Beruflich Dokumente

Kultur Dokumente

How GST Works

Hochgeladen von

Trang Thanh NguyenOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

How GST Works

Hochgeladen von

Trang Thanh NguyenCopyright:

Verfügbare Formate

how gst (goods and services tax)

works 10%

on most g ods

and servicesoso

or consumed inld

australia

sells goods

or provides

sells goods and sells goods and services and

charges gst charges gst charges gst

importer / manufacturer wholesaler retailer / service provider consumer

gst on gst collected gst collected gst collected

imported less gst paid less gst paid less gst paid

goods

police and

ambulance

ATO

public

department of transport

immigration

and border

protection

housing

roads

distributes

gst collected

total gst collected australian government states and territories

gst

example

Total value of final sales

GST on final sales value ($110 ÷ 11)

Total to be remitted to the ATO

$110

$10

$10

ATO

local wool farmer GST paid $-

$1

Sells wool to clothing GST Collected $1

manufacturer for

Payable to ATO $1

$10 + GST $1

clothing manufacturer $8

Buys from local wool farmer for GST paid $(1)

$ 11

$

$10 + $1 GST GST collected $2

Sells jumper to retailer for Payable to ATO $1

$20 + $2 GST = $22

$1

$ 10

$8

retailer

$$ 88

Buys from clothing manufacturer GST paid $(2)

for $20 + $2 GST GST collected $10

Sells to consumer for Payable to ATO $8

$100 + GST $10

$ 10

$ 10

consumer

$ 10

Total GST received by the ATO

Buys from retailer for

$100 + GST $10 = $110

JS 38132

Das könnte Ihnen auch gefallen

- An Insight Into GST in IndiaDokument26 SeitenAn Insight Into GST in IndiaSrikantNoch keine Bewertungen

- Intro To TaxationDokument8 SeitenIntro To TaxationPavan JayaprakashNoch keine Bewertungen

- It - All - Notes & Mcqs Merged - Final ExamDokument1.503 SeitenIt - All - Notes & Mcqs Merged - Final ExamSushil PrajapatNoch keine Bewertungen

- Personal BudgetDokument2 SeitenPersonal BudgetCărnăreasa Bogdan AndreiNoch keine Bewertungen

- ML Aggarwal I S Chawla J Agarwal Munish Sethi Ravinder Singh - Self-Help To ICSE Class 10 X Understanding Mathematics Solutions of ML Aggarwal I S Chawla J Agarwal Munish Sethi Ravinder Singh and SonsDokument692 SeitenML Aggarwal I S Chawla J Agarwal Munish Sethi Ravinder Singh - Self-Help To ICSE Class 10 X Understanding Mathematics Solutions of ML Aggarwal I S Chawla J Agarwal Munish Sethi Ravinder Singh and SonsUtkarsh JainNoch keine Bewertungen

- Tugas 1 Akuntansi Manajemen - Darma Guna (2019104432)Dokument14 SeitenTugas 1 Akuntansi Manajemen - Darma Guna (2019104432)Darma GunaNoch keine Bewertungen

- About This TemplateDokument3 SeitenAbout This TemplateRebeca BanariNoch keine Bewertungen

- Computations On Relevant CostingDokument9 SeitenComputations On Relevant CostingVixen Aaron EnriquezNoch keine Bewertungen

- Excel Budget Spreadsheet Template Young and The InvestedDokument3 SeitenExcel Budget Spreadsheet Template Young and The InvestedRebeca BanariNoch keine Bewertungen

- Break Even Point Analysis: Calculation of Variable CostsDokument3 SeitenBreak Even Point Analysis: Calculation of Variable Costsaquitenshot791Noch keine Bewertungen

- Daily Report Sales 2021Dokument4 SeitenDaily Report Sales 2021mian tandooriNoch keine Bewertungen

- GST Seminar Bcom - 2022Dokument49 SeitenGST Seminar Bcom - 2022anshirmampally2022Noch keine Bewertungen

- Calculator Hay Storage PlannerDokument2 SeitenCalculator Hay Storage PlannerGoodman HereNoch keine Bewertungen

- 6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Dokument21 Seiten6 - COMPUTATION OF TAXABLE VALUE - Q - As - AFTER SESSION - 9Mighty SinghNoch keine Bewertungen

- Personal Monthly Budget1Dokument3 SeitenPersonal Monthly Budget1Alam Mo Ba?Noch keine Bewertungen

- Techoggers Manufacturers: Cost Description Fixed Costs Variable CostsDokument1 SeiteTechoggers Manufacturers: Cost Description Fixed Costs Variable CostsANUPAM MSHRANoch keine Bewertungen

- Task AccountingDokument13 SeitenTask AccountingYordan LawijayaNoch keine Bewertungen

- Actg Lab 6Dokument12 SeitenActg Lab 6RAJA ZARRAR100% (1)

- GSTDokument10 SeitenGSTShubham JadhavNoch keine Bewertungen

- National Income Analysis: MeaningDokument18 SeitenNational Income Analysis: Meaningkapil kumarNoch keine Bewertungen

- Premium Personal Monthly Budget1Dokument10 SeitenPremium Personal Monthly Budget1nagul kmtcNoch keine Bewertungen

- GST N Agriculture StudentsDokument34 SeitenGST N Agriculture StudentsNisha NarangNoch keine Bewertungen

- Loonkosttabel1 En-Gb RevDokument1 SeiteLoonkosttabel1 En-Gb RevStephanie CasetNoch keine Bewertungen

- Loonkosttabel1 En-Gb Rev PDFDokument1 SeiteLoonkosttabel1 En-Gb Rev PDFStephanie CasetNoch keine Bewertungen

- Penetuan Biaya Dalam Produksi Helm: Biaya Tetap Biaya Variabel Biaya Total Menghitung HPP Menghitung Harga Jual BEPDokument8 SeitenPenetuan Biaya Dalam Produksi Helm: Biaya Tetap Biaya Variabel Biaya Total Menghitung HPP Menghitung Harga Jual BEPLuq SyNoch keine Bewertungen

- A. A Used Car Dealer Buys A Car For $3,000 and Resells It For $3,300Dokument10 SeitenA. A Used Car Dealer Buys A Car For $3,000 and Resells It For $3,300Faisal Rizqi AtthoriqNoch keine Bewertungen

- Pratice InventoryDokument4 SeitenPratice InventoryBbjhe SilfavanNoch keine Bewertungen

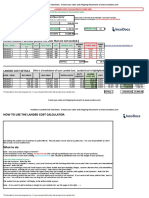

- Landed Cost CalculatorDokument12 SeitenLanded Cost Calculatorvaddana haisocheatNoch keine Bewertungen

- Econ Proj WsDokument9 SeitenEcon Proj Wsapi-735244288Noch keine Bewertungen

- May Expenses 2022Dokument3 SeitenMay Expenses 2022rajatshubham.sharma9Noch keine Bewertungen

- How Much Does It CostDokument1 SeiteHow Much Does It Costapi-531441145Noch keine Bewertungen

- Budget Template Sheep Sell All Weaned 2021 GMDokument15 SeitenBudget Template Sheep Sell All Weaned 2021 GMefacwerexNoch keine Bewertungen

- GST Invoice Format No. 37Dokument1 SeiteGST Invoice Format No. 37Priyanka VermaNoch keine Bewertungen

- 2029 - 2030 Sky Spirit Studio GSTDokument36 Seiten2029 - 2030 Sky Spirit Studio GSTWade Stephen BakerNoch keine Bewertungen

- GLBL Budget Template v1 1Dokument14 SeitenGLBL Budget Template v1 1Ankur Jain0% (1)

- Financial Statements TemplateDokument17 SeitenFinancial Statements Templatevaddana haisocheatNoch keine Bewertungen

- ABC Company Fabrics: (Expenses) No. of Rolls Price No. of Kgs Per Roll Produce Per KGDokument3 SeitenABC Company Fabrics: (Expenses) No. of Rolls Price No. of Kgs Per Roll Produce Per KGLeila CruzNoch keine Bewertungen

- QUIZ SolutionsDokument21 SeitenQUIZ SolutionsElyjah Thomas AvilaNoch keine Bewertungen

- FAR P - L and Balance SheetsDokument5 SeitenFAR P - L and Balance SheetsArun PanwarNoch keine Bewertungen

- Module 6 - National Income and OutputDokument3 SeitenModule 6 - National Income and OutputjessafesalazarNoch keine Bewertungen

- Mobile Car Wash Business Plan FinancialsDokument14 SeitenMobile Car Wash Business Plan FinancialsTakudzwa Maposa100% (2)

- Fabozzi Handbook Fixed Income 7th EditionDokument2 SeitenFabozzi Handbook Fixed Income 7th EditionBhagyeshGhagiNoch keine Bewertungen

- GST Unit 2 ADokument46 SeitenGST Unit 2 AMukul BhatnagarNoch keine Bewertungen

- Nominal GDP, Real GDP, and GDPDokument17 SeitenNominal GDP, Real GDP, and GDPEistellaNoch keine Bewertungen

- Nominal GDP, Real GDP, and GDPDokument17 SeitenNominal GDP, Real GDP, and GDPEistellaNoch keine Bewertungen

- MSC142 Presentaion BracuDokument26 SeitenMSC142 Presentaion BracuZidan HassanNoch keine Bewertungen

- Australia - Retail Price & Fob Calculation Guide (As at December 2016)Dokument3 SeitenAustralia - Retail Price & Fob Calculation Guide (As at December 2016)Radith ShakindaNoch keine Bewertungen

- Umang PDF Fo MathDokument24 SeitenUmang PDF Fo MathAlok RajNoch keine Bewertungen

- "Extra Costs": ENTER PRODUCT DETAILS (Delete The Lines That Are Not Needed.)Dokument6 Seiten"Extra Costs": ENTER PRODUCT DETAILS (Delete The Lines That Are Not Needed.)callraza19100% (1)

- Invoice # 75668Dokument1 SeiteInvoice # 75668Patrick WhiteNoch keine Bewertungen

- Variable Cost (Biaya Perseorangan) : Destination Period Date Total Pax TLDokument3 SeitenVariable Cost (Biaya Perseorangan) : Destination Period Date Total Pax TLCharlosa GoNoch keine Bewertungen

- Total: Cuchillo Pala Platos de PlásticosDokument5 SeitenTotal: Cuchillo Pala Platos de PlásticosAmérica Merari Paqui PiñaNoch keine Bewertungen

- 09abepg1126a1zg Gstr3br1 Reconciled Summary (2017-2018)Dokument19 Seiten09abepg1126a1zg Gstr3br1 Reconciled Summary (2017-2018)Aishvary GuptaNoch keine Bewertungen

- Kgs Per Does Kgs Per Buck: Cost Per Each Weight in Kgs Rate Per KGDokument10 SeitenKgs Per Does Kgs Per Buck: Cost Per Each Weight in Kgs Rate Per KGPradeep Kumar VaddiNoch keine Bewertungen

- Landed Cost CalculatorDokument6 SeitenLanded Cost CalculatorMi Mi100% (2)

- Abbott Workers Requisitioned Out The Following MaterialsDokument10 SeitenAbbott Workers Requisitioned Out The Following MaterialsBhoomi GhariwalaNoch keine Bewertungen

- Correct Unit Mix ApodDokument2 SeitenCorrect Unit Mix Apodassistant_sccNoch keine Bewertungen

- Forecast NBDokument1 SeiteForecast NBDay MalaroNoch keine Bewertungen

- RE AnalysisDokument64 SeitenRE AnalysisWill MillerNoch keine Bewertungen

- VavDokument8 SeitenVavkprasad_56900Noch keine Bewertungen

- Raneem AlbazazDokument33 SeitenRaneem AlbazazGordana PuzovicNoch keine Bewertungen

- Badminton ReviewerDokument10 SeitenBadminton ReviewerHailsey WinterNoch keine Bewertungen

- Model Detailed Project Report: Animal Feed Making UnitDokument19 SeitenModel Detailed Project Report: Animal Feed Making UnitShashi ShekharNoch keine Bewertungen

- FebvreDokument449 SeitenFebvreIan Pereira AlvesNoch keine Bewertungen

- Yoga SadhguruDokument6 SeitenYoga Sadhgurucosti.sorescuNoch keine Bewertungen

- GBJ0232 - en GLX 3101 T2Dokument43 SeitenGBJ0232 - en GLX 3101 T2mnbvqwert100% (2)

- Airport Security Post 9-11Dokument7 SeitenAirport Security Post 9-11lewisNoch keine Bewertungen

- Clocks (New) PDFDokument5 SeitenClocks (New) PDFAbhay DabhadeNoch keine Bewertungen

- Harmonic Analysis of Separately Excited DC Motor Drives Fed by Single Phase Controlled Rectifier and PWM RectifierDokument112 SeitenHarmonic Analysis of Separately Excited DC Motor Drives Fed by Single Phase Controlled Rectifier and PWM RectifierGautam Umapathy0% (1)

- Joby Aviation - Analyst Day PresentationDokument100 SeitenJoby Aviation - Analyst Day PresentationIan TanNoch keine Bewertungen

- DIVAR IP All-In-One 7000 3U Datasheet 51 en 66297110155Dokument5 SeitenDIVAR IP All-In-One 7000 3U Datasheet 51 en 66297110155Javier RochaNoch keine Bewertungen

- Tips For A Healthy PregnancyDokument2 SeitenTips For A Healthy PregnancyLizaNoch keine Bewertungen

- Electronic Ticket Receipt, January 27 For MS NESHA SIVA SHANMUGAMDokument2 SeitenElectronic Ticket Receipt, January 27 For MS NESHA SIVA SHANMUGAMNesha Siva Shanmugam ShavannahNoch keine Bewertungen

- LinkageDokument9 SeitenLinkageHarshu JunghareNoch keine Bewertungen

- Exam 3 DynamicsDokument7 SeitenExam 3 DynamicsJulioNoch keine Bewertungen

- Warehouse Management Solution SheetDokument2 SeitenWarehouse Management Solution Sheetpatelnandini109Noch keine Bewertungen

- Wang Jinhui - Competitive Physics - Thermodynamics, Electromagnetism and Relativity (2019, World Scientific Publishing Co. Pte. LTD.)Dokument961 SeitenWang Jinhui - Competitive Physics - Thermodynamics, Electromagnetism and Relativity (2019, World Scientific Publishing Co. Pte. LTD.)Paritosh PandeyNoch keine Bewertungen

- Solar Charge Controller: Solar Car Solar Home Solar Backpack Solar Boat Solar Street Light Solar Power GeneratorDokument4 SeitenSolar Charge Controller: Solar Car Solar Home Solar Backpack Solar Boat Solar Street Light Solar Power Generatorluis fernandoNoch keine Bewertungen

- Ict 2120 Animation NC Ii Week 11 20 by Francis Isaac 1Dokument14 SeitenIct 2120 Animation NC Ii Week 11 20 by Francis Isaac 1Chiropractic Marketing NowNoch keine Bewertungen

- English Class Vii PDFDokument101 SeitenEnglish Class Vii PDFpannapurohitNoch keine Bewertungen

- Precision CatalogDokument256 SeitenPrecision CatalogImad AghilaNoch keine Bewertungen

- Beastlikebalsam - Muscle BuildingDokument10 SeitenBeastlikebalsam - Muscle BuildingBalsam LaaroussiNoch keine Bewertungen

- CCNA Training New CCNA - RSTPDokument7 SeitenCCNA Training New CCNA - RSTPokotete evidenceNoch keine Bewertungen

- DJI F450 Construction Guide WebDokument21 SeitenDJI F450 Construction Guide WebPutu IndrayanaNoch keine Bewertungen

- Parameters Identification of Induction Motor Model BasedDokument10 SeitenParameters Identification of Induction Motor Model Basedretrueke1170Noch keine Bewertungen

- Conceptual Artist in Nigeria UNILAGDokument13 SeitenConceptual Artist in Nigeria UNILAGAdelekan FortuneNoch keine Bewertungen

- The Manufacture and Uses of Expanded Clay Aggregate: Thursday 15 November 2012 SCI HQ, LondonDokument36 SeitenThe Manufacture and Uses of Expanded Clay Aggregate: Thursday 15 November 2012 SCI HQ, LondonVibhuti JainNoch keine Bewertungen

- Pellicon 2 Validation Guide PDFDokument45 SeitenPellicon 2 Validation Guide PDFtakwahs12135Noch keine Bewertungen

- Kami Export - Subject Complements-1 PDFDokument3 SeitenKami Export - Subject Complements-1 PDFkcv kfdsaNoch keine Bewertungen