functions: Customers and

Internal users.

Sign-off (Approval) for this document :

Name of Team member Organization/Bus. Unit Signature

M M Naik KBL - Kirloskarvadi

S Shreekrishnan KBL - Dewas

V R Kulkarni KBL - Pune Head Office

M R Rajwade KBL - Pune Projects

R R Kittur KBL - Pune Area Office

L&T Information Technology Limited 37 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

Area Offices

AS-IS Document

For KBL e-MAD Project

Date : June 24, 2000

Business Unit : Kirloskar Brothers Limited

Module : Finance and Controlling Chapter: FI-AR

Name of Business Process : Domestic Sales – Area Offices (Dewas & Shirwal

Products)

Flow Chart of Business Process : FC-Sales-Area Offices.Doc

Details of Business Process:

Pre-sales Activity

Orders are placed by dealers on area offices / factories. As of today 14 area

offices have their godowns and they are also operating through C&F agents. In

case of orders placed on area offices the material is dispatched from the stocking

point (godowns /C&F). In case of order placed on factory the material is

dispatched directly to the destination of the dealer. Area offices place indents on

factory for the requirement of material based on the best judgement of marketing

personnel.

Production Planning

At the factory level the production plan is taken on forecasting basis as also on

the basis of indents received from various area offices. In case of made to order

products the production is made on the basis of orders placed directly and the

dispatches are made according to the requirements.

Invoicing

Factory raises stock transfer invoice under 54 series for dispatches to area

offices.

On receipt of material at area office godowns the store- keeper takes out store

memo on the basis of physical receipt of material. Deviation in receipt of material

in relation of stock transfer invoice is informed to accounts dept. Accountant on

the basis of store memo and stock transfer invoice pass following entries.

1) Stock Recd – Dr . Stock Received from Factory (General Ledger)

Cr. Current Account of Factory (Depot Ledger)

In case of excess / short / wrong receipt of material, the same is informed to

factory and simultaneously accounting entry for the same is passed in AO books.

Credit or debit advices are send to factory.

1) For short qty. Dr Current Account of Factory (Depot Ledger)

Cr. Stock Recd from Factory (General Ledger)

L&T Information Technology Limited 38 of 105

D1007AIP/FICO /1.0/24/06/2000 Financial Accounting & Controlling AS IS D1007 KBL e-MAD

2) For excess qty. Dr Stock Recd from Factory (General Ledger)

Cr. Current account of Factory (Depot Ledger)

Sales Invoices from Area Office:

In case of dealer/customer the material is delivered to transporter / individual

customer against delivery note / sale invoice. Wherever the sale invoice is raised

on a latter date the same is prepared on the basis of dispatch document such as

LWB, delivery note. While preparing the invoice pricing is done on the basis of

commercial policy. As regards sales tax the same is charged as per prevailing

tax rules/act. Specific codification for tax rate is given in the invoice.

The following entry is passed

Sale Invoice - Dr. Dealer / Customer A/C (Debtors Ledger)

Cr. Sale of Respective Product (General Ledger)

Cr. Taxes / Duties Recovered (General Ledger)

Cr. Cash Discount (General Ledger)

In case of short /excess/wrong supply to dealer / customer the same is

accounted for by issuing credit note or by raising invoice as the case may be.

In few area offices the handling charges are recovered at @1% of product value