Beruflich Dokumente

Kultur Dokumente

2019 TSP Catch-Up Contributions and Effective Date Chart

Hochgeladen von

RayCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2019 TSP Catch-Up Contributions and Effective Date Chart

Hochgeladen von

RayCopyright:

Verfügbare Formate

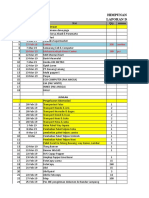

2019 THRIFT SAVINGS PLAN (TSP) CATCH-UP CONTIBUTIONS

EFFECTIVE DATE CHART

It is important to verify your benefits election/deductions on your Leave and Earnings Statement (LES)

each pay period. Notify a BEST counselor immediately of any problem. An error in deductions may

result in an indebtedness to the government. The annual maximum TSP Catch- up Contributions

for 2019 is $6,000.

If you enroll or make a TSP The effective The Catch‐Up Pay Amount Deducted to

change during this pay period. date of your deduction will Periods contribute the

election will reflect in the Elective Deferral

be. paycheck/LES you Limit

receive on:

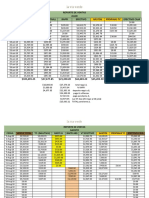

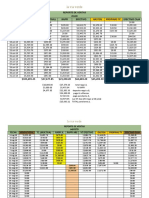

9 Dec 18 to 22 Dec 18 23 Dec 18 11 Jan 19 26 $231

23 Dec 18 to 5 Jan 19 6 Jan 19 25 Jan 19 25 $240

6 Jan 19 to 19 Jan 19 20 Jan 19 8 Feb 19 24 $250

20 Jan 19 to 2 Feb 19 3 Feb 19 22 Feb 19 23 $261

3 Feb 19 to 16 Feb 19 17 Feb 19 8 Mar 19 22 $273

17 Feb 19 to 2 Mar 19 3 Mar 19 22 Mar 19 21 $286

3 Mar 19 to 16 Mar 19 17 Mar 19 5 Apr 19 20 $300

17 Mar 19 to 30 Mar 19 31 Mar 19 19 Apr 19 19 $316

31 Mar 19 to 13 Apr 19 14 Apr 19 3 May 19 18 $334

14 Apr 19 to 27 Apr 19 28 Apr 19 17 May 19 17 $353

28 Apr 19 to 11 May 19 12 May 19 31 May 19 16 $375

12 May 19 to 25 May 19 26 May 19 14 Jun 19 15 $400

26 May 19 to 8 Jun 19 9 Jun 19 28 Jun 19 14 $429

9 Jun 19 to 22 Jun 19 23 Jun 19 12 Jul 19 13 $462

23 Jun 19 to 6 Jul 19 7 Jul 19 26 Jul 19 12 $500

7 Jul 19 to 20 Jul 19 21 Jul 19 9 Aug 19 11 $546

21 Jul 19 to 3 Aug 19 4 Aug 19 23 Aug 19 10 $600

4 Aug 19 to 17 Aug 19 18 Aug 19 6 Sep 19 9 $667

18 Aug 19 to 31 Aug 19 1 Sep 19 20 Sep 19 8 $750

1 Sep 19 to 14 Sep 19 15 Sep 19 4 Oct 19 7 $858

15 Sep 19 to 28 Sep 19 29 Sep 19 18 Oct 19 6 $1000

29 Sep 19 to 12 Oct 19 13 Oct 19 1 Nov 19 5 $1200

13 Oct 19 to 26 Oct 19 27 Oct 19 15 Nov 19 4 $1500

27 Oct 19 to 9 Nov 19 10 Nov 19 29 Nov 19 3 $2000

10 Nov 17 to 23 Nov 19 24 Nov 18 13 Dec 19 2 $3000

24 Nov 19 to 7 Dec 19 8 Dec 19 27 Dec 19 1 $6000

Das könnte Ihnen auch gefallen

- Sample Business PlanDokument17 SeitenSample Business PlanNikita Garg95% (60)

- Cs Cost MCQ Part 11Dokument48 SeitenCs Cost MCQ Part 11dmaxprasangaNoch keine Bewertungen

- Investigating The Value of An MBA Education Using NPV Decision ModelDokument72 SeitenInvestigating The Value of An MBA Education Using NPV Decision ModelnabilquadriNoch keine Bewertungen

- ACCTSPTRANS All About PartnershipDokument7 SeitenACCTSPTRANS All About PartnershipShailene David0% (1)

- 2019 TSP Contributions and Effective Date ChartDokument1 Seite2019 TSP Contributions and Effective Date ChartRayNoch keine Bewertungen

- 2018 TSP Catch-Up Contributions and Effective Date ChartDokument1 Seite2018 TSP Catch-Up Contributions and Effective Date ChartAnonymous O6Pgmls4Noch keine Bewertungen

- BPI Trading Account: Running TOTAL 81,435.32 Total Cost + CashDokument3 SeitenBPI Trading Account: Running TOTAL 81,435.32 Total Cost + CashjonNoch keine Bewertungen

- Tabla de AmortizacionesDokument1 SeiteTabla de AmortizacionesOscar IsidoroNoch keine Bewertungen

- Detalle 16 Al 30 Septiembre.Dokument2 SeitenDetalle 16 Al 30 Septiembre.perlaramirezNoch keine Bewertungen

- Pension AlimenticiaDokument1 SeitePension AlimenticiaMayesi Hernandez ZapataNoch keine Bewertungen

- Payment Scheme 3.21.2fDokument1 SeitePayment Scheme 3.21.2fFara Dinaa SusiloNoch keine Bewertungen

- Controle de Pagamento Dos ContratosDokument13 SeitenControle de Pagamento Dos Contratosgeo construçoesNoch keine Bewertungen

- Dynamic Chart With ScrollerDokument7 SeitenDynamic Chart With ScrollerPADMANABHAN33Noch keine Bewertungen

- 4 AN Price 2017-2022Dokument4 Seiten4 AN Price 2017-2022nsrkprasad61Noch keine Bewertungen

- For Students 24 9 19 Pivot-TablesDokument21 SeitenFor Students 24 9 19 Pivot-TablesKr RishiNoch keine Bewertungen

- 52 Week Money Challenge Template Choose Day and SumDokument2 Seiten52 Week Money Challenge Template Choose Day and SumNicolle IlídioNoch keine Bewertungen

- Apuestas GBDokument1 SeiteApuestas GBgabrielaNoch keine Bewertungen

- Apuestas GBDokument1 SeiteApuestas GBgabrielaNoch keine Bewertungen

- Capex Budget 2019: Fixed Assets Register (Prior Spend)Dokument8 SeitenCapex Budget 2019: Fixed Assets Register (Prior Spend)Umair KamranNoch keine Bewertungen

- Daily Report 2021 - Rudi KurniawanDokument46 SeitenDaily Report 2021 - Rudi KurniawanRudi KurniawanNoch keine Bewertungen

- Adeudo Tecnica IndustrialDokument4 SeitenAdeudo Tecnica IndustrialpatowongNoch keine Bewertungen

- Trading PlanDokument54 SeitenTrading Planandriantsoo tonioNoch keine Bewertungen

- Tugas 1 (IDX)Dokument42 SeitenTugas 1 (IDX)Sintya AgustinaNoch keine Bewertungen

- Escuela Preparatoria Estatal No.8 "Carlos Castillo Peraza" Equipo Negro Ada 4Dokument28 SeitenEscuela Preparatoria Estatal No.8 "Carlos Castillo Peraza" Equipo Negro Ada 4AnetteNoch keine Bewertungen

- Ela Tuition Accurate - May 2021Dokument31 SeitenEla Tuition Accurate - May 2021Mihaela IlasNoch keine Bewertungen

- Himpunan Mahasiswa Akuntansi Laporan Dana Masuk Dan KeluarDokument12 SeitenHimpunan Mahasiswa Akuntansi Laporan Dana Masuk Dan KeluarElis_1001Noch keine Bewertungen

- Fecha N. Factura ValorDokument4 SeitenFecha N. Factura ValorBrayan DavidNoch keine Bewertungen

- Grupo 1.0 Grupo 2.0 Grupo 3.0 Grupo 4.0 Grupo 5.0 Grupo 6.0 Grupo 7.0 Grupo 8.0Dokument9 SeitenGrupo 1.0 Grupo 2.0 Grupo 3.0 Grupo 4.0 Grupo 5.0 Grupo 6.0 Grupo 7.0 Grupo 8.0Bolao SuperNoch keine Bewertungen

- Reporte de Ventas Via Verde Al 17 AgostoDokument8 SeitenReporte de Ventas Via Verde Al 17 AgostoDiana Grise SanchezNoch keine Bewertungen

- Reporte de Ventas Via Verde Al 07 SeptDokument31 SeitenReporte de Ventas Via Verde Al 07 SeptDiana Grise SanchezNoch keine Bewertungen

- Reporte de Ventas Via Verde Al 02 SeptDokument29 SeitenReporte de Ventas Via Verde Al 02 SeptDiana Grise SanchezNoch keine Bewertungen

- Escuela Preparatoria Estatal No.8 "Carlos Castillo Peraza" Equipo Negro Ada 2Dokument9 SeitenEscuela Preparatoria Estatal No.8 "Carlos Castillo Peraza" Equipo Negro Ada 2Isaac Andres Pech SanchezNoch keine Bewertungen

- Week Dates Amount Total Week Dates Amount TotalDokument1 SeiteWeek Dates Amount Total Week Dates Amount Totalirenev_1Noch keine Bewertungen

- Reporte de Ventas Via Verde Al 15 AgostoDokument5 SeitenReporte de Ventas Via Verde Al 15 AgostoDiana Grise SanchezNoch keine Bewertungen

- Debit & CreditDokument11 SeitenDebit & CreditHandoko MuhammadNoch keine Bewertungen

- PivotTable July2023 SampledataDokument13 SeitenPivotTable July2023 Sampledatamuhammad shamsadNoch keine Bewertungen

- Combust I VelDokument7 SeitenCombust I VelLuana SantosNoch keine Bewertungen

- Reporte de Ventas Via Verde Al 10 SeptDokument28 SeitenReporte de Ventas Via Verde Al 10 SeptDiana Grise SanchezNoch keine Bewertungen

- Revenue Per Employee CalculatorDokument2 SeitenRevenue Per Employee Calculatorsucheta menonNoch keine Bewertungen

- Disciplined Trader Trade Journal (Lots)Dokument873 SeitenDisciplined Trader Trade Journal (Lots)JasonNoch keine Bewertungen

- Desafio2020 de DineroDokument1 SeiteDesafio2020 de DineroReyna Villavicencio GarcíaNoch keine Bewertungen

- QM Assignment Group 1Dokument23 SeitenQM Assignment Group 1vijay bhardwajNoch keine Bewertungen

- #OC Proveedor #Factura Fecha de Entrega P/Ing Fecha de EmisionDokument28 Seiten#OC Proveedor #Factura Fecha de Entrega P/Ing Fecha de EmisionMayra RoqueNoch keine Bewertungen

- Resumen Ventas DiarisDokument32 SeitenResumen Ventas DiarisMio Y Mia Romeo De La CruzNoch keine Bewertungen

- Expenses 2019Dokument74 SeitenExpenses 2019carol ciplesNoch keine Bewertungen

- 2019 PricingDokument1 Seite2019 Pricingapi-444533631Noch keine Bewertungen

- Finanzas 2022Dokument18 SeitenFinanzas 2022william gutierrezNoch keine Bewertungen

- Gestão Infinity XDokument6 SeitenGestão Infinity XAnderson DutraNoch keine Bewertungen

- Tugas Pivot TikDokument5 SeitenTugas Pivot TikAulia ZakiyahNoch keine Bewertungen

- ExcelExpert 2-2cDokument4 SeitenExcelExpert 2-2cEdenilson HernandezNoch keine Bewertungen

- Buku Stok Koperasi ATKDokument7 SeitenBuku Stok Koperasi ATKariani alghomaishaNoch keine Bewertungen

- IntegradoraDokument184 SeitenIntegradoraAnetteNoch keine Bewertungen

- Coins and Canada - 5 Cents 1858 To 1901 - Canadian Coins Price Guide and ValuesDokument5 SeitenCoins and Canada - 5 Cents 1858 To 1901 - Canadian Coins Price Guide and ValuesAmado KhammashNoch keine Bewertungen

- Rafael EstopasDokument1 SeiteRafael EstopasLuiz HabkostNoch keine Bewertungen

- Infaq & SodaqohDokument13 SeitenInfaq & SodaqohRamdhan MaulanaNoch keine Bewertungen

- Monitoring of Waste DisposalDokument3 SeitenMonitoring of Waste Disposal刘文俊Noch keine Bewertungen

- Total Osan 2015 Rp9,433,500Dokument2 SeitenTotal Osan 2015 Rp9,433,500nato carvalhoNoch keine Bewertungen

- HistoricalData 1696051848229Dokument63 SeitenHistoricalData 1696051848229oguliyev201Noch keine Bewertungen

- SAND BAND SonglistDokument2 SeitenSAND BAND Songlistrandy singerNoch keine Bewertungen

- LPJ Pengeluaran Di Rumah Imam Dan DelaDokument16 SeitenLPJ Pengeluaran Di Rumah Imam Dan DelaArthur jr.Noch keine Bewertungen

- Inter Transfer OktoberDokument13 SeitenInter Transfer Oktoberit cordelasuitesNoch keine Bewertungen

- Statement of Check Issued F.Y. 2019 (For JHS & SHS) : Mamasapano National High SchoolDokument2 SeitenStatement of Check Issued F.Y. 2019 (For JHS & SHS) : Mamasapano National High SchoolBai Alleha MusaNoch keine Bewertungen

- Construction Hard Costs S-Curve Distribution CumulativeDokument11 SeitenConstruction Hard Costs S-Curve Distribution CumulativeAlexNoch keine Bewertungen

- Possible Reasons of Declining SalesDokument9 SeitenPossible Reasons of Declining SalesLong Dong Mido0% (1)

- Payroll AccountingDokument26 SeitenPayroll AccountingShean VasilićNoch keine Bewertungen

- Prestige Telephone CompanyDokument13 SeitenPrestige Telephone CompanyKim Alexis MirasolNoch keine Bewertungen

- Annual Report Accounts 2002Dokument156 SeitenAnnual Report Accounts 2002AlezNgNoch keine Bewertungen

- The Craig Proctor Ultimate Real Estate Success Super ConferenceDokument12 SeitenThe Craig Proctor Ultimate Real Estate Success Super ConferenceMike Le0% (1)

- Auditor General's Report 2011 - Synopsis (English)Dokument100 SeitenAuditor General's Report 2011 - Synopsis (English)openid_OtVX6n9hNoch keine Bewertungen

- Badal Haji I SaveDokument5 SeitenBadal Haji I SaveShadaitul M ZinNoch keine Bewertungen

- Advanced Pricing Techniques: Ninth Edition Ninth EditionDokument28 SeitenAdvanced Pricing Techniques: Ninth Edition Ninth EditionNiraj SharmaNoch keine Bewertungen

- Financial Times (UK Edition) No. 41,387 (28 Jul 2023)Dokument26 SeitenFinancial Times (UK Edition) No. 41,387 (28 Jul 2023)Csm 112Noch keine Bewertungen

- MSTC - Quick Bites - 2024-01-15Dokument5 SeitenMSTC - Quick Bites - 2024-01-15Ranjan BeheraNoch keine Bewertungen

- Confederation of Central GovernmentDokument120 SeitenConfederation of Central Governmentpindorri100% (1)

- GCC 2019Dokument117 SeitenGCC 2019Srinivas MantryNoch keine Bewertungen

- Quick Revision Notes (CPT Economics December 2014) ReadyDokument32 SeitenQuick Revision Notes (CPT Economics December 2014) ReadyKiranDudu67% (3)

- AnandRathi On HG Infra On The Road To A Better Future RetainingDokument12 SeitenAnandRathi On HG Infra On The Road To A Better Future RetainingamsukdNoch keine Bewertungen

- Fisher Vs TrinidadDokument9 SeitenFisher Vs TrinidadJanMarkMontedeRamosWongNoch keine Bewertungen

- HyperinflationDokument2 SeitenHyperinflationDanix Acedera50% (2)

- Cost EstimationDokument28 SeitenCost Estimationmayur1980100% (1)

- Goods and Financial Markets: The IS-LM Model: Prepared By: Fernando Quijano and Yvonn QuijanoDokument35 SeitenGoods and Financial Markets: The IS-LM Model: Prepared By: Fernando Quijano and Yvonn QuijanoKumarGauravNoch keine Bewertungen

- Managerial Accounting Exercises Chapter 12Dokument6 SeitenManagerial Accounting Exercises Chapter 12Angelica Lorenz100% (1)

- 20 H Tambunting Pawnshop, Inc. vs. Commissioner of Internal RevenueDokument13 Seiten20 H Tambunting Pawnshop, Inc. vs. Commissioner of Internal RevenueAriel Conrad MalimasNoch keine Bewertungen

- Ias 21 Example Basic Translation Foreign Operation 01Dokument4 SeitenIas 21 Example Basic Translation Foreign Operation 01devanand bhawNoch keine Bewertungen

- Thomas Green of Laramie Wyoming Has Been A Retail SalesclerkDokument2 SeitenThomas Green of Laramie Wyoming Has Been A Retail SalesclerkCharlotteNoch keine Bewertungen

- Help Save Is A Private Not For Profit Entity That OperatesDokument1 SeiteHelp Save Is A Private Not For Profit Entity That OperatesAmit PandeyNoch keine Bewertungen

- Horizontal and Vertical AnalysisDokument4 SeitenHorizontal and Vertical AnalysisJasmine ActaNoch keine Bewertungen

- 2013 Budget Survey Report ResponsesDokument82 Seiten2013 Budget Survey Report ResponsesHugo RodriguesNoch keine Bewertungen

- FAR 2 REVIEWER Other SourceDokument120 SeitenFAR 2 REVIEWER Other SourceAirish GeronimoNoch keine Bewertungen